Jessica Lantz

Jessica Lantz

What’s New in October: V/AI Estate Summary page improvements, waterfall enhancements, and more!

October brings meaningful enhancements to Vanilla—from enhanced AI estate summary capabilities to more intuitive waterfall modeling. Each improvement is designed to help you work faster and deliver deeper insights to your clients. Here’s what’s coming soon.

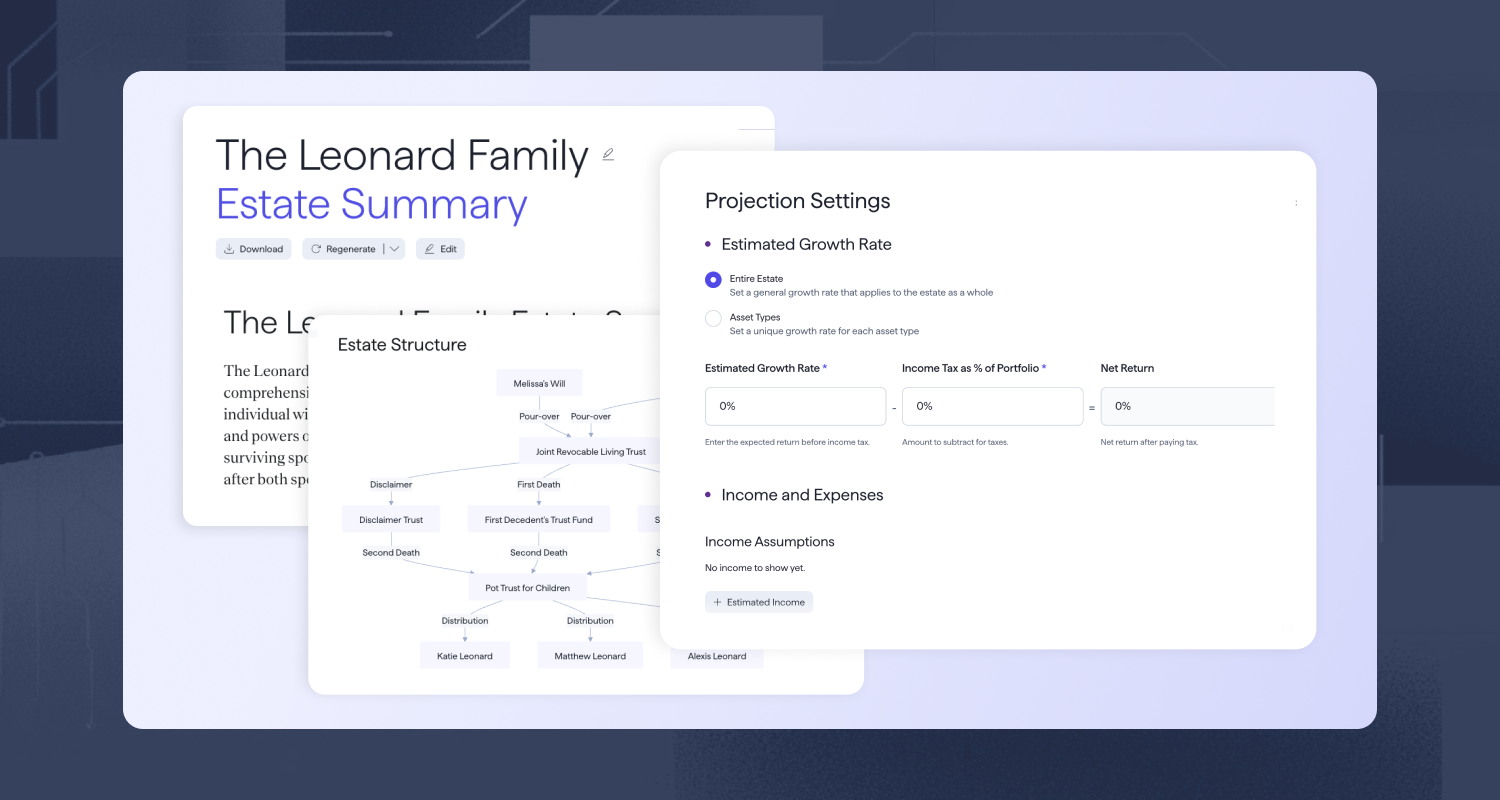

V/AI Estate Summary page improvements: More control, better readability, clearer insights

The challenge: Advisors need AI-generated summaries that are easy to scan, read, and present to clients without extensive reformatting.

The solution:

- Enhanced typography and spacing create a more visually appealing, scannable layout that makes key information immediately more readable

- V/AI will clearly show which documents were used to generate the summary, building your confidence in the AI’s analysis and making it easier to verify source material

- Visual enhancements in tax planning, family & people, estate diagram, and opportunities sections make key insights easier to digest, transforming dense information into clear, actionable intelligence you can present with confidence

These improvements transform your V/AI Estate Summaries into presentation-ready deliverables that accelerate your review process and elevate client conversations. Coming soon.

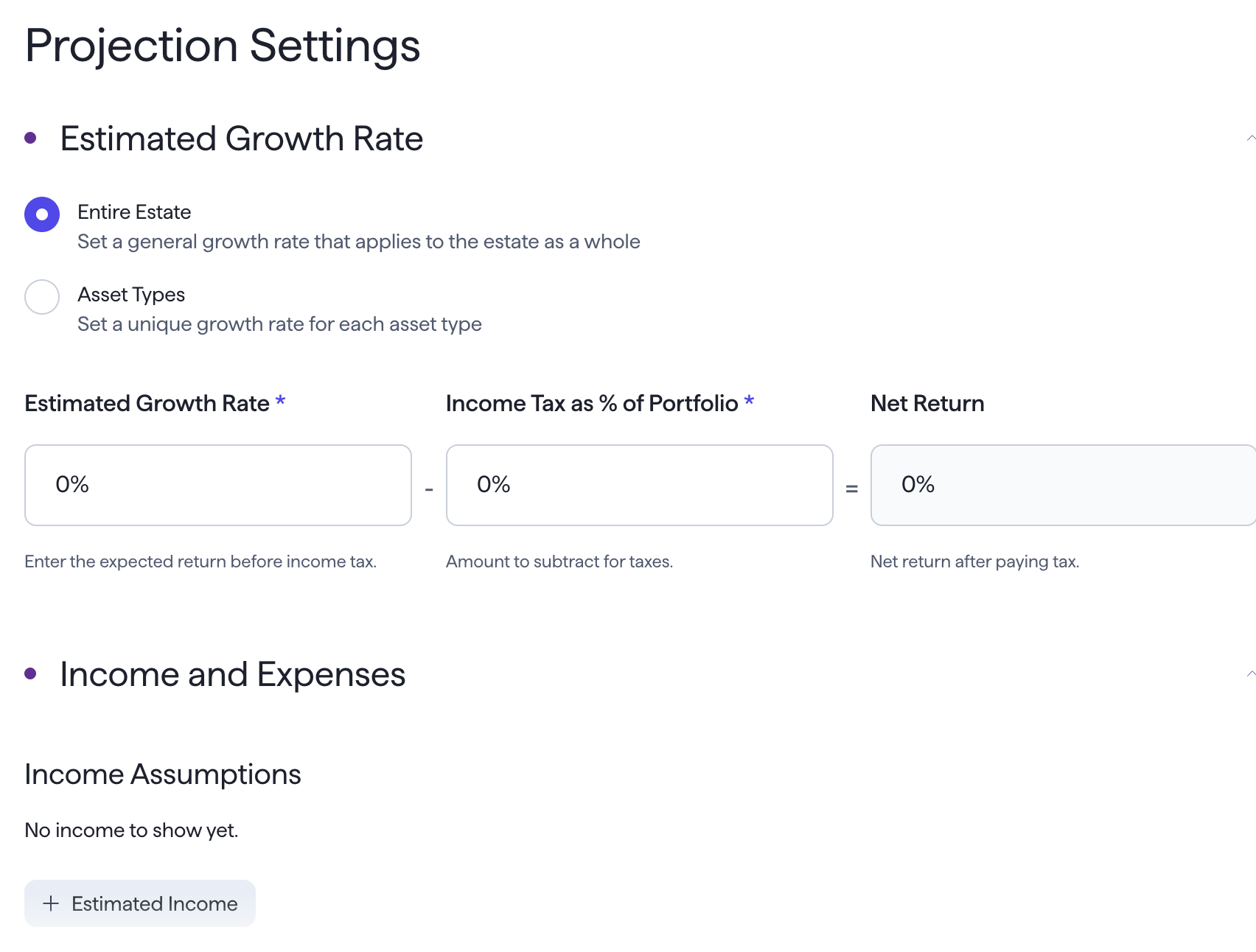

Waterfall income and expense enhancements: Streamlined inputs, clearer calculations

The challenge: Estate planning requires accurate income and expense modeling, but advisors often struggle with cumbersome data entry processes and unclear ownership that makes waterfall impact difficult to explain to clients.

The solution:

- Income and expenses will be combined into single area on the flyout for easier input and review, eliminating unnecessary navigation and reducing the chance of overlooking critical data

- Income and expenses are now assigned to client or co-client, making waterfall impact easier to understand and allowing you to demonstrate the precise impact of different income streams

- Waterfall income and expenses can now be incorporated into Vanilla Scenarios for more comprehensive planning, enabling you to model real-world situations like retirement income changes, major expenses, or evolving family obligations and show clients exactly how these factors impact their wealth transfer strategy

Transform income and expense information into clear, visual projections that demonstrate the long-term impact of financial decisions on your clients’ estate plans. Coming soon.

Rolling GRATs: Model cascading strategies with automated reinvestment

The challenge: Advisors need to model sophisticated cascading GRAT strategies that reinvest annuity payments, but manually calculating these structures is time-consuming and prone to errors.

The solution:

- Create rolling GRATs in Vanilla Scenarios that automatically reinvest annuity payments into new GRATs, eliminating manual calculations and demonstrating the compounding, long-term benefits of this advanced strategy

- Model how rolling GRATs can transfer more wealth to beneficiaries while minimizing gift tax exposure, helping clients understand the long-term value of this sophisticated planning technique

Show clients exactly how strategic GRAT structuring can enhance their wealth transfer goals over time. Coming soon.

Ready to dive in?

October’s enhancements represent our continued commitment to removing friction from your workflow and helping you deliver more sophisticated planning with less effort. To learn more about these upcoming features, connect with your CSM or schedule a demo.

Note that all unpublished features and enhancements mentioned are subject to change in both content and timeline without notice. Vanilla reserves the right to modify or cancel roadmap items at any time.

Published: Oct 29, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.