Vanilla

•

Mar 04, 2025

10 Diagrams to Explain Advanced Estate Planning Strategies

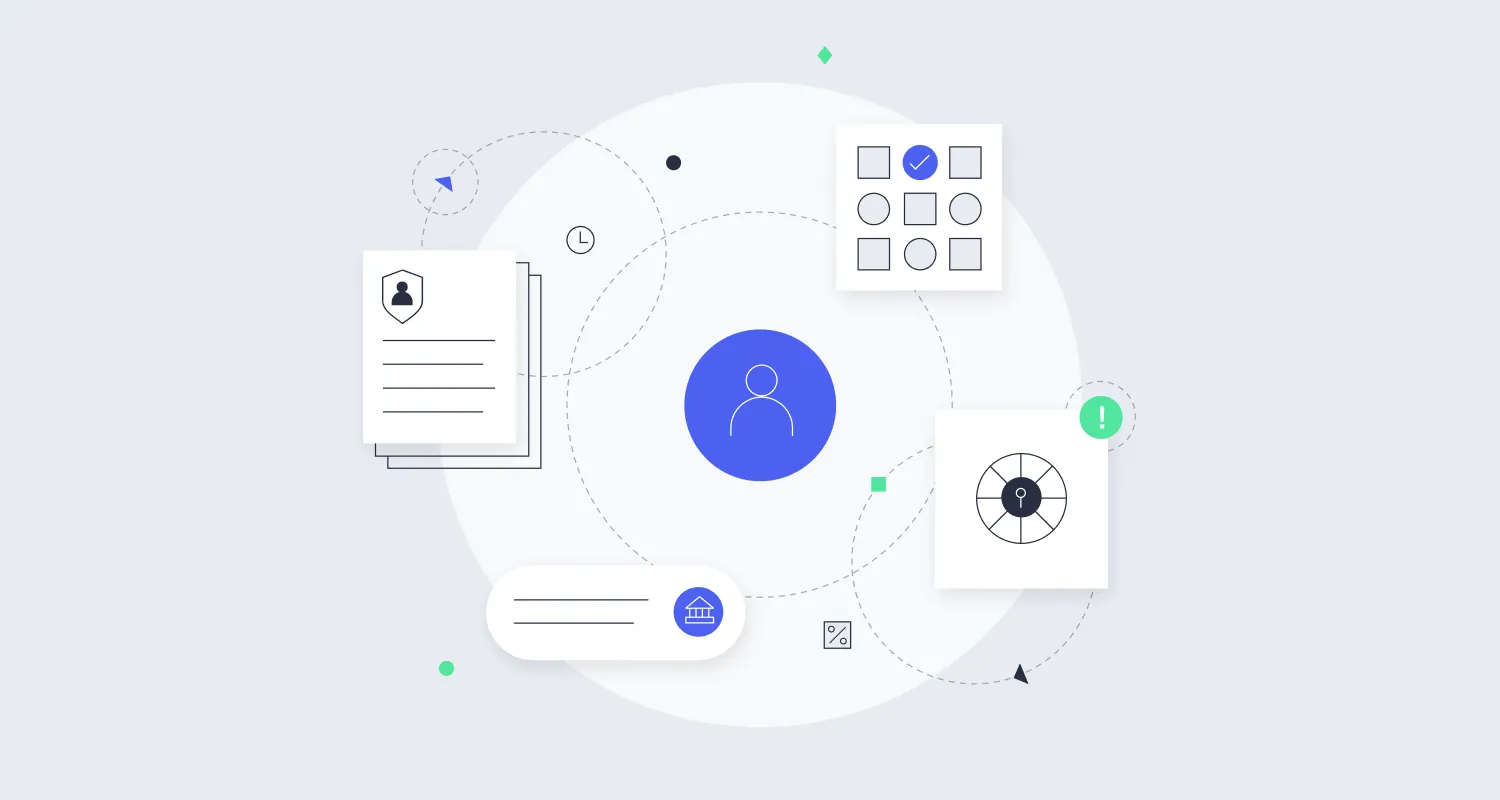

Tax planning for clients with taxable estates has always been complex. We’ve learned the best way to explain estate planning strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced strategies and why household with $10M in assets should care about estate tax. Why $10M in household assets? In 2026 the Estate Tax exemption drops down to just about $10M (or higher based on inflation). The 10 diagrams explain both why you need advanced strategies and how 8 different strategies work. We’ve explained them all below but if...

Vanilla

•

Jan 10, 2023

What is a charitable remainder trust? (with examples)

Many people have charitable intentions that they would like to consider as part of their estate planning. However, donating assets outright during their lifetime may not meet their financial goals. A more advanced estate planning strategy, such as a charitable remainder trust, may provide the flexibility to meet their personal financial needs while guaranteeing that a charity or charities end up with the remaining asset at the end of the term or when the settlor/donor is no longer living. When to use a Charitable Remainder Trust (CRT): When you are charitably inclined; and, You have highly appreciated securities you would...

Vanilla

•

Jan 17, 2023

What is a grantor retained annuity trust (GRAT)?

In a grantor retained annuity trust (GRAT) , a grantor transfers a particular asset(s) into an irrevocable trust and retains an annuity stream from the trust for a specified term of years. The annuity amount is calculated based on an IRS interest rate (referred to as the “hurdle rate”). At the end of the trust’s term, if the grantor survives the term of the trust, any assets remaining in the GRAT (the appreciation above the hurdle rate) will pass transfer-tax-free to the named “remainder beneficiary”, generally a trust for family members. How does a GRAT work? Grantor retained annuity trusts...

Vanilla

•

Feb 06, 2025

What is a spousal lifetime access trust (SLAT), and how does it work?

What is a spousal lifetime access trust (SLAT)? A Spousal Lifetime Access Trust (“SLAT”) is an irrevocable trust set up by an individual (the “donor”) during his or her lifetime for the benefit of the individual’s spouse and if, desired, other family members. How does the SLAT work? A SLAT is created under a trust agreement, which contains the terms of the trust and the name of the individuals or entity that will act as trustee (typically a trusted friend or advisor). A SLAT is funded by way of a gift from the donor to the SLAT. During the...

Vanilla

•

Jan 26, 2023

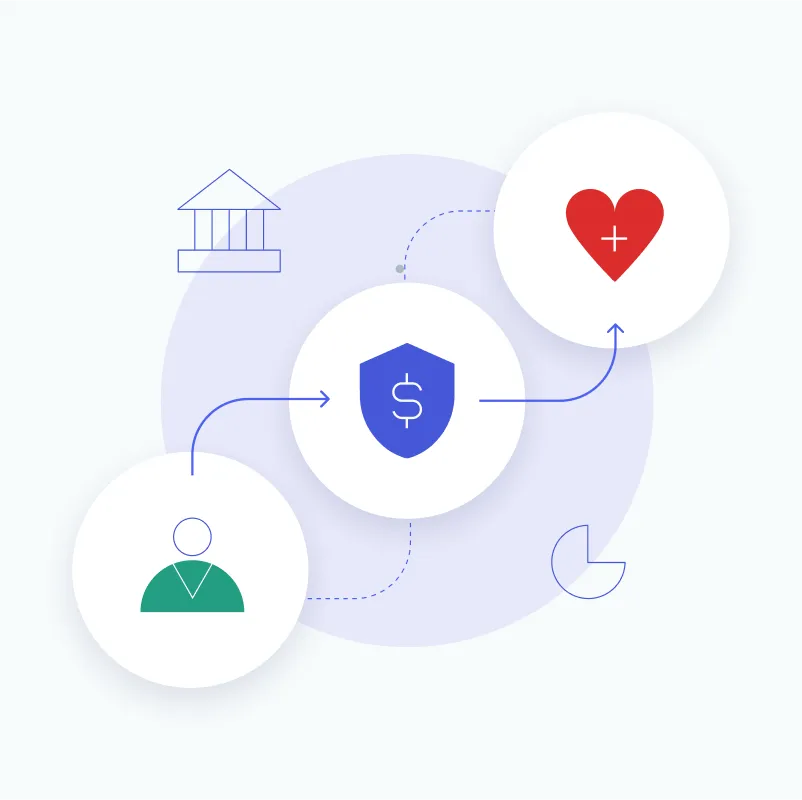

What is an irrevocable life insurance trust (ILIT)?

Estate planning presents a significant challenge when substantial assets could face hefty taxation after death. Irrevocable Life Insurance Trusts (ILITs) offer a strategic solution as specialized legal vehicles designed to own life insurance policies during your lifetime. By keeping insurance proceeds outside your taxable estate, these trusts help beneficiaries avoid the steep 40% federal estate tax that would otherwise diminish their inheritance. ILITs serve dual purposes by either creating immediate liquidity for families or preserving estates by covering tax obligations without forcing the sale of illiquid assets. Business owners, real estate investors, and families approaching the federal estate tax threshold...

Vanilla

•

Apr 04, 2025

What You Need to Know about Generation-Skipping Gifts (and Their Tax Implications)

Gifting to your children is an excellent way to reduce estate tax liabilities, but sometimes it makes more sense to give directly to grandchildren, rather than to your children. Because these gifts “skip” a generation, they are referred to as generation-skipping transfers (GST) and have special tax treatment. There are a few important things to keep in mind when considering a generation-skipping transfer gift, including the generation-skipping transfer tax. We’ll break the tax down for you and give you a few more important pointers to pay attention to. What is the generation-skipping transfer tax? The generation-skipping transfer tax (or “GSTT”)...

Vanilla

•

Sep 19, 2022

Estate Planning: Advanced strategies

Tax planning for clients with taxable estates has always been complex. The best way to explain strategies is with diagrams, not documents. That’s why we’ve put together this deck of 10 diagrams to explain some of the advanced estate planning strategies and why anyone with $10M in assets should care about estate tax.

Vanilla

•

Dec 11, 2020

7 Major reasons why estate planning isn’t a ‘set it and forget it’...

Imagine that you're having your first consultation with a new client. You ask them whether they have an estate plan in place. They proudly tell you that they drew up a will and assigned guardianship as soon as their first child was born — 25 years ago. Job well done, next question — right? Not quite! Let's examine why treating an estate plan as a one-off task comes with significant risks that could end in nightmare scenarios for your client and their family. 1: Beneficiaries and fiduciaries are often temporary While your client may express a desire to designate loved...

Vanilla

•

Jun 14, 2021

Family Estate Planning: An advisor’s guide to helping clients transfer wealth to the...

As the financial planning industry anticipates the Great Wealth Transfer from baby boomers to their heirs, reports show that at least 80% of adult children and heirs will find their own advisors after receiving an inheritance. In other words, if you’re waiting until your client dies to introduce yourself to their family, you’ve waited too long to win their heirs as new clients. But there’s good news: family estate planning provides the perfect opportunity to connect with your client’s family early on and cultivate an ongoing relationship that can extend into the next generation. By anticipating their family’s estate planning...

Daniel Brockley

•

Oct 04, 2022

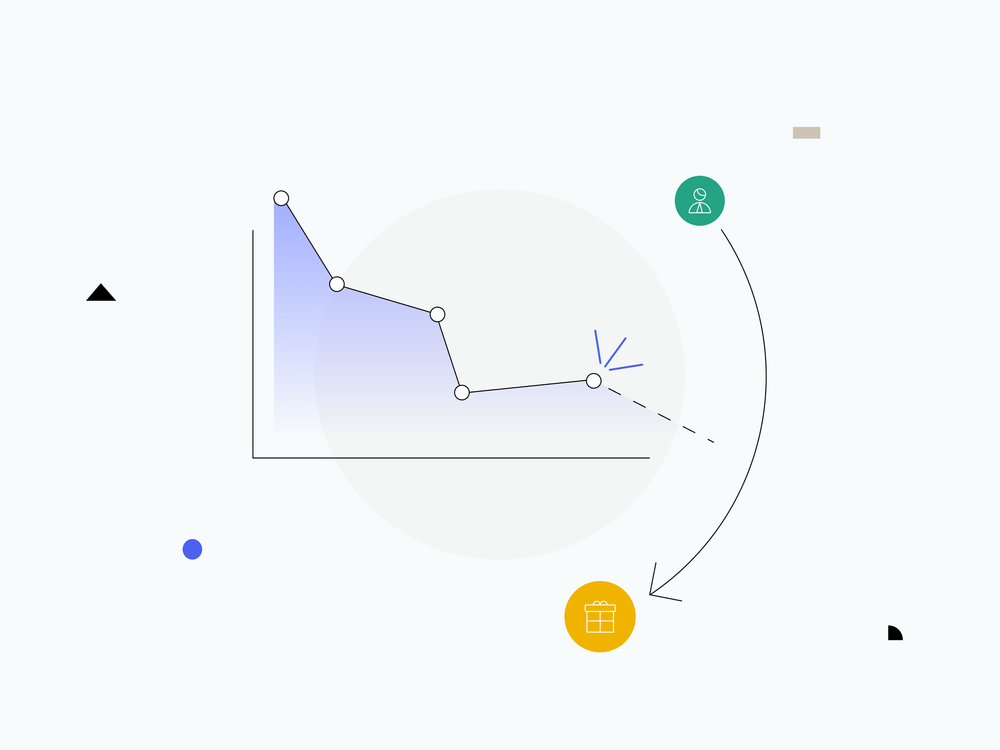

How financial advisors can add value in a bear market

It’s officially a bear market, now what? How advisors can add value when times are tough It’s brutal out there. After riding the sugar high of the pandemic, client portfolios – and probably your own portfolio as well – have found themselves in miserable hangover territory. The S&P recently hit a two year low and the Dow, not to be outdone, touched a yearly bottom as well. Instead of celebrating portfolio windfalls with your clients, you’re likely having some difficult conversations. But as challenging as these times are, there’s opportunity here. The current climate is the perfect chance to show...

Vanilla

•

Jul 19, 2021

Top 5 challenges of estate planning for blended families (and how to solve...

Deciding who gets what after one’s passing is tough. According to a survey by Caring.com, only 42% of American adults have essential estate planning documents, such as a will or a living trust. People avoid planning for the inevitable for many reasons. But for blended families, a major reason is that estate planning requires more than a simple will. Many difficult questions come up: How do I ensure everyone is well taken care of after I am gone? Should I leave everything to my spouse and hope they take care of my children? How do I avoid disinheriting my children?...

Daniel Brockley

•

Nov 03, 2022

Turning-Point Conversations: How to use important life events to refocus clients and deepen...

Curiosity – genuine curiosity – is one of the most important traits a financial advisor can have. Sure, this means curiosity about the different levers and pulleys of the economic machine, but it also means curiosity about clients. Not just about their risk tolerance, but about what makes them tick. Their goals, their fears. What gets them out of bed in the morning. A deeper understanding of clients as people, not just portfolios, enables you to bring the kind of value that goes far beyond index funds. There are certain times in life that lend themselves to these clarifying conversations–when...