Search Results for: settlor

Madison Eubanks

•

Apr 12, 2024

Settlor

What is a settlor of a trust? A settlor is someone who creates or establishes a trust, either for the benefit of a beneficiary after the settlor’s death and/or for their own benefit during their lifetime. The trust settlor typically owns assets that are then legally transferred into a trust which is managed by a trustee based on the terms and conditions that the settlor outlined when creating the trust. In some circumstances, the settlor can also be the trustee and the one receiving benefits from the established trust. A settlor of a trust expresses their goals for how they...

Vanilla

•

Apr 07, 2023

Communicating Between the Lines: Using Letters of Wishes to Guide Trustees

When it comes to estate planning, there’s no substitute for having the right core legal documents drafted, and ensuring they align with your clients’ wishes. But no matter how carefully estate planning documents are drafted, it’s impossible to anticipate every eventuality – and, the truth is, life often moves faster than clients do when it comes to updating their documents. One great way to bolster an estate plan against the unexpected, and to help trustees make decisions in accord with client expectations, is through letters of wishes. What is a letter of wishes? A letter of wishes is simply a...

Daniel Brockley

•

Nov 17, 2022

What is a trust, and what are the different types of trusts?

Trusts come up a lot in estate planning, and for good reason. They can be incredibly effective in helping fund education, provide for heirs, donate to charities and more. For high net worth individuals, trusts are also an important strategy to reduce taxable estates. What are trusts? Trusts are legal entities, much like corporations, which are considered distinct from the various parties involved. Trusts come in many forms, but in essence they are fiduciary arrangements in which, as the IRS states, “one person (the trustee) holds title to property or assets…for the benefit of another (the beneficiary).” The person who...

Madison Eubanks

•

Apr 12, 2024

What is a Marital Trust and How Does it Work?

Estate planning presents a delicate balancing act for many American families as they navigate the complexities of wealth transfer between generations. As diverse family structures become increasingly common and investment portfolios grow more sophisticated, couples often face the challenge of providing financial security for a surviving spouse while maintaining control over how assets are ultimately distributed to specific beneficiaries. This fundamental tension requires thoughtful planning strategies that can accommodate seemingly competing priorities without requiring extensive legal expertise. Marital trusts offer a strategic solution to this planning dilemma, providing lifetime financial support for a surviving spouse while preserving the original asset...

Simona Ondrejkova, CFP

•

Nov 15, 2023

What is an Intentionally Defective Grantor Trust (IDGT)?

An intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and leave a lasting legacy. It is especially effective for high net worth individuals who want to pass on highly appreciated or high-growth assets while minimizing estate taxes and potentially reducing income taxes. Due to their more complex nature, IDGTs can sometimes be misunderstood and underutilized, causing clients to miss out on their many tax-saving benefits. So what is an intentionally defective grantor trust? What makes it “defective” and how can this feature be used to help your clients pass...

Simona Ondrejkova, CFP

•

Mar 14, 2024

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes. Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically...

Madison Eubanks

•

Apr 12, 2024

Inter Vivos Trust

What is an inter vivos trust? An inter vivos trust is a type of trust created by an individual or a married couple to hold and manage assets during their lifetime. Also known as a living trust, this trust is often used by individuals or married couples to avoid probate, maintain privacy, and ensure efficient distribution of assets during their lifetime and after death. An inter vivos trust set up during an individual’s lifetime can ensure that the assets remaining in the trust after the settlor’s death are distributed to beneficiaries according to the settlor’s wishes. To do this, the...

Vanilla

•

Jan 20, 2023

Charitable Lead Trust (CLT)

What is a charitable lead trust (CLT)? A charitable lead trust (CLT) is a type of trust established by an individual to provide regular payments to one or more charities for a specified period. At the end of that period, the remaining assets in the trust either revert to the settlor (also referred to as the donor in this article) or pass to non-charitable beneficiaries, such as family members or other individuals named by the donor. In a charitable lead trust, the charity has a primary or “lead” interest in the trust assets before anything is passed down to other...

Madison Eubanks

•

Apr 12, 2024

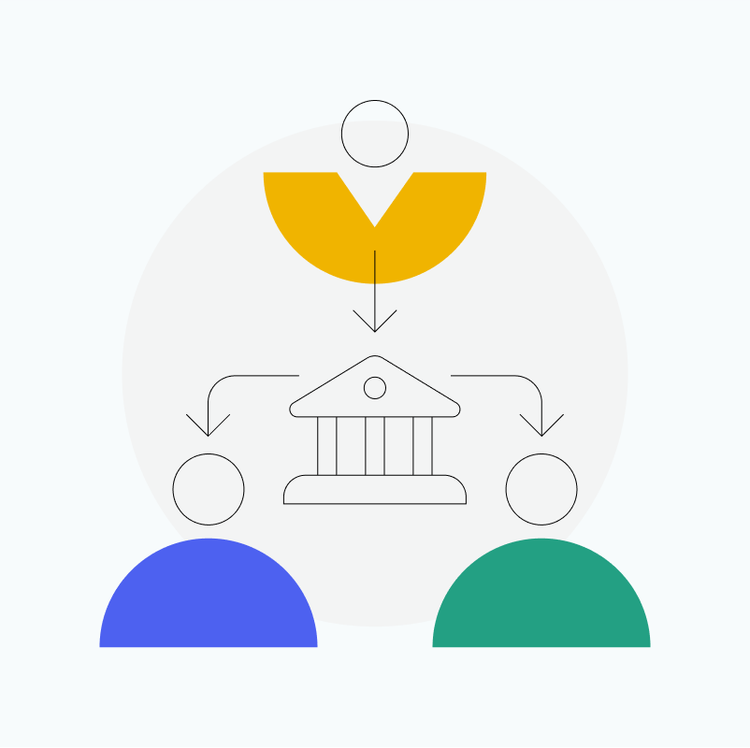

Family Trust

What is a family trust? A family trust is one of many different types of trusts to help individuals pass on their assets according to their wishes. The person creating the family trust, the settlor, will specifically name family members such as spouses, children, grandchildren, nephews, nieces, or other family members as the beneficiaries of the trust so they can preserve and pass on wealth to future generations. How does a family trust work? In a family trust, the settlor will specify which assets will go into the family trust fund and how those assets will be distributed to beneficiaries....

Vanilla

•

Jan 20, 2023

Trust Certification

What is a certificate of trust? A certificate of trust, also known as a trust certificate, certification of trust document, or an affidavit of trust, is used to represent and verify an interest or ownership in a trust. The certificate of trust is similar to a stock certificate for a corporation. It includes important information about the trust to confirm its existence to outside parties without disclosing sensitive information that the creator of the trust (the settlor) may not want to share publicly. What’s the purpose of a certificate of trust? Before allowing trustees to act on behalf of a...

Madison Eubanks

•

Apr 22, 2025

The Complete Guide to Estate Planning

Though an often overlooked part of financial planning, estate planning is a critical part of a well-rounded wealth management strategy. In fact, estate planning is about much more than just creating a will. A thoughtful estate plan is a comprehensive strategy for things like: Managing one’s wealth during life and after death Ensuring one’s family is cared for Supporting causes that align with one’s values Minimizing taxes and fees Documenting wishes in case of incapacitation Planning for one’s future legacy The common myth that estate planning is only for the ultra-wealthy is patently false. Estate planning benefits individuals at all...

Simona Ondrejkova, CFP

•

May 07, 2025

What Is a Credit Shelter Trust? And How Can It Help Minimize Estate...

In estate planning, there are several types of trusts especially designed to help individuals avoid or reduce estate taxes. One of these is the credit shelter trust. The credit shelter trust is often used by married couples as one of many estate planning strategies that can help them pass on more wealth to beneficiaries after both spouses pass away. Here, we explain what a credit shelter trust is, how it works, and when you or your clients should consider using it to leave a greater legacy by minimizing or even eliminating the estate tax bill. What is a credit shelter...

Vanilla

•

Jan 20, 2023

General Assignment of Assets

General assignment of assets to a trust is a legal process in which an individual transfers ownership of their property to a trust they have established. Facilitated by the use of the general assignment of assets document, this is a fundamental step in creating and funding a trust so the assets can pass according to the terms and instructions outlined in the trust document. How do you transfer assets into a trust? Completing a transfer of assets into a trust starts with drafting a formal trust document. This document outlines the terms, conditions, beneficiaries, trustee(s), and instructions for how the...

Simona Ondrejkova, CFP

•

Feb 23, 2024

How Estate Administration Works & Ways to Simplify it for Your Beneficiaries

Whether you’re putting together your estate plan, assisting your clients in the process, or figuring out how to navigate the intricacies of distributing a loved one’s estate, it’s helpful to understand the estate planning and administration process. This can save you or your beneficiaries time by planning ahead so you can reduce unnecessary stress in transferring assets to heirs. When considering estate planning strategies to maximize your legacy and transfer your assets according to your wishes, it’s also helpful to consider how your estate planning & administration can be affected by probate. So today we explain the steps involved in...

Madison Eubanks

•

Sep 19, 2024

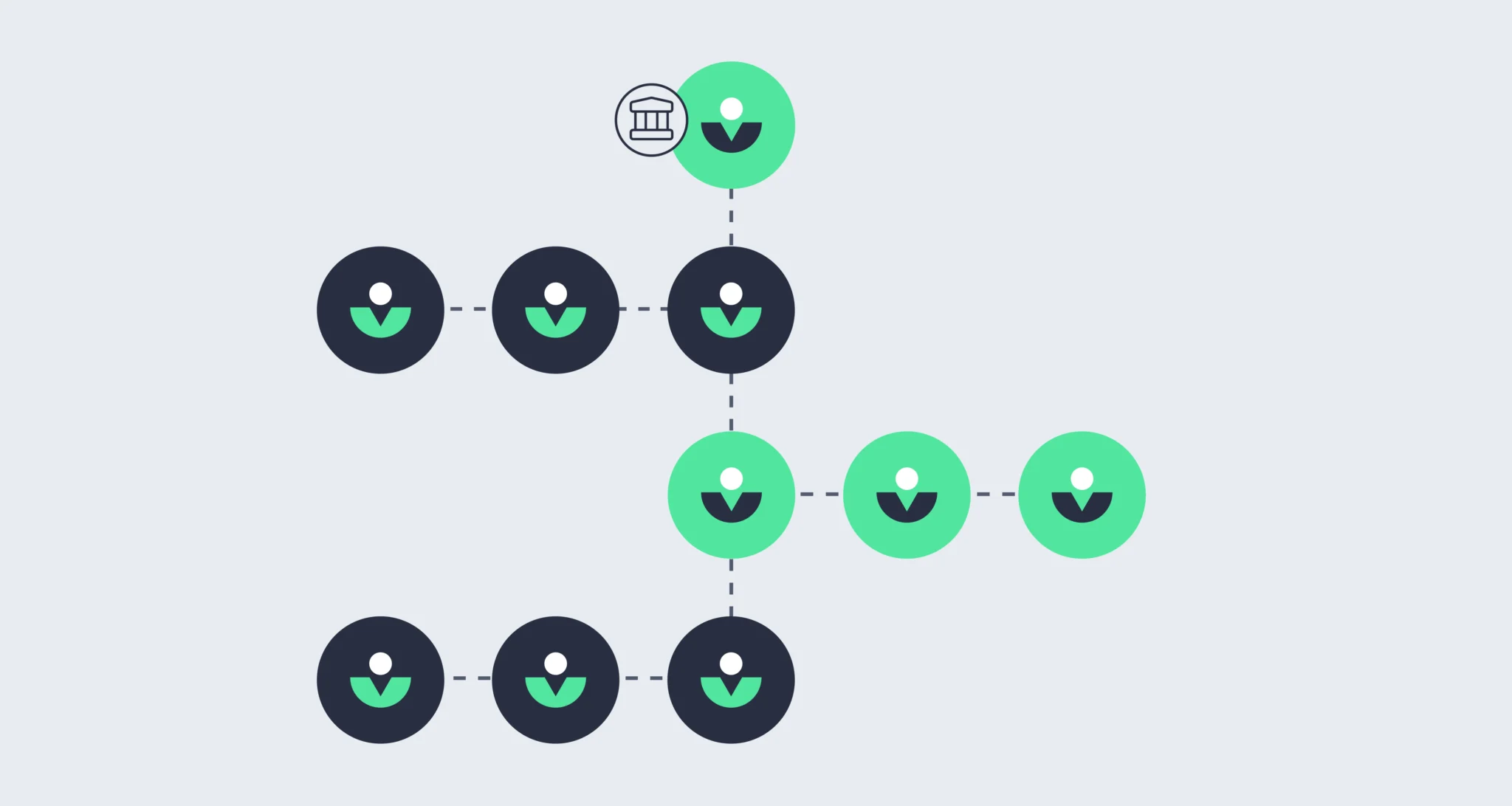

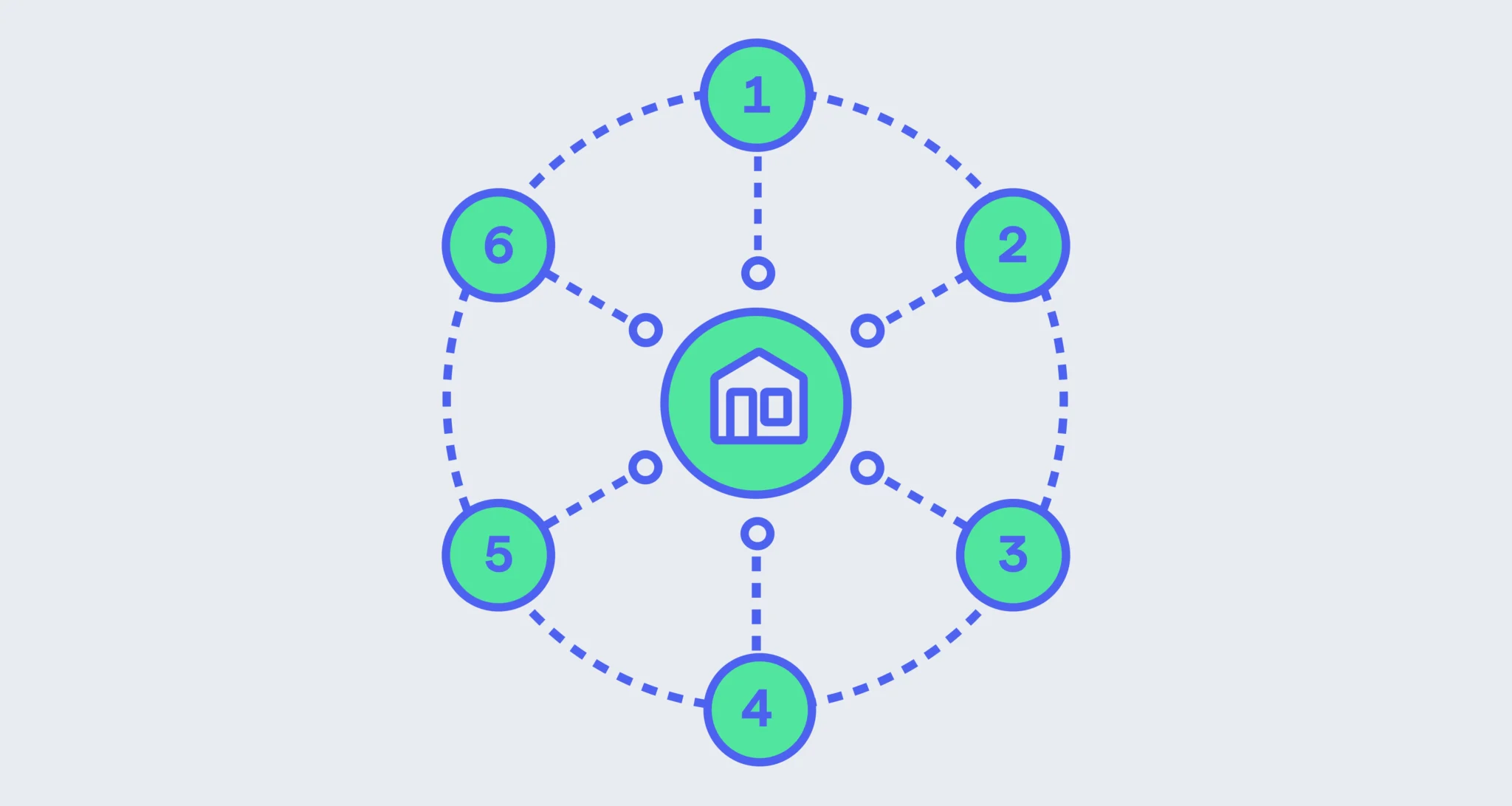

6 Estate Planning Scenarios: When to Use Which Strategy

Estate planning strategies are like tools in a toolbox: Different tools do different jobs. Deciding which estate planning strategies to employ depends on any number of personal factors including (but not limited to) marital status, level of wealth, whether or not someone has children, charitable inclination, liquidity, and many more. A savvy planner takes all these variables into account and chooses the most appropriate tool for a person’s situation, values, and goals. In this article, we provide fictional examples of when someone might use six different trust strategies, and illustrate how the right strategy can achieve their estate planning goals. ...

Madison Eubanks

•

Oct 24, 2024

An Intro to Revocable and Sub-Trusts for Estate Planning

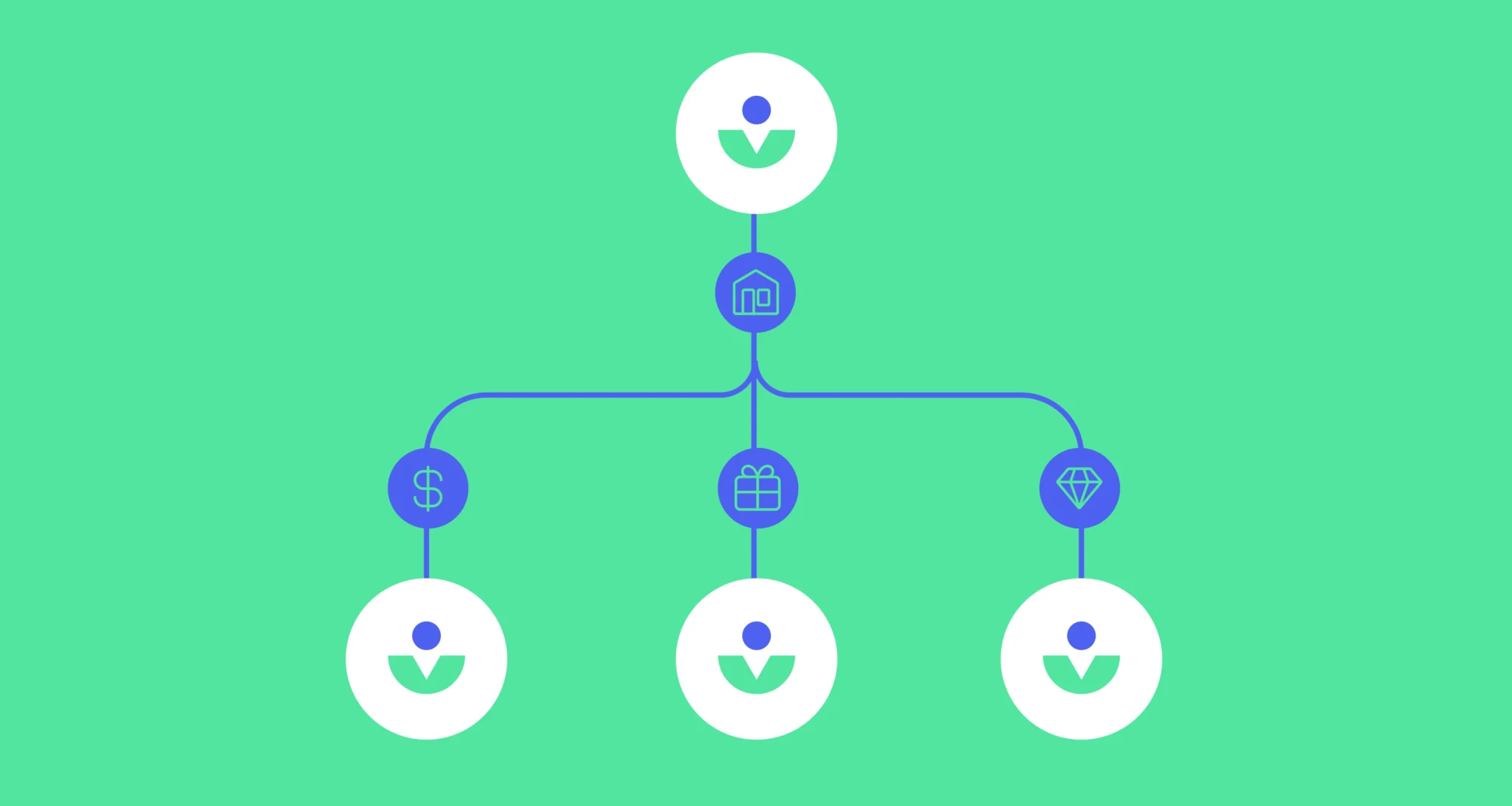

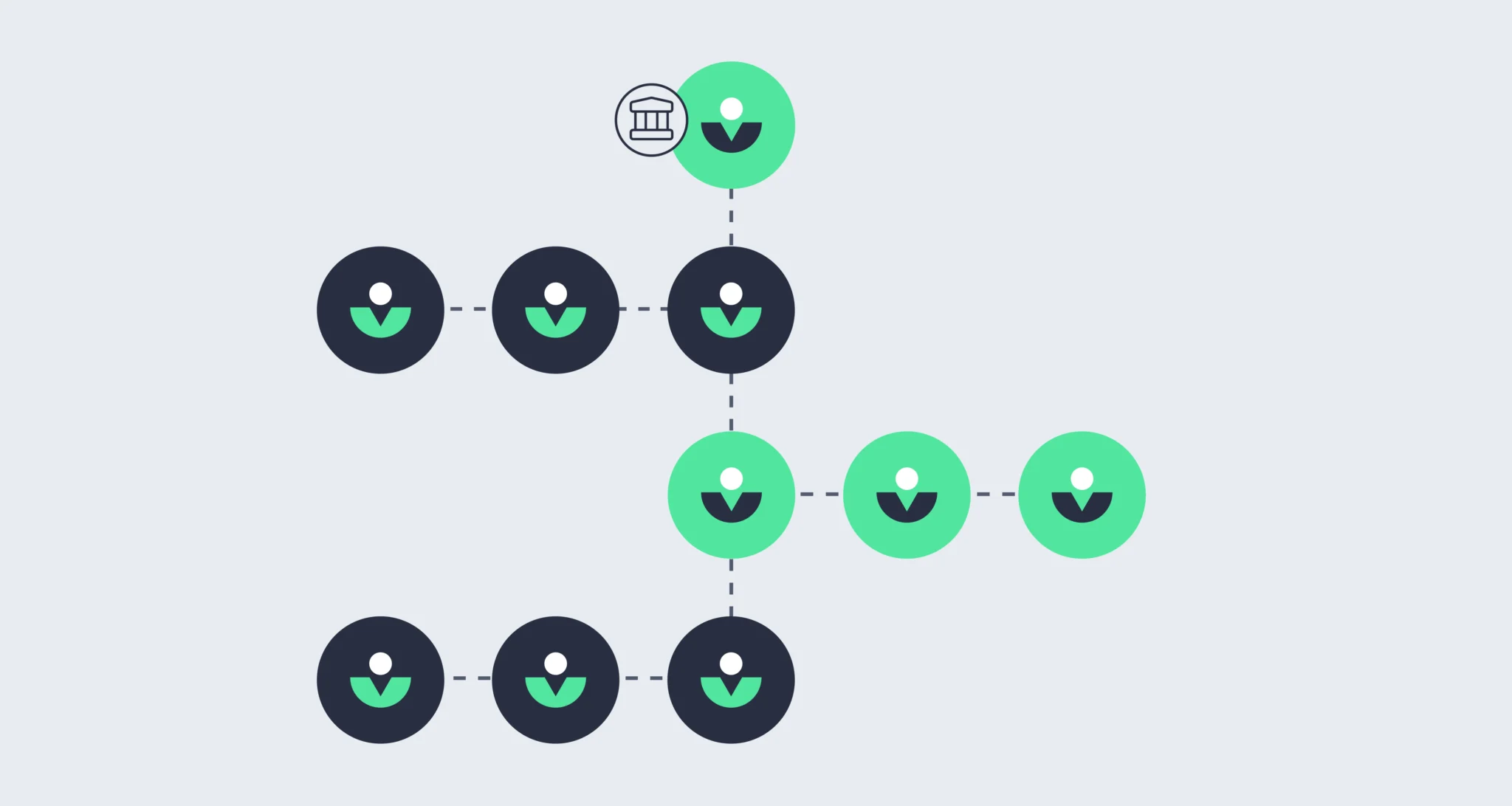

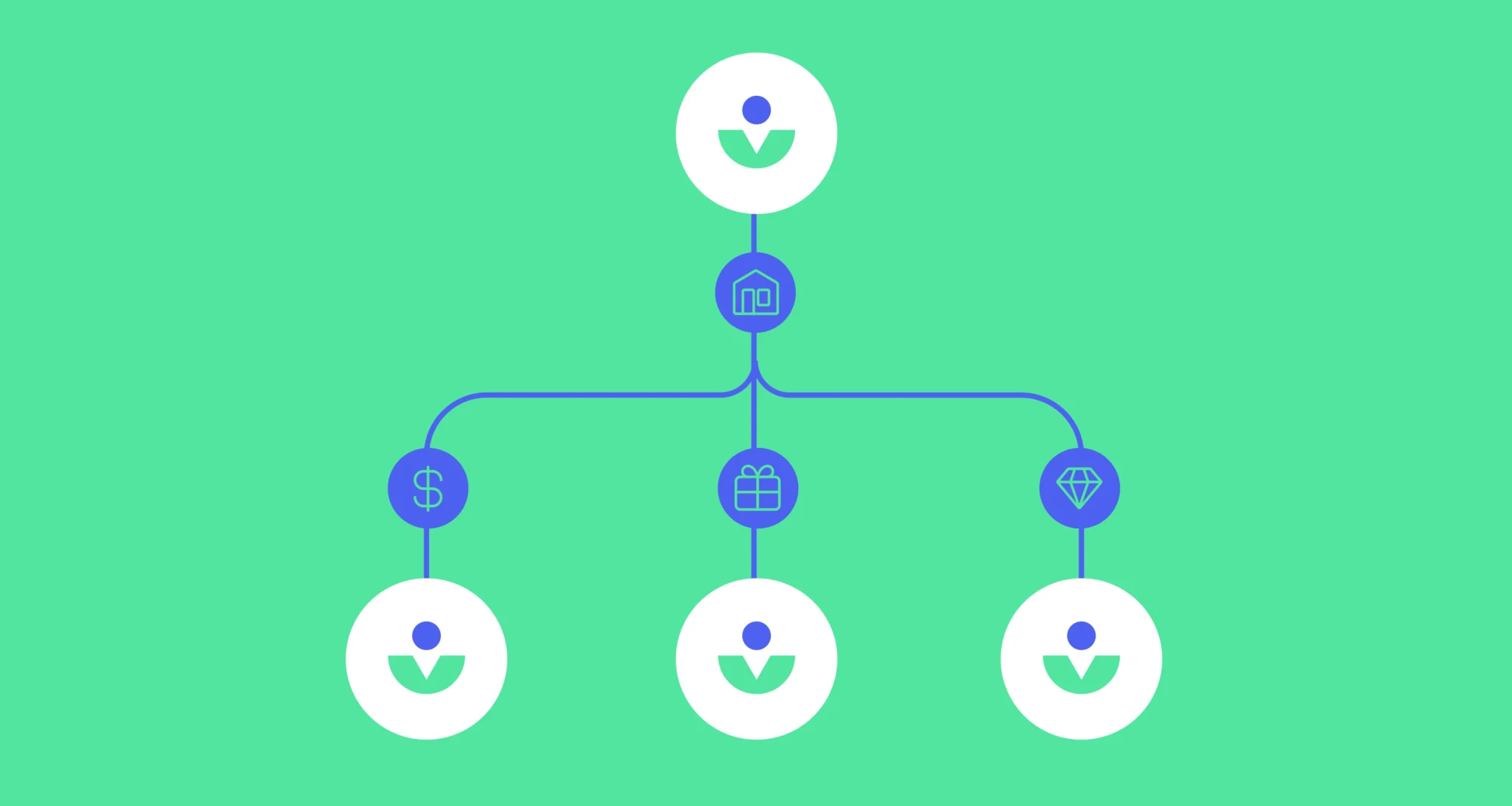

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for. Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post,...

Vanilla

•

Nov 13, 2024

Estate Planning for Business Owners: Strategies and Solutions for Wealth Advisors

There are over 33 million small businesses in the United States, employing over 60 million people. In many ways, private businesses are the heart and soul of the country’s economy, and—unsurprisingly—business owners often feel passionately about what happens to their share when they pass away. Wealth advisors should be prepared to help their business-owning clients create a thoughtful succession plan, regardless of the size or value of their business. In a recent webinar, estate planning experts Steve Lockshin and Patrick Carlson sat down to discuss everything from foundational concepts to advanced strategies wealth advisors should consider for clients who own...

Madison Eubanks

•

May 14, 2024

The Roles and Responsibilities of a Trustee

There are many different types of trusts that can be used in estate planning to achieve a range of various purposes and goals. One common element among all trusts is the appointment of a trustee to manage its assets. What exactly does a trustee do? This article will cover everything you need to know about trustee responsibilities, how a trustee should be chosen, and more. What is a trustee? [embed]https://justvanilla.wistia.com/medias/lzt8tzm231[/embed] A trustee is a person or entity that holds and administers a trust’s assets or properties for the trust’s beneficiaries. In general, a trustee is tasked with managing a trust’s...

Madison Eubanks

•

Apr 12, 2024

Inheritance Tax

The inheritance tax is a tax imposed by certain states on heirs or beneficiaries when they receive assets upon the death of the settlor or grantor. This tax is determined by the laws of the state in which the deceased was a resident, the value of the inheritance received, and the relationship of the heir to the deceased individual. Inheritance tax vs estate tax Unlike the estate tax, which is imposed by the federal government, the inheritance tax is levied by the states. The six states that currently impose an inheritance tax include Iowa, Kentucky, Maryland, Nebraska, New Jersey, and...

Simona Ondrejkova, CFP

•

Apr 29, 2024

Survivor’s Trusts: Everything You Need to Know

Of the many different types of trusts out there, some are designed specifically to help married couples transfer their assets according to the wishes and needs of each individual within the marriage. These trusts can be structured to provide for the surviving spouse while also being mindful of estate tax considerations for the surviving spouse and future beneficiaries. What is a survivor’s trust? [embed]https://justvanilla.wistia.com/medias/fsmtiu16us[/embed] A survivor's trust is an estate planning tool used by married couples to ensure that after one spouse passes away, the surviving spouse will have access to a portion of the assets to provide for their...

Madison Eubanks

•

Apr 30, 2024

Intentionally Defective Grantor Trust (IDGT)

An intentionally defective grantor trust is an irrevocable trust structured to allow certain assets to be passed on without being subject to estate taxes while still retaining the settlor’s liability for income taxes generated within the trust. Read more: What is an intentionally defective grantor trust (IDGT)?

Madison Eubanks

•

Apr 12, 2024

What is an Irrevocable Trust and How Does it Work?

Estate planning offers many tools to protect your assets and provide for your loved ones, but few estate planning techniques generate as much curiosity and caution as the irrevocable trust. Often viewed as both powerful and intimidating, these specialized legal arrangements serve a variety of important purposes in comprehensive estate plans. Understanding their unique characteristics and when they might be appropriate requires careful consideration of both their advantages and limitations. This article explores the fundamental aspects of irrevocable trusts, their various forms and functions, and the situations where they might prove most beneficial. We'll examine their distinctive features, potential benefits, important...

Brian Falldin

•

May 15, 2024

Discover Vanilla’s Latest Enhancements: VAI Chat, Estate Health Check, GST Capabilities, and More

As we embrace the vibrant spring season, Vanilla is excited to unveil even more new features and enhancements designed to simplify complex processes, provide intuitive planning tools, and foster deeper advisor-client conversations: Get estate planning answers fast with the full launch of VAI Chat, now generally available. VAI chat offers immediate AI-driven answers and insights, enabling users to efficiently navigate the complexities of estate planning. Streamline client assessments with the Estate Health Check, a quick and effective way for advisors to gather critical insights about a client's current estate situation without the need for exhaustive document reviews. Optimize wealth transfer...

Madison Eubanks

•

Jan 22, 2025

Independent Trustee

An independent trustee is a trustee who is not a beneficiary or related party of the settlor or beneficiary of a trust, and is typically engaged to act in isolated situations to ensure impartiality. Their role is typically limited to certain tasks that cannot be done by an interested party, to ensure that the trust assets are managed in the best interest of the beneficiaries according to the trust’s instructions. Powers are often given to an independent trustee in a trust to incorporate flexibility in order to address future unforeseen circumstances and avoid court involvement if the trust terms need...

Vanilla

•

May 12, 2025

Trust vs. Will: What’s the Difference, and Which Do Your Clients Need?

You've likely had clients ask, "Do I need a will or a trust?" It's a common question that deserves a thoughtful, personalized response. The confusion between wills and trusts often leads clients to make decisions that don't fully address their specific needs. Without proper guidance, they might opt for the simplest solution without understanding the long-term implications for their families and estates. This guide will equip you with clear explanations of the key differences between wills and trusts, their respective advantages and disadvantages, and a framework for helping clients determine which option or combination of options best suits their unique...

Madison Eubanks

•

Apr 12, 2024

Trustor

A trustor is the individual who creates a trust, and is also commonly referred to as the settlor or grantor of a trust. A trustor establishes a trust by defining its terms in the trust document and transferring assets into it. When a trustor transfers assets into a trust, the trust itself becomes the legal owner of those assets, which can include real estate, investments, personal property, etc. Typically, a trust is established so that the trustor can control how their assets are managed and distributed, protect assets from probate and taxation, and ensure that their wishes are carried out...

Madison Eubanks

•

Apr 12, 2024

Grantor

A grantor is an individual or entity that establishes a trust and transfers assets into it. The grantor—also known as the settlor, trustor, or creator—defines the trust’s terms and provisions, including naming its beneficiaries and detailing how the assets should be managed and distributed. Depending on the type of trust, the grantor may retain certain powers over it like the ability to amend or revoke the trust, designate successor trustees, and more.

Vanilla

•

Feb 04, 2025

The 4 Core Estate Documents: What they are and why they’re essential for...

According to a 2024 survey from Caring.com, 40% of Americans don’t think they have enough assets to create a will. This reveals a general lack of understanding around the purpose of a will, which does more than handle financial assets. There’s an enormous opportunity for advisors to help educate clients about the goals of estate planning and core estate documents. If you have a handle on the core estate documents and how they benefit your clients’ finances in the long term, you’ll be more likely to provide advice and guidance that will strengthen ongoing relationships with clients and their families....

Simona Ondrejkova, CFP

•

Feb 15, 2024

Grantor Trust vs Non-Grantor Trust: What’s the Difference?

If you or your clients are considering an estate planning strategy that includes a trust, you may be wondering about the difference between the many types of trusts out there. Specifically, if you hear a trust referred to as a grantor trust, what does that mean? And how is this different from a non-grantor trust? Today, we’ll explain the difference between a grantor trust and a non-grantor trust and help you understand when to use each one to achieve your estate planning goals. What is a grantor trust? A grantor trust is a type of trust in which the person...

Simona Ondrejkova, CFP

•

Dec 14, 2023

8 Key estate planning tools for financial advisors and clients

Advisors often hesitate to bring up estate planning with clients because they’re not sure where to start…or which aspects of estate planning to cover. While some estate planning strategies can be complex, advisors can still start meaningful conversations by understanding some basic estate planning tools that every client should consider. While many basic estate planning tools are simple to implement, many clients are simply unaware of their existence or importance. That’s where great advisors can come in and potentially help uncover missing pieces that could drastically affect how a clients’ wishes are carried out. Regardless of your level of estate...

Simona Ondrejkova, CFP

•

Oct 09, 2023

A Guide to Estate Planning for Individuals with Special Needs

Estate planning for clients who have adults or children with special needs in their lives can be complex. Unlike traditional estate planning, special needs estate planning requires paying careful attention to the individual with special needs’ eligibility for government benefits. This is in addition to skillfully leveraging assets to most effectively attend to their unique health and wellness needs. Imagine that one of your clients is a family with three adult children, all living in different states. The two younger brothers have established their own families and are financially comfortable. But their oldest sister is living with muscular dystrophy and...

Simona Ondrejkova, CFP

•

Sep 05, 2023

What is a pot trust and how could it benefit your clients?

Do your clients struggle to structure their estate plan in a way that aligns with their wishes while providing for their heirs in times of need? They may want to consider an estate planning strategy that offers flexibility in distributing assets based on individual needs. This approach allows the trustee to manage the assets as a single pool, with the discretion to distribute them to beneficiaries as needed. It’s particularly useful for clients who want to ensure that each beneficiary receives support based on their unique circumstances, rather than an equal share. While many advisors recommend this strategy for its...

Daniel Brockley

•

Jun 20, 2023

The 2026 estate tax exemption sunset is coming. Here’s what you need to...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. In 2018, the estate tax exemption was raised to an historical high of $11.18 million ($22.35 million per married couple), which has been raised yearly to adjust for inflation and put it out of sight for most estates. But the same law that raised the exemption, The Tax Cuts and Jobs Act (TCJA), is set to expire in 2026, bringing the estate tax exemption back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) –...

Vanilla

•

Jan 10, 2023

What is a charitable remainder trust? (with examples)

Many people have charitable intentions that they would like to consider as part of their estate planning. However, donating assets outright during their lifetime may not meet their financial goals. A more advanced estate planning strategy, such as a charitable remainder trust, may provide the flexibility to meet their personal financial needs while guaranteeing that a charity or charities end up with the remaining asset at the end of the term or when the settlor/donor is no longer living. When to use a Charitable Remainder Trust (CRT): When you are charitably inclined; and, You have highly appreciated securities you would...

Vanilla

•

Feb 28, 2023

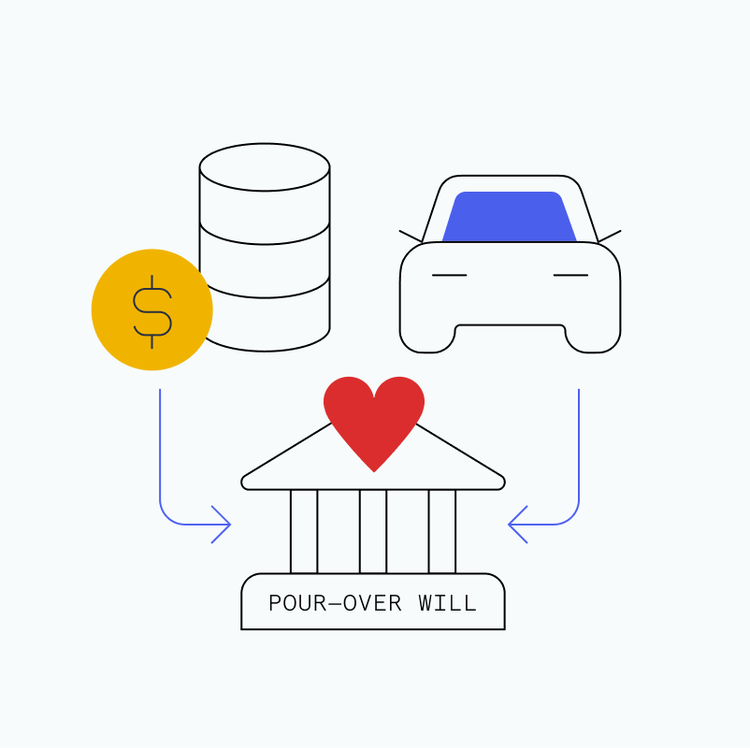

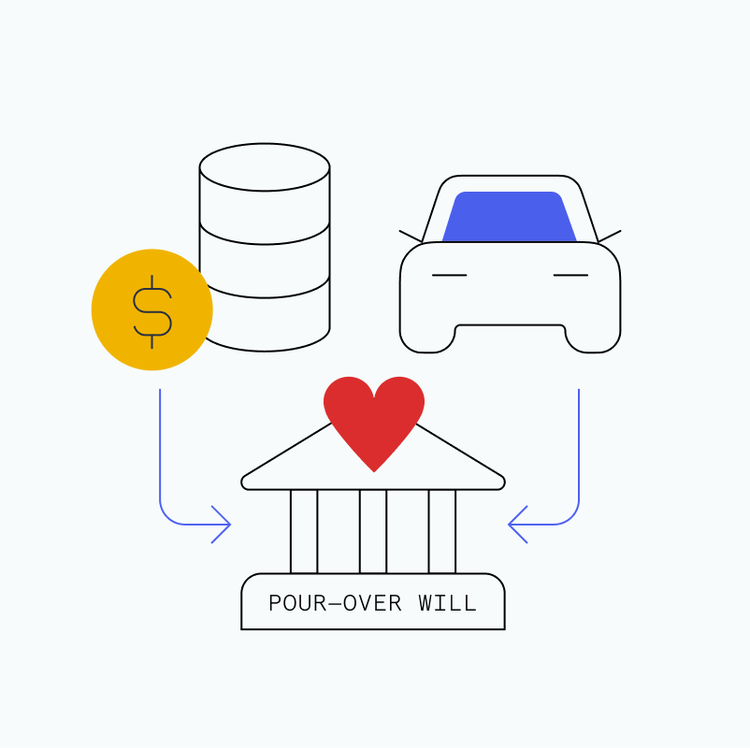

What is a pour-over will? The essentials financial advisors and their clients need...

Once a client has their last will and testament (“will”) and revocable trust created, their financial situation doesn’t just stand still. More often than not, a client’s financial situation will fluctuate throughout their life. A pour-over will brings added security to an estate plan–making room for all of those potential life changes–by allowing for new and unaccounted assets to automatically transfer to a previously set up revocable trust. This helps keep up with asset changes between times when your client updates their will and trust. What is a pour-over will? A pour-over will is a last will and testament that...

Vanilla

•

Feb 06, 2025

What is a spousal lifetime access trust (SLAT), and how does it work?

What is a spousal lifetime access trust (SLAT)? A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”) during his or her lifetime for the benefit of the individual’s spouse and if, desired, other family members. How does the SLAT work? A SLAT is created under a trust agreement, which contains the terms of the trust and the name of the individuals or entity that will act as trustee (typically a trusted friend or advisor). A SLAT is funded by way of a gift from the donor to the SLAT. During the...

Vanilla

•

Jan 26, 2023

What is an irrevocable life insurance trust (ILIT)?

Estate planning presents a significant challenge when substantial assets could face hefty taxation after death. Irrevocable Life Insurance Trusts (ILITs) offer a strategic solution as specialized legal vehicles designed to own life insurance policies during your lifetime. By keeping insurance proceeds outside your taxable estate, these trusts help beneficiaries avoid the steep 40% federal estate tax that would otherwise diminish their inheritance. ILITs serve dual purposes by either creating immediate liquidity for families or preserving estates by covering tax obligations without forcing the sale of illiquid assets. Business owners, real estate investors, and families approaching the federal estate tax threshold...

Vanilla

•

Jan 24, 2023

Estate Planning Checklist: Everything your clients’ documents should cover, according to our legal...

If something should happen to your clients, regardless of their age or income, it’s crucial that they have a plan for their financial assets. As their financial advisor, you’re in the best position to keep your clients on task so they can reach their goals and ensure their families are taken care of. But between a myriad of documents, individual state requirements, and shifting federal estate tax laws, it’s no wonder the estate planning process can be overwhelming for financial advisors and their clients. That’s why we’ve created this easy-to-follow estate planning checklist. We’ll give you clear insights into a...