Vanilla

Vanilla

Estate Planning Checklist: Everything your clients’ documents should cover, according to our legal expert

If something should happen to your clients, regardless of their age or income, it’s crucial that they have a plan for their financial assets. As their financial advisor, you’re in the best position to keep your clients on task so they can reach their goals and ensure their families are taken care of.

But between a myriad of documents, individual state requirements, and shifting federal estate tax laws, it’s no wonder the estate planning process can be overwhelming for financial advisors and their clients.

That’s why we’ve created this easy-to-follow estate planning checklist. We’ll give you clear insights into a difficult topic: what your clients need to have in place in the event of their death or incapacitation.

Our checklist will help you understand why each estate planning element is essential and what to consider as you and your clients plan for 2023. It will also dispel common assumptions and misperceptions financial advisors have when it comes to estate documents.

Download the complete estate planning document checklist here.

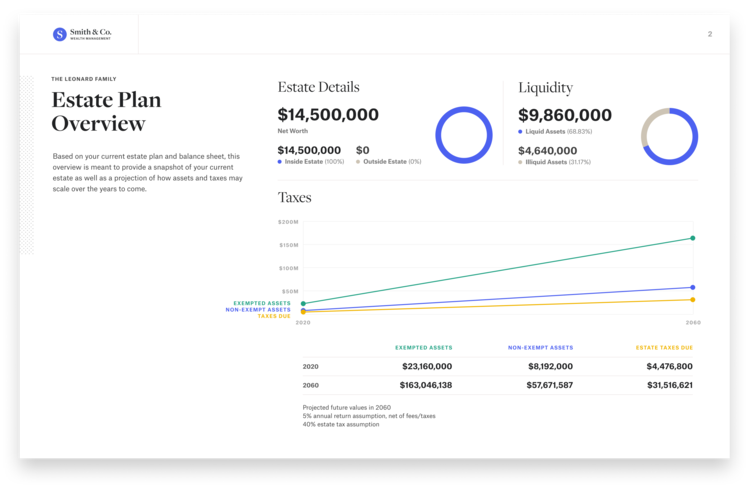

1. The estate planning personal balance sheet

Before diving into the official estate planning documents, make sure your client has a complete list of their assets and estimates of each asset’s value.

Dina Nam says to think of assets in two different ways:

- Things that your clients own a title to directly, like their house, vehicles, bank, and investment accounts.

- Things intended for a payout later, like retirement accounts, and life insurance.

Help your client by determining which assets are easier to estimate based on current market value, and which assets, like private business interests, may need an independent professional appraisal.

Let’s take a look at what your client should include in their balance sheet:

- Real property: Any land, building, or residence that your client owns or has a mortgage on.

- Bank accounts: Checking, savings, certificate of deposit, and money market accounts.

- Digital assets: Many estates overlook digital assets such as airline miles, credit card reward points, cryptocurrencies, and log-in credentials. But this blind spot could lead to identity theft and unnecessary taxation.

- Vehicles: Automobiles, boats, motorcycles, and aircraft.

- Retirement accounts: General pension, 401(k), 403(b), IRA, Simple IRA, SEP IRA, Roth IRA, HSA, and ESA.

- Investments: General investment account, mutual funds, ETF, stocks (equities), bonds, money market, and Treasury bills.

- Insurance: Term, whole life, split-dollar, group life, and annuity.

- Promissory notes: If your client has loaned money to a family member with a written promise of repayment, it’s crucial that they include the amount in their estate.

- Business interests: Your client will need an attorney to help them determine which business assets they hold (and can place in a trust) and which assets belong to the business structure.

- Anticipated inheritance, gifts, and lawsuit judgments: If your client has inherited money or received a financial windfall, help them avoid possible tax penalties by planning what to do with it now (see below).

Planning for 2023

In recent years, your more well-off clients enjoyed favorable federal gift and estate tax exemptions. However, the current exemption levels are expected to automatically expire on January 1, 2026 resulting in the exemption levels reverting back to $5 million per person (adjusted for inflation).

Individuals with more than $12.92 million and couples with more than $25.84 million can reduce possible tax liabilities on their estates by doing the following before the end of the year:

- Gift a significant portion of the estate to beneficiaries

- Sell assets for promissory notes (with may be forgiven if the tax laws are less likely to change)

Our expectation is that clients will want to leverage the higher exemption levels prior to January 1, 2026 and therefore, it’s a good idea to look for opportunities to make gifts now.

Such large transactions will need careful planning so your clients avoid any IRS risks and maintain their financial independence.

2. Outstanding debt

If your client owns any debt, that debt will transfer to their estate. The client should make a note of all outstanding debt on their balance sheet.

Debts are always going to be the responsibility of the estate. As long as they’re legitimate debt, like medical bills, hospital bills, credit card bills, they don’t go away just because you die.

Depending on what assets they own, the client’s named executor or trustee will have to gather information about what debts are outstanding at death and deal with it at that time. The beneficiaries receive whatever remains at the end of that repayment process.

If your client has more debt than assets, it’s also possible that their beneficiaries won’t get anything.

Planning for 2023

Protect beneficiaries from future pain by helping your clients work out a debt-repayment plan.

The better organized clients are during life, the easier it is for whomever has to step into your client’s shoes and trying to manage things.

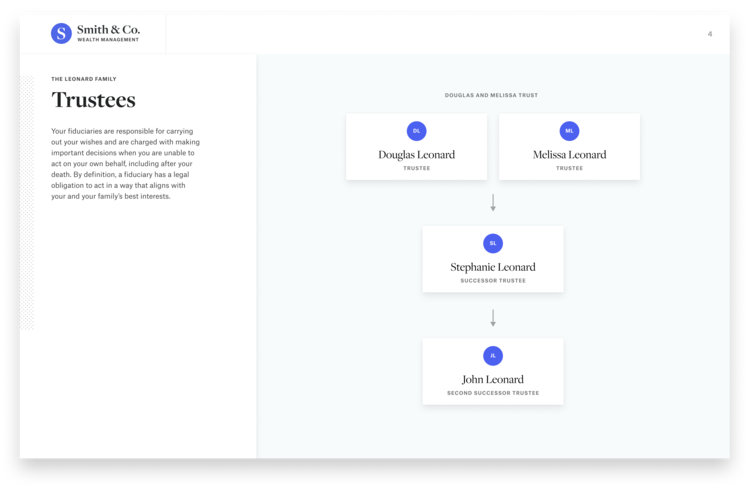

3. Fiduciary and Beneficiary Designation

A fiduciary is a person or entity responsible for carrying out your client’s wishes. The fiduciary makes crucial decisions on behalf of the client in the event of death or incapacitation. In client documents, the people they select will play essential roles, such as trustees of the client’s trust or executor of the will. For married couples, spouses typically choose one another as their primary fiduciaries.

Here are the types of fiduciaries your client may need to designate:

- Executor: The executor takes the financial actions needed to settle the estate under the terms of the will after your client dies.

- Trustee: The trustee is responsible for managing the assets in the client’s trust during life (if they are incapacitated) or after they die. In estate planning documents, the person your client names as their primary fiduciary also serves as their trustee. This means meeting their trust beneficiaries’ needs using trust assets in a way that aligns with the wishes outlined in your client’s trust document. Although the trustee manages the trust’s assets, the trustee does not personally own them.

- Guardians: If your client has minor children or an adult dependent, the guardian cares for them and is legally responsible for them. Guardians are usually trusted family members who your client is confident could provide sufficient care for the child or adult dependent, factoring in their age, health, and financial stability.

- Attorney-in-Fact/Agent: The person your client names as their primary fiduciary will serve as their attorney-in-fact or “agent.” Their agent will be responsible for managing assets with titles in the client’s name (which are not otherwised titled in the name of a trust). They act per any directions that your client has included in a Power of Attorney document.

It’s a big decision to appoint a fiduciary. Help your client determine the best candidates to manage their estate by asking three critical questions:

- Do you trust them to represent your family’s best interests?

- Are they financially responsible?

- Are they likely to be alive when you die?

Vanilla makes it easy for you to create a clear picture of how your clients want to leave their estate after they’re gone. To learn more, download a sample report.

Designate Beneficiaries

A beneficiary is a person or entity the client names as a recipient of assets upon death or incapacitation. Your client can give beneficiaries access to trust assets up front or over time. Your client can name more than one beneficiary, who can be any of the following:

- An individual (or group of people)

- The trustee of the client’s trust

- A charity or nonprofit

- A minor (child under 18 years of age)

Some of the biggest mistakes in estate planning involve naming (or not naming) beneficiaries or naming the wrong people or entities as beneficiaries. If your client doesn’t name a beneficiary for an asset, the asset will have to go through probate. Probate could be a lengthy and costly process that can cause undue hardship on your client’s relatives.

Planning for 2023

Be sure to regularly check in with your client to make sure their fiduciary and beneficiary designations are up to date and reflect significant life changes like births, deaths, marriages, and divorces.

It’s also essential to have a plan in the event of the death of fiduciaries and beneficiaries, so your client’s wishes are carried out.

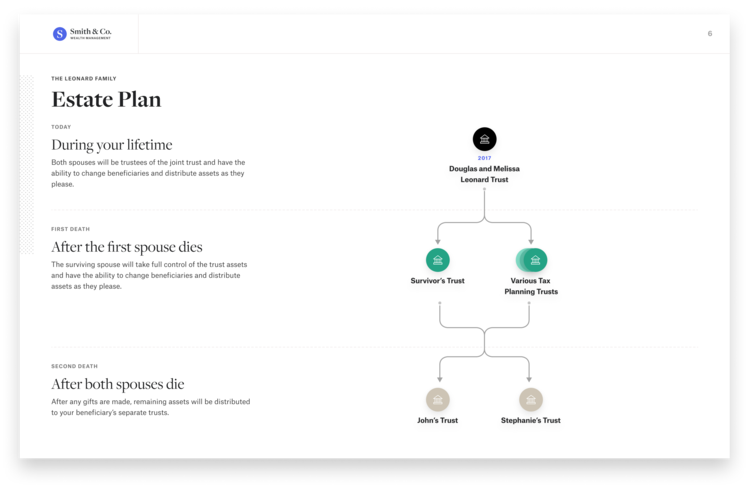

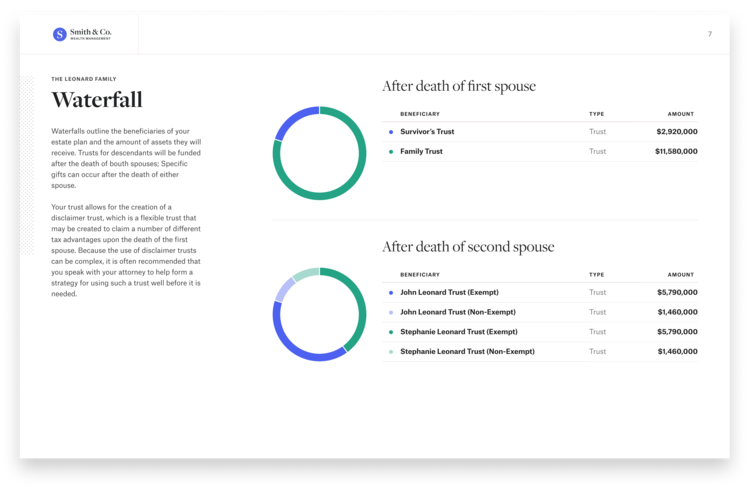

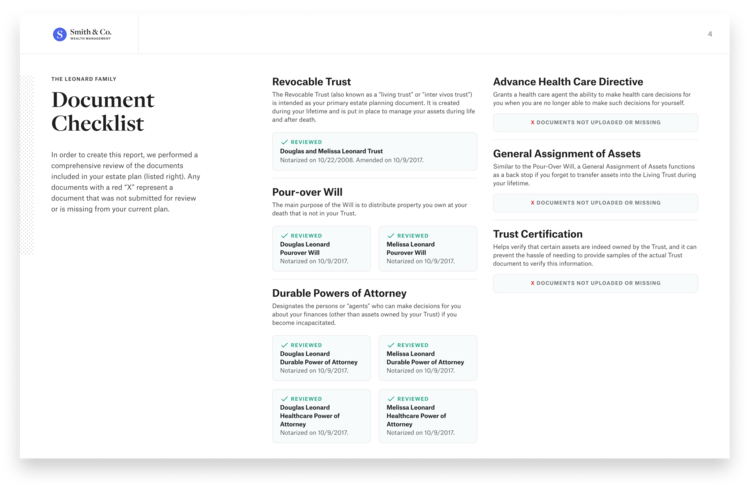

4. The revocable trust

The revocable trust is the primary estate planning document. It’s also known as a “living trust” or an “inter vivos trust,” and not to be confused with a “living will.”

The purpose of the trust is to help your client’s beneficiaries avoid probate upon the client’s death.

If you have a trust, you don’t have to go to court to transfer any of those assets to your intended beneficiaries. You can deal with it privately.

If your client is married, you can help them determine how they want their trust assets to be divided both after their death and after their spouse’s death.

Planning for 2023

The revocable trust is a living document—your clients can change it at any time, for any reason. After such an eventful year, it’s understandable if your clients reassessed their priorities for what they want to leave behind. If your clients have a revocable trust, check in with them to see what changes have come up that might impact how their wishes will be carried out after they’re gone.

5. The “Pour-over” Will

The pour-over will acts as a safeguard to distribute any property that has not already been transferred into the trust.

Many people mistakenly think that having a will is enough to prevent possible disputes over inheritance or keep things from going into probate.

What people don’t realize is if you just have a will, you still have to go through the court process to transfer those assets to your intended beneficiaries. In some states, like California, it’s a very long and onerous process. It could take up to two years to do. It can be very expensive versus if your client has everything set up in a trust. A pour-over will ensures that any unassigned assets go into your client’s trust upon their death.

Planning for 2023

With the possible estate law changes mentioned earlier, it’s even more essential that your client safeguard their assets against intestate succession laws—the unique (and convoluted) state laws that govern how unassigned property passes through a line of inheritance.

If your client doesn’t have a pour-over will in place, now is the time to set one up. With a pour-over will, if anything happens to your client in the next year, any new property your client acquires will automatically pass into their trust—and out of the hands of the government.

6. Power-of-Attorney Documents

There are two types of power-of-attorney documents: the durable power of attorney and health care power of attorney (aka advance medical directive).

Let’s examine how these documents differ:

-

Durable power of attorney: Your client designates an agent to make decisions about finances (other than assets owned by the client’s trust) on the client’s behalf in the event of their incapacitation.

-

Health care power of attorney (aka advance health care directive): Your client designates an agent to make medical decisions on their behalf when they’re no longer able to. In this document, they can outline their wishes about medical care and treatment, and the disposition of their remains (e.g., organ donation, burial, cremation, etc.). Clients can choose to have this document effective immediately or only upon their incapacitation. A power of attorney is no longer effective once the person who creates it is deceased. This document can sometimes be referred to as a “living will.”

Planning for 2023

Now more than ever, it’s important for your clients to have health care directives that reflect their desires should they need medical interventions such as ventilators and other forms of life support.

“Many people assume that a ‘do not resuscitate’ (DNR) is sufficient legal documentation in the event of a life-threatening injury or illness,” Dina says. “A healthcare power of attorney addresses healthcare directives in a more specific way and gives loved ones clearer advice on what to do.”

7. Tangible Personal Property Memo

Your client may have personal property that holds sentimental value (e.g., art, jewelry, heirlooms, and household goods) that they wish to assign to beneficiaries.

The tangible personal property memo can act as a safeguard for your client’s wishes. Your client must sufficiently name each beneficiary of personal property and sufficiently describe in detail the property the beneficiary is to receive.

The tangible property memo can also act as an explanatory letter so your client can express their personal reasons for leaving property to certain beneficiaries.

It’s always a good idea to provide some kind of letter, whether it’s to the trustees or to the beneficiaries, indicating “here’s why I did what I did so that you understand, and you don’t fight about it.’”

Planning for 2023

There are few topics more personal than what should happen after you die. After such a tumultuous year, and with so much uncertainty about the future, your clients may struggle with making the “right” decisions. They may try to put off estate planning until the world seems more predictable.

People are sometimes uncomfortable talking about death and dying.

‘What I would tell somebody who’s hesitating about doing estate planning is: they already have an estate plan in place. It’s just one dictated to them by the state. And if you don’t want the government or the state to tell you who should receive your assets or who can receive your assets, then you should do planning now.’

— DINA NAM

Summary: Every document you could need for will and estate planning

For your convenience, below is a list of common documents needed in a typicalr estate plan:

- Will: The last will and testament is a legal document that details your client’s wishes regarding assets. In addition, it is also the document where you name your executor and who you wish to care for minor children after your client’s death.

- Revocable living trust: For large or complicated estates(or to keep your affairs private), there are other structures which may be more useful than just a will. A living trust is a legal entity that holds a person’s assets and designates beneficiaries, and can be altered during the settlor’s lifetime. It ultimately controls the disposition of a person’s assets and helps avoid probate for any asset held in the trust

- Beneficiary designations: Beneficiary designations are part of retirement accounts, life insurance contracts, and annuities. They allow an individual to name who should receive any remaining assets in those accounts or policies when the owner dies.

- Advance healthcare directive (AHCD): An advance healthcare directive is a term that may refer to a combination of several different documents. Often this term is used to refer to a living will and a medical power of attorney. This document outlines your client’s medical preferences and allows someone else to make medical decisions on their behalf. In addition, it is common for this document to contain a HIPAA waiver that allows your client’s designee to access protected health care information in order to act on your client’s behalf.

- Financial power of attorney (POA): This document gives another person the authority to manage your client’s finances and property.

- Insurance and financial documents: Your client’s insurance policies, bank accounts, credit cards, mortgages, loans, tax documents, pensions, retirement benefits, and investments fall under this category.

- Identification documents: Proof of identity documents include your client’s social security card, birth, marriage, and divorce certificates, and any army discharge papers.

- Titles and property deeds: You’ll also need to gather your client’s titles and deeds for any property, including homes, vehicles, and other real estate.

- Digital account logins and passwords: Clients may have a digital executor in their will who manages their digital assets and accounts after their passing.

- Funeral instructions: These instruction may be in any form your client chooses. It is meant to t detail how your client would like to be buried and any other funeral wishes they may have.

Help your clients future-proof their estates

In uncertain times, so much of your clients’ financial future is up for grabs—but one thing that doesn’t change is the importance of estate planning. The checklist above is fundamental to an estate plan, regardless of what may come in 2023.

Change the way you serve your clients with Vanilla estate planning documents and reporting for financial advisors. Get in touch to get started. Looking for additional information on how to approach estate planning in your practice? Check out the Vanilla Estate Planning Playbook.

About the author

Dina Nam has a Bachelor of Arts in Economics from Pomona College in Claremont, California. She earned her Juris Doctor from Brooklyn Law School in New York and later earned her Master of Law (LL.M.) in Business Law and Tax at the UCLA School of Law, graduating in the top 10% of her class. She is an active member of the State Bar of California and certified by the California Board of Legal Specialization as a legal specialist in Estate Planning, Trust and Probate Law.

Prior to joining AdvicePeriod, Dina spent her career as a practicing attorney at large international law firms as a wealth planning and tax associate specializing in sophisticated estate and tax planning. Her work included working closely with high net worth individuals and families to facilitate wealth transfers for large estates, complex estate and gift tax savings techniques, and probate and trust administration work.

Published: Jan 24, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.