Vanilla

Vanilla

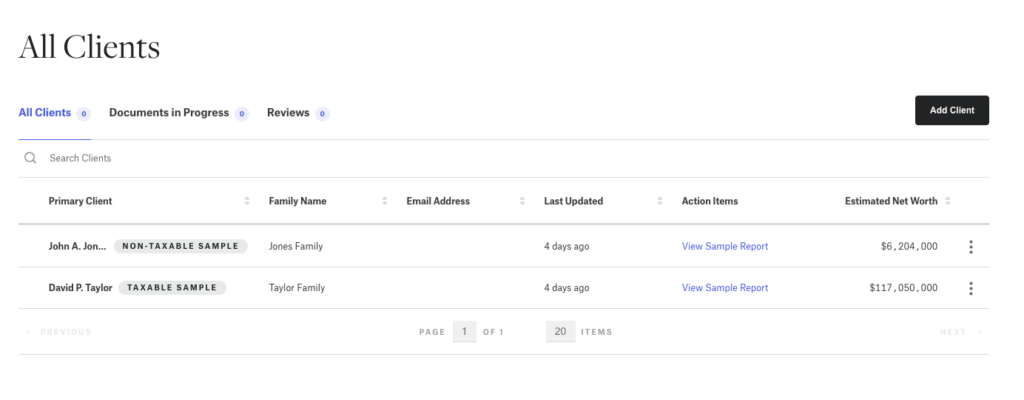

Leverage sample profiles to illustrate Vanilla’s value to your clients

With the launch of taxable and non-taxable sample profiles, advisors can now review an example of a completed client account in Vanilla. Their clients can see how the complete picture of their estate and financial plan would be represented on the platform before onboarding their own family, financial, and estate information.

During client and prospect conversations, advisors can share the completed sample profile or download the taxable or non-taxable estate PDF report.

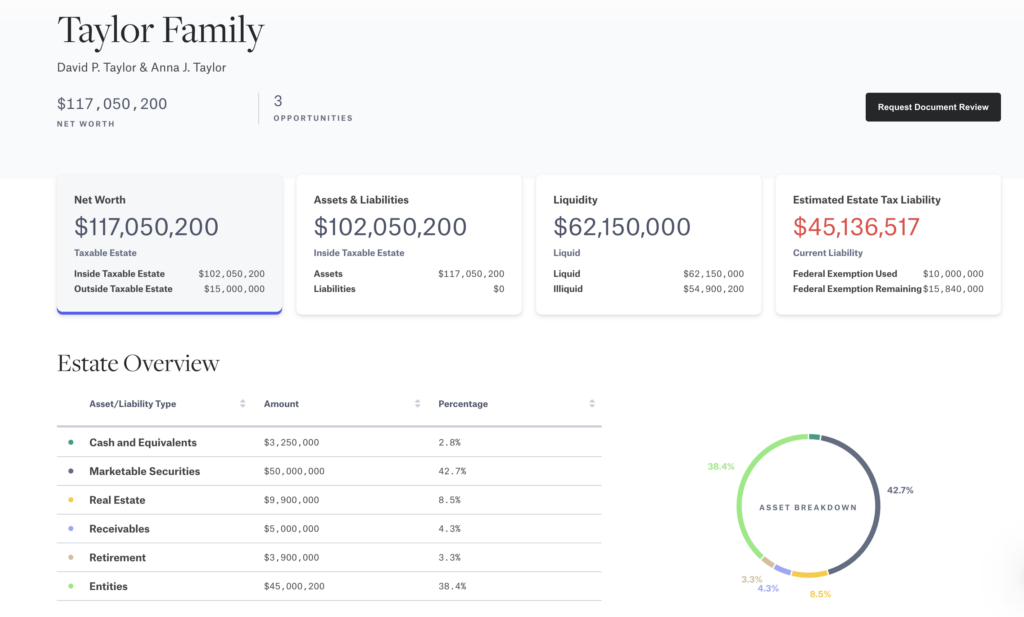

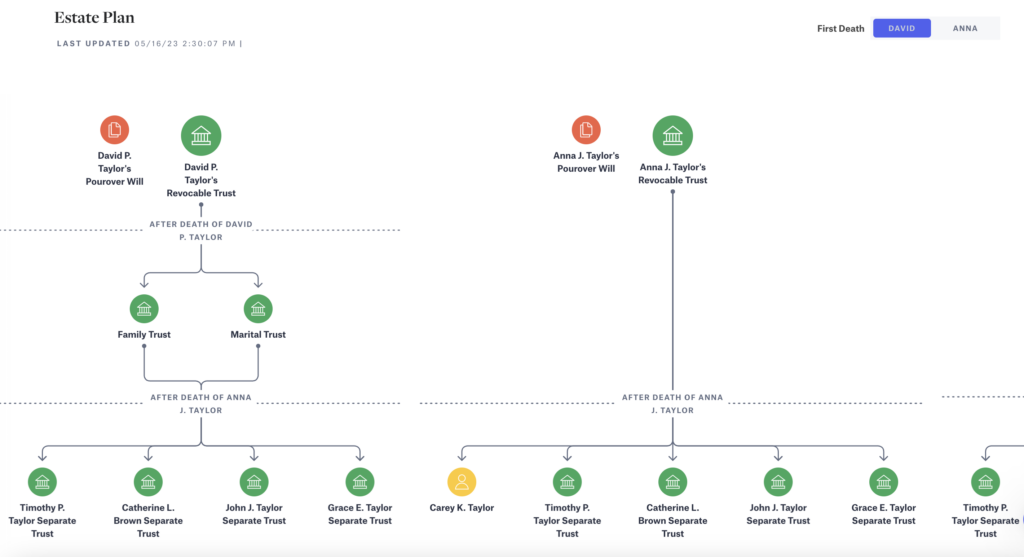

The Taylor Family is an example of a high-net worth family living in Florida with a taxable estate of $117,050,000. Their estate plan includes revocable trusts, an irrevocable trust, and an ILIT.

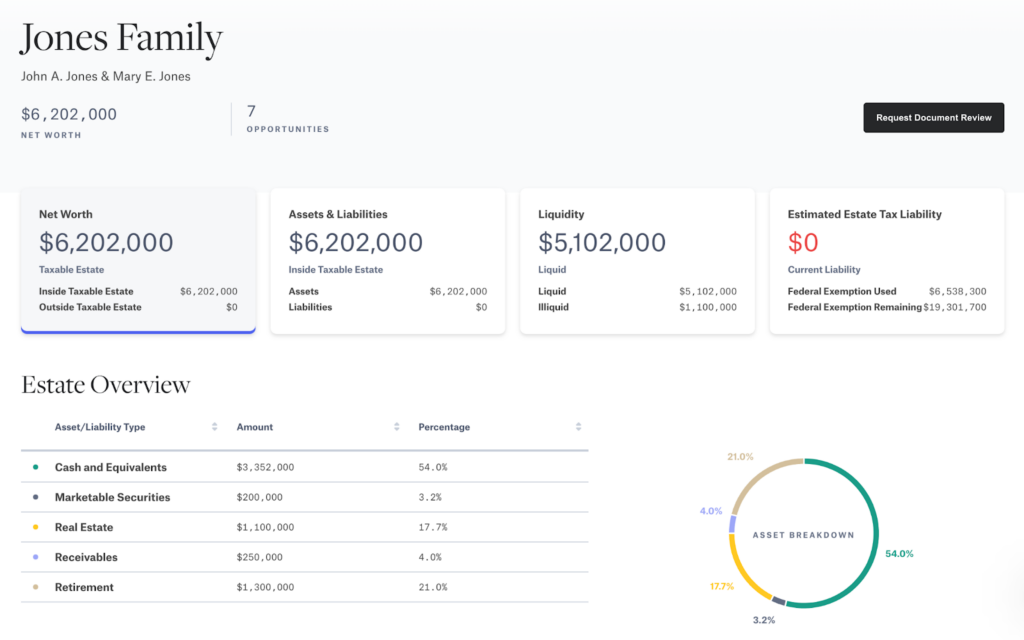

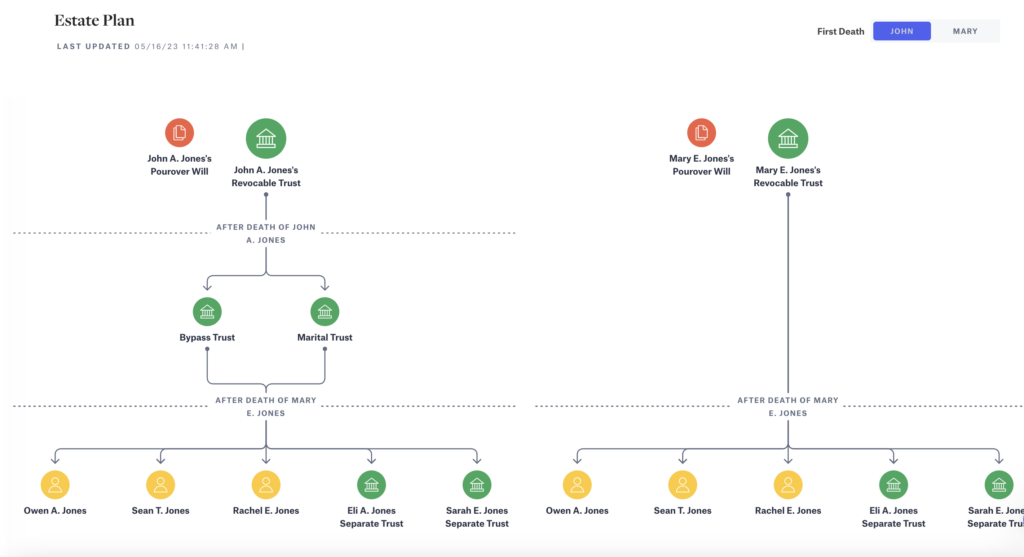

The Jones Family is an example of a New York-based family with a net worth of $6,202,000. Their estate plan involves core documents including revocable trusts.

By offering dynamic visualizations representing a client’s estate, advisors can start to engage their clients in estate planning conversations, better serve their clients needs, and stand out. Sample profiles are available to all Vanilla customers in their advisor dashboard. To download Vanilla’s sample client profiles for your clients, check out the links below:

Sample report for taxable estates

Sample report for non-taxable estates

Published: May 18, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.