Vanilla

•

Feb 03, 2026

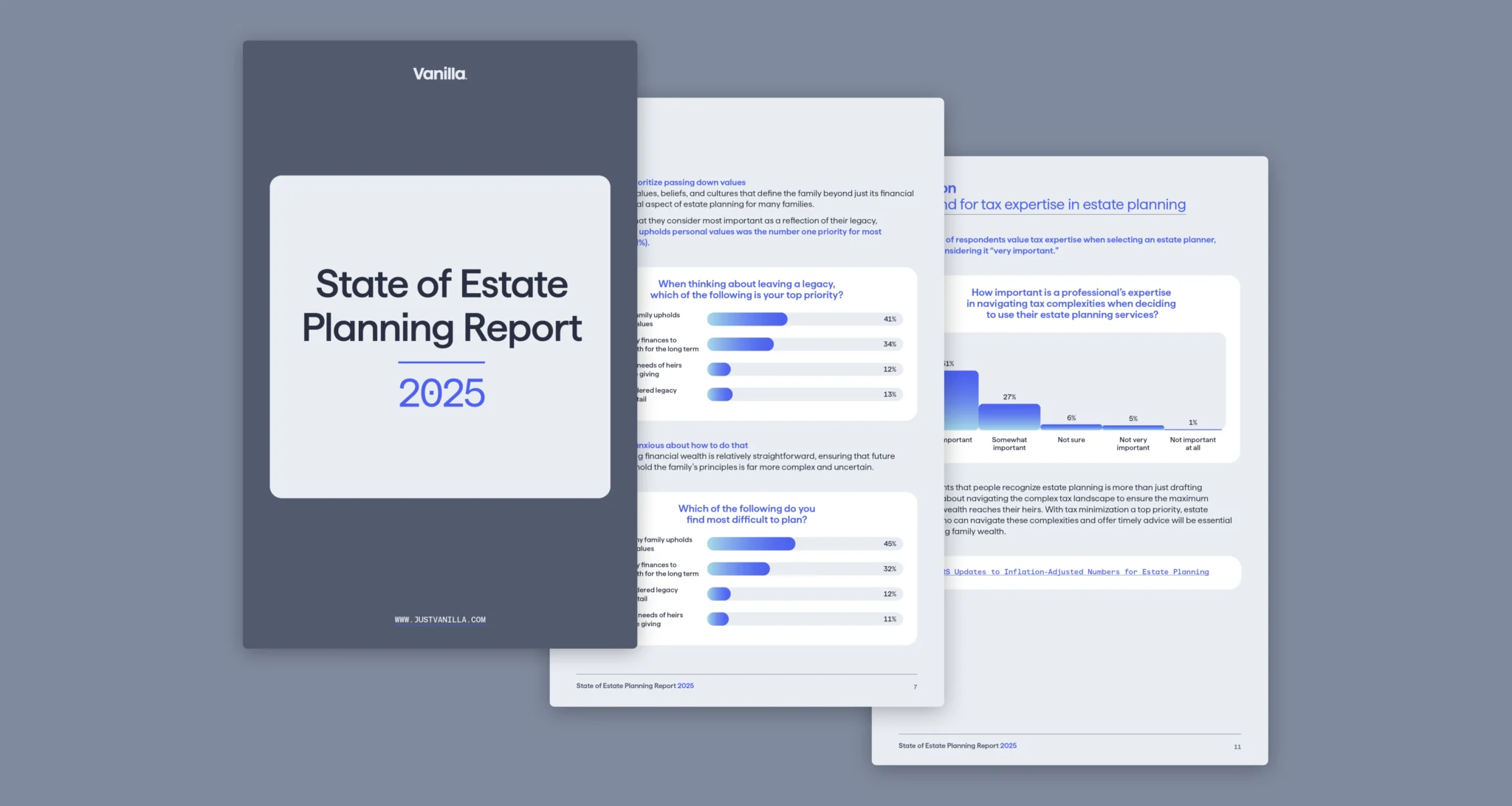

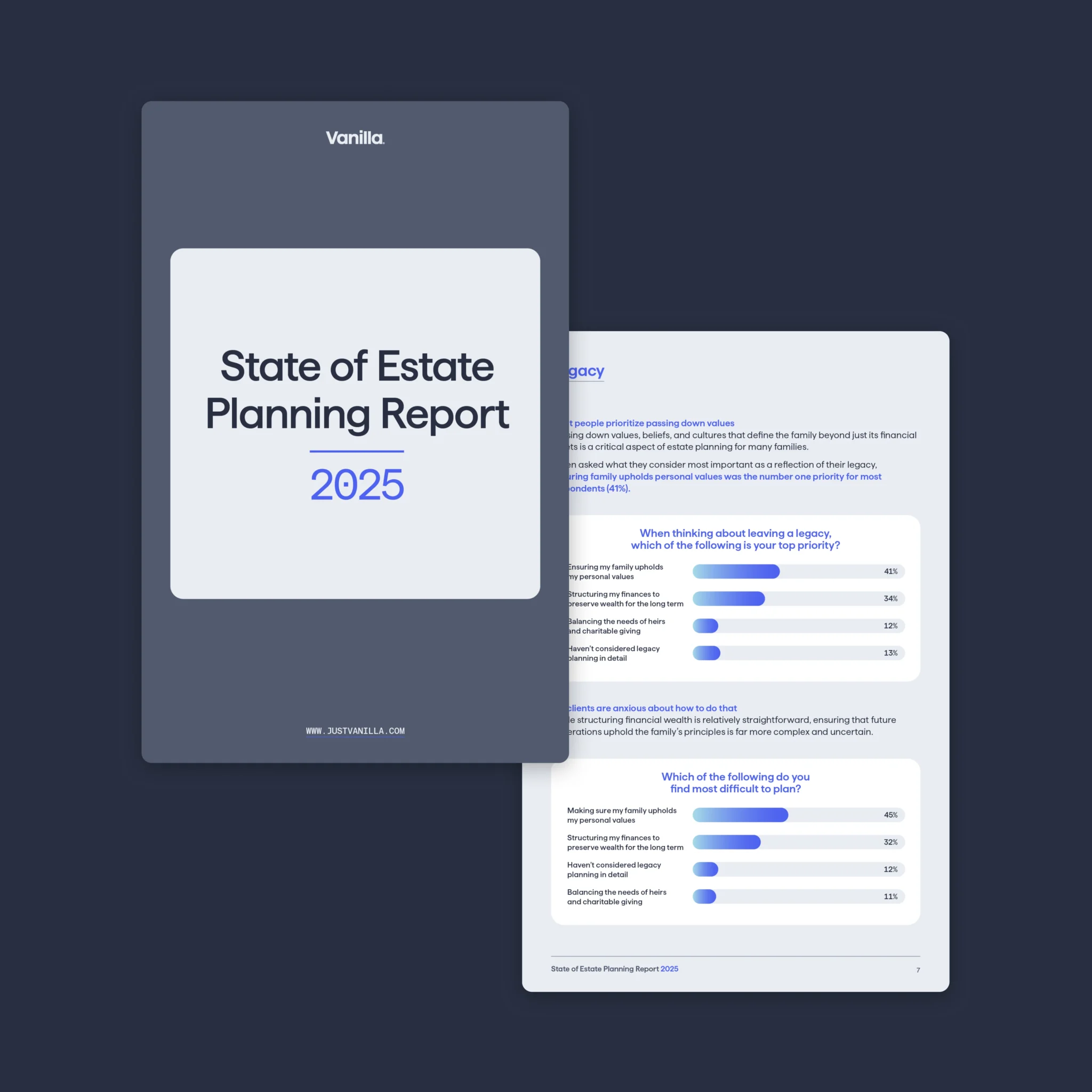

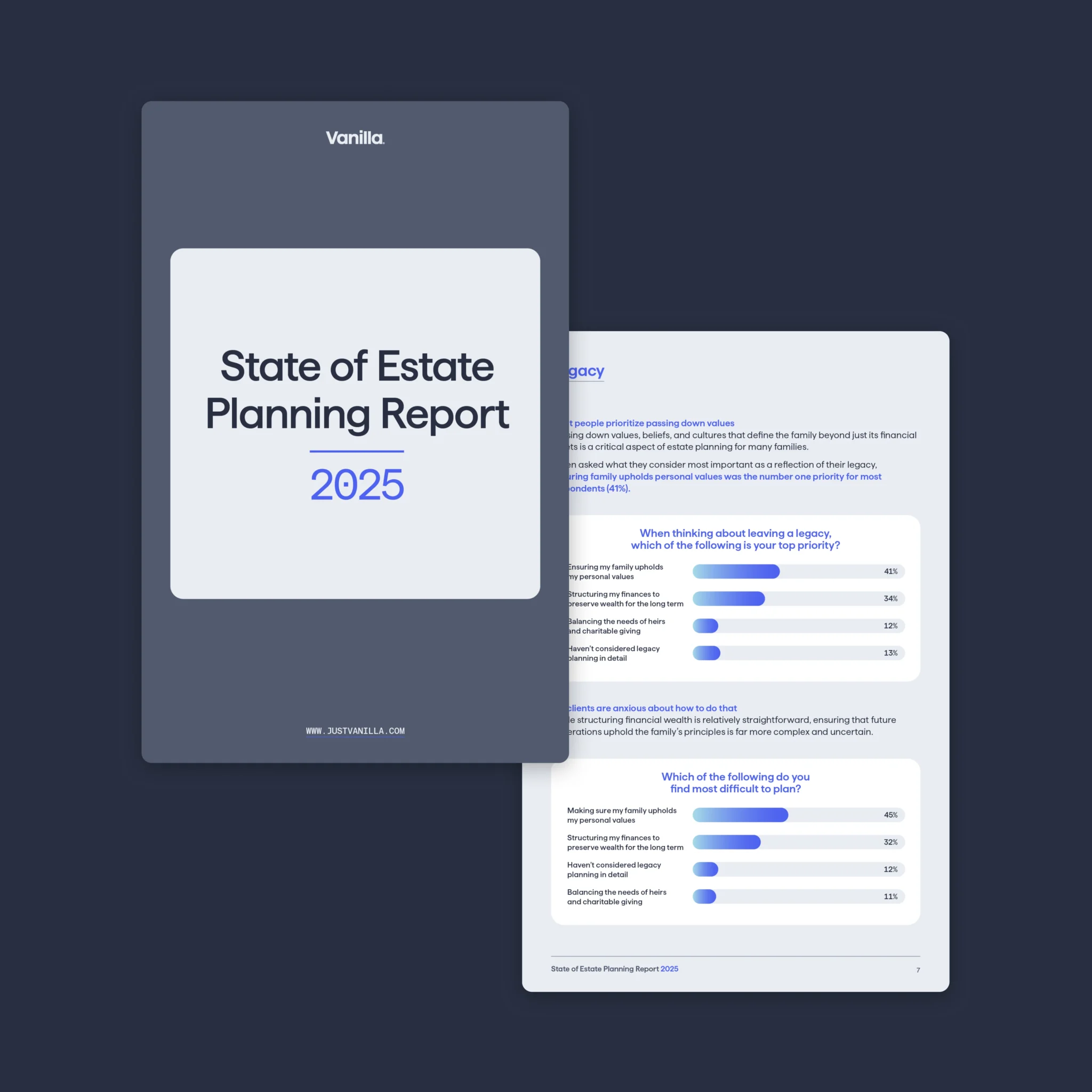

10 Key Findings from the 2026 State of Estate Planning Report

In case you missed it, Vanilla's 2026 State of Estate Planning Report is out, and it's packed with insights about how consumers really think about estate planning. This annual survey of over 1,000 U.S. consumers explores how people view legacy, family dynamics, and the role of advisors and technology in the planning process. The full report is worth a read, but here's a skimmable roundup of some of the findings that stood out most. Read the complete, ungated State of Estate Planning report here. Estate planning, family, and values Estate planning is personal. It's less about tax optimization and more...

Sarah D. McDaniel, CFA

•

Feb 02, 2026

February Is American Heart Month: Turn Healthcare Awareness Into Estate Planning Action

February's designation as American Heart Month offers more than a themed social media post, it's an opening to facilitate crucial conversations that deepen client relationships and establish trust with the next generation. The heart month hook: from health to healthcare planning Every February, Americans are reminded to prioritize heart health, scheduling checkups, improving diets, and reducing stress. It's a month dedicated to prevention and preparedness. Yet while clients may dutifully schedule their cardiology appointments, most haven't had equally important conversations about what happens if a health crisis does occur. This disconnect creates an opportunity for advisors. The national focus on...

Jessica Lantz

•

Jan 28, 2026

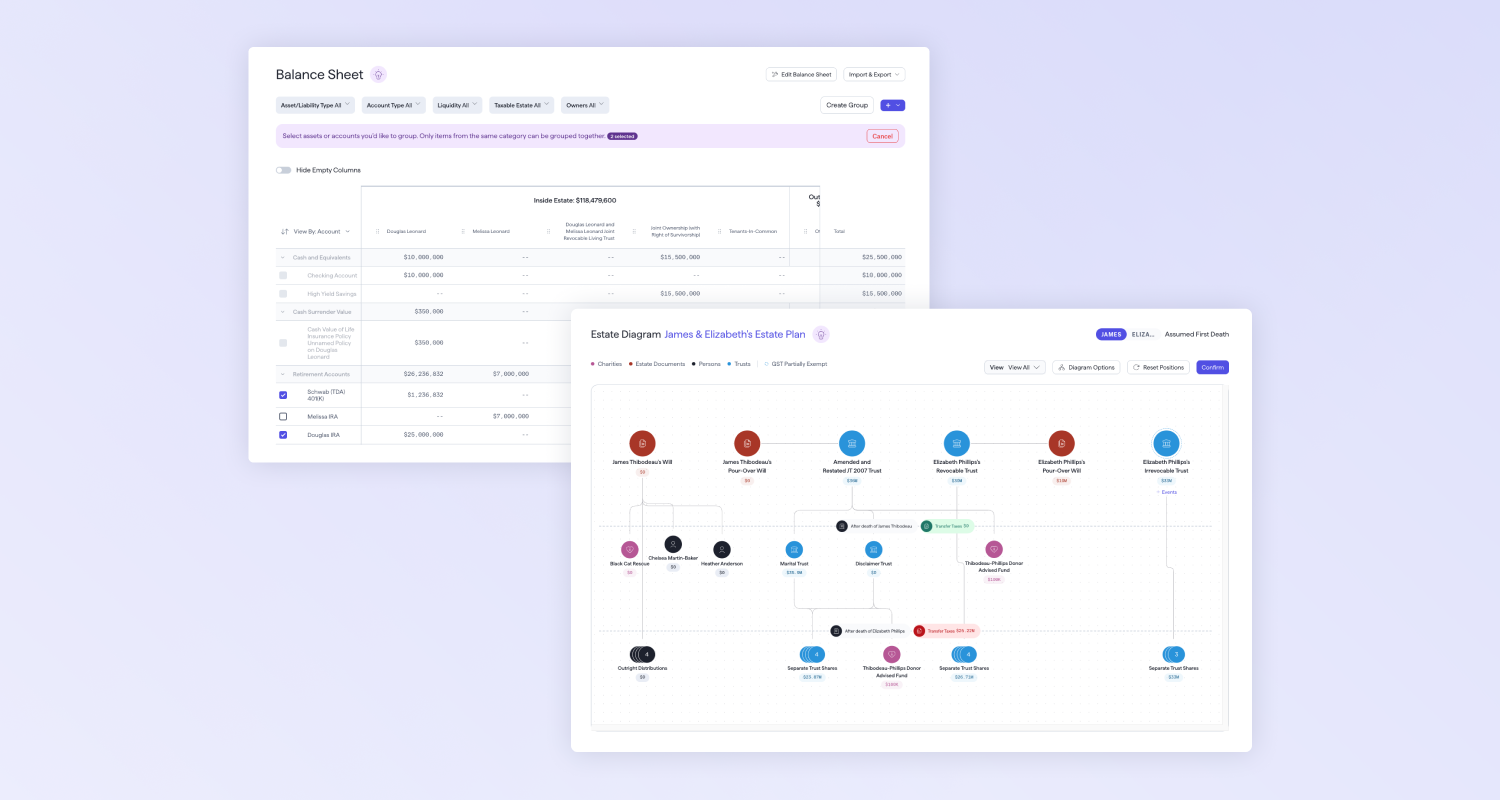

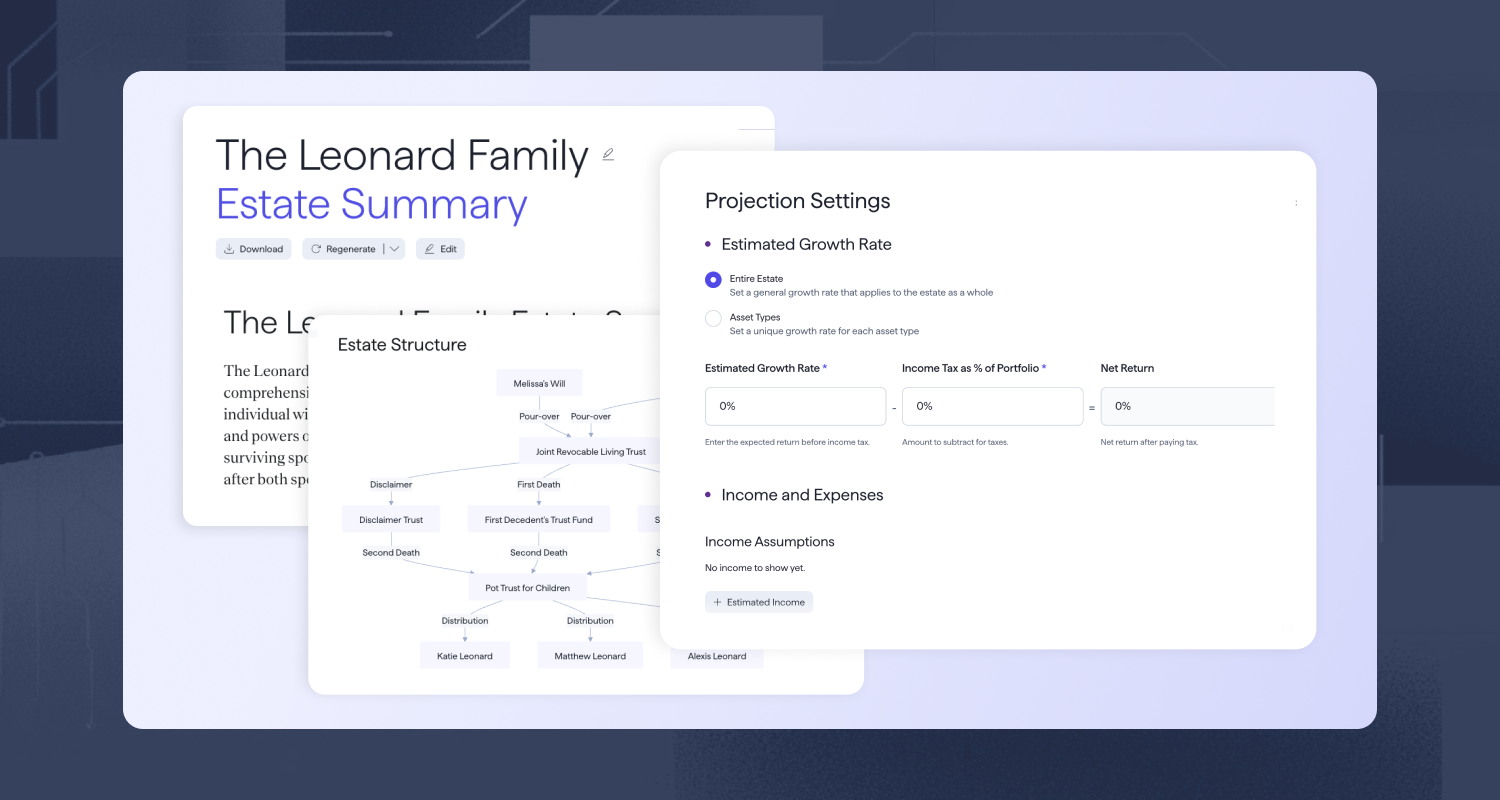

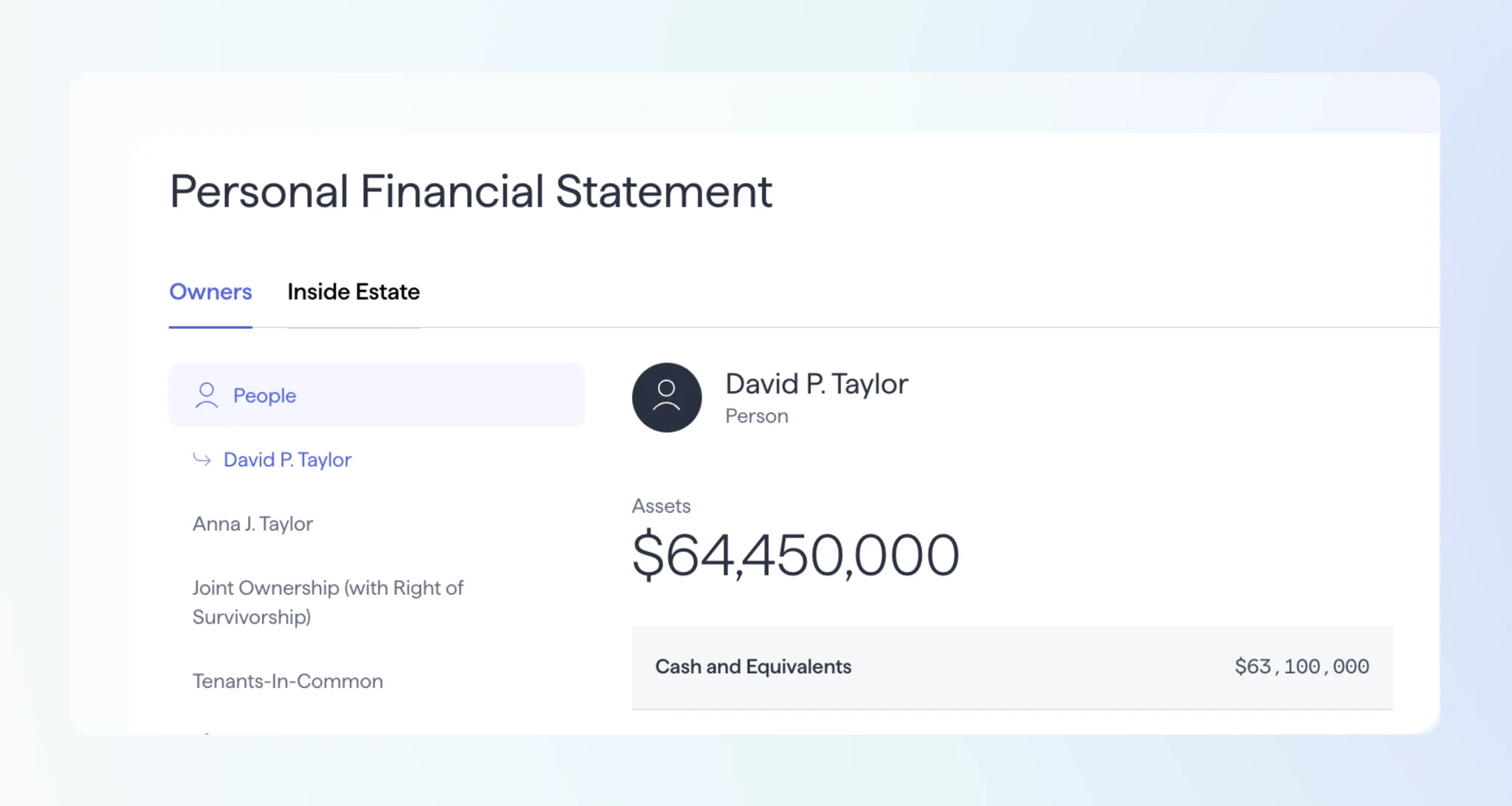

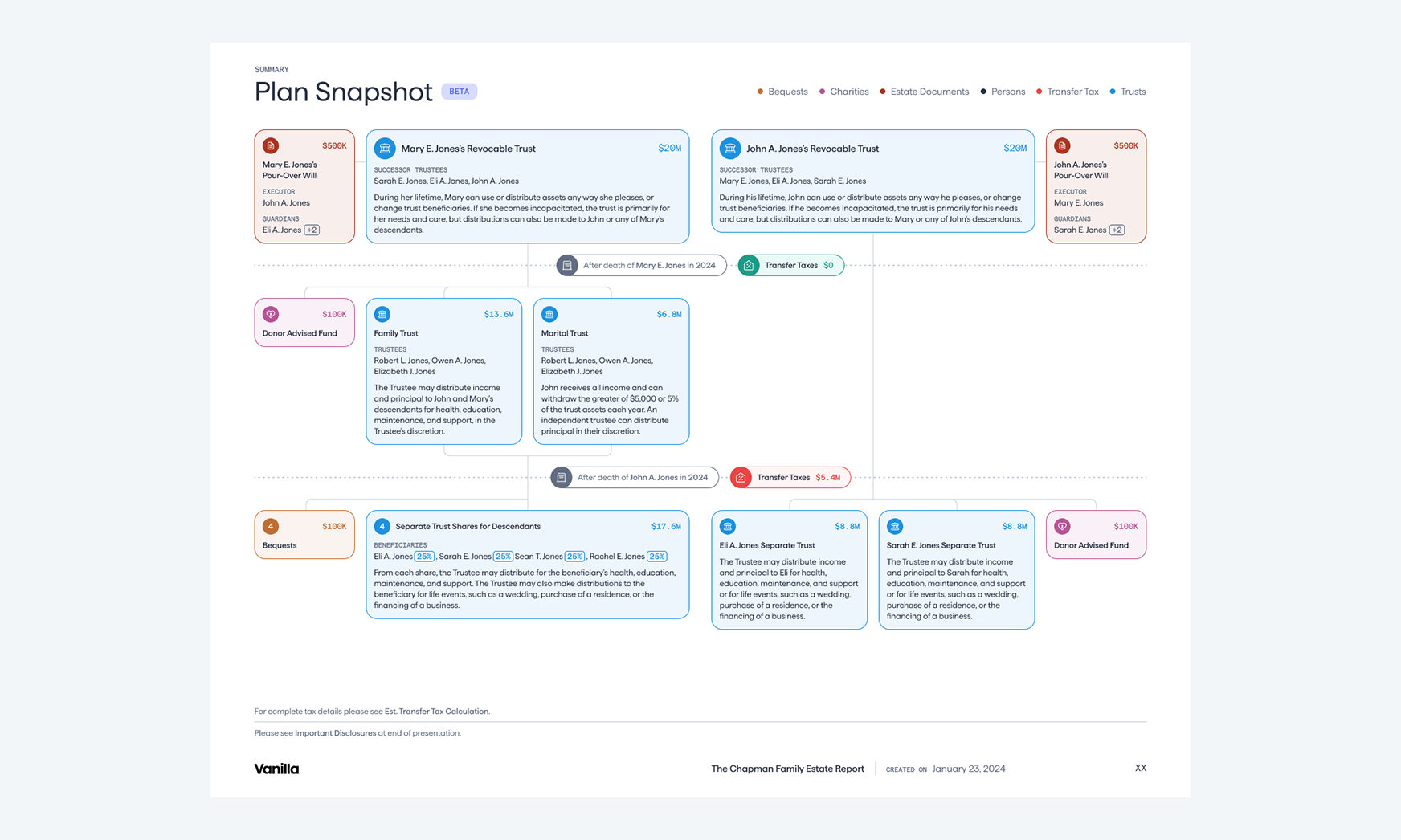

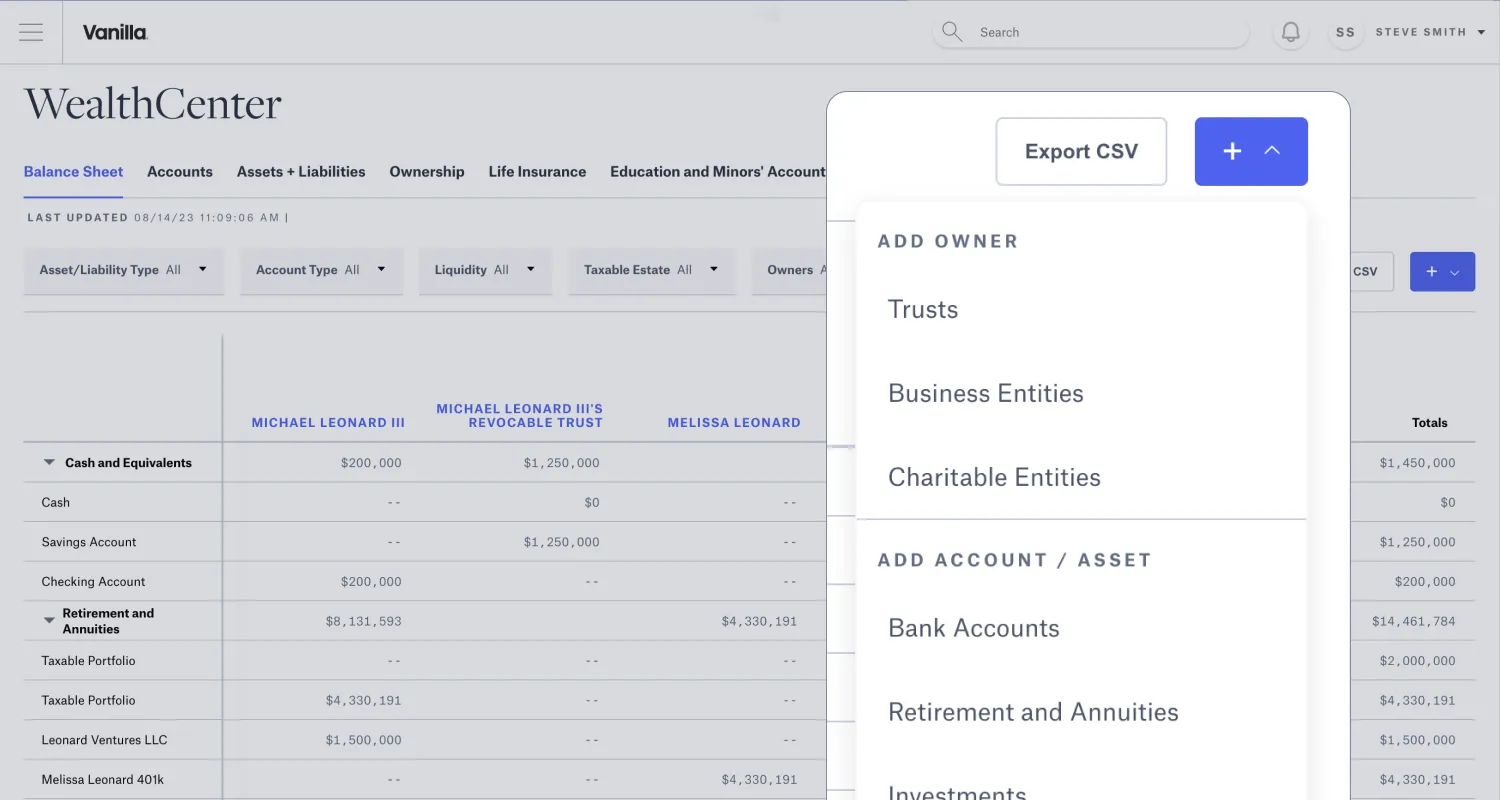

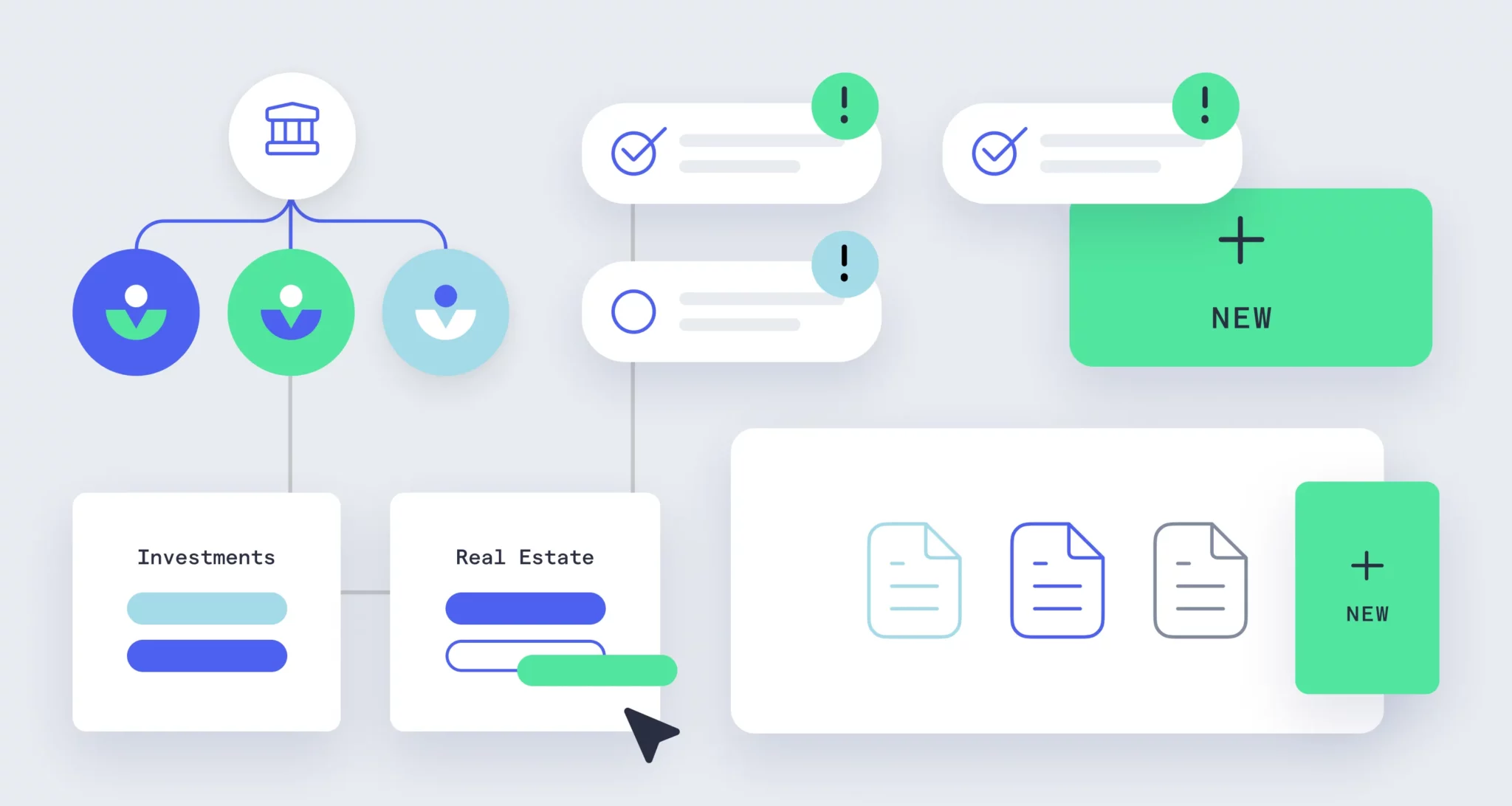

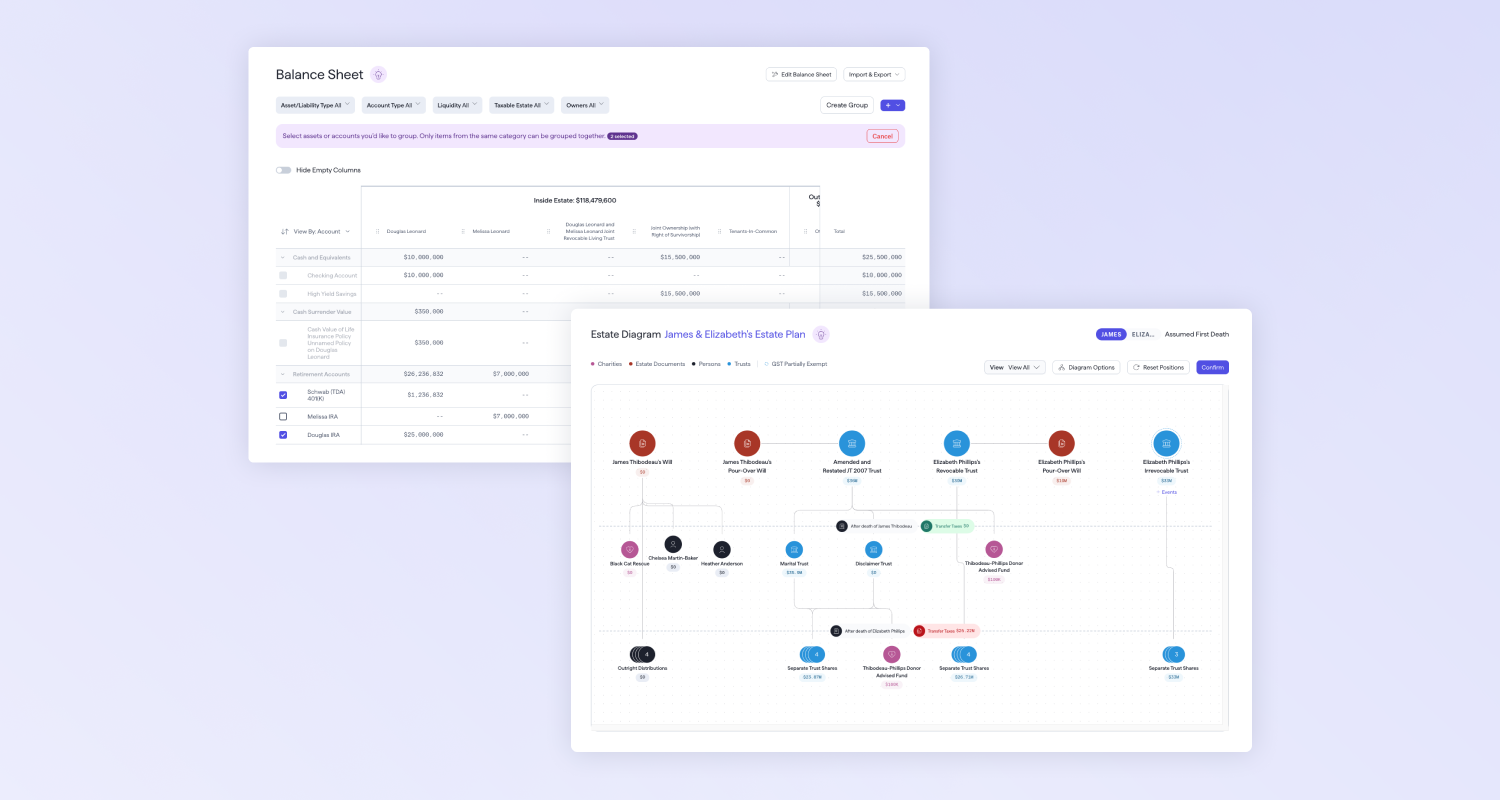

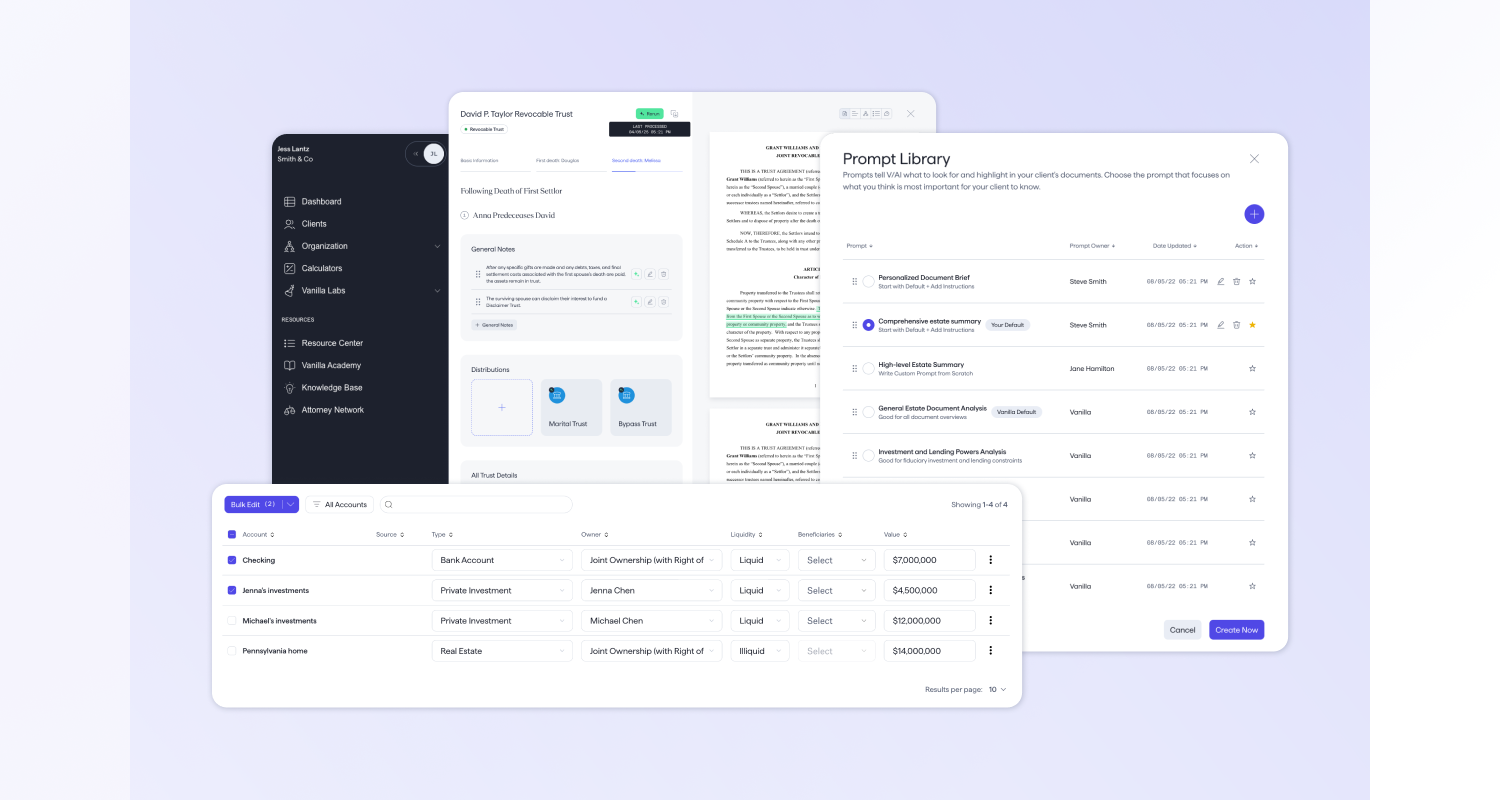

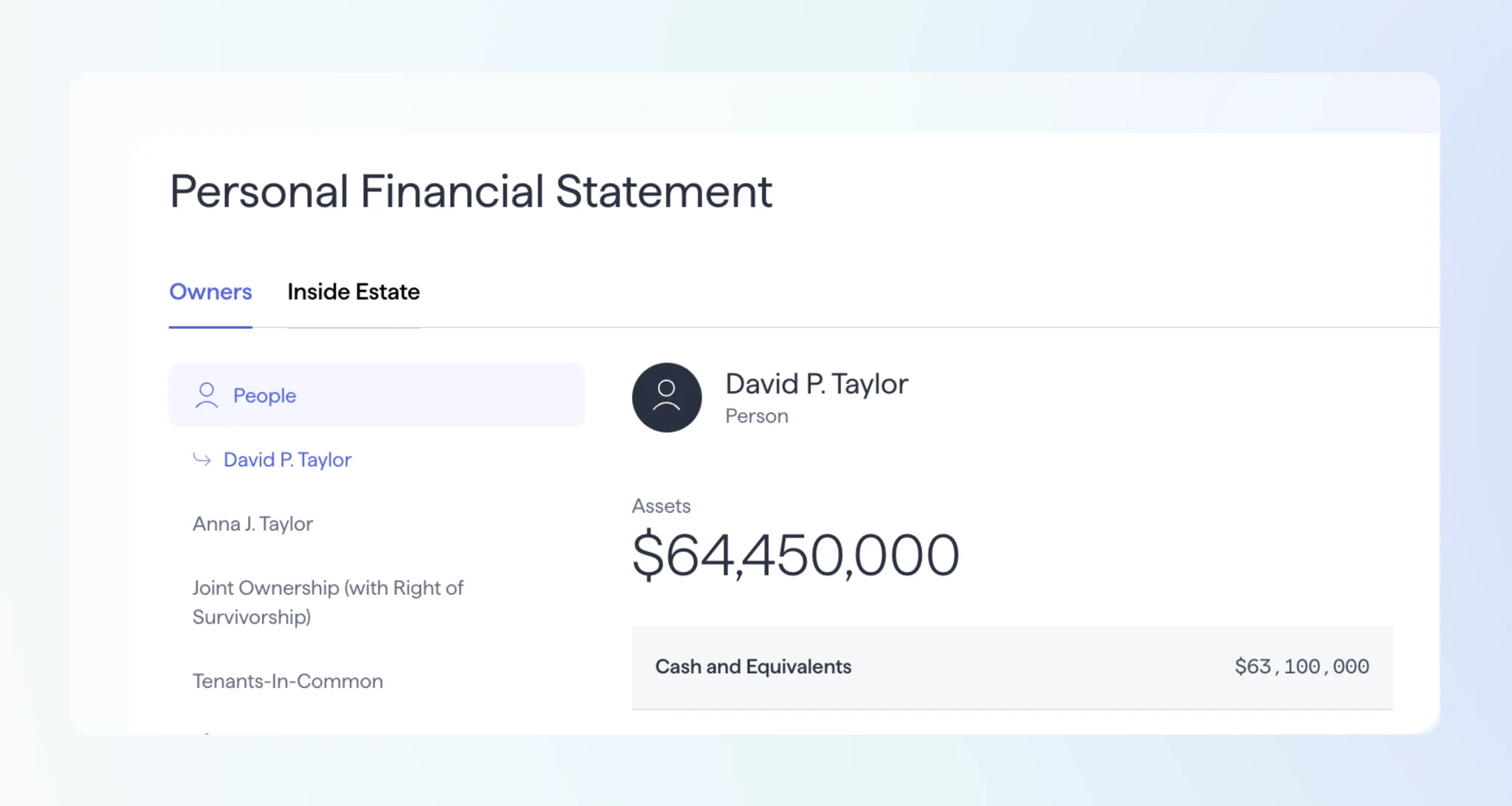

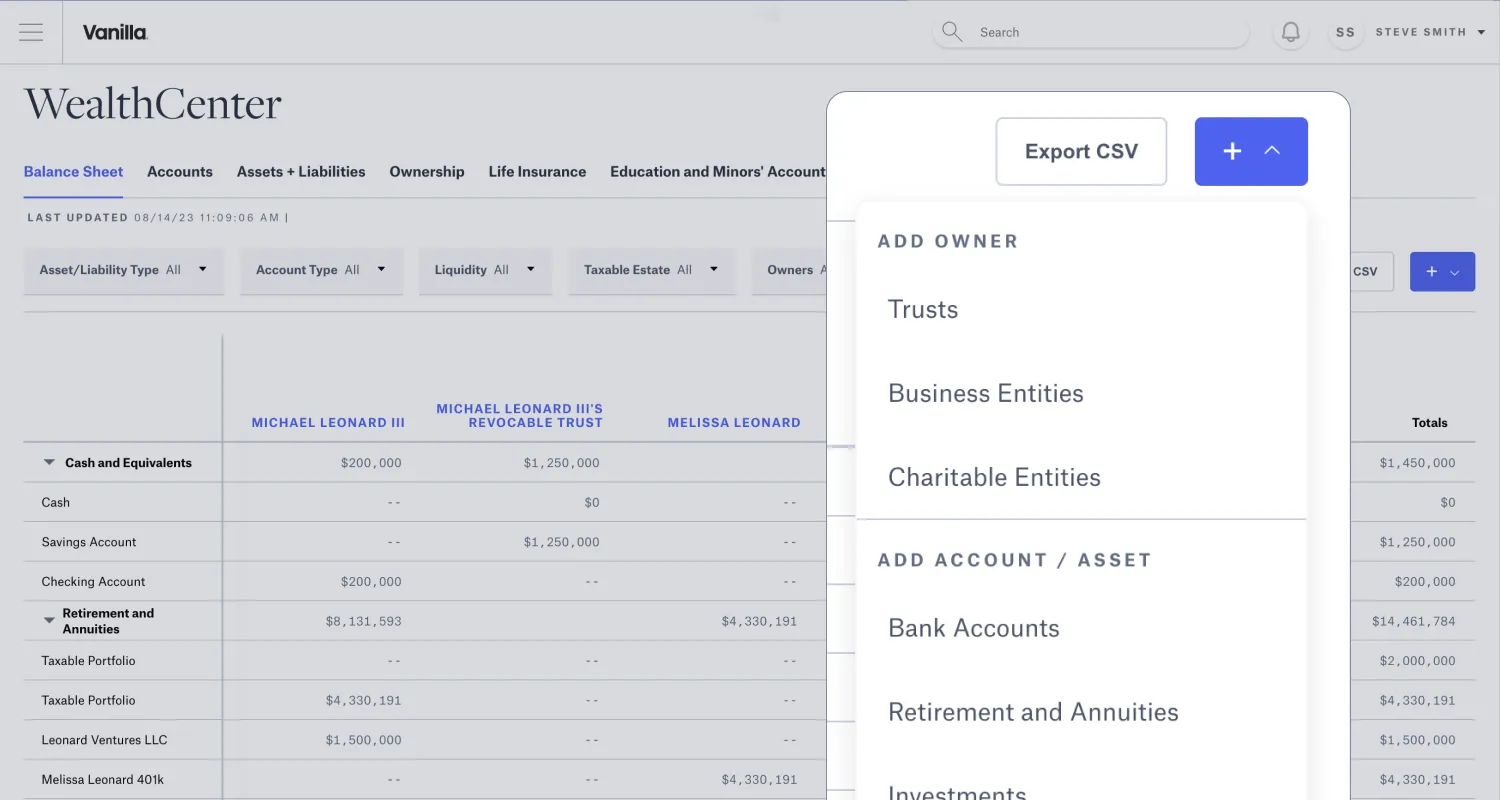

What’s New in January: Balance Sheet Enhancements, V/AI Summary Source Tracking, and big...

January brings powerful upgrades that streamline how you manage complex estate data and present plans to clients. From flexible Balance Sheet organization to AI transparency and dynamic estate visualizations, these releases help you work more efficiently while delivering exceptional client experiences. Balance Sheet grouping: Organize complex data with ease The challenge: Estates with numerous assets create lengthy Balance Sheets that make it harder to highlight what matters most and understand critical financial information at a glance. The solution: Create custom groups to consolidate similar assets or accounts into single, collapsible line items, reducing visual clutter Quickly expand grouped items to...

Vanilla

•

Jan 27, 2026

Estate Planning Trends in 2026: Key Themes from Vanilla’s Annual Report

When clients come to their advisors about estate planning, they're rarely asking about trusts and tax brackets first. They're asking: Will my kids be okay? Will my spouse be taken care of? Will the business I built survive me? Will my family stay close when I'm gone? Estate planning lives at the intersection of money and meaning. It asks clients to confront mortality, navigate family dynamics, and articulate what legacy truly means to them. Few other services offer advisors such an intimate window into their clients' lives. This year, we surveyed over 1,000 U.S. consumers to understand how they think...

Vanilla

•

Jan 26, 2026

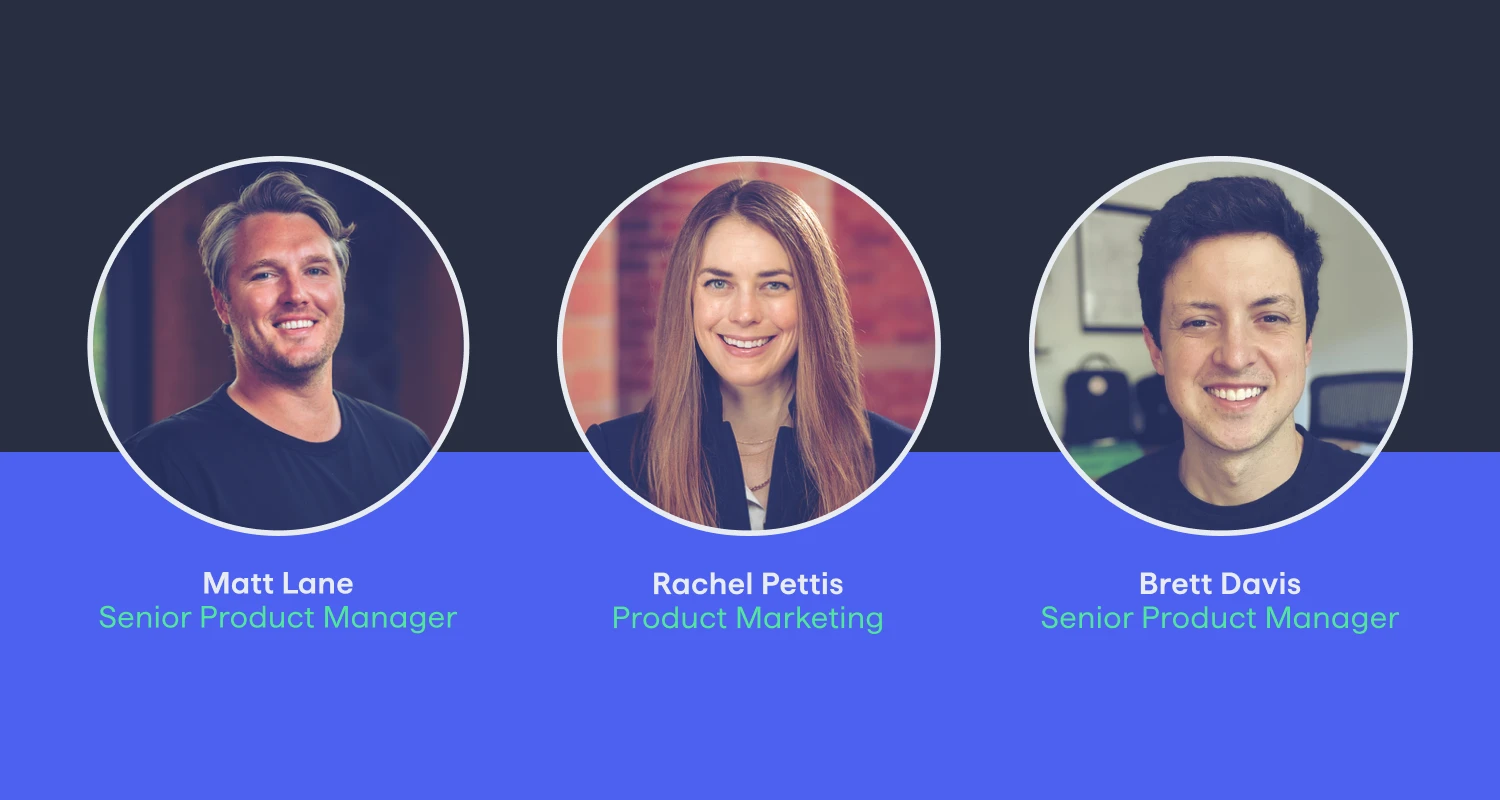

Estate Planning in 2026: The Data Behind What Clients Actually Want

What do clients really want from estate planning, and their advisors? Vanilla’s third annual State of Estate Planning survey of 1,000 U.S. consumers reveals shifting expectations around legacy, wealth transfer, and the role advisors play in these deeply personal conversations. What we’ll cover: Why 80% of clients now expect estate planning as part of their advisor’s offering The gap between intention and action—and where advisors can step in How the gender gap in estate planning represents an untapped opportunity What clients actually want from AI-assisted planning (hint: it’s not replacement) How to position estate planning conversations around values, not just...

Vanilla

•

Jan 22, 2026

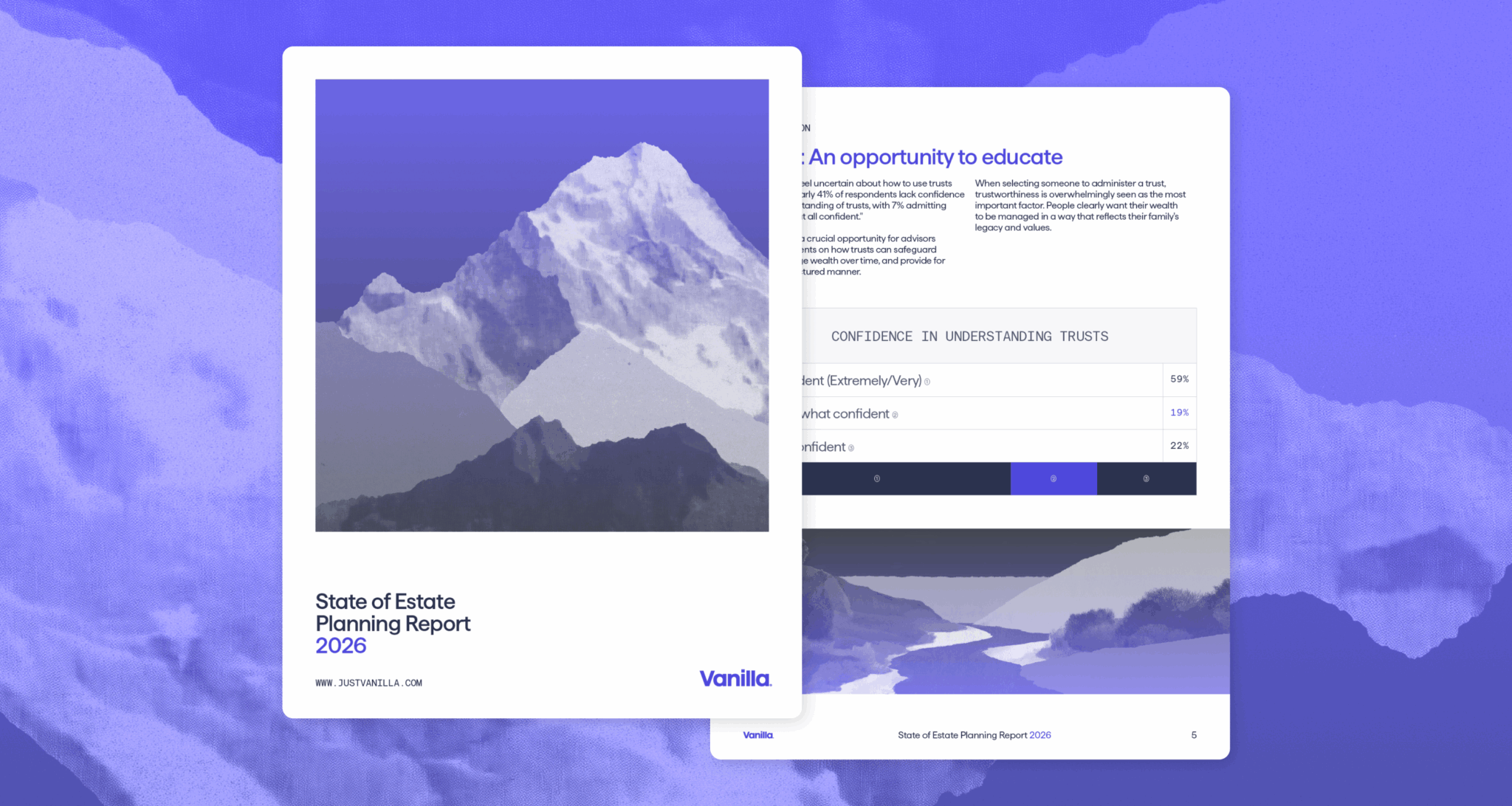

State of Estate Planning Report 2026

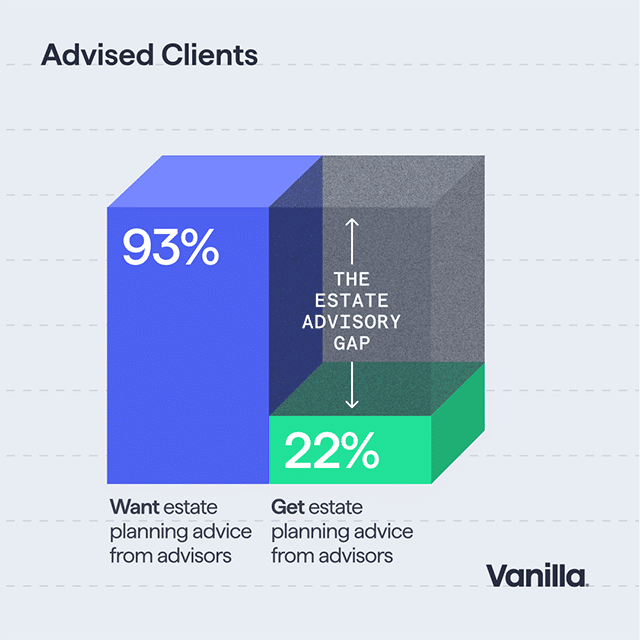

The emerging trends and sentiments advisors need to know for the coming year The 2026 State of Estate Planning Report reveals what’s on consumers’ minds as they think about legacy, wealth transfer, and the professionals they trust to guide them. Vanilla’s third annual survey of 1,000 U.S. consumers uncovers the trends shaping estate planning conversations—and the opportunities advisors can’t afford to miss. This year’s key findings: Nearly all (97%) say discussing estate plans with loved ones matters—but a gap exists between intention and action 8 in 10 expect their financial advisor to offer estate planning, either directly or through collaboration...

Vanilla

•

Jan 19, 2026

12 Financial Planning Strategies for High-Earning Clients Building Wealth

The financial advisory profession has shifted from selling investments to building long-term client relationships grounded in comprehensive wealth stewardship. Today’s clients expect a holistic approach to financial planning from their financial advisor, and the ongoing commoditization of investment management means that advisors can no longer rely on returns alone to prove their value. Think of this shift as an opportunity to deepen client relationships, boost satisfaction, and differentiate your practice, particularly if you’re serving mass affluent clients and high earners building wealth. Leveraging the following 12 strategies can help you deliver the end-to-end experience modern clients are looking for while...

Sarah D. McDaniel, CFA

•

Jan 08, 2026

Why January is the Perfect Time to Start Estate Planning Conversations

The new year naturally prompts clients to reflect on their priorities and reassess their goals. While many focus on financial resolutions and self reflection, this mindset creates an ideal opportunity to introduce estate planning conversations to ensure client wishes are properly documented and their loved ones protected. Just as clients wouldn't operate with an outdated financial strategy, their estate plans require regular attention to remain aligned with current circumstances and intentions. A systematic review identifies gaps between clients' current plans and present reality, demonstrating your commitment to holistic wealth management beyond investment performance. Frame it as an estate health check...

Vanilla

•

Jan 06, 2026

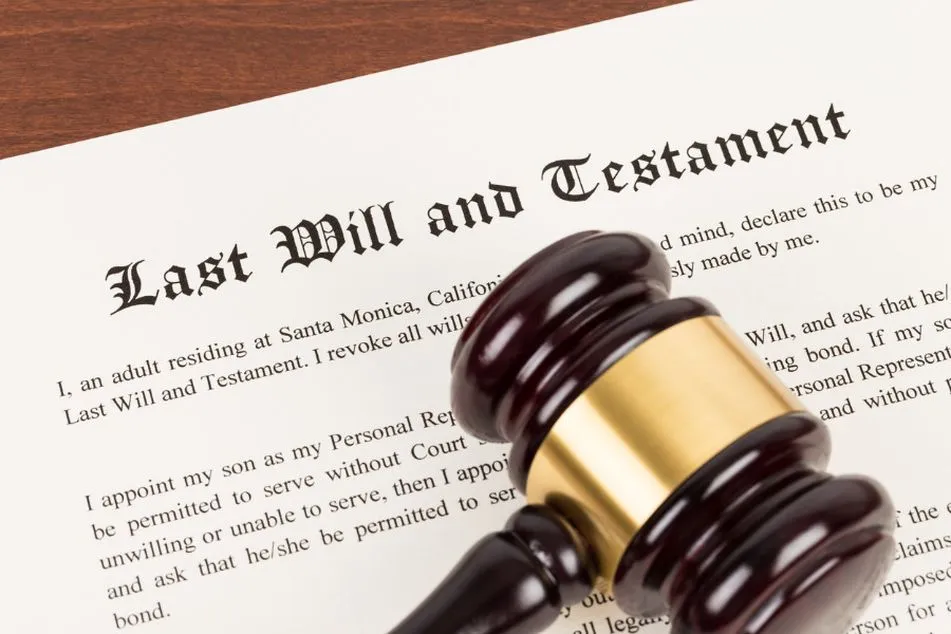

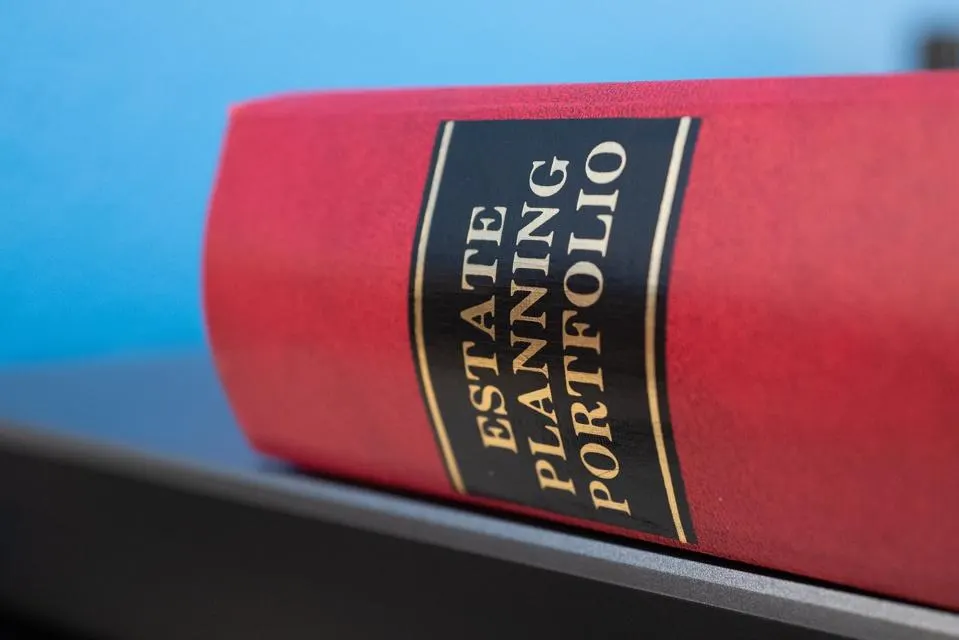

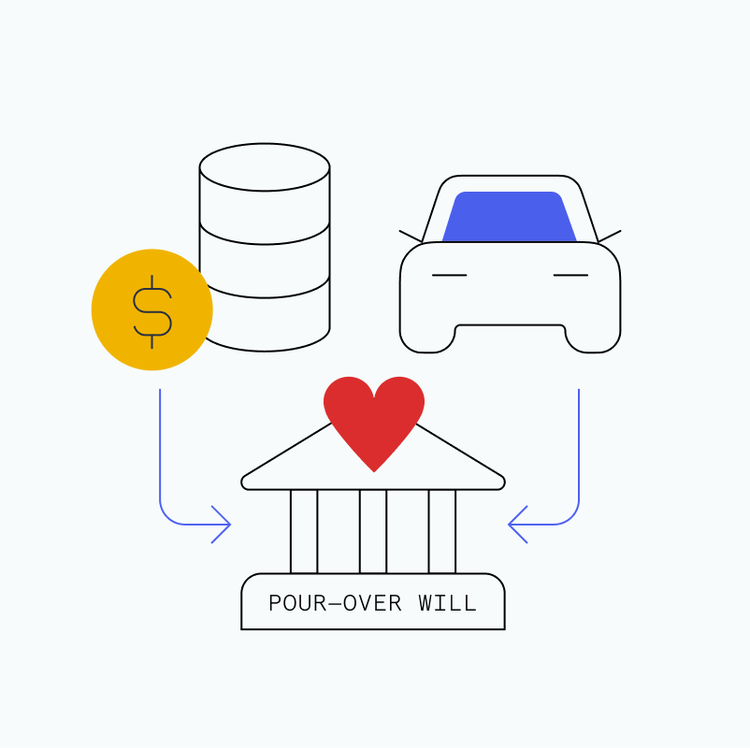

The Complete Guide to Estate Planning

Though an often overlooked part of financial planning, estate planning is a critical part of a well-rounded wealth management strategy. In fact, estate planning is about much more than just creating a will. A thoughtful estate plan is a comprehensive strategy for things like: Managing one’s wealth during life and after death Ensuring one’s family is cared for Supporting causes that align with one’s values Minimizing taxes and fees Documenting wishes in case of incapacitation Planning for one’s future legacy The common myth that estate planning is only for the ultra-wealthy is patently false. Estate planning benefits individuals at all...

Vanilla

•

Jan 06, 2026

Steve Lockshin’s Estate Planning Playbook

A step-by-step checklist to guide your client conversations, updated for 2025. This playbook is inspired by the guide used by Vanilla founder Steve Lockshin and his advisory firm AdvicePeriod, based on Lockshin’s 30+ years of financial advice and estate planning for some of the most successful ultra-high net worth clients in the world.

Vanilla

•

Jan 05, 2026

From Planners to Process: How Verdence Capital Advisors Scaled Financial Planning

Running a successful advisory practice isn’t just about having great planners—it’s about building systems and processes that enable those planners to deliver exceptional client experiences consistently and efficiently. At Verdence Capital Advisors, a $5B+ RIA, Sarah Mouser has spent over a decade developing comprehensive approaches to financial planning that go beyond individual expertise to create scalable, systematic client service. Join us to hear how Sarah, a sought-after speaker at Barron’s, FPA National Conferences, and other industry events, thinks about practice management, technology integration, and building planning processes that support growth. Together with Vanilla’s Sarah Marriott, Sarah will discuss: The evolution...

Sarah D. McDaniel, CFA

•

Jan 05, 2026

New Year, New Approach: How to Use Estate Planning to Stay Top of...

Let’s face it—most people procrastinate. Deadlines are often the only motivators that spur action, and for financial planning, this “crunch time” tends to hit in November and December. Unfortunately, this end-of-year rush isn’t ideal for a number of reasons: The holidays: Advisors and clients alike are juggling travel, vacations, and family obligations. Emotional decision-making: Whether it’s the stress of family reunions or the joy of celebrations, emotions can cloud judgment. Rushed choices: Big-picture financial planning requires clarity and focus, neither of which are easy to achieve in a hectic environment. The result? A less-than-optimal setup for making critical long-term decisions....

Karen Nachbar

•

Dec 29, 2025

Four Years of Security Excellence: Vanilla’s SOC 2 Type II Milestone

As Vanilla’s Chief Legal Officer, I talk to customers every day about the trust they have put in us to handle their clients' most confidential financial and estate planning data. I’m thrilled to share that Vanilla has successfully completed its annual SOC 2 Type II audit with no findings—marking our fourth consecutive year (since we began our SOC 2 audits in 2022) with a clean report. This achievement reflects our ongoing commitment to maintaining the highest standards of security, availability, and confidentiality for our customers' data. What This Means for Our Customers A SOC 2 Type II audit is an...

Vanilla

•

Dec 18, 2025

How Financial Advisors Add Estate Planning Value

As your clients’ lives evolve, so should their estate plan. Your role as their financial advisor is to guide them through each stage, ensuring their plans stay relevant and aligned with their goals while working alongside estate attorneys to protect what they've built. In this article, we’ll take a closer look at how to position your estate planning services and deliver real value throughout the entire estate planning process. Why estate planning requires wealth management expertise For even simple estates, clients need professional help beyond drafting documents. They need someone who understands how their wealth connects to their legacy goals....

Vanilla

•

Dec 16, 2025

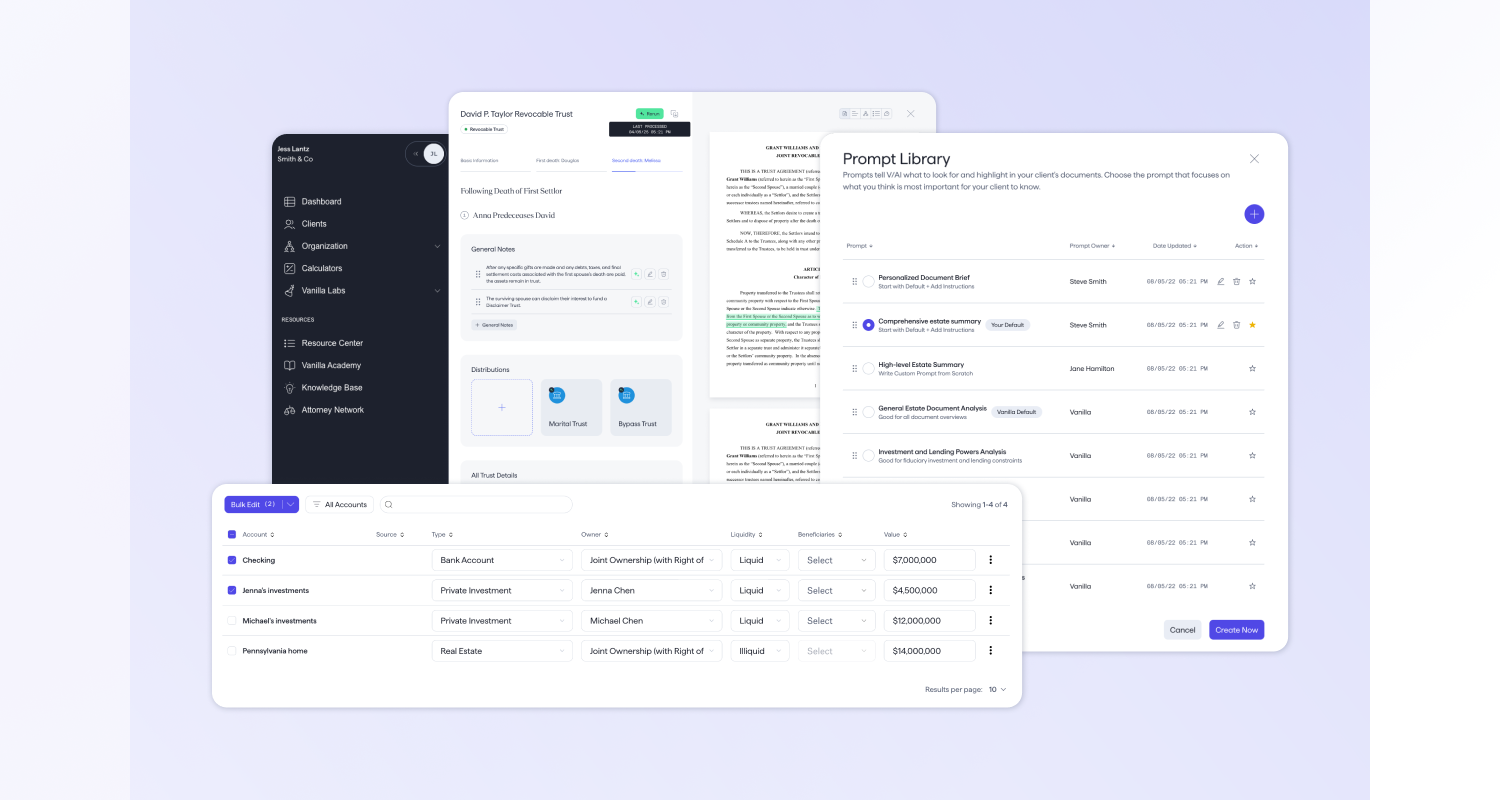

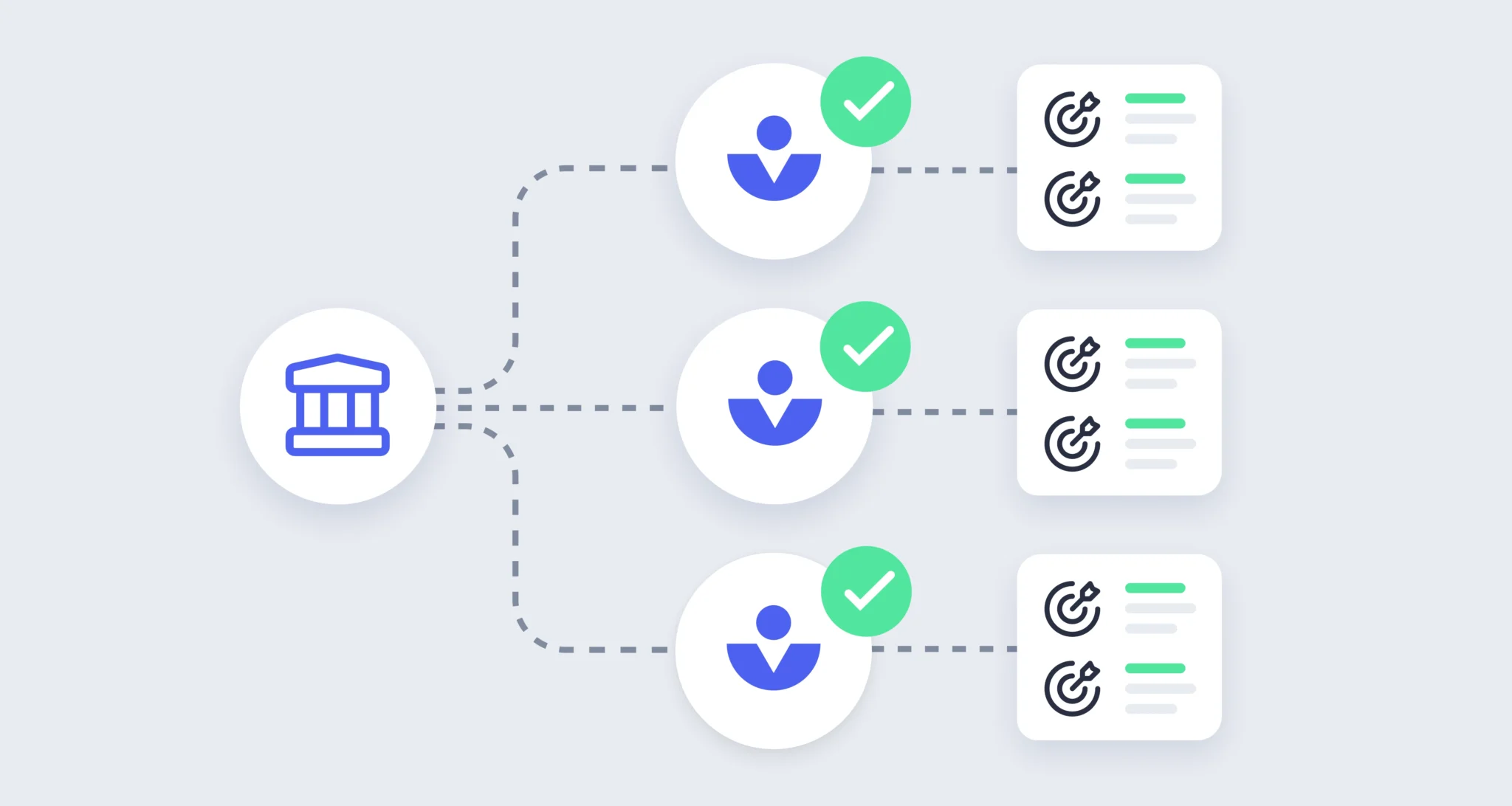

Cetera Chooses Vanilla, Further Enhancing Estate Planning Services for Approximately 12,000 Advisors

Through the partnership, Vanilla’s modern estate planning platform offers streamlined workflows, deeper client conversations, and planning confidence to Cetera advisors BELLEVUE, WA – December 16, 2025 – Vanilla, the trusted and modern estate planning platform for financial advisors, today announced a partnership with Cetera Financial Group (Cetera), the premier financial advisor Wealth Hub, that supports independent advisors and institutions with personalized support, flexible affiliation models, and end-to-end growth solutions.Through the partnership, Cetera’s network of more than 12,000 financial advisors and institutions can leverage Vanilla’s comprehensive estate planning platform to simplify complex workflows, visualize planning scenarios, and support more engaging, outcome-driven...

Vanilla

•

Dec 15, 2025

2025 Year in Innovation: What We Built and Where We’re Headed

We recently hosted our Year in Innovation webinar with CEO Gene Farrell and Head of Product Strategy Sam Trapkin. For those who couldn't join live, here's the recap. Estate Planning Is No Longer a Fringe Offering Just a few years ago, estate planning was still seen as a niche service—something advisors assumed belonged exclusively to attorneys or ultra-high-net-worth practices. That's changed. Today, advisors from independents to the largest institutions recognize estate planning as essential to their value proposition. The shift makes sense. Advisors who quarterback estate planning conversations build deeper relationships, retain more assets across generations, and differentiate in ways...

Vanilla

•

Dec 09, 2025

The Importance of Estate Planning: 6 Ways to Start the Conversation

All of your clients need estate planning. Many of them don't realize it yet. Only a little over 50% of Baby Boomers have a trust, will, or an estate plan in place, a figure that decreases with each subsequent generation. Meanwhile, your ability to retain their families through generational wealth transfers hangs in the balance. Only 27% of heirs plan to keep their benefactor's wealth advisor, dropping to 20% for those who have already received an inheritance. Estate planning isn't just critical for your clients. It's critical for your practice. As an advisor, you can influence your clients’ ability to...

Jessica Lantz

•

Dec 03, 2025

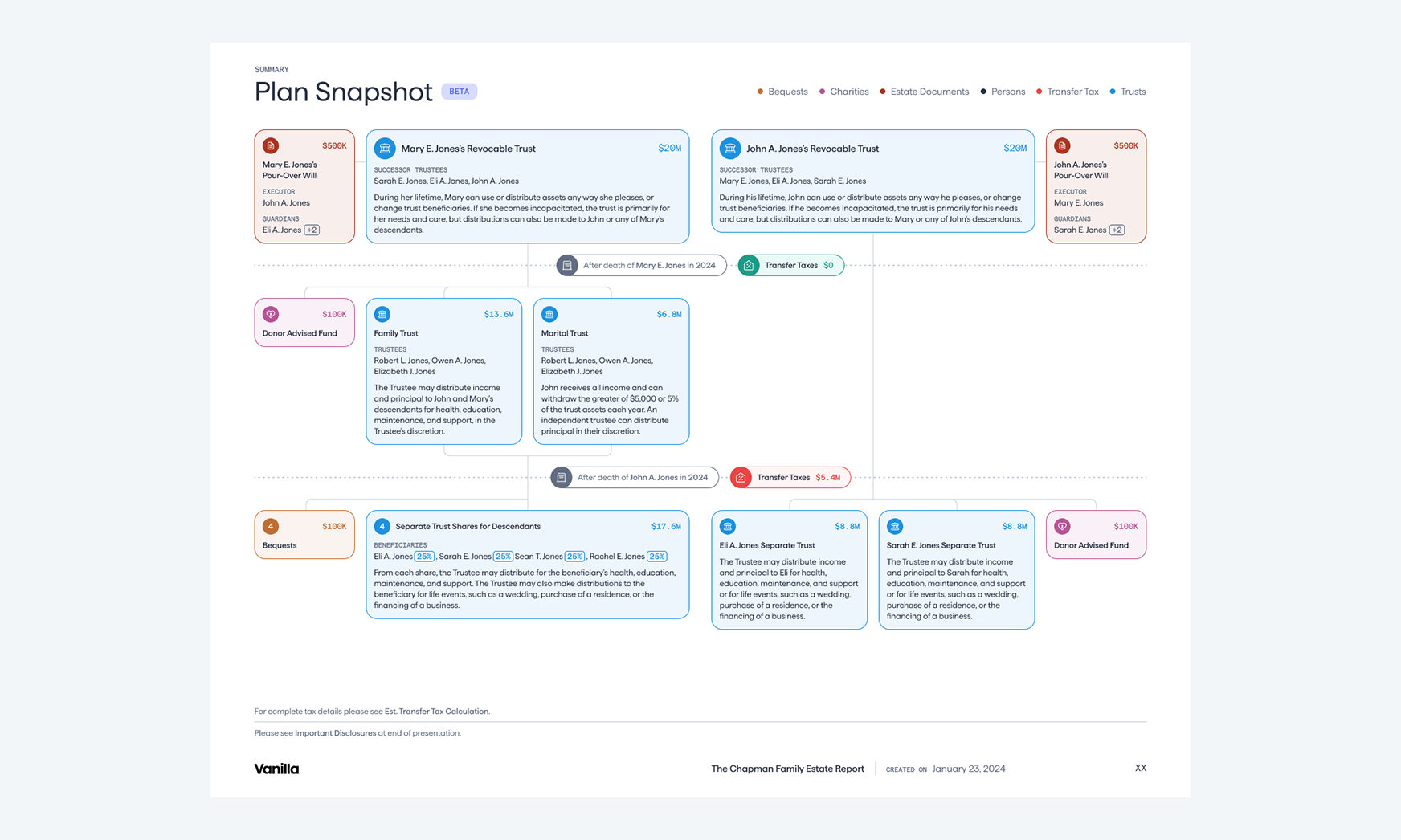

What’s New in December: Enhanced navigation, estate diagram upgrades, and powerful integration updates

This month brings transformative changes to how you interact with Vanilla. We've reimagined core navigation experiences, unified our estate visualization tools, and rebuilt our integration infrastructure from the ground up. Each enhancement addresses friction points in your daily workflows while unlocking new possibilities for managing complex client portfolios. Edit Balance Sheet data in one unified workspace The challenge: Cleaning up imported Balance Sheet data requires navigating between multiple accounts, creating a fragmented workflow that consumes hours and makes it difficult to maintain context across portfolios. The solution: A single, table-like workspace where you can review, validate, and correct all imported...

Vanilla

•

Dec 01, 2025

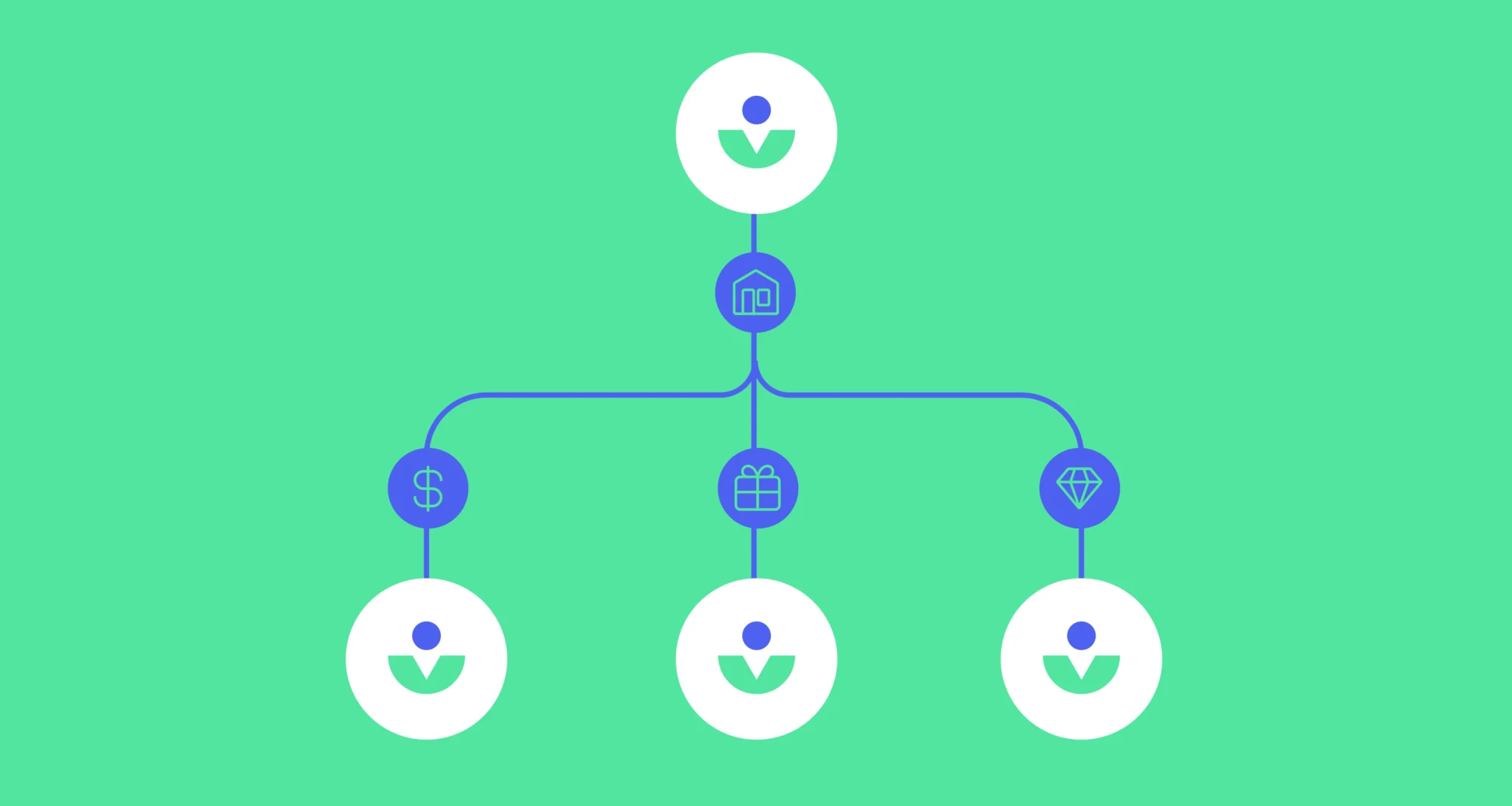

The Guide to Legacy Planning for Financial Advisors

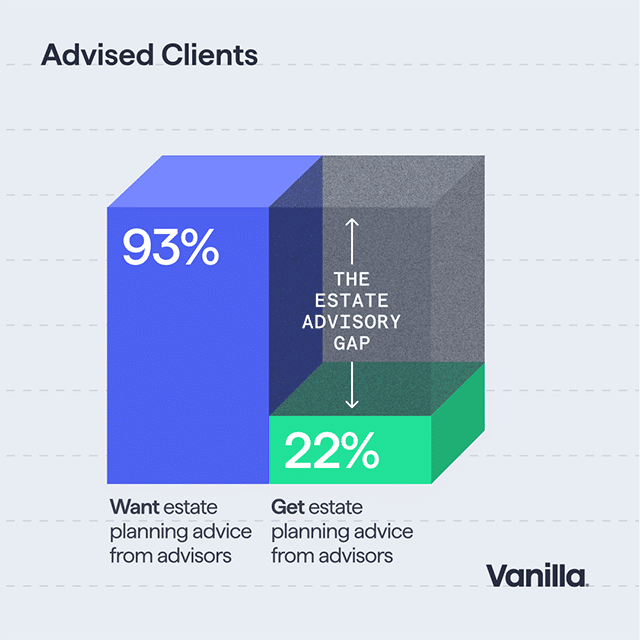

Over the next two decades, $124 trillion will transfer from baby boomers to younger generations. Your clients are part of this colossal shift, and they want help navigating it. Research confirms this: 93% of clients want estate planning advice from their advisor. Beyond the legal structures of estate planning, legacy planning is increasingly a key component of a comprehensive financial plan. Where estate planning focuses on wills, trusts, and tax strategies, legacy planning adds another dimension, addressing personal values, family dynamics, charitable intentions, and the stories your clients want to pass down. Legacy planning: Estate planning plus intent Your clients...

Vanilla

•

Nov 20, 2025

How Advisors Are Moving Upmarket by Redefining Value

Industry data reveals the strategies behind revenue growth in wealth management—and why the most productive advisors serve fewer clients, not more. On November 13th, Vanilla hosted Michael Kitces and Steve Lockshin for a conversation about building thriving practices in today's market. Their insights, backed by decades of industry research and direct experience managing billions in client assets, challenge conventional wisdom about scaling an advisory firm. Below are their key takeaways. The Stability of Advisory Fees The median advisory fee has remained at one percent for over twenty-five years. This benchmark held steady through the introduction of robo-advisors, algorithmic trading,...

Vanilla

•

Nov 18, 2025

A Year of Innovation: Vanilla’s 2025 Highlights & 2026 Vision

This year has been transformative for Vanilla and the advisors we serve. From major product launches to key milestones that strengthened our position as the category-creating estate planning platform, we’ve continued our mission to make comprehensive estate planning accessible and scalable for advisors across all wealth segments. Gene and Sam will walk through: The innovations we shipped in 2025 and what they mean for your practice The moments that defined our year and reinforced our market leadership What’s coming next in 2026 and how we’re building toward the future of estate planning technology We’ll reserve plenty of time for Q&A,...

Vanilla

•

Nov 18, 2025

Vanilla Named a Preferred Estate Planning Technology Partner by Elevation Point

New Partnership Brings State-of-the-Art Estate Planning Tech to Independent Advisors BELLEVUE, Wash.-- Vanilla, a leading estate planning technology platform, today announced its partnership with Elevation Point, a growth accelerator and minority stake partner for independent advisors and breakaway firms. Through the partnership, Vanilla becomes a preferred estate planning software provider for Elevation Point’s network of growth-oriented advisors. Elevation Point partners with successful independent RIAs and breakaway advisors who recognize that continuous growth and innovation are essential to serving the complex needs of high-net-worth and ultra-high-net-worth clients – and to consistently delivering an exceptional client experience. Its collaboration with Vanilla reflects...

Vanilla

•

Nov 11, 2025

What Are the Six Different Types of Power of Attorney?

Choosing the wrong power of attorney (POA) can leave families scrambling during a crisis. Each state has its own rules governing these documents, and understanding which POA is suitable for a situation matters more than most people realize. In this guide, we break down the six main types of POAs for individuals, families, caregivers, financial advisors, and estate planners who need clarity on this essential part of estate planning. 1. General power of attorney A general power of attorney is a legal document that gives one person (called the agent or attorney-in-fact) broad authority over another person’s (called the principal)...

Jennifer Raess JD, CFP®, CLU®

•

Nov 05, 2025

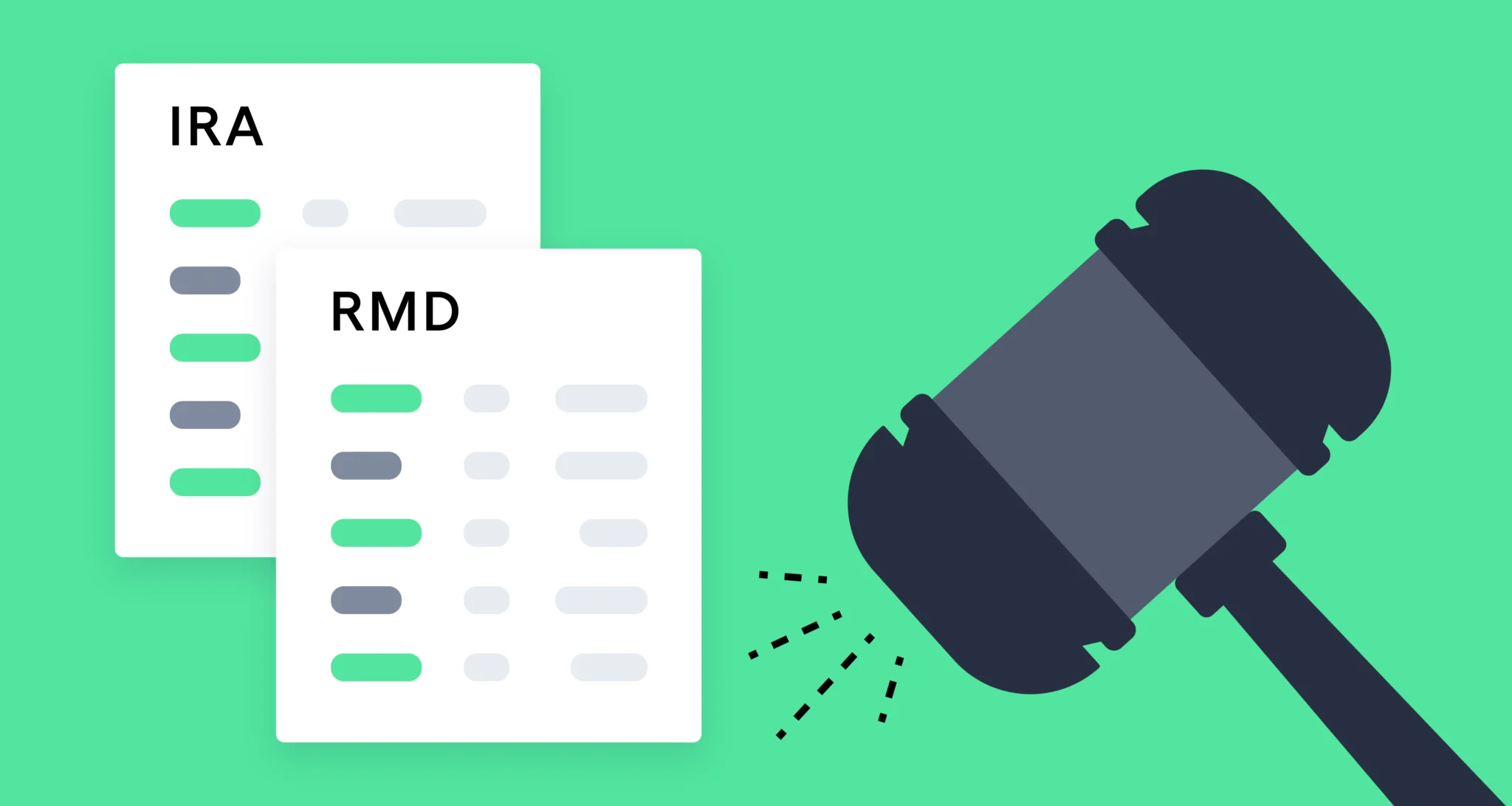

2026 Tax Planning Reset: What Advisors Need to Know About OBBBA and IRS...

The IRS has released its inflation-adjusted numbers for 2026, confirming key updates for estate, gift, and income tax planning. These changes, combined with provisions from the One Big Beautiful Bill Act (OBBBA), will reshape how advisors approach gifting, deductions, and trust taxation. Now is the time for advisors to revisit clients’ estate strategies to prepare for 2026. Here's a snapshot of the key changes advisors need to know: 2026 Changes at a Glance Category 2025 2026 Lifetime estate & gift exemption $13.99M/person $27.98M/married couple $15M/person $30M/married couple Annual gift exclusion $19,000/ $38,000 if gift splitting $19,000/ $38,000 if gift splitting...

Vanilla

•

Oct 31, 2025

A Guide to Gifting (Charitable)

Making lifetime gifts is one of the most common, tried-and-true strategies to reduce estate tax liability. We’ll walk you through the major types of charitable gifts that you might want to consider, as this year draws to an end.

Jessica Lantz

•

Oct 29, 2025

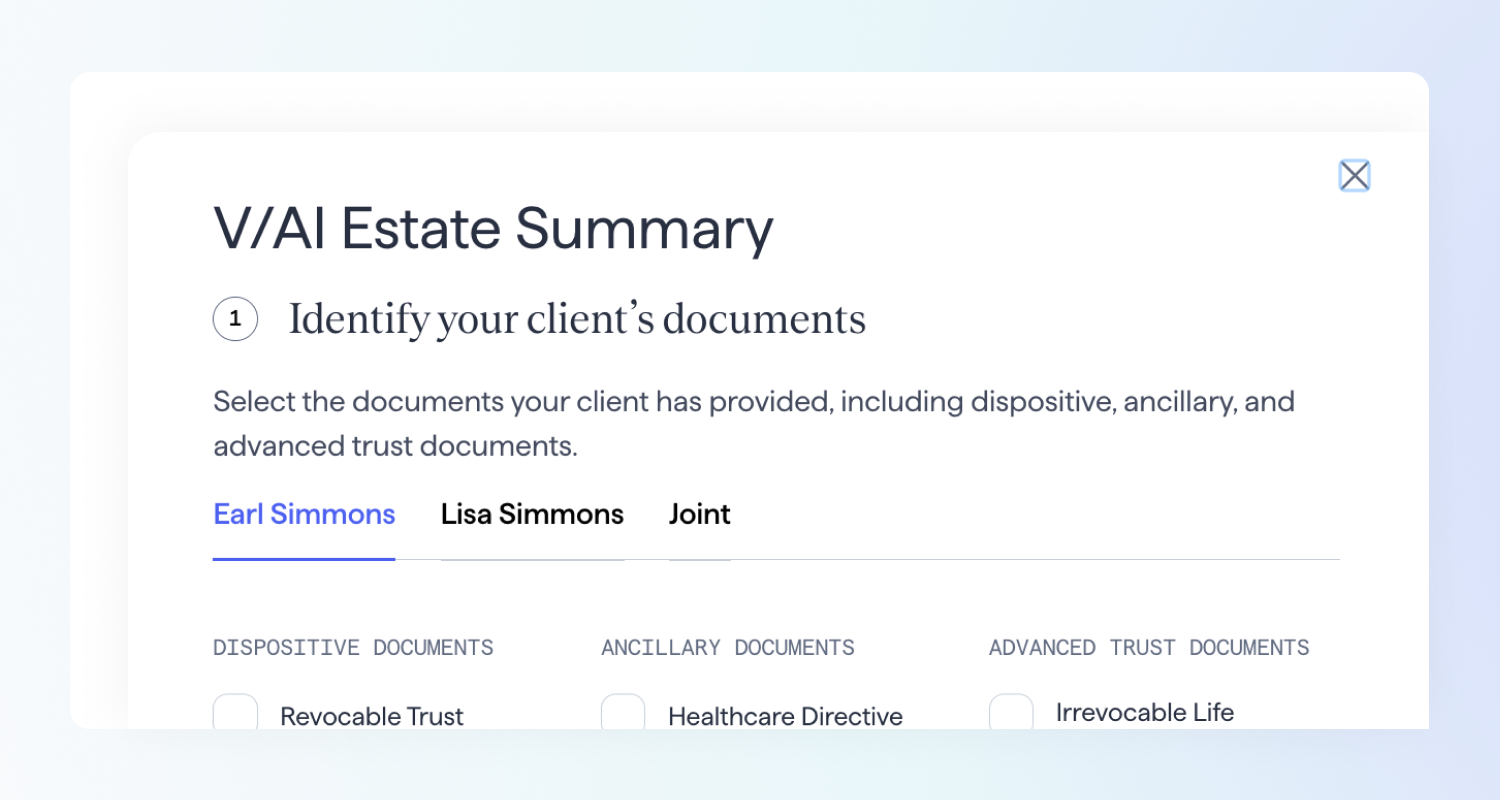

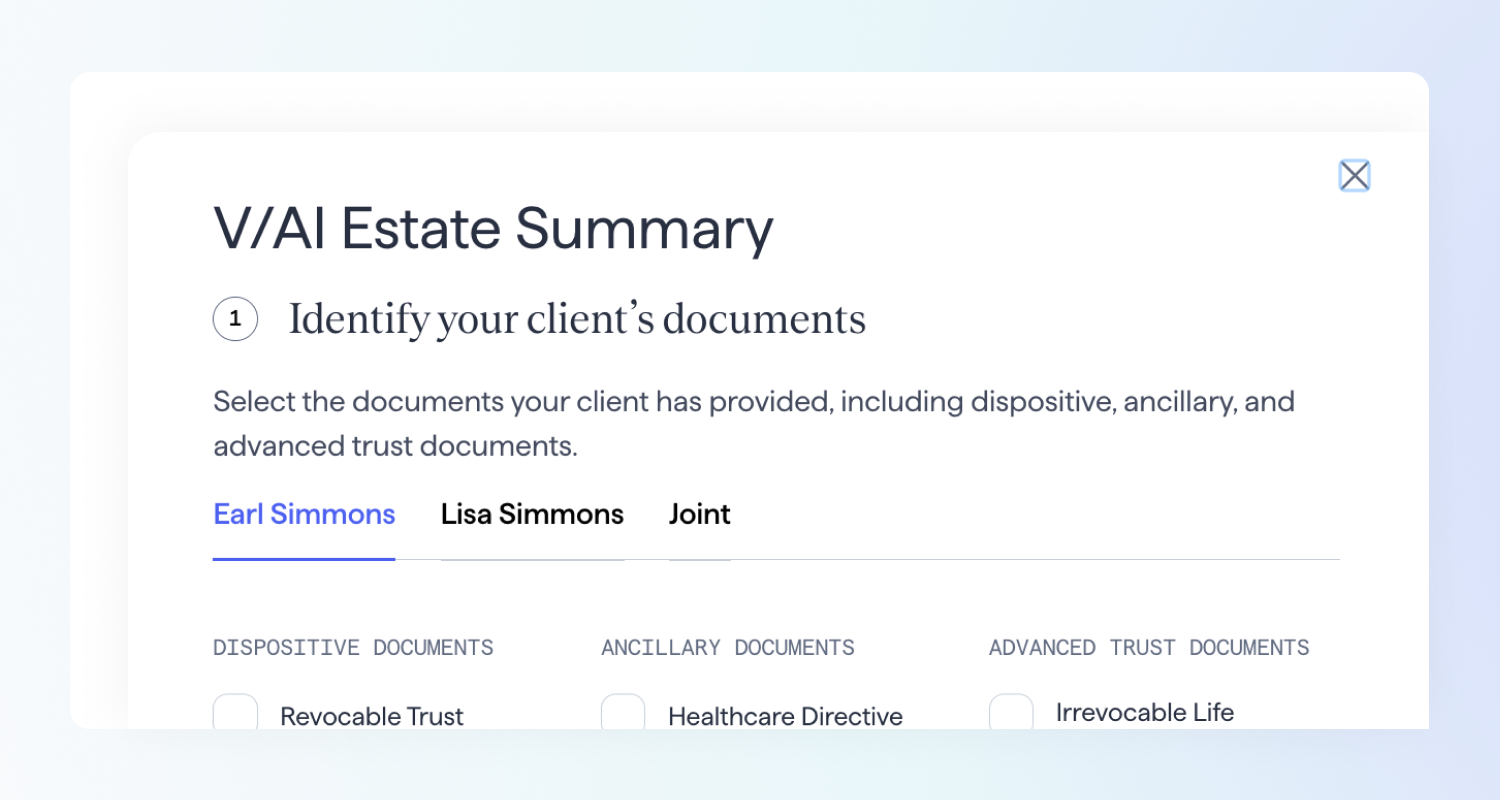

What’s New in October: V/AI Estate Summary page improvements, waterfall enhancements, and more!

October brings meaningful enhancements to Vanilla—from enhanced AI estate summary capabilities to more intuitive waterfall modeling. Each improvement is designed to help you work faster and deliver deeper insights to your clients. Here's what's coming soon. V/AI Estate Summary page improvements: More control, better readability, clearer insights The challenge: Advisors need AI-generated summaries that are easy to scan, read, and present to clients without extensive reformatting. The solution: Enhanced typography and spacing create a more visually appealing, scannable layout that makes key information immediately more readable V/AI will clearly show which documents were used to generate the summary, building your...

Jennifer Raess JD, CFP®, CLU®

•

Oct 28, 2025

The OBBBA Clock Is Ticking: Why 2025 Might be the Year to Act...

The One Big Beautiful Bill Act (OBBBA), signed into law in July 2025, introduces some significant charitable giving changes starting in 2026. It expands opportunities for everyday donors while tightening limits for high-income taxpayers. With year-end approaching, advisors should review these shifts now to help clients maximize charitable impact and tax benefits before the new rules take effect in 2026. The impact of these changes will vary depending on whether clients itemize their deductions, making it important to tailor charitable strategies accordingly. New rule for non-itemizing individuals Starting in 2026, taxpayers who take the standard deduction can claim an "above-the-line"...

Vanilla

•

Oct 16, 2025

Redefining Advisor Value: A Conversation on Productivity, Pricing, and Moving Upmarket

Join industry thought leaders Michael Kitces and Steve Lockshin for a live fireside chat and Q&A on Nov. 13th. They’ll unpack the evolving landscape of financial advice—from the realities of advisor productivity to the enduring importance of estate planning. In an era where advisors are expanding their services and redefining value, Kitces and Lockshin will explore what it really takes to move upmarket, scale efficiently, and deliver deeper client impact. Drawing on decades of experience, they’ll separate myth from reality around fee compression, discuss how holistic planning drives growth, and highlight why estate planning remains a cornerstone of exceptional client...

Vanilla

•

Oct 09, 2025

A Differentiated Approach: How Robertson Stephens Stands Out with Estate Planning

In a crowded marketplace of advisory firms, going the extra mile for clients can be the difference between multi-generational retention and losing out to competitors. At Robertson Stephens, Mallon FitzPatrick is prioritizing client success and satisfaction through white glove estate planning services supported by Vanilla. Join us to hear how Mallon, who was recently named a Finalist for Thought Leader of the Year in the ThinkAdvisor Luminaries, is driving long-term success for Robertson Stephens through strategic differentiation and client centricity. Together with Vanilla’s Laura Jogani, Mallon will discuss: The framework behind Robertson Stephens’ differentiated approach to planning and what sets...

Vanilla

•

Oct 08, 2025

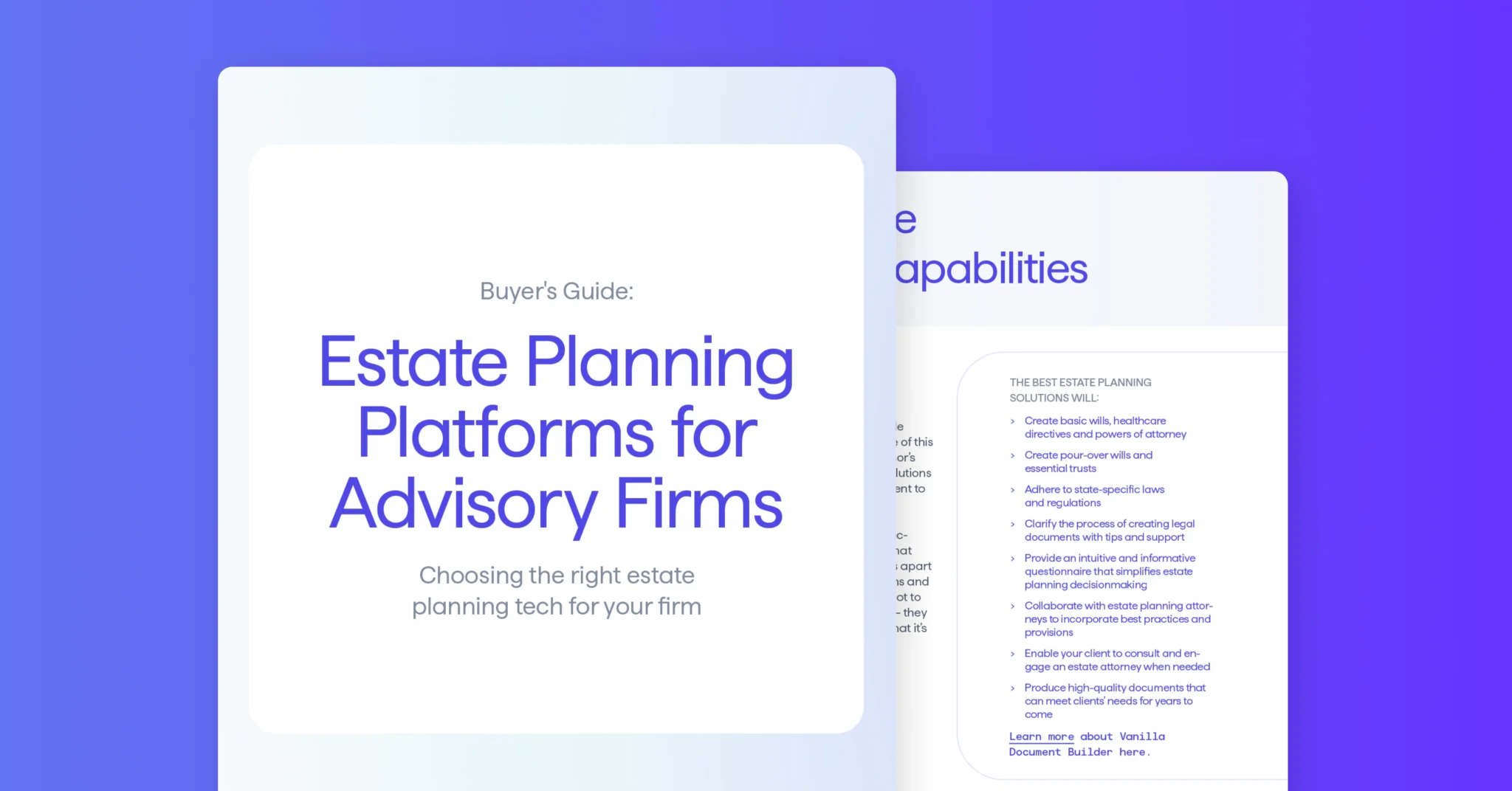

10 Questions Every Advisor Should Ask Before Choosing an Estate Planning Solution

By nature, the practice of estate planning has a level of seriousness and substantiality that few other advisor-client conversations will ever reach. When you bring technology into that process, you want to make sure it reflects the importance of the topic at hand. Choosing an estate planning software that brings the appropriate credibility and accuracy is no small task, and it’s easy to get lost in the details when comparing solutions. To help cut through the noise, we built the Buyer’s Guide to Estate Planning Platforms for Advisory Firms, which walks through the criteria to consider when choosing a solution...

Vanilla

•

Oct 07, 2025

Vanilla Approved by Osaic as a Comprehensive Estate Planning Solutions Provider to Over...

The partnership empowers Osaic's advisor network with cutting-edge estate planning technology to enhance client relationships and drive holistic wealth management BELLEVUE, Wash.--Vanilla, the most trusted modern estate planning platform for financial advisors, today announced a strategic partnership with Osaic, Inc. (Osaic), one of the nation's largest providers of wealth management solutions. Through this partnership, Osaic's national network of more than 11,000 financial advisors can now access Vanilla's comprehensive estate planning platform to streamline complex processes, create compelling planning scenarios, and deliver more meaningful, results-focused client experiences. "Estate planning has become essential to comprehensive wealth management, especially as our clients navigate...

Vanilla

•

Oct 03, 2025

Vanilla Appoints Larry Steinberg as Chief Technology Officer

We’re excited to announce that Larry Steinberg has joined Vanilla as our new Chief Technology Officer (CTO). Larry brings decades of technology and business leadership experience, from founding and scaling startups to guiding global tech organizations through major transformation. His career reflects a consistent track record of building high-performing teams, modernizing technology platforms, and driving innovation to accelerate business growth. A proven technology leader Most recently, Larry served as CTO at Spring Health, where he led the company’s technology strategy and operations. Before that, he was CTO at Rent the Runway, playing a pivotal role in preparing the company for...

Sarah D. McDaniel, CFA

•

Oct 01, 2025

Changes in Interest Rates and Why Estate Planning Reviews Matter

The Federal Reserve's September 2025 rate cut may create planning opportunities The Federal Reserve's recent quarter-point reduction to 4.00%-4.25% represents the first rate cut of 2025 with Fed projections indicating additional cuts may follow later this year. While these monetary policy shifts primarily target economic conditions, they create significant ripple effects throughout the estate planning landscape that may warrant immediate attention. Why interest rates drive estate planning effectiveness Estate planning isn't a "set it and forget it" process. The effectiveness of wealth transfer strategies fluctuates dramatically based on prevailing interest rate environments, making periodic reviews essential—particularly during periods of monetary...

Citywire RIA

•

Sep 30, 2025

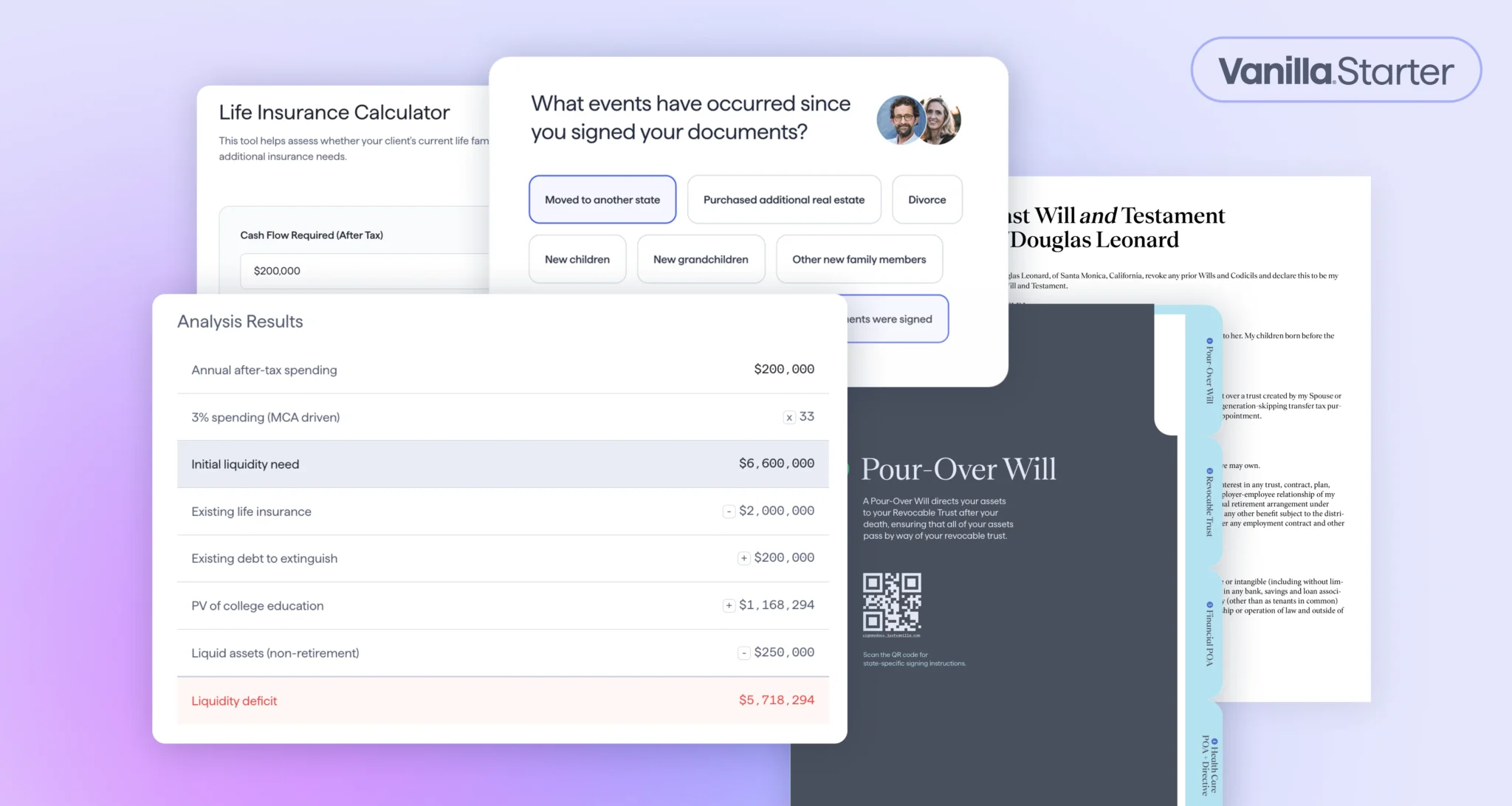

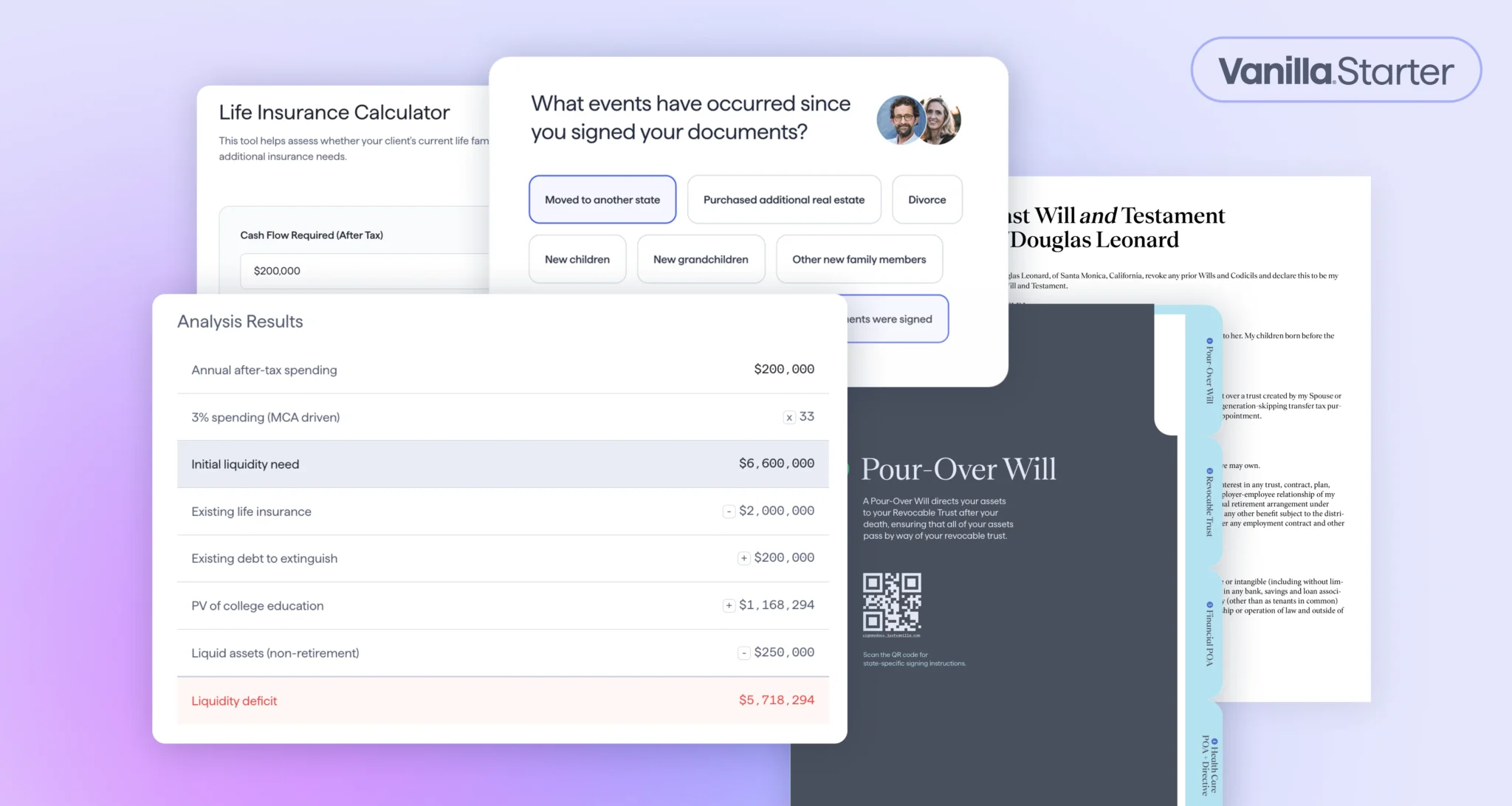

Vanilla moves downstream with boutique subscription offering

Gene Farrell, Vanilla's chief executive, told Citywire that the mass affluent offering differentiates the estate planning tech company from its peers in the space and fills a need for small RIAs. In a push to cater to a wider base of advisors, estate planning technology firm Vanilla revealed on Tuesday it is launching a subscription offering for boutique RIAs. The plan, called Vanilla Starter, will be rolled out in October for a monthly price of $99 and is geared toward both solo practices and small RIAs. Built on Vanilla’s existing estate document software platform, Vanilla Starter will provide...

Vanilla

•

Sep 30, 2025

Vanilla Opens Waitlist for Vanilla Starter: Essential Estate Planning Technology for Independent RIAs

New offering brings institutional-grade estate planning capabilities to boutique advisory firms at accessible pricing BELLEVUE, Wash.--Vanilla, the leading estate planning technology platform trusted by several of the country’s largest wealth management firms, today announced the opening of the waitlist for Vanilla Starter, a groundbreaking solution designed to make professional estate planning services accessible for boutique RIA firms. Built on the same proven, institutional-grade technology that serves ultra-high-net-worth clients, Vanilla Starter will launch with pricing starting at $99 per month. Solo practices and small RIA firms have long faced a critical challenge: wanting to offer estate planning services in-house but lacking...

Vanilla

•

Sep 29, 2025

What Is a Spendthrift Trust and How Do You Set One Up?

Many families worry about what will happen to wealth after it passes to the next generation. There may be concerns about poor financial decision-making, personal debts, unstable relationships, or even exposure to lawsuits. In some cases, some traditional estate planning strategies may not offer enough protection if beneficiaries are financially vulnerable. In these situations, there are additional legal structures that can be used to help protect wealth from being misused, mismanaged, or lost to credits when it passes to future generations. This article will offer a detailed overview of one of the most effective tools for balancing long-term support with...

Vanilla

•

Sep 25, 2025

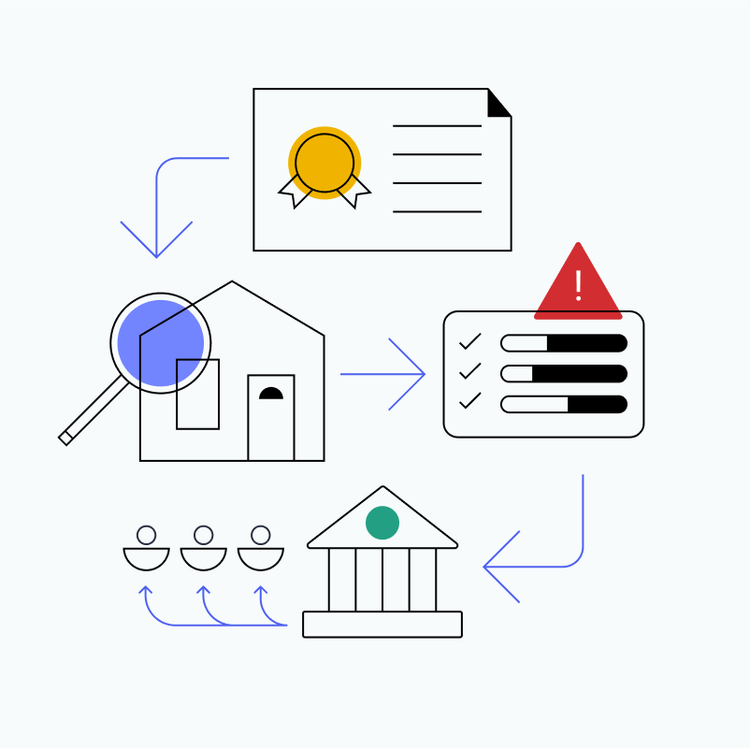

45,000 Documents Later: The Most Common Estate Planning Mistakes

Estate planning is one of the most impactful ways advisors can help clients protect their families, preserve wealth, and ensure their intentions are honored. Yet, despite its importance, we’ve seen time and again that estate plans—even carefully drafted ones—often contain blind spots. At Vanilla, we’ve abstracted over 45,000 estate planning documents. This vantage point provides a unique window into the recurring mistakes and oversights that surface in client plans. For advisors, understanding these pitfalls is critical not just for catching errors, but also for building trust and proactively guiding clients through difficult conversations. Below are the most common mistakes we...

Jessica Lantz

•

Sep 23, 2025

What’s New in September: Nationwide Inheritance Tax Calculations, New V/AI Features, and more!

This month's release tackles the friction points you've told us about—from inconsistent AI results across your team to managing multi-state inheritance tax requirements. Each enhancement works seamlessly with your existing processes while expanding what's possible. Here’s what came out in September, along with some features that are coming soon. Nationwide inheritance tax: Never miss inheritance tax implications again The challenge: Advisors with multi-state clients manually track varying inheritance tax rules across jurisdictions, risking costly oversights and planning errors. The solution: Vanilla is introducing inheritance tax calculation support for Maryland, Nebraska, and New Jersey—completing our nationwide coverage Automated, state-specific calculations integrate...

Vanilla

•

Sep 10, 2025

Betterment Advisor Solutions Launches Partnership with Vanilla to Make Advanced Estate Planning Technology...

New York, NY - September 10, 2025 - Betterment Advisor Solutions, an all-in-one custodian for modern RIAs, today announced a new partnership with Vanilla, the modern estate planning solution for advisors. Through this partnership, advisors who custody assets with Betterment Advisor Solutions will have special access to the Vanilla platform in addition to exclusive educational opportunities with Vanilla’s team of estate planning experts. Vanilla’s tools enable advisors to offer customized estate planning services at scale to clients across all wealth levels. “Having the right technology in place can make or break an advisory firm, and we want advisors to have...

Vanilla

•

Sep 09, 2025

4 Lessons from Steve Lockshin’s Estate Planning Playbook

As an advisor, you probably know how rare it is to retain AUM after the death of the primary wealthholder. You may also know that there’s a proven way to decrease the likelihood of getting fired when the relationship passes to a surviving spouse or the next generation: estate planning. Advisors who engage their clients and clients’ families in estate planning are more likely to retain assets as they transfer to a surviving spouse or next generation. If wading into the waters of estate planning with clients seems intimidating, we have practical advice for navigating these conversations and processes. Here,...

Vanilla

•

Sep 05, 2025

Vanilla’s Industry Leadership Recognized with Two 2025 Wealthies Awards

Bellevue, WA — September 5, 2025 — Vanilla, the most trusted estate planning platform for advisors, today announced it was a two-time winner at the 2025 Wealth Management Industry Awards (the “Wealthies”), held on September 4, 2025 in New York City. Vanilla’s was recognized for the following categories and achievements: Advisor Service and Support category: Document Abstraction Services Thought Leadership Category: The State of Estate Planning Report 2025 These prestigious awards highlight Vanilla’s ongoing leadership in delivering innovative solutions to advisors and thought leadership to the broader wealth management community. "We are extremely proud to once again be recognized by...

Vanilla

•

Sep 03, 2025

10 Helpful Benefits of Trusts You Should Know

Trusts are one of the most versatile and frequently used tools in estate planning. Not only do they help clients protect their wealth, they can also provide clarity, flexibility, and peace of mind for families. Whether you work with high-net-worth clients, blended families, or individuals who simply want more control over their legacy, trusts offer benefits that go far beyond what a will alone can accomplish. In this article, we’ll explore 10 helpful benefits of trusts you should know, and the strategic advantages each offers for clients. 1. Avoiding probate saves time and costs Probate is the court-supervised process of...

Vanilla

•

Aug 22, 2025

Lifespan & Legacy: The Role of Life Insurance in Estate Planning

Life insurance is a critical aspect of any client’s estate plan, no matter their age or wealth-level. But how exactly does life insurance fit into a client’s broader estate and financial picture, and how can advisor support this aspect of planning? Join Vanilla and Allianz for a webinar exploring the intersection of estate planning and life insurance, where we’ll cover what advisors need to know about life insurance planning. Topics will include: How life insurance fits into the estate plan, including liquidity, tax efficiency, wealth transfer Term vs. permanent insurance, and which makes sense for clients Common mistakes when life...

Vanilla

•

Aug 22, 2025

Vanilla Shortlisted for “Disruptor of the Year” in 2025 US FinTech Awards

Bellevue, WA, August 22, 2025 – Vanilla, the most trusted estate planning platform for financial advisors, today announced it has been shortlisted for Disruptor of the Year in the 2025 US FinTech Awards. This recognition highlights Vanilla’s leading role in redefining how estate planning is integrated into wealth management and delivered at scale. Estate planning has long been disconnected from everyday financial advice, making it feel inaccessible to many advisors and clients. Vanilla’s patented technology is changing that. By transforming dense, complex legal documents into instantly digestible, interactive visuals, Vanilla empowers advisors to have deeper, values-based conversations with clients about...

Vanilla

•

Aug 20, 2025

What Are Letters of Administration and How to Obtain Them

When someone passes away without a valid will, it can create significant challenges for their heirs and loved ones. Letters of administration are provided by the probate court once an estate is opened and are crucial in such cases as they grant the legal authority to an individual to manage and settle the deceased’s estate. In the absence of a will, obtaining a letter of administration is the first step in the probate process. Letters of administration give the estate’s executor the power to handle the deceased’s financial obligations, sell property, and distribute the estate to its heirs in accordance...

Financial Advisor

•

Aug 13, 2025

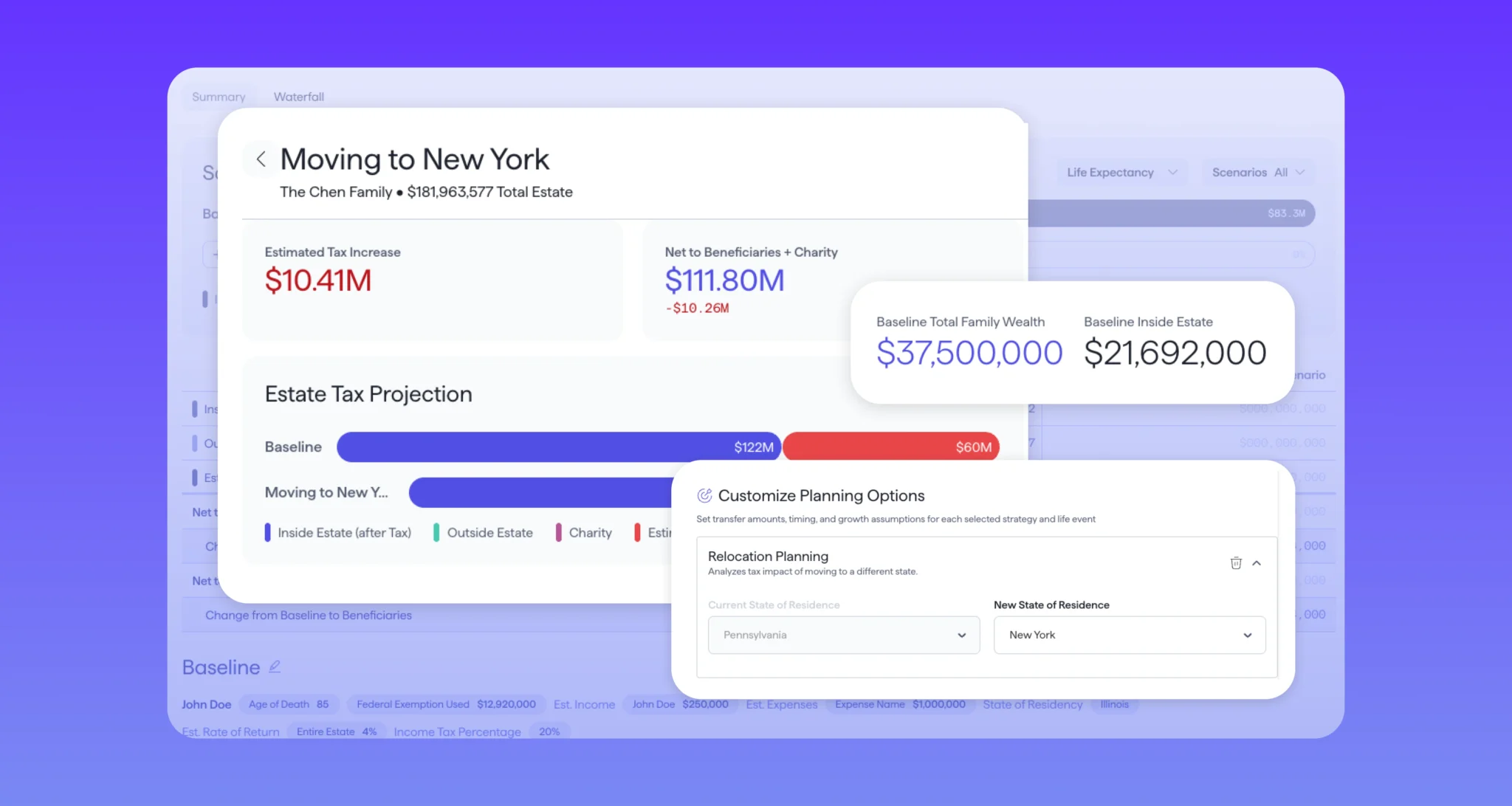

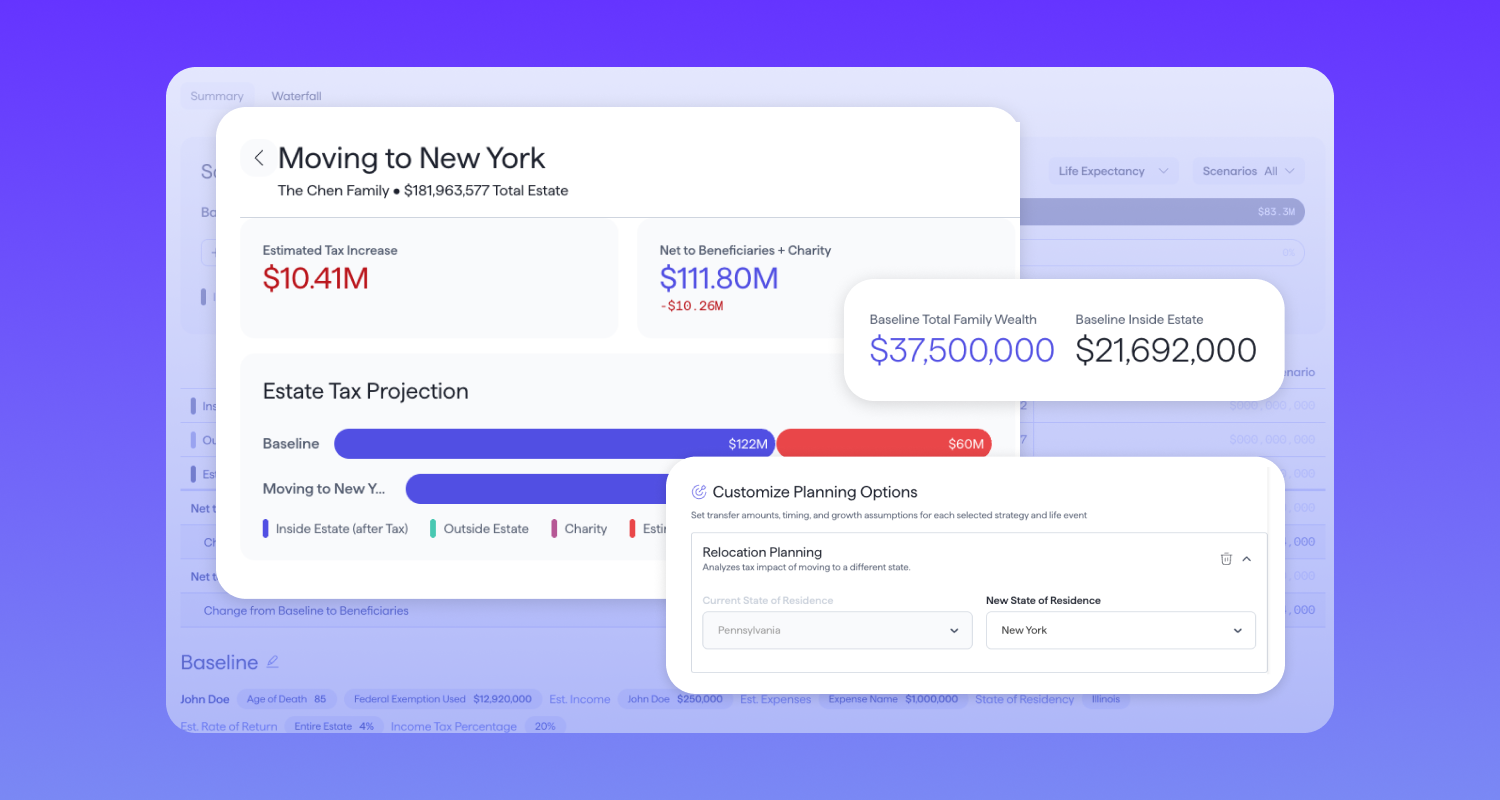

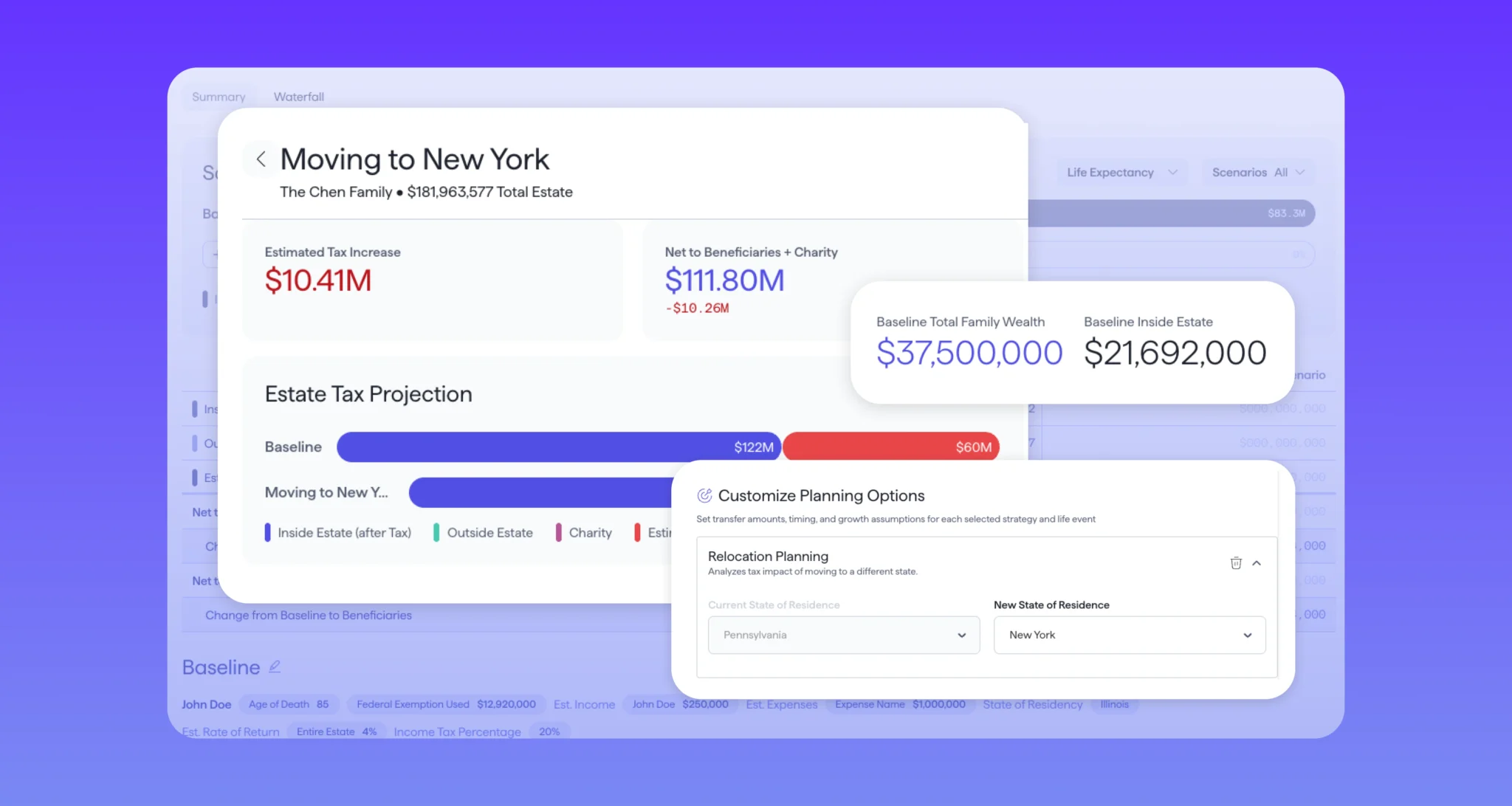

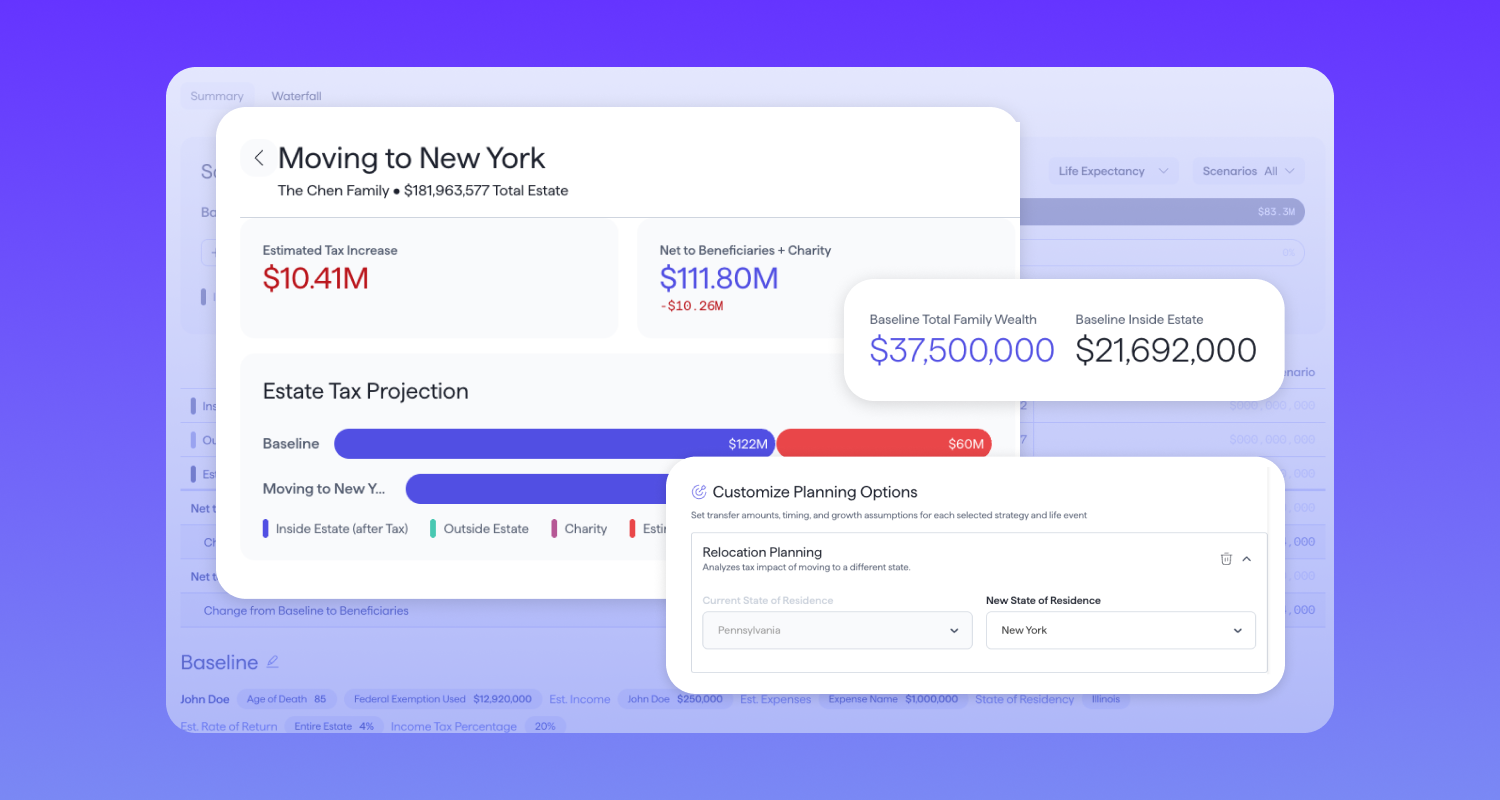

Vanilla Rolls Out Estate Planning Scenarios Tool For Advisors

Vanilla, an estate planning technology firm, has introduced a new tool advisors can use with existing and potential clients to illustrate what their retirement plans will look like under various scenarios, such as when they are subject to estate taxes in various areas. Vanilla Scenarios Advanced Planning is an all-in-one financial planning tool that models, compares, and presents estate planning strategies instantaneously for advisors. Advisors can plug in as much information as they have on their clients and examine multiple scenarios to determine how these would change the overall plan. Advisors can incorporate major changes that take place...

Vanilla

•

Aug 12, 2025

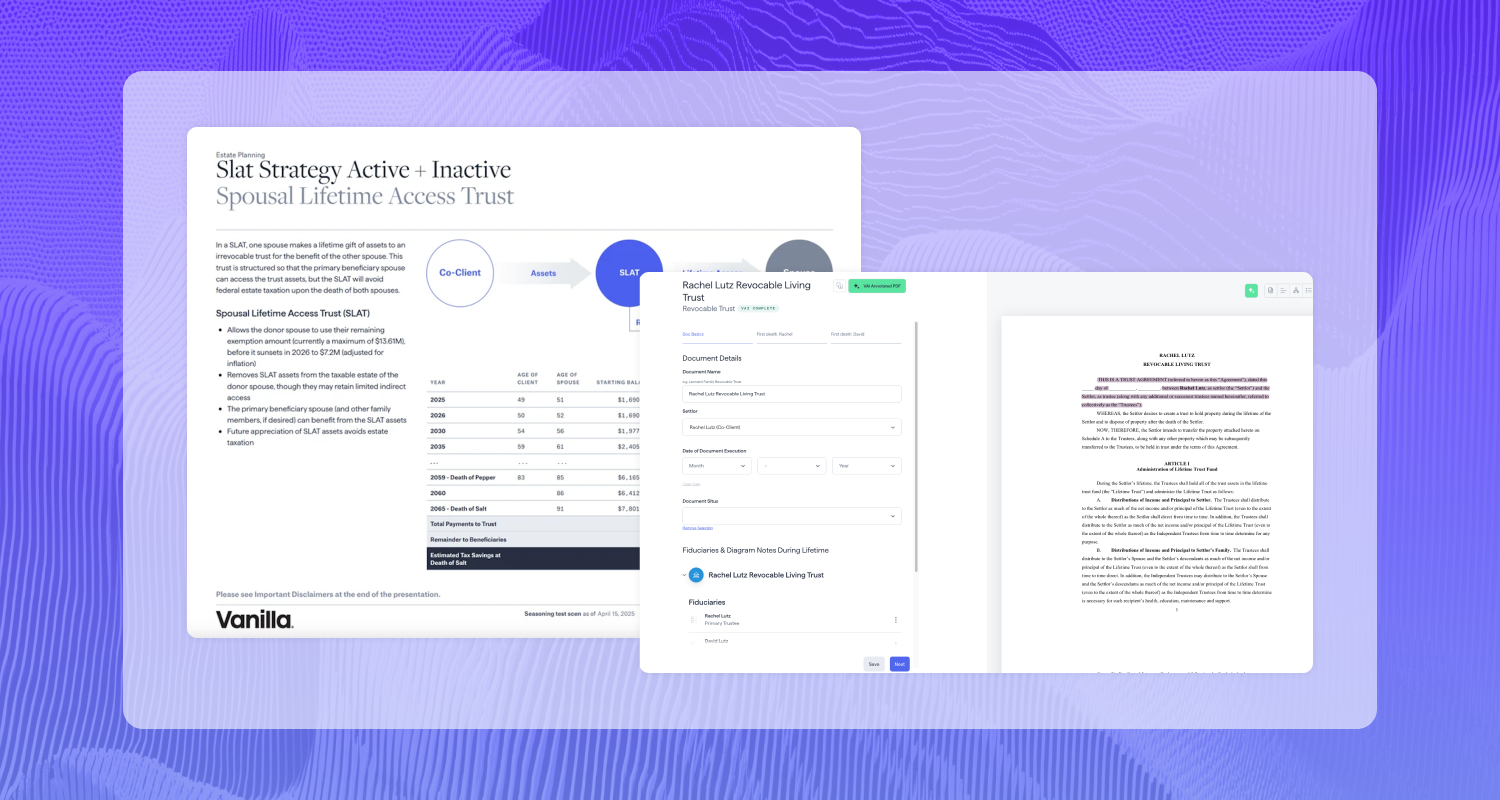

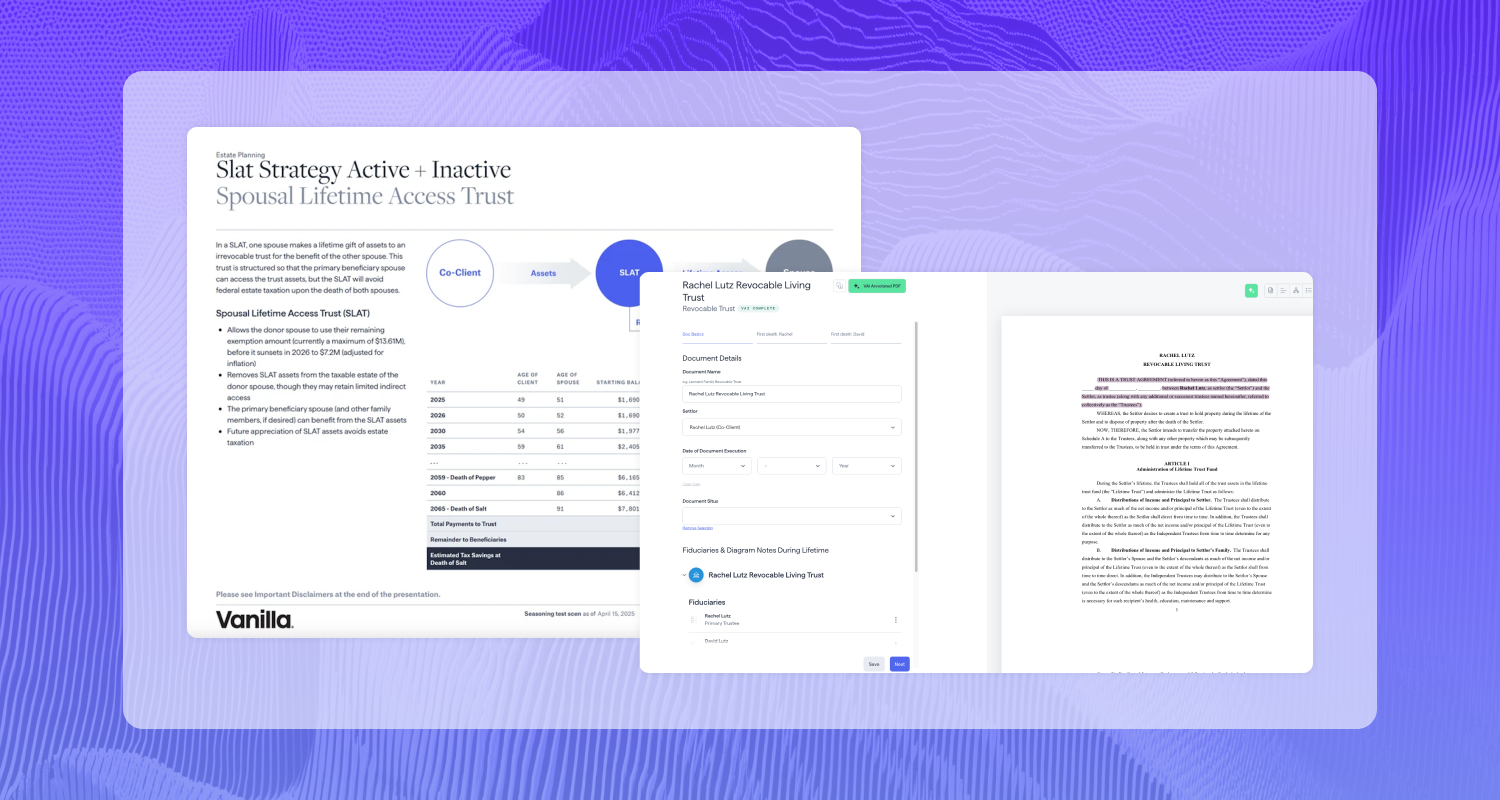

Vanilla Unveils Vanilla Scenarios™ Advanced Planning: The First Instant Modeling and Unified Workflow...

Advanced capabilities enable advisors to model complex estate planning strategies in minutes, transforming client conversations into collaborative planning sessions Bellevue, WA – August 12, 2025 – Vanilla, the leading provider of estate planning technology for advisors, today announced Vanilla Scenarios™ Advanced Planning, the next evolution of its all-in-one scenario planning tool. Building on the strong foundation established since its introduction in April 2024, this evolution of Vanilla Scenarios™️ delivers a more unified experience that enables financial advisors to model, compare, and present estate planning strategies with unprecedented speed and flexibility. Vanilla Scenarios™ Advanced Planning represents the most advanced estate planning...

Jessica Lantz

•

Aug 12, 2025

The Future of Estate Planning is Here: Introducing Vanilla Scenarios™ Advanced Planning

From first conversation to comprehensive strategy in minutes—powered by proven expertise and unmatched accuracy Today, we're excited to introduce Vanilla Scenarios™️ Advanced Planning—the next evolution of our all-in-one scenario planning tool that sets the standard for estate planning innovation. Building on success Over the past year, we've seen advisors achieve remarkable results with Vanilla Scenarios. But we've also heard a consistent request: make it even faster to get started, even more flexible for different workflows, and even more powerful for client conversations. The estate planning industry still faces fundamental challenges: fragmented tools that don't talk to each other, lengthy setup...

Vanilla

•

Aug 06, 2025

12 Probate Documents to Include in Your Probate Checklist

Probate—the court process of settling an estate—can be a complicated, time-consuming process. It’s also document-heavy. Having all the necessary documents in order can help streamline probate, reducing potential conflicts and hang ups. [embed]https://justvanilla.wistia.com/medias/vd3bfy1xvp[/embed] There are 12 essential documents that should be part of every probate checklist, each of which plays a part in ensuring the estate is properly administered and that the decedent’s wishes are honored. In this article, you’ll learn what each document is, how to obtain it, and what purpose it serves. Making sure you have and understand all the necessary documents can help make probate a smoother...

Vanilla

•

Aug 05, 2025

Estate Planning for Advisors: Foundational Concepts and Best Practices

Tune in for this estate planning 101 course with Vanilla’s expert team. We’ll cover all the basics an advisor needs to know about estate planning, from core documents to common types of trusts. Plus, we’ll take a look at the soft skills an advisor needs to hone to start having these important conversations with clients. Whether you’re exploring the idea of adding estate planning to your firm’s offering or just need a refresher on the basics, this CE-eligible course will offer a valuable overview of estate planning topics geared toward advisors. Topics will include: Intro to estate planning, core documents,...

Jessica Lantz

•

Jul 29, 2025

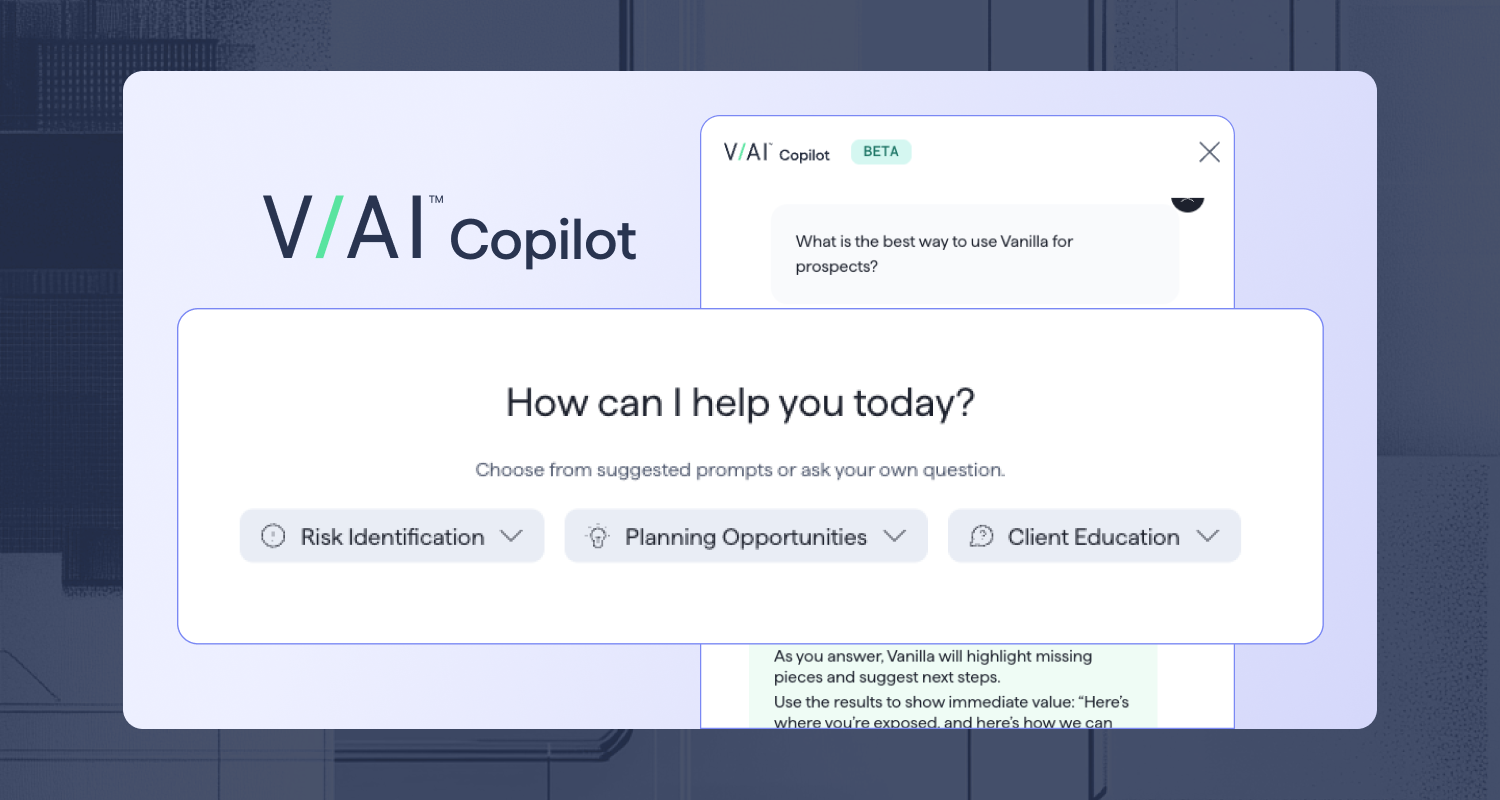

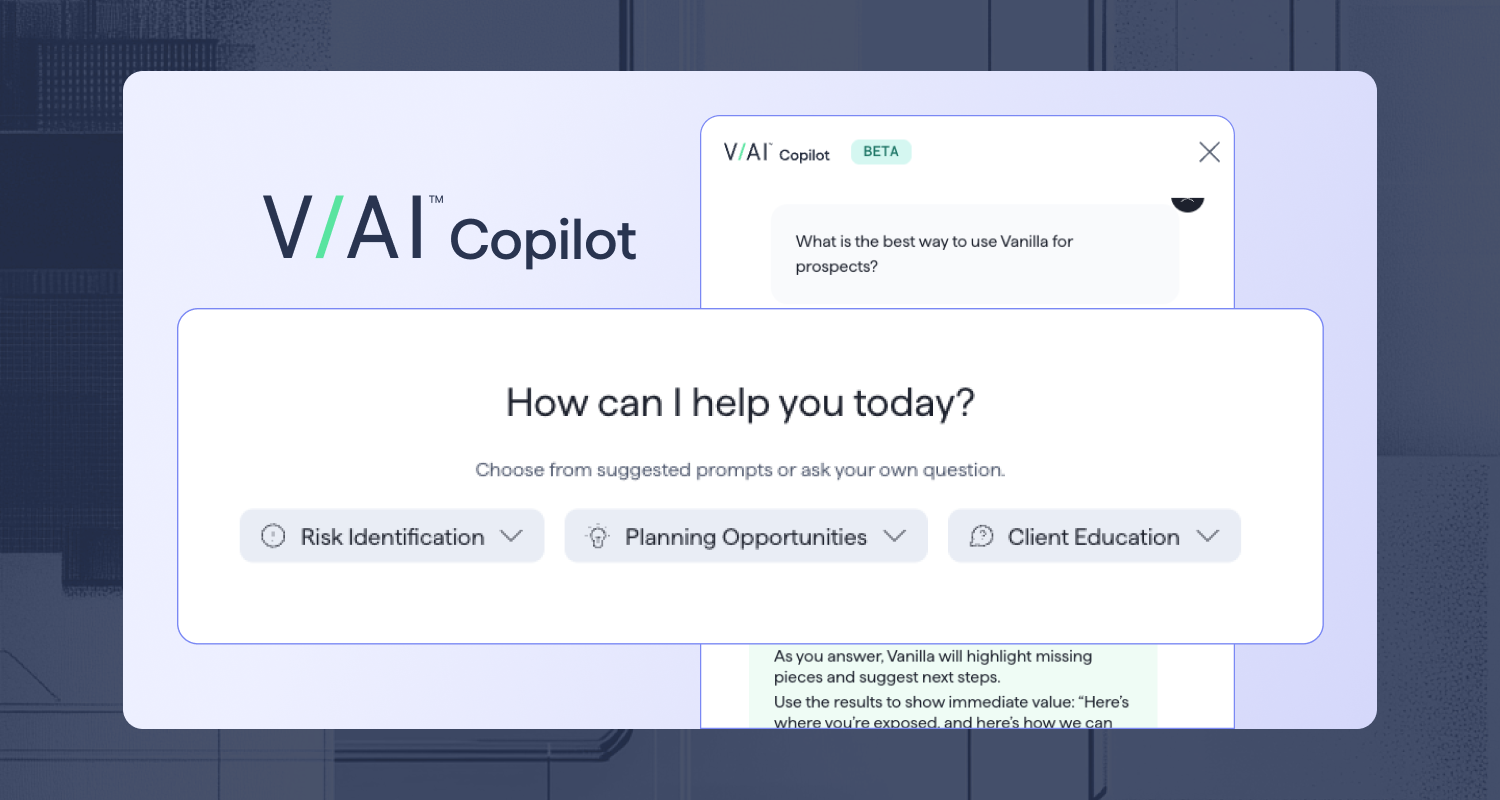

What’s New in July: Updates to V/AI, enhanced integrations, and a sneak peek...

We’re launching some serious upgrades for July! This month's releases focus on expanding AI capabilities, customizing Vanilla's appearance, and enhancing your integration experience – plus, catch a special preview of our most sophisticated planning tool yet. V/AI enhancements: Your AI estate planning assistant just got smarter We’re excited to announce some game-changing updates to V/AI Copilot, and an upgraded version of V/AI Summaries this month. The Problem: Estate planning requires deep analysis across multiple data points—from financial structures to family dynamics—and advisors need AI that can provide comprehensive insights across multiple areas of a client's profile and for multiple types...

ThinkAdvisor

•

Jul 25, 2025

Vanilla Granted Patent for Its Estate Planning Technology

Vanilla, an estate planning platform, says it had received a U.S. patent for its event-based resource allocation system. The proprietary technology underpins many of the platform’s advanced capabilities, including report automation, waterfall calculations, estate visualizations and abstractions, the company said Thursday. "This patent represents years of innovation in solving one of the most persistent challenges in estate planning — keeping plans current and accurate in an ever-changing world," said Amjad Hussain, lead inventor and Vanilla CTO. "Our system transforms static estate documents into dynamic, responsive plans that seamlessly adjust to life events and regulatory changes." Read more: Vanilla...

Vanilla

•

Jul 24, 2025

Vanilla Secures US Patent for Groundbreaking Estate Planning Technology for Financial Advisors

Bellevue, WA — July 24, 2025 — Vanilla, the modern estate planning platform that simplifies and elevates the advisor-client experience, announced today that it has been granted a U.S. patent for its innovative event-based resource allocation system. This proprietary technology underpins many of the platform’s most advanced capabilities, including report automation, waterfall calculations, estate visualizations and abstractions, and AI-powered opportunity discovery. The patented system represents a major breakthrough in estate planning technology, utilizing advanced machine learning models and real-time event processing to transform how financial advisors manage and allocate client resources. This technology addresses the complex challenges of estate planning...

Vanilla

•

Jul 23, 2025

Starting the Conversation: 12 Estate Planning Questions to Ask Clients

Estate planning is one of the most important conversations you'll have with your clients, yet it's often one of the most overlooked. While many people think estate planning is simply about filling out forms and signing documents, the reality is far more nuanced. True estate planning begins with understanding what your clients truly value and ensuring their deepest wishes are reflected in their plan. The key to successful estate planning lies in asking the right questions during that crucial initial consultation to help you understand not just your client's financial situation, but their hopes, fears, and long-term goals for their...

Jacob Halpern

•

Jul 15, 2025

A guide to non-charitable gifting (Brandable PowerPoint)

Making lifetime gifts is one of the most common, tried-and-true strategies to reduce estate tax liability. We’ll walk you through the major types of non-charitable gifts that you might want to consider, as this year draws to an end.

Vanilla

•

Jul 11, 2025

Why estate planning matters

Win new clients by downloading and sending this presentation to potential clients and prospects alike. It can help them understand why estate planning matters and how you, as their trusted advisor, can make the process as simple as possible by using Vanilla.

Vanilla

•

Jul 11, 2025

A Guide to Gifting (Non-Charitable)

Making lifetime gifts is one of the most common, tried-and-true strategies to reduce estate tax liability. We’ll walk you through the major types of non-charitable gifts that you might want to consider, as this year draws to an end.

Vanilla

•

Jul 11, 2025

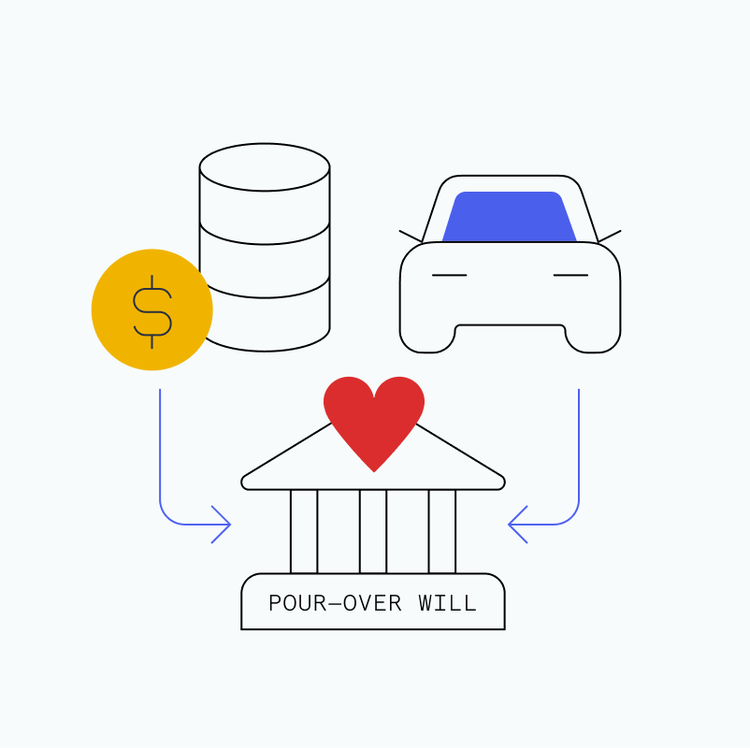

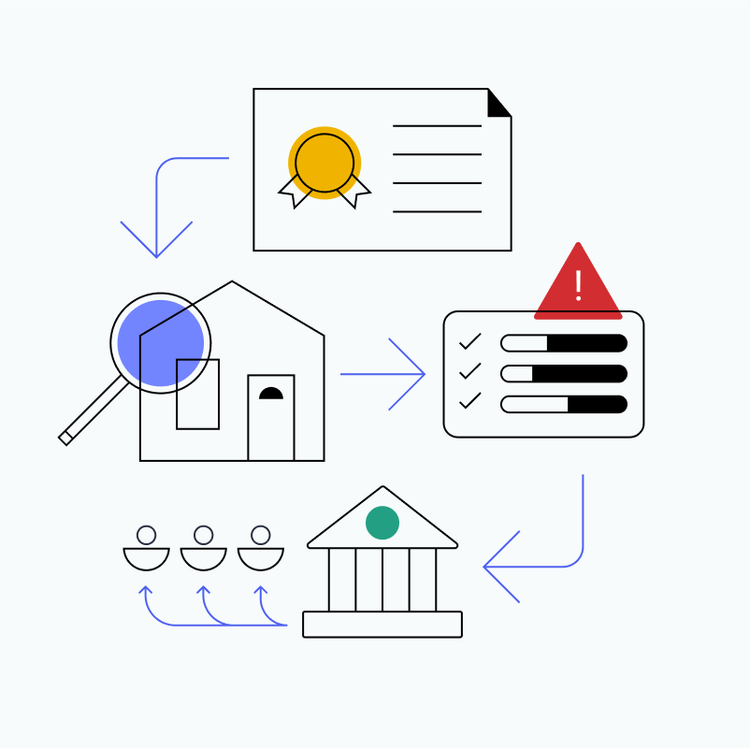

Does a Will Avoid Probate? The Truth and Common Misconceptions

A persistent, common misconception is the belief that having a will helps to avoid probate. Clients frequently assume their carefully crafted will protects their family from probate and its potentially lengthy court proceedings, expensive legal fees, and public disclosure of financial information. The truth often surprises clients: wills require probate to be legally effective in most situations. Understanding this relationship, and knowing how to educate clients about effective probate avoidance strategies, can significantly improve your advisory relationships while helping families achieve their actual estate planning goals. Why probate avoidance matters to your clients It's crucial to understand why probate avoidance...

Vanilla

•

Jul 10, 2025

Top 8 Benefits of Estate Planning (And Why It Matters)

Introduction Imagine a family caught off guard by the sudden loss of a loved one—left scrambling to make legal decisions, untangle financial assets, and settle emotional disputes without a clear plan. Unfortunately, this is a common reality for families without an estate plan. Many people delay or avoid estate planning due to common misconceptions: “It’s only for the wealthy,” or “I’m too young to need it.” In truth, estate planning is not just for the ultra-rich or elderly—it’s a critical process that benefits people of all ages and financial backgrounds. Whether you want to protect your children, support a charitable...

Patrick Carlson, JD, LLM

•

Jul 10, 2025

Estate Planning Under the Big Beautiful Bill

The landscape of estate planning has shifted dramatically with the passage of the One Big Beautiful Bill Act (OBBBA). For financial advisors, understanding these changes is crucial for guiding clients through a new era of permanent estate tax rules that fundamentally alter planning strategies. The game has changed: OBBBA rewrites estate tax rules The OBBBA eliminates the looming 2026 sunset provision and establishes permanent estate tax rules with a $15 million federal exemption per person starting in 2026, rather than the estimated $7.3 million that would have resulted from the sunset. This isn't just a temporary reprieve—it's a complete restructuring...

Vanilla

•

Jul 01, 2025

Winning the next generation of wealth holders

The wealth management landscape is undergoing a seismic shift, and advisors who want their firms to thrive in the future need to pay attention. Join us for a candid fireside chat featuring Ron Bullis, Founder & CEO of Lifeworks Advisors and the Future of Advice Academy, in conversation with Michael Schwoerer, Head of Partnerships at Vanilla. Together, they’ll explore how shifting client expectations, emerging technologies, and the rise of holistic planning are redefining the advisor-client relationship. They’ll also discuss the core tenet of holistic advice: the firms that win the next generation of wealth holders will be those that prioritize...

Steve Lockshin

•

Jun 27, 2025

What Jimmy Buffett’s Estate Battle Can Teach Us About Trustee Selection and Legacy...

The recent headlines surrounding Jimmy Buffett’s $275 million estate are not just tabloid fodder—they’re a case study in what happens when good planning on paper meets the unpredictability of human relationships and unclear expectations. While we don’t yet know the full facts, what’s emerging is an all-too-familiar theme: a fight over control of a legacy that was likely intended to bring comfort, not conflict. Buffett was known for living life on his own terms, building an iconic brand that fused music, real estate, hospitality, and culture. He also did what many high-profile individuals do: he put his assets into a...

Karen Nachbar

•

Jun 26, 2025

Understanding the Risks of UPL

As Chief Legal Officer at Vanilla, I speak with customers frequently about the risk that the unauthorized practice of law (UPL) presents for wealth advisors. Balancing UPL risks as we build product is top of mind for our incredible team at Vanilla. We include thoughtful guardrails but also provide flexibility to our customers who can decide for themselves how to best mitigate their risk. What is UPL, and why should you care? UPL is giving legal advice when you’re not a lawyer. Every state has its own definition of UPL, but generally speaking, it includes: Drafting or preparing legal documents...

Jessica Lantz

•

Jun 24, 2025

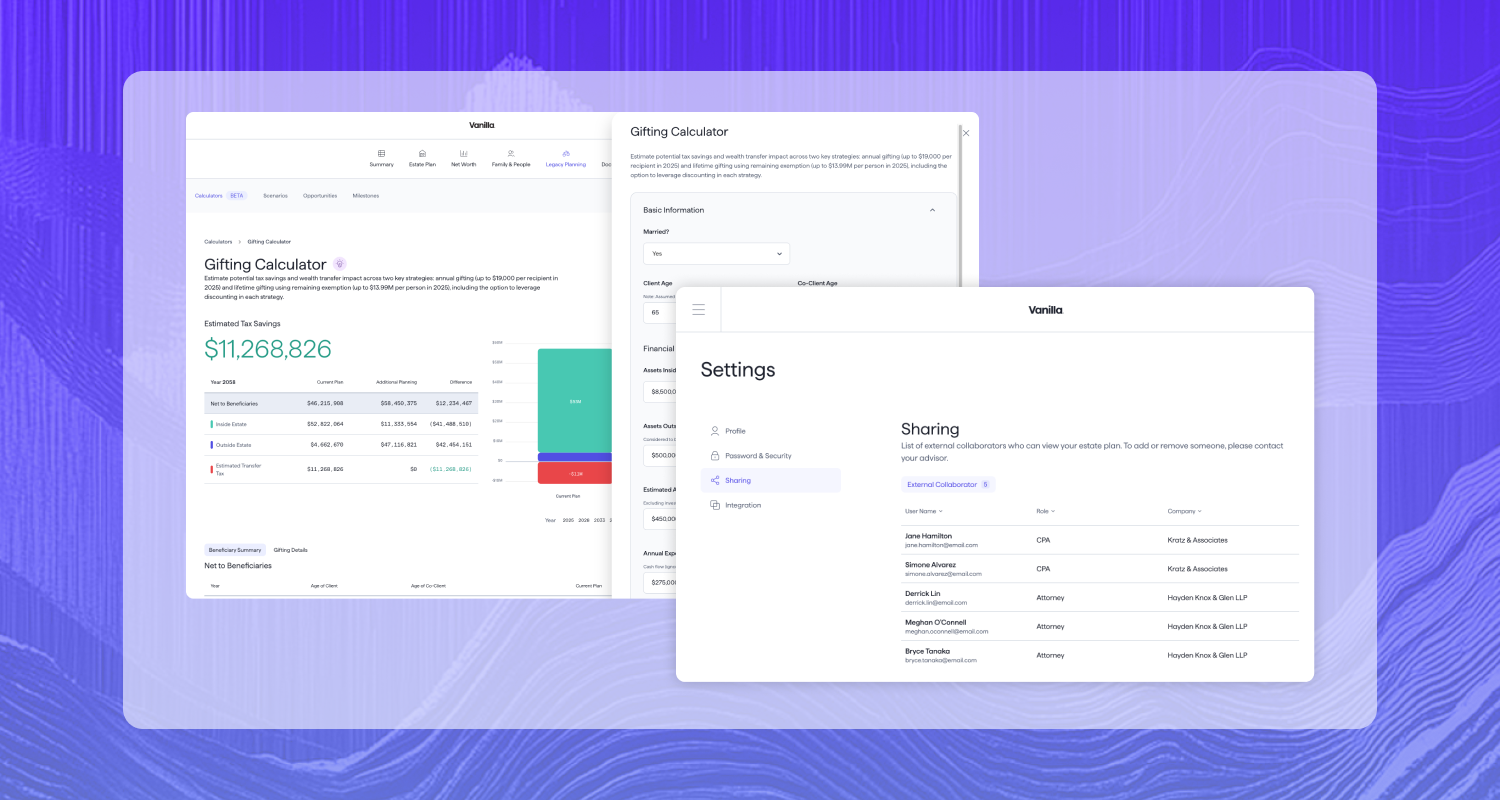

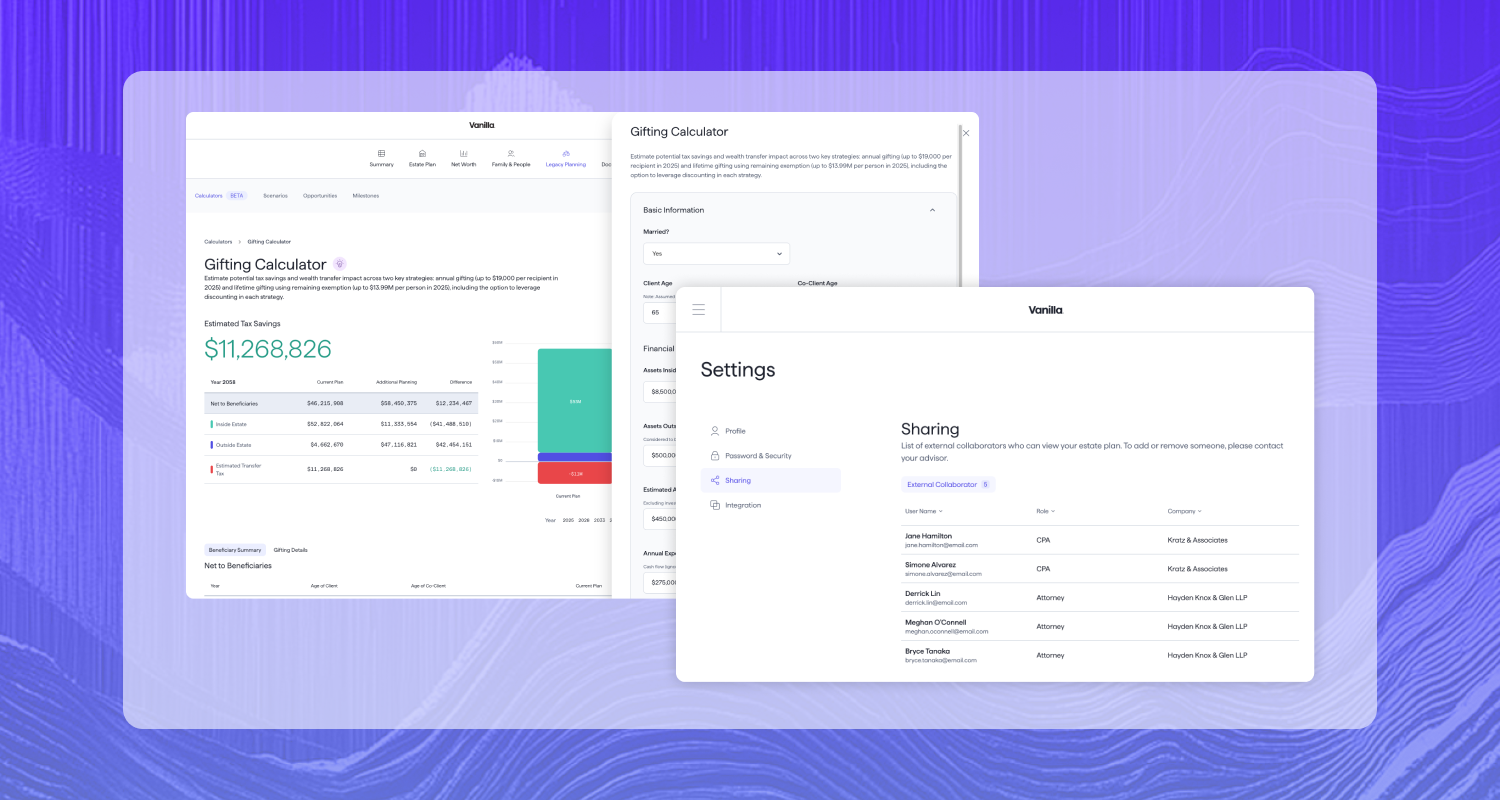

What’s New in June: Gifting Calculator, Third-Party Collaboration, and a unified Vanilla experience!

June brings powerful new changes to help you calculate, collaborate, and customize like never before. This month’s releases are focused on delivering a more intuitive and frictionless experience for both you and your clients. Unified Vanilla Experience: Everything in one seamless workflow The Problem: Vanilla users often work across multiple functions, requiring a unified interface that supports their diverse responsibilities. The Solution: Access all client functions from a single, intuitive dashboard that adapts to your workflow needs Enjoy streamlined document management with a simplified upload process—add files directly and choose your next steps, whether that's AI summaries, abstraction requests, or...

Vanilla

•

Jun 24, 2025

Vanilla Appoints Emily Tran as Vice President of Marketing to Accelerate Growth

BELLEVUE, Wash.-- Vanilla, the category-defining estate planning platform for financial advisors, announced today that Emily Tran has joined the company as Vice President of Marketing. Tran will lead all facets of Vanilla’s marketing strategy, with a focus on driving awareness, deepening advisor engagement, and accelerating adoption of the platform across the wealth management industry. Tran brings over 10 years of financial services marketing experience to the role, most recently serving as Head of Marketing at Practifi, a CRM platform for advisory firms. Prior to that, she held senior marketing positions at Morningstar, where she led integrated campaigns that supported product...

Vanilla

•

Jun 24, 2025

10 Benefits of Revocable Trusts All People Should Know About

Estate planning can be complex—but a revocable trust (also known as a living trust) offers a flexible, effective, and increasingly popular solution for managing and distributing assets. A revocable trust is a legal entity you create during your lifetime to hold and manage your assets, which you can change or revoke at any time. It provides control while you're alive, protection during incapacity, and streamlined asset transfer after death. Whether you're a high-net-worth individual or simply looking to protect your family, understanding the benefits of a revocable trust is essential. Below are ten compelling reasons to consider adding one to...

Vanilla

•

Jun 17, 2025

How Survivorship Life Insurance Policies Can Be Helpful in Estate Planning

Introduction Survivorship life insurance, often referred to as second-to-die insurance, is a specialized form of life insurance that covers two individuals—typically spouses—and pays out a death benefit only after both have passed away. While this policy type may not be as widely discussed as traditional single-life insurance, it plays a pivotal role in strategic estate planning, especially for high-net-worth couples. This article explores how survivorship life insurance works, its unique benefits for estate planning, how it compares to single-insured policies, and when it’s most effectively utilized. We’ll also examine optimal funding structures and common pitfalls to avoid. Whether you’re a...

Vanilla

•

Jun 13, 2025

Organic Growth and Lead Generation: Using Estate Planning to Win New Business

Estate planning is quickly becoming one of the most effective ways for advisors to differentiate their offering and generate new business—without relying on cold outreach or traditional marketing. In this live webinar, you’ll learn how forward-thinking firms are using estate planning as a lead-generation engine. From offering free planning checkups to delivering visual summaries of complex documents, you’ll see how this once-overlooked service can open the door to more conversations, referrals, and assets under management. We’ll also show how Vanilla can help you scale these efforts without adding overhead. Steve and Larry will cover topics like: Creative ways to use...

Vanilla

•

Jun 13, 2025

Setting the Standard with Steve Lockshin

Setting the standard in estate planning: From experience to innovation When Steve Lockshin—ranked the #1 financial advisor in the country by Barron’s—founded Vanilla, he didn’t set out to build just another software platform. He set out to solve a problem he lived every day: the complexity of managing ultra-high-net-worth (UHNW) estates. With over 35 years of experience advising the wealthiest families in America, Steve knew the stakes. From generation-skipping transfer tax planning and state estate taxes to derivative strategies and complex fiduciary structures—these aren’t theoretical problems. They’re daily realities. That’s why he built Vanilla: the platform that transforms real-life expertise...

Kiplinger

•

Jun 12, 2025

Is Your Will ‘Fair’? Estate Planning Is About More Than Money

Your will and estate plan should leave your heirs feeling loved. An expert weighs in on how to avoid family feuds after you're gone. Creating a will or estate plan is a good way to help ensure that your wishes are carried out once you’ve passed away. But in the course of writing your will, trust, or whatever tool you use to dictate the terms of an inheritance, you don’t want to only think about the assets you have and how you’re splitting them up among your heirs. It’s essential to look at the big picture, too. An estimated 35% of U.S....

Steve Lockshin

•

Jun 11, 2025

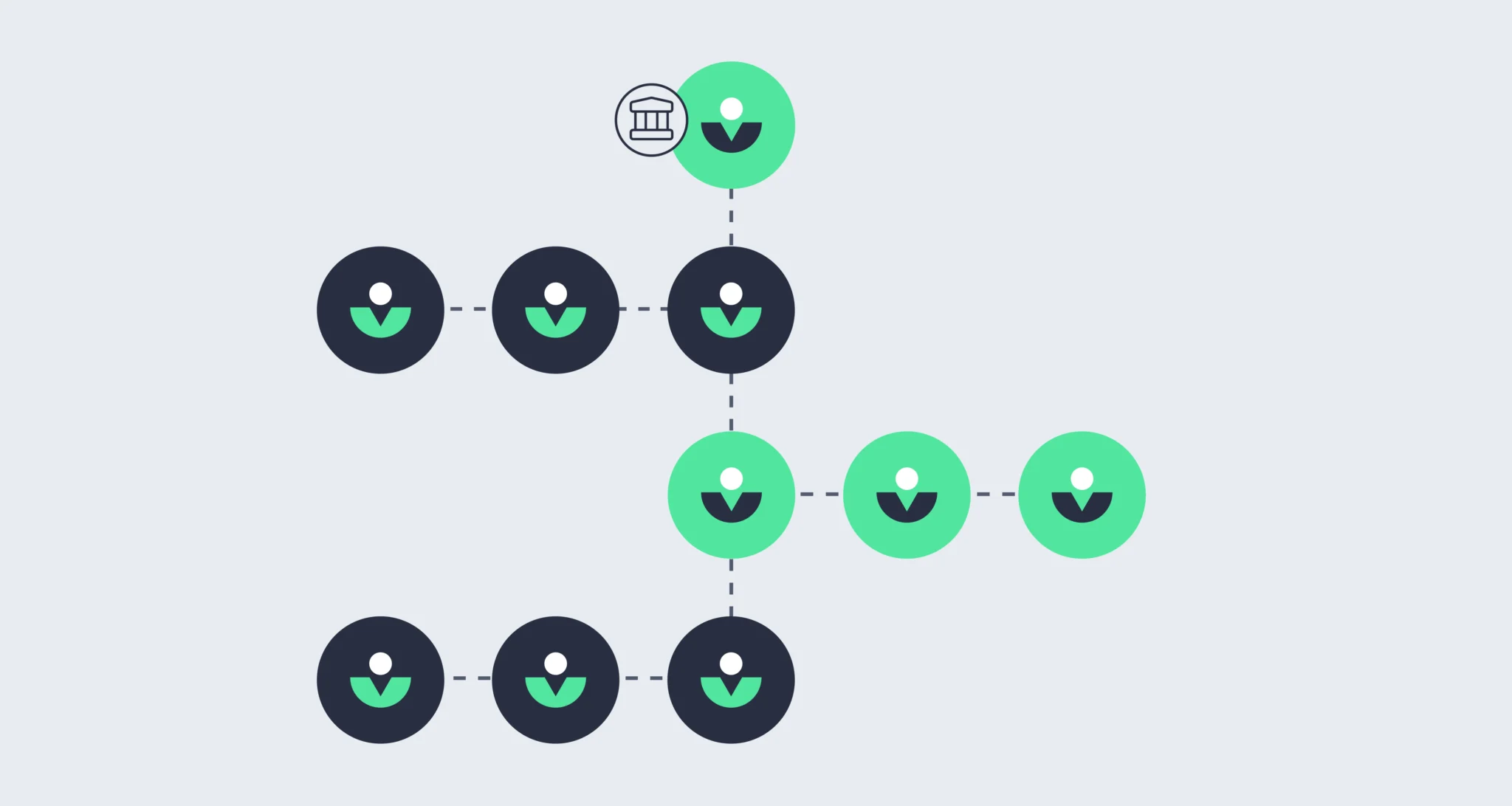

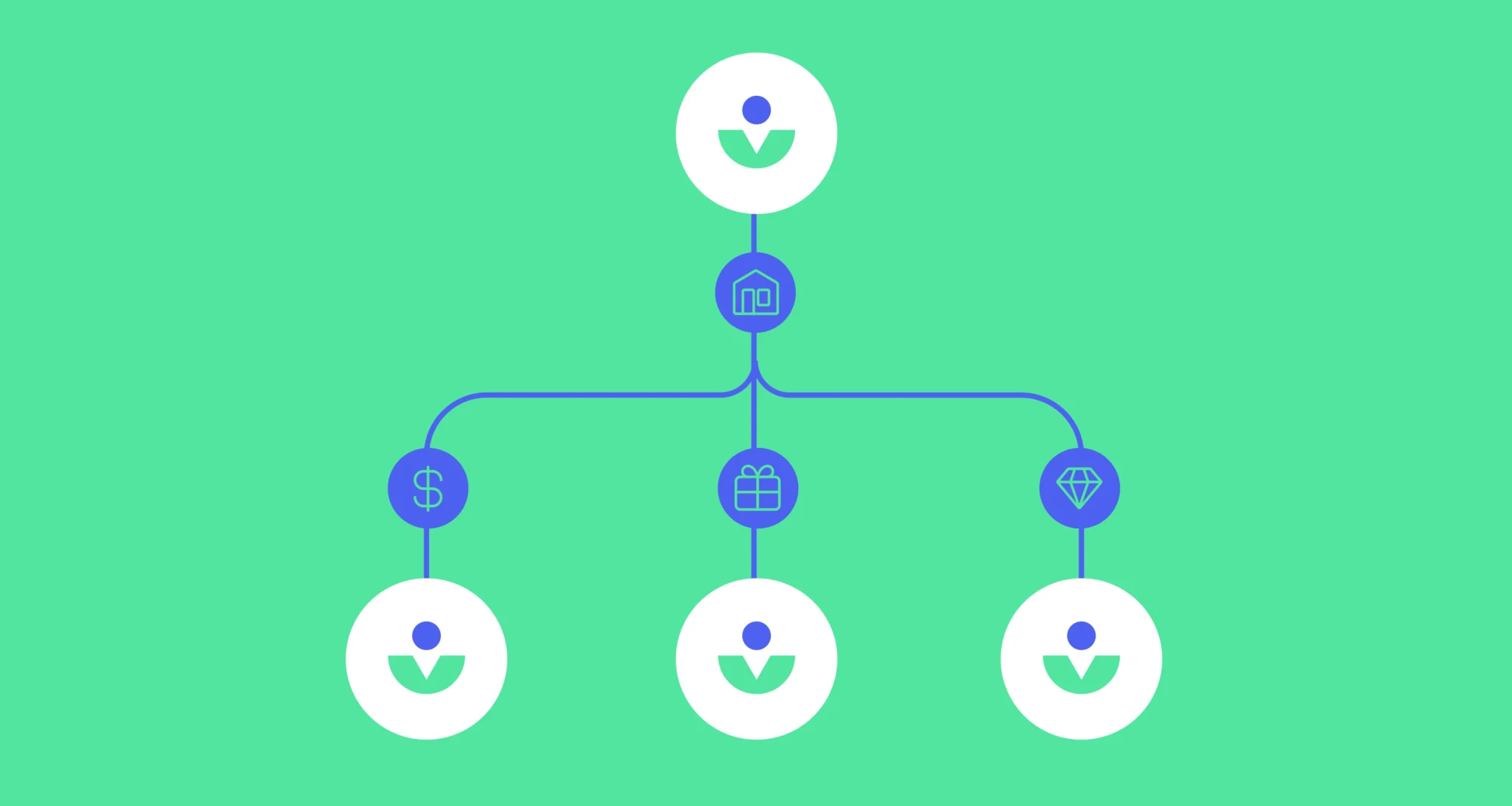

The Estate Planning Hierarchy for Wealthy Families: A Practical Guide for Advisors

For advisors working with very wealthy families, understanding the hierarchy of estate planning tools is essential to structuring optimal, tax-efficient, and flexible multigenerational plans. Here’s a practical framework to guide your thinking. To dive deeper, download How Vanilla Helps Advisors Plan Across Generations here. Start at the top: GST-exempt trusts Generation skipping transfer tax-exempt trusts are the gold standard for multigenerational wealth transfer. When properly structured, a GST-exempt trust: Is exempt from transfer taxes for generations—forever Can include a spouse as a beneficiary, providing flexibility and access Is highly effective for multi-generational planning when situs is established in favorable jurisdictions...

Vanilla

•

Jun 02, 2025

How to Bring Up Conversations About Estate Planning With Clients

Estate planning is one of the most important—and frequently overlooked—aspects of a client’s financial life. Despite its importance, a significant number of adults don’t even have a basic will in place. This gap represents both a risk to clients’ families and a tremendous opportunity for advisors to deepen relationships by addressing a crucial area of need. While estate planning conversations can feel awkward or emotional, avoiding them may result in confusion, unnecessary expenses, or the client’s final wishes not being carried out. When advisors take the lead in these discussions, they provide peace of mind, safeguard client legacies, and position...

Vanilla

•

Jun 02, 2025

Vanilla Named a Finalist in Four Categories in the 2025 “Wealthies”

June 2, 2025 — Vanilla, the most trusted estate planning platform for advisors, was named a finalist in four categories at the 2025 WealthManagement.com Industry Awards, recognizing our continued innovation and impact in estate planning software. Now in its 11th year, the “Wealthies” honor outstanding organizations and individuals that support financial advisor success. Vanilla has been recognized in estate planning across the following categories: Advisor Service and Support: Document Abstraction Services Implementation: Vanilla Academy Technology: V/AI Copilot Thought Leadership: The State of Estate Planning Report 2025 “These recognitions affirm what we’ve known from the start—that modern estate planning requires tools...

Jessica Lantz

•

May 28, 2025

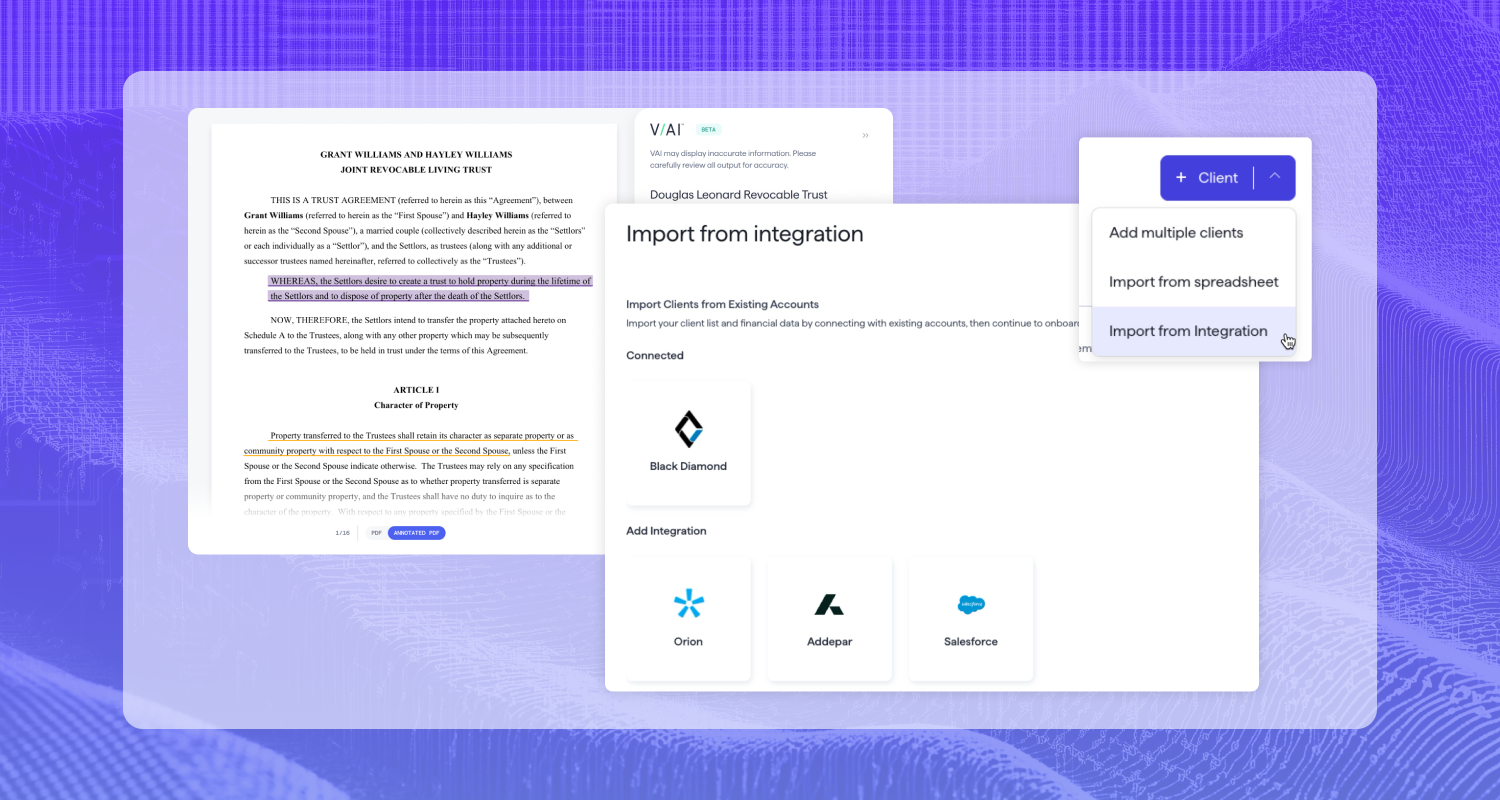

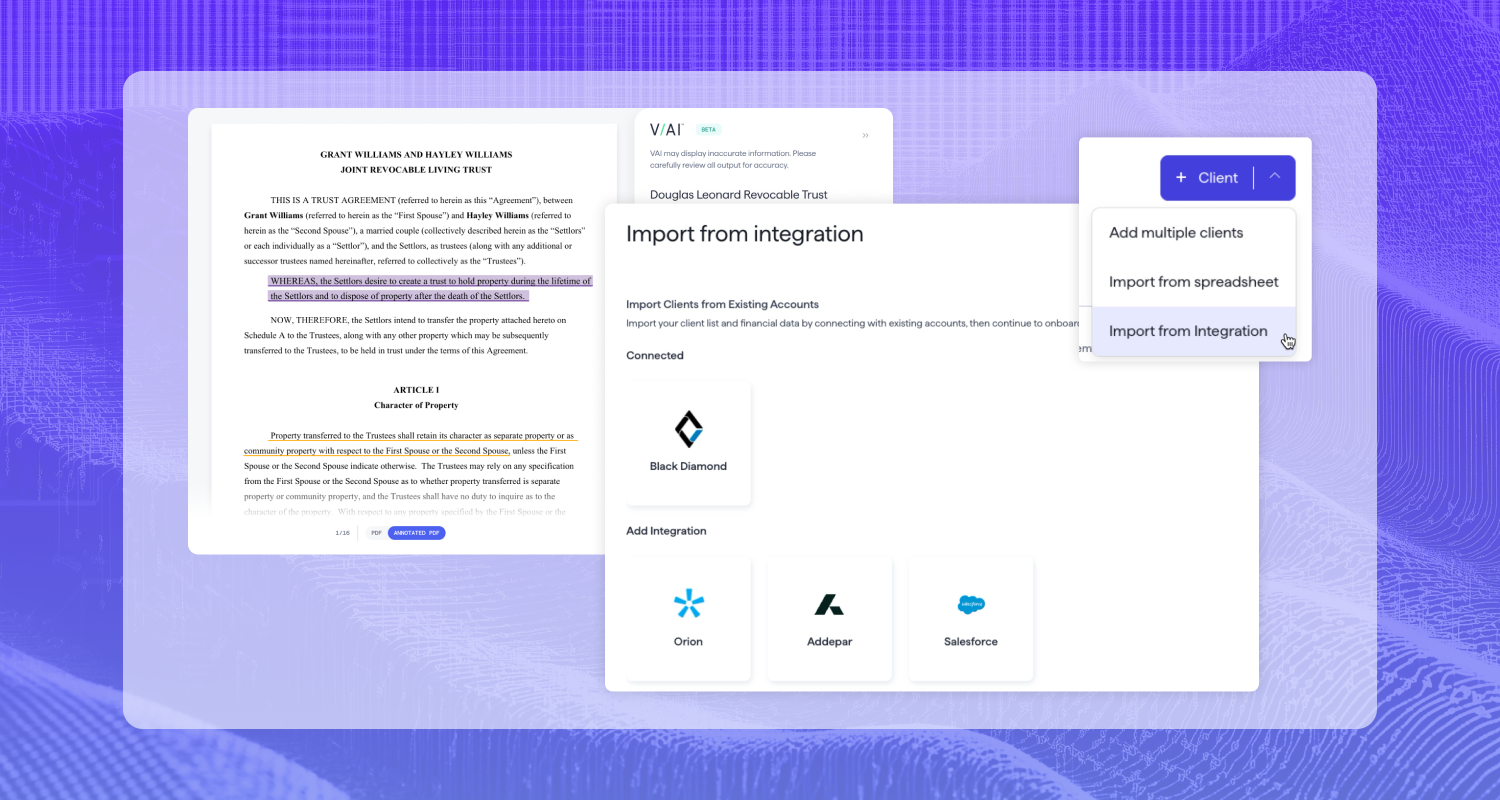

What’s New in May: Salesforce Integration, Family Tree Enhancements, and More!

Vanilla's newest innovations are here! This month's feature releases represent a significant leap forward, combining cutting-edge functionality with the seamless experience you’ve come to expect. Salesforce Integration: Serve more clients with ease The Problem: Manual data entry prevents advisors from scaling their estate planning practice efficiently. The Solution: Import your client list from Salesforce into Vanilla instantly Eliminate hours of manual data entry Maintain synchronized, up-to-date client data across both systems, reducing potential errors in client communications Enhanced Groups: Scale securely across teams The Problem: Client data is highly sensitive, and firms need to ensure only authorized users can access...

Madison Eubanks

•

May 22, 2025

6 Most Common Types of Wills and Who Should Use Them

Making plans for what happens after you’re gone can be uncomfortable and even frightening—but in the long run it’s one of the most important things you can do for your loved ones. Leaving behind a will is the best way to ensure your wishes are followed and that your family isn’t left making difficult decisions with no guidance. Wills are essential tools in estate planning, and there are several different types to be aware of. Choosing the right type of will depends on your own personal, financial, and familial circumstances. Not all wills are the same; different types serve different...

Vanilla

•

May 20, 2025

Unauthorized Practice of Law (UPL) Training (1 hour CFP® CE)

For many advisors and wealth management professionals, unauthorized practice of law (UPL) is a vague, looming worry—but what exactly does UPL entail and how can you avoid it? This session will dive into what advisors need to know about UPL and how to navigate the risks while successfully serving clients. Karen and Pete will cover: What UPL is Why advisors and others in the financial industry need to understand it Potential risks of UPL for advisors How advisors and others can protect themselves from UPL claims Attendees who are CFP® professionals and stay for the duration of the webinar will...

Vanilla

•

May 12, 2025

Trust vs. Will: What’s the Difference, and Which Do Your Clients Need?

You've likely had clients ask, "Do I need a will or a trust?" It's a common question that deserves a thoughtful, personalized response. The confusion between wills and trusts often leads clients to make decisions that don't fully address their specific needs. Without proper guidance, they might opt for the simplest solution without understanding the long-term implications for their families and estates. This guide will equip you with clear explanations of the key differences between wills and trusts, their respective advantages and disadvantages, and a framework for helping clients determine which option or combination of options best suits their unique...

Vanilla

•

May 08, 2025

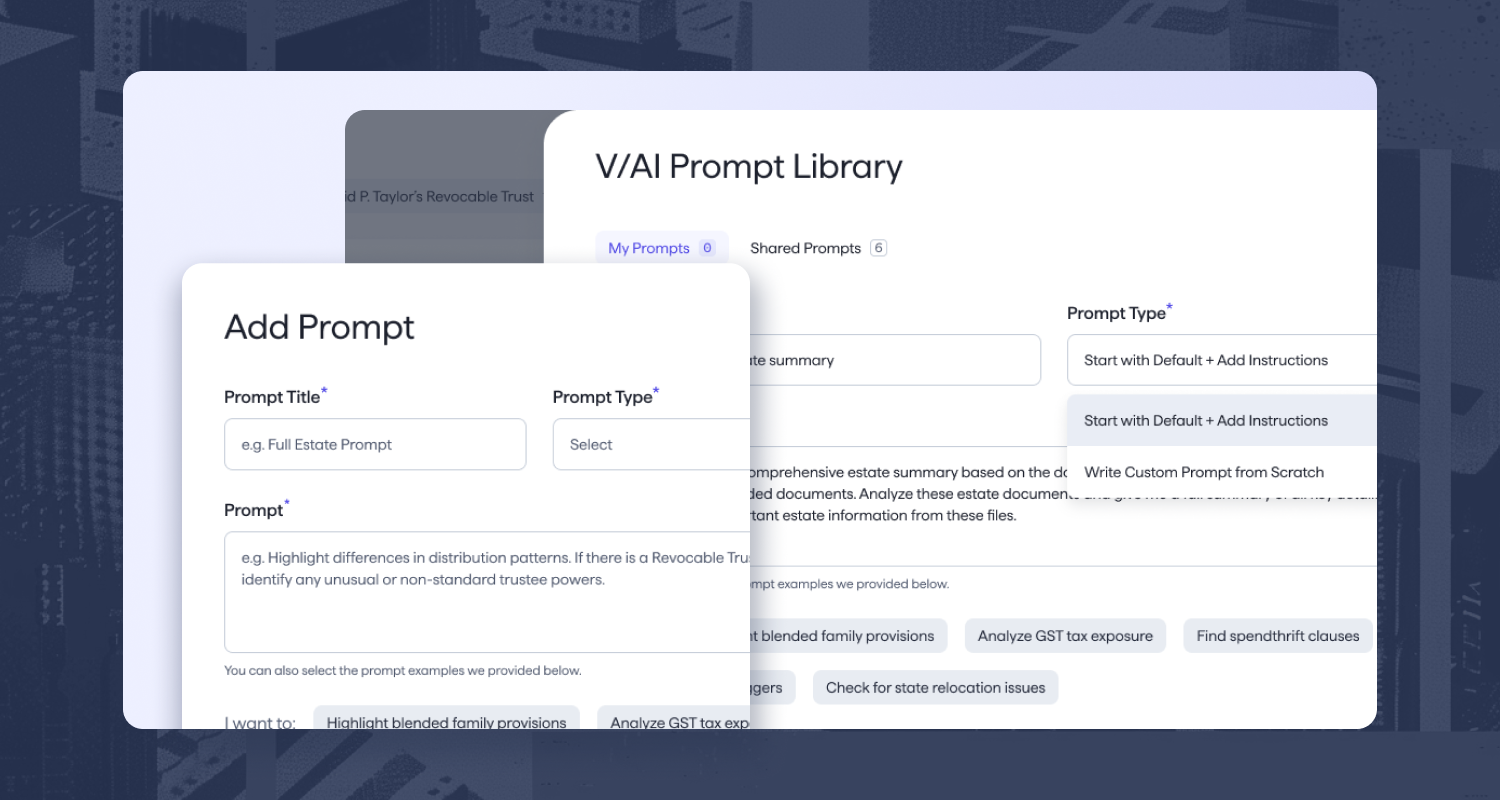

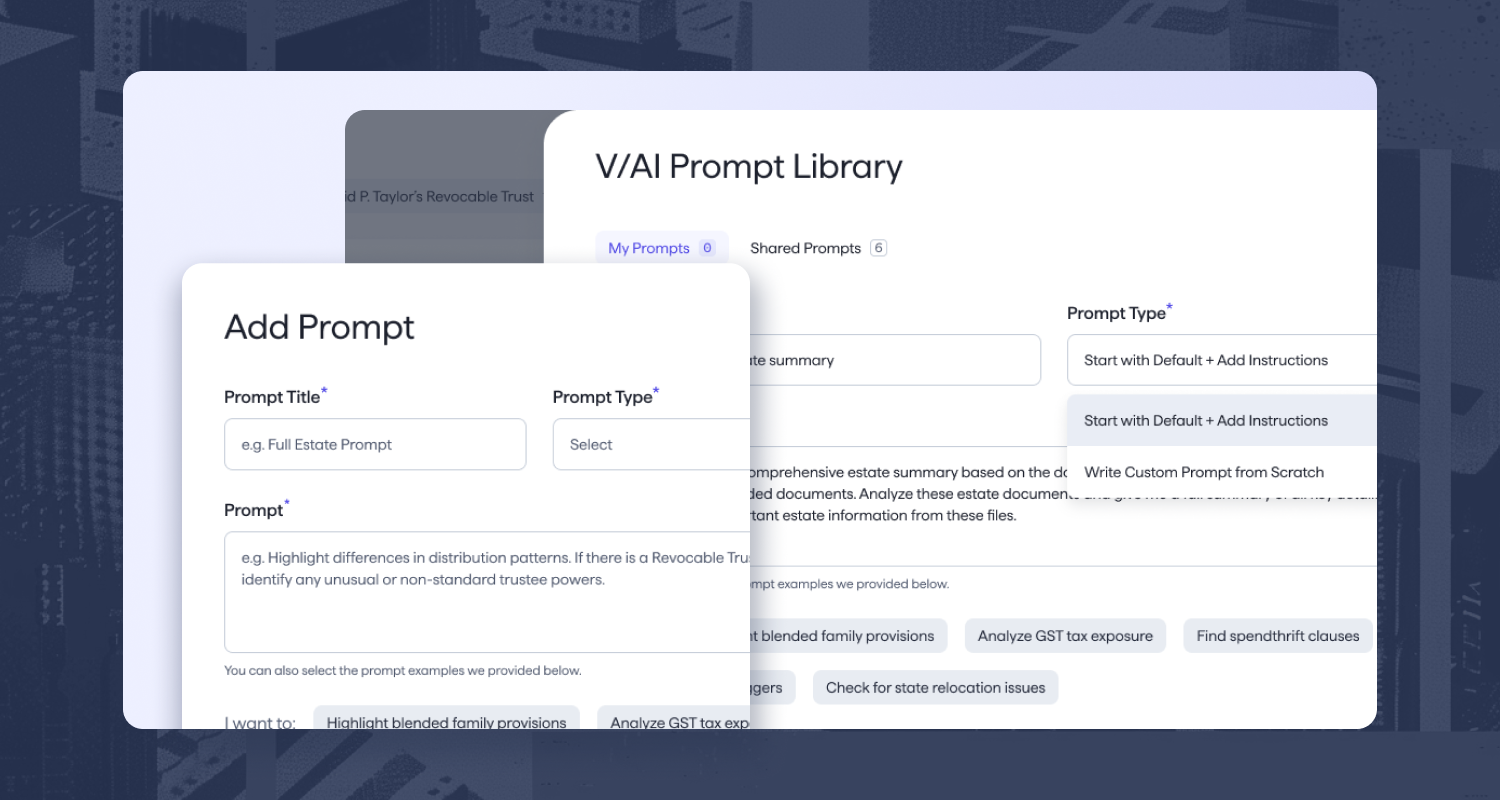

Vanilla Unveils New AI Capabilities, Redefining the Future of Scalable Estate Planning

AI-powered tools accelerate meaningful conversations, eliminate manual processes, and deliver holistic insights at scale BELLEVUE, Wash.--(BUSINESS WIRE)--Vanilla, the most trusted platform in modern estate planning, today announced significant enhancements to its AI suite, delivering a new level of intelligence and scale to the estate planning workflow. Designed to go far beyond basic summarization, the updated toolkit empowers advisors to analyze estate documents as a cohesive whole, uncover planning opportunities, and deliver personalized guidance with greater speed and accuracy. “At Vanilla, AI isn’t a bolt-on; it’s a belief system,” said Amjad Hussain, Chief Technology Officer at Vanilla. “Our vision was always...

Vanilla

•

May 07, 2025

AI in Estate Planning: Setting the Standard

AI won’t replace advisors—but advisors who use AI will replace those who don’t. Advisors who understand how to use AI to do their jobs better will set the standard for holistic advice going forward, and this webinar focuses on how to get your firm there. We’ll discuss the evolution of advice and why right now is a critical moment, demystify the real business value of AI, and share examples of firms who are taking the lead. Designed to go far beyond basic summarization, Vanilla’s evolving AI toolkit empowers advisors to analyze estate documents as a cohesive whole, uncover planning opportunities, and...

Simona Ondrejkova, CFP

•

May 07, 2025

What Is a Credit Shelter Trust? And How Can It Help Minimize Estate...

In estate planning, there are several types of trusts especially designed to help individuals avoid or reduce estate taxes. One of these is the credit shelter trust. The credit shelter trust is often used by married couples as one of many estate planning strategies that can help them pass on more wealth to beneficiaries after both spouses pass away. Here, we explain what a credit shelter trust is, how it works, and when you or your clients should consider using it to leave a greater legacy by minimizing or even eliminating the estate tax bill. What is a credit shelter...

Vanilla

•

May 05, 2025

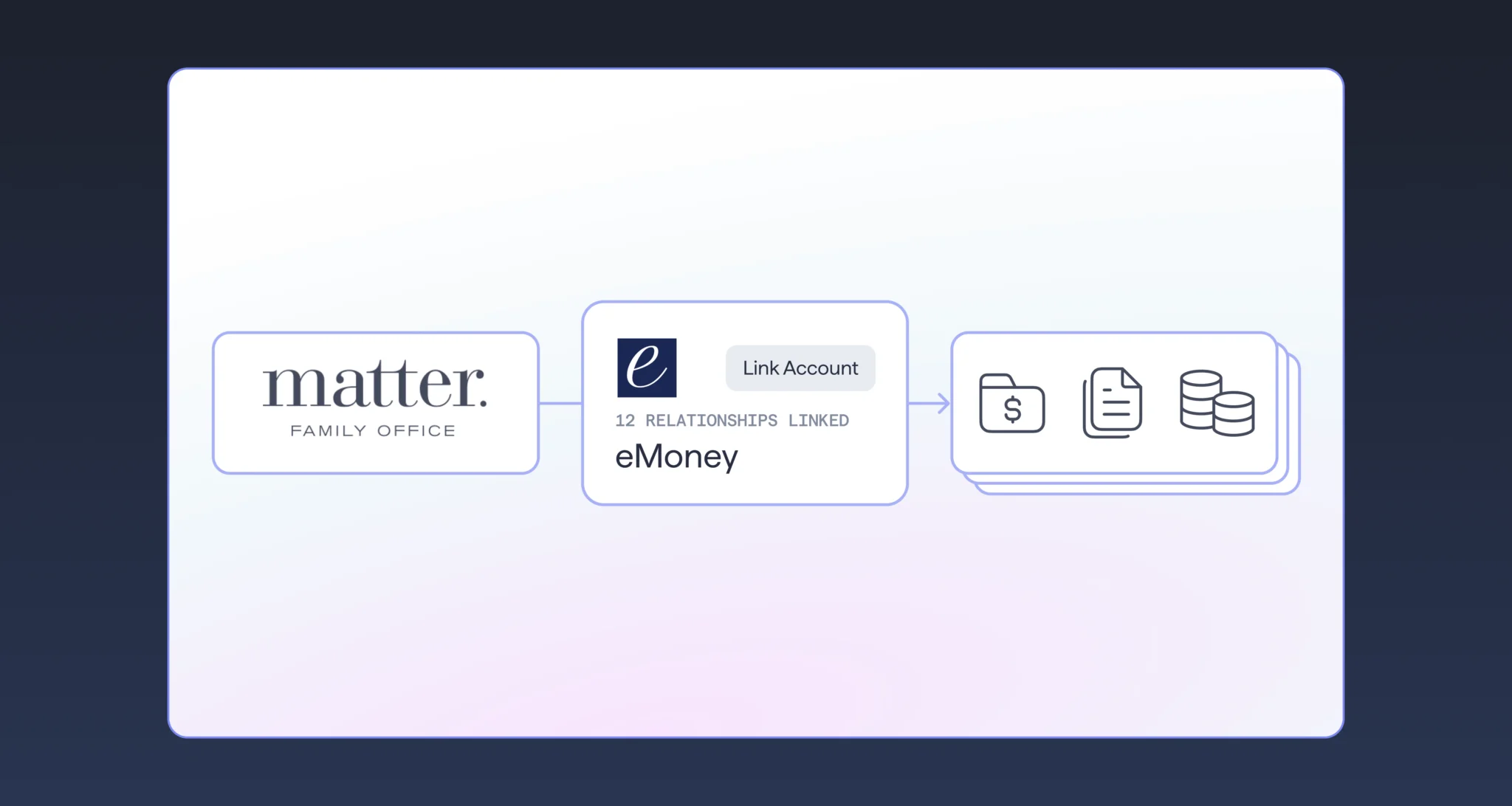

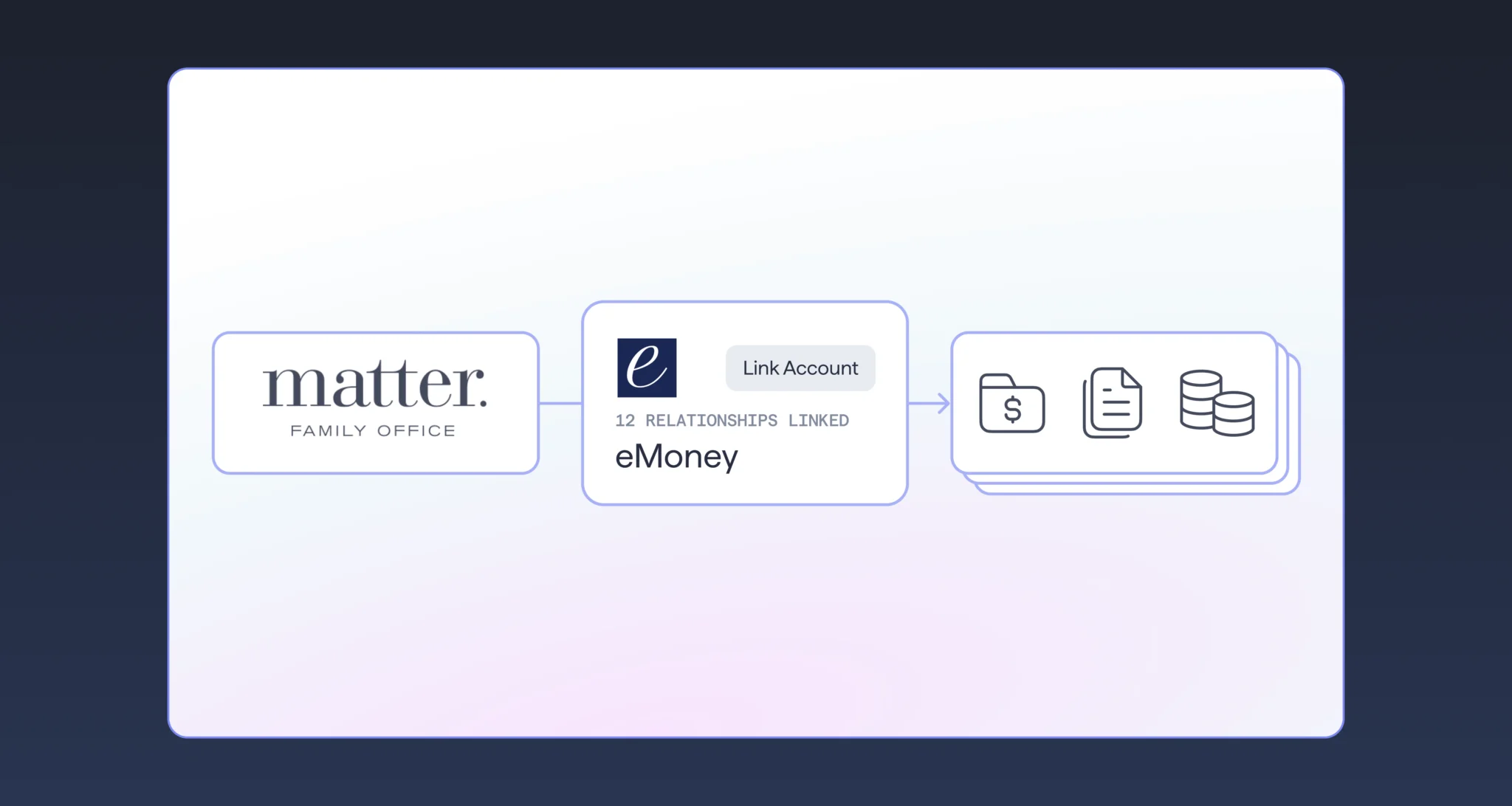

Connected Financial and Estate Planning: Delivering Holistic Client Outcomes

Financial advisors are increasingly recognizing that comprehensive financial planning must include estate planning to truly serve clients’ long-term goals. Traditionally, financial planning (investments, retirement, tax, etc.) and estate planning (wills, trusts, legacy) operated in silos. However, this separation is no longer viable or competitive in today’s client-centric advisory landscape. In this whitepaper, we explore: Why integrating financial and estate planning is essential How leading platforms like eMoney Advisor and Vanilla enable a seamless, holistic planning experience when connected What benefits advisors and clients can expect from this integration. Industry statistics, real-world workflow examples, and forward-looking trends to help financial advisors...

Vanilla

•

May 01, 2025

Driving Results: How Matter Family Office Embraces AI and Integrated Tech

Matter Family Office understands the importance of holistic advice and doesn’t shy away from innovation—and the results speak for themselves. Through an integrated, personalized approach to wealth management, Matter serves as a strategic partner, guiding families to navigate wealth complexities, make informed decisions and build enduring legacies. By integrating Vanilla and eMoney, Matter Family Office removes time-consuming manual steps and enhances its ability to deliver personalized estate planning at scale. The results have been immediate: Time savings: Advisors cut estate plan prep time by hours per client. Expanded capacity: The team can now engage more clients in estate planning conversations...

Vanilla

•

Apr 30, 2025

Revocable Trust vs. Irrevocable Trust: Understanding Six Key Differences

Helping clients navigate estate planning is becoming a non-negotiable aspect of comprehensive wealth management. Research indicates 70% of clients believe their advisors should offer estate planning services, and 40% would change advisors if it meant switching to one who did offer estate planning. So while you may not draft legal documents yourself, understanding the nuances of estate planning, like trust structures, allows you to have more meaningful conversations with clients and collaborate effectively with their attorneys. Two primary trust options—revocable and irrevocable—serve distinctly different purposes in your clients' financial plans. The right choice depends on each client's unique circumstances, priorities,...

Vanilla

•

Apr 24, 2025

Critical Estate Planning Mistakes Costing Your Clients (and Your Advisory Firm)

In today’s complex financial landscape, estate planning errors don’t just damage client legacies—they can permanently sever advisor relationships. With research showing that over 70% of assets transfer away from the original advisor after the death of a primary client, the stakes couldn’t be higher for your practice. Join us for an essential conversation with Patti Brennan, CFP®, CFS, CEO of Key Financial, Inc., and author of Am I Going to Be Okay?, as she partners with Sarah Marriott to reveal the most damaging estate planning pitfalls threatening your clients’ wealth and your firm’s future. In this practice-changing webinar, you’ll discover: Top...

Jessica Lantz

•

Apr 23, 2025

What’s New in April: Plaid Integration, Scenarios PDF Export, Estate Builder upgrades, and...

Here at Vanilla, we’re thrilled to unveil a powerful lineup of new features and enhancements launching this month. These updates are all about delivering an intuitive, high-quality experience to elevate the advisor and end client journey. New client portal unveiled: A unified net worth experience, powered by Plaid We’re excited to introduce a reimagined client experience that brings financial and estate planning into a single, more connected view. Clients can self-serve and securely link accounts through Plaid with thousands of financial institutions with just a few clicks Automatic daily data syncs ensure that information stays current - reducing the need...

ThinkAdvisor

•

Apr 18, 2025

Mariner and Vanilla Strike Estate Planning Deal

Vanilla says it is expanding its partnership with Mariner, an RIA that works with about $560 billion in client assets. The arrangement gives all of Mariner’s 700-plus advisors access to Vanilla’s estate planning platform. “Since the partnership began, Mariner has seen a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning,” according to the platform provider. “Vanilla’s technology is yet another tool in our arsenal as we look to grow our practice to more than 5,000 advisors by 2027,” Mariner CEO Marty Bicknell said in a statement. “The ability to offer...

Vanilla

•

Apr 17, 2025

Vanilla Announces Partnership with $560B Firm Mariner

Vanilla Delivers Modern Estate Planning Capabilities to More Than 700 Advisors at Mariner Salt Lake City, UT – April 17, 2025 – Vanilla, the leading platform in modern estate planning, announced a partnership with Mariner, a national financial services firm, to deliver estate planning and advisory capabilities to the more than 700 advisors managing $560B in assets at the firm. Since the partnership began, Mariner has seen a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning. “We’re thrilled to have expanded our relationship with an iconic firm like Mariner, which is leading...

Vanilla

•

Apr 16, 2025

Helping Clients Navigate Market Volatility

As advisors well know, periods of market volatility can elicit anxiety, frustration, and lots of questions from clients. These moments of instability are the time for advisors to lean in, calmly and confidently helping clients navigate through uncertainty. Rather than hunkering down to wait out the storm, savvy advisors can pivot to other planning opportunities during times like these. In this webinar, Vanilla’s experts will draw on their years of industry experience to share tips for navigating market volatility, like: Think about asset protection Focus on the long-term planning goals Look beyond investing to more holistic planning Optimize tax efficiency...

Sarah D. McDaniel, CFA

•

Apr 10, 2025

An Advisor’s Guide to Helping Clients Navigate Market Volatility

For advisors, staying on top of financial markets and structural developments to identify opportunities for your clients and prospects—and then guiding them through implementation—is essential for success. When markets are turbulent, it’s a smart time to revisit estate planning. While the instinct might be to pause and wait for stability, volatile periods can actually open up strategic opportunities. Using the blog The Building Blocks of Estate Planning Techniques as a guide, we’ll outline some timely actions advisors can take to calmly and confidently help clients at different wealth stages navigate periods of uncertainty. For a deeper dive, download the complete...

Vanilla

•

Apr 09, 2025

Vanilla Named a Finalist in the Twelfth Annual Family Wealth Report Awards 2025

Vanilla Recognized in Product Innovation and Outstanding Contribution categories; Chairman Steve Lockshin a Finalist for Outstanding Individual Contribution Salt Lake City, UT – April 7, 2025 – Vanilla, the leading platform in modern estate planning, has been selected as a finalist for the Twelfth Annual Family Wealth Report Awards 2025 program in the following categories: Product Innovation (B2B) Outstanding Contribution to Wealth Management Thought Leadership (Company) Outstanding Contribution to Wealth Management Thought Leadership (Individual) – Steve Lockshin Through a rigorous and independent judging process, the annual Family Wealth Report Awards program honors the most innovative and exceptional firms, teams and...

Vanilla

•

Apr 08, 2025

Unlocking Scale: How Matter Family Office Streamlines Estate Planning with Vanilla + eMoney

Vanilla recently announced our integration with eMoney, empowering financial advisors to streamline their estate planning workflows like never before. Matter Family Office, a nationally recognized advisory firm managing approximately $3.5 billion in assets, is already leveraging this integration to enhance efficiency, improve client engagement, and scale the impact of estate planning across their client base. The Power of Integration A truly comprehensive approach to estate planning is not complete without visibility into the client’s balance sheet. For many advisory teams, this data already exists in eMoney. Until now, this gap has led to inefficient workarounds to get eMoney data into...

Vanilla

•

Apr 07, 2025

Kitces Survey Spotlights Vanilla as a Leader in Market Share and Satisfaction Ratings...

The 2024 Financial Financial Planner Productivity Study from Kitces, How Financial Planners Actually Do Financial Planning, collects data on the key drivers of team productivity for advisory firms. This data is crucial for firm success as clients continuously expect more from their relationships with their advisors, and advisors are faced with finding ways to meet these evolving needs without adding hours to their day or increasing overhead costs. Importantly, this survey reflects how real advisors operate in their practices day to day—shedding light on the tools they use, how they approach certain processes, their client interactions, and more. This sets...

Vanilla

•

Apr 04, 2025

What You Need to Know about Generation-Skipping Gifts (and Their Tax Implications)

Gifting to your children is an excellent way to reduce estate tax liabilities, but sometimes it makes more sense to give directly to grandchildren, rather than to your children. Because these gifts “skip” a generation, they are referred to as generation-skipping transfers (GST) and have special tax treatment. There are a few important things to keep in mind when considering a generation-skipping transfer gift, including the generation-skipping transfer tax. We’ll break the tax down for you and give you a few more important pointers to pay attention to. What is the generation-skipping transfer tax? The generation-skipping transfer tax (or “GSTT”)...

Jessica Lantz

•

Mar 26, 2025

What’s New in March: V/AI Estate Summaries, New Opportunities, and More!

At Vanilla, we're excited to share our March lineup of powerful new features designed to enhance your estate planning workflows and provide deeper insights for you and your clients. Here's what's new this month: Unlock integrated Estate Summaries and onboard clients in minutes with V/AI Summarizing documents individually adds value. But synthesizing them into a single, integrated estate view within minutes sets a new standard for what’s possible in estate planning. With the launch of V/AI Estate Summaries and our expanded V/AI Automatic Profiles, you are able to: Upload multiple estate plan documents to unlock a high-level overview of your...

Newsweek

•

Mar 25, 2025

America’s Greatest Startup Workplaces 2025

Innovation and ambition drive the startup world, where companies are built on bold ideas, agile thinking and close-knit teams. Yet, growing a successful business from the ground up comes with unique challenges, from maintaining proper work-life balance in a fast-paced environment to providing competitive benefits and opportunities for career advancement. According to research, about 90 percent of startups fail. Data from the U.S. Bureau of Labor Statistics also shows that approximately one in four U.S. businesses fail within the first year of operation. Despite the stressful nature of these challenges, many startups are proving that success and employee well-being go hand in...

Vanilla

•

Mar 11, 2025

6 Steps to Get Started with Estate Planning

More and more clients are seeking holistic financial planning from their advisors, rather than just investment advice. According to Vanilla’s 2025 State of Estate Planning survey, 8 in 10 people expect estate planning to be incorporated into their financial advisor’s offerings in some way. The data plainly shows that advisors who want to remain competitive need to offer estate planning—but getting started can seem daunting. In this webinar, Vanilla’s experts will dive into practical, bite-sized ways advisors can begin to fold estate planning into their firm’s services. They’ll discuss topics and considerations like: How to determine the scope of estate...

Vanilla

•

Mar 04, 2025

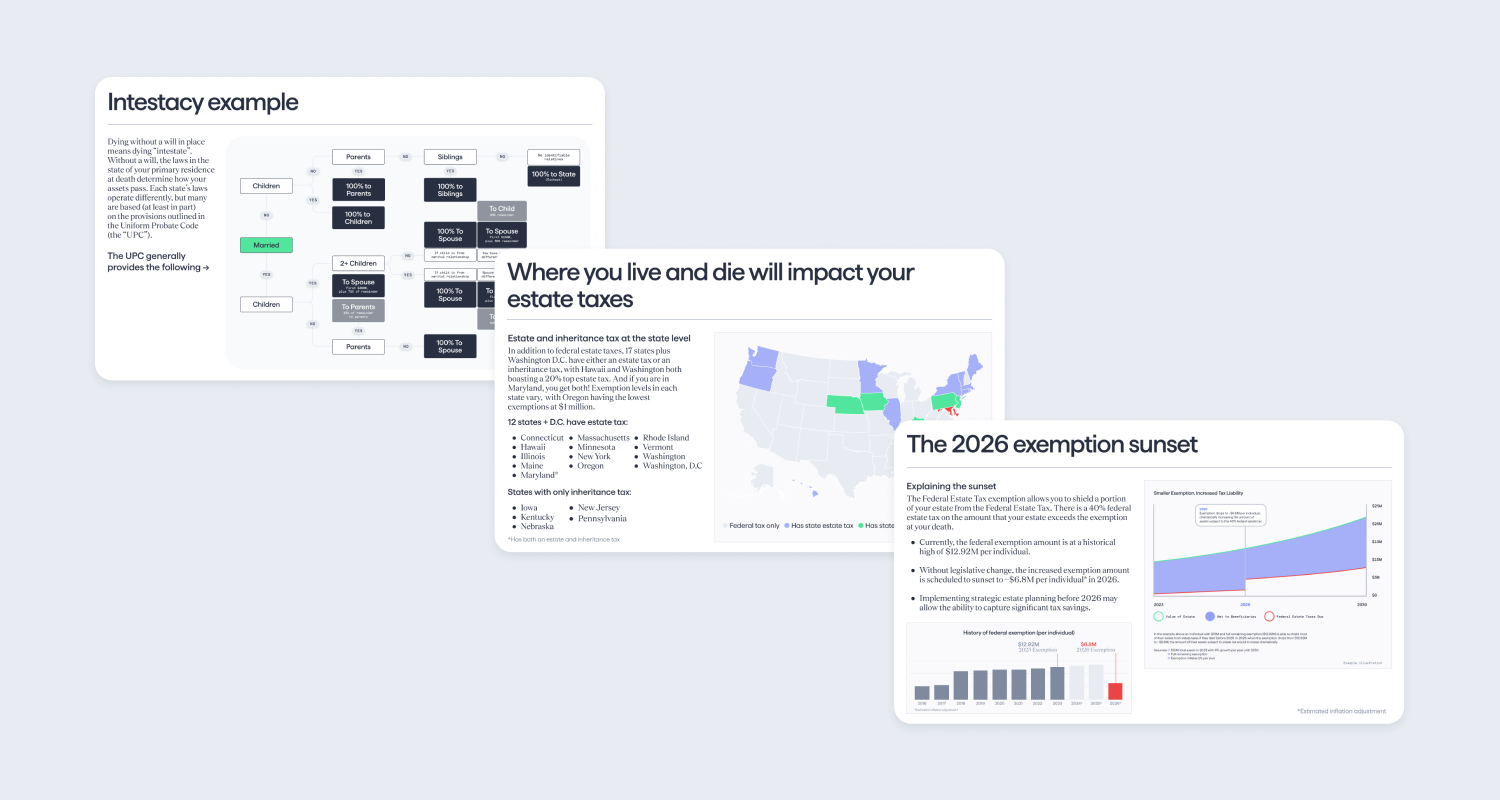

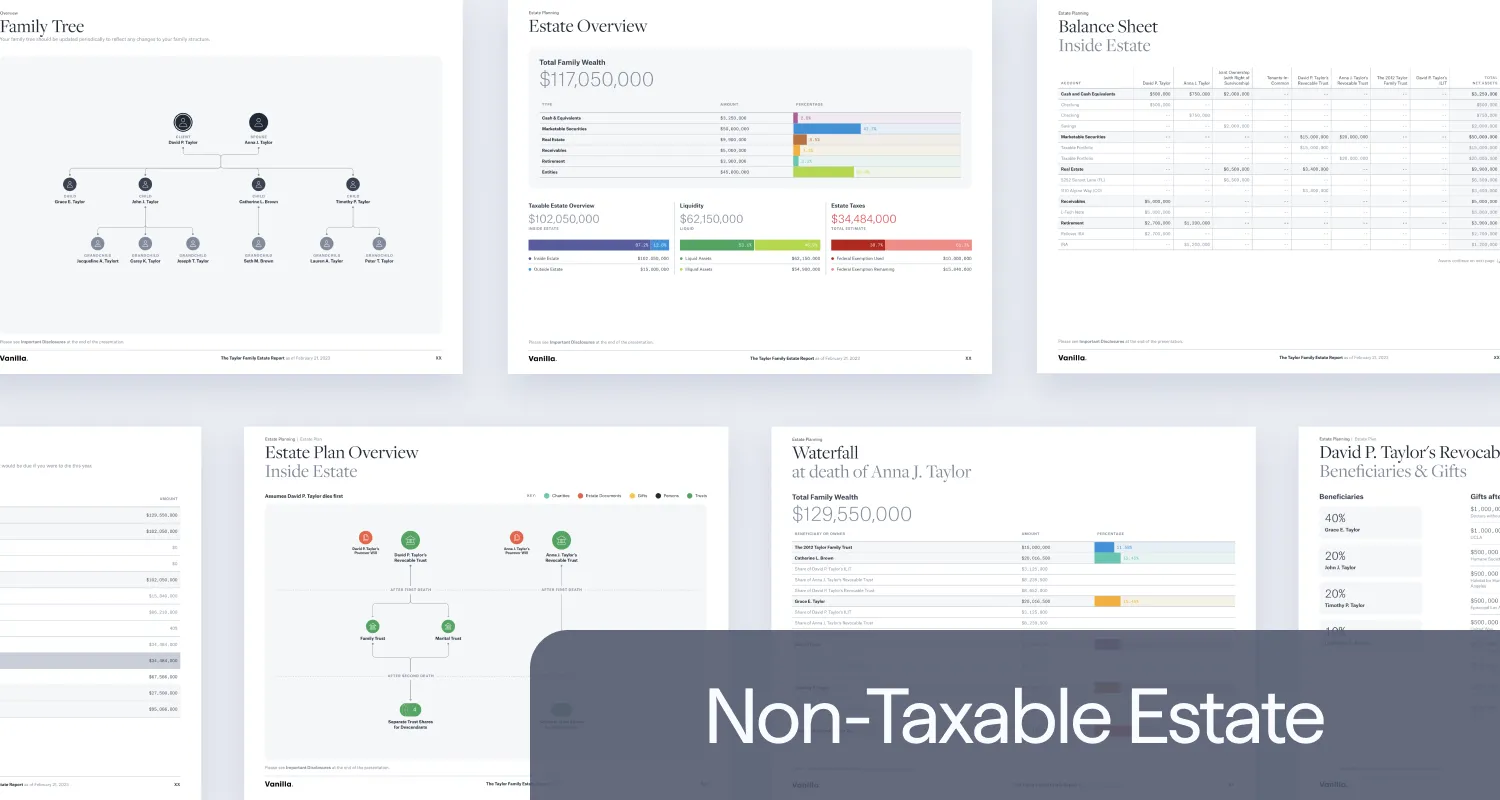

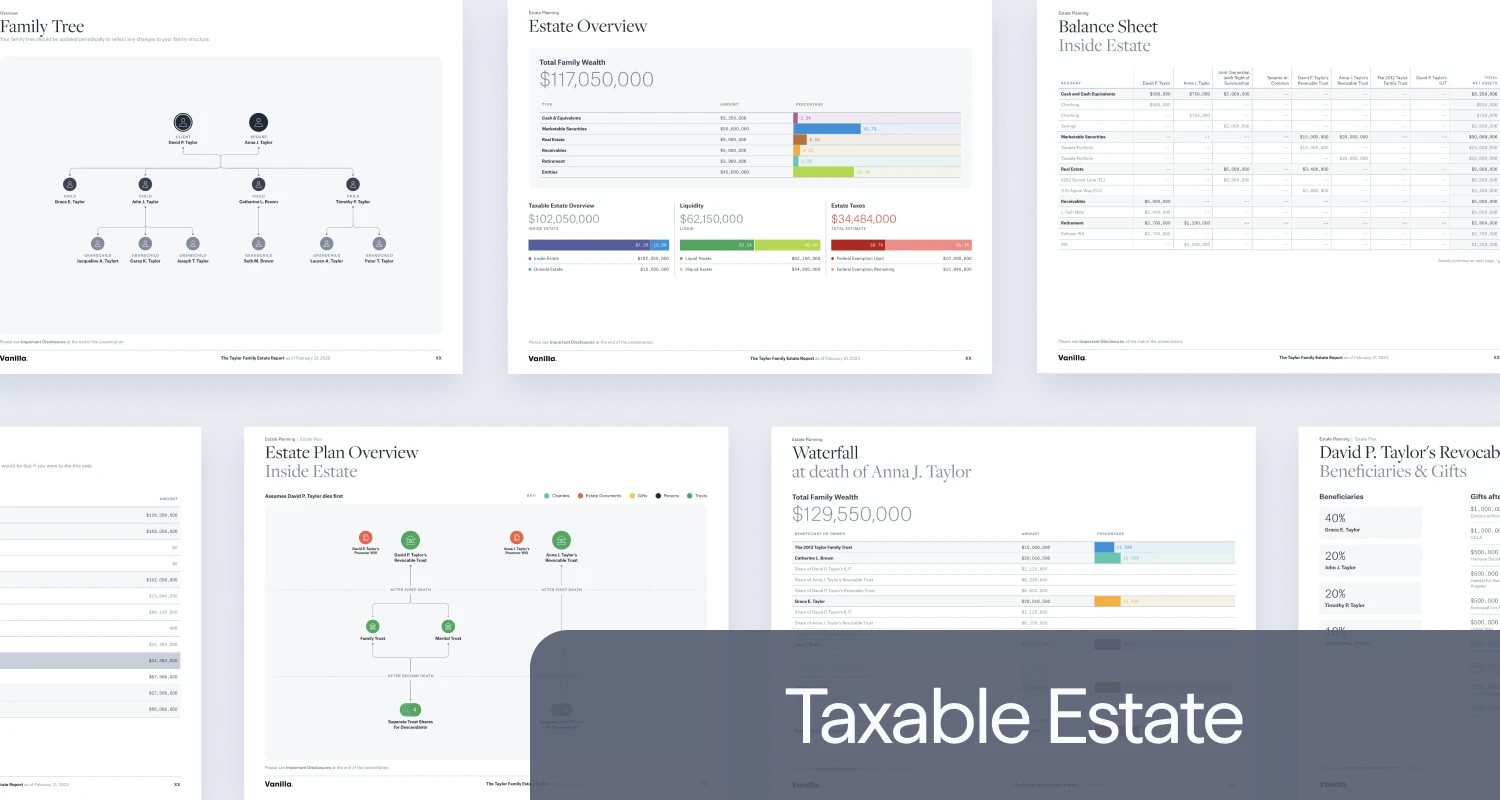

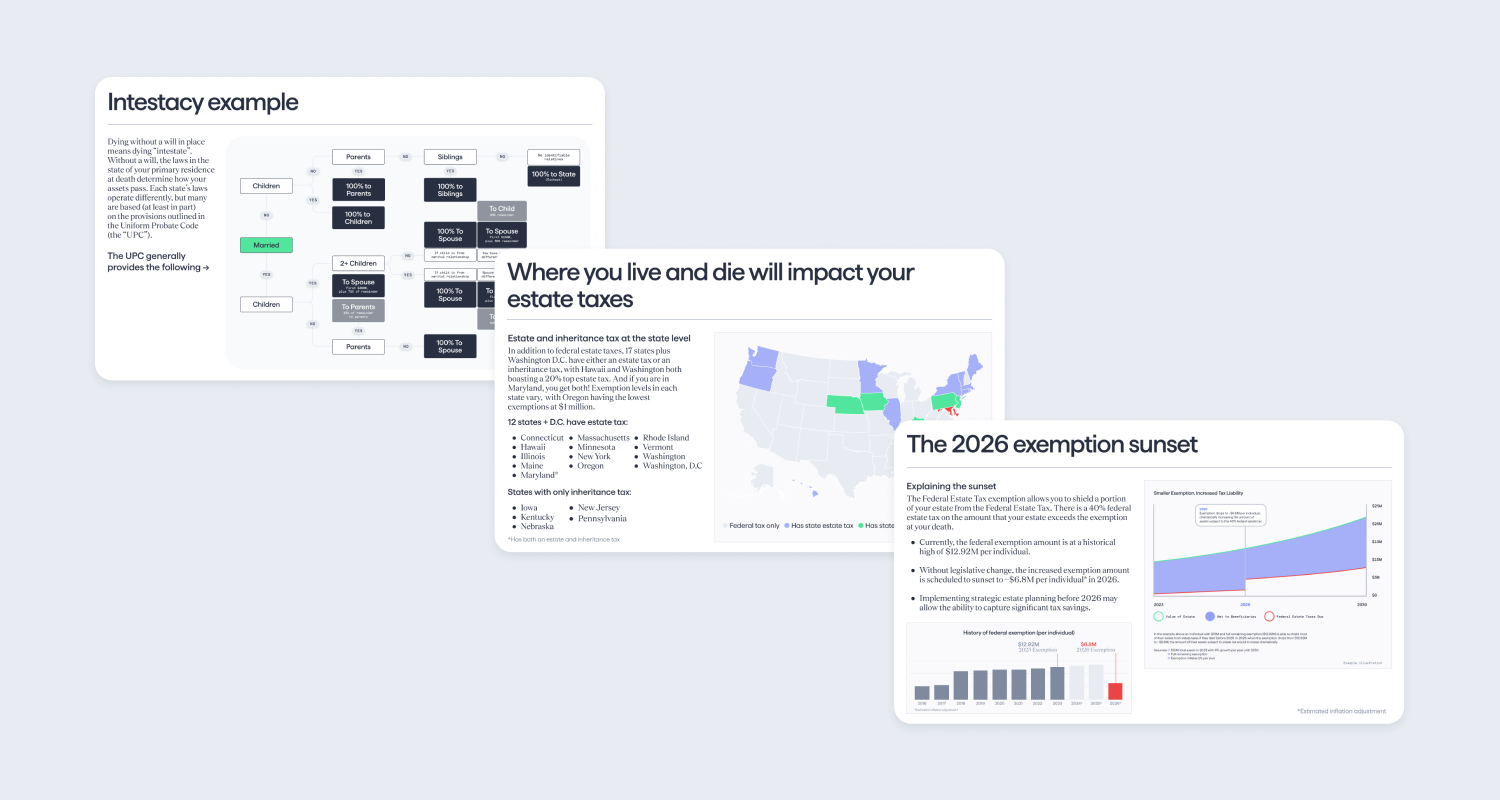

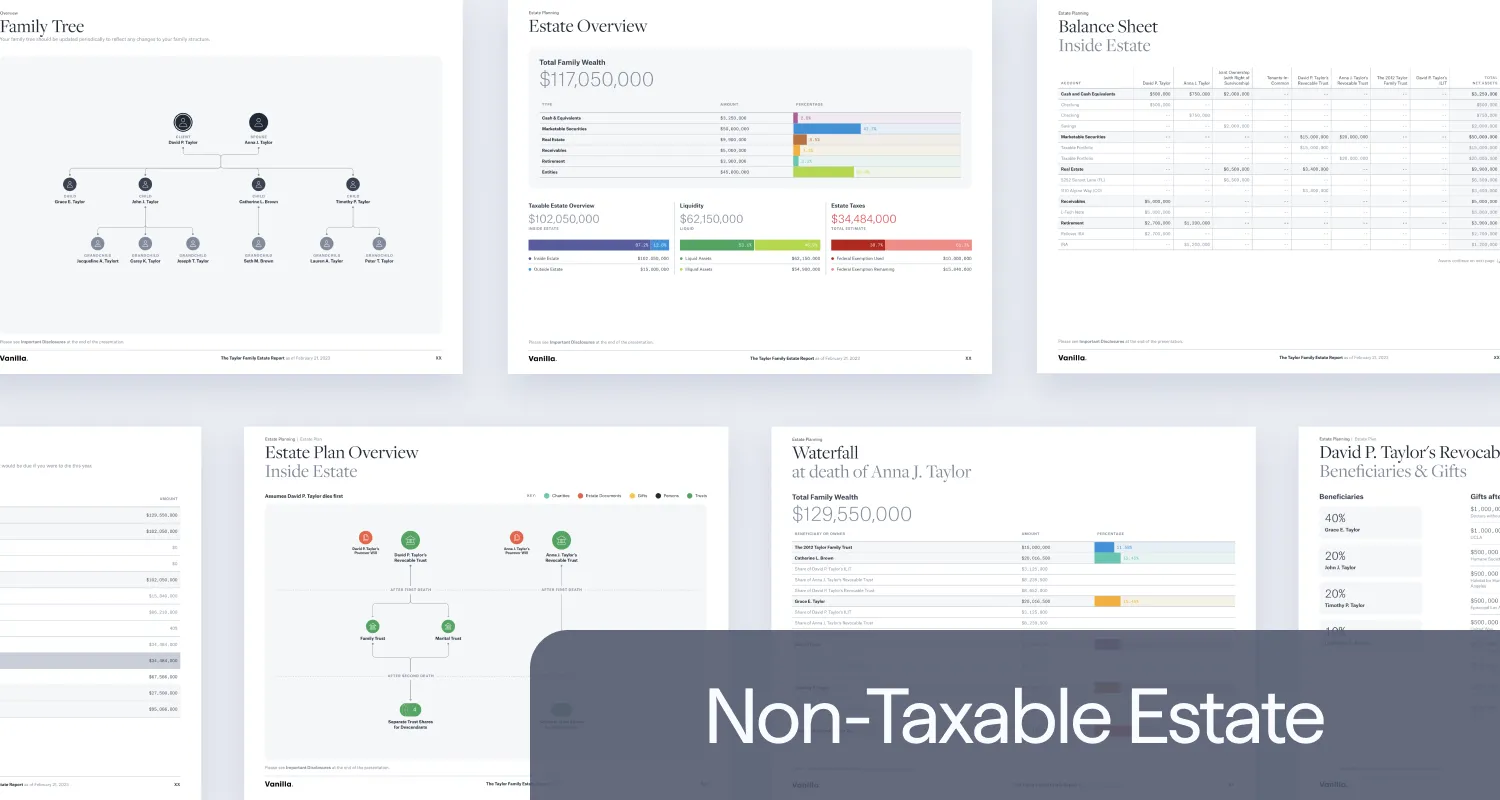

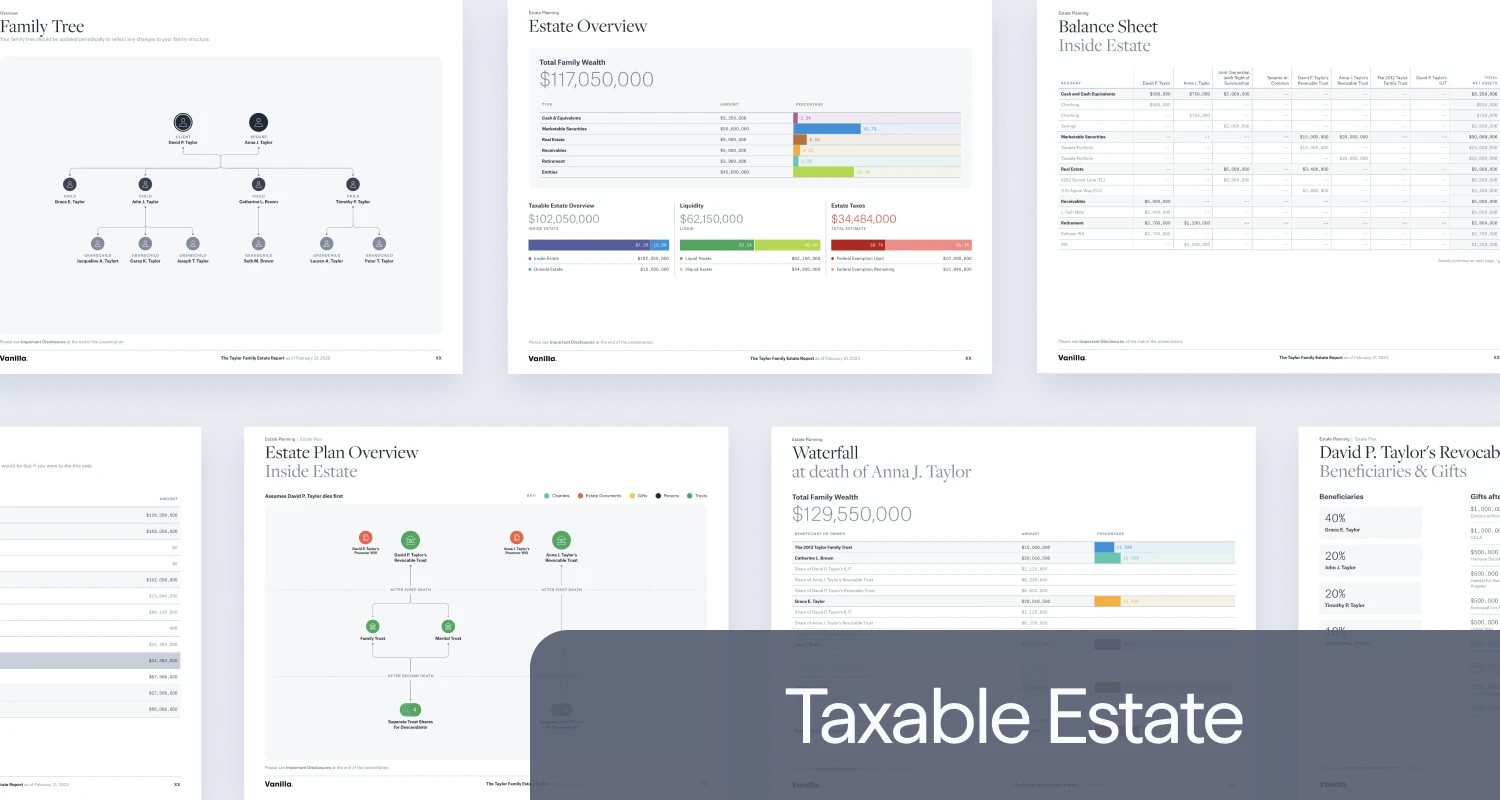

10 Diagrams to Explain Advanced Estate Planning Strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Jessica Lantz

•

Feb 28, 2025

What’s New in February: Advanced Calculators, Streamlined Document Creation, and More

February brings exciting enhancements to the Vanilla platform, with new features designed to support advanced planning techniques and make document creation easier than ever. Here's what you can expect: Make starting the estate conversation easier than ever The latest evolution of Estate Health Check arrives with an improved advisor landing page to help enable clients and prospects access Estate Health Check more easily. This comprehensive update revolutionizes how advisors engage with prospects and clients and identify planning opportunities, featuring: Facilitate conversations with personalized discussion topics based on client inputs Branded public links for seamless prospect and client outreach An enhanced...

Think Advisor

•

Feb 26, 2025

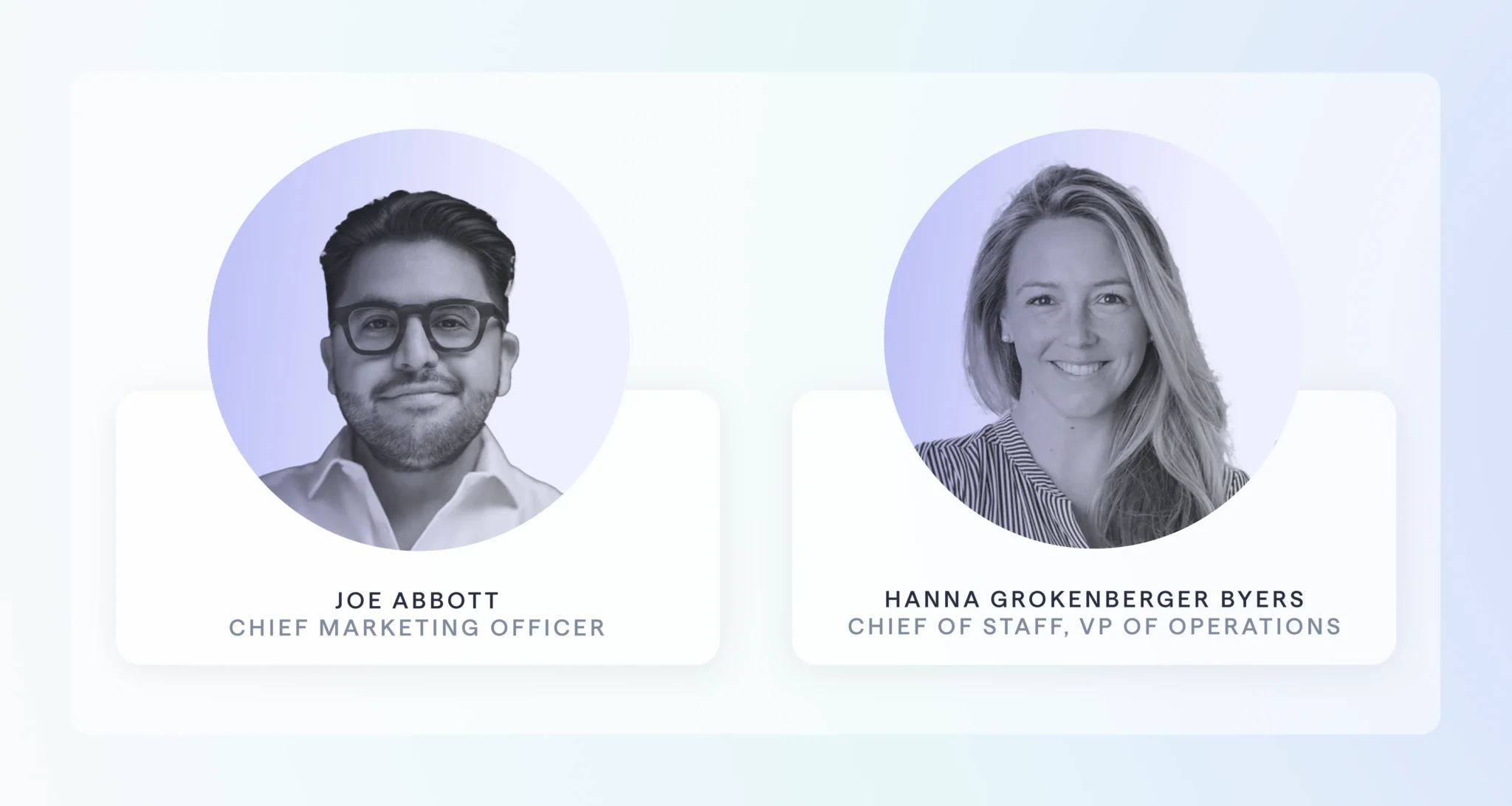

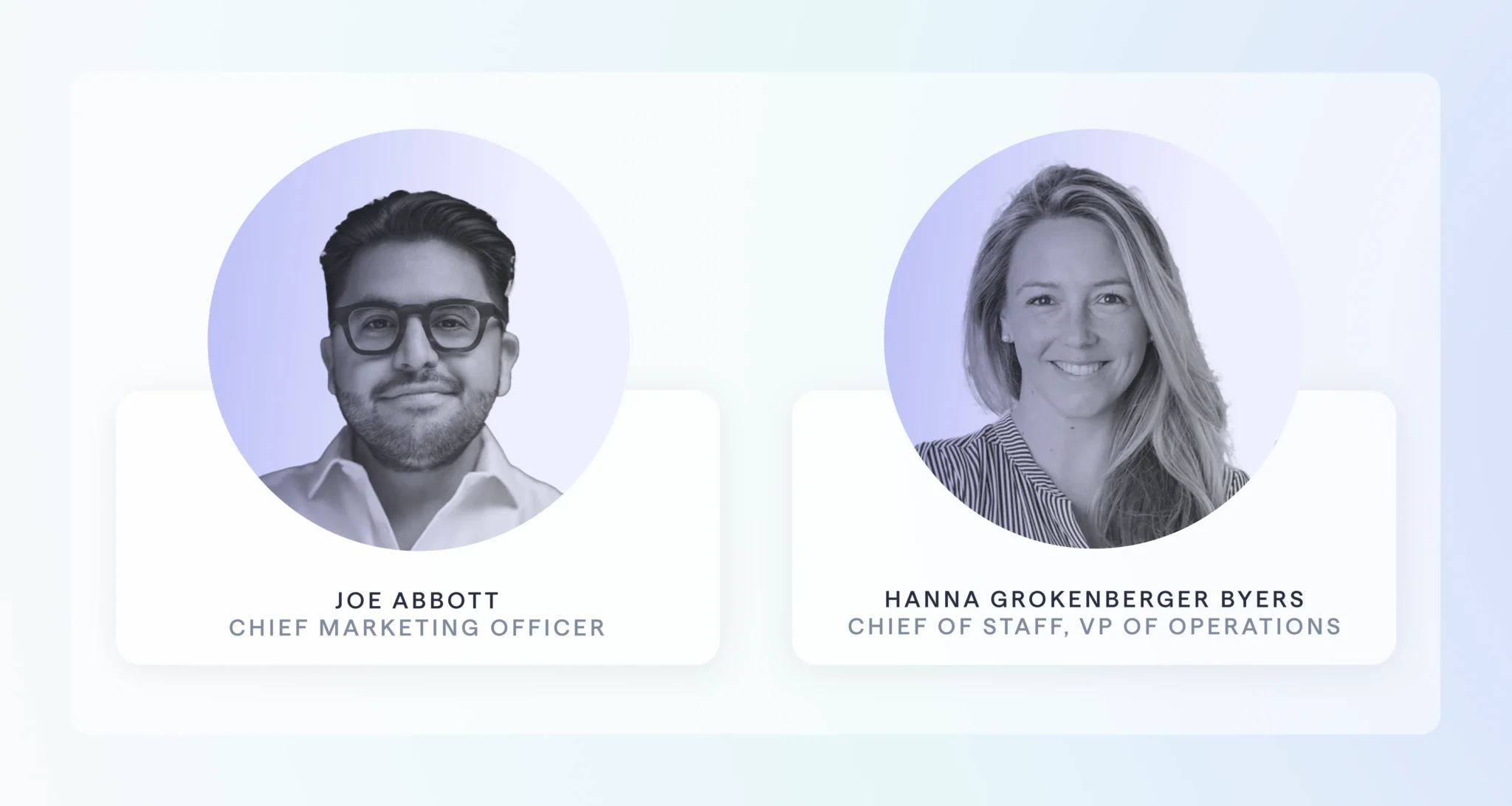

Vanilla Appoints Marketing Head and Chief of Staff

Vanilla, the estate planning technology provider, has appointed a new chief marketing officer, Joe Abbott, as well as a new chief of staff and vice president of operations, Hanna Grokenberger Byers. The executive appointments come a few weeks after Vanilla closed its fiscal year with nearly 300% year-over-year platform growth, surpassing 15,000 client estates, and some eight months after it secured $35 million in additional capital led by Insight Partners and new strategic investors Edward Jones Ventures, Nationwide and Allianz. “Bringing in experienced startup operators like Joe and Hanna is a critical part of further accelerating business momentum,”...

Vanilla

•

Feb 26, 2025

A guide to trusts for estate planning

Trusts are an important component of financial and estate planning, but there are many types of trusts – each with unique pros and cons. This guide helps financial advisors and clients sort through the many different types of trusts to better understand what they might want to employ for their own estate strategies.

Vanilla

•

Feb 26, 2025

Vanilla Adds New Executives from Brex, Goldman Sachs Amidst Nearly 300% YoY Growth

Joe Abbott joins as Chief Marketing Officer and Hanna Grokenberger Byers named Chief of Staff and VP of Operations as the Vanilla platform surpasses 15,000 client estates Vanilla, the leading platform in modern estate planning, today announced the appointment of Joe Abbott as Chief Marketing Officer and Hanna Grokenberger Byers as Chief of Staff and Vice President of Operations. This comes just weeks after the company ended its fiscal year with 293% year-over-year platform growth and the release of V/AI Copilot, the first AI agent for estate advisory. In the last year, Vanilla has cemented its position as category leader...

Jessica Lantz

•

Feb 24, 2025

2024 in Review: A Transformational Year for Estate Planning

As we gear up for our first product release in the new fiscal year, we’re reflecting on 2024 and the remarkable achievements and transformative features that have shaped estate planning for advisors and their clients. Here are some high points: Platform adoption skyrocketed 300% 16,000+ estates and $250B in assets were modeled with Vanilla 80+ new features were shipped to make estate planning easier than ever Let’s dive into our top product releases of 2024. Accelerate onboarding and planning with the power of AI Delivering time savings and facilitating client conversations with AI was a big focus in 2024. We...

Madison Eubanks

•

Feb 21, 2025

Why You Need to Periodically Update Your Estate Plan (and the Risks of...