Vanilla

Vanilla

10 Diagrams to Explain Advanced Estate Planning Strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation).

The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if you want to just grab the deck for client conversation, you can download it here.

Explaining the Sunset

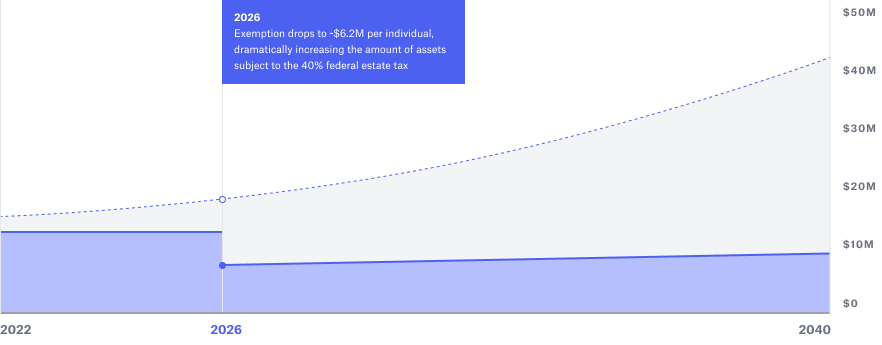

Federal Estate Tax exemption allows your client to shield a portion of their taxable estate from the Federal Estate Tax. Any taxable transfers that exceed your client’s available exemption amount at their death are subject to a 40% tax.

-

Currently, the federal exemption amount is at a historical high of $13.99M per individual.

-

Without legislative change, the increased exemption amount is scheduled to sunset to ~$6.2M per individual* in 2026.

-

Implementing strategic planning before 2026 may allow the ability to capture significant tax savings.

Annual Gifting

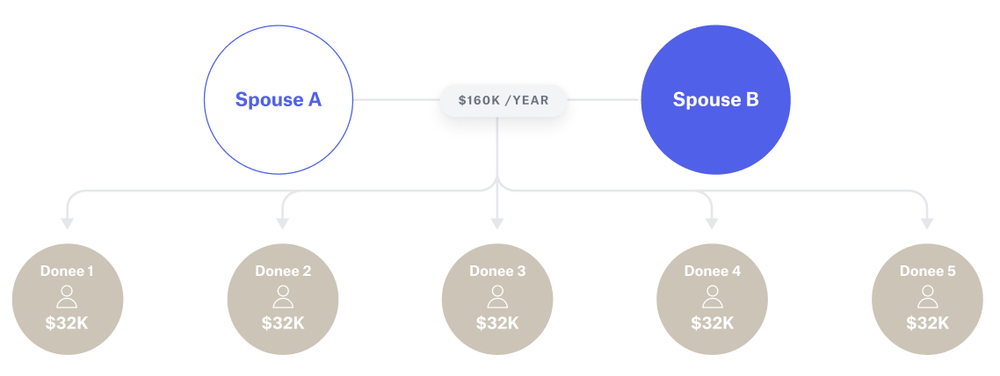

A person is allowed to transfer a given amount (currently $19,000) to another person over the course of each year, federal gift tax-free. This “annual exclusion” amount is allowed per recipient, and spouses can elect to split gifts of their combined annual exclusion amounts.

-

An annual gifting plan can reduce the size of one’s taxable estate

-

Multiple people can make annual exclusion gifts to the same recipient. For example, a married couple with five children can transfer a total of $190,000 to their children in 2023, gift tax-free ($19,000 × 2 spouses × 5 children)

-

Annual gifts do not consume one’s lifetime federal exemption

Spousal Lifetime Access Trust (SLAT)

In a spousal lifetime access trust, one spouse makes a lifetime gift of assets to an irrevocable trust for the other spouse’s benefit. This trust is structured so that the primary beneficiary spouse can access the trust assets, but the SLAT will avoid federal estate taxation upon the death of both spouses.

-

Allows the donor spouse to use their remaining exemption amount (currently a maximum of $13.99M), before it sunsets in 2026 to ~$6.2M

-

Removes SLAT assets from the taxable estate of the donor spouse, though they may retain limited indirect access

-

The primary beneficiary spouse (and other family members, if desired) can benefit from the SLAT asset

-

Future appreciation of SLAT assets avoids estate taxation

Irrevocable Life Insurance Trust (ILIT)

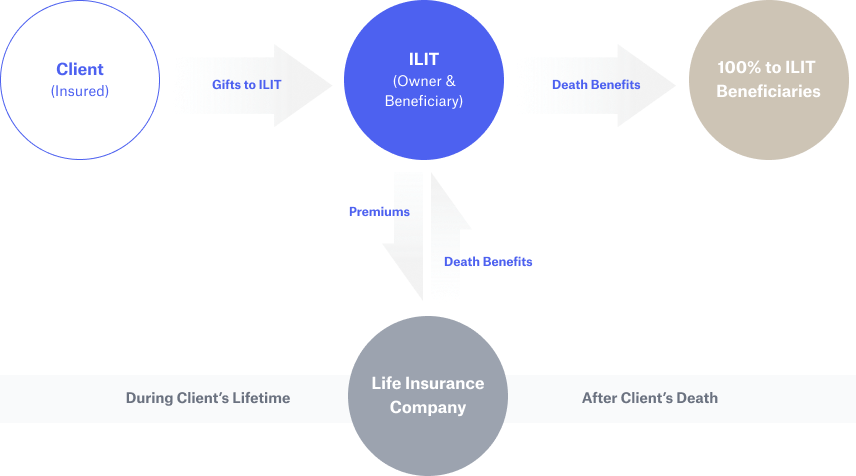

A irrevocable life insurance trust is an irrevocable trust that can shield life insurance death benefits from federal estate tax. When structured properly, an ILIT allows proceeds of policies insuring one’s life to avoid inclusion in their federal taxable estate upon death. This can provide liquidity and a tax-free transfer to one’s beneficiaries. If a person’s estate will owe federal estate tax upon their death, life insurance proceeds sheltered in an ILIT can be used to help offset the impact of taxes on beneficiaries.

-

Prevents the death benefit of a life insurance policy from being included in the gross estate

-

Either new policies can be purchased or existing policies can be transferred (survivorship requirements apply

-

Some lifetime exemption may be used either in transferring an existing policy into the ILIT or in transferring assets into the ILIT to pay premiums, but it may be possible to leverage the annual exclusion amount

-

ILITs can receive gifts from other sources besides life insurance

-

Properly structured ILITs can provide liquidity to cover estate tax costs and other debts

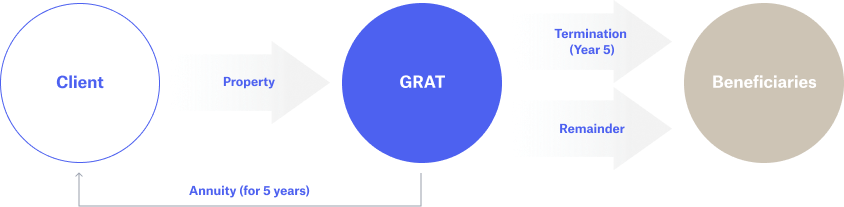

Grantor Retained Annuity Trust (GRAT)

A grantor retained annuity trust allows a grantor to transfer the appreciation of high-growth assets outside of their federally taxable estate without using much or any of their federal lifetime exemption.

In a GRAT transaction, assets are transferred to an irrevocable trust in exchange for an annuity payment to the grantor for a designated term of years. If a GRAT is structured so that the net amount given to the trust is valued at zero, and the annuity is paid in full, no federal transfer tax is due on the transaction.

-

The value of the grantor’s annuity interest offsets the value of the gift to the trust

-

If the grantor out lives the trust’s term, the assets and any appreciation will pass to the trust’s beneficiaries

-

If the grantor dies during the trust’s term, the transferred assets may be included in the grantor’s taxable estate (as if the strategy were not implemented at all)

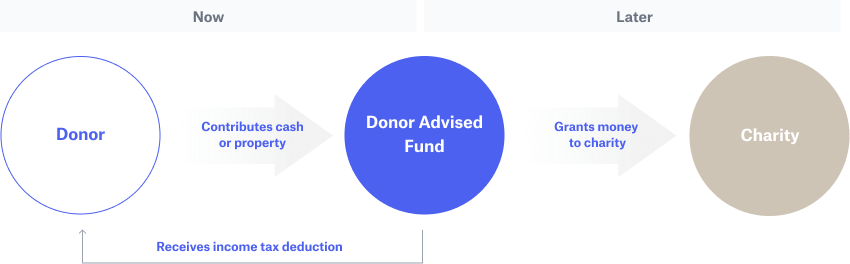

Donor Advised Fund (DAF)

A DAF is an investment account that’s earmarked for the exclusive benefit of public charities. As a person funds a DAF, they can take a charitable income tax deduction each year they gift. However, assets can remain in the DAF until one directs distributions to the ultimate charitable beneficiaries. Accordingly, one can manage the timing of their deductions and a charity’s access to the gifts separately.

Advantages Over Ordinary Charitable Giving:

-

Funds can remain invested for tax-free growth and grants can be recommended to virtually any IRS-qualified public charity.

-

Tax-deductible contributions can be made to the DAF before choosing what charities to support.

-

Easy to fund with a wide range of assets, including appreciated investment.

-

Less administrative burden than private foundations.

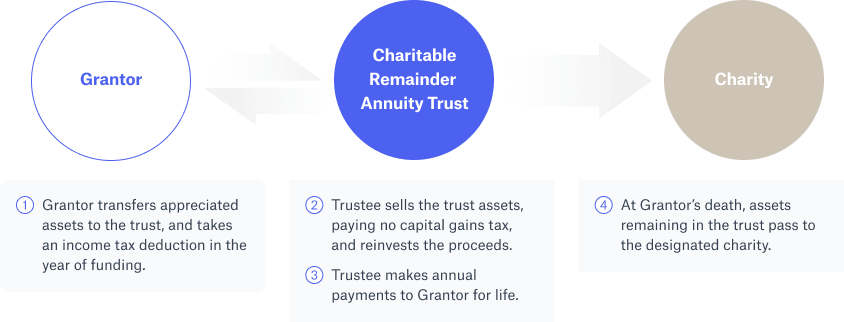

Charitable Remainder Trust (CRT)

A charitable remainder trust is a “split-interest” irrevocable trust that provides an income stream to the grantor (or other non charitable beneficiaries) for a specified period of time, after which the trust assets are distributed to one or more charities.

In the year of funding, the grantor can take an income tax deduction for the present value of the remainder interest that will pass to charity.

Advantages Over Ordinary Charitable Giving:

-

Annual payments can be structured as a fixed annuity amount (CRAT) or a unitrust amount (CRUT) for a lifetime(s) or a term of no longer than 20 years

-

The trust is a charitable entity, and as such isn’t taxable to the grantor

-

Allows the grantor to transform the sale of a highly-appreciated asset — which would incur large capital gains in a single year — into an income stream that could be more easily offset by capital losses

-

Assets owned by the CRT are excluded from the grantor’s federally taxable estate

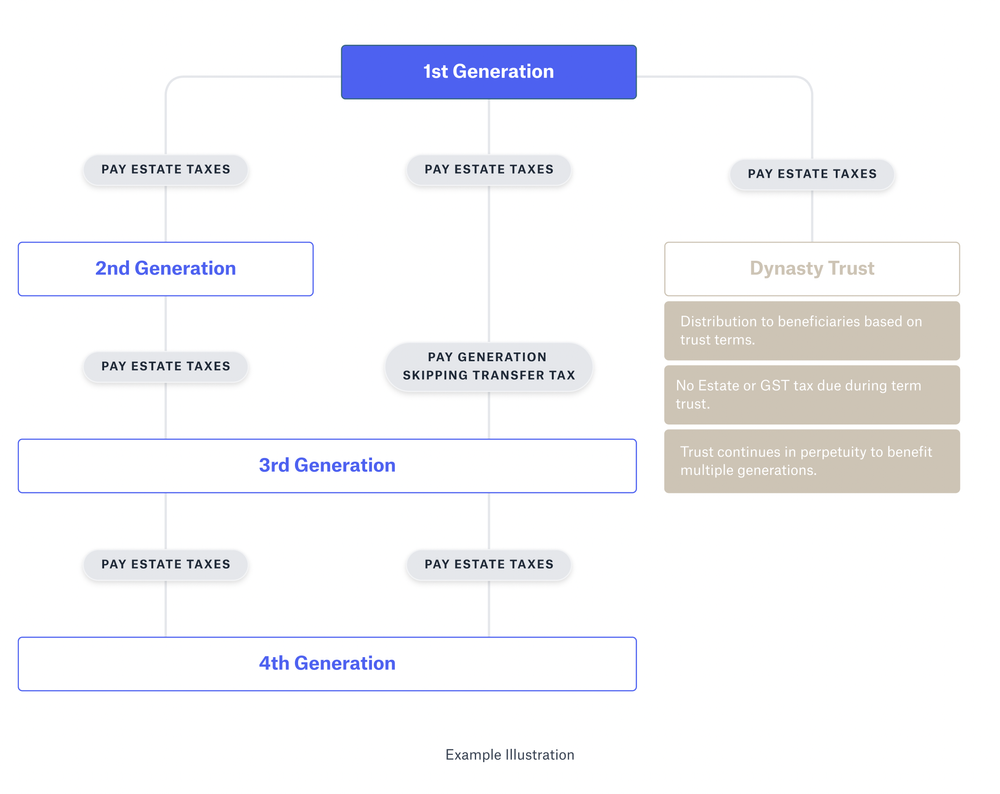

Dynasty Trust

A dynasty trust is a type of trust that is designed to continue in perpetuity. The assets stay within the trust and remain outside of the taxable estates of the original grantor(s) and all beneficiaries. By allowing the trust to exist for an extended period of time, the trust can benefit multiple generations of beneficiaries. Dynasty trust planning can be incorporated into any type of trust structure. By structuring the trust properly, it is possible to pass wealth from generation to generation without incurring any transfer tax (i.e. estate, gift, or generation skipping taxes).

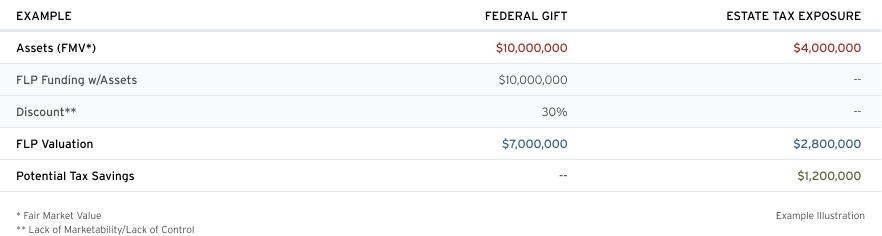

Valuation Discounts

Valuation discounts are an estate planning tool used to reduce the value of an asset for transfer tax purposes. This allows the owner to reduce either the amount of tax paid as a result of the gift or the amount of their lifetime exemption that must be used.

For example, it is possible to reduce the valuation of assets for tax purposes by changing the form of ownership from personal ownership to entity ownership. If one transfers assets into a Limited Liability Company (LLC) or a Family Limited Partnership (FLP) in exchange for an ownership interest, then the value that’s relevant for taxes is the value of the entity interest that they own, not the value of the underlying assets owned by the LLC/FLP. Discounts for lack of marketability may be available for the LLC/FLP units. These same discounts apply to closely held corporation interests.

Starting the conversation

As you can see, there are many different estate planning strategies that can be used to reduce or even eliminate estate taxes. The best way to understand which of these strategies is right for your client is to start a conversation, with diagrams. And when you are ready to start visualizing your clients complete estate plan, Vanilla’s estate planning software is here.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Mar 04, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.