INTEGRATIONS

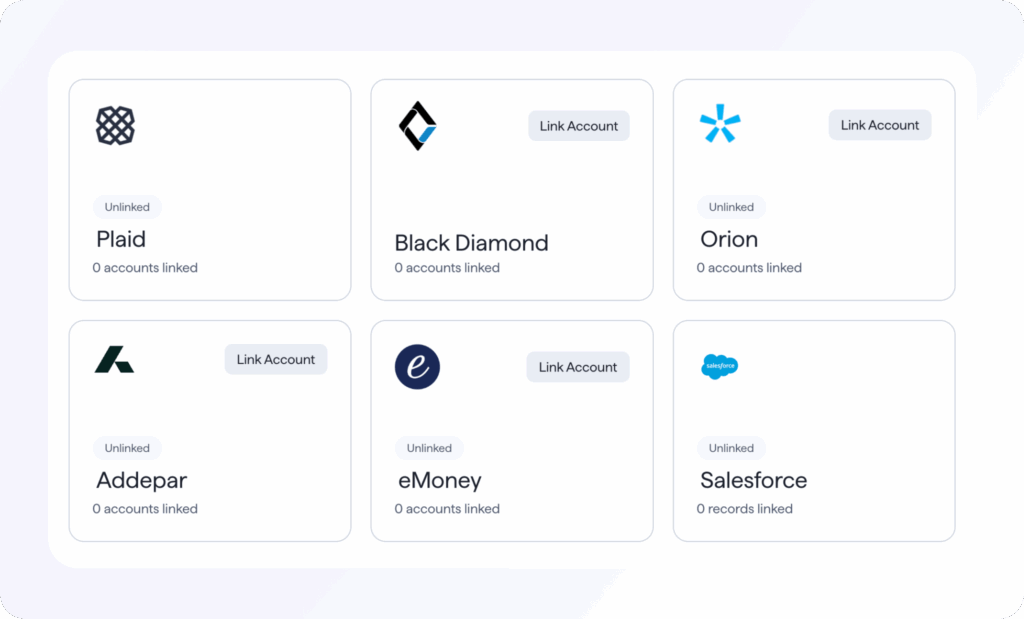

Seamlessly integrate with the industry’s leading platforms

Vanilla connects to the tools you already use daily, so you can deliver comprehensive estate planning without switching platforms or duplicating work. Less data entry for you, and more time to focus on what’s important.

Data that works as hard as you do

1 • Hours back

Hours back every week

Client data syncs automatically from your existing systems, eliminating manual work and freeing you up for what matters; meaningful planning conversations. Build deeper relationships and capture next-generation clients, all because you’re not stuck entering data.

2 • Serve more clients

Serve more clients confidently

Deliver estate planning services across your entire book of business without complicating workflows or sacrificing quality.

3 • Reduce risk

Reduce risk, increase trust

Eliminate manual errors and keep data current with automated syncing, building trust and reducing compliance risk with every interaction.

Get up and running in minutes

Resources

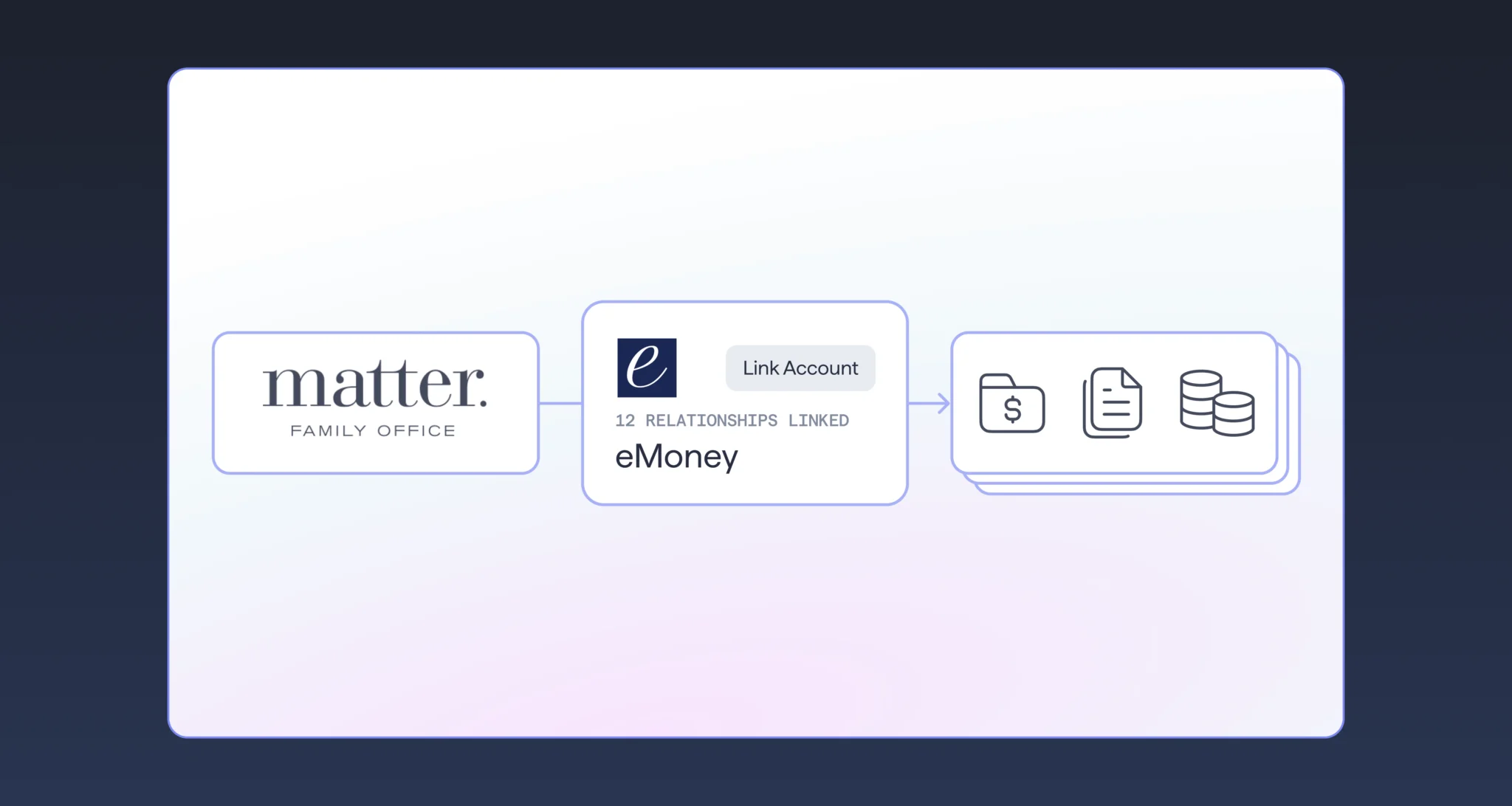

Unlocking Scale: How Matter Family Office Streamlines Estate Planning with Vanilla + eMoney

Vanilla recently announced our integration with eMoney, empowering financial advisors to streamline their estate planning workflows like never before. Matter Family Office, a nationally recognized...

Mariner Offices Drive Revenue and Growth with Vanilla

Mariner sees a 200% increase in revenue growth rates among the advisors who have adopted Vanilla for holistic planning

Steve Lockshin’s Estate Planning Playbook

A step-by-step checklist to guide your client conversations, updated for 2025. This playbook is inspired by the guide used by Vanilla founder Steve Lockshin and...

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.