Jim Sinai

Jim Sinai

Vanilla’s new estate planning research reveals key opportunities for advisors

Introducing Vanilla’s first-ever State of Estate Planning report

Advisors are at a crossroads. Technology is shaking things up, economic policies are evolving, and new generations of clients are knocking on the door. Finding ways to future-proof your business in the face of change and uncertainty can be daunting, so we decided to shine a light on clients’ ever-changing needs and help advisors anticipate where the industry might be headed. This summer, we surveyed more than 1,000 Americans to capture the pulse of public opinion on a wide spectrum of estate planning issues.

Today, we are thrilled to share the result of that research — the first-ever Vanilla State of Estate Planning report.

We conducted this research to understand client sentiment, values, and preconceptions around estate planning and to provide some direction for advisors navigating this shifting landscape. It offers insight on big issues including creating and updating estate plans, fostering stronger advisor-client relationships, concerns related to conflict and protecting legacy, and more.

Estate planning is an emotional and complex experience.

Estate planning is an emotional undertaking. And whether it’s helping stay ahead of potential family conflict, simplifying the complexity and jargon, or relieving fears that a key strategy might be overlooked, the best advisors help clients navigate the many emotions involved in protecting their legacy. We aimed to uncover not just the financial dimensions, but also those powerful emotional and familial dynamics that influence estate planning decisions.

Estate planning can be confusing and intimidating, but advisors are well positioned to help clients develop and understand strategies to protect their family’s long-term financial wellbeing and legacy

- Those with $25M+ were the most likely to talk to their trusted estate advisor regularly, with 40% reporting seeking advice from them multiple times per year.

- Just 34% know their state’s estate tax and/or probate rate.

Estate advice requires intimate, difficult conversations, presenting unique opportunities to deliver differentiated advice and foster trust with clients

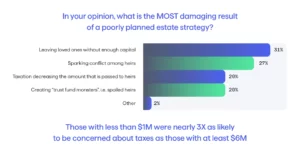

- 71% of respondents believe assets can be split among heirs in a way that is fair but not necessarily equal.

- Those with a household net worth of more than $25 million were 5x as concerned about creating “trust fund monsters” as they were about taxes.

The importance of a good estate plan, regardless of wealth

A well-planned estate strategy should reflect one’s core values, their relationships with family and friends, their hopes, their fears. It requires having a perspective that looks beyond one’s own lifetime and considers the future of generations to come.

We found a higher net worth does not completely alleviate the pervasive fear of leaving loved ones without capital or sparking family conflict. These were the top concerns for almost every wealth cohort, with one notable exception: ultra-high net worth individuals, whose top concern was spoiling their heirs. In fact those with $25M+ were 5X as concerned about creating “trust fund monsters” as they were about taxes. The only other group that cited trust fund monsters as their top concern were Gen Z respondents, who selected that nearly 2X more than did all other age groups.

Few estate planning tasks evoke fear of family conflict more than splitting an inheritance fairly among beneficiaries. “Fair” distribution involves navigating complex familial issues, individual needs, and varying perceptions of what constitutes fairness. The more complicated the family dynamics become, the trickier the question of fairness gets. According to UBS Investor Watch, nearly 90% of blended families struggle with dividing assets in a way they consider fair, if not necessarily equal, compared to 62% of those not in a blended family.

Each family member may have different expectations and attachments to specific assets, which can lead to heightened emotions and potential disputes. Estate planners must delicately balance the desire to treat loved ones equitably while acknowledging that fairness may not always mean an equal division of assets.

Estate planning is about connecting across generations

We are on the brink of the largest transfer of wealth in American history. In the next 25 years, as much as $84.4 trillion from 45 million U.S. households will be passed down from older Americans to their Millennial and Gen X inheritors. This exchange of wealth and change in who the wealthy demographic is will dramatically shift the landscape of wealth management across the U.S.

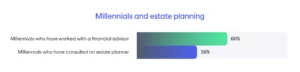

And yet, while nearly 60% of Millennial respondents reported having worked with a financial advisor, only 38% have consulted an estate planner. But Millennials’ hesitation about working with advisors may be a reflection of the personal interactions they’ve had with advisors. According to Accenture data, less than a third of millennials who work with an advisor “feel their advisor takes the time to get to know them.” Meanwhile, 57% think their advisor “is only motivated to make money for themselves and their employer.”

Advisors can expand share of wallet by discovering unmanaged assets and connect with the next generation. Our survey results show how much of a role generational continuity can play: Those whose parents had an estate planner were 2.5X more likely to have consulted with an estate planner, estate attorney or family attorney regarding a trust or will.

Whether they’re family members are clients or not, attracting a younger clientele is key to any firm’s longevity. Just because they don’t have a lot of wealth now doesn’t mean this generation won’t become wealthy later through inheritance or career success. It’s in a firm’s best interest to make this longer-term investment and help grow a more financially literate, younger client base.

Embracing estate planning software to simplify complexity

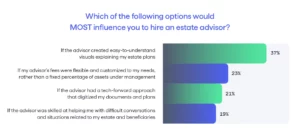

Today, advisors not only face pressure to differentiate from one another, but also to provide a modern user experience that their customers have come to expect, given the rise of consumer fintech alternatives. There’s room for improvement on this front when it comes to estate planning, in particular. According to research by Kitces, less than 20% of advisors have adopted a software solution for estate planning—which could present a stumbling block to working with technology-minded generations.

Easy-to-understand visuals were the most important factor among all wealth cohorts, increasing with wealth, with nearly 60% of those with $25M+ wanting this above all else (compared to only 3% who were most influenced by fee structure). Generational, easy-to-understand visuals were the most important factor to Gen X and younger, while flexible fees were the most important to older generations.

With tech and designer-forward tools, advisors will be better positioned to proactively partner with their clients to evaluate and optimize their estate plan as their needs change. This is how they become total wealth advisors and turn estate planning into legacy building.

The Need for a Total Wealth Advisor

Our survey found that as wealth increases, the preference for a total wealth advisor over a specialist also increases (and ambivalence decreases). 77% of those with $25M+ said they’d prefer a total wealth advisor, with under 5% having no preference. 45% of those with <$1M still preferred a total wealth advisor over specialists, though another 35% expressed no preference. And the ability to include estate planning as part of the wealth advisory offering not only increases an advisor’s value, but saves clients on expensive attorney fees.

Advisors should seek to digitize and connect a previously underserved component of the wealth management continuum. Those that are doing so are deepening client relationships, expanding share of wallet, winning new business, and growing assets under management by providing differentiated estate advisory.

“In the next 10 years, advisers will gradually shed their role as investment managers and become more like integrated life/wealth coaches.”

– On the cusp of change: North American wealth management in 2030, McKinsey & Company

The best advisors collaborate on the most intimate planning with their clients—and empower everyone to make the most of their life’s work. Hope and dreams aren’t the only wishes that advisors must keep in mind when helping to craft an estate plan—fears can be just as potent in driving individuals to take proactive measures to protect their assets and loved ones.

Key Takeaways

As we analyzed the responses to our survey, the data reinforced our belief that the time to embrace estate advisory—a more expansive way to think about an advisor’s role and potential impact in the estate planning process—is now. Estate advisory bridges the advisor-client relationship gap through consistent, proactive messaging about goals and connections with the entire family.

We hope that our first State of Estate Planning report will provide fodder for advisors to start more conversations with their clients. Because with a deeper understanding of their clients’ ultimate goals, advisors can deliver differentiated advice, expand their client relationships, win new business, and increase their ongoing value.

If you find our research surprising, illuminating, or inspiring, we want to hear from you! We also hope you’ll join us for an in-depth panel discussion covering the report’s key takeaways for advisors. Download the full report to read it in depth.

Published: Sep 15, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.