Jessica Lantz

Jessica Lantz

What’s New in June: Gifting Calculator, Third-Party Collaboration, and a unified Vanilla experience!

June brings powerful new changes to help you calculate, collaborate, and customize like never before. This month’s releases are focused on delivering a more intuitive and frictionless experience for both you and your clients.

Unified Vanilla Experience: Everything in one seamless workflow

The Problem: Vanilla users often work across multiple functions, requiring a unified interface that supports their diverse responsibilities.

The Solution:

- Access all client functions from a single, intuitive dashboard that adapts to your workflow needs

- Enjoy streamlined document management with a simplified upload process—add files directly and choose your next steps, whether that’s AI summaries, abstraction requests, or client collaboration

- For Planners, the abstraction workflow has been integrated into the Documents tab

- An updated and optimized interface reduces clicks and transitions while maintaining all existing permissions and security standards

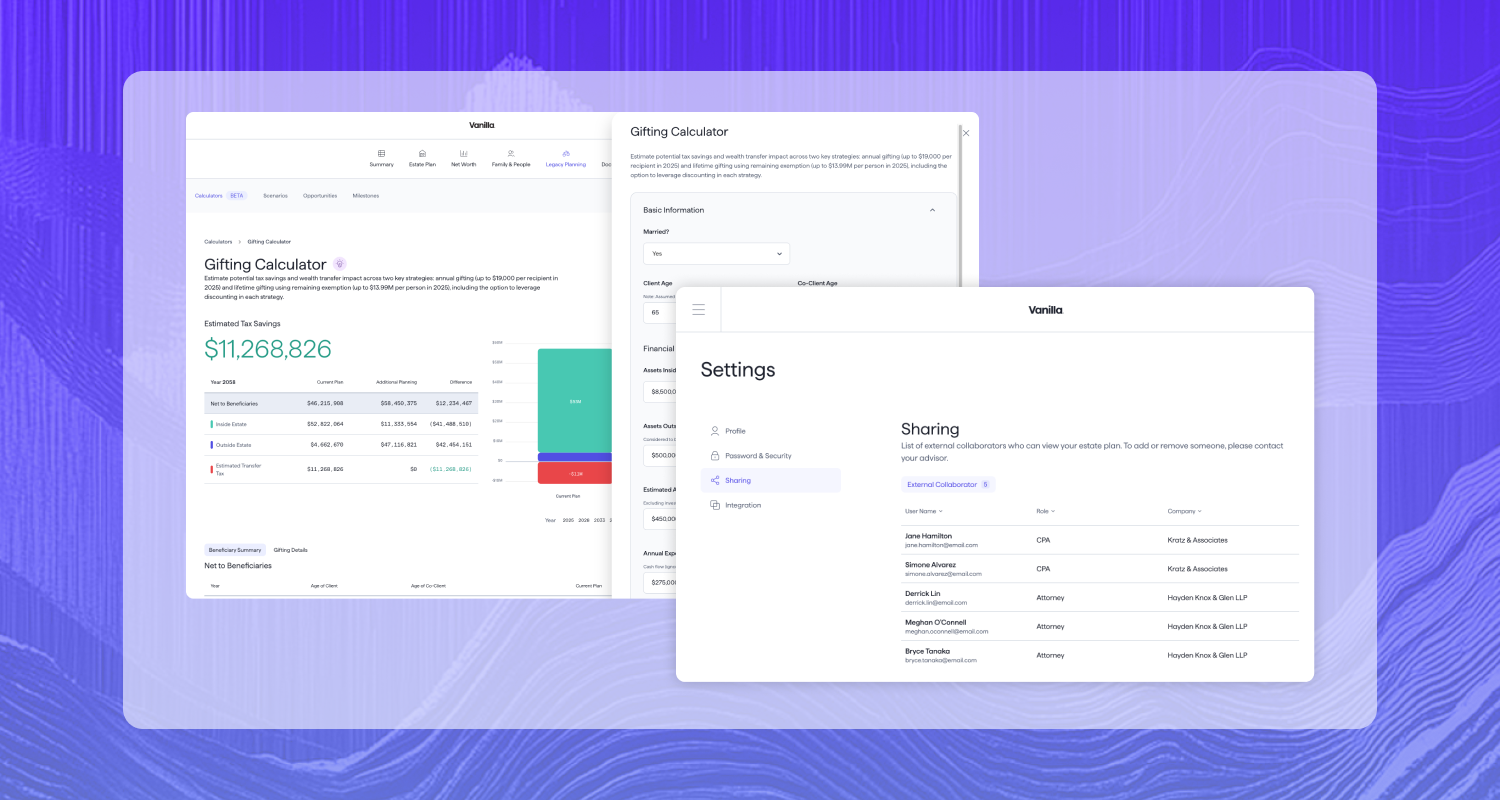

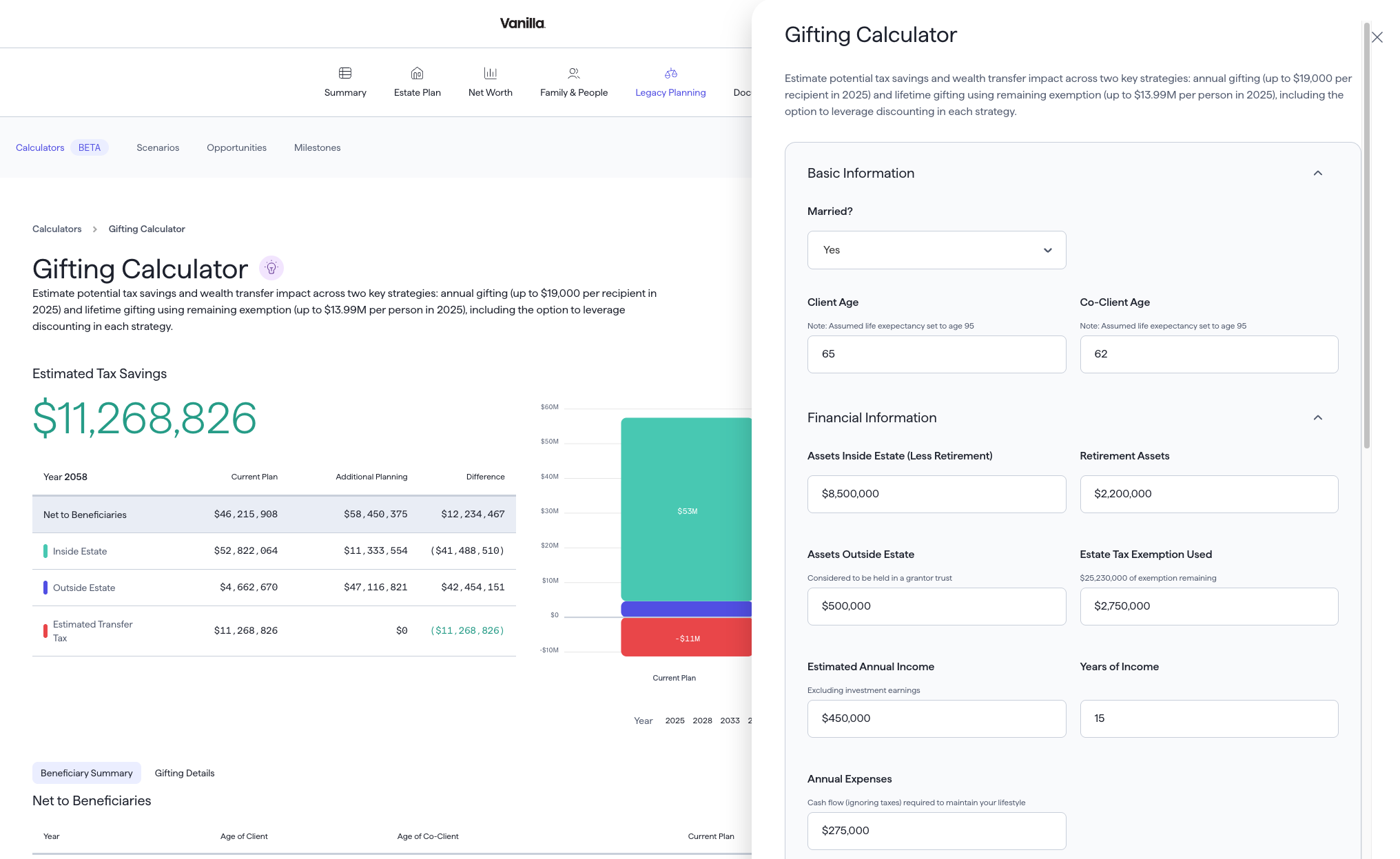

Gifting Calculator: Model wealth transfer strategies with precision

The Problem: Advisors need robust calculators to support foundational planning conversations around annual exclusion and lifetime exemption gifting strategies, especially for families looking to reduce estate tax burden.

The Solution:

- Model one-time large gifts utilizing lifetime exemption with optional discount scenarios

- Calculate annual exclusion gifts up to $19,000 per recipient in 2025, automatically including both spouses’ exclusions for married couples

- Create multiple gifting duration groups to model complex family scenarios and anticipated family changes over time (marriage, children, grandchildren, etc.)

- Analyze gifts flowing into trusts to demonstrate the full impact of gifting plus growth on transferred assets

- Include basis analysis to estimate potential capital gains tax impact on assets sold later

Third-Party Collaboration: Eliminate manual coordination

The Problem: Collaboration with CPAs, independent attorneys, and other advisors requires time-consuming manual communication through emails and phone calls, creating inefficiencies and potential compliance gaps.

The Solution:

- Invite non-Vanilla users directly into client profiles for real-time collaboration within the platform

- Provide external collaborators edit access to shared estates while maintaining security controls

- Share multiple client estates with the same external collaborator across different organizations

- Utilize automatic compliance support with built-in email notifications to estate owners

- Enable clients to view collaboration permissions through their client portal for complete transparency

- Make inviting others easy with a magic shareable link

Kentucky Inheritance Tax: Streamline tax planning for Kentucky clients

The Problem: Kentucky’s unique inheritance tax structure requires specialized calculations.

The Solution:

- Calculate Kentucky inheritance tax automatically with different percentages based on beneficiary relationships

- Customize tax percentage assumptions to match specific client scenarios

- Display inheritance tax information seamlessly across Vanilla on key pages including Waterfall, Transfer Taxes, and Plan Snapshot

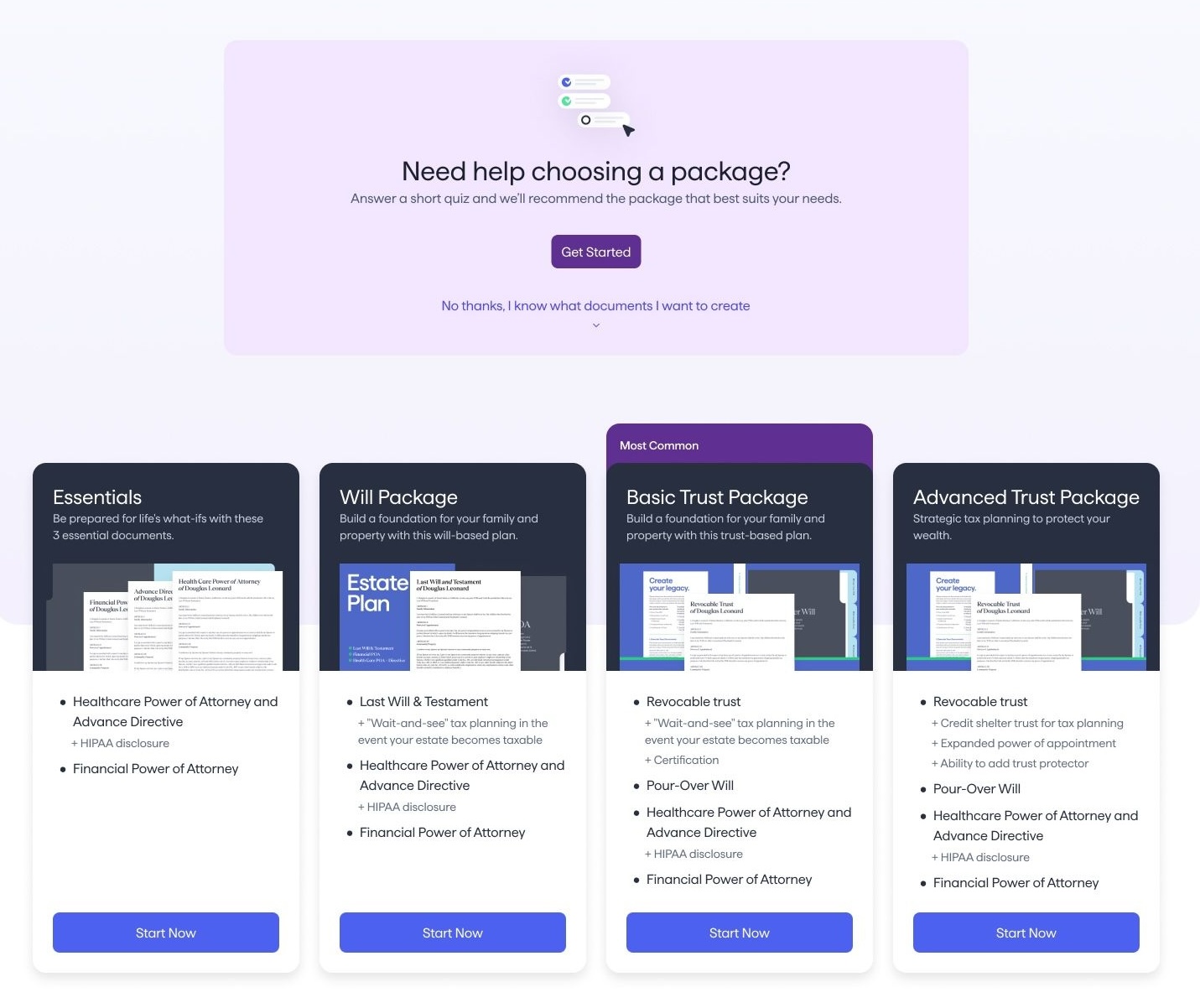

Package Selection Quiz: Eliminate guesswork in document selection

The Problem: Clients can struggle to determine which document package best suits their specific estate planning needs without expert guidance.

The Solution:

- Quiz analyzes each client’s situation to make choosing a package easier

- Self-guided decision tree eliminates need for advisor intervention in initial package selection

- Considers family situation, multi-state property ownership, probate preferences, and tax implications

Now in Beta – Configurable Branding: Make Vanilla yours

The Problem: Advisors need their estate planning tools to reflect their brand identity to build confidence, trust, and loyalty with clients.

The Solution:

- Configure primary and secondary colors to match your brand across the application and PDF reports

- Automatically generate darker and lighter primary color shades for consistent branding

- Customizable branding elements help prospects feel connected to your practice rather than a generic platform

Configurable Branding for Vanilla is currently a beta feature. Reach out to your CSM if you are interested in trying it out!

Enhanced Addepar Integration: Import complex families in minutes

The Problem: Estate planning for families requires comprehensive data import capabilities that can handle complex ownership structures and diverse asset types efficiently.

The Solution:

- Support for Addepar’s Households data model enables complete family unit planning from the start

- Intelligent data mappings using keywords to identify account types

- Native support for fractional ownership and complex family structures with TOD/POD beneficiary logic

- Streamlined integration workflow handles account categorization and recategorization seamlessly

- Enhanced business logic automatically populates Vanilla’s entity structures for immediate estate modeling

Looking forward

We’re committed to building the comprehensive toolkit you need to bring you closer to effortless estate planning that scales with your ambitions and adapts to your unique workflow. Ready to explore these new capabilities? Connect with your CSM or schedule a demo to see more.

Published: Jun 24, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.