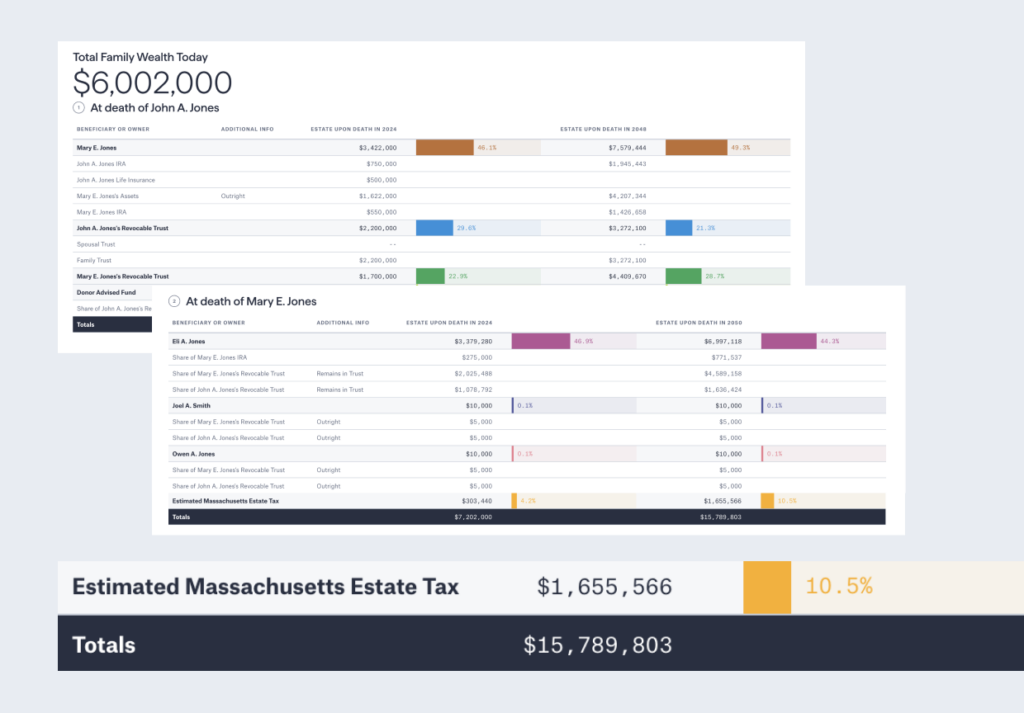

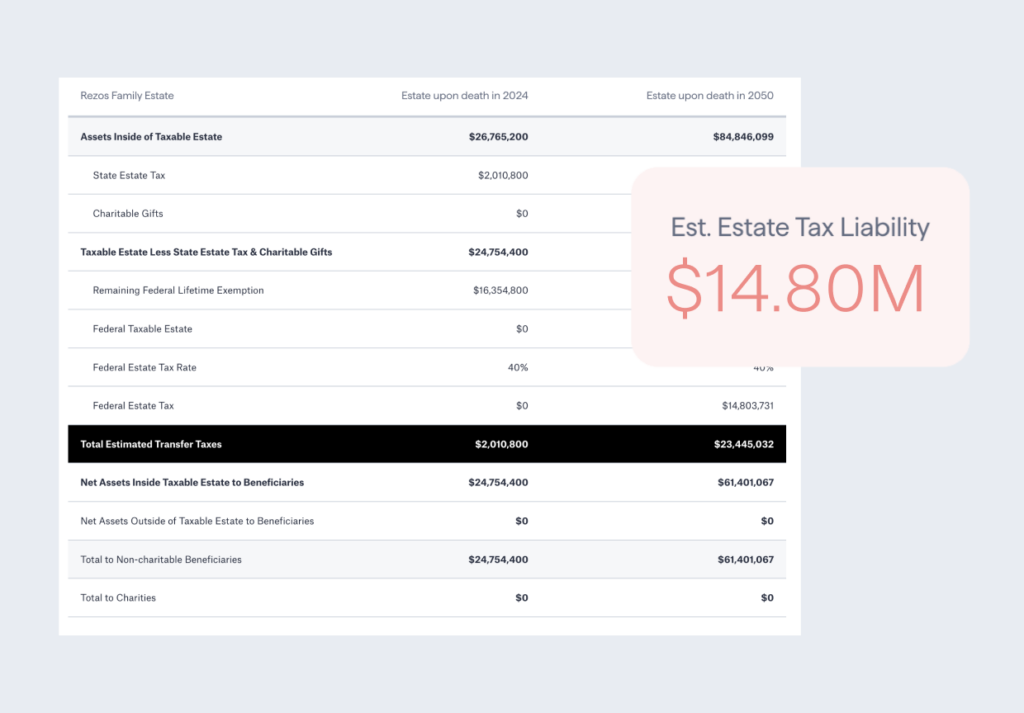

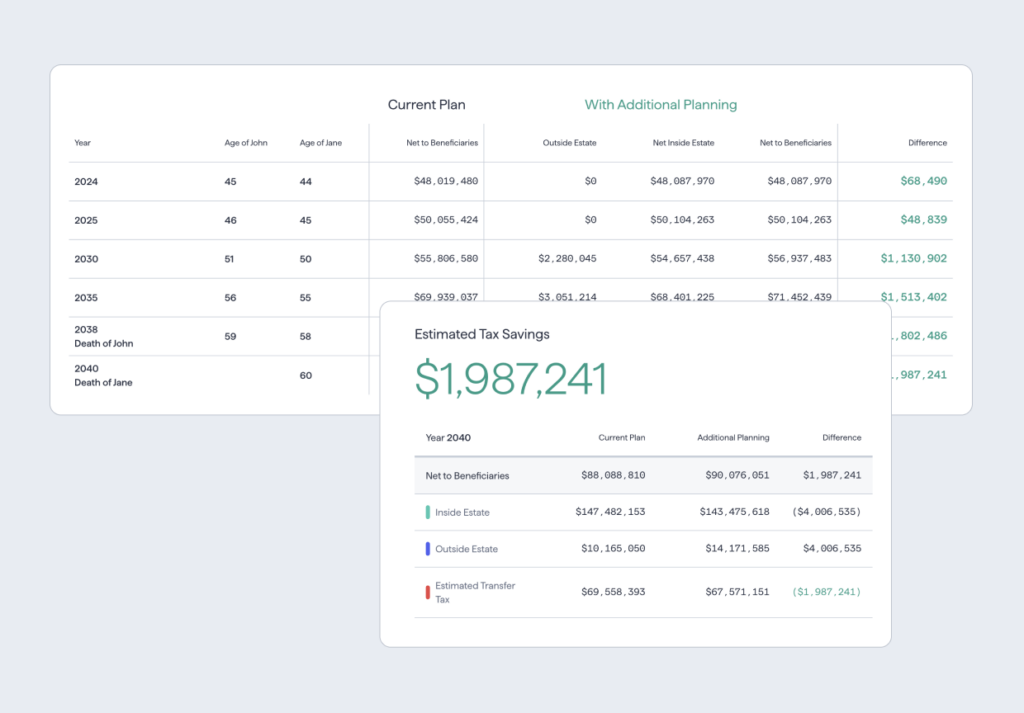

“Using Vanilla during a prospect meeting was extremely powerful in helping us guide a family through a recommendation we were making. This type of analysis was eye opening for our prospect, and now new client, who then worked with our team to restructure his entire estate plan.”

Jennifer Pcholinsky, CFP, AEP

Senior Associate Relationship Manager, Balentine