Jessica Lantz

•

Feb 25, 2026

What’s New in February: Full estate summary source tracking, smarter data syncing with...

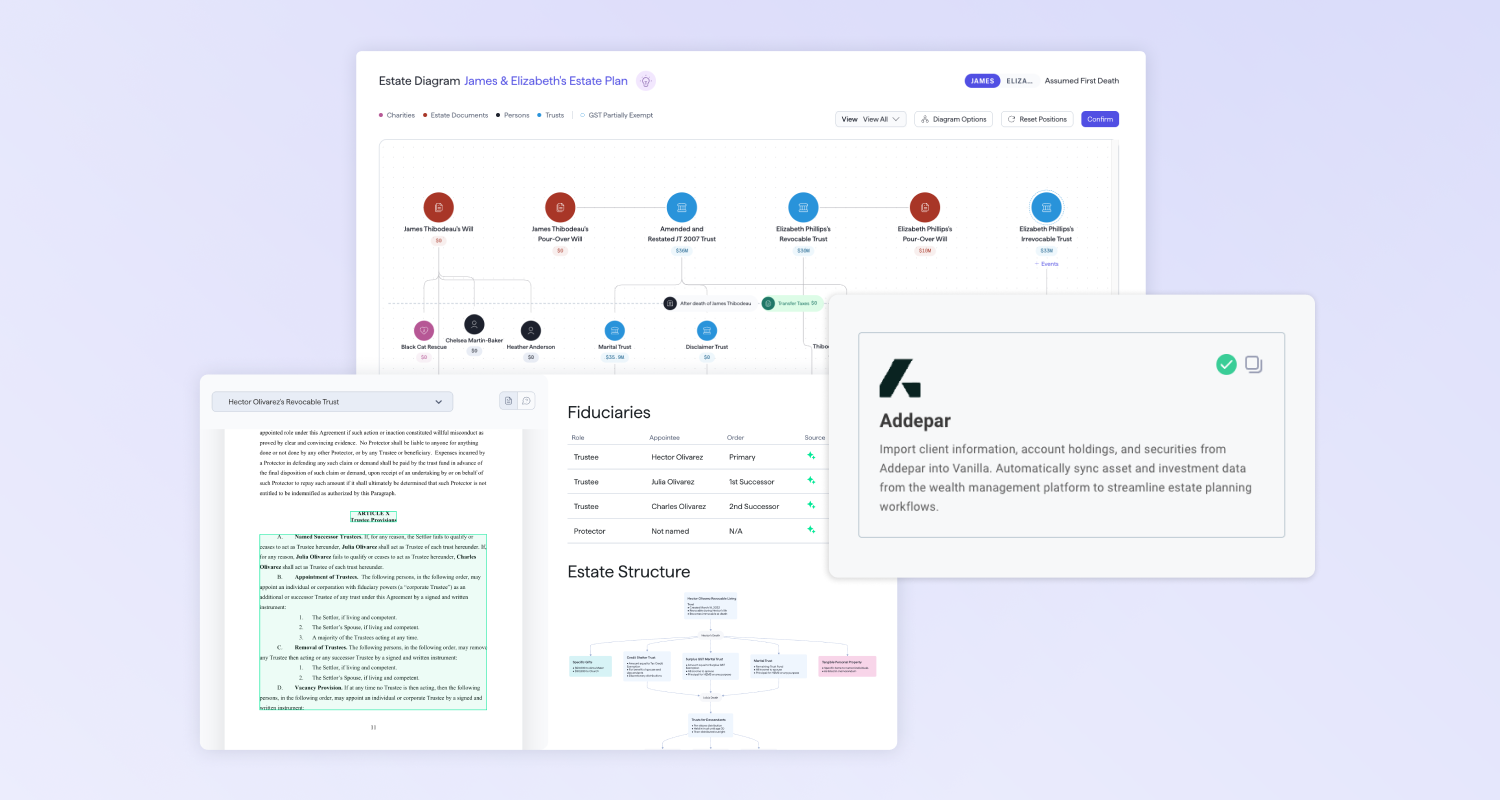

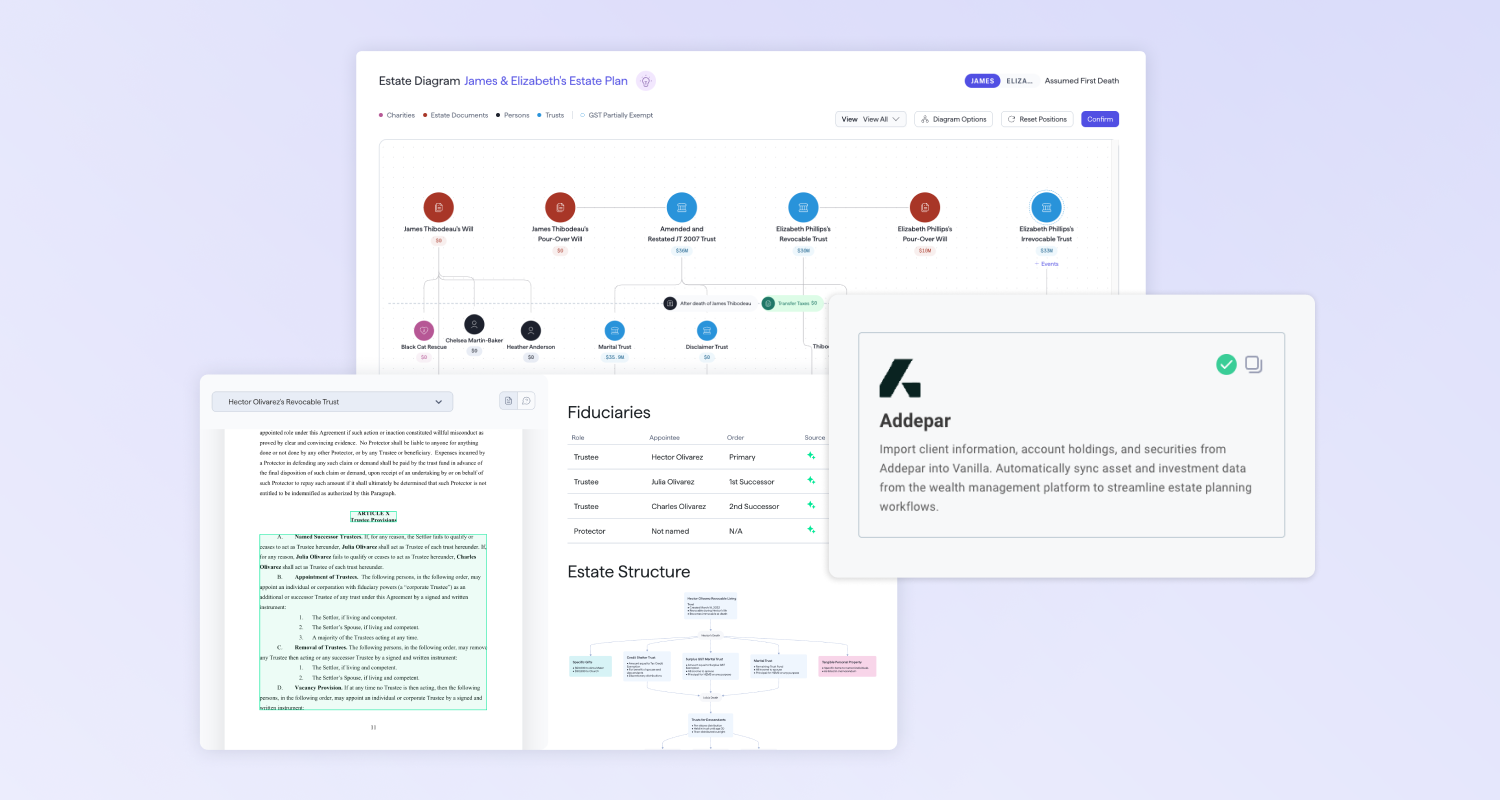

This month's releases are about removing friction—the kind that slows advisors down before they ever get to the work that matters. From smarter AI verification to an upgraded integration, February's updates are built around one idea: your time is better spent on clients, not on your tools. Here's what's new. Source tracking for all of VAI’s work: Trust every insight, across every document The challenge: When V/AI generates a full estate summary, advisors need to know exactly where each insight is coming from. Manually cross-referencing AI-generated insights against a stack of documents takes away time advisors should be spending on...

Jessica Lantz

•

Feb 05, 2026

2025 Year in Review: A Transformative Year in Estate Planning

2025 was a groundbreaking year at Vanilla. We fundamentally changed how advisors approach estate planning, from announcing our patented estate planning technology to reimagining scenario modeling from the ground up. There’s been a lot to celebrate. We welcomed almost 400 new customers. Over 22,000 new estates were modeled with Vanilla, and we delivered over 60 revolutionary new features to make estate planning easier than ever. Let's walk through the major milestones that shaped 2025. Auto-abstraction In February, we launched auto-abstraction through Vanilla Document Builder. Advisors are saving hours per client by having Vanilla automatically generate professional estate diagrams when clients...

Jessica Lantz

•

Jan 28, 2026

What’s New in January: Balance Sheet Enhancements, V/AI Summary Source Tracking, and big...

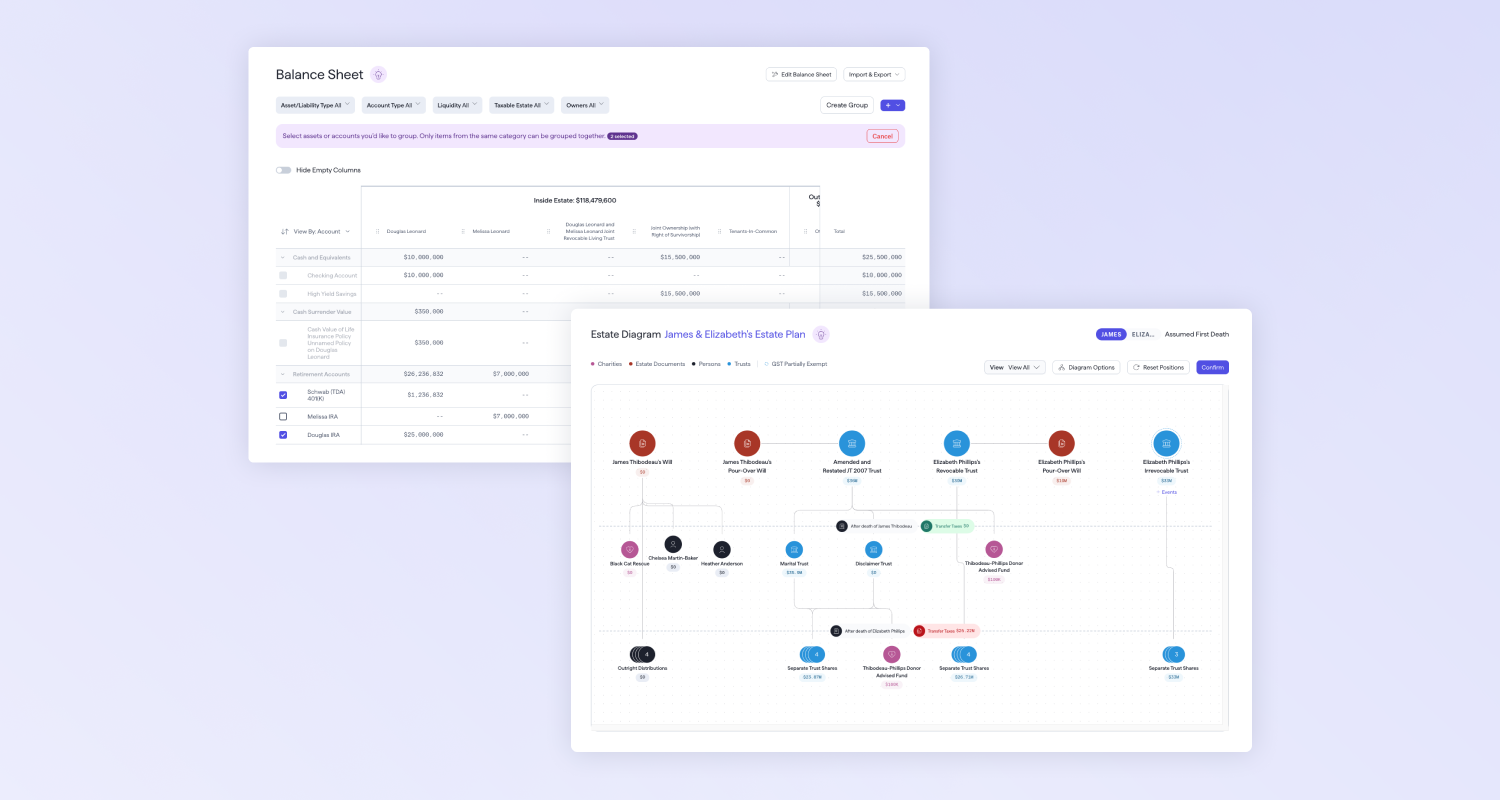

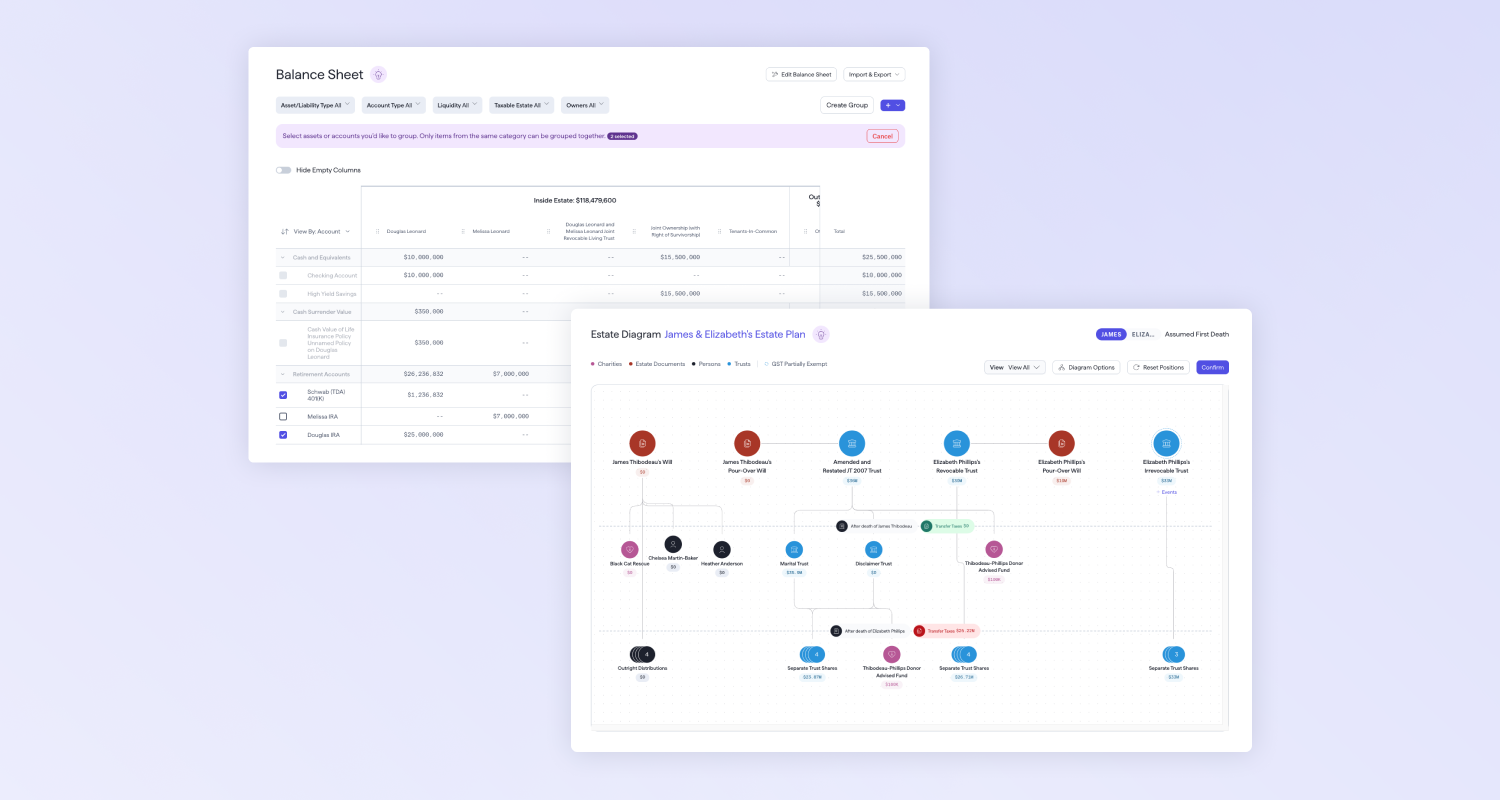

January brings powerful upgrades that streamline how you manage complex estate data and present plans to clients. From flexible Balance Sheet organization to AI transparency and dynamic estate visualizations, these releases help you work more efficiently while delivering exceptional client experiences. Balance Sheet grouping: Organize complex data with ease The challenge: Estates with numerous assets create lengthy Balance Sheets that make it harder to highlight what matters most and understand critical financial information at a glance. The solution: Create custom groups to consolidate similar assets or accounts into single, collapsible line items, reducing visual clutter Quickly expand grouped items to...

Jessica Lantz

•

Dec 03, 2025

What’s New in December: Enhanced navigation, estate diagram upgrades, and powerful integration updates

This month brings transformative changes to how you interact with Vanilla. We've reimagined core navigation experiences, unified our estate visualization tools, and rebuilt our integration infrastructure from the ground up. Each enhancement addresses friction points in your daily workflows while unlocking new possibilities for managing complex client portfolios. Edit Balance Sheet data in one unified workspace The challenge: Cleaning up imported Balance Sheet data requires navigating between multiple accounts, creating a fragmented workflow that consumes hours and makes it difficult to maintain context across portfolios. The solution: A single, table-like workspace where you can review, validate, and correct all imported...

Jessica Lantz

•

Oct 29, 2025

What’s New in October: V/AI Estate Summary page improvements, waterfall enhancements, and more!

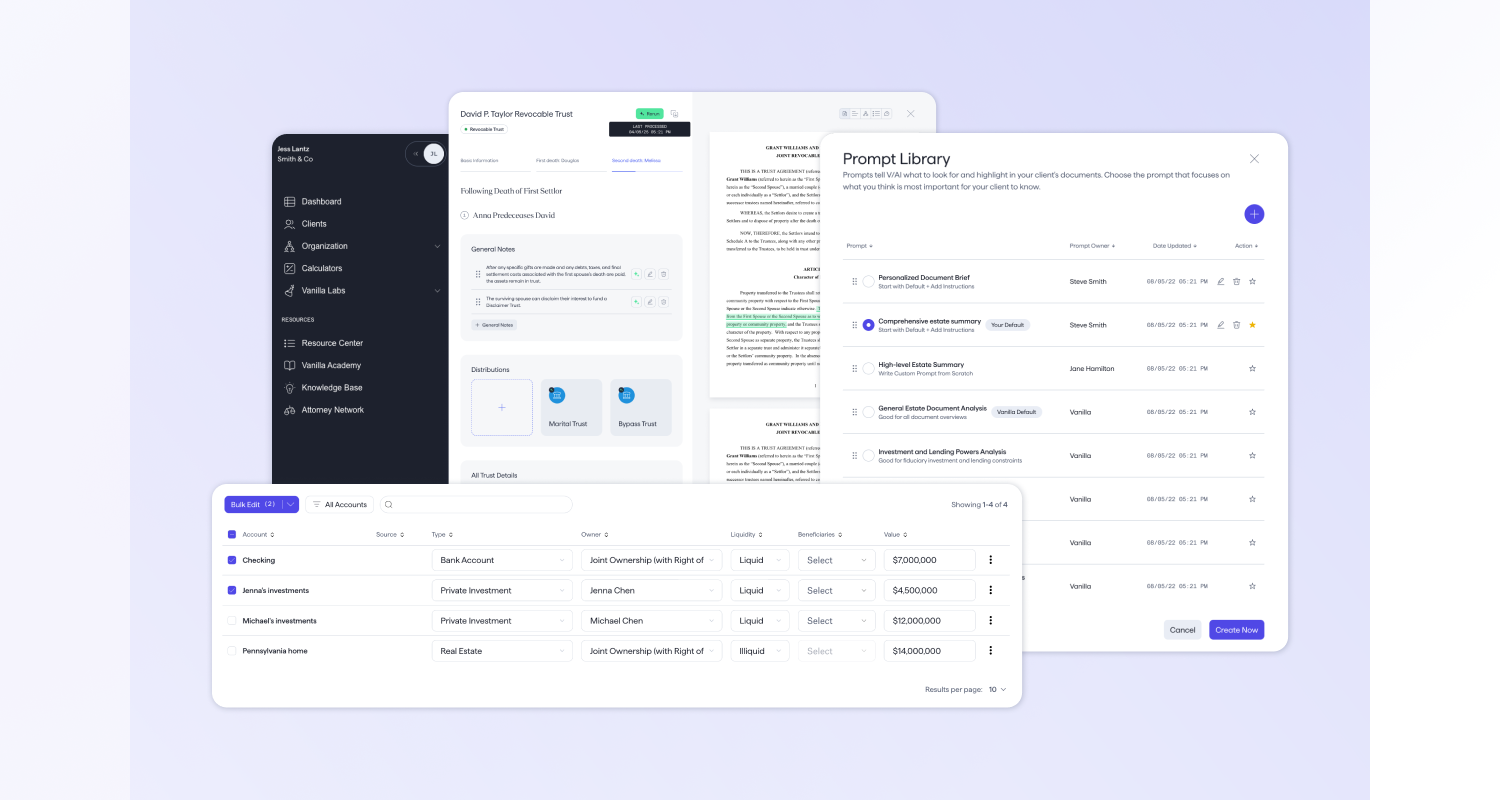

October brings meaningful enhancements to Vanilla—from enhanced AI estate summary capabilities to more intuitive waterfall modeling. Each improvement is designed to help you work faster and deliver deeper insights to your clients. Here's what's coming soon. V/AI Estate Summary page improvements: More control, better readability, clearer insights The challenge: Advisors need AI-generated summaries that are easy to scan, read, and present to clients without extensive reformatting. The solution: Enhanced typography and spacing create a more visually appealing, scannable layout that makes key information immediately more readable V/AI will clearly show which documents were used to generate the summary, building your...

Jessica Lantz

•

Sep 23, 2025

What’s New in September: Nationwide Inheritance Tax Calculations, New V/AI Features, and more!

This month's release tackles the friction points you've told us about—from inconsistent AI results across your team to managing multi-state inheritance tax requirements. Each enhancement works seamlessly with your existing processes while expanding what's possible. Here’s what came out in September, along with some features that are coming soon. Nationwide inheritance tax: Never miss inheritance tax implications again The challenge: Advisors with multi-state clients manually track varying inheritance tax rules across jurisdictions, risking costly oversights and planning errors. The solution: Vanilla is introducing inheritance tax calculation support for Maryland, Nebraska, and New Jersey—completing our nationwide coverage Automated, state-specific calculations integrate...

Vanilla

•

Aug 12, 2025

Vanilla Unveils Vanilla Scenarios™ Advanced Planning: The First Instant Modeling and Unified Workflow...

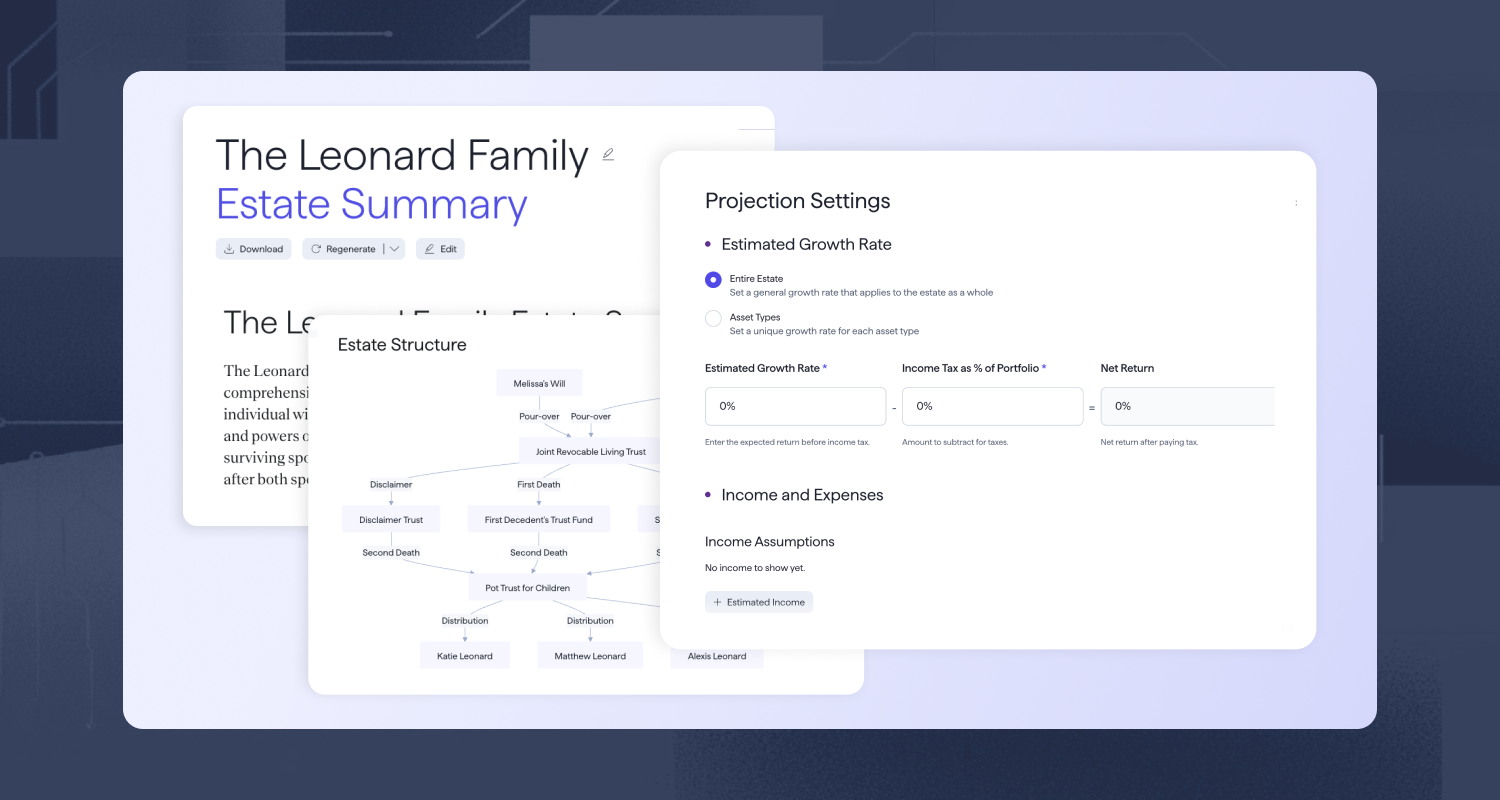

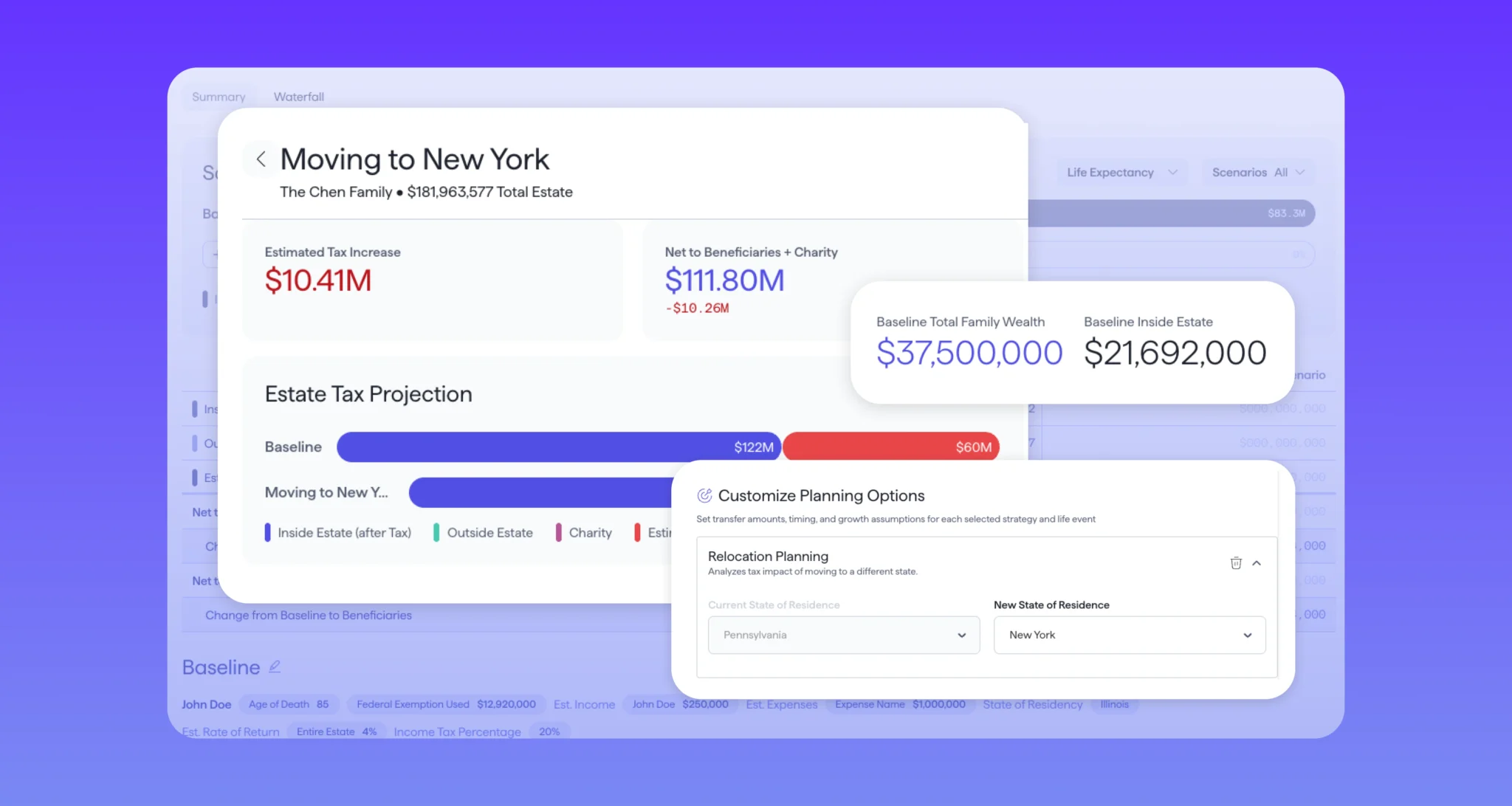

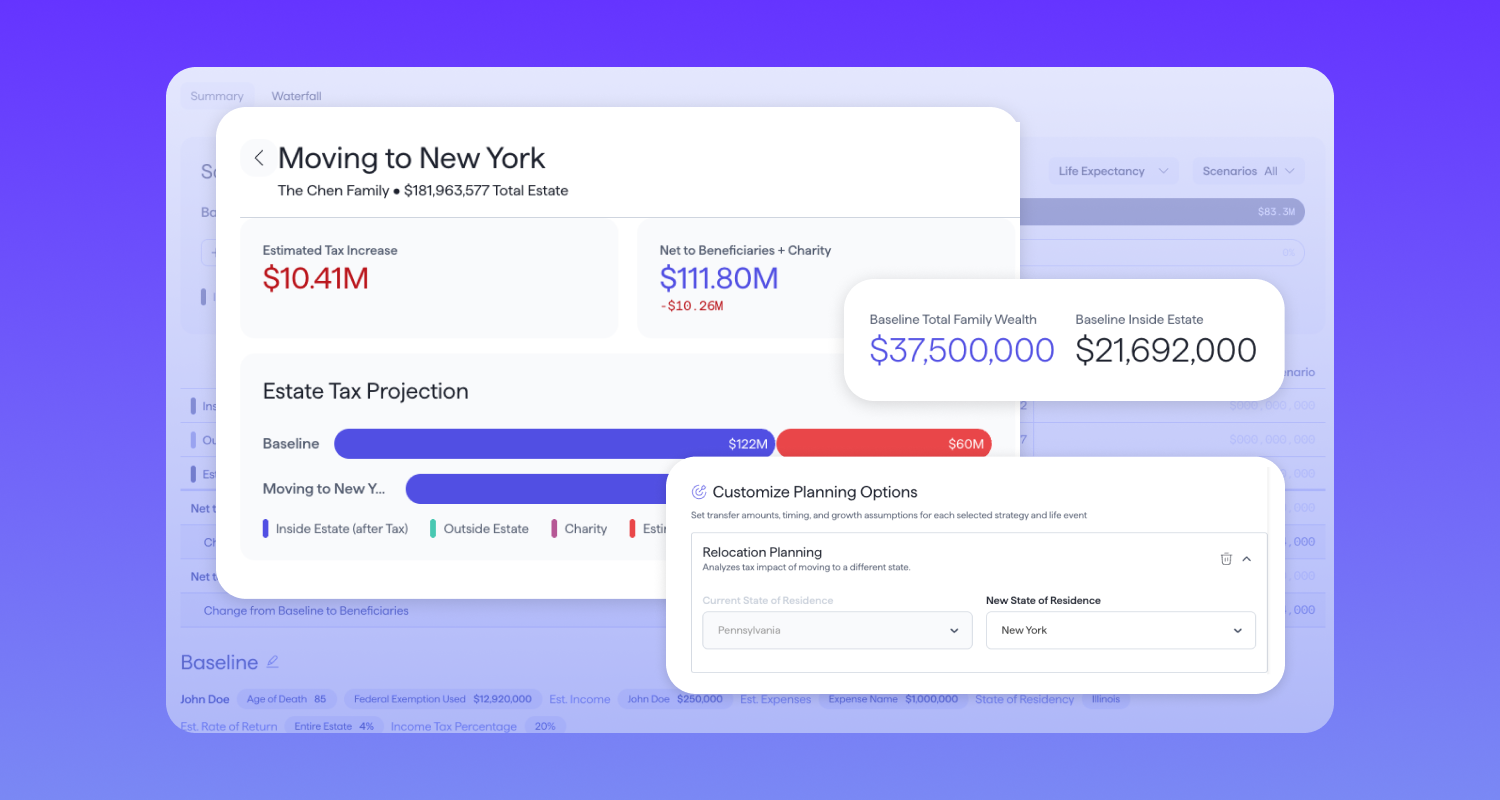

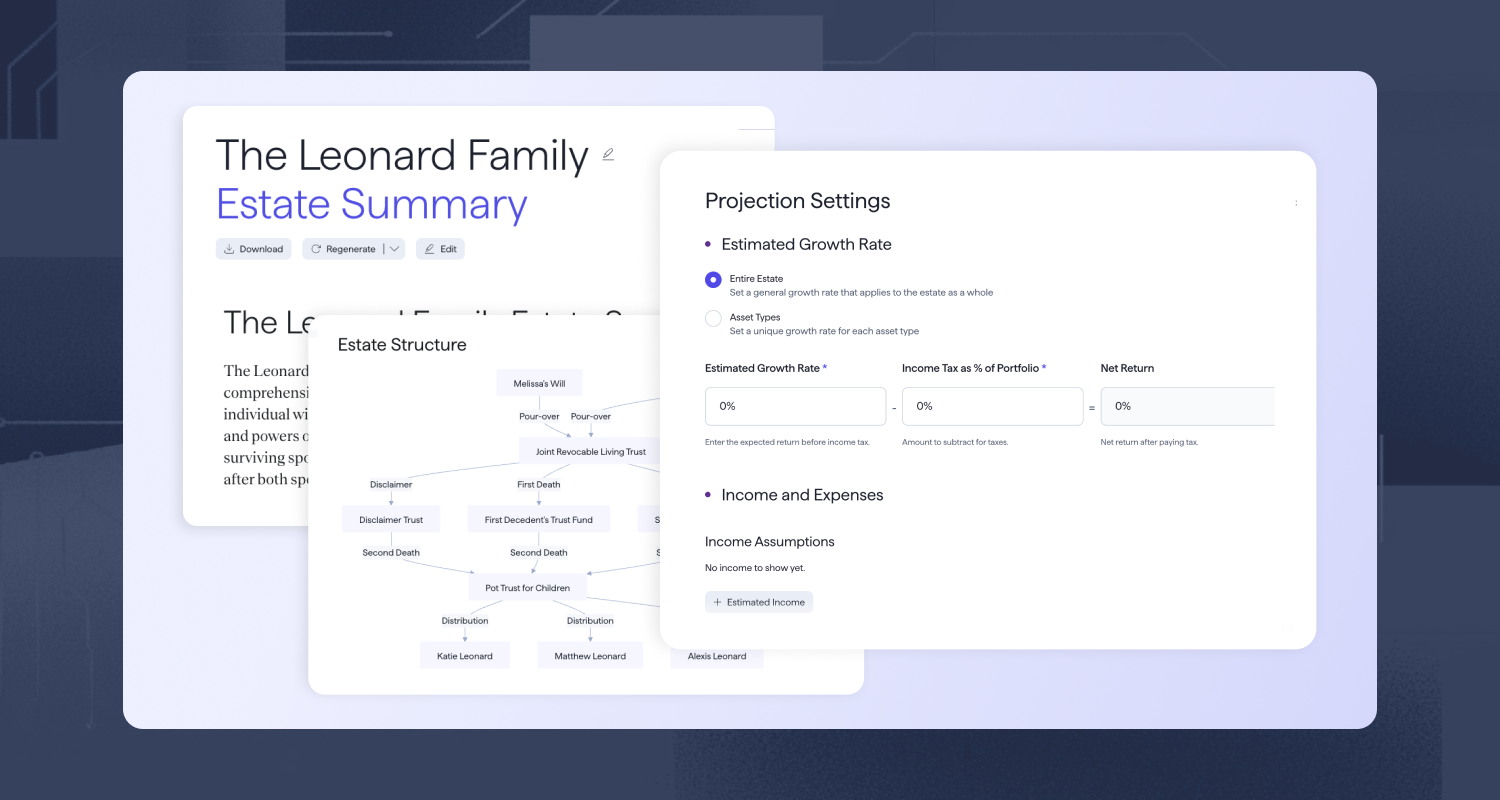

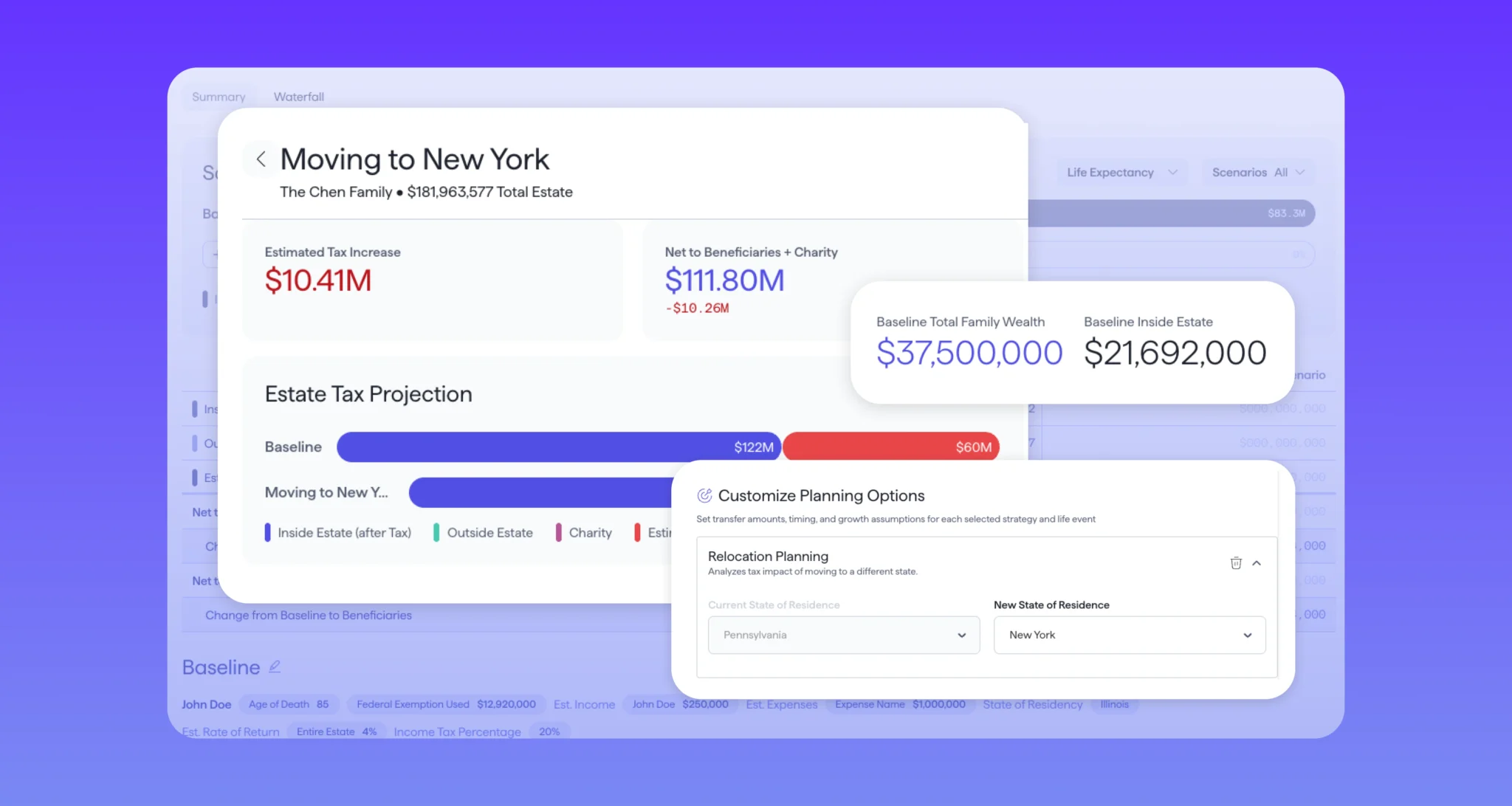

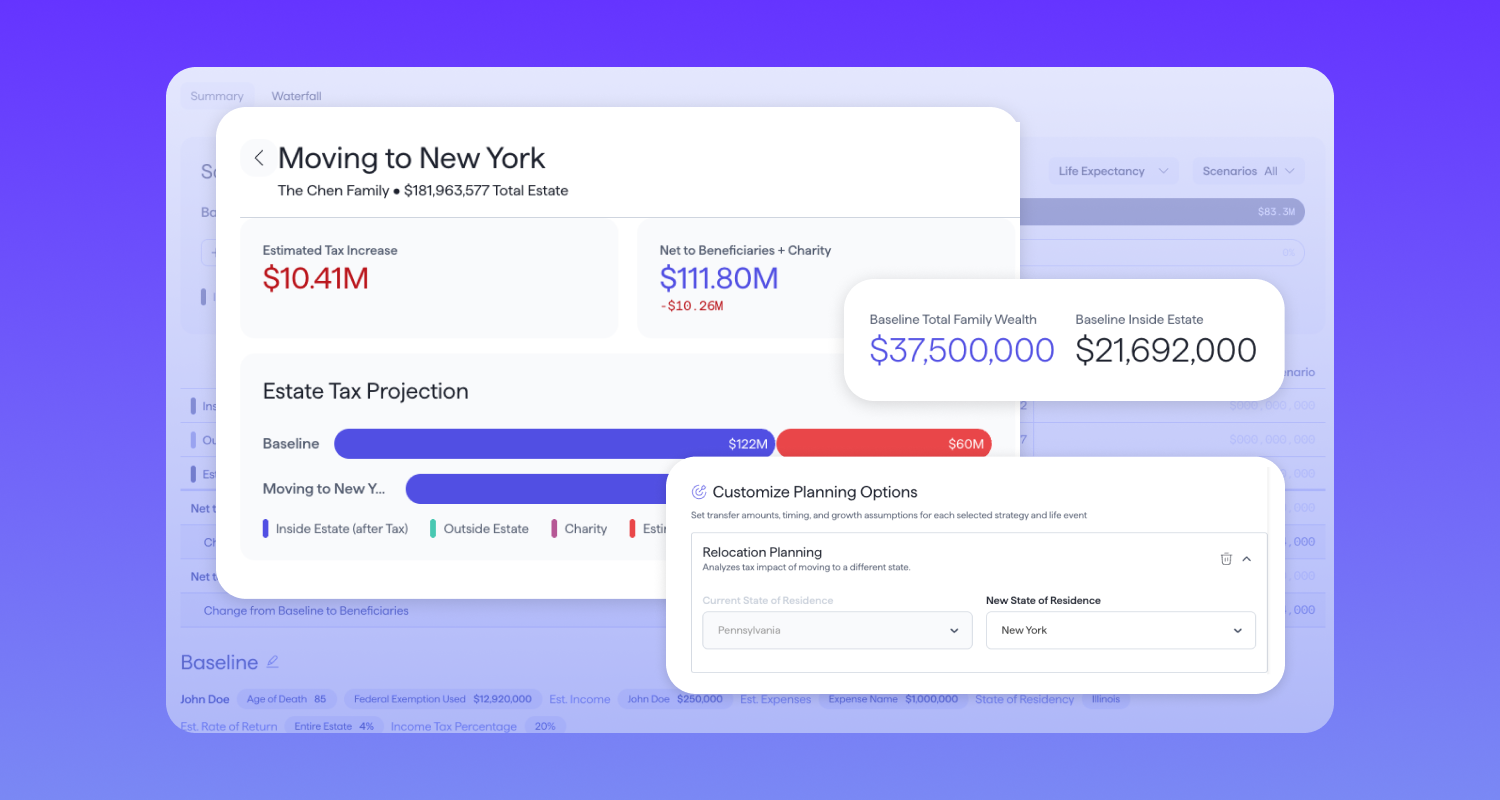

Advanced capabilities enable advisors to model complex estate planning strategies in minutes, transforming client conversations into collaborative planning sessions Bellevue, WA – August 12, 2025 – Vanilla, the leading provider of estate planning technology for advisors, today announced Vanilla Scenarios™ Advanced Planning, the next evolution of its all-in-one scenario planning tool. Building on the strong foundation established since its introduction in April 2024, this evolution of Vanilla Scenarios™️ delivers a more unified experience that enables financial advisors to model, compare, and present estate planning strategies with unprecedented speed and flexibility. Vanilla Scenarios™ Advanced Planning represents the most advanced estate planning...

Jessica Lantz

•

Aug 12, 2025

The Future of Estate Planning is Here: Introducing Vanilla Scenarios™ Advanced Planning

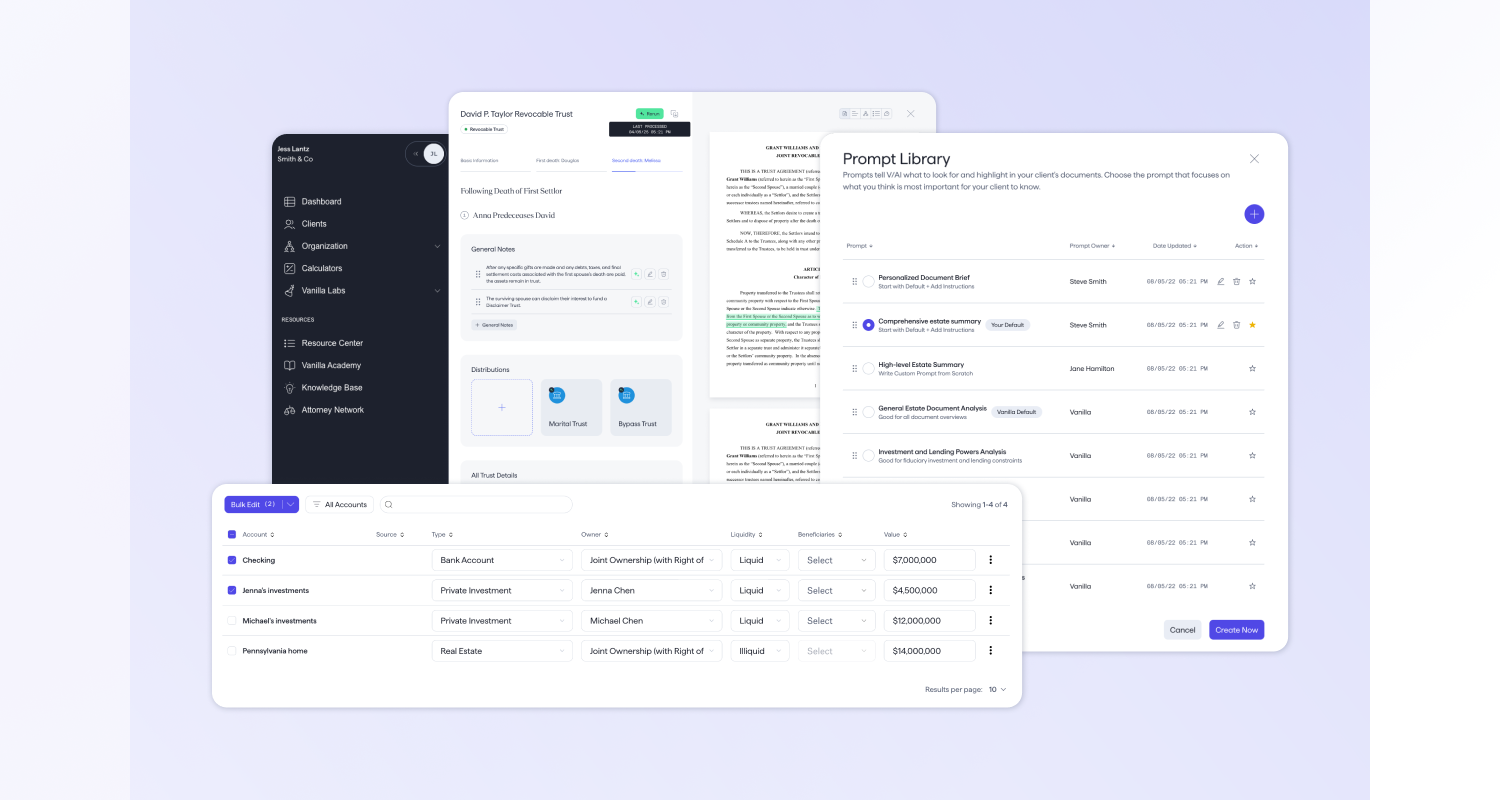

From first conversation to comprehensive strategy in minutes—powered by proven expertise and unmatched accuracy Today, we're excited to introduce Vanilla Scenarios™️ Advanced Planning—the next evolution of our all-in-one scenario planning tool that sets the standard for estate planning innovation. Building on success Over the past year, we've seen advisors achieve remarkable results with Vanilla Scenarios. But we've also heard a consistent request: make it even faster to get started, even more flexible for different workflows, and even more powerful for client conversations. The estate planning industry still faces fundamental challenges: fragmented tools that don't talk to each other, lengthy setup...

Jessica Lantz

•

Jul 29, 2025

What’s New in July: Updates to V/AI, enhanced integrations, and a sneak peek...

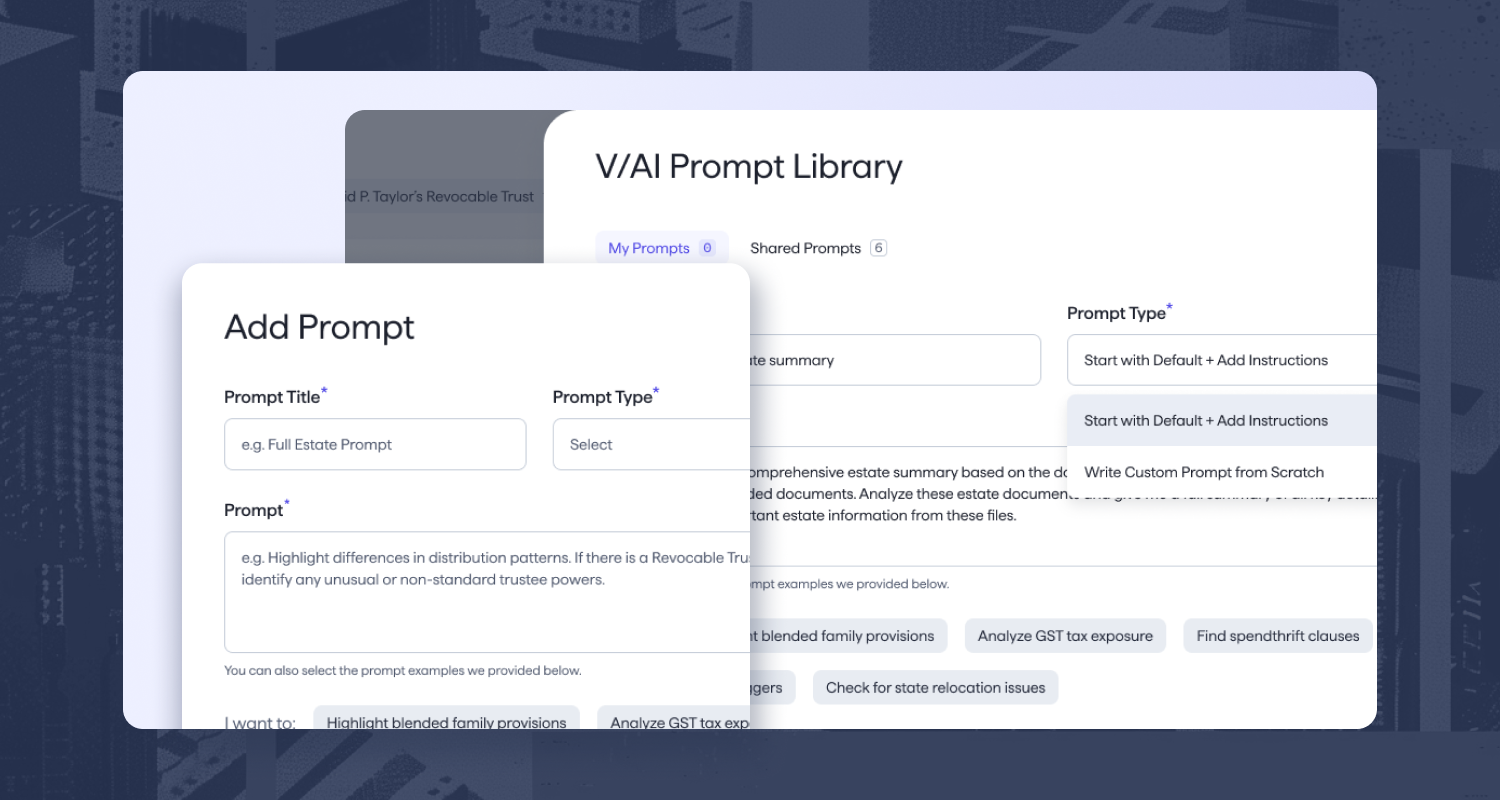

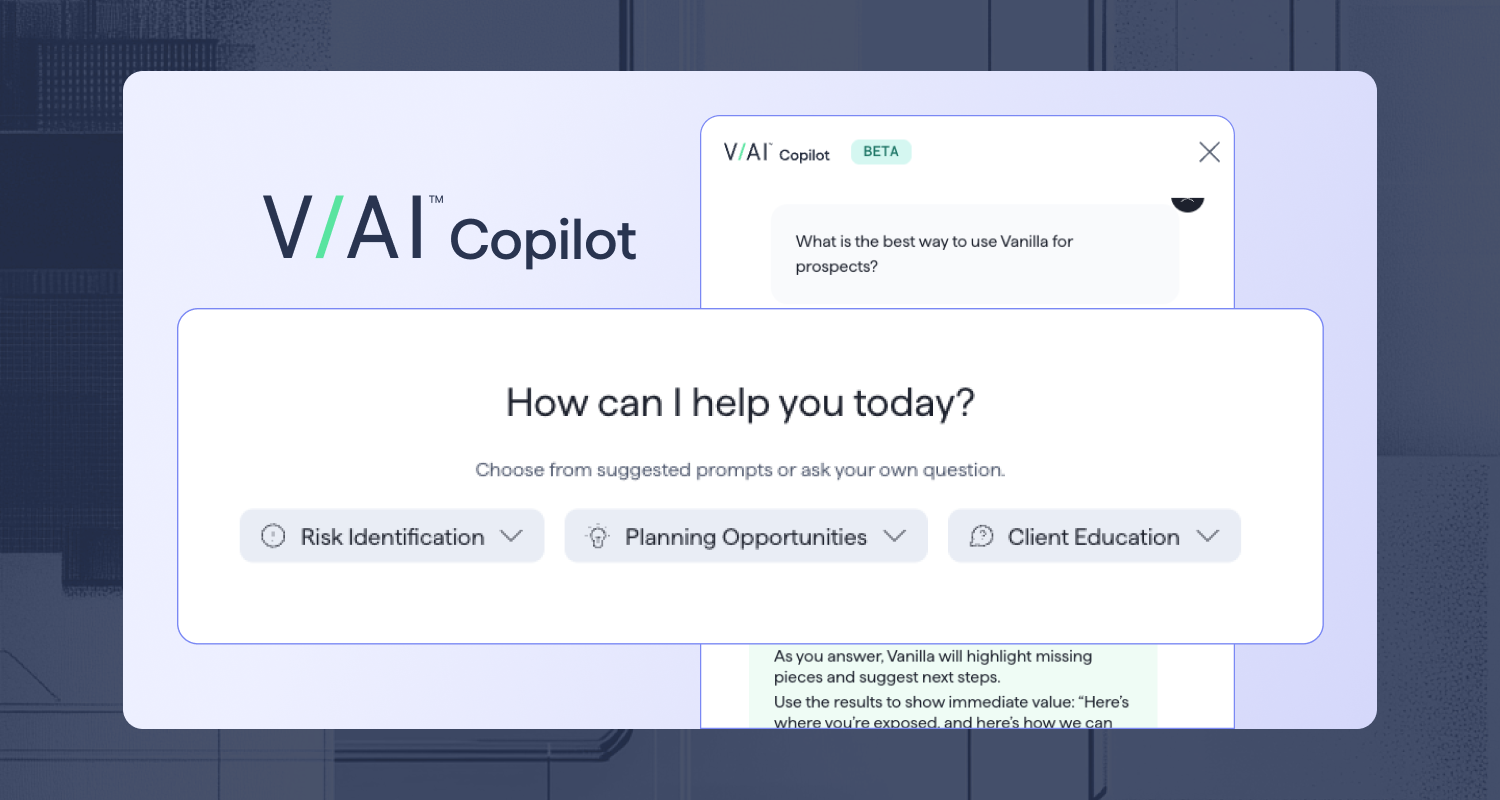

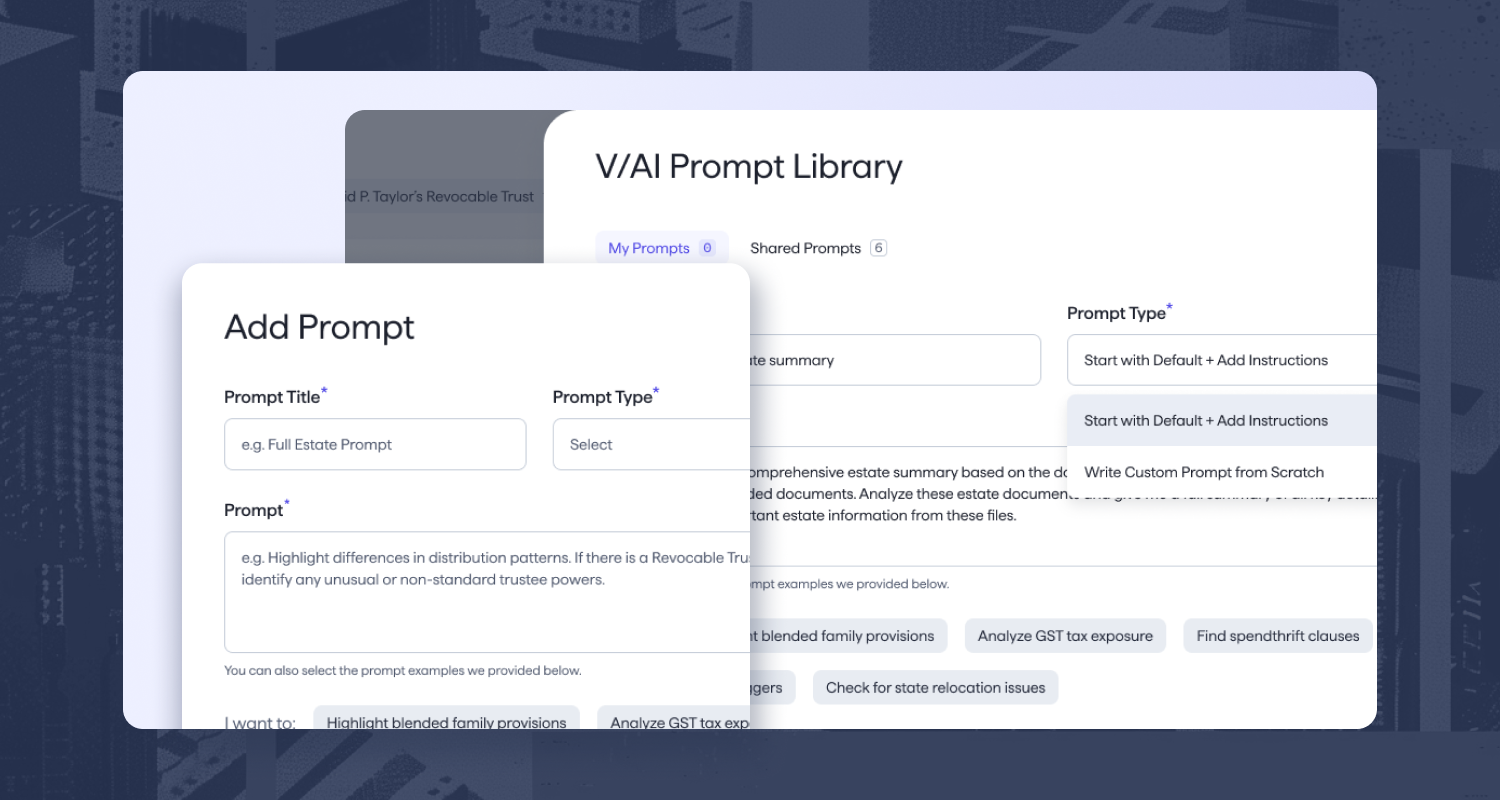

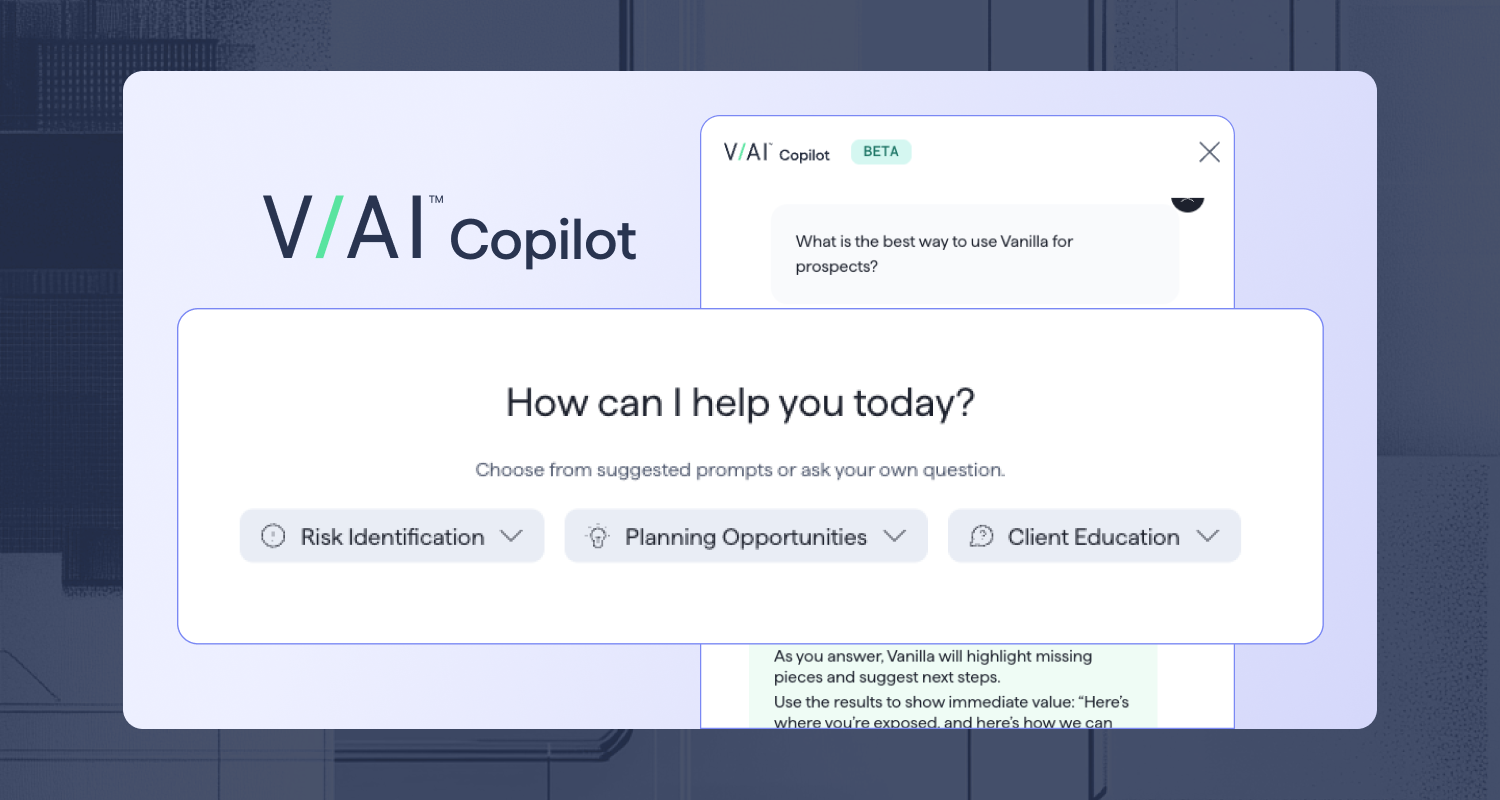

We’re launching some serious upgrades for July! This month's releases focus on expanding AI capabilities, customizing Vanilla's appearance, and enhancing your integration experience – plus, catch a special preview of our most sophisticated planning tool yet. V/AI enhancements: Your AI estate planning assistant just got smarter We’re excited to announce some game-changing updates to V/AI Copilot, and an upgraded version of V/AI Summaries this month. The Problem: Estate planning requires deep analysis across multiple data points—from financial structures to family dynamics—and advisors need AI that can provide comprehensive insights across multiple areas of a client's profile and for multiple types...