Daniel Brockley

Daniel Brockley

Process Matters: Why “bespoke” is not enough when it comes to estate planning

Part I in a series of 3 on The Vanilla Estate Planning Playbook.

Talk to any financial advisor out there, and you’ll hear a common refrain: Sure, we do estate planning.

The thing is, what advisors mean when they say they do estate planning varies wildly. For many, doing estate planning simply means asking clients if they have basic documents in place, such as a Will, trust(s), healthcare directive and power of attorney. If the client has docs, the financial advisor moves on to other matters like investments. If they don’t, they refer the client to an estate attorney and…move on to other matters like investments. While this level of service is certainly better than not inquiring about a client’s estate plan at all, it misses huge opportunities.

There is another level of estate planning financial advisors sometimes offer that we’ll call “bespoke.” This approach elevates the estate planning conversation beyond just checking the boxes, and some of the best advisors in the world subscribe to the bespoke model. But it, too, falls short. It leaves value on the table.

The bespoke model

First, what exactly is the bespoke model of estate strategy? It’s simply the philosophy that an advisor will deliver completely tailored counsel to clients based on their needs. Nothing wrong with that, right? In fact, it sounds pretty ideal. Advisors always want to take a tailored approach with clients, considering not only their holistic financial health, but also their short and long term goals, unique priorities and special circumstances. But embracing an open-ended, unstructured bespoke strategy, without any sort of rigor or process, allows for opportunities to fall through the cracks.

Steve Lockshin, co-founder of Vanilla, created the structure he and his firm needed in the form of a playbook. He recounts the genesis of this playbook in a recent webinar saying, “The playbook came out of my frustration that even at my own firm there were things that weren’t being done for clients. When we talk about estate planning, there are a lot of things that need to happen. The playbook was a checklist of sorts for everything we should do for every client periodically, most of them at least once a year.”

A more comprehensive picture, a deeper conversation

Establishing a process for how you and your firm approach estate planning ensures that not only is the initial strategy set up well, but that the plan is continually updated and evolves with your clients’ needs. It also gives advisors an important window into clients’ complete balance sheet, including assets that may not be currently under their management. With insights gleaned from this more comprehensive picture, advisors are positioned to give more valuable counsel – and can potentially flag assets or investments that they might be able to better sheppard. In this way of working, we are not eliminating the bespoke nature of the advice, but adding structure around it to ensure advisors bring the most value possible.

Steve Lockshin created his playbook for AdvicePeriod, on which we based The Vanilla Estate Planning Playbook, when he realized that even experienced advisors were leaving opportunities on the table. Lockshin had the advantage of decades of experience in financial and estate strategy to pull from as he created his firm’s guide, and it’s a great starting point if you’re looking to create one for your firm.

The right approach for your firm

There isn’t a single perfect way to integrate estate planning into a wealth management firm – it will depend on a variety of factors. For some advisors, like Lockshin, whose client base is ultra-high net worth, they might isolate different elements of estate strategy throughout multiple meetings or touchpoints in a year. Others, like FMB, Dogwood and Balentine consider estate planning one of the core pillars of their firms and have a single estate planning meeting per year with existing clients, along with additional meetings for investments, insurance and taxes. However your firm organizes estate planning in relationship to other disciplines, though, if “estate planning” is on your website as an offering, it’s got to be more than an afterthought. It needs to be done right.

Regardless of meeting cadence, you can think of estate planning in two primary categories: new client engagements (discovery and foundational strategy) and annual maintenance (evolving the plan in accordance with life changes). Within both of those states, the advisor and team will need to:

-

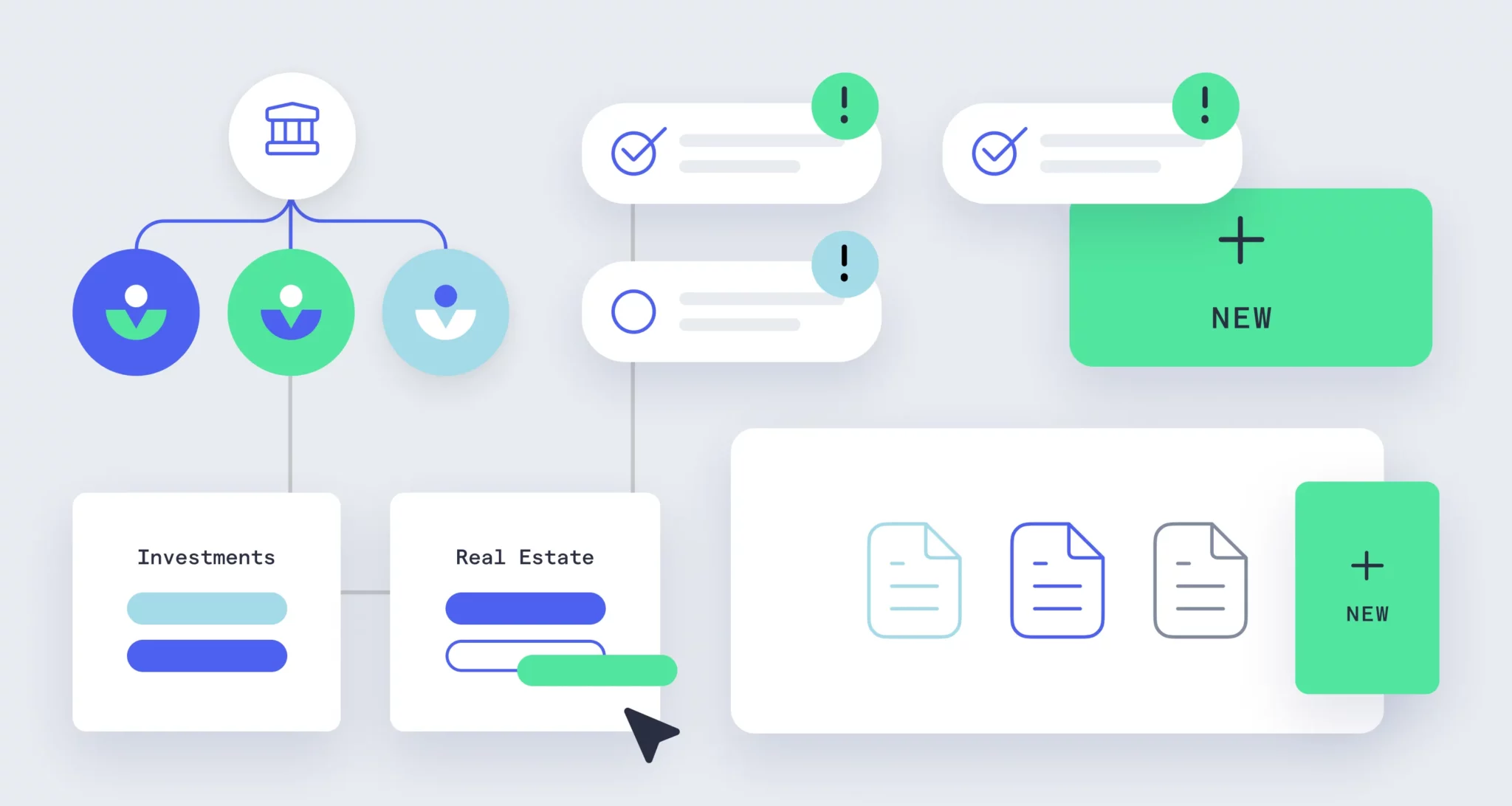

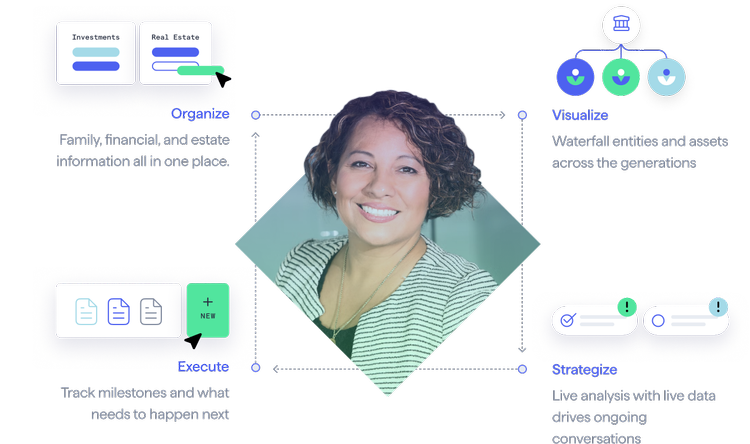

Organize

-

Visualize

-

Strategize

-

Execute

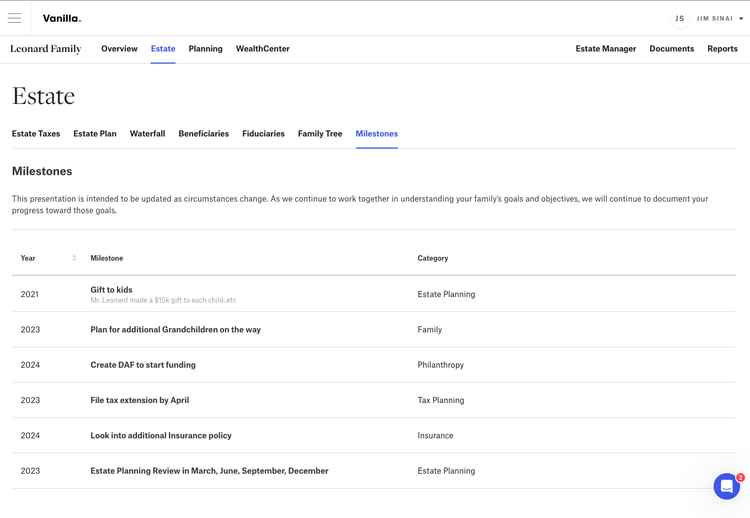

Use milestones to guide the conversation

Vanilla enables both the advisor and client to get a holistic picture of assets, beneficiaries and the waterfall of distribution. It offers a more complete view than just an overview of investments, and enables the advisor to have a deeper, more meaningful conversation with the client. It also helps you guide that conversation throughout your client relationship, meeting after meeting, year after year, through the use of milestones. These milestones (example below) help you codify your clients goals so that you can come back to them ensure their financial and estate strategy is on course – and adjust it when that course needs to change.

If you’d like to learn more about how Vanilla can help you offer high-quality estate strategy at scale, reach out to our sales team.

We’ll continue our conversation on the playbook with parts two and three of this series, where we’ll take a deeper dive into new client engagements and annual maintenance. Stay tuned!

About Vanilla

Vanilla is the Estate Advisory Platform, purpose-built to enable financial advisors to build deeper relationships with their clients and empower clients to build and protect their legacy. From robust and easy-to-understand visualizations of complex estates, detailed diagrams of how assets transfer to future generations, to ongoing estate monitoring, Vanilla is reinventing the estate planning experience, end-to-end. Learn more about Vanilla at https://www.justvanilla.com/.

Media inquiries: Please contact press@justvanilla.com

The information provided here does not, and is not intended to, constitute legal advice or tax advice; it is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with your financial advisor or estate attorney who can advise as to whether the information contained herein is applicable or appropriate to your particular situation.

Published: Mar 02, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.