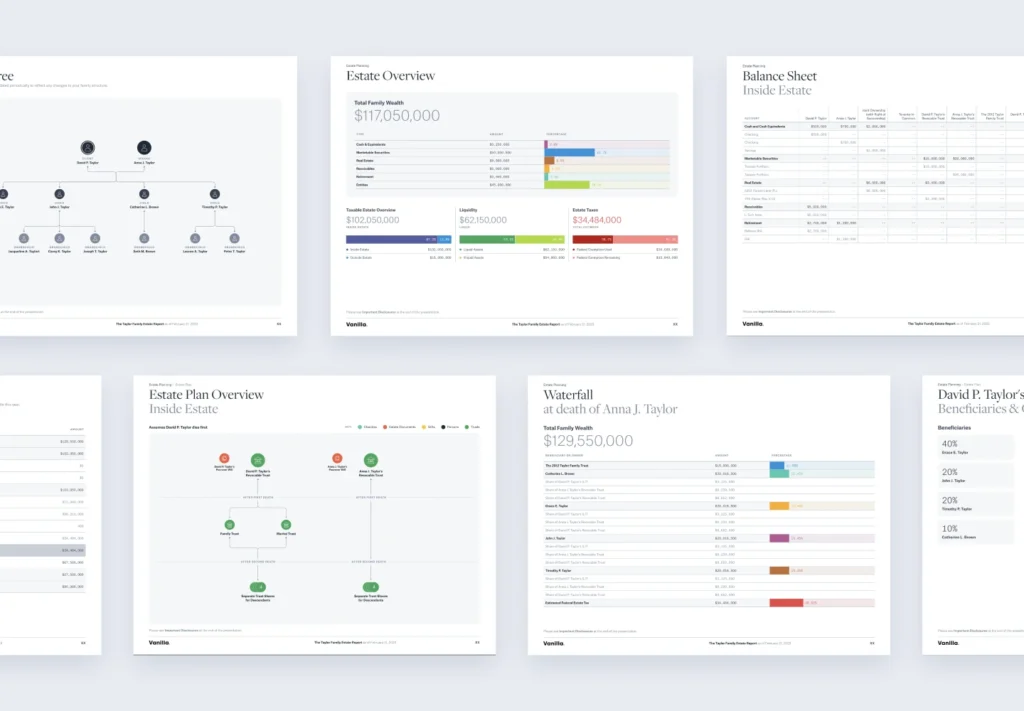

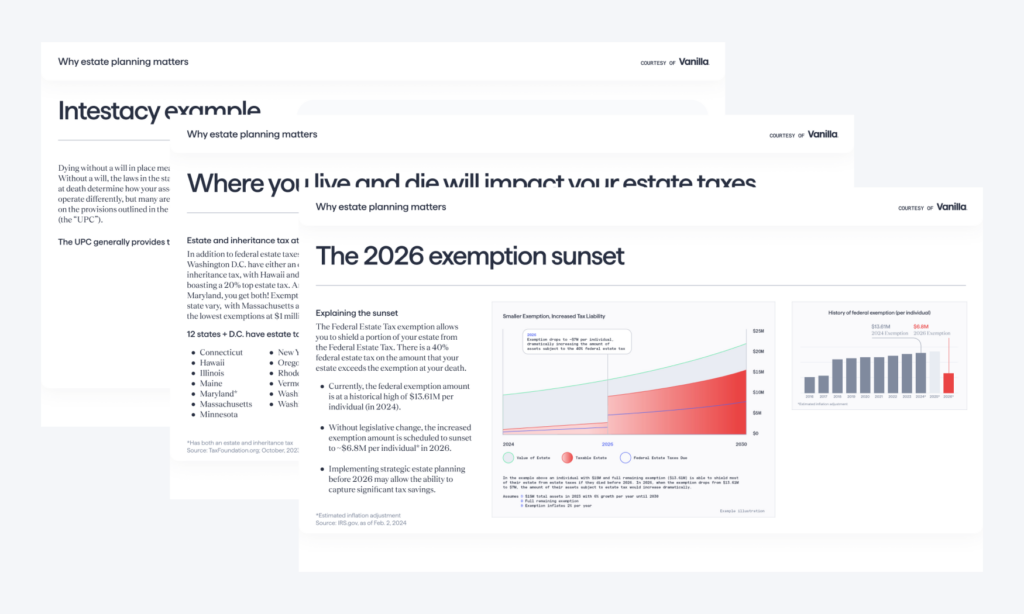

“Vanilla provides our team with a complete estate planning solution. The visualizations make it easy to identify gaps and recommend areas for improvement.”

Jason Newcomer

Co-Founder at Dogwood Wealth Management