Jessica Lantz

•

Feb 25, 2026

What’s New in February: Full estate summary source tracking, smarter data syncing with...

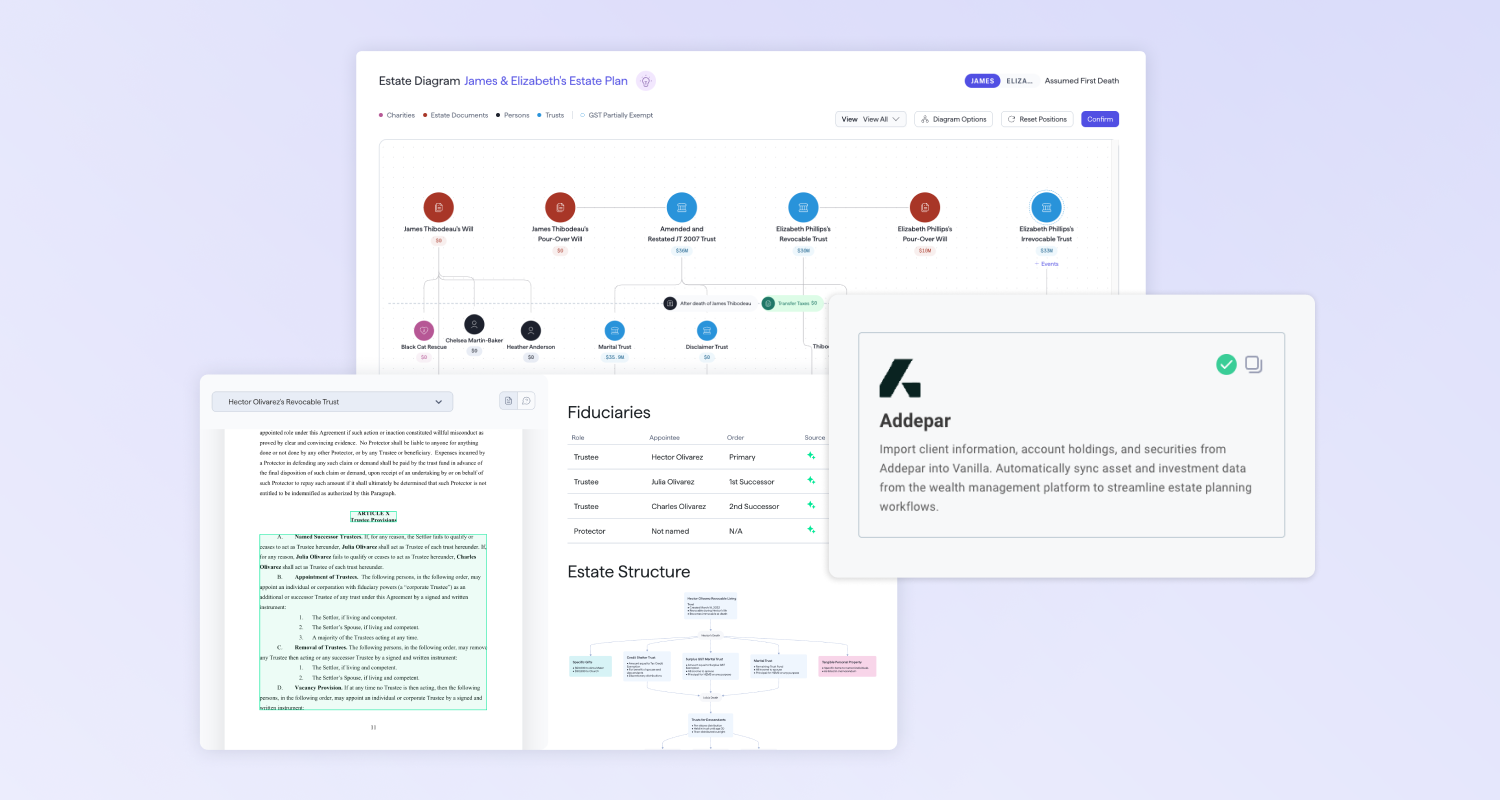

This month's releases are about removing friction—the kind that slows advisors down before they ever get to the work that matters. From smarter AI verification to an upgraded integration, February's updates are built around one idea: your time is better spent on clients, not on your tools. Here's what's new. Source tracking for all of VAI’s work: Trust every insight, across every document The challenge: When V/AI generates a full estate summary, advisors need to know exactly where each insight is coming from. Manually cross-referencing AI-generated insights against a stack of documents takes away time advisors should be spending on...

Vanilla

•

Feb 24, 2026

Choosing Estate Planning Software for Your RIA: A Decision-Making Framework

For RIA principals and wealth management firm leaders, estate planning software is a strategic investment that will shape how your team delivers advice, deepens client relationships, and scales personalized planning across your firm. Depending on the platform you choose, estate planning software can create a significant competitive advantage, enabling advisors to deliver sophisticated estate strategies efficiently and helping clients clearly see the impact of complex plans. Within this framework, we’ll explore how to evaluate estate planning platforms through the lens of what your firm needs to grow while bringing more value to clients. Why choosing the right estate planning software...

Vanilla

•

Feb 16, 2026

Why Leading Wealth Management Firms Are Offering Estate Planning

As investment management becomes increasingly commoditized through low-cost index funds and robo-advisors, firms need strategies that deliver value to clients beyond portfolio construction. Leading firms are finding that bringing estate planning in house as a core service offering enables them to provide the holistic guidance today’s clients are looking for, while also acting as a powerful growth and retention tool. Estate planning turns advisors from portfolio managers into indispensable financial partners, positioning them to guide clients through legacy planning, tax optimization, and wealth transfer strategies. Overwhelming research indicates clients are looking for this kind of comprehensive experience: 95% of investors...

Vanilla

•

Feb 10, 2026

10 Essential Estate Planning Tips for Financial Advisors

According to Spectrem Group research, 93% of people want estate planning services from their financial advisor but only 22% are actually getting that advice. That’s a massive gap between client expectations and reality; one that presents a compelling opportunity for the advisors willing to close it. Estate planning can deepen client relationships and lock in loyalty for multiple generations. When you help someone think through what happens to their wealth after they're gone, you're talking about family, values, and legacy, a fundamentally different conversation than the quarterly portfolio review. Most advisors already know estate planning is a critical part of...

Jessica Lantz

•

Feb 05, 2026

2025 Year in Review: A Transformative Year in Estate Planning

2025 was a groundbreaking year at Vanilla. We fundamentally changed how advisors approach estate planning, from announcing our patented estate planning technology to reimagining scenario modeling from the ground up. There’s been a lot to celebrate. We welcomed almost 400 new customers. Over 22,000 new estates were modeled with Vanilla, and we delivered over 60 revolutionary new features to make estate planning easier than ever. Let's walk through the major milestones that shaped 2025. Auto-abstraction In February, we launched auto-abstraction through Vanilla Document Builder. Advisors are saving hours per client by having Vanilla automatically generate professional estate diagrams when clients...

Vanilla

•

Feb 03, 2026

10 Key Findings from the 2026 State of Estate Planning Report

In case you missed it, Vanilla's 2026 State of Estate Planning Report is out, and it's packed with insights about how consumers really think about estate planning. This annual survey of over 1,000 U.S. consumers explores how people view legacy, family dynamics, and the role of advisors and technology in the planning process. The full report is worth a read, but here's a skimmable roundup of some of the findings that stood out most. Read the complete, ungated State of Estate Planning report here. Estate planning, family, and values Estate planning is personal. It's less about tax optimization and more...

Sarah D. McDaniel, CFA

•

Feb 02, 2026

February Is American Heart Month: Turn Healthcare Awareness Into Estate Planning Action

February's designation as American Heart Month offers more than a themed social media post, it's an opening to facilitate crucial conversations that deepen client relationships and establish trust with the next generation. The heart month hook: from health to healthcare planning Every February, Americans are reminded to prioritize heart health, scheduling checkups, improving diets, and reducing stress. It's a month dedicated to prevention and preparedness. Yet while clients may dutifully schedule their cardiology appointments, most haven't had equally important conversations about what happens if a health crisis does occur. This disconnect creates an opportunity for advisors. The national focus on...

Jessica Lantz

•

Jan 28, 2026

What’s New in January: Balance Sheet Enhancements, V/AI Summary Source Tracking, and big...

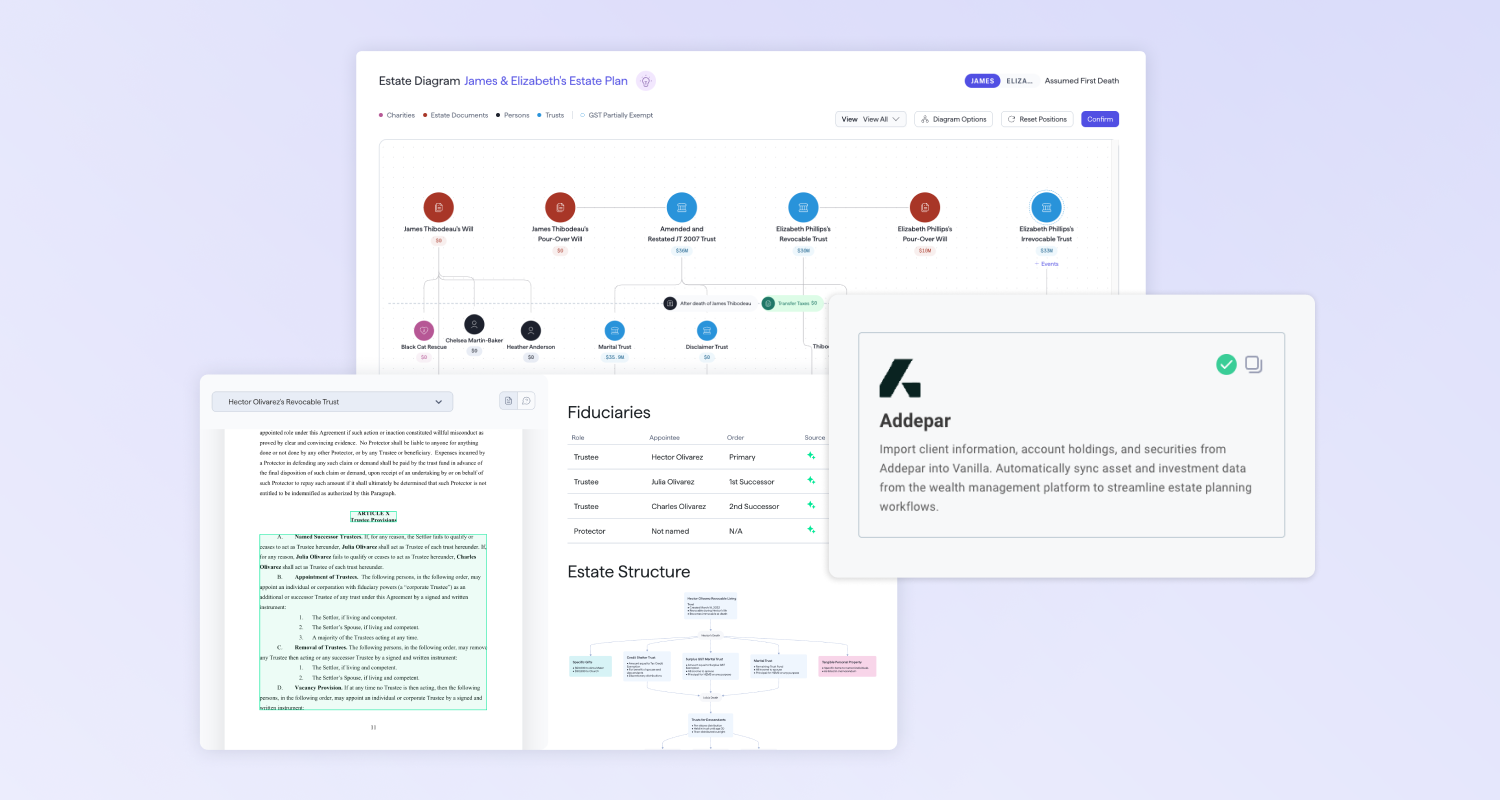

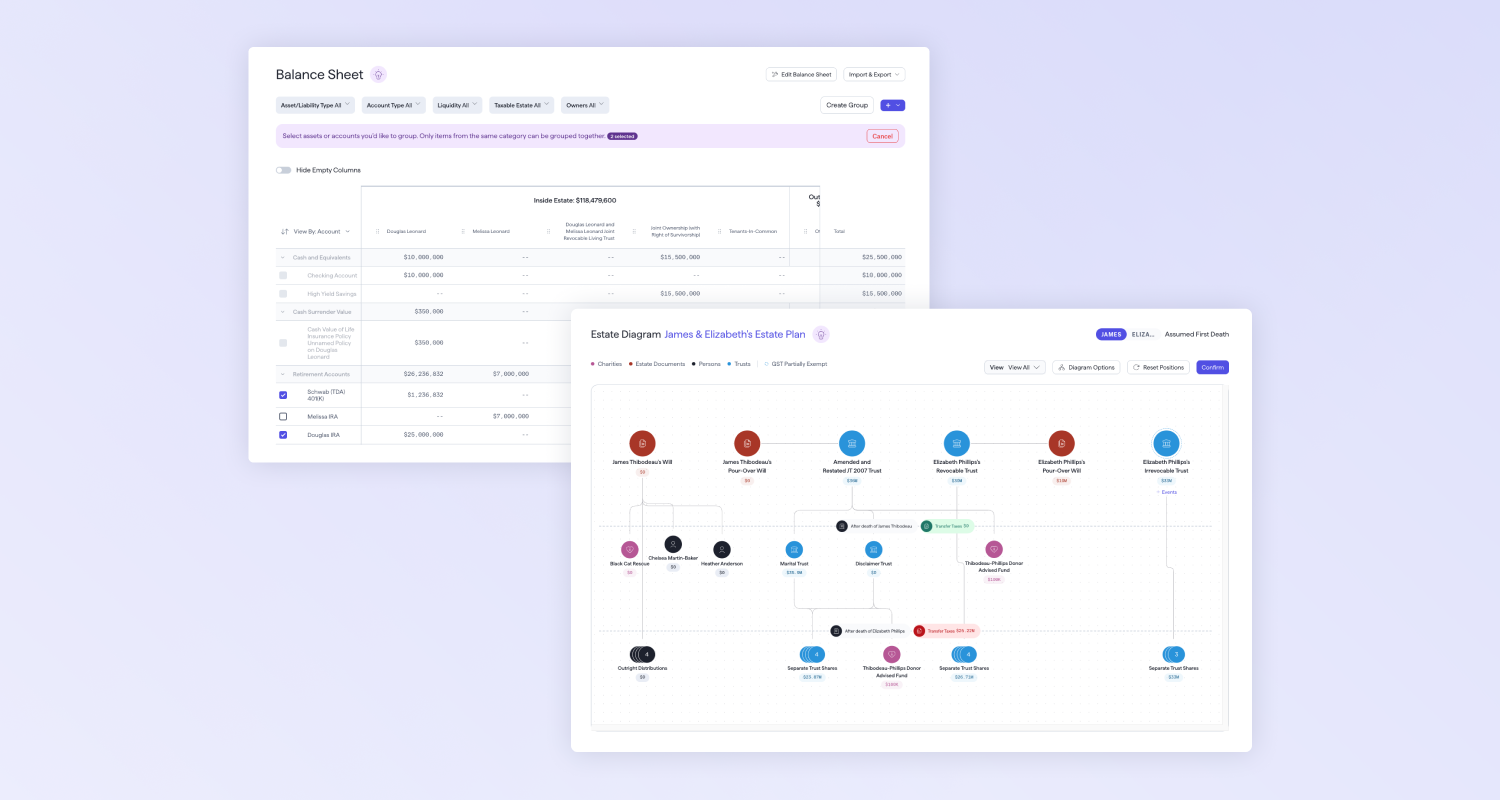

January brings powerful upgrades that streamline how you manage complex estate data and present plans to clients. From flexible Balance Sheet organization to AI transparency and dynamic estate visualizations, these releases help you work more efficiently while delivering exceptional client experiences. Balance Sheet grouping: Organize complex data with ease The challenge: Estates with numerous assets create lengthy Balance Sheets that make it harder to highlight what matters most and understand critical financial information at a glance. The solution: Create custom groups to consolidate similar assets or accounts into single, collapsible line items, reducing visual clutter Quickly expand grouped items to...

Vanilla

•

Jan 27, 2026

Estate Planning Trends in 2026: Key Themes from Vanilla’s Annual Report

When clients come to their advisors about estate planning, they're rarely asking about trusts and tax brackets first. They're asking: Will my kids be okay? Will my spouse be taken care of? Will the business I built survive me? Will my family stay close when I'm gone? Estate planning lives at the intersection of money and meaning. It asks clients to confront mortality, navigate family dynamics, and articulate what legacy truly means to them. Few other services offer advisors such an intimate window into their clients' lives. This year, we surveyed over 1,000 U.S. consumers to understand how they think...

Vanilla

•

Jan 19, 2026

12 Financial Planning Strategies for High-Earning Clients Building Wealth

The financial advisory profession has shifted from selling investments to building long-term client relationships grounded in comprehensive wealth stewardship. Today’s clients expect a holistic approach to financial planning from their financial advisor, and the ongoing commoditization of investment management means that advisors can no longer rely on returns alone to prove their value. Think of this shift as an opportunity to deepen client relationships, boost satisfaction, and differentiate your practice, particularly if you’re serving mass affluent clients and high earners building wealth. Leveraging the following 12 strategies can help you deliver the end-to-end experience modern clients are looking for while...

Sarah D. McDaniel, CFA

•

Jan 08, 2026

Why January is the Perfect Time to Start Estate Planning Conversations

The new year naturally prompts clients to reflect on their priorities and reassess their goals. While many focus on financial resolutions and self reflection, this mindset creates an ideal opportunity to introduce estate planning conversations to ensure client wishes are properly documented and their loved ones protected. Just as clients wouldn't operate with an outdated financial strategy, their estate plans require regular attention to remain aligned with current circumstances and intentions. A systematic review identifies gaps between clients' current plans and present reality, demonstrating your commitment to holistic wealth management beyond investment performance. Frame it as an estate health check...

Vanilla

•

Jan 06, 2026

The Complete Guide to Estate Planning

Though an often overlooked part of financial planning, estate planning is a critical part of a well-rounded wealth management strategy. In fact, estate planning is about much more than just creating a will. A thoughtful estate plan is a comprehensive strategy for things like: Managing one’s wealth during life and after death Ensuring one’s family is cared for Supporting causes that align with one’s values Minimizing taxes and fees Documenting wishes in case of incapacitation Planning for one’s future legacy The common myth that estate planning is only for the ultra-wealthy is patently false. Estate planning benefits individuals at all...