Steve Lockshin

Steve Lockshin

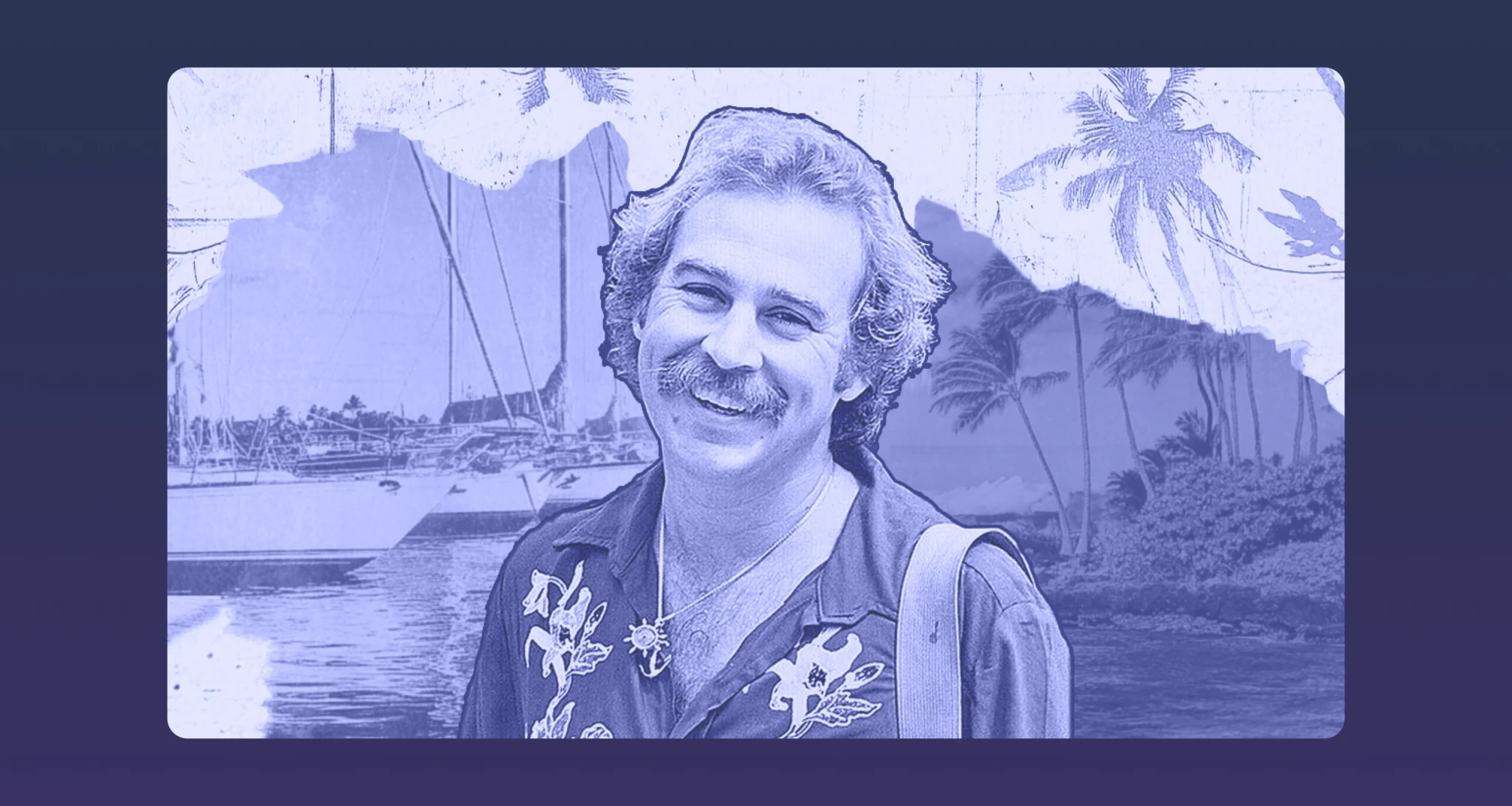

What Jimmy Buffett’s Estate Battle Can Teach Us About Trustee Selection and Legacy Clarity

The recent headlines surrounding Jimmy Buffett’s $275 million estate are not just tabloid fodder—they’re a case study in what happens when good planning on paper meets the unpredictability of human relationships and unclear expectations. While we don’t yet know the full facts, what’s emerging is an all-too-familiar theme: a fight over control of a legacy that was likely intended to bring comfort, not conflict.

Buffett was known for living life on his own terms, building an iconic brand that fused music, real estate, hospitality, and culture. He also did what many high-profile individuals do: he put his assets into a trust, presumably to maintain privacy and avoid probate.

The basic outline of Buffett’s estate plan is as follows: His will, first written over three decades ago and amended in 2017 and 2023, instructed that most of his assets be placed in a marital trust for his wife, Jane, upon his death. Their three children would receive any remaining assets left after Jane’s death. The messiness arises with his appointment of co-trustees on the estate: his wife, Jane, and his former accountant, business manager, and financial advisor, Richard Mozenter.

Since Buffett’s passing, the co-trustees have filed dueling lawsuits, each suing to have the other replaced as trustee.

This dispute highlights something that’s easy to overlook when it comes to trust planning: It’s about more than asset protection and tax minimization—it’s about people. And the current controversy highlights two critical elements that we emphasize in every estate plan we oversee:

1. The wrong trustee is worse than no plan at all

It can’t be emphasized enough: Choosing the right trustee (or even the right type of trustee) is critical to the success of trust planning. The key points to know are:

- A trustee’s role is part financial steward, part family diplomat, and part business operator.

- Conflicts of interest, whether real or perceived, can erode trust faster than any market correction.

- Naming a spouse or child as trustee without fully considering the dynamics between beneficiaries or co-trustees can invite division, not resolution.

Buffett’s case underscores how important it is to balance legal authority with emotional intelligence and interpersonal respect. A well-drafted trust with the wrong person at the helm can still end in disaster.

2. Letters of wishes: The most underrated document in the estate planning toolbox

While not legally binding, a letter of wishes can serve as a moral compass for trustees. It bridges the gap between the black-and-white language of a trust document and the gray areas of intent, values, and expectations. For Buffett, including the following information in a letter of wishes may have helped avoid the ongoing turmoil facing his family and his estate:

- What did Jimmy Buffett want for his children, his wife, his business, and his brand?

- How should conflicts be resolved?

- What were his priorities—continuity, liquidity, control, or peace?

Without a letter of wishes, trustees are left interpreting silence. With one, they have guidance rooted in the voice of the grantor. It doesn’t remove discretion, but it helps anchor decisions.

A cautionary reminder for advisors and families alike

We see this time and again: the legal structure exists, but the emotional infrastructure is missing. That’s where proactive advisors add real value—not just drafting documents, but helping clients think through the practical, human impact of their planning.

For ultra-high-net-worth families, especially those with complex assets (businesses, brand IP, real estate, operating companies), the trustee role is too important to be filled by default.

Key takeaways for families of wealth:

The ongoing disputes around Jimmy Buffett’s estate can teach us three key lessons about planning:

- Treat trustee selection as a hiring process. Evaluate based on competence, emotional neutrality, and ability to communicate—not just trust.

Use letters of wishes to supplement, not replace, trust documents. Give your trustees the context and compass to act in your spirit. - Review your plan through the lens of practical application. Ask yourself: if I were gone tomorrow, would my plan work—legally, emotionally, and operationally?

- Buffett’s music taught us to “breathe in, breathe out, and move on.” But unfortunately, when estate plans are incomplete or unclear, families don’t move on—they dig in. Let’s use this high-profile moment as a low-key reminder: the best legacy plans don’t just transfer wealth—they transfer wisdom.

Have questions about how estate planning software can help you protect your clients’ legacies and avoid future conflicts? Get in touch with our team.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Jun 27, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.