Vanilla

Vanilla

2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning

Welcome to 2024! It’s a new year which means higher inflation-adjusted exemptions. Accordingly, we have updated the Vanilla Estate Advisory Platform with the newest inflation-adjusted estate planning figures recently released by the IRS. This will enable advisors to accurately project the growth of clients’ estates and strategize on trust structures, gifting, tax mitigation and more.

Source: IRS.gov

Source: IRS.gov

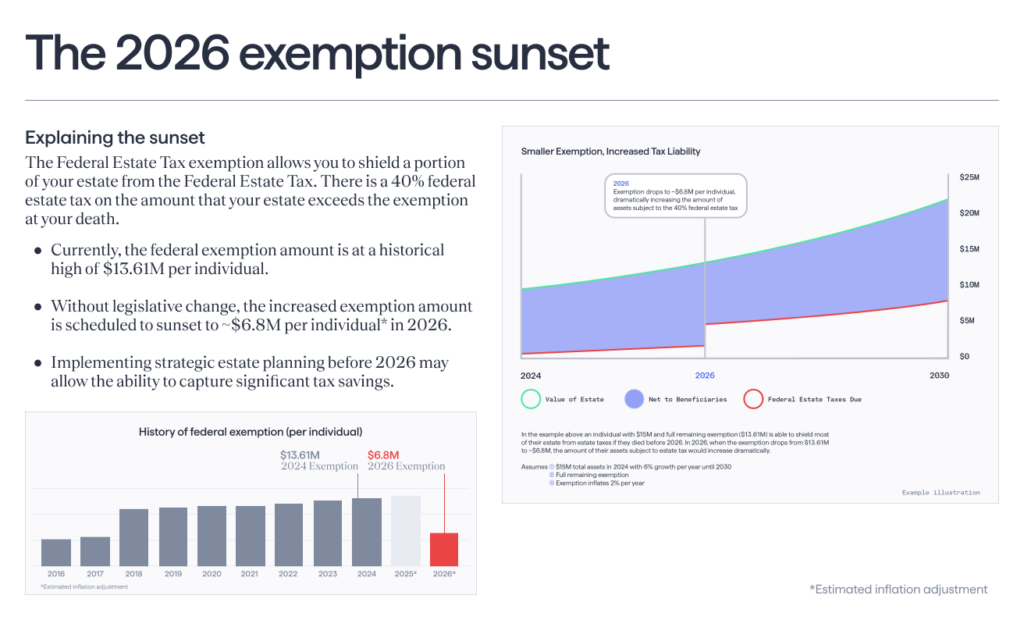

Federal Estate Tax Exemption

The federal estate tax exemption has increased from $12.92M to $13.61M per individual (or $27.22M per married couple). For advisors whose clients have taxable estates, it’s important to note that estate tax exemptions are “unified”. This means that if a client makes a gift to someone today, they will use up a portion of their lifetime estate tax exemption, thereby reducing how much they can give away, tax free, at death. For example, if a client who’s never previously made any taxable gifts gives a child $2M today, they will have $11.61M remaining at death to give away tax free.

Looking ahead, on January 1, 2026 the federal estate tax exemption will sunset to approximately $6.8M, adjusted for inflation.

Annual Gift Exemption

The 2024 annual gift exemption, the amount a person can give to another person tax-free over the course of a year, rose to $18,000 from $17,000. Annual gifts are a useful strategy to mitigate estate tax liability and do not consume an individual’s lifetime exemption. Multiple individuals can also make annual exclusion gifts to the same person. For example, a married couple can transfer a total of $180,000 ($18,000 x 2 x 5) in 2024 to their children, gift-tax free.

Planning ahead, here are a few ways that advisors can help their taxable or soon to be taxable clients prepare for the 2026 sunset:

- Clients have used most or all of their exemption before now have an extra $690,000 to use for additional planning (the higher, pre-sunset exemption is use-it-or-lose-it).

- Clients who haven’t used exemption but will be taxable after sunset and now is a great time to get ahead of the crowd for sunset planning – we only have 2024 and 2025!

- For clients who may be impacted by the 2026 sunset, The Vanilla Estate Advisory Platform can help strategize and visualize your approach, to ensure the financial and legal tools put in place meet your client’s goals.

Published: Dec 29, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.