Vanilla

Vanilla

Vanilla’s new features for February – detailed projections, collaborative onboarding, charitable calculations

February is a short month, but that doesn’t mean we’re short on new features. The Vanilla team has been working hard and are excited to bring three high-impact new features in February:

- Enhanced Projections

- Collaborative Onboarding

- Auto-calculations for Charitable Gifts

Let’s dive in.

Visualize the future value of an estate with the new Projections

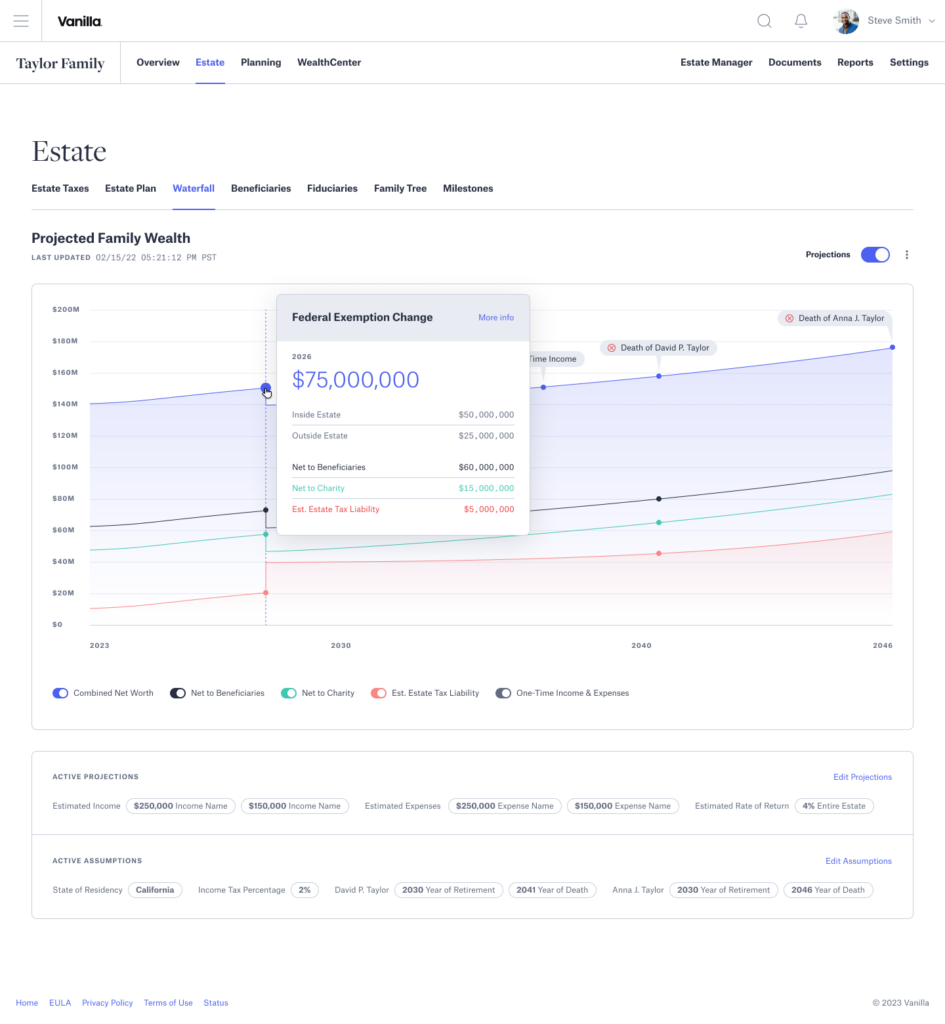

Wealth advisors play a crucial role in helping their clients understand the full picture of their wealth both today and in the future. Generalized financial planning tools are helpful for understanding how assets grow and fall over time. But they fall short when it comes to modeling out estate plans and wealth transfer. We’ve made it even easier to explain to clients how their base case estate plan works with new enhancements to our Projections feature in Vanilla. With more assumptions and Facts added and a reimagined Waterfall, advisors can better illustrate asset distributions and estimated estate tax liability and help their clients plan accordingly.

In addition to a growth rate, Projections now include split years of death, income, expenses, and income tax for a richer financial picture. Additionally, we have added a new Facts tab displaying important tax data such as state of residence or estate tax exemption used. Advisors can now also enter the existing federal, Hawaii, or Maryland Deceased Spouse Unused Exclusion amount (DSUE) for either spouse for inclusion in the total exemption amount.

We’ve also reimagined the Waterfall into an intuitive graph displaying changes in wealth over time and at specific points. For example, at the 2026 sunset, an advisor can see the impact of the lower estate tax exemption on their client’s net worth, amounts inside and outside the estate, asset distributions amounts, and estate tax liability. We’re excited to announce that the Waterfall will now be available during onboarding with just one asset added to the Balance Sheet. Advisors can use the data to provide their clients with preliminary advice on asset distributions without waiting for their estate planning documents to be reviewed.

Expedite client onboarding with Collaborative Onboarding

Advisors always have clients in different stages of the estate planning process, with some already having documents and others in need of a new or updated plan. With Vanilla, you can serve every client and tailor their onboarding process accordingly. For clients that need documents, check out Vanilla Document Builder and invite your clients to get their estate plan created on-demand and shipped directly to them for signature.

For your clients with existing documents, the new Collaborative Onboarding speeds up onboarding as you collaborate to enter the family, financial, and estate information into Vanilla.

Advisors have the flexibility to choose between an advisor-led or client self-service option when building a client profile. With the advisor-led flow, the advisor can pre-fill information and optionally send it to their client for review. Or, the client can begin the guided questionnaire while the advisor tracks their progress and receives a summary of answers highlighting any areas in need of review. For advisors and clients alike, we’ve included helpful resources throughout the Collaborative Onboarding flow to answer common planning questions and ease the onboarding process.

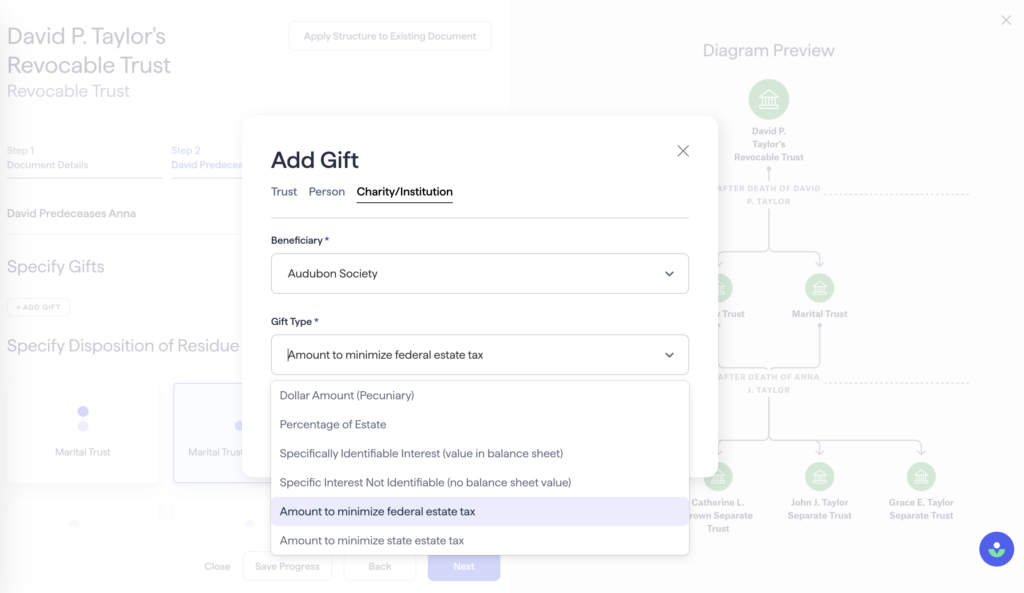

Automatically calculate charitable contributions in Estate Builder

For planners using Estate Builder, we’ve added the ability to automatically calculate the amount to leave to charity to minimize a client’s estate tax liability. Rather than a static calculation, planners can now reflect tax-minimizing charitable planning strategies outlined in their client’s documents today and over time using Projections and help advisors provide clients with opportunities for additional planning.

Published: Feb 12, 2024

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.