Search Results for: irrevocable

Madison Eubanks

•

Apr 12, 2024

What is an Irrevocable Trust and How Does it Work?

Estate planning offers many tools to protect your assets and provide for your loved ones, but few estate planning techniques generate as much curiosity and caution as the irrevocable trust. Often viewed as both powerful and intimidating, these specialized legal arrangements serve a variety of important purposes in comprehensive estate plans. Understanding their unique characteristics and when they might be appropriate requires careful consideration of both their advantages and limitations. This article explores the fundamental aspects of irrevocable trusts, their various forms and functions, and the situations where they might prove most beneficial. We'll examine their distinctive features, potential benefits, important...

Vanilla

•

Apr 30, 2025

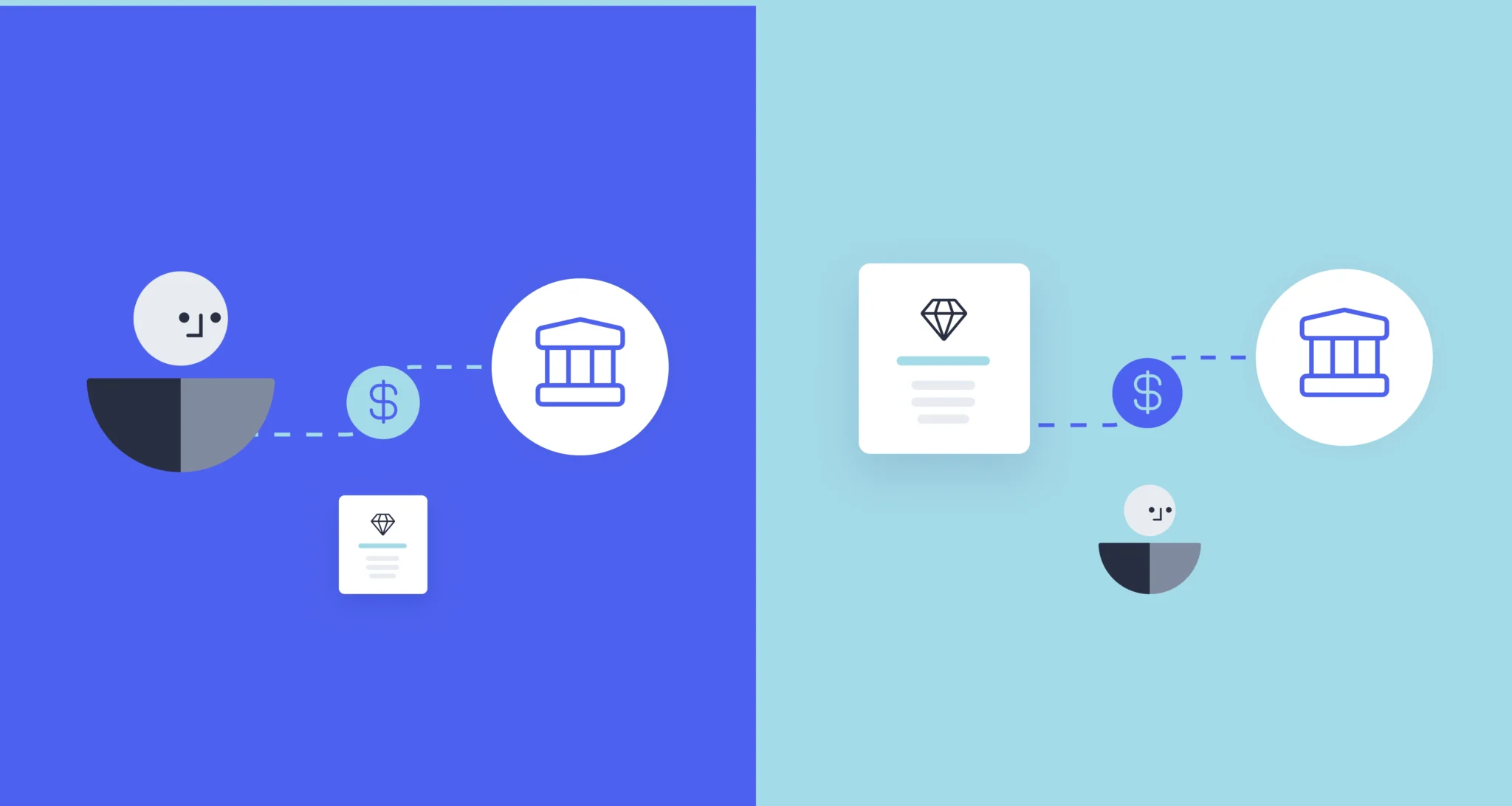

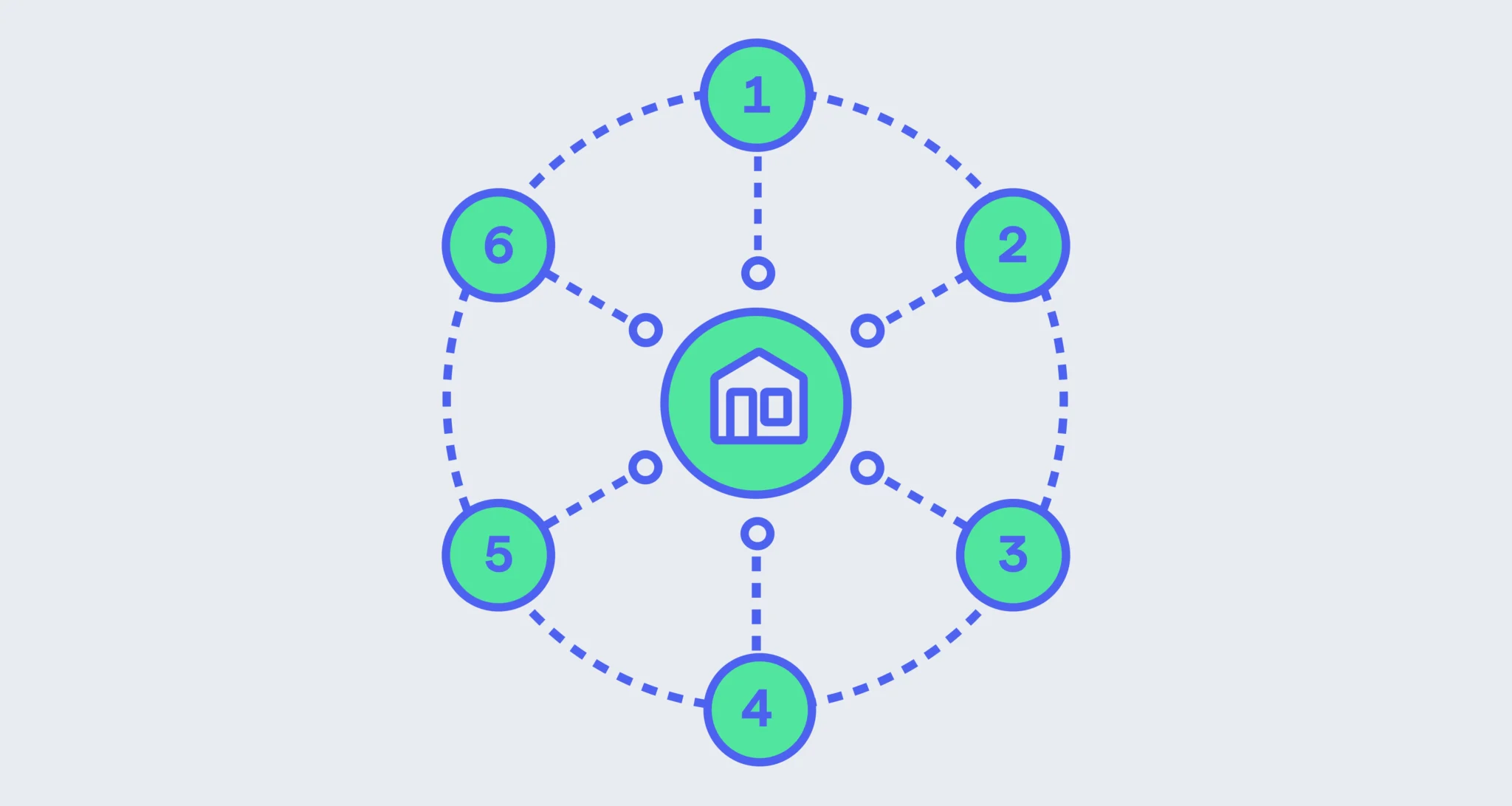

Revocable Trust vs. Irrevocable Trust: Understanding Six Key Differences

Helping clients navigate estate planning is becoming a non-negotiable aspect of comprehensive wealth management. Research indicates 70% of clients believe their advisors should offer estate planning services, and 40% would change advisors if it meant switching to one who did offer estate planning. So while you may not draft legal documents yourself, understanding the nuances of estate planning, like trust structures, allows you to have more meaningful conversations with clients and collaborate effectively with their attorneys. Two primary trust options—revocable and irrevocable—serve distinctly different purposes in your clients' financial plans. The right choice depends on each client's unique circumstances, priorities,...

Vanilla

•

Jan 26, 2023

What is an irrevocable life insurance trust (ILIT)?

Estate planning presents a significant challenge when substantial assets could face hefty taxation after death. Irrevocable Life Insurance Trusts (ILITs) offer a strategic solution as specialized legal vehicles designed to own life insurance policies during your lifetime. By keeping insurance proceeds outside your taxable estate, these trusts help beneficiaries avoid the steep 40% federal estate tax that would otherwise diminish their inheritance. ILITs serve dual purposes by either creating immediate liquidity for families or preserving estates by covering tax obligations without forcing the sale of illiquid assets. Business owners, real estate investors, and families approaching the federal estate tax threshold...

Daniel Brockley

•

Nov 17, 2022

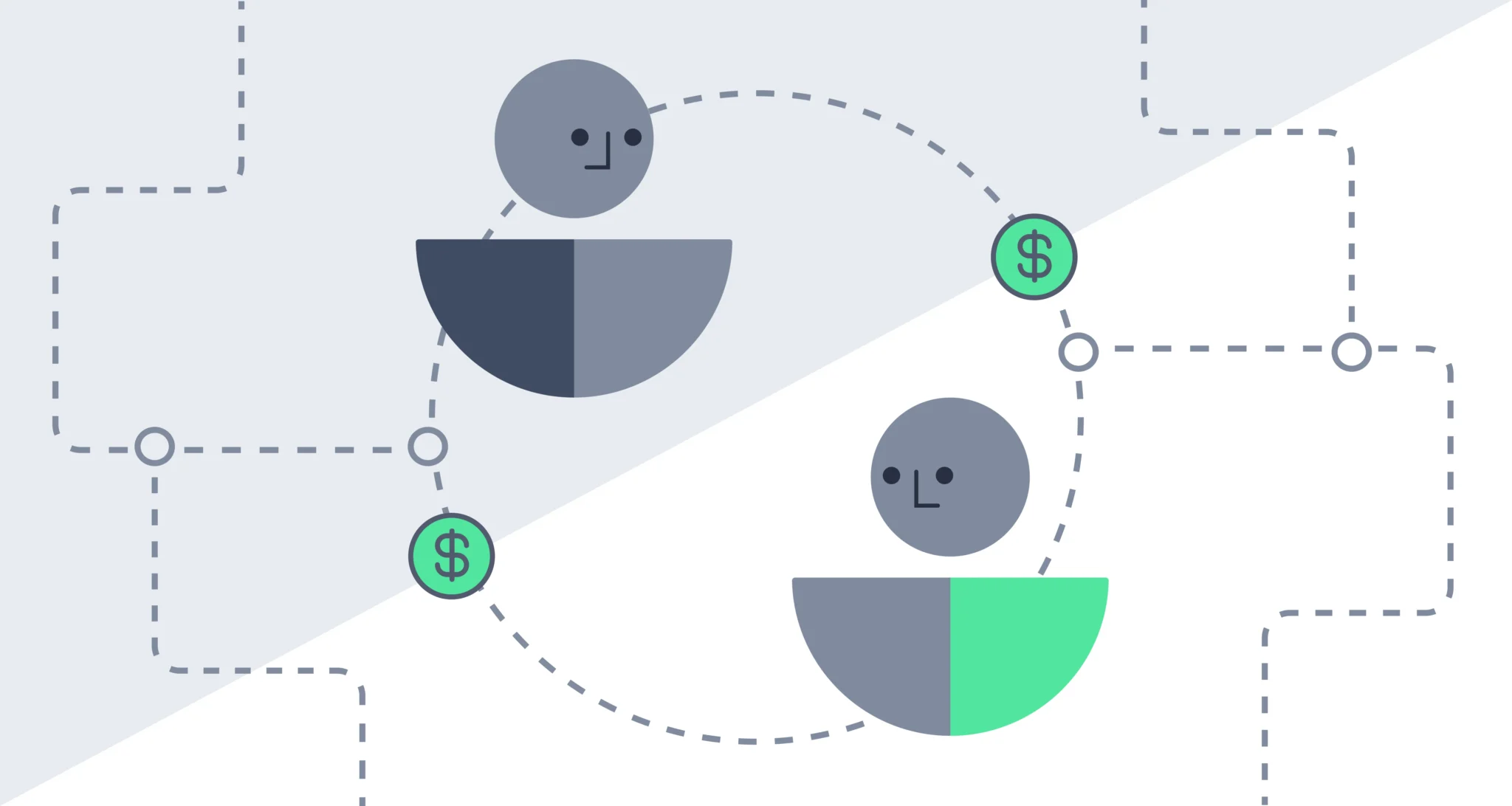

What is a trust, and what are the different types of trusts?

Trusts come up a lot in estate planning, and for good reason. They can be incredibly effective in helping fund education, provide for heirs, donate to charities and more. For high net worth individuals, trusts are also an important strategy to reduce taxable estates. What are trusts? Trusts are legal entities, much like corporations, which are considered distinct from the various parties involved. Trusts come in many forms, but in essence they are fiduciary arrangements in which, as the IRS states, “one person (the trustee) holds title to property or assets…for the benefit of another (the beneficiary).” The person who...

Vanilla

•

Mar 04, 2025

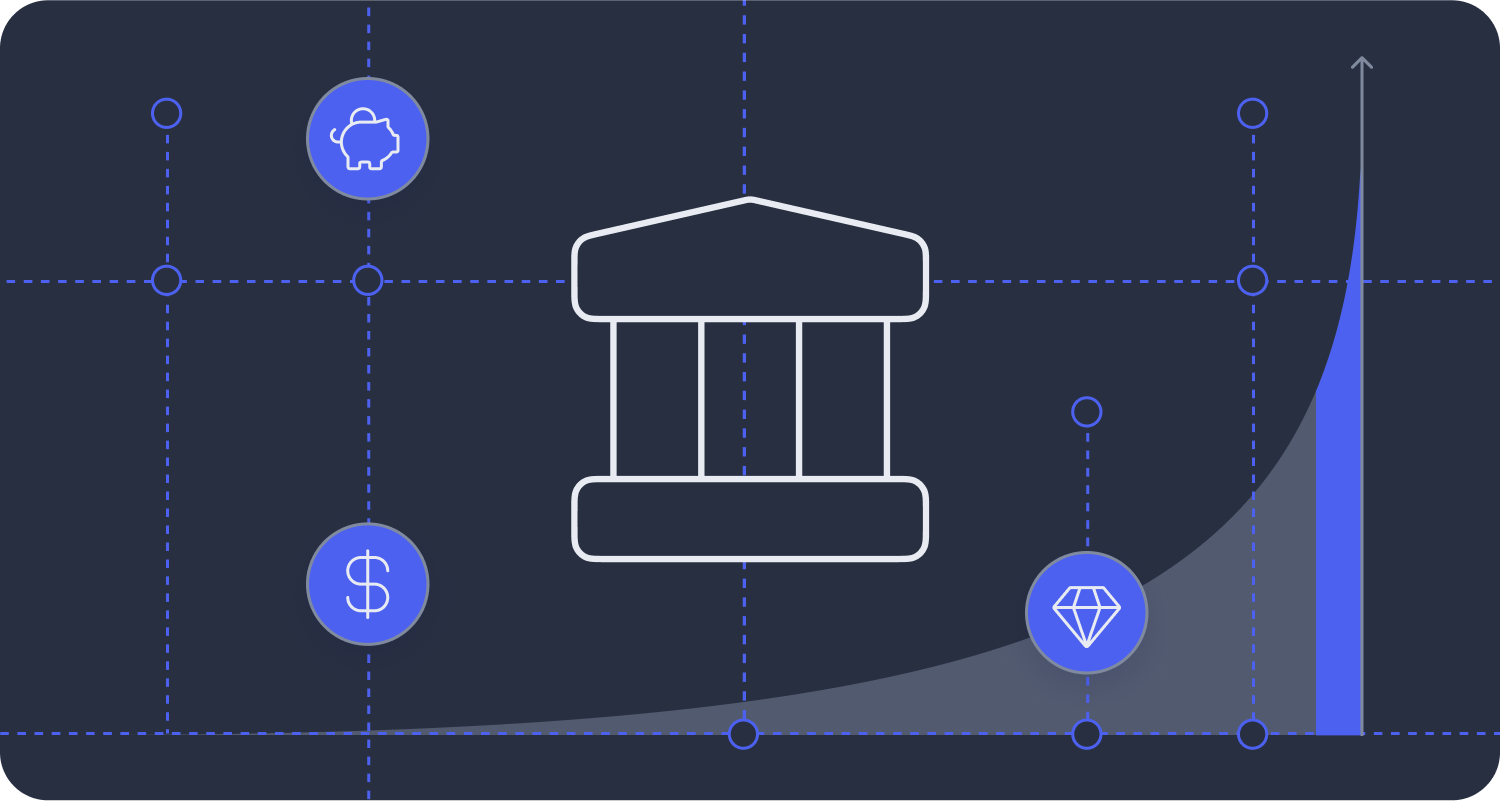

10 Diagrams to Explain Advanced Estate Planning Strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Madison Eubanks

•

Oct 24, 2024

An Intro to Revocable and Sub-Trusts for Estate Planning

A sub-trust, often created within a larger trust, is a type of estate planning tool that can allow you to customize how portions of your estate are managed and distributed to specific beneficiaries. They can add both flexibility and control to your plan, bringing peace of mind that your estate will be distributed according to your wishes and your beneficiaries will be cared for. Whether you want to set aside funds for minor children, protect a special needs beneficiary, or create tax-efficient structures, sub-trusts offer a tailored approach to address the unique needs of your family. In this blog post,...

Madison Eubanks

•

Apr 12, 2024

What is a Marital Trust and How Does it Work?

Estate planning presents a delicate balancing act for many American families as they navigate the complexities of wealth transfer between generations. As diverse family structures become increasingly common and investment portfolios grow more sophisticated, couples often face the challenge of providing financial security for a surviving spouse while maintaining control over how assets are ultimately distributed to specific beneficiaries. This fundamental tension requires thoughtful planning strategies that can accommodate seemingly competing priorities without requiring extensive legal expertise. Marital trusts offer a strategic solution to this planning dilemma, providing lifetime financial support for a surviving spouse while preserving the original asset...

Simona Ondrejkova, CFP

•

Nov 15, 2023

What is an Intentionally Defective Grantor Trust (IDGT)?

An intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and leave a lasting legacy. It is especially effective for high net worth individuals who want to pass on highly appreciated or high-growth assets while minimizing estate taxes and potentially reducing income taxes. Due to their more complex nature, IDGTs can sometimes be misunderstood and underutilized, causing clients to miss out on their many tax-saving benefits. So what is an intentionally defective grantor trust? What makes it “defective” and how can this feature be used to help your clients pass...

Simona Ondrejkova, CFP

•

Sep 26, 2023

A guide to estate tax planning for financial advisors

Beyond helping clients reduce capital gains taxes or income taxes, advisors are uniquely positioned to help clients preserve more of their wealth through proper estate tax planning. Imagine that just a few months after the unfortunate death of one of your clients, their surviving spouse or children find out they have to pay a large unexpected estate tax bill. What if this tax bill could’ve been avoided? Taking advantage of estate tax planning tools like gifting, trusts, and the marital deduction can help clients achieve their unique goals, maximize tax savings, and reduce survivors’ financial stress. Here, you’ll learn how...

Simona Ondrejkova, CFP

•

Mar 14, 2024

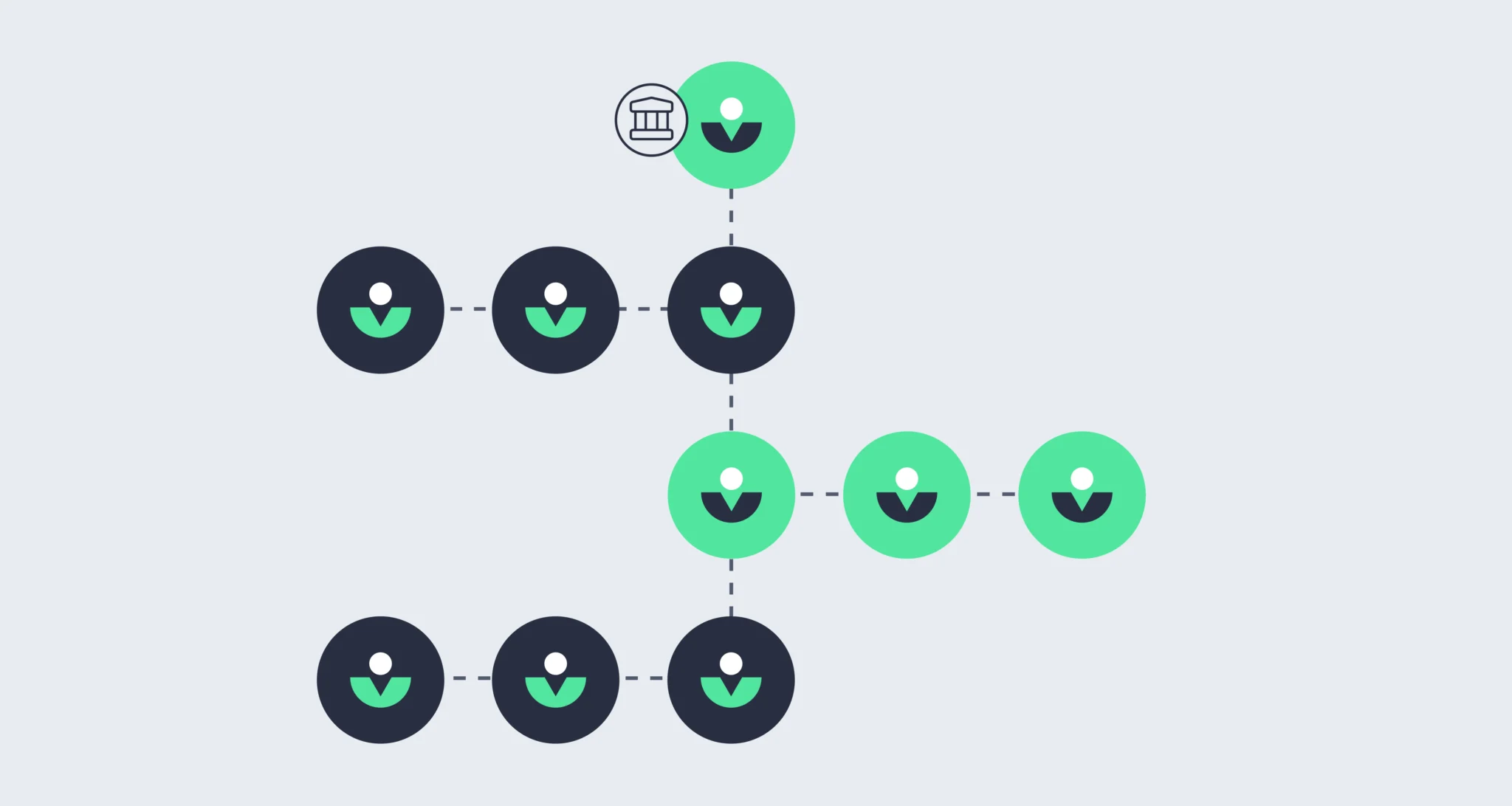

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes. Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically...

Madison Eubanks

•

Apr 12, 2024

Inter Vivos Trust

What is an inter vivos trust? An inter vivos trust is a type of trust created by an individual or a married couple to hold and manage assets during their lifetime. Also known as a living trust, this trust is often used by individuals or married couples to avoid probate, maintain privacy, and ensure efficient distribution of assets during their lifetime and after death. An inter vivos trust set up during an individual’s lifetime can ensure that the assets remaining in the trust after the settlor’s death are distributed to beneficiaries according to the settlor’s wishes. To do this, the...

Madison Eubanks

•

May 22, 2024

Is a Medicaid Trust Right For You or Your Clients?

Typically, we think of an estate plan as an arrangement to maximize wealth transfer and minimize taxes after a person passes away. However, there are some elements of estate planning that can take effect while a person is still living—like a Medicaid trust. In this article, you’ll learn what trusts and Medicaid have to do with one another, the advantages and disadvantages of Medicaid trusts, as well as when it may be appropriate for your clients to set one up. What is a Medicaid asset protection trust (MAPT)? [embed]https://justvanilla.wistia.com/medias/prx1k9xyba[/embed] A Medicaid asset protection trust—also known as a Medicaid trust or...

Simona Ondrejkova, CFP

•

Sep 29, 2023

Estate planning for high-net-worth and ultra-high-net-worth individuals

While everyone can benefit from a properly structured estate plan, it becomes even more critical for those with higher levels of wealth. High net worth and ultra-high net worth families often face unique challenges that may demand more sophisticated approaches to preserve and protect their wealth. Estate planning for high net worth individuals often starts with the same foundation as for smaller estates. But because larger estates are more likely to be exposed to estate taxes, creditors, and family or business conflicts, additional planning is required to mitigate these and other risks. Before offering several strategies that advisors and clients...

Simona Ondrejkova, CFP

•

Feb 15, 2024

Grantor Trust vs Non-Grantor Trust: What’s the Difference?

If you or your clients are considering an estate planning strategy that includes a trust, you may be wondering about the difference between the many types of trusts out there. Specifically, if you hear a trust referred to as a grantor trust, what does that mean? And how is this different from a non-grantor trust? Today, we’ll explain the difference between a grantor trust and a non-grantor trust and help you understand when to use each one to achieve your estate planning goals. What is a grantor trust? A grantor trust is a type of trust in which the person...

Madison Eubanks

•

Apr 12, 2024

Settlor

What is a settlor of a trust? A settlor is someone who creates or establishes a trust, either for the benefit of a beneficiary after the settlor’s death and/or for their own benefit during their lifetime. The trust settlor typically owns assets that are then legally transferred into a trust which is managed by a trustee based on the terms and conditions that the settlor outlined when creating the trust. In some circumstances, the settlor can also be the trustee and the one receiving benefits from the established trust. A settlor of a trust expresses their goals for how they...

Daniel Brockley

•

Jun 20, 2023

The 2026 estate tax exemption sunset is coming. Here’s what you need to...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. In 2018, the estate tax exemption was raised to an historical high of $11.18 million ($22.35 million per married couple), which has been raised yearly to adjust for inflation and put it out of sight for most estates. But the same law that raised the exemption, The Tax Cuts and Jobs Act (TCJA), is set to expire in 2026, bringing the estate tax exemption back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) –...

Madison Eubanks

•

Apr 12, 2024

Decanting Provision

A decanting provision is a method by which a trustee may remove or modify the provisions of an irrevocable trust to distribute its assets into a new trust with different terms due to significant life or law changes. Decanting provisions are typically included in the original trust document to provide trustees with flexibility to modify or update the terms of an irrevocable trust under certain circumstances. Decanting may only occur if the trust was created in a state that allows trust decanting. There are several reasons to decant a trust, including but not limited to: Correct errors or ambiguities Update...

Madison Eubanks

•

Apr 22, 2025

The Complete Guide to Estate Planning

Though an often overlooked part of financial planning, estate planning is a critical part of a well-rounded wealth management strategy. In fact, estate planning is about much more than just creating a will. A thoughtful estate plan is a comprehensive strategy for things like: Managing one’s wealth during life and after death Ensuring one’s family is cared for Supporting causes that align with one’s values Minimizing taxes and fees Documenting wishes in case of incapacitation Planning for one’s future legacy The common myth that estate planning is only for the ultra-wealthy is patently false. Estate planning benefits individuals at all...

Vanilla

•

May 12, 2025

Trust vs. Will: What’s the Difference, and Which Do Your Clients Need?

You've likely had clients ask, "Do I need a will or a trust?" It's a common question that deserves a thoughtful, personalized response. The confusion between wills and trusts often leads clients to make decisions that don't fully address their specific needs. Without proper guidance, they might opt for the simplest solution without understanding the long-term implications for their families and estates. This guide will equip you with clear explanations of the key differences between wills and trusts, their respective advantages and disadvantages, and a framework for helping clients determine which option or combination of options best suits their unique...

Madison Eubanks

•

Apr 12, 2024

What is a Revocable Trust and How Does it Work?

Estate planning involves making important decisions about how your assets will be managed and distributed both during your lifetime and after your death. Among the various estate planning options available, revocable trusts have gained popularity for their flexibility and the control they offer to individuals who want to protect their legacy while maintaining authority over their assets. Unlike some more complex legal arrangements, revocable trusts provide a balance of protection and accessibility that makes them worth considering for many people, regardless of the size of their estate. A revocable trust creates an arrangement that can adapt to your changing circumstances...

Simona Ondrejkova, CFP

•

Apr 29, 2024

Survivor’s Trusts: Everything You Need to Know

Of the many different types of trusts out there, some are designed specifically to help married couples transfer their assets according to the wishes and needs of each individual within the marriage. These trusts can be structured to provide for the surviving spouse while also being mindful of estate tax considerations for the surviving spouse and future beneficiaries. What is a survivor’s trust? [embed]https://justvanilla.wistia.com/medias/fsmtiu16us[/embed] A survivor's trust is an estate planning tool used by married couples to ensure that after one spouse passes away, the surviving spouse will have access to a portion of the assets to provide for their...

Madison Eubanks

•

Sep 19, 2024

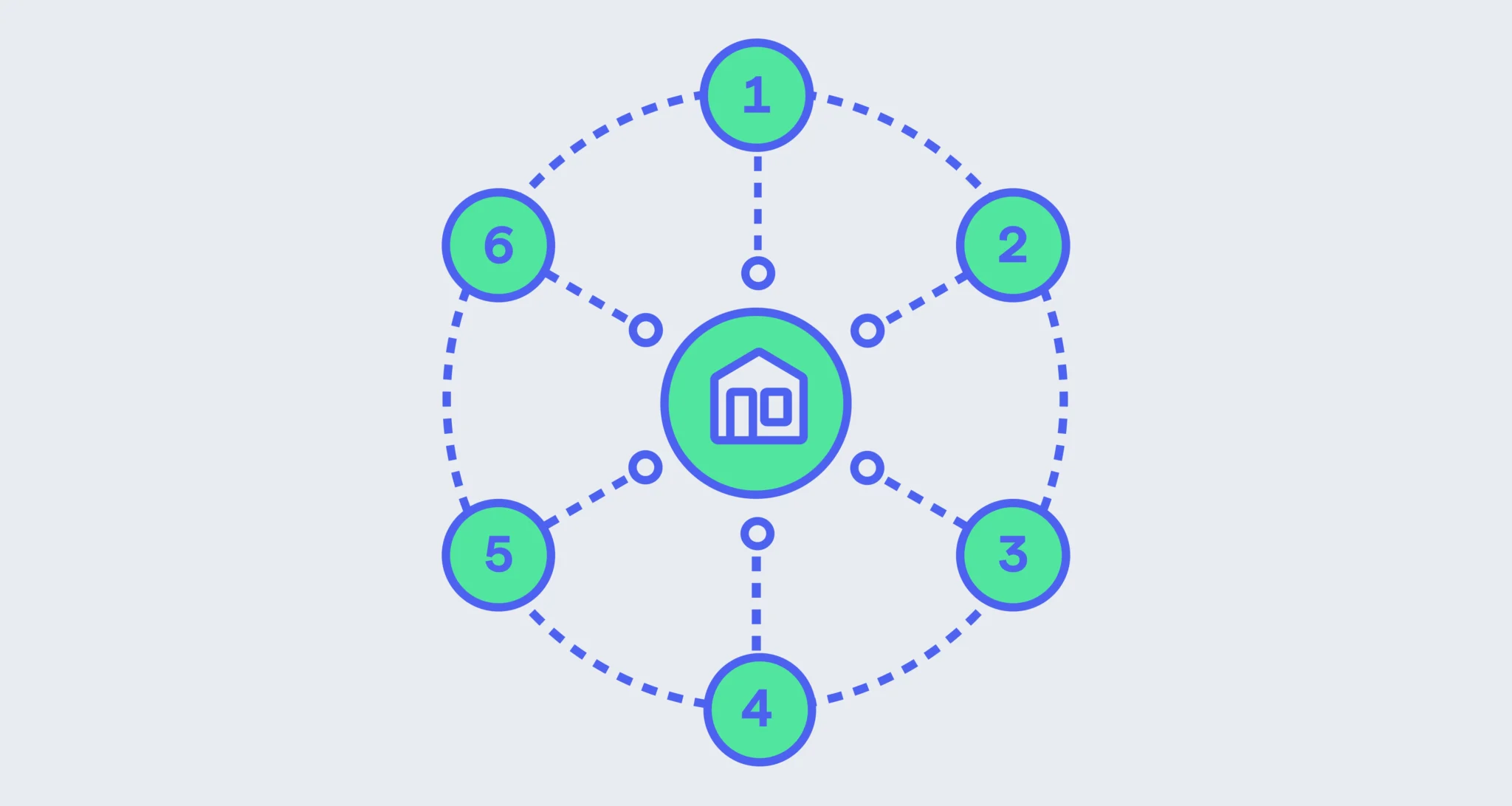

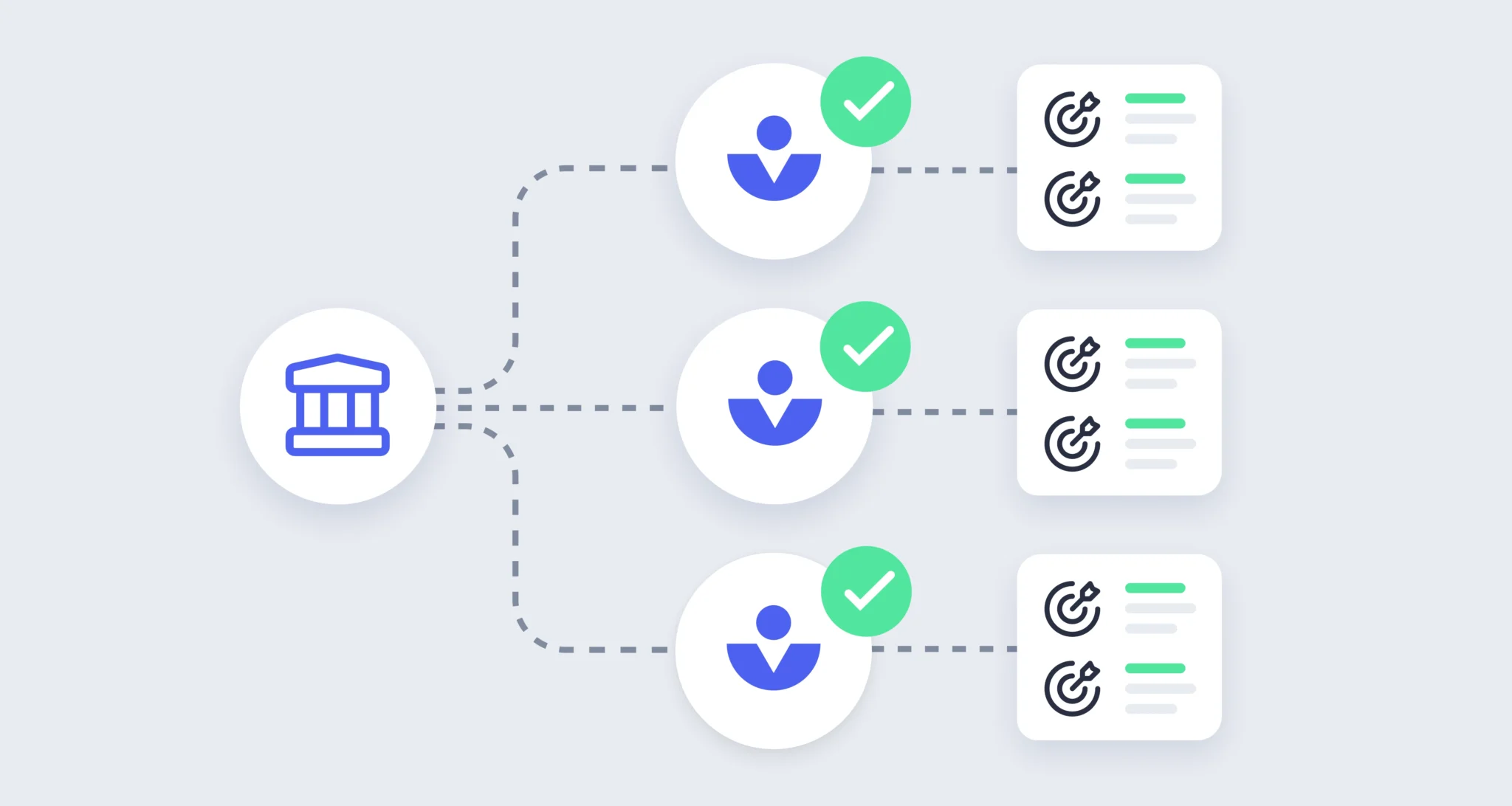

6 Estate Planning Scenarios: When to Use Which Strategy

Estate planning strategies are like tools in a toolbox: Different tools do different jobs. Deciding which estate planning strategies to employ depends on any number of personal factors including (but not limited to) marital status, level of wealth, whether or not someone has children, charitable inclination, liquidity, and many more. A savvy planner takes all these variables into account and chooses the most appropriate tool for a person’s situation, values, and goals. In this article, we provide fictional examples of when someone might use six different trust strategies, and illustrate how the right strategy can achieve their estate planning goals. ...

Madison Eubanks

•

May 08, 2024

Retirement Trusts: Are They Right for Your Clients?

The retirement accounts you've built over decades represent more than just numbers on a statement. They embody years of work, sacrifice, and planning for a secure future. While most people focus on growing these accounts during their working years, fewer consider what happens to these valuable assets when they're no longer here to manage them. This oversight can leave your financial legacy exposed to risks you never anticipated and beneficiaries unprepared for managing sudden wealth. Retirement trusts offer a level of protection and control that goes well beyond simply naming beneficiaries on your accounts. By creating specific instructions for how...

Simona Ondrejkova, CFP

•

May 07, 2025

What Is a Credit Shelter Trust? And How Can It Help Minimize Estate...

In estate planning, there are several types of trusts especially designed to help individuals avoid or reduce estate taxes. One of these is the credit shelter trust. The credit shelter trust is often used by married couples as one of many estate planning strategies that can help them pass on more wealth to beneficiaries after both spouses pass away. Here, we explain what a credit shelter trust is, how it works, and when you or your clients should consider using it to leave a greater legacy by minimizing or even eliminating the estate tax bill. What is a credit shelter...

Vanilla

•

Jun 18, 2024

Vanilla’s hottest features for June 2024: Executive Summary, planning Essentials, and more!

Summer’s here and new features at Vanilla are hotter than New York City asphalt. This month we’re excited about: Executive Summary and an enhanced Estate Diagram for the Vanilla platform and PDF report Vanilla Essentials: key documents for your client’s loved ones Generation Skipping Transfer Tax available in Vanilla Estate Builder, Estate Diagram, and more ILITs now available as a modeling strategy in Vanilla Scenarios New fields present in Estate Builder powered by VAI for advanced trusts Give clients a personalized snapshot of their estate with Executive Summary Thanks to feedback from Vanilla customers, we have added an Executive Summary...

Madison Eubanks

•

Jul 15, 2024

Qualified Disability Trusts: Everything You Need to Know

For families planning for individuals with disabilities or special needs, special considerations have to be made to ensure the person is cared for long-term. In some cases, specialized planning tools like qualified disability trusts can be used to achieve certain benefits like tax exemptions or federal aid eligibility. At the most basic level, a qualified disability trust (also known as a QDisT or QDT) is a trust that qualifies for a federal tax exemption. It’s a financial planning tool that an individual with special needs or disabilities’ family or caregivers may use to provide for their needs. Here, we’ll walk...

Simona Ondrejkova, CFP

•

Sep 05, 2023

What is a pot trust and how could it benefit your clients?

Do your clients struggle to structure their estate plan in a way that aligns with their wishes while providing for their heirs in times of need? They may want to consider an estate planning strategy that offers flexibility in distributing assets based on individual needs. This approach allows the trustee to manage the assets as a single pool, with the discretion to distribute them to beneficiaries as needed. It’s particularly useful for clients who want to ensure that each beneficiary receives support based on their unique circumstances, rather than an equal share. While many advisors recommend this strategy for its...

Vanilla

•

Feb 04, 2025

The 4 Core Estate Documents: What they are and why they’re essential for...

According to a 2024 survey from Caring.com, 40% of Americans don’t think they have enough assets to create a will. This reveals a general lack of understanding around the purpose of a will, which does more than handle financial assets. There’s an enormous opportunity for advisors to help educate clients about the goals of estate planning and core estate documents. If you have a handle on the core estate documents and how they benefit your clients’ finances in the long term, you’ll be more likely to provide advice and guidance that will strengthen ongoing relationships with clients and their families....

Vanilla

•

Jul 10, 2025

Top 8 Benefits of Estate Planning (And Why It Matters)

Introduction Imagine a family caught off guard by the sudden loss of a loved one—left scrambling to make legal decisions, untangle financial assets, and settle emotional disputes without a clear plan. Unfortunately, this is a common reality for families without an estate plan. Many people delay or avoid estate planning due to common misconceptions: “It’s only for the wealthy,” or “I’m too young to need it.” In truth, estate planning is not just for the ultra-rich or elderly—it’s a critical process that benefits people of all ages and financial backgrounds. Whether you want to protect your children, support a charitable...

Vanilla

•

May 03, 2023

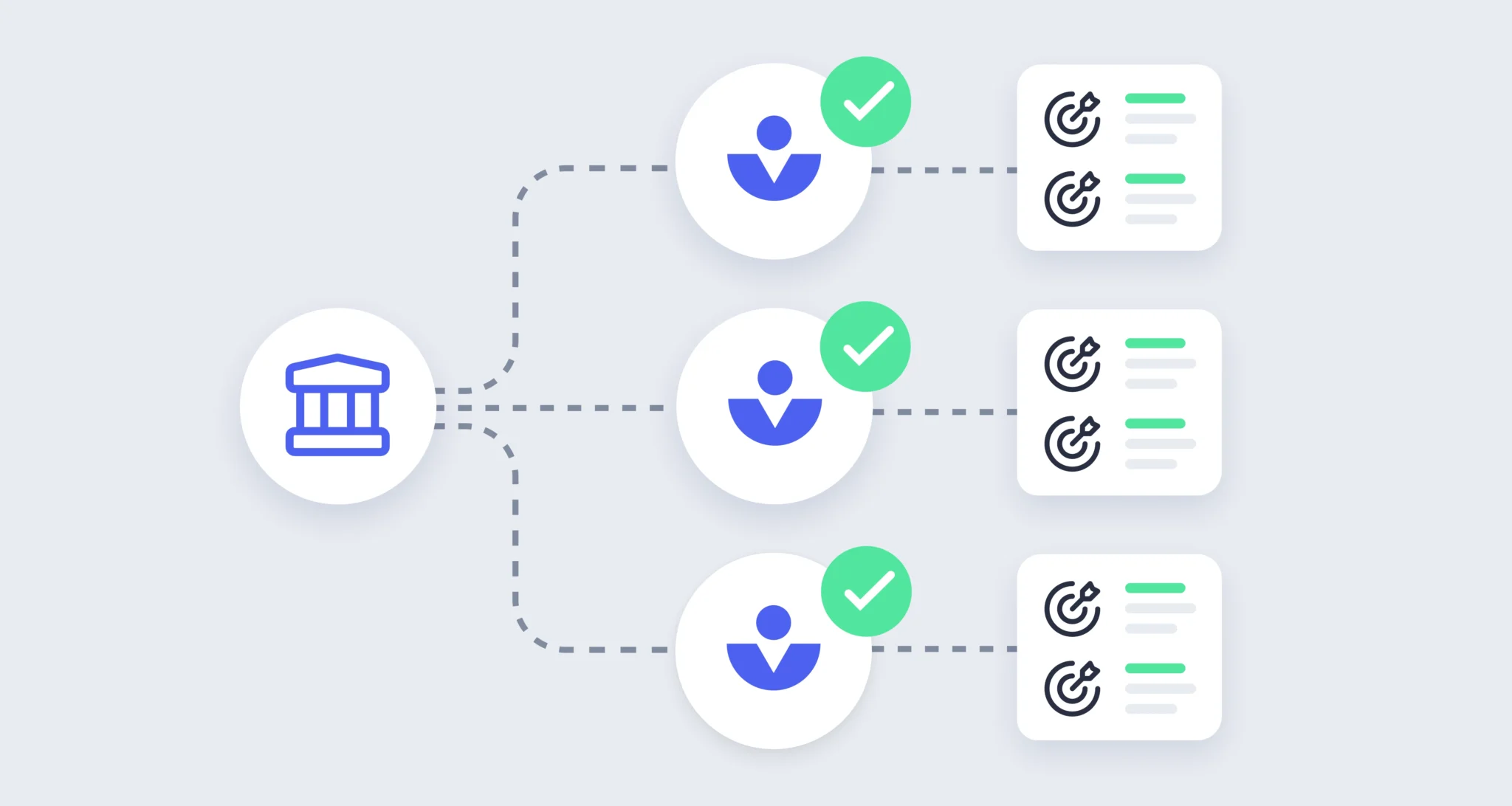

Level setting: How to approach estate planning differently depending on estate size

Many clients (and some financial advisors as well) tend to reduce estate planning to two simple categories: taxable estates and non-taxable estates. While it’s true that there are important differences in these asset levels, estate planning is not binary. It takes a nuanced approach, one that requires understanding a client’s situation and goals deeply. However, even with the understanding that a good advisor will always tailor their approach to each individual client’s needs, it can be helpful to think of client needs according to a few different distinct buckets of asset classes – beyond just taxable and non-taxable. We’ve...

Vanilla

•

Apr 07, 2023

Communicating Between the Lines: Using Letters of Wishes to Guide Trustees

When it comes to estate planning, there’s no substitute for having the right core legal documents drafted, and ensuring they align with your clients’ wishes. But no matter how carefully estate planning documents are drafted, it’s impossible to anticipate every eventuality – and, the truth is, life often moves faster than clients do when it comes to updating their documents. One great way to bolster an estate plan against the unexpected, and to help trustees make decisions in accord with client expectations, is through letters of wishes. What is a letter of wishes? A letter of wishes is simply a...

Simona Ondrejkova, CFP

•

Dec 14, 2023

8 Key estate planning tools for financial advisors and clients

Advisors often hesitate to bring up estate planning with clients because they’re not sure where to start…or which aspects of estate planning to cover. While some estate planning strategies can be complex, advisors can still start meaningful conversations by understanding some basic estate planning tools that every client should consider. While many basic estate planning tools are simple to implement, many clients are simply unaware of their existence or importance. That’s where great advisors can come in and potentially help uncover missing pieces that could drastically affect how a clients’ wishes are carried out. Regardless of your level of estate...

Vanilla

•

Jul 11, 2025

Does a Will Avoid Probate? The Truth and Common Misconceptions

A persistent, common misconception is the belief that having a will helps to avoid probate. Clients frequently assume their carefully crafted will protects their family from probate and its potentially lengthy court proceedings, expensive legal fees, and public disclosure of financial information. The truth often surprises clients: wills require probate to be legally effective in most situations. Understanding this relationship, and knowing how to educate clients about effective probate avoidance strategies, can significantly improve your advisory relationships while helping families achieve their actual estate planning goals. Why probate avoidance matters to your clients It's crucial to understand why probate avoidance...

Daniel Brockley

•

Nov 03, 2022

Turning-Point Conversations: How to use important life events to refocus clients and deepen...

Curiosity – genuine curiosity – is one of the most important traits a financial advisor can have. Sure, this means curiosity about the different levers and pulleys of the economic machine, but it also means curiosity about clients. Not just about their risk tolerance, but about what makes them tick. Their goals, their fears. What gets them out of bed in the morning. A deeper understanding of clients as people, not just portfolios, enables you to bring the kind of value that goes far beyond index funds. There are certain times in life that lend themselves to these clarifying conversations–when...

Patrick Carlson, JD, LLM

•

Jul 10, 2025

Estate Planning Under the Big Beautiful Bill

The landscape of estate planning has shifted dramatically with the passage of the One Big Beautiful Bill Act (OBBBA). For financial advisors, understanding these changes is crucial for guiding clients through a new era of permanent estate tax rules that fundamentally alter planning strategies. The game has changed: OBBBA rewrites estate tax rules The OBBBA eliminates the looming 2026 sunset provision and establishes permanent estate tax rules with a $15 million federal exemption per person starting in 2026, rather than the estimated $7.3 million that would have resulted from the sunset. This isn't just a temporary reprieve—it's a complete restructuring...

Vanilla

•

Jun 24, 2025

10 Benefits of Revocable Trusts All People Should Know About

Estate planning can be complex—but a revocable trust (also known as a living trust) offers a flexible, effective, and increasingly popular solution for managing and distributing assets. A revocable trust is a legal entity you create during your lifetime to hold and manage your assets, which you can change or revoke at any time. It provides control while you're alive, protection during incapacity, and streamlined asset transfer after death. Whether you're a high-net-worth individual or simply looking to protect your family, understanding the benefits of a revocable trust is essential. Below are ten compelling reasons to consider adding one to...

Vanilla

•

Jun 17, 2025

How Survivorship Life Insurance Policies Can Be Helpful in Estate Planning

Introduction Survivorship life insurance, often referred to as second-to-die insurance, is a specialized form of life insurance that covers two individuals—typically spouses—and pays out a death benefit only after both have passed away. While this policy type may not be as widely discussed as traditional single-life insurance, it plays a pivotal role in strategic estate planning, especially for high-net-worth couples. This article explores how survivorship life insurance works, its unique benefits for estate planning, how it compares to single-insured policies, and when it’s most effectively utilized. We’ll also examine optimal funding structures and common pitfalls to avoid. Whether you’re a...

Steve Lockshin

•

Jun 11, 2025

The Estate Planning Hierarchy for Wealthy Families: A Practical Guide for Advisors

For advisors working with very wealthy families, understanding the hierarchy of estate planning tools is essential to structuring optimal, tax-efficient, and flexible multigenerational plans. Here’s a practical framework to guide your thinking. To dive deeper, download How Vanilla Helps Advisors Plan Across Generations here. Start at the top: GST-exempt trusts Generation skipping transfer tax-exempt trusts are the gold standard for multigenerational wealth transfer. When properly structured, a GST-exempt trust: Is exempt from transfer taxes for generations—forever Can include a spouse as a beneficiary, providing flexibility and access Is highly effective for multi-generational planning when situs is established in favorable jurisdictions...

Madison Eubanks

•

Sep 05, 2024

ILIT

[embed]https://justvanilla.wistia.com/medias/a6o64kz1pm[/embed] An ILIT, or irrevocable life insurance trust, is a specialized type of trust designed to own and manage a person’s life insurance policy outside of the person’s estate. The purpose of an ILIT is to prevent the proceeds of a life insurance policy from being subject to the policyholder’s estate tax. Although life insurance is income tax-free, it is subject to estate taxes. An ILIT allows people to have those life insurance assets exist outside of their taxable estate. ILITs are often structured to provide liquidity for the estate, in order to keep assets within the family to provide...

Madison Eubanks

•

Jan 22, 2025

Separate Trust Shares

Separate trust shares are a single irrevocable trust for each beneficiary, where distributions can be made to beneficiaries at the trustee's discretion. The trustee is required to make distributions for the beneficiary’s health, education, maintenance or support.

Vanilla

•

Nov 13, 2024

Estate Planning for Business Owners: Strategies and Solutions for Wealth Advisors

There are over 33 million small businesses in the United States, employing over 60 million people. In many ways, private businesses are the heart and soul of the country’s economy, and—unsurprisingly—business owners often feel passionately about what happens to their share when they pass away. Wealth advisors should be prepared to help their business-owning clients create a thoughtful succession plan, regardless of the size or value of their business. In a recent webinar, estate planning experts Steve Lockshin and Patrick Carlson sat down to discuss everything from foundational concepts to advanced strategies wealth advisors should consider for clients who own...

Madison Eubanks

•

Dec 30, 2024

2503(c) Trust

A Section 2503(c) trust is a type of irrevocable trust created under the guidelines of Section 2503(c) of the Internal Revenue Code. It is specifically designed to hold and manage assets for the benefit of a minor, while allowing the contributions to the trust to qualify for the annual gift tax exclusion. This type of trust is often used as part of an estate planning strategy to transfer wealth to younger generations in a tax-efficient manner.

Madison Eubanks

•

Dec 30, 2024

Charitable Remainder Unitrust (CRUT)

A Charitable Remainder Unitrust (CRUT) is a type of irrevocable trust that provides financial benefits to both the donor and a charitable organization. In a CRUT, the donor transfers assets to the trust, and the trust pays a variable annual amount, based on a fixed percentage of the trust’s annually revalued assets, to one or more non-charitable beneficiaries (such as the donor or their family) for a specified term or the lifetime of the beneficiaries. After the trust term ends, the remaining assets, known as the "remainder interest," are distributed to one or more designated charitable organizations. CRUTs offer significant...

Vanilla

•

Dec 05, 2024

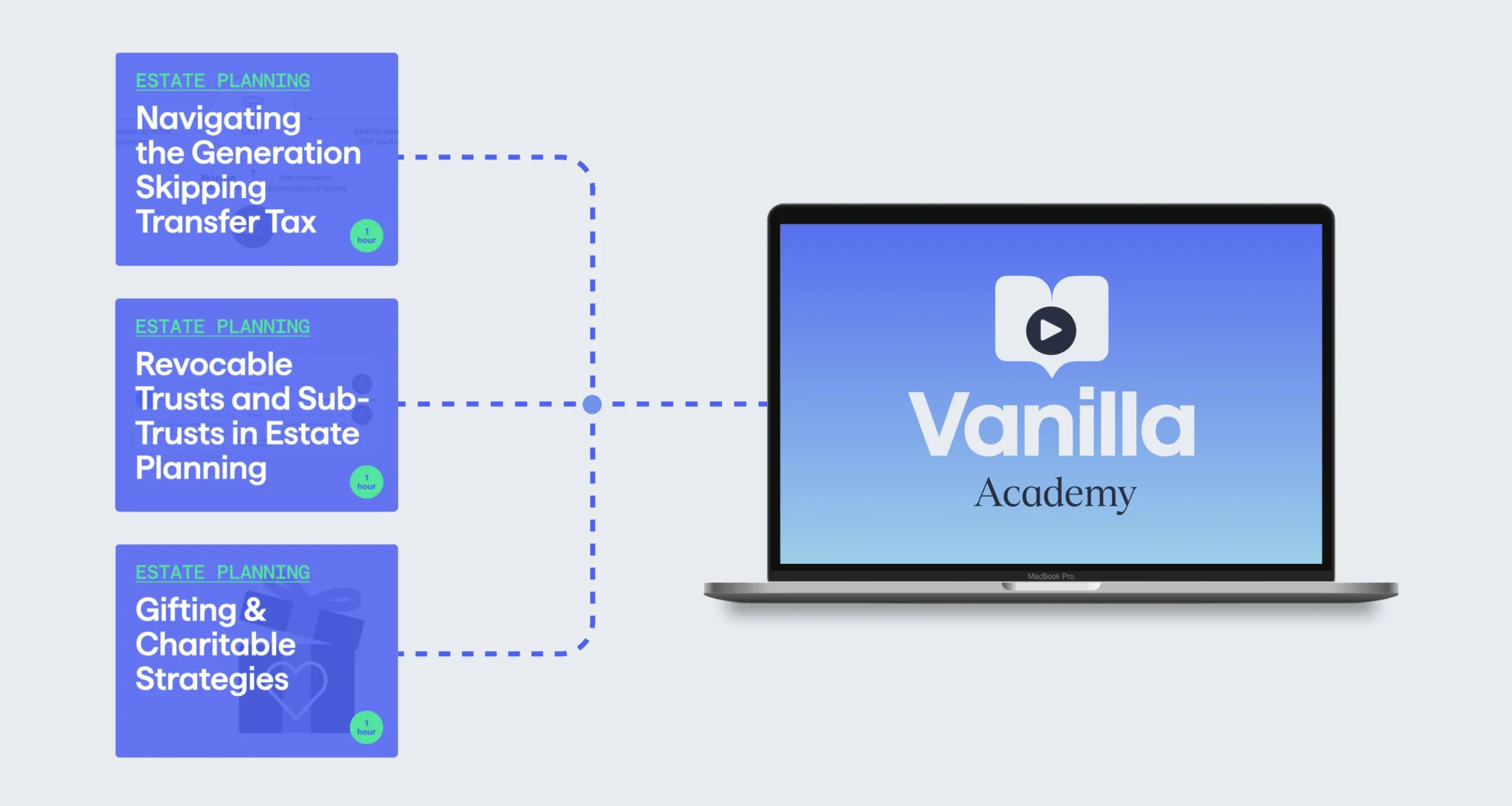

3 All New CE Courses Now Available in Vanilla Academy

The best advisors (and, truthfully, our favorite people) are the curious ones—they dig in, ask questions, and are always learning. They want to bring clients great advice that’s backed by education, experience, and perspective. For all the lifelong learners out there, Vanilla is your partner for refreshing, broadening, honing, brushing up, mastering, reviewing, or just dipping your toes into estate planning topics and skills. Vanilla Academy launched earlier this year as an estate planning learning hub for advisors who want to up-level their offering and show clients a breadth of expertise, and we’ve just added three additional courses to the...

Madison Eubanks

•

Dec 30, 2024

Charitable Lead Trust (CLT)

A Charitable Lead Trust (CLT) allows individuals to support charitable organizations while also potentially reducing their estate and gift taxes. A CLT is an irrevocable trust in which the donor transfers assets to the trust, and the trust provides payments, or "lead interest," to one or more designated charities for a specified period or the lifetime of an individual. After the charitable term ends, the remaining trust assets, known as the "remainder interest," are distributed back to the donor, or to the donor’s heirs or other beneficiaries. There are two primary types of CLTs: Charitable Lead Annuity Trust (CLAT), in...

Madison Eubanks

•

Dec 30, 2024

Charitable Remainder Annuity Trust (CRAT)

A Charitable Remainder Annuity Trust (CRAT) is a type of irrevocable trust designed to provide financial benefits to both the donor and a charitable organization. With a CRAT, the donor transfers assets into the trust and designates non-charitable beneficiaries, such as themselves or their family members, to receive fixed annual payments (the annuity) for a specified term or for the lifetime of one or more beneficiaries. At the end of the trust term, the remaining assets, known as the "remainder interest," are distributed to one or more designated charitable organizations. CRATs can offer significant tax advantages, including an immediate charitable...

Vanilla

•

Jul 19, 2021

Top 5 challenges of estate planning for blended families (and how to solve...

Deciding who gets what after one’s passing is tough. According to a survey by Caring.com, only 42% of American adults have essential estate planning documents, such as a will or a living trust. People avoid planning for the inevitable for many reasons. But for blended families, a major reason is that estate planning requires more than a simple will. Many difficult questions come up: How do I ensure everyone is well taken care of after I am gone? Should I leave everything to my spouse and hope they take care of my children? How do I avoid disinheriting my children?...

Vanilla

•

Feb 02, 2021

Top 6 costly risks that come with free estate planning documents

Tempted to give your clients free estate planning documents to create a will, trust, or other after-death protections? Think again. Free estate planning documents come with risks that may ultimately cost clients and their heirs more than they saved in legal fees. Let’s take a look at some of the significant — and expensive — problems that using free estate planning documents could cause. 1. Excluding family members from a will Free DIY wills don’t always tailor an estate plan to an individual’s circumstances and goals. This is particularly the case for blended families and new additions when it's easy...

Vanilla

•

Dec 11, 2020

7 Major reasons why estate planning isn’t a ‘set it and forget it’...

Imagine that you're having your first consultation with a new client. You ask them whether they have an estate plan in place. They proudly tell you that they drew up a will and assigned guardianship as soon as their first child was born — 25 years ago. Job well done, next question — right? Not quite! Let's examine why treating an estate plan as a one-off task comes with significant risks that could end in nightmare scenarios for your client and their family. 1: Beneficiaries and fiduciaries are often temporary While your client may express a desire to designate loved...

Vanilla

•

Jan 17, 2023

What is a grantor retained annuity trust (GRAT)?

In a grantor retained annuity trust (GRAT) , a grantor transfers a particular asset(s) into an irrevocable trust and retains an annuity stream from the trust for a specified term of years. The annuity amount is calculated based on an IRS interest rate (referred to as the “hurdle rate”). At the end of the trust’s term, if the grantor survives the term of the trust, any assets remaining in the GRAT (the appreciation above the hurdle rate) will pass transfer-tax-free to the named “remainder beneficiary”, generally a trust for family members. How does a GRAT work? Grantor retained annuity trusts...

Vanilla

•

Apr 04, 2025

What You Need to Know about Generation-Skipping Gifts (and Their Tax Implications)

Gifting to your children is an excellent way to reduce estate tax liabilities, but sometimes it makes more sense to give directly to grandchildren, rather than to your children. Because these gifts “skip” a generation, they are referred to as generation-skipping transfers (GST) and have special tax treatment. There are a few important things to keep in mind when considering a generation-skipping transfer gift, including the generation-skipping transfer tax. We’ll break the tax down for you and give you a few more important pointers to pay attention to. What is the generation-skipping transfer tax? The generation-skipping transfer tax (or “GSTT”)...

Vanilla

•

Jan 20, 2023

Trust Certification

What is a certificate of trust? A certificate of trust, also known as a trust certificate, certification of trust document, or an affidavit of trust, is used to represent and verify an interest or ownership in a trust. The certificate of trust is similar to a stock certificate for a corporation. It includes important information about the trust to confirm its existence to outside parties without disclosing sensitive information that the creator of the trust (the settlor) may not want to share publicly. What’s the purpose of a certificate of trust? Before allowing trustees to act on behalf of a...

Vanilla

•

Feb 06, 2025

What is a spousal lifetime access trust (SLAT), and how does it work?

What is a spousal lifetime access trust (SLAT)? A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”) during his or her lifetime for the benefit of the individual’s spouse and if, desired, other family members. How does the SLAT work? A SLAT is created under a trust agreement, which contains the terms of the trust and the name of the individuals or entity that will act as trustee (typically a trusted friend or advisor). A SLAT is funded by way of a gift from the donor to the SLAT. During the...

Vanilla

•

Mar 08, 2023

11 Common Estate Planning Mistakes to Avoid

These common estate planning mistakes could leave your clients vulnerable to unintended consequences such as probate, loss of assets in a divorce, and avoidable estate tax liability. Financial advisors can help their clients avoid the 11 most common estate planning mistakes listed below. #1 Not updating estate planning documents regularly Some clients may think that creating an estate plan is a one-and-done proposition, but you should review and update your client’s estate plan with them when they experience any of the following: Major life events: Your client’s estate planning documents should reflect significant milestones, such as having a child, getting...

Vanilla

•

May 18, 2023

Leverage sample profiles to illustrate Vanilla’s value to your clients

With the launch of taxable and non-taxable sample profiles, advisors can now review an example of a completed client account in Vanilla. Their clients can see how the complete picture of their estate and financial plan would be represented on the platform before onboarding their own family, financial, and estate information. During client and prospect conversations, advisors can share the completed sample profile or download the taxable or non-taxable estate PDF report. The Taylor Family is an example of a high-net worth family living in Florida with a taxable estate of $117,050,000. Their estate plan includes revocable trusts, an irrevocable...

Simona Ondrejkova, CFP

•

Jul 08, 2024

How to Create a Family LLC for Estate Planning

Clients who own a business often face an additional layer of complexity when it comes to estate planning. From determining the most effective strategy for passing on the business to minimizing taxes and maximizing wealth transfer for loved ones, navigating through countless estate planning strategies can be exhausting. The good news is that there are certain business structures, such as the family limited liability company (family LLC), that could make things easier for those who run a business that’s meant to stay in the family. Here, we explain what a family limited liability company is, how it can help business...

Simona Ondrejkova, CFP

•

Oct 09, 2023

A Guide to Estate Planning for Individuals with Special Needs

Estate planning for clients who have adults or children with special needs in their lives can be complex. Unlike traditional estate planning, special needs estate planning requires paying careful attention to the individual with special needs’ eligibility for government benefits. This is in addition to skillfully leveraging assets to most effectively attend to their unique health and wellness needs. Imagine that one of your clients is a family with three adult children, all living in different states. The two younger brothers have established their own families and are financially comfortable. But their oldest sister is living with muscular dystrophy and...

John Costello

•

Mar 12, 2024

Vanilla Unveils Vanilla Scenarios™ to Power Interactive Estate Planning and Modeling

Vanilla Scenarios provides advisors and estate strategists with powerful planning tools to identify planning gaps, visualize future projections, and optimize plans for maximum impact. Vanilla, a leading provider of innovative estate planning software, today announced the availability of Vanilla Scenarios™, a powerful new tool designed to optimize clients' estate plans for the future. Vanilla Scenarios modernizes estate planning by providing advisors, wealth planners, and estate lawyers with unparalleled capabilities to model multiple planning scenarios dynamically and in real-time. Advisors can effortlessly layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state...

Madison Eubanks

•

Apr 02, 2024

Letter of Testamentary: What It Is & Why You Need It

Creating a last will and testament is one of the most fundamental efforts in estate planning, and a key component is naming an executor to carry out the will’s instructions. The executor is the person who will administer the estate, sees it through the probate process, and settles the decedent’s final affairs—in short, it’s a big responsibility. Before the executor can begin administering a deceased person’s estate, though, the executor needs to obtain a Letter of Testamentary (also called letters testamentary). In this article, we’ll explain what a letter of testamentary is, why you might need one, how to get...

Madison Eubanks

•

Apr 12, 2024

Family Trust

What is a family trust? A family trust is one of many different types of trusts to help individuals pass on their assets according to their wishes. The person creating the family trust, the settlor, will specifically name family members such as spouses, children, grandchildren, nephews, nieces, or other family members as the beneficiaries of the trust so they can preserve and pass on wealth to future generations. How does a family trust work? In a family trust, the settlor will specify which assets will go into the family trust fund and how those assets will be distributed to beneficiaries....

Madison Eubanks

•

Apr 12, 2024

Joint Revocable Trust

A joint revocable trust is a legal arrangement established by two people—usually a married couple—to hold their assets together to be managed and distributed during their lifetimes and after their deaths. Both spouses are considered grantors of the trust and jointly manage the trust. A joint revocable trust, also referred to as a joint living trust or a joint revocable living trust, can be funded with jointly owned or separately owned assets. Benefits of a joint revocable trust might include: Flexibility: Unlike an irrevocable trust, the grantors of a joint revocable trust are able to make changes to the trust...

Madison Eubanks

•

Apr 30, 2024

Intentionally Defective Grantor Trust (IDGT)

An intentionally defective grantor trust is an irrevocable trust structured to allow certain assets to be passed on without being subject to estate taxes while still retaining the settlor’s liability for income taxes generated within the trust. Read more: What is an intentionally defective grantor trust (IDGT)?

Vanilla

•

May 24, 2023

The 2026 estate tax exemption sunset: How to prepare – and why you...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. But that’s all about to change. At the end of 2025, the historically high estate exemption of $12.92M ($25.84 million per married couple) will sunset back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) – suddenly making the estate tax an important consideration for many more households. And the time to act is now. In this webinar, you’ll learn: How the estate tax exemption sunset will impact your clients Key strategies including SLATS, gifting,...

Vanilla

•

Aug 10, 2023

A guide to trusts for estate planning

Trusts are an important component of financial and estate planning, but there are many types of trusts – each with unique pros and cons. This guide helps financial advisors and clients sort through the many different types of trusts to better understand what they might want to employ for their own estate strategies.