Vanilla

Vanilla

What is a pour-over will? The essentials financial advisors and their clients need to know.

Once a client has their last will and testament (“will”) and revocable trust created, their financial situation doesn’t just stand still. More often than not, a client’s financial situation will fluctuate throughout their life.

A pour-over will brings added security to an estate plan–making room for all of those potential life changes–by allowing for new and unaccounted assets to automatically transfer to a previously set up revocable trust. This helps keep up with asset changes between times when your client updates their will and trust.

What is a pour-over will?

A pour-over will is a last will and testament that is used in conjunction with a revocable (a/k/a living) trust. The pour-over will instructs your personal representative to transfer (or pour over) any assets owned in your client’s individual name to your client’s revocable trust after your client’s death.

A pour-over will is a safeguard for those assets that may not have been moved into the client’s revocable trust before their death.

What is the difference between a will and a pour-over will?

A will is a standalone legal document that outlines how a person’s assets should be distributed after their death. It can specify beneficiaries, designate guardians for minor children, and appoint executors to manage the estate’s distribution. Wills are subject to probate, the legal process in which the will is validated and assets are distributed to heirs. During probate, the contents of the will become public.

A pour-over will works in conjunction with a living trust. This living trust, which can be changed during the settlor’s lifetime, dictates how a person’s assets should be distributed upon their death. However, it can be difficult to account for every asset a person owns, so a pour-over will directs any assets not already placed in the trust to “pour over” into the trust upon death. The assets then become part of the trust and are distributed according to its terms. The pour-over will essentially acts as a safety net, ensuring that any assets not explicitly placed in the trust still end up there. Unlike a will, the living trust will not be made public through the process of probate – though assets which “pour over” by direction of the pour-over will be subject to probate.

A pour-over will example

How does a pour-over will work in practice? Let’s take a look at an example:

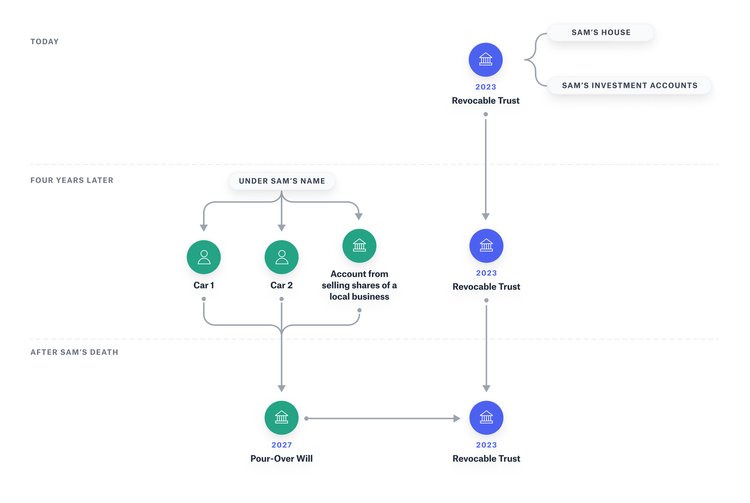

Sam worked with his financial advisor to form an estate plan that holds almost all of his assets and property in his revocable trust. They created a revocable trust with Sam’s house and investment accounts.

Four years later, (i) Sam purchased two new fancy cars in his individual name, not in the name of his revocable trust and (ii) Sam received a new account in his individual name from selling his shares of a local business. These new assets are not titled in the name of his revocable trust.

Sam has a pour-over will, though, which directs his personal representative that any assets and property that are titled in Sam’s individual name at his death, should be given to the trustee of his revocable trust. This means that even the cars and the new account created above will be disposed of in accordance with the terms of Sam’s revocable trust after Sam’s death.

How do you write a pour-over will?

Pour-over wills should be drafted by a qualified estate attorney. To be an effective legal tool, the pour-over will needs to be paired with a revocable trust that specifies how a person’s assets should be distributed and who the trustee(s) will be. The will should name the estate’s executor(s) and a residual beneficiary, typically the trustee of the revocable trust, to ensure any assets that weren’t transferred to the trust before the person’s death end up there.

How does a pour-over will work with a revocable trust?

People often set up revocable trusts to avoid probate, provide tax benefits and maintain privacy. But even the most detailed estate plans do not retitle all assets in the name of the client’s revocable trust before the client’s death.

Therefore, when a client creates a revocable trust, they will also create a pour-over Will at the same time, to ensure that any assets that the client owns in their individual name at their death, will be given to the trustee of their revocable trust, and be disposed of in accordance with the terms of their revocable trust.

Does a pour-over will avoid probate?

A pour-over will does not inherently avoid probate. A pour-over will simply directs assets to a trust upon the testator’s death. However, the assets that weren’t already in the trust at the time of the person’s death must typically go through the probate process before they can be transferred into the trust. The trust itself, once funded, can help avoid probate for its assets in the future, but the pour-over will’s main function is to ensure that assets not previously transferred to the trust get there upon the decedent’s passing, even if it means going through probate first.

Create the right safety net for your clients

As you guide your clients in the estate planning process, you have many tools and techniques at your disposal. Any client that wants to use a revocable trust to dispose of their assets will need a pour-over will.

Vanilla provides tools that make financial advice accessible to your clients so they can make better-informed decisions. Contact sales to schedule a demo.

About Vanilla

Vanilla is the Estate Advisory Platform, purpose-built to enable financial advisors to build deeper relationships with their clients and empower clients to build and protect their legacy. From robust and easy-to-understand visualizations of complex estates, detailed diagrams of how assets transfer to future generations, to ongoing estate monitoring, Vanilla is reinventing the estate planning experience, end-to-end. Learn more about Vanilla at https://www.justvanilla.com/.

Media inquiries: Please contact press@justvanilla.com

The information provided here does not, and is not intended to, constitute legal advice or tax advice; it is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with your financial advisor or estate attorney who can advise as to whether the information contained herein is applicable or appropriate to your particular situation.

Published: Feb 28, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.