Daniel Brockley

Daniel Brockley

What should you include in a will?

A last will and testament (also known as a will) is a legal document that outlines your instructions in the event of your death. It provides direction to your family, chosen representatives, and the court regarding how your assets should pass, as well as who should take care of your minor children (or pets!). Without a Will that expressly explains your wishes, the court will identify who gets your assets (generally your next of kin), based on applicable laws. And as for your kids? Well, without a Will, the court will make those decisions, too.

In the United States, wills are drafted based on state laws (and are often created by estate attorneys licensed to practice in your state). Though states generally recognize wills that were duly created in other states, it’s best to conform to your state of residence and the laws that apply to you and your estate.

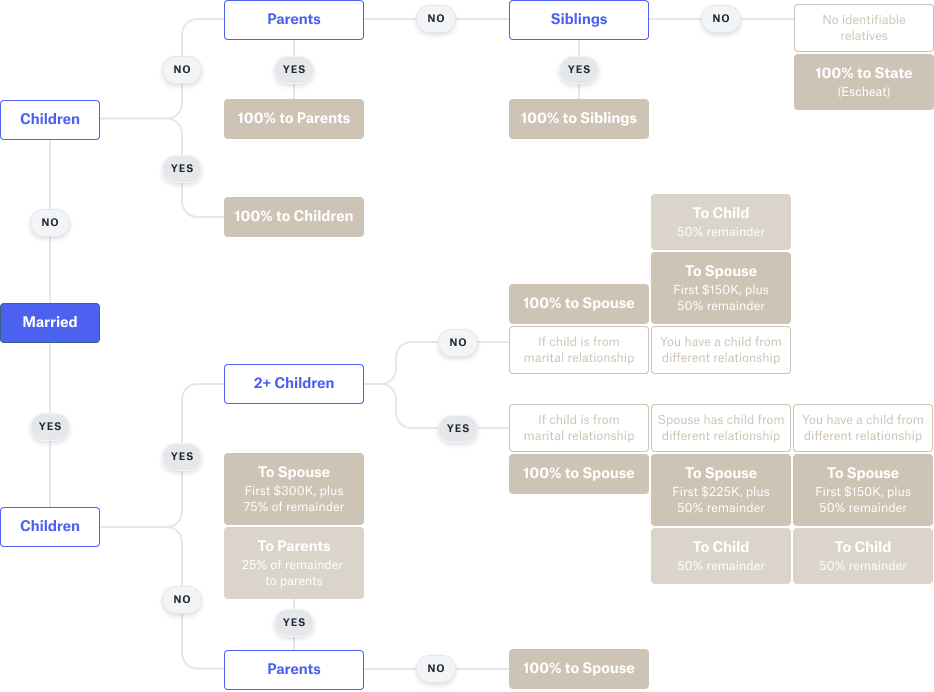

Here’s a basic flowchart that maps the framework that many states follow to determine the beneficiaries of your estate in the absence of a will:

Who needs a will?

You do. I do. Everyone does. Well, every adult at any rate. It’s not uncommon for people to put off creating a will because they are relatively young and in good health or because they don’t have extensive assets to leave behind, but not having a will leaves extremely important and sensitive decisions to the courts and appointed representatives. It also puts a burden on your loved ones while they are grieving your loss. You’ll do them a great service by taking away the stress and writing your wishes down. It’s also a good idea to give them direction on how they can access your necessary digital accounts.

Making an inventory of your assets

The first step as you prepare to create your Will (or have it created for you) is to make a list of your assets. (If you already have a financial advisor, you may have this in the form of a balance sheet.) This includes anything of either financial or sentimental value, including:

-

Home(s) and other real property

-

Car(s), boats, and other vehicles

-

Financial accounts, cash, stocks, bonds, and mutual funds

-

Digital assets such as crypto or digital land

-

Business interests

-

Art and collectibles, and other tangible personal property of value

This list will help you better visualize your estate and allow you to consider how you’d like to divide it.

Listing beneficiaries in your will

Once you have a better understanding of the scope of your estate, give some thought to how (and to whom) you would like to split it up. Common beneficiaries include spouses, kids, siblings, parents, and friends. You can also leave money to charities.

One question that often comes up when deciding beneficiaries is how to divide the estate between children and grandchildren. For example, if you have two kids, one of whom (let’s call her Sandra) has four children and the other of whom (let’s call him Todd) has two children, do you:

-

Divide the estate by giving 50% to Sandra and 50% to Todd (outright or in trust)

-

Make generation-skipping gifts to your grandchildren (outright or in trust)

-

Create a pot trust designed to benefit your children and grandchildren, allowing for flexibility and future balancing. (A pot trust allows the trustee to distribute a sum of money to the beneficiaries unequally. It is one “pot” distributed according to need and not equity.)

This is just one of many examples of how dividing an estate can be tricky. There are no right answers. Dividing your estate is a personal choice. But ideally, it should be a reflection of the legacy that you want to leave behind. It should speak to your values, sense of fairness, and hope for the future.

Addressing guardianship in your will

If you have children who are minors, the single most important part of your will is outlining how they will be provided for upon your death. That means determining a guardian who will take care of them (and having a conversation with that person/people prior to creating the official will). And it also means taking into account how your assets could provide for your minor children in the event of your death. You can appoint both a guardian of the “person” (who has physical custody and the responsibility of raising the child) and a guardian of the “property” (assets that are left to that child). As with other portions of your will, it’s important to periodically verify that the guardian you’ve listed is still the best person to take care of your child.

What assets are not controlled by a will?

There are certain items that can (and should) be left out of a will completely. That’s because there are other, simpler ways of directing their distribution. For instance, if you have a retirement account (e.g., IRA, 401k, etc.), you can designate a primary and secondary beneficiary directly through the financial institution responsible for the account. This avoids those assets having to go through the probate process.

Other assets that are not controlled by your will (i.e., “non-probate assets”) include:

-

Assets distributed by operation of law; for example, if you have joint tenancy and the other party has rights of survivorship

-

Assets for which you completed a beneficiary designation form such as life insurance policies and annuities

-

Transfer or pay on death accounts (TOD/POD)

-

Assets owned by your Trust

Naming an executor in your will

Estates generally have to go through probate, the court-supervised process of analysis and transfer of assets. You need to assign an executor (also referred to as a personal representative, or administrator, depending upon your state law) to oversee this process of carrying out the instructions you have left in your will. Typically, this person is someone close to you–a relative or good friend. Sometimes, however, especially for larger estates, people decide to name professional executors. The job of the executor is not always an easy one.

The Executor must:

-

File the Will with the local probate court

-

Notify government agencies, financial institutions, creditors, etc. of the death

-

Represent the estate in court

-

Collect and protect all assets until they can be sold or distributed

-

Set up a bank account to continue to pay bills and accept incoming funds

-

Pay the estate’s debts and taxes

-

Distribute assets and account to the court

Going through probate

As noted, a Will is subject to probate, so as a general rule, a probate court will be involved in estate administration. Although a properly drafted will can make this process go more smoothly, probate often takes six months to a year and longer. The will, the estate inventory, and named beneficiaries are a matter of public record. If you own property in other states, they may require ancillary probate proceedings as well. Having a will does not in and of itself result in estate tax savings, however you can incorporate tax saving strategies into the will.

How to create a will

There are a number of online resources that enable you to draft a basic will, which you can then execute with appropriate witnesses and a notary public present. However, there’s a lot to consider when creating a will and it’s a good idea to get expert advice, as a Will can be invalid if executed improperly. Additionally, a will is just one of several core documents you’ll want to make sure you have in place.

Other important documents include:

-

Power of attorney

-

Healthcare directive

-

Trust (optional, but often a good idea)

A holistic estate plan is important, and can be complex. We recommend you consult with your financial advisor and an estate attorney, who can help guide you through the process and direct you to strategies that make sense for your particular situation. A will and your other core documents will serve as the foundation of your legacy – directing how your beneficiaries and preferred charities will be taken care of after you’re gone.

When is a will not enough?

For larger or more complex estates, it is generally a good idea to consider strategies beyond a will, such as trusts. There are many types of trusts (which we will detail in an article to come), but the key benefits of trusts include the ability to manage your assets through a trustee both during your lifetime and once you are deceased to avoid probate, and to optimize your estate tax planning. In 2024, the federal estate tax rate on estates over $13.61 million ($27.22 for married couples) is 40% – and that threshold is currently set to lower by almost half in 2026. Trusts are also exempt from going through probate, which keeps your wishes private.

Working with an estate attorney and financial advisor

If you’re not in the position to hire a financial planner or estate attorney, don’t let that stop you from creating a will. It’s too important a document not to have. Go to one of the several reputable online document generating companies, complete the paperwork, and get it duly executed (i.e. signed, witnessed, and notarized). However, the best way to create a will is as a part of a more holistic estate plan – one that takes into account the subtleties of your personal circumstances and includes ancillary documents that plan for your incapacity and end-of-life decisions.

Once you’ve created a will (and hopefully other core documents such as your power of attorney and healthcare directive), you’re still not done. wills, trusts and other estate planning documents need to be reviewed yearly or anytime you make a significant life change such as getting married, moving or having kids.

One of the best ways to create a holistic estate plan that becomes a touchstone for ongoing conversations with your estate attorney and financial planner is with Vanilla. Vanilla is an estate planning software used by financial advisors and estate attorneys that not only helps identify potential strategies that could be right for you, but also serves to help you visualize the complexities of the estate plan in a way that’s easier to understand – and provides guideposts for ongoing conversations with your financial advisor and estate attorney.

Interested in learning more about how Vanilla can work for you and your clients? Let us give you a demo.

Published: Oct 20, 2022

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.