Category: Vanilla Updates

Vanilla

•

Dec 16, 2025

Cetera Chooses Vanilla, Further Enhancing Estate Planning Services for Approximately 12,000 Advisors

Through the partnership, Vanilla’s modern estate planning platform offers streamlined workflows, deeper client conversations, and planning confidence to Cetera advisors BELLEVUE, WA – December 16, 2025 – Vanilla, the trusted and modern estate planning platform for financial advisors, today announced a partnership with Cetera Financial Group (Cetera), the premier financial advisor Wealth Hub, that supports independent advisors and institutions with personalized support, flexible affiliation models, and end-to-end growth solutions.Through the partnership, Cetera’s network of more than 12,000 financial advisors and institutions can leverage Vanilla’s comprehensive estate planning platform to simplify complex workflows, visualize planning scenarios, and support more engaging, outcome-driven...

Vanilla

•

Dec 15, 2025

2025 Year in Innovation: What We Built and Where We’re Headed

We recently hosted our Year in Innovation webinar with CEO Gene Farrell and Head of Product Strategy Sam Trapkin. For those who couldn't join live, here's the recap. Estate Planning Is No Longer a Fringe Offering Just a few years ago, estate planning was still seen as a niche service—something advisors assumed belonged exclusively to attorneys or ultra-high-net-worth practices. That's changed. Today, advisors from independents to the largest institutions recognize estate planning as essential to their value proposition. The shift makes sense. Advisors who quarterback estate planning conversations build deeper relationships, retain more assets across generations, and differentiate in ways...

Vanilla

•

Nov 18, 2025

Vanilla Named a Preferred Estate Planning Technology Partner by Elevation Point

New Partnership Brings State-of-the-Art Estate Planning Tech to Independent Advisors BELLEVUE, Wash.-- Vanilla, a leading estate planning technology platform, today announced its partnership with Elevation Point, a growth accelerator and minority stake partner for independent advisors and breakaway firms. Through the partnership, Vanilla becomes a preferred estate planning software provider for Elevation Point’s network of growth-oriented advisors. Elevation Point partners with successful independent RIAs and breakaway advisors who recognize that continuous growth and innovation are essential to serving the complex needs of high-net-worth and ultra-high-net-worth clients – and to consistently delivering an exceptional client experience. Its collaboration with Vanilla reflects...

Vanilla

•

Sep 30, 2025

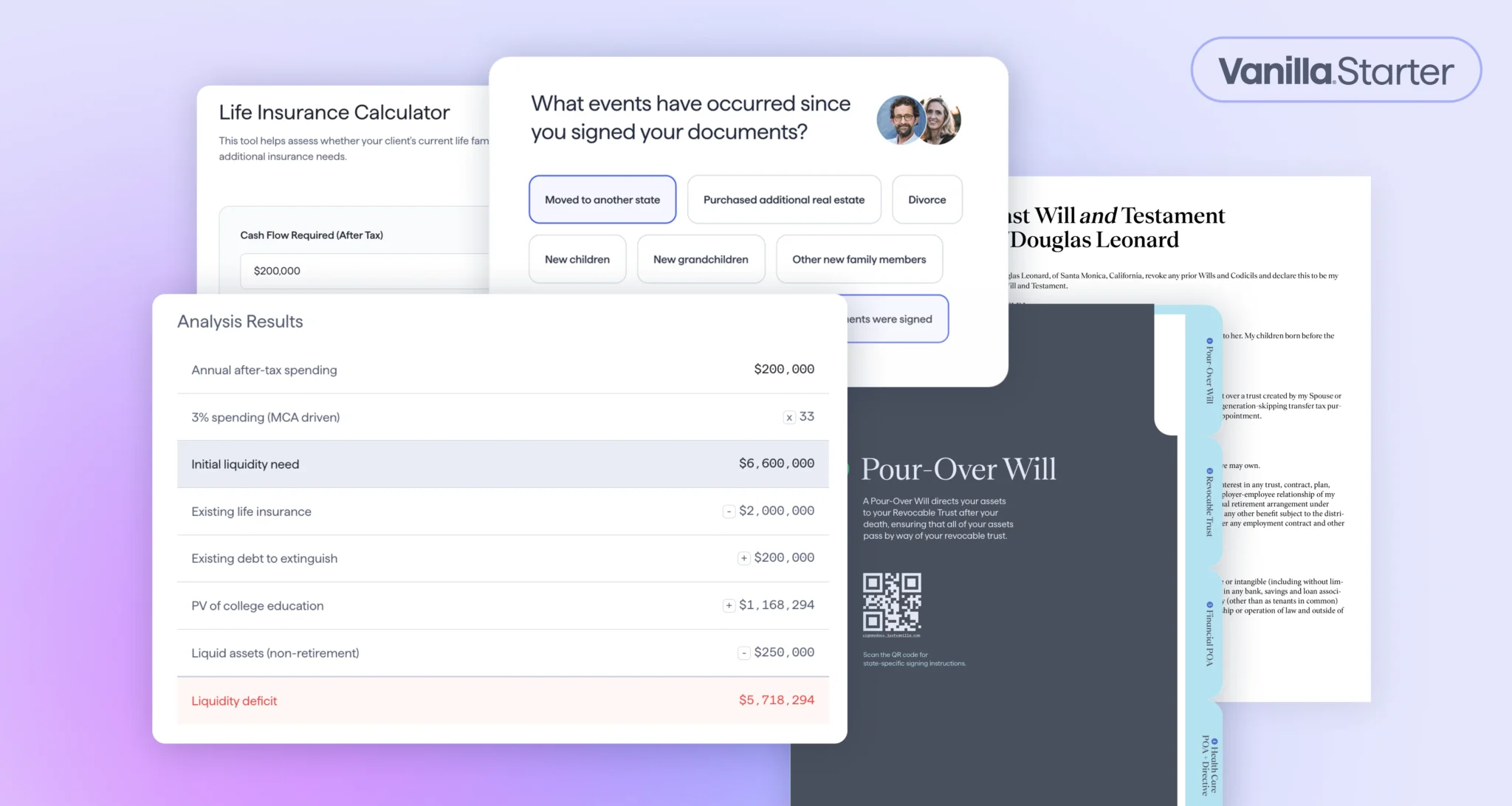

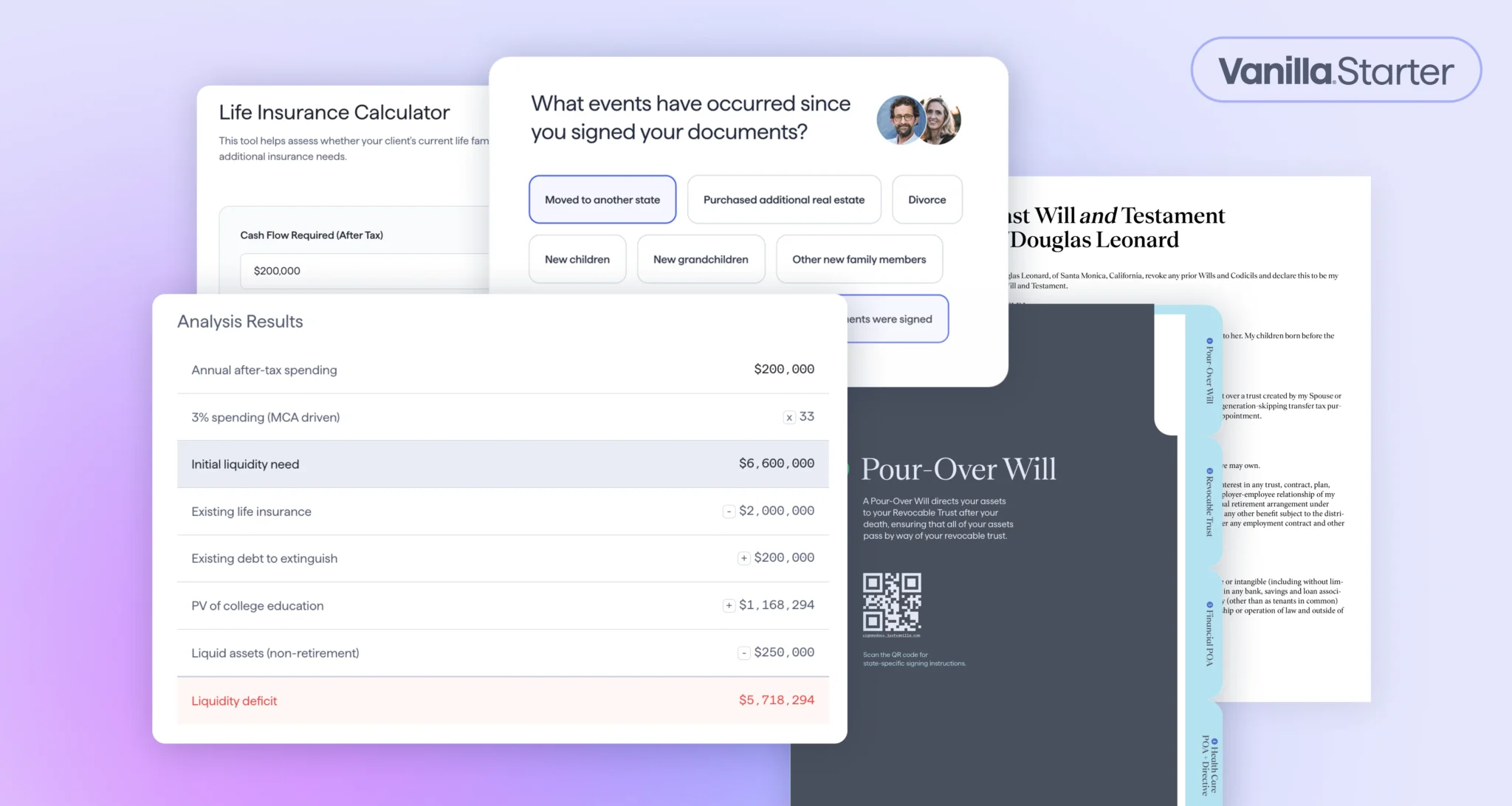

Vanilla Opens Waitlist for Vanilla Starter: Essential Estate Planning Technology for Independent RIAs

New offering brings institutional-grade estate planning capabilities to boutique advisory firms at accessible pricing BELLEVUE, Wash.--Vanilla, the leading estate planning technology platform trusted by several of the country’s largest wealth management firms, today announced the opening of the waitlist for Vanilla Starter, a groundbreaking solution designed to make professional estate planning services accessible for boutique RIA firms. Built on the same proven, institutional-grade technology that serves ultra-high-net-worth clients, Vanilla Starter will launch with pricing starting at $99 per month. Solo practices and small RIA firms have long faced a critical challenge: wanting to offer estate planning services in-house but lacking...

Vanilla

•

Sep 10, 2025

Betterment Advisor Solutions Launches Partnership with Vanilla to Make Advanced Estate Planning Technology...

New York, NY - September 10, 2025 - Betterment Advisor Solutions, an all-in-one custodian for modern RIAs, today announced a new partnership with Vanilla, the modern estate planning solution for advisors. Through this partnership, advisors who custody assets with Betterment Advisor Solutions will have special access to the Vanilla platform in addition to exclusive educational opportunities with Vanilla’s team of estate planning experts. Vanilla’s tools enable advisors to offer customized estate planning services at scale to clients across all wealth levels. “Having the right technology in place can make or break an advisory firm, and we want advisors to have...

Vanilla

•

Sep 05, 2025

Vanilla’s Industry Leadership Recognized with Two 2025 Wealthies Awards

Bellevue, WA — September 5, 2025 — Vanilla, the most trusted estate planning platform for advisors, today announced it was a two-time winner at the 2025 Wealth Management Industry Awards (the “Wealthies”), held on September 4, 2025 in New York City. Vanilla’s was recognized for the following categories and achievements: Advisor Service and Support category: Document Abstraction Services Thought Leadership Category: The State of Estate Planning Report 2025 These prestigious awards highlight Vanilla’s ongoing leadership in delivering innovative solutions to advisors and thought leadership to the broader wealth management community. "We are extremely proud to once again be recognized by...

Vanilla

•

Aug 22, 2025

Vanilla Shortlisted for “Disruptor of the Year” in 2025 US FinTech Awards

Bellevue, WA, August 22, 2025 – Vanilla, the most trusted estate planning platform for financial advisors, today announced it has been shortlisted for Disruptor of the Year in the 2025 US FinTech Awards. This recognition highlights Vanilla’s leading role in redefining how estate planning is integrated into wealth management and delivered at scale. Estate planning has long been disconnected from everyday financial advice, making it feel inaccessible to many advisors and clients. Vanilla’s patented technology is changing that. By transforming dense, complex legal documents into instantly digestible, interactive visuals, Vanilla empowers advisors to have deeper, values-based conversations with clients about...

Vanilla

•

Aug 12, 2025

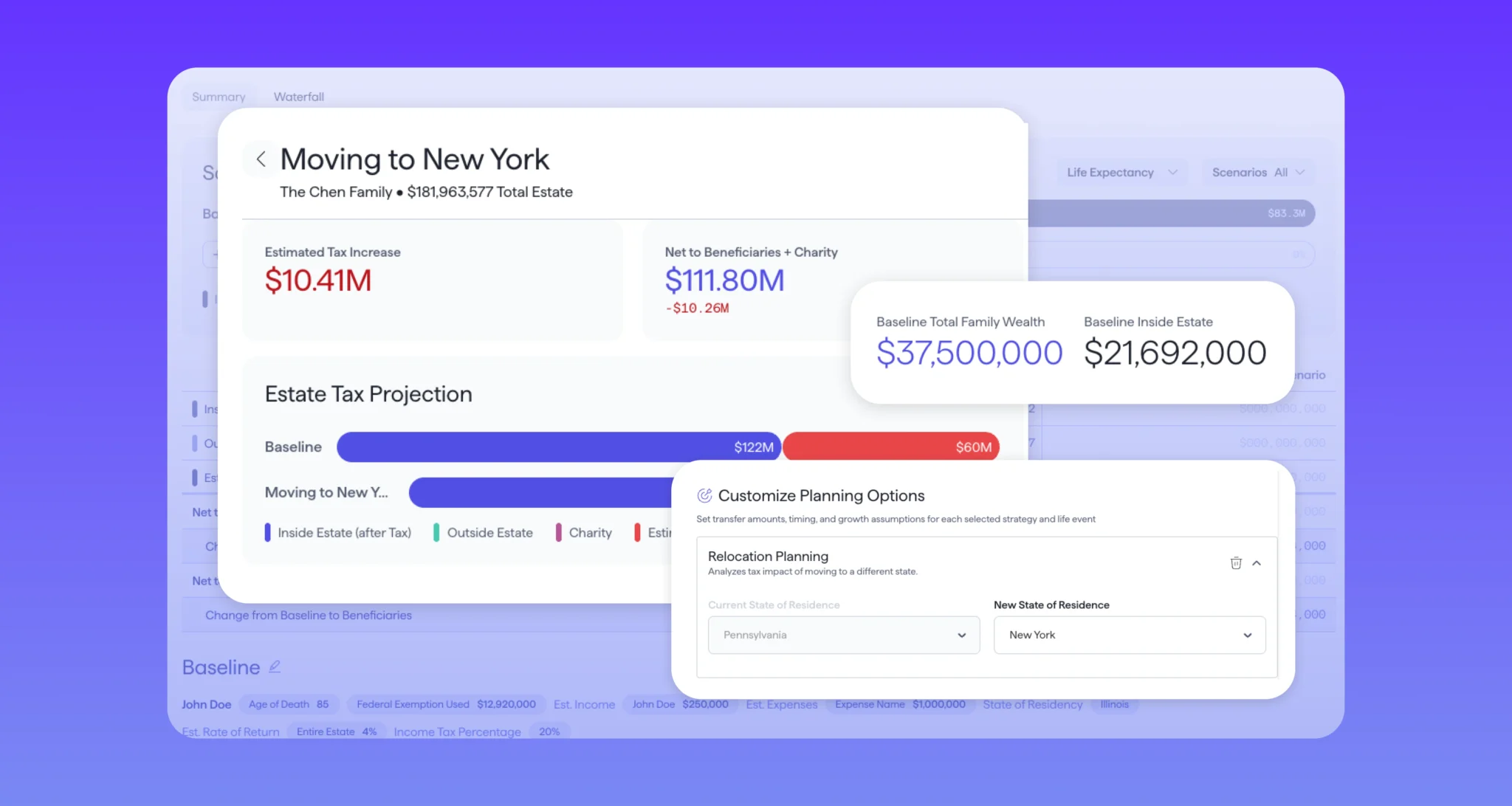

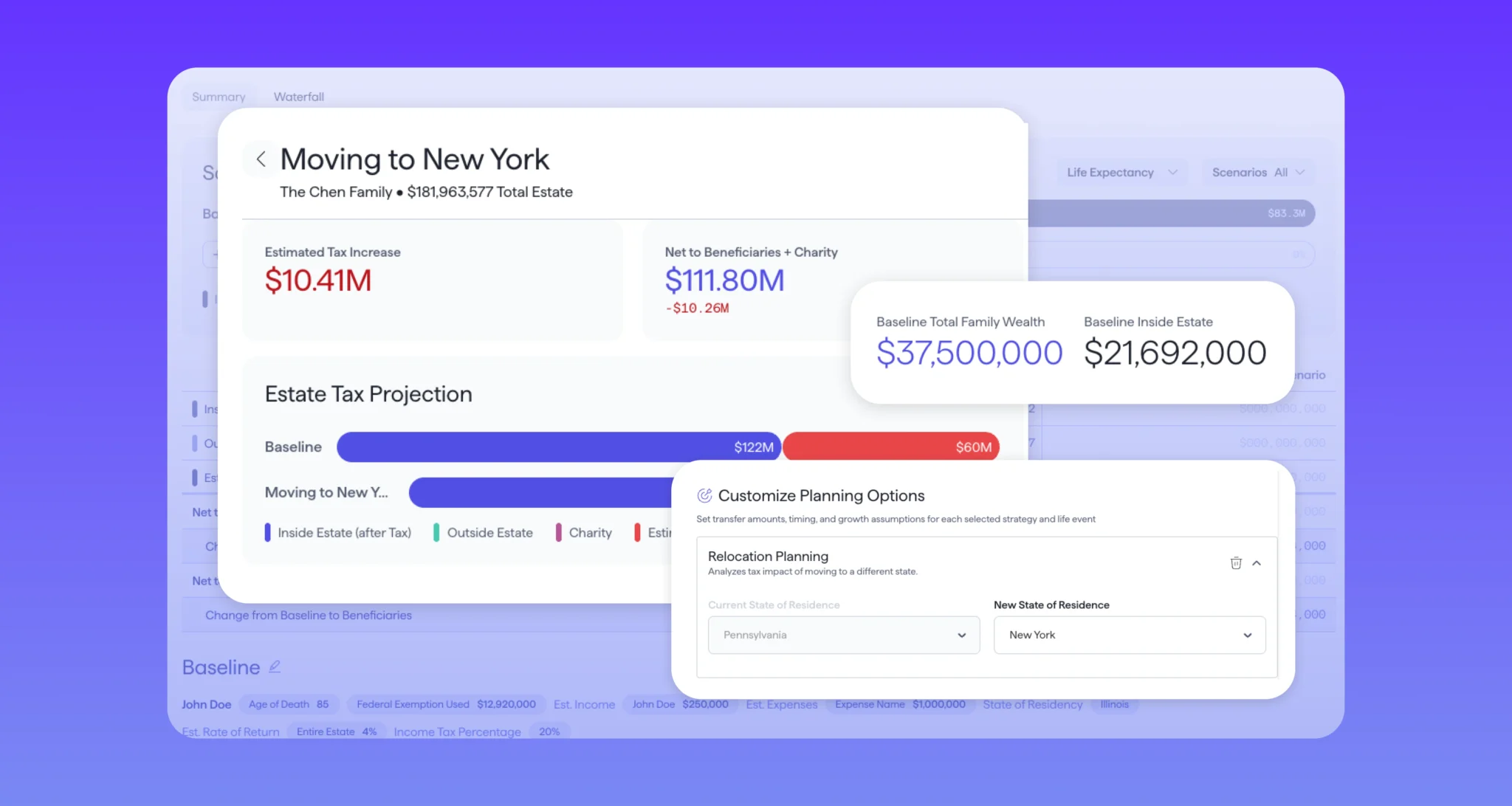

Vanilla Unveils Vanilla Scenarios™ Advanced Planning: The First Instant Modeling and Unified Workflow...

Advanced capabilities enable advisors to model complex estate planning strategies in minutes, transforming client conversations into collaborative planning sessions Bellevue, WA – August 12, 2025 – Vanilla, the leading provider of estate planning technology for advisors, today announced Vanilla Scenarios™ Advanced Planning, the next evolution of its all-in-one scenario planning tool. Building on the strong foundation established since its introduction in April 2024, this evolution of Vanilla Scenarios™️ delivers a more unified experience that enables financial advisors to model, compare, and present estate planning strategies with unprecedented speed and flexibility. Vanilla Scenarios™ Advanced Planning represents the most advanced estate planning...

Vanilla

•

Jul 24, 2025

Vanilla Secures US Patent for Groundbreaking Estate Planning Technology for Financial Advisors

Bellevue, WA — July 24, 2025 — Vanilla, the modern estate planning platform that simplifies and elevates the advisor-client experience, announced today that it has been granted a U.S. patent for its innovative event-based resource allocation system. This proprietary technology underpins many of the platform’s most advanced capabilities, including report automation, waterfall calculations, estate visualizations and abstractions, and AI-powered opportunity discovery. The patented system represents a major breakthrough in estate planning technology, utilizing advanced machine learning models and real-time event processing to transform how financial advisors manage and allocate client resources. This technology addresses the complex challenges of estate planning...