Gene Farrell

Gene Farrell

The future of estate advisory: A new way to think about estate planning

[Watch Legacy Now on demand, to learn more about Vanilla’s vision for estate advisory.]

I believe that technology – when used thoughtfully – can be truly transformative. And this week at our Legacy Now event, with the help of Vanilla co-founder Steve Lockshin, I had the opportunity to share how Vanilla plans to transform not just estate planning, but financial advising as a whole, with the new Vanilla Estate Advisory Software.

The technology itself is only a part of the picture. It’s a tool. It’s the enabler that, when paired with exceptional advisors, will allow for a new kind of relationship between advisor and client, and a new paradigm in advising. In this new paradigm, advisors will no longer be relegated to managing a client’s portfolio or assets piecemeal, but will be trusted partners in holistic wealth and estate planning.

We know that clients crave something more from financial advisors, advice that goes beyond their investment portfolios.

A recent survey by UBS found that:

- 68% of clients are concerned that their heirs will use their inheritance wisely

- 83% are worried about a smooth transition.

- About half also worry that their distribution plan may not distribute assets fairly.

This raises the question: Who do clients trust to help them think through these issues? It turns out that most clients want to partner with their wealth advisor to build their estate plan.

The Estate Advisory Gap

- 93% of people want/expect estate planning services from their advisor

- But only 22% of the same people surveyed are actually getting estate planning advice from their advisors.

That’s a huge gap between what clients want and need vs. what most advisors are currently delivering.

We call this the Estate Advisory Gap.

We think this is because many advisors still think about estate planning as something that should be led by an attorney and that their role is really to remind their clients that they need a plan – or, even if an advisor wants to offer estate advisory, many of them lack the expertise and don’t have the tools and resources to assist their clients.

This gap is one of the reasons why despite a majority of clients believing that having an estate plan is important, it is estimated that over 50% of advised clients do not have a plan in place or the plan they have is out of date.

So how can clients avoid the Estate Advisory Gap?

The Total Wealth Advisor

On this front I have some good news. The industry is starting to change and in the last few years we have seen the emergence of a new type of advisor we call a Total Wealth Advisor.

- They prioritize holistic advice over selling products.

- They are expert investors but even better planners

- Estate advice is one of the best ways to create a deeper connection with their clients

- Enables them to connect across generations.

- Creates focus on clients goals

Total Wealth Advisors aren’t just building estate plans. They are actually guiding clients through a series of conversations to think deeply about how to optimize their impact on the people they love and causes they care most about.

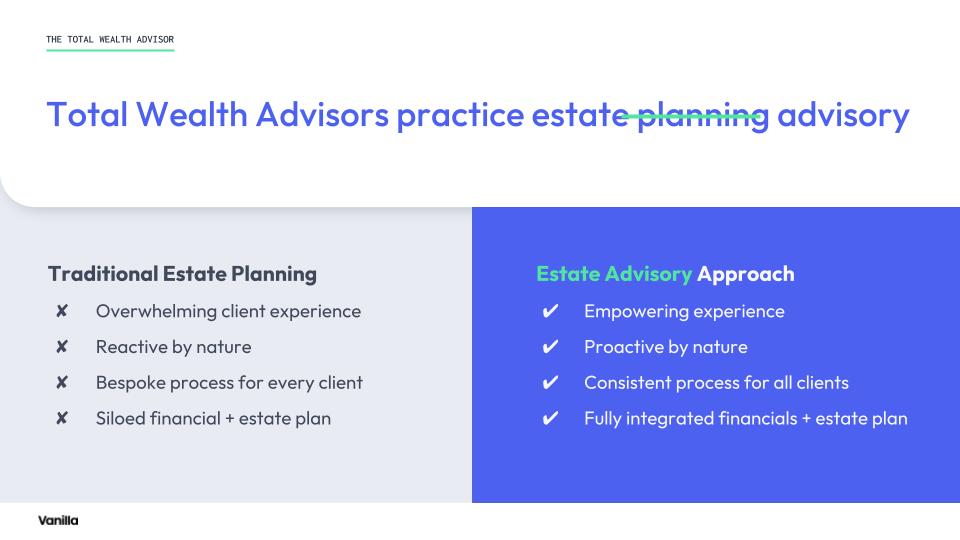

The shift from estate planning to Estate Advisory

Many of you reading may already be Total Wealth Advisors. The fact that you’re here, learning about what’s on the horizon for you and your clients speaks to that. And you should know that if you are a Total Wealth Advisor, you have the advantage when it comes to winning new clients and building deeper connections. By shifting from estate planning to estate advisory, you can truly transform your relationship with your client and be a partner in building their legacy.

But advisors still need better resources and tools to support this new approach and this is where Vanilla comes in.

The complete platform for Estate Advisory

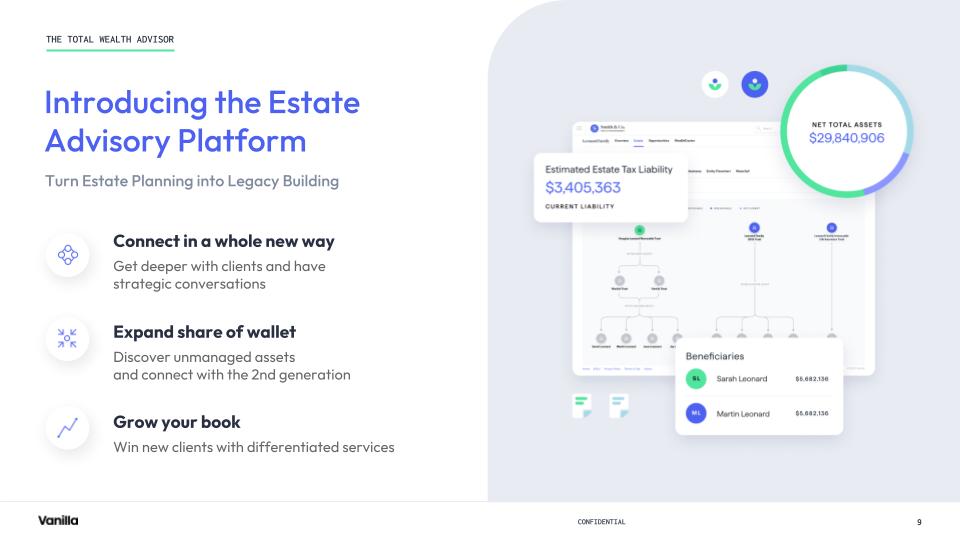

I’m proud to introduce the Vanilla Estate Advisory Platform.

A new platform that enables you, the Total Wealth Advisor, to help clients build their legacy.

The Estate Advisory Platform connects advisors to their clients to deliver high impact advisory wherever they are. Whether they have a completed plan or just getting started. It starts by providing you and your teams with all the materials you need to educate your client on the importance of a good plan. With tips on what questions to ask and how to run a great meeting.

If the client has an existing plan, Vanilla will visualize it alongside their assets, showing the total impact as well as uncovering opportunities where the plan may need to be adjusted.

By fully integrating the estate plan with real time financial data, you can project out how the estate could grow over time and where the plan might need to change as the client’s needs or goals change.

And if they need new documents, we will soon be able to help there too. Tune into the full Legacy Now presentation to learn more.

Now that’s a big vision. But we’ve been building our platform alongside some of our earliest design partners and customers – Vanguard, Mariner Wealth Advisors, Balentine, and Hightower. As well as dozens of amazing smaller independent RIAs who are already creating impact for their clients using our platform.

Vanilla is empowering them with our technology, but make no mistake that this is not just about technology. It’s about redefining the advisor/client relationship. Vanilla is excited to be a catalyst in growing that relationship, today and in the future.

Published: May 17, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.