Simona Ondrejkova, CFP

Simona Ondrejkova, CFP

How Estate Administration Works & Ways to Simplify it for Your Beneficiaries

Whether you’re putting together your estate plan, assisting your clients in the process, or figuring out how to navigate the intricacies of distributing a loved one’s estate, it’s helpful to understand the estate planning and administration process. This can save you or your beneficiaries time by planning ahead so you can reduce unnecessary stress in transferring assets to heirs.

When considering estate planning strategies to maximize your legacy and transfer your assets according to your wishes, it’s also helpful to consider how your estate planning & administration can be affected by probate. So today we explain the steps involved in the estate administration process, demystify the complexities around probate, and provide a few tips to help ease this task for your beneficiaries.

What is estate administration?

When an individual passes away, the collection of the assets they are leaving behind is called their estate. These assets can range from cash to investments, real estate, and personal property such as personal jewelry or art collections. The process of properly distributing these assets in line with the deceased individual’s wishes is called estate administration.

The complexity and length of the estate planning administration process depends on several factors. The first to consider is whether the individual who passed away did so with or without a will, trusts, or beneficiary designations. If none of these were present, that individual’s estate will likely be going through probate. This may take months or even years before the assets are officially transferred to beneficiaries.

The role of probate in estate administration

Probate is a legal process through which the court validates and executes the last will and testament of a deceased individual. Or, if that individual doesn’t have a will, probate is the process through which the court determines who receives the individual’s assets after their death.

While probate serves to ensure the settlement of outstanding debts and the orderly distribution of assets in accordance with the decedent’s wishes, the downside is that it’s a public process and can take significantly longer than other asset distribution methods.

With the guidance of an estate planning attorney and a financial advisor, it’s possible to plan ahead so an estate does not have to go through probate. Accounts that have designated beneficiaries (such as retirement accounts or insurance policies), assets that are held jointly, and trusts generally bypass the probate process.

Use our estate planning checklist to get started with your estate planning so you can ensure you’ve got everything in place to maximize your legacy while minimizing the stress for your beneficiaries.

The steps to the probate process

Since probate is often part of the estate administration process for those who don’t have all of their accounts titled in different types of trusts or accounts with designated beneficiaries, it’s helpful to be familiar with the general steps involved in it. Below are the seven common steps of probate within estate administration:

1. Probate is initiated with the courts

The probate process starts with the filing of a petition in the probate court. This legal document formally requests the initiation of probate proceedings. It includes essential information about the deceased individual, the location and details of the will, and the name of the executor who will be handling the probate case.

2. The court validates the will

The court examines the submitted will to ensure its validity. This involves confirming that the document meets legal requirements, such as being properly executed, signed, and witnessed. If the court deems the will valid, then the dispositions and instructions (like the appointment of the personal representative) in the will are typically followed by the court. On the other hand, if the will is invalid (or if there is no will), the court will move forward with the probate process and instead make distributions and follow instructions from applicable state law.

3. The court appoints a personal representative

Once the will is validated, a personal representative (also known as an executor or administrator) is appointed to oversee the estate administration process. If the deceased individual did not specify an executor in the will, the court will appoint an administrator on their behalf. This individual assumes the responsibility for managing the deceased person’s financial affairs, settling debts, and distributing assets to beneficiaries. Around this point, an estate account may be created to hold the estate assets before they are distributed to any beneficiaries.

4. The value of the estate is determined

The appointed executor or administrator takes on the responsibility of identifying and cataloging all assets owned by the deceased. An accurate valuation of these assets is crucial for determining the estate’s overall value which is used to calculate estate taxes if the estate is greater than the estate tax exemption amount. Through proper estate tax planning, these taxes can be minimized.

5. Debts and tax obligations are settled

In most states, the executor must notify creditors of the probate proceedings, providing them with an opportunity to make claims against the estate for outstanding debts. This step helps avoid surprises during the distribution of assets. IRS Form 706 must be filed within 9 months of the deceased individual’s death in order to pay any estate taxes or utilize portability for married couples.

6. Assets are distributed to beneficiaries

Once any claims or disputes against the estate are settled, the remaining assets are distributed to the beneficiaries under the supervision of the court to ensure fairness and compliance with the deceased’s wishes, if they had a valid will, or in accordance with state law, if they didn’t have a will.

7. The probate case is closed

Once all debts are settled, assets are distributed, and any outstanding issues are resolved, the probate case is closed. Depending on the state, this may be a formal, paperwork intensive process where the court reviews the final accounting of the estate’s transactions and, if satisfied, issues an order officially closing the probate proceedings. In other states, it may be a less formal process to close the probate.

There are certain cases under which the probate and estate planning administration process can be delayed further. These include disputes among beneficiaries and will contests due to undue influence, fraud, duress, or questions about the deceased’s mental capacity at the time of the will creation.

Estate administration without probate

If an individual has structured their estate planning so their estate doesn’t have to go through probate, the estate administration process can be much easier and quicker.

In the case of joint accounts or accounts with a payable on death/transfer on death beneficiary for example, the transfer of assets can be as simple as presenting a death certificate and waiting a few weeks for the assets to be retitled into the beneficiary’s account.

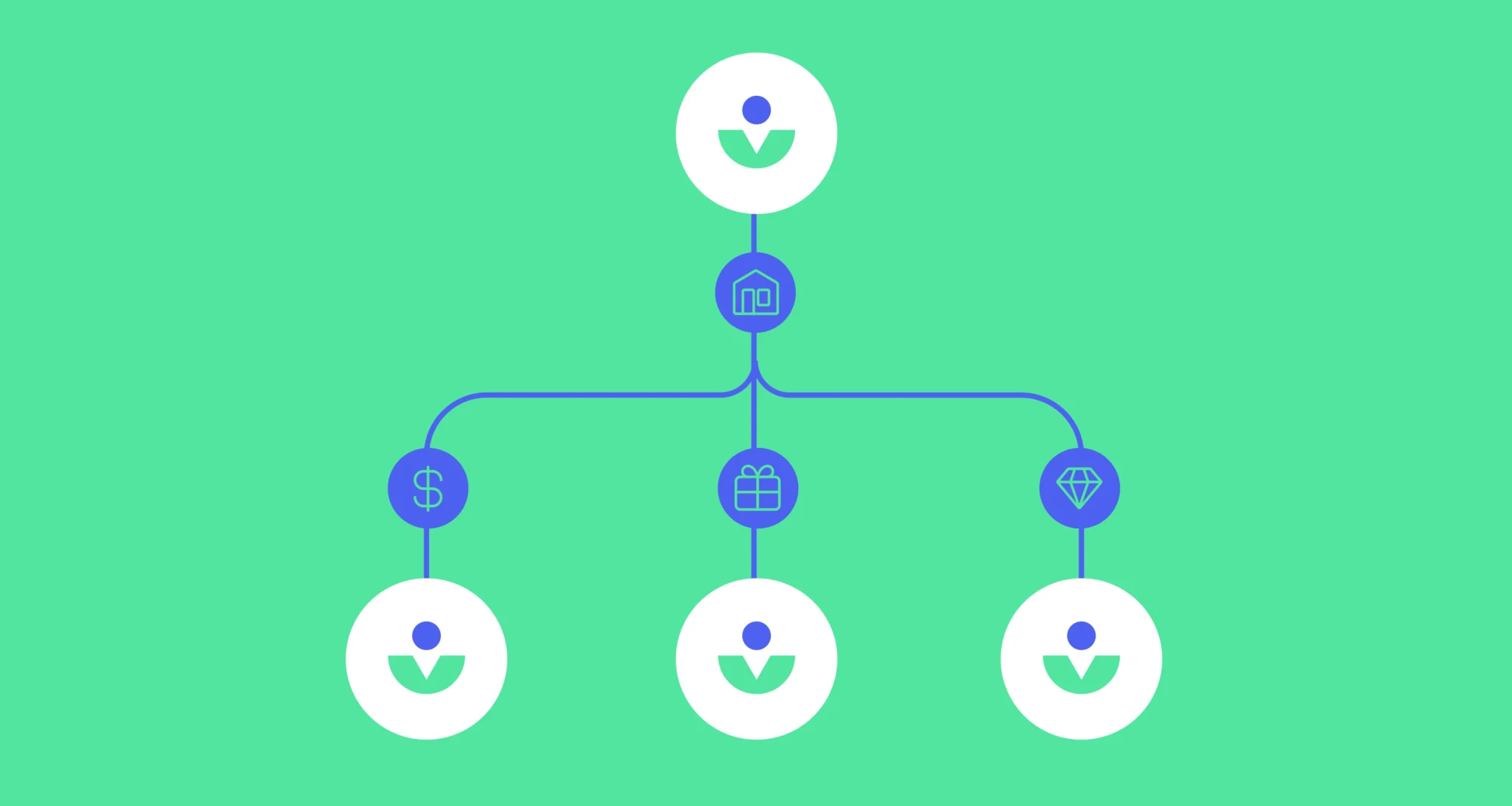

In the case of trusts, the trustee or successor trustee generally takes care of managing or distributing the assets once the trust settlor passes away. In general, this also involves presenting a death certificate and working with the financial institution holding the assets to ensure the smooth transfer or distribution of the assets in accordance with the trustee’s directives and the settlor’s wishes.

5 ways to simplify the estate administration process for your beneficiaries

While estate planning and administration can seem like a challenging task for those involved, it can be simplified. Working with an estate planning attorney, you can determine the best way to structure your estate to minimize legal and administrative burdens while potentially saving on estate taxes. Some of these include:

- Ensure you name beneficiaries (and contingent beneficiaries) on eligible accounts such as retirement accounts, annuities, and life insurance policies.

- Add Payable on Death/Transfer on Death beneficiaries to your investment accounts if your state allows you to do so.

- Title accounts in joint names where appropriate so that the assets pass straight to the joint owner without going through probate.

- Utilize trusts to achieve specific objectives, outline how your assets should pass to beneficiaries, and potentially save on estate taxes.

- Keep clear and transparent lines of communication open amongst beneficiaries and your executors so they are familiar with your wishes and know what to expect in the estate administration process.

With the help of a financial advisor, you can also lean on tools like estate planning software for financial advisors to help you visualize how your assets will flow in the case of your death so you can easily adjust your plan to minimize the burden for your heirs. Click here to see how Vanilla can help you reduce the burden of estate administration by helping you plan out your estate today.

Published: Feb 23, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.