“The company has taken the wealth management industry by storm”

Meet Vanilla

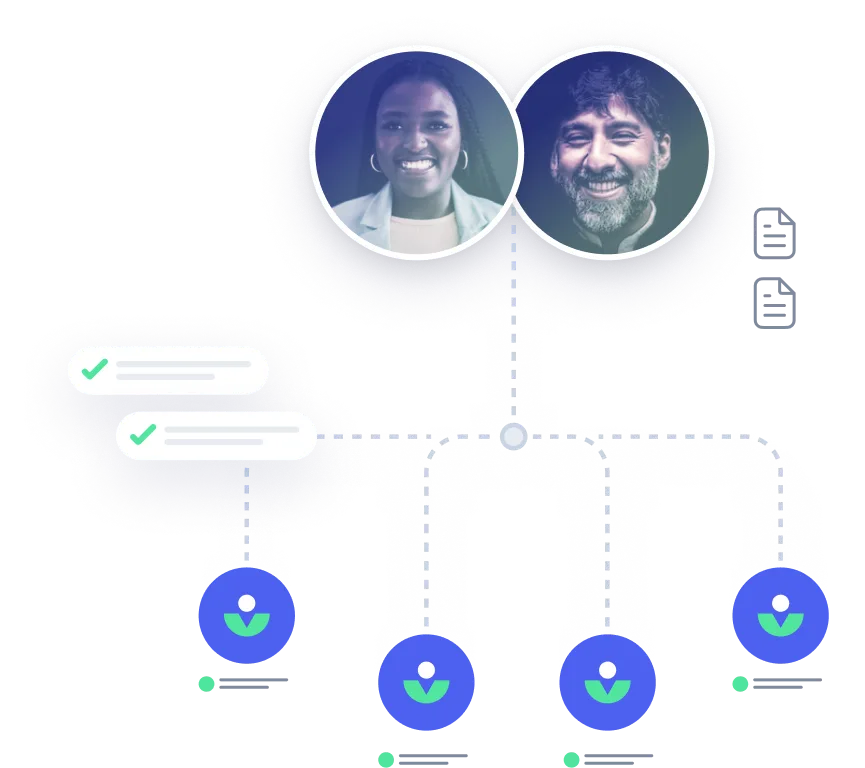

We’re dedicated to helping advisors, planners, and attorneys deliver differentiated advice, expand their client relationships, win new business, and increase your ongoing value by offering simplified, scalable estate planning to every client.

Vanilla was born out of need. In his career as one of Barron’s top ranked independent advisors, Steve Lockshin understood the power of estate planning to bring enormous value to clients. But he also saw first hand how broken the system was for people of all income levels. It was a costly, convoluted practice made up of a maze of obsolete tools and processes.

In 2019, Lockshin founded Vanilla to simplify and automate the process of estate planning, making it easier for financial advisors and attorneys to give bespoke estate strategies at scale.

With funding from Venrock and Insight Partners and other investors including F. William McNabb III, former CEO of Vanguard Group, Michael Jordan, NBA legend and businessman, and Jason Wenk, advisor and founder and CEO of Altruist, we have assembled a diverse team of top-performers from wealth management, estate planning, and enterprise software.

We believe that tech is at its most powerful when guided by the right human expertise, and at Vanilla we have assembled teams of top attorneys, paralegals, CFPs, and estate planning experts with over 180 years of combined experience. Making estate planning simple for you is not always simple for us, so it’s vital we have the right people to ask tough questions at every step of the way.

Julia Santullano, JD

Director of Estate Abstraction Services

Our team brings together diverse perspectives from wealth management, design, technology, and estate planning backgrounds. We hail from small RIAs as well as some of the largest wealth management firms in the world. Our team draws on experience at Amazon, Smartsheet, Stripe, Addepar, and many other leaders in technology.

As a fintech startup focused on simplifying a complex space, we have built our team around people that have a passion for building beautifully designed products that make the complex simple.

We are customer obsessed

Trust

We build and maintain trust

Collaboration

We work collaboratively as one team

Drive

We are proactive and have a bias for action

Pioneering

We build and grow strategically

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.