Vanilla Academy

The estate planning learning center for financial advisors

Learn about estate strategy, business growth and more

Vanilla Courses

New Client Conversations: How to engage new clients with estate planning

Client conversations, grow your business

22 min.

Learn what to ask new clients — and what to listen for in their answers — as you engage with them for the first time regarding their estate plans. Download the New Client Conversations Checklist to follow along with the presentation.

Lectors

Steve Lockshin

Founder, Vanilla

Estate Planning 101

core documents, wills, trusts, healthcare directives, powers of attorney, advanced strategies

This three-part series will give you a primer on core estate planning concepts as well as an overview of advanced strategies.

Start Watching

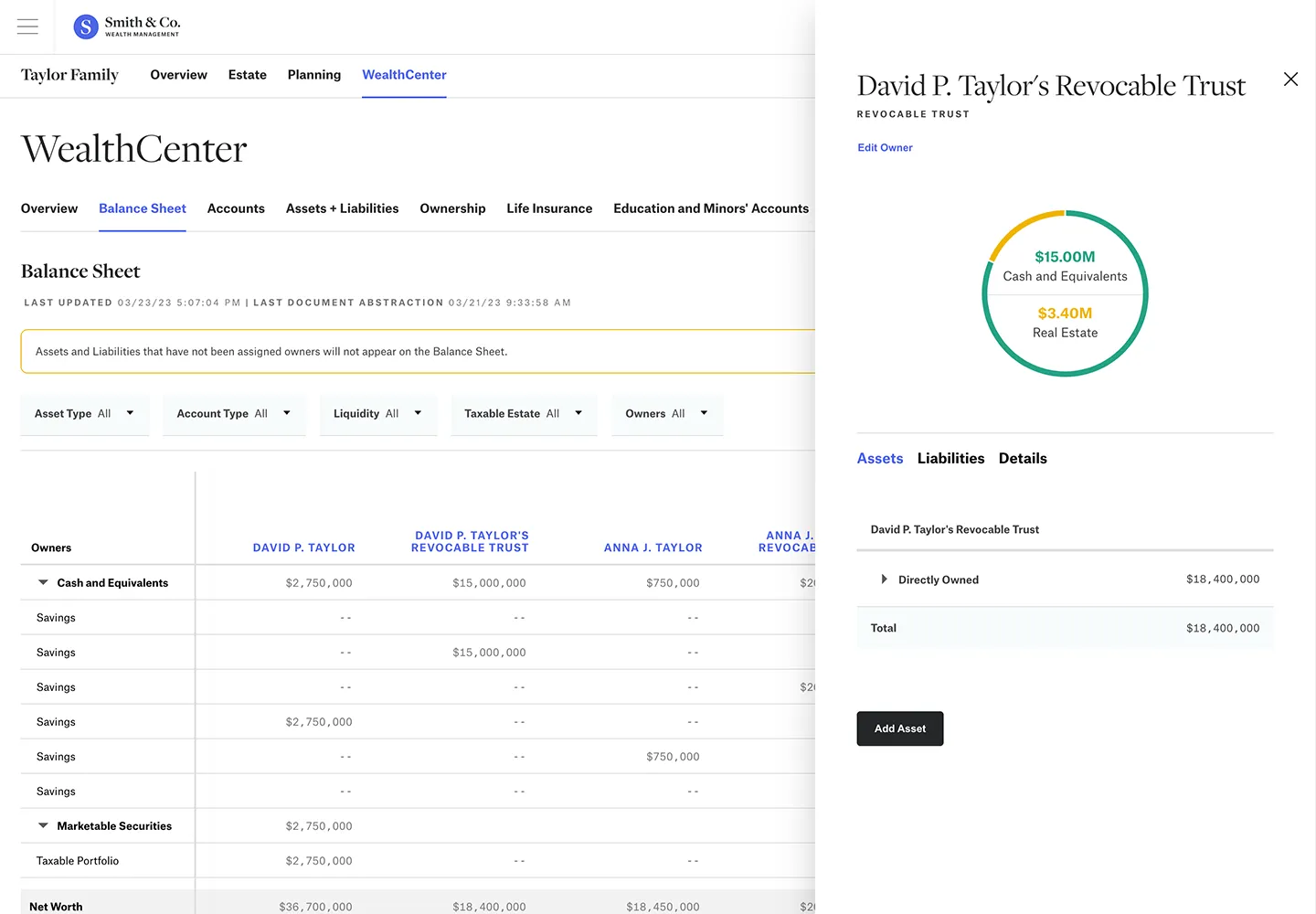

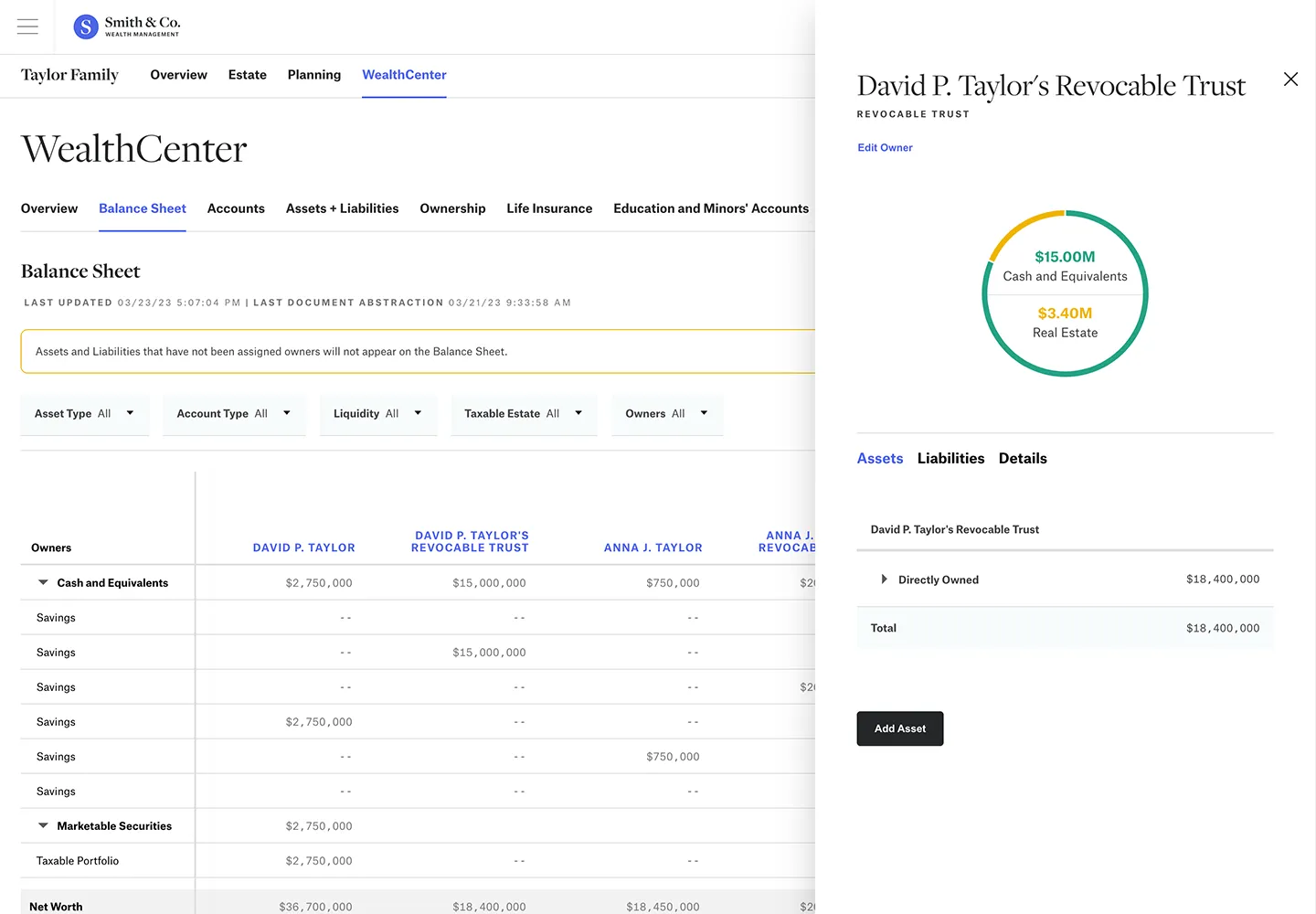

Improving Client Conversations with Vanilla

client conversations, grow your business

Wondering how you can use the Vanilla platform to help guide your client conversations and add value? We have some quick tips on how you can leverage the platform to build more complete strategies, differentiate yourself from the competition and grow your share of wallet.

Start WatchingEstate Planning Fundamentals

7 Major reasons why estate planning isn’t a ‘set it and forget it’...

Imagine that you're having your first consultation with a new client. You ask them whether they have an estate plan in place. They proudly tell...

Process Matters: Why “bespoke” is not enough when it comes to estate planning

Part I in a series of 3 on The Vanilla Estate Planning Playbook. Talk to any financial advisor out there, and you’ll hear a...

How do I know if estate planning documents are high quality?

As a financial advisor, you may be uncertain about the myriad of estate planning documents clients use, and which to recommend for the best possible...

The advisor’s guide to naming the right fiduciary trustee for an estate

One of the biggest estate planning mistakes people make is placing the power and responsibilities of a trustee in the wrong hands. Poor fiduciary selection...

10 Diagrams to Explain Advanced Estate Planning Strategies

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not...

What is a charitable remainder trust? (with examples)

Many people have charitable intentions that they would like to consider as part of their estate planning. However, donating assets outright during their lifetime may...

What is a grantor retained annuity trust (GRAT)?

In a grantor retained annuity trust (GRAT) , a grantor transfers a particular asset(s) into an irrevocable trust and retains an annuity stream from the...

What is a spousal lifetime access trust (SLAT), and how does it work?

What is a spousal lifetime access trust (SLAT)? A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”)...

Family Estate Planning: An advisor’s guide to helping clients transfer wealth to the...

As the financial planning industry anticipates the Great Wealth Transfer from baby boomers to their heirs, reports show that at least 80% of adult children...

How to prepare for the death of a client

You’ve built a solid financial foundation for your client, made investments with an eye on the future, and helped them strive toward making their financial...

How financial advisors can add value in a bear market

It’s officially a bear market, now what? How advisors can add value when times are tough It’s brutal out there. After riding the sugar high...

Millennials and Estate Planning: What advisors should know

How millennials think about wealth management—including estate planning Millennials take their financial lives seriously—and they’re ready to enlist the experts to help. The past few...

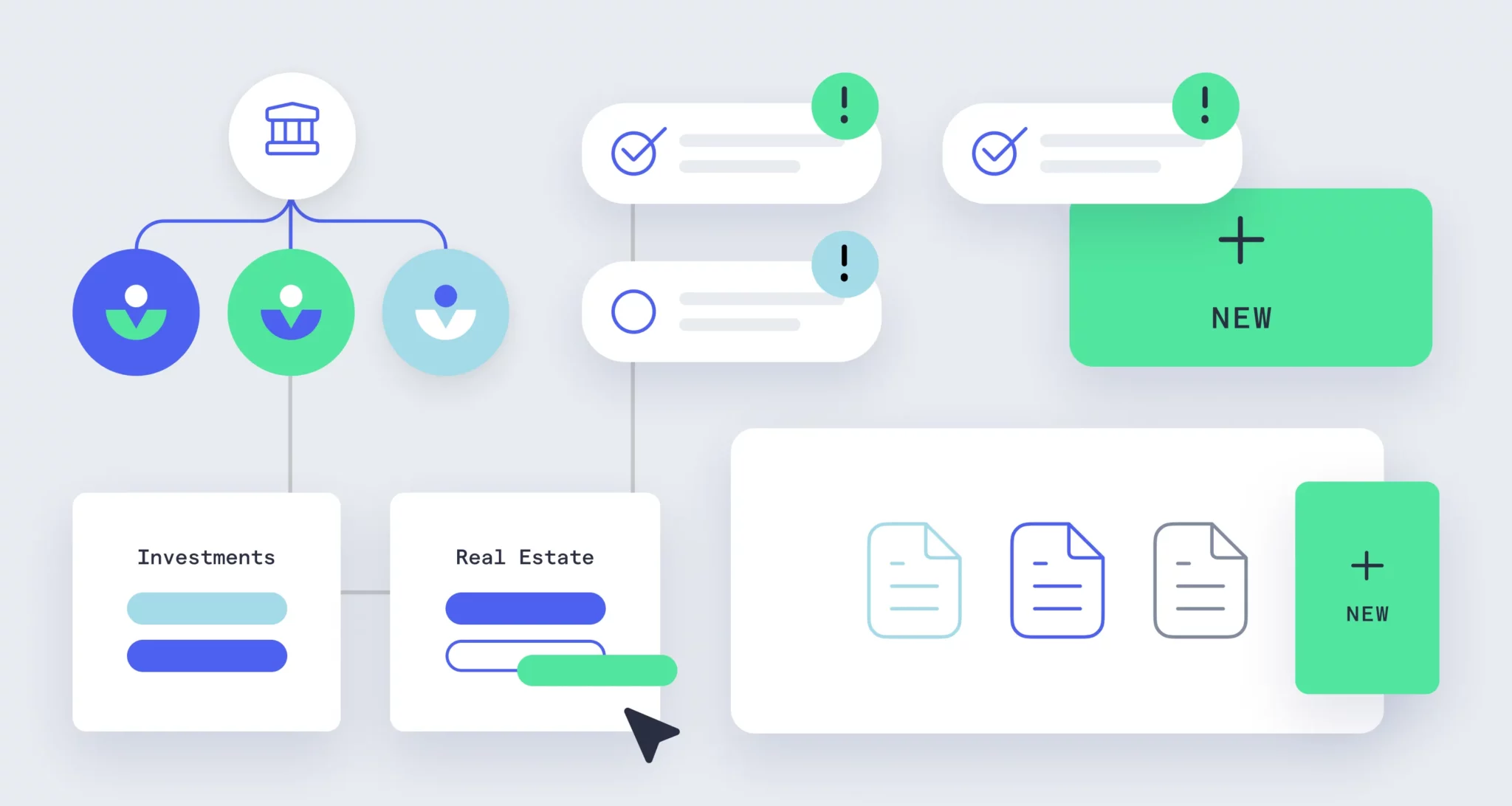

How Vanilla Helps Advisors & Planners

Glossary

Frequently Asked Questions

I'm a current customer. Where do I find information about how to use the Vanilla product?

You’ll find “how to” articles and videos on the Vanilla product in help center. There, you will find information on onboarding, getting started, document abstraction and more.

I'm ready to incorporate estate planning as a major part of my practice. How to I go about doing that?

Congratulations! In addition to checking out our Vanilla Estate Planning 101 course, we recommend you use our Vanilla Estate Planning Playbook to help create a framework for your advisory. For added insights, check out our webinar on the Playbook.

My clients have attorneys. As a financial advisor, why should I be involved in their estate planning?

Attorneys play vital roles in estate planning. They will need to draft any legal documents your clients need. But advisors talk to clients more frequently than their attorneys do, and have a more holistic picture of clients’ financial health and goals. Advisors can help identify potentially issues or opportunities for clients, and ensure their estate plan aligns with their evolving needs and goals.

I'd like to talk to my clients about estate planning, but am unsure how to broach the subject. How to I begin?

You can start by emphasizing the importance of estate planning. Lots of people push estate planning off because they don’t want to think about it, but not having a plan will likely mean their wishes aren’t met in the event of their incapacity or death. Start by showing them the presentation Why Estate Planning Matters.