Vanilla

•

Dec 11, 2020

7 Major reasons why estate planning isn’t a ‘set it and forget it’...

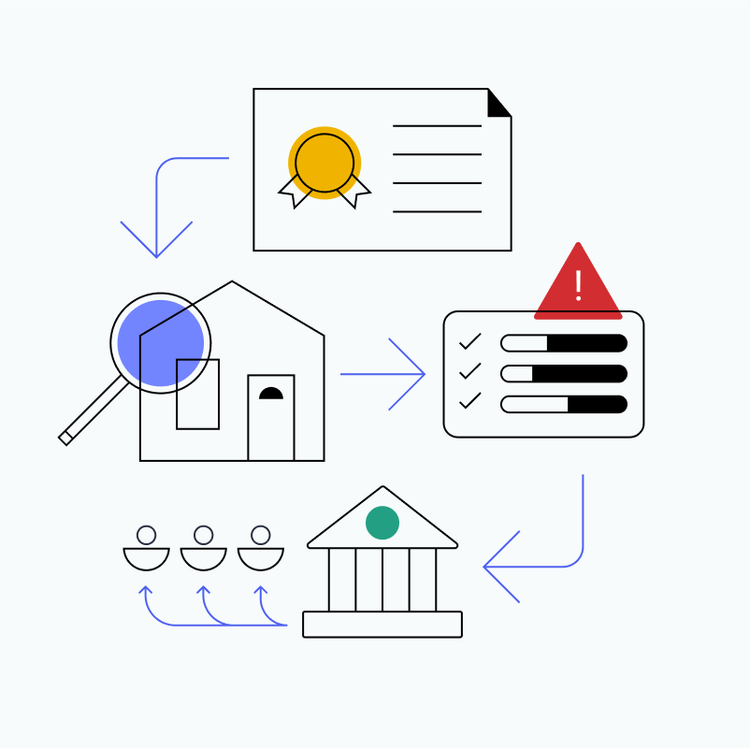

Imagine that you're having your first consultation with a new client. You ask them whether they have an estate plan in place. They proudly tell you that they drew up a will and assigned guardianship as soon as their first child was born — 25 years ago. Job well done, next question — right? Not quite! Let's examine why treating an estate plan as a one-off task comes with significant risks that could end in nightmare scenarios for your client and their family. 1: Beneficiaries and fiduciaries are often temporary While your client may express a desire to designate loved...

Daniel Brockley

•

Mar 02, 2023

Process Matters: Why “bespoke” is not enough when it comes to estate planning

Part I in a series of 3 on The Vanilla Estate Planning Playbook. Talk to any financial advisor out there, and you’ll hear a common refrain: Sure, we do estate planning. The thing is, what advisors mean when they say they do estate planning varies wildly. For many, doing estate planning simply means asking clients if they have basic documents in place, such as a Will, trust(s), healthcare directive and power of attorney. If the client has docs, the financial advisor moves on to other matters like investments. If they don’t, they refer the client to an estate attorney...

Vanilla

•

Sep 16, 2020

How do I know if estate planning documents are high quality?

As a financial advisor, you may be uncertain about the myriad of estate planning documents clients use, and which to recommend for the best possible financial outcomes for your client. Estate planning documents come in all shapes and sizes, but good planning documents need to address specific, important details. To help you sort through your clients’ paperwork, here’s how to discern if all those forms are well executed, high-quality estate planning documents. High-quality estate planning documents are updated regularly Thinking about the future and completing estate planning documents is an excellent first step, but your client’s financial situation is bound...

Vanilla

•

Apr 22, 2021

The advisor’s guide to naming the right fiduciary trustee for an estate

One of the biggest estate planning mistakes people make is placing the power and responsibilities of a trustee in the wrong hands. Poor fiduciary selection can lead to family in-fighting, lengthy legal disputes, and a substantial loss of assets due to mismanagement. As a relationship-driven financial advisor, it’s essential that you understand the role of a fiduciary trustee and that you help your client select the right individuals or corporations to act as fiduciaries for their estate. A trustworthy, knowledgeable trustee helps safeguard the estate plan from mishandling and assures that beneficiaries get the full value of the assets. What...

Vanilla

•

Feb 04, 2025

The 4 Core Estate Documents: What they are and why they’re essential for...

According to a 2024 survey from Caring.com, 40% of Americans don’t think they have enough assets to create a will. This reveals a general lack of understanding around the purpose of a will, which does more than handle financial assets. There’s an enormous opportunity for advisors to help educate clients about the goals of estate planning and core estate documents. If you have a handle on the core estate documents and how they benefit your clients’ finances in the long term, you’ll be more likely to provide advice and guidance that will strengthen ongoing relationships with clients and their families....

Vanilla

•

Dec 02, 2020

“How do I get a medical power of attorney for my adult child?”...

With more young adults living with their parents now since the Great Depression, families with college-age children need questions answered about where parents’ legal rights begin and end. As a financial advisor, you should be ready to answer the questions your clients have, such as “how do I get a medical power of attorney?” and connect them with the documents they and their adult children need to protect their families. This concise guide will help you point your clients in the right direction. [embed]https://justvanilla.wistia.com/medias/mzm95qqia5[/embed] “What are the legal realities of my child turning 18?” When a young adult turns...

Vanilla

•

Feb 28, 2023

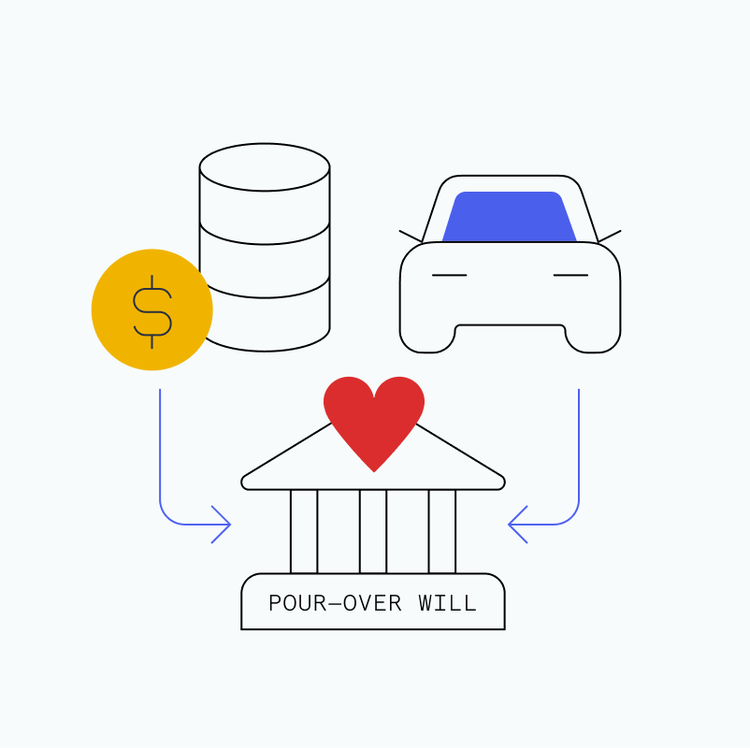

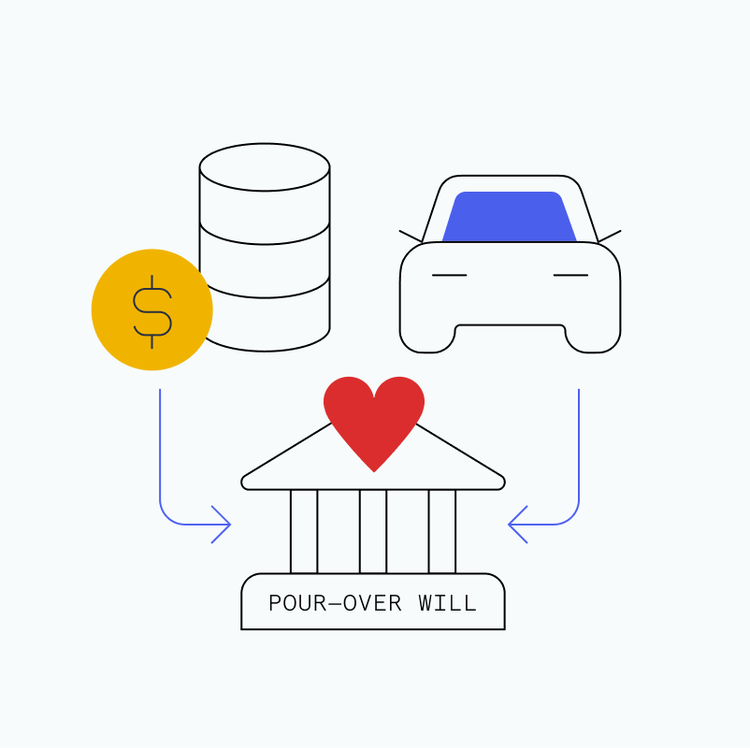

What is a pour-over will? The essentials financial advisors and their clients need...

Once a client has their last will and testament (“will”) and revocable trust created, their financial situation doesn’t just stand still. More often than not, a client’s financial situation will fluctuate throughout their life. A pour-over will brings added security to an estate plan–making room for all of those potential life changes–by allowing for new and unaccounted assets to automatically transfer to a previously set up revocable trust. This helps keep up with asset changes between times when your client updates their will and trust. What is a pour-over will? A pour-over will is a last will and testament that...

Vanilla

•

Feb 09, 2023

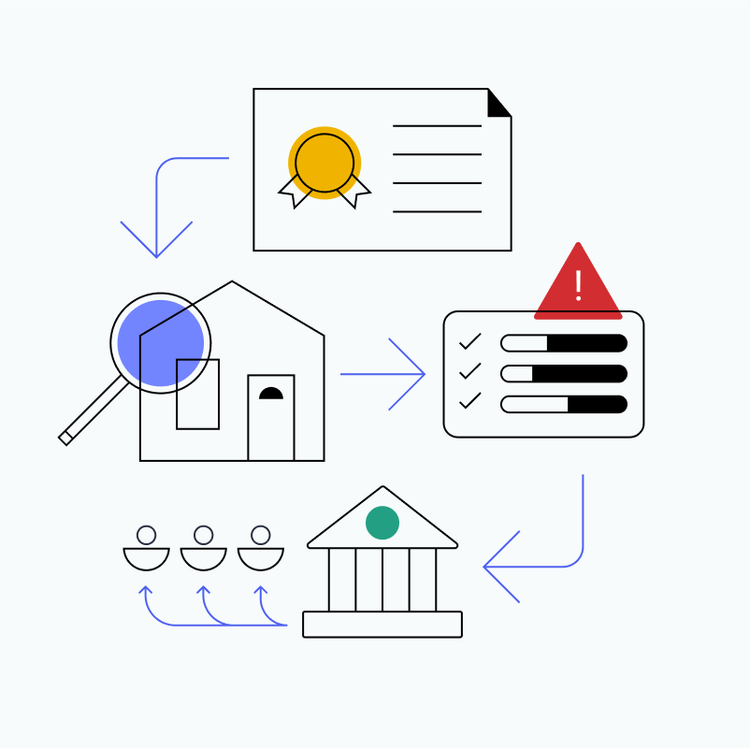

What is probate, and how can you make it easier for clients?

When it comes to estate planning, there is often a lot of focus on avoiding delays, reducing costs, and making things easier for loved ones. One topic that comes up again and again in these conversations is probate. Clients may not always understand what it involves, but they know it is something they want to avoid or simplify. As a financial advisor or estate planner, helping clients prepare for probate can make a big difference in how smoothly their estate is handled. From guiding clients through the planning process to helping them put the right documents in place, your role...

Daniel Brockley

•

Oct 20, 2022

What should you include in a will?

A last will and testament (also known as a will) is a legal document that outlines your instructions in the event of your death. It provides direction to your family, chosen representatives, and the court regarding how your assets should pass, as well as who should take care of your minor children (or pets!). Without a Will that expressly explains your wishes, the court will identify who gets your assets (generally your next of kin), based on applicable laws. And as for your kids? Well, without a Will, the court will make those decisions, too. In the United States, wills...

Vanilla

•

Jan 24, 2023

Estate Planning Checklist: Everything your clients’ documents should cover, according to our legal...

If something should happen to your clients, regardless of their age or income, it’s crucial that they have a plan for their financial assets. As their financial advisor, you’re in the best position to keep your clients on task so they can reach their goals and ensure their families are taken care of. But between a myriad of documents, individual state requirements, and shifting federal estate tax laws, it’s no wonder the estate planning process can be overwhelming for financial advisors and their clients. That’s why we’ve created this easy-to-follow estate planning checklist. We’ll give you clear insights into a...

Vanilla

•

May 19, 2020

Financial Advisors: Start talking to your clients about death

Thanks to recent technological advances, basic investment management doesn’t cut it for your clients anymore. You’re expected to deliver something technology cannot — a three-dimensional view of your clients’ finances, life and death included. Talking about what happens to one’s financial legacy upon death is an emotional conversation. It requires trust, and it requires humanity. If you can manage to have that conversation, your clients might learn that their investment returns aren’t necessarily worth much to their family without proper estate planning. People who pass away without properly planning their estate leave their family susceptible to years of legal hassle....

Daniel Brockley

•

Nov 03, 2022

Turning-Point Conversations: How to use important life events to refocus clients and deepen...

Curiosity – genuine curiosity – is one of the most important traits a financial advisor can have. Sure, this means curiosity about the different levers and pulleys of the economic machine, but it also means curiosity about clients. Not just about their risk tolerance, but about what makes them tick. Their goals, their fears. What gets them out of bed in the morning. A deeper understanding of clients as people, not just portfolios, enables you to bring the kind of value that goes far beyond index funds. There are certain times in life that lend themselves to these clarifying conversations–when...

Daniel Brockley

•

Nov 17, 2022

What is a trust, and what are the different types of trusts?

Trusts come up a lot in estate planning, and for good reason. They can be incredibly effective in helping fund education, provide for heirs, donate to charities and more. For high net worth individuals, trusts are also an important strategy to reduce taxable estates. What are trusts? Trusts are legal entities, much like corporations, which are considered distinct from the various parties involved. Trusts come in many forms, but in essence they are fiduciary arrangements in which, as the IRS states, “one person (the trustee) holds title to property or assets…for the benefit of another (the beneficiary).” The person who...

Vanilla

•

Sep 25, 2020

Who needs estate planning? Everyone, no matter the excuse.

Who needs estate planning? Everyone. But a lot of people avoid estate planning because they think they’re too young, they’re too busy, they feel estate planning is too expensive or too complicated, they’ve done it once in the past and don’t think they need to again, or they just don’t believe they have anything to plan for. The costs of making excuses not to estate plan can be high. Failure to plan means probate could keep beneficiaries in court for years while their assets are frozen and expenses mount. It could even mean that those they worked hard to take...

Vanilla

•

Mar 22, 2021

Why financial planning clients need advisors to collaborate with estate planning lawyers (and...

It’s common for clients, financial advisors, and estate planning lawyers to treat estate planning and financial planning as separate entities. But financial plans and estate plans are closely intertwined. Without a well-made estate plan, all the financial goals a client achieves can fall apart. Sadly, a poorly made estate plan often leaves the grieving family to pick up the pieces. You can advise your client on strategies for maximizing assets, but for asset protection, they need an attorney. When financial assets change, so should an estate plan. An attorney can provide the legal expertise by recording and adapting the estate...

Vanilla

•

Apr 07, 2023

Communicating Between the Lines: Using Letters of Wishes to Guide Trustees

When it comes to estate planning, there’s no substitute for having the right core legal documents drafted, and ensuring they align with your clients’ wishes. But no matter how carefully estate planning documents are drafted, it’s impossible to anticipate every eventuality – and, the truth is, life often moves faster than clients do when it comes to updating their documents. One great way to bolster an estate plan against the unexpected, and to help trustees make decisions in accord with client expectations, is through letters of wishes. What is a letter of wishes? A letter of wishes is simply a...

Vanilla

•

Apr 25, 2023

What is a living trust?

A living trust (also called a revocable trust) is a legal document created by a person during their lifetime that directs how their assets are managed during their life, and how they are to be distributed after their death. It can also help bypass or minimize the sometimes expensive and time consuming probate process required by a traditional will. A living trust is typically used in conjunction with a short will that directs all assets held in the individual’s name to “pour over” to the revocable trust on death (referred to as a “pour-over will”). This living trust estate planning...