Daniel Brockley

Daniel Brockley

The 2026 estate tax exemption sunset is coming. Here’s what you need to know – and how to prepare your clients now.

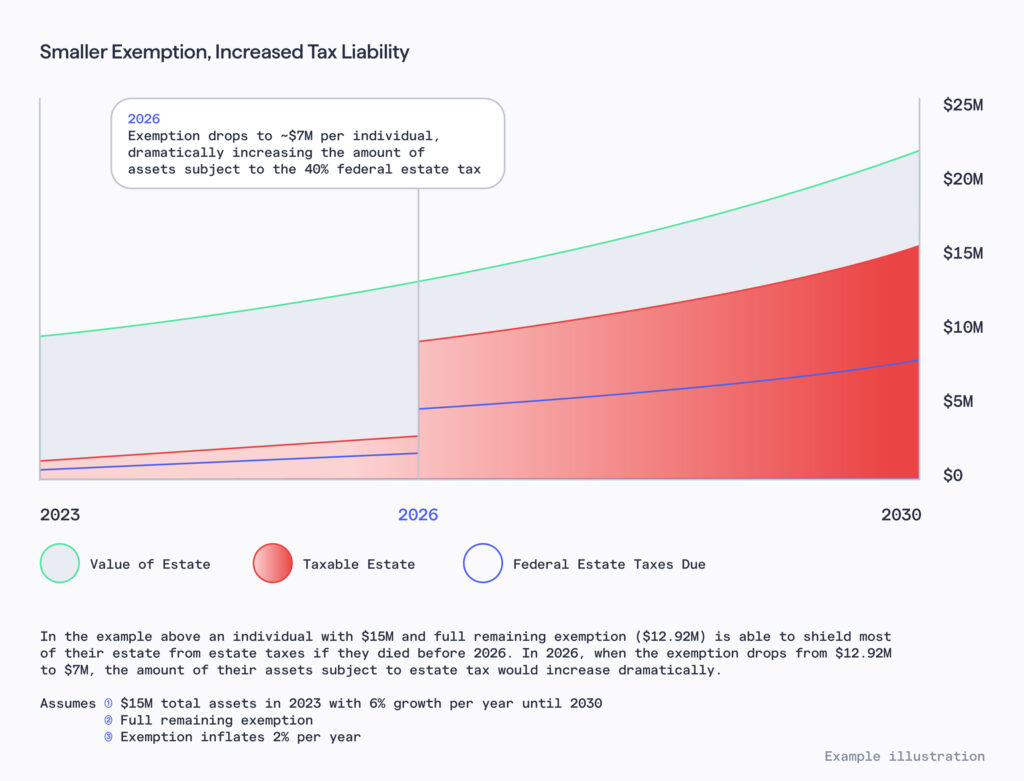

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. In 2018, the estate tax exemption was raised to an historical high of $11.18 million ($22.35 million per married couple), which has been raised yearly to adjust for inflation and put it out of sight for most estates. But the same law that raised the exemption, The Tax Cuts and Jobs Act (TCJA), is set to expire in 2026, bringing the estate tax exemption back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) – suddenly making the estate tax an important consideration for many more households.

Now is the time for financial advisors to look carefully at clients’ estates and ascertain whether they will be taxable when the federal exemption sunsets – or if the estate might be taxable in the future based on projected values. If a client’s estate will become taxable, your client may want to use their exemption before the sunset, while it’s still at a historic high. Waiting too long to form and implement a strategy could be costly.

We created a guide for you to give to clients to help them understand the sunset. We also talked with Vanilla and AdvicePeriod co-founder Steve Lockshin and AdvicePeriod senior advisor Arielle Lederman (formerly an estate attorney at top NY law firms) to learn more about what advisors and strategies advisors and clients should think about as the exemption sunset nears. You can watch the webinar on demand.

Refresher: What is the estate tax exemption and when does it sunset?

The gift and estate tax is a federal tax that is overseen by the Internal Revenue Service (IRS) and applies to individuals residing in all 50 states. The federal gift and estate tax exemption is the amount of money an individual can gift to their heirs during lifetime or at death without being subject to the gift or estate tax. In addition, some states have their own gift or estate tax, as well as an exemption threshold, which is often lower than the federal exemption.

The current federal estate tax exemption, which is slated to sunset at the end of 2025, is $13.61 million per person or $27.22 million per married couple for 2024. This means that if an individual dies and leaves less than $13.61 million to their heirs (other than their spouse), their estate will not be subject to the federal estate tax. Anything above that amount will be subject to a federal estate tax at 40% and another 40% on top of that if given to a “skip person.” (A skip person is someone who is two or more generations younger than the transferor.) But those numbers are set to go down to $12-16M for married couples and $6-8M for individuals (this number will be adjusted for inflation) in 2026, when the Tax Cuts and Jobs Act expires – the sunset.

How can financial advisors prepare clients for the sunset?

The first step of preparation is understanding your client’s total net worth, including which assets are includable in their estate tax calculation and which are not, and how much exemption they have remaining. Next you’ll want to review each client’s current estate plans and determine which clients have or will likely have estates falling outside the 2026 exemption limit. For these clients you’ll want to consider some potential strategies for moving assets out of the estates in a way that aligns with your client’s goals and values.

Top strategies for using the estate tax exemption before 2026

Strategic gifting

If your clients have estates valued above $6 million per person or $12 million per married couple, they may want to consider gifting strategies to reduce their taxable estate. Gifting strategies can include annual gifts, lifetime gifts, and charitable giving.

Annual gifts: Clients can make annual gifts of up to $18,000 per recipient (as of January 1, 2024) without triggering gift taxes or use of their exemption. This means that a married couple can give up to $36,000 to as many recipients as they like per year. These annual gifts are not limited to family members and can include friends or causes (regardless of its charitable status).

Other exempt gifts: Under Section 2503(e) of the Internal Revenue Code (the “Code”), tuition payments made directly to an educational organization on behalf of a person and payments for a person’s medical care made directly to the provider are not treated as taxable gifts.

Lifetime gifts: Clients can make lifetime gifts of up to $13.61M over their lifetime, including the annual gifts mentioned above.

Irrevocable Trusts

Irrevocable trusts are structured in a variety of ways, and will have to be evaluated on a per-client basis, but they are effective tools in moving assets out of estates.

Spousal Lifetime Access Trusts

The Spousal Lifetime Access Trust (SLAT) is a particularly helpful vehicle for managing around the sunset. SLATs enable one spouse to create a trust for the benefit of the other spouse. The trust is irrevocable, and the assets, if properly transferred, are outside the settlor’s estate. However, by having a spouse as a beneficiary of the trust, the trustee may make distributions to that spouse if access to the assets is ever necessary (hence the moniker for the trust). This may alleviate the stress couples may feel when they are in a position where they should plan to minimize their estate and transfer taxes but do not feel wealthy enough to part from the assets fully.

SLATs are best used when spouses are both physically healthy and their marriage is healthy, too. In addition, it’s important to follow the rules to avoid the reciprocal trust doctrine and not to use these trusts as a “piggy bank,” invading the trust frequently.

The Half-Step

If, after understanding how SLATs work, a client remains uncomfortable with gifting much or all of their exemption to a trust, they can take an intermediate step. Specifically, a client can make a small seed gift to the trust, selling the remainder of the assets to the trust in exchange for a promissory note. This way, they can test drive the complexity of the trust structure (or lack thereof) before fully committing the assets. If they are comfortable with the new structure the client(s) may forgive part or all of the notes up to their exemption limit at the time of that gift. This mechanism allows the client to put all of the plumbing in place for a completed gift without having to complete the entire transaction.

Avoid the estate planning traffic jam

Clients need to understand that the time to act on the estate tax exemption sunset is now – not the end of 2025. Not only will those financial advisors who understand high net worth portfolios be inundated as the date gets closer, but the client also may not have the time to implement the strategy that’s right for them – or use their lifetime exemption in a way that aligns with their goals.

We encourage you to share this overview of estate tax exemption sunset with your clients, so you can talk through some of the strategies that might be right for them and act before it’s too late.

FAQs: Frequently asked questions about the estate tax exemption sunset

What is the current estate tax exemption amount?

The current 2024 federal estate tax exemption is $13.61 million per person or $27.22 million per married couple. This means that if an individual dies and leaves less than $13.61 million to their heirs (other than their spouse), their estate will not be subject to the estate tax. Anything above that amount will be subject to a federal estate tax at 40%.

Will the estate tax exemption change after the 2026 sunset?

Yes, the estate tax exemption will drop from $13.61 million per person ($27.22 million per married couple) to between $6-8M for individuals and $12-16M for couples.

What is the estate tax exemption?

The federal gift and estate tax is overseen by the Internal Revenue Service (IRS) and applies to individuals residing in all 50 states. The federal gift and estate tax exemption is the amount of money an individual can gift to their heirs during their lifetime or at death without being subject to the gift or estate tax.

In addition, some states have their own gift or estate tax, as well as an exemption threshold, which is often lower than the federal exemption. The federal estate tax exemption is $13.61M per person or $27.22M per married couple for 2024. This means that if an individual dies and leaves less than $12.92M to their heirs (other than their spouse), their estate will not be subject to the estate tax.

Anything above that amount will be subject to a federal estate tax at 40% and another 40% on top of that if given to a “skip person,”1 due to the generation-skipping tax. But the federal estate tax exemption is set to go down to $12-16M for married couples and $6-8M for individuals (this number will be adjusted for inflation) in 2026 – the sunset.

What is 2026 estate tax exemption sunset?

For the past few years, most US tax residents haven’t needed to worry too much about the estate tax. In 2017, with the passing of The Tax Cuts and Jobs Act (TCJA), the estate tax exemption was raised to a historic high of $10 million per person ($20M per couple). After adjusting for inflation, the exemption stands at $13.61M ($27.22M per married couple) in 2023, putting it out of sight for most estates. But that’s set to change as the TCJA expires at the end of 2025, bringing the estate tax exemption back down to an estimated $6-8M per person or $12-16M per couple.

The information provided here does not, and is not intended to, constitute legal advice or tax advice; it is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with your financial advisor or estate attorney who can advise as to whether the information contained herein is applicable or appropriate to your particular situation.

Published: Jun 20, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.