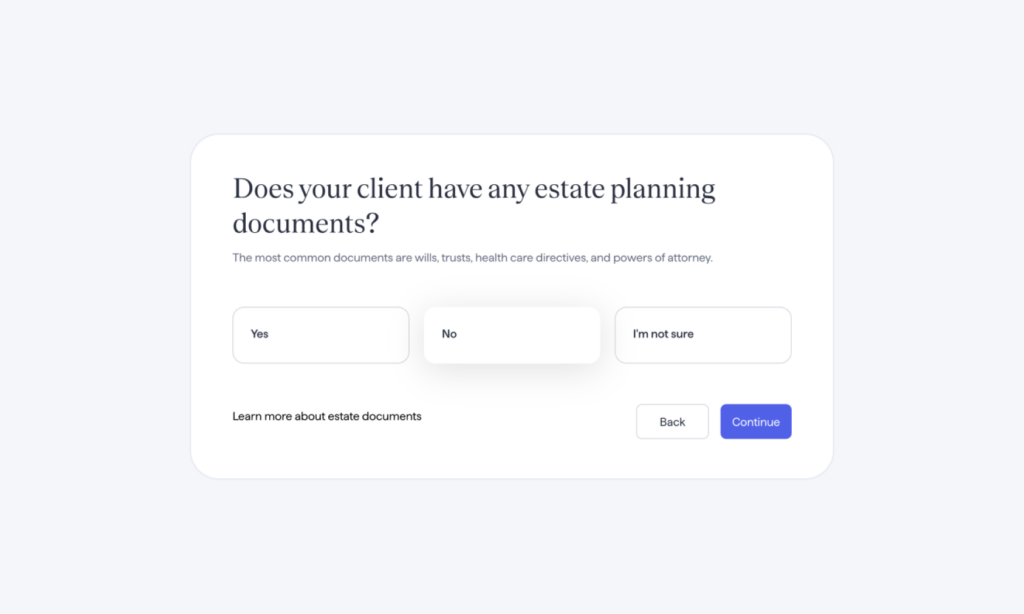

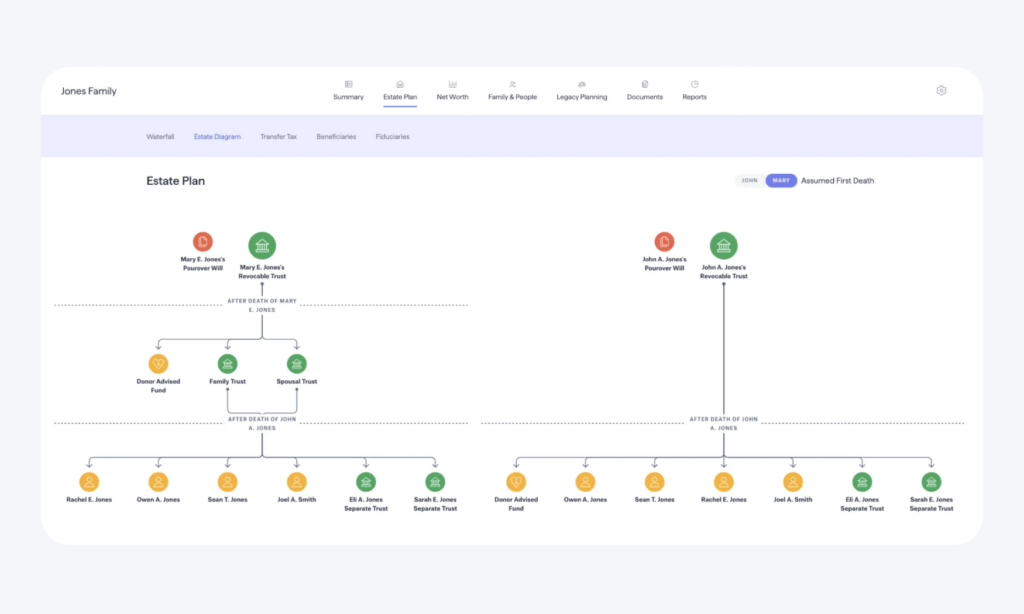

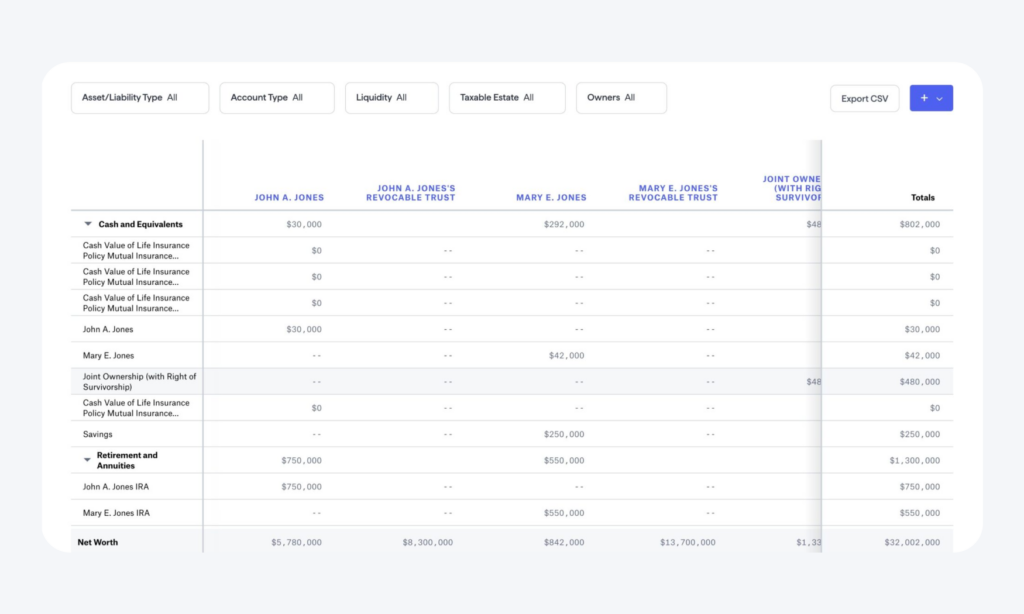

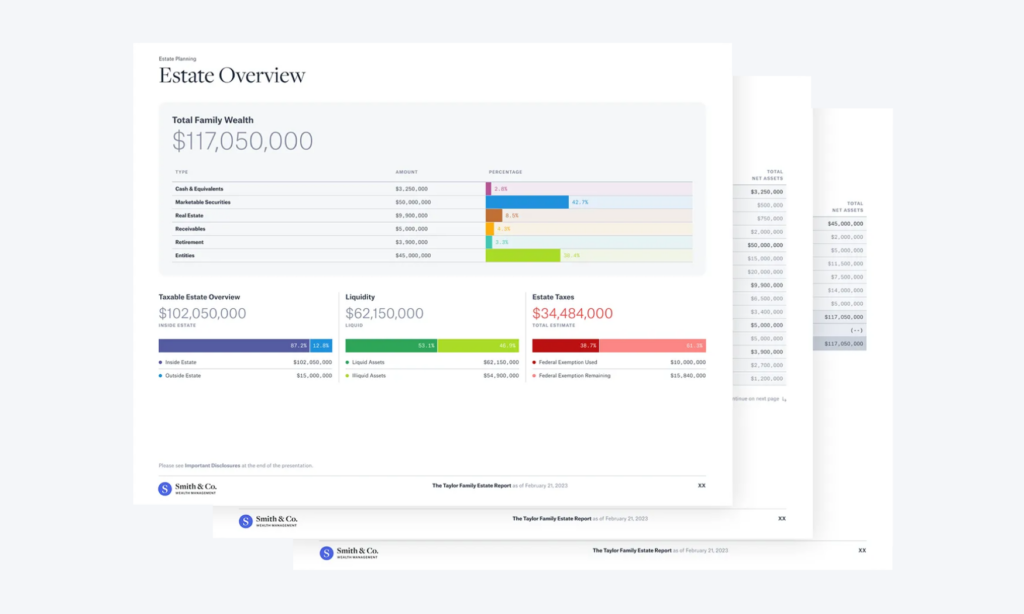

“Vanilla helps us create outstanding estate plan reviews that our clients can see and understand. And the platform helps us engage clients in ongoing conversations around their legacy.”

Michael Rossi, CFP®

Financial Advisor