Vanilla

•

Aug 22, 2025

Vanilla Shortlisted for “Disruptor of the Year” in 2025 US FinTech Awards

Bellevue, WA, August 22, 2025 – Vanilla, the most trusted estate planning platform for financial advisors, today announced it has been shortlisted for Disruptor of the Year in the 2025 US FinTech Awards. This recognition highlights Vanilla’s leading role in redefining how estate planning is integrated into wealth management and delivered at scale. Estate planning has long been disconnected from everyday financial advice, making it feel inaccessible to many advisors and clients. Vanilla’s patented technology is changing that. By transforming dense, complex legal documents into instantly digestible, interactive visuals, Vanilla empowers advisors to have deeper, values-based conversations with clients about...

Vanilla

•

Aug 20, 2025

What Are Letters of Administration and How to Obtain Them

When someone passes away without a valid will, it can create significant challenges for their heirs and loved ones. Letters of administration are provided by the probate court once an estate is opened and are crucial in such cases as they grant the legal authority to an individual to manage and settle the deceased’s estate. In the absence of a will, obtaining a letter of administration is the first step in the probate process. Letters of administration give the estate’s executor the power to handle the deceased’s financial obligations, sell property, and distribute the estate to its heirs in accordance...

Vanilla

•

Aug 12, 2025

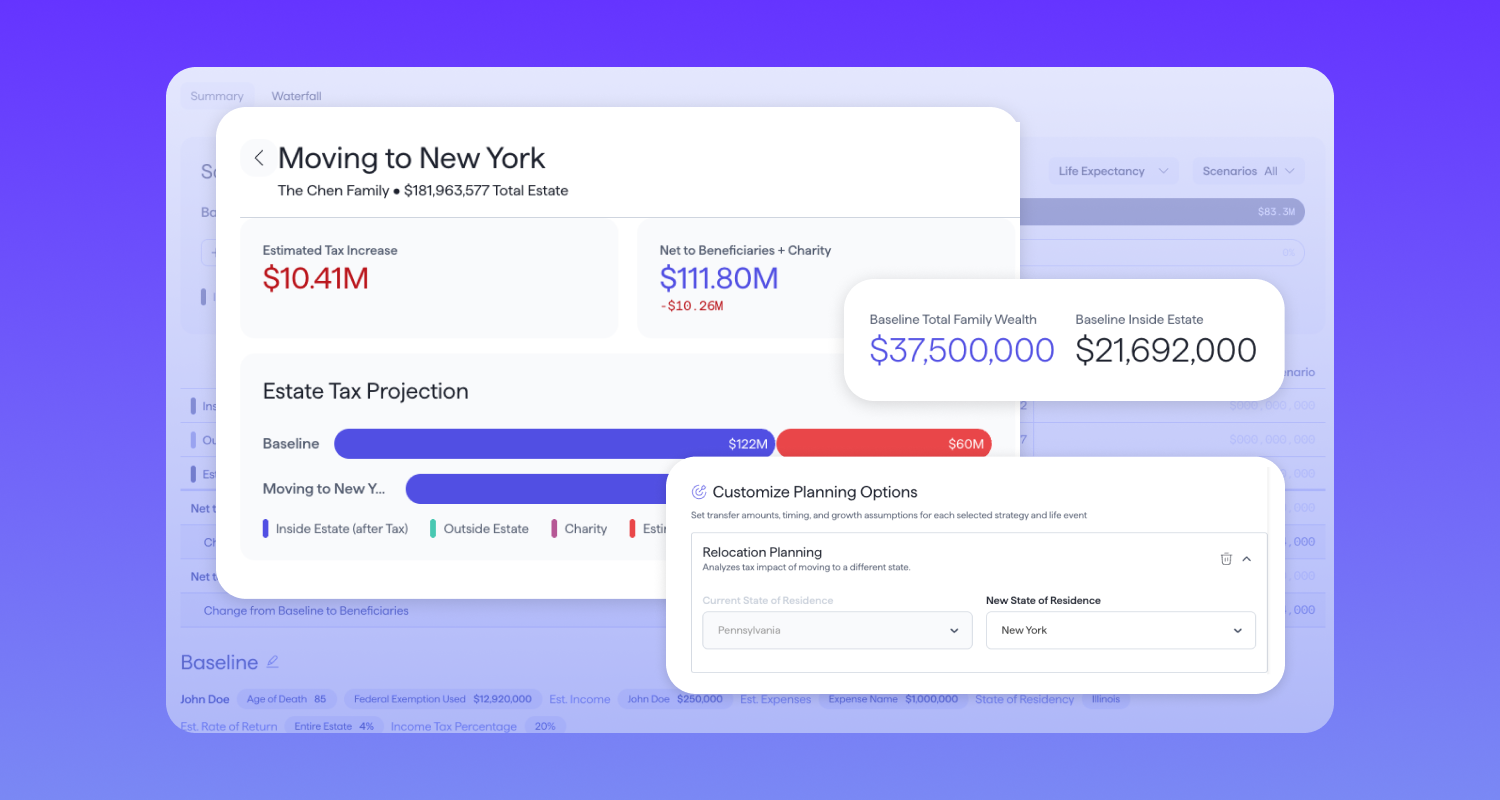

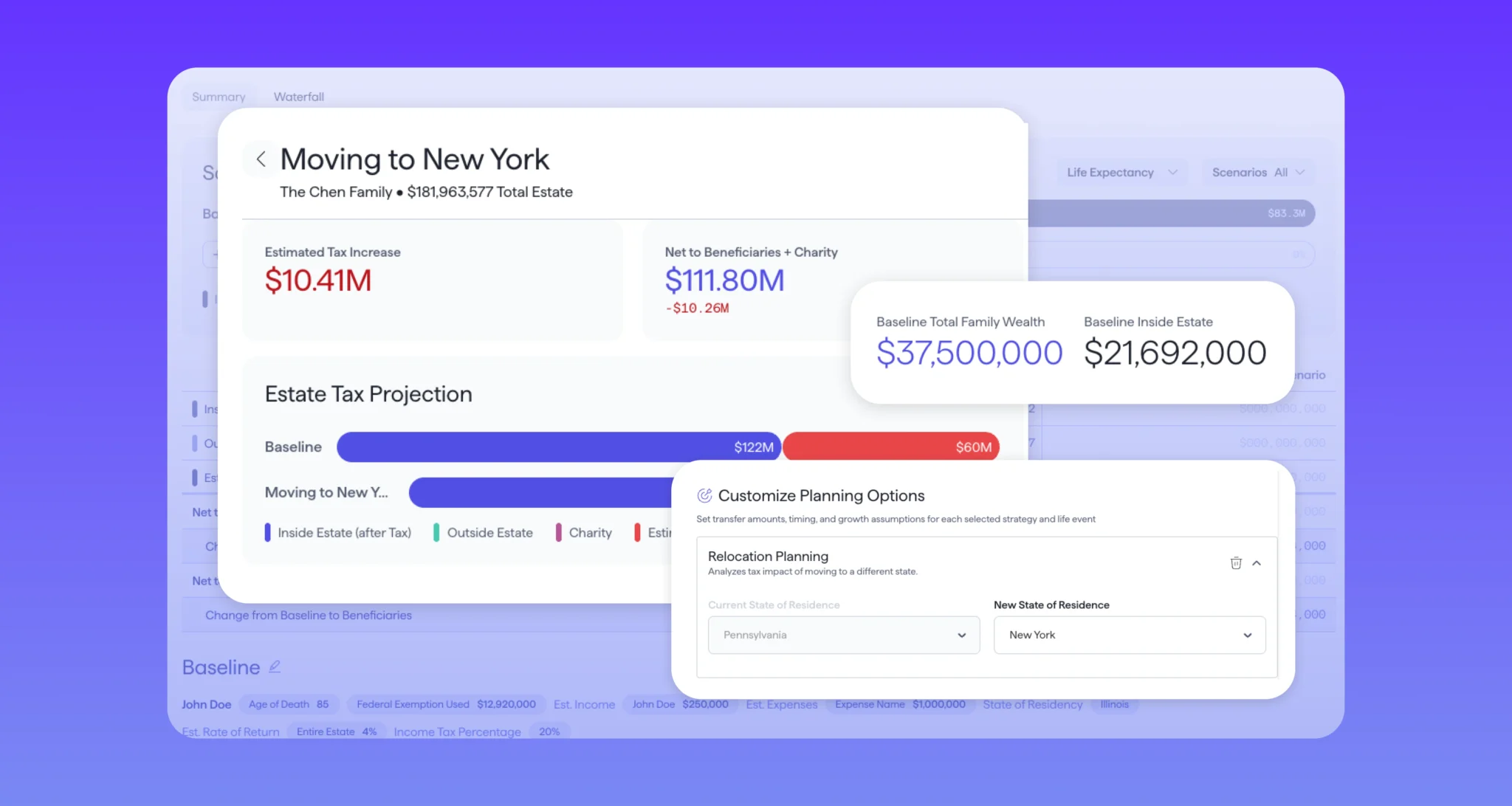

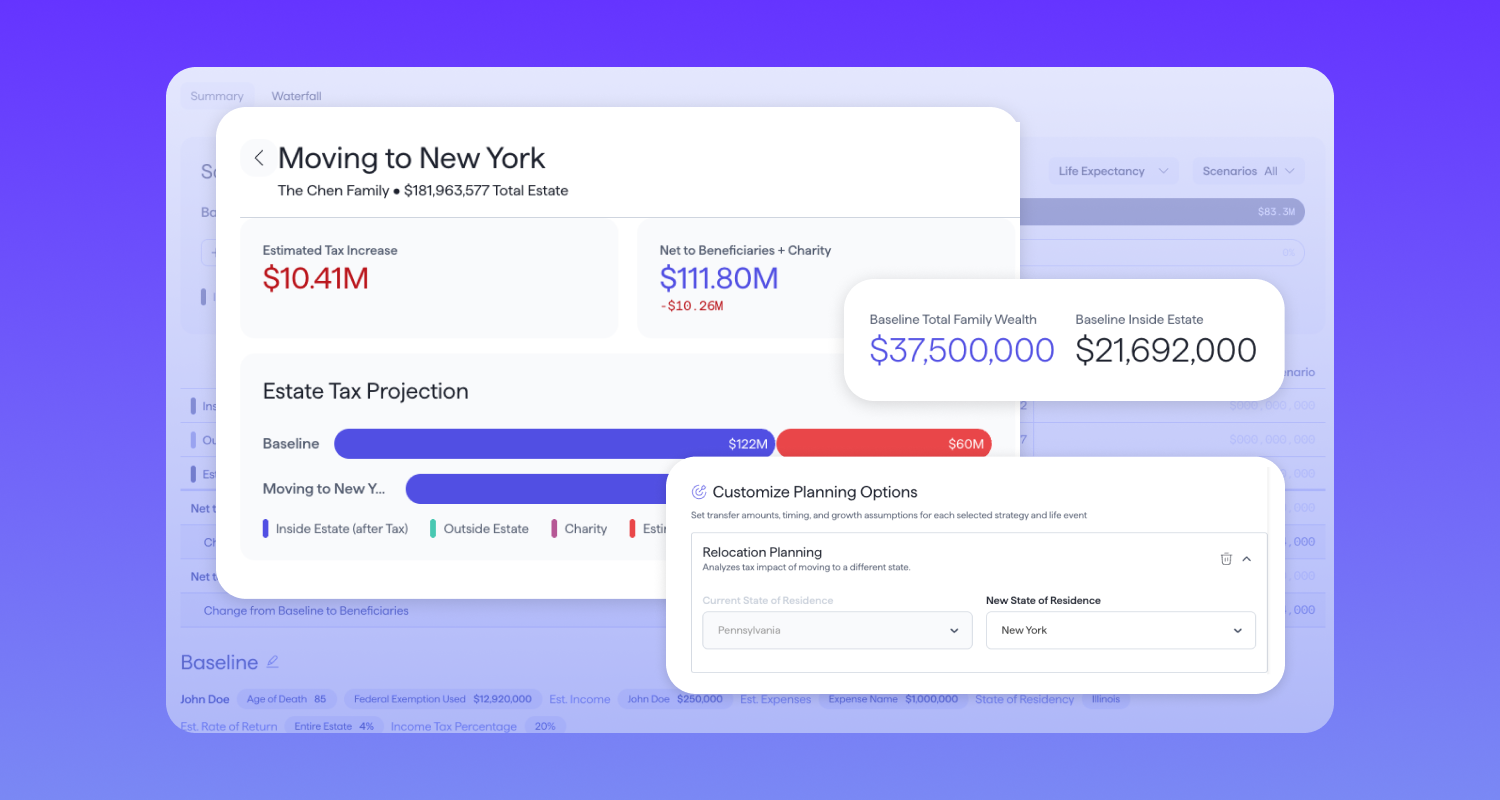

Vanilla Unveils Vanilla Scenarios™ Advanced Planning: The First Instant Modeling and Unified Workflow...

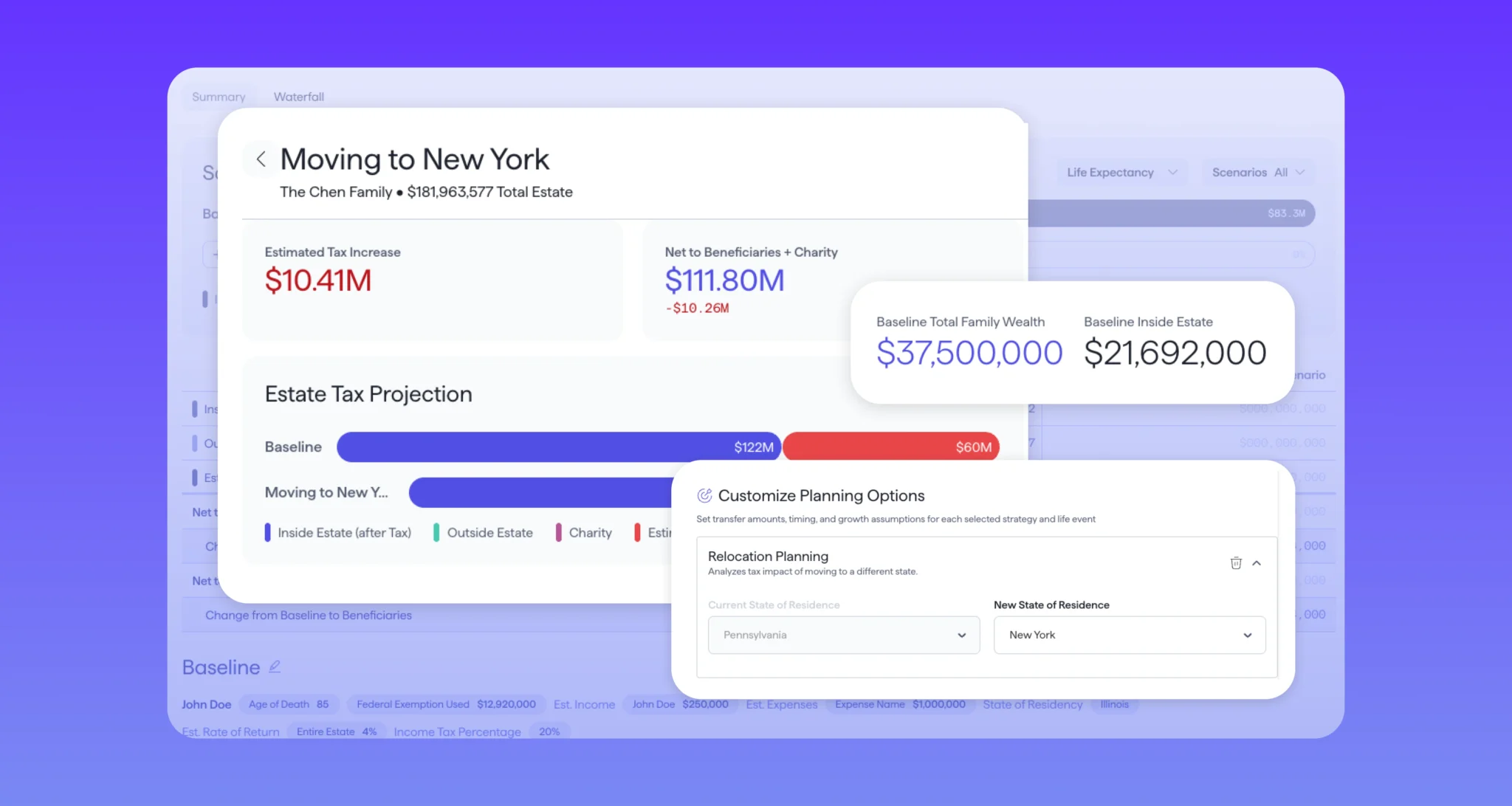

Advanced capabilities enable advisors to model complex estate planning strategies in minutes, transforming client conversations into collaborative planning sessions Bellevue, WA – August 12, 2025 – Vanilla, the leading provider of estate planning technology for advisors, today announced Vanilla Scenarios™ Advanced Planning, the next evolution of its all-in-one scenario planning tool. Building on the strong foundation established since its introduction in April 2024, this evolution of Vanilla Scenarios™️ delivers a more unified experience that enables financial advisors to model, compare, and present estate planning strategies with unprecedented speed and flexibility. Vanilla Scenarios™ Advanced Planning represents the most advanced estate planning...

Jessica Lantz

•

Aug 12, 2025

The Future of Estate Planning is Here: Introducing Vanilla Scenarios™ Advanced Planning

From first conversation to comprehensive strategy in minutes—powered by proven expertise and unmatched accuracy Today, we're excited to introduce Vanilla Scenarios™️ Advanced Planning—the next evolution of our all-in-one scenario planning tool that sets the standard for estate planning innovation. Building on success Over the past year, we've seen advisors achieve remarkable results with Vanilla Scenarios. But we've also heard a consistent request: make it even faster to get started, even more flexible for different workflows, and even more powerful for client conversations. The estate planning industry still faces fundamental challenges: fragmented tools that don't talk to each other, lengthy setup...

Vanilla

•

Aug 06, 2025

12 Probate Documents to Include in Your Probate Checklist

Probate—the court process of settling an estate—can be a complicated, time-consuming process. It’s also document-heavy. Having all the necessary documents in order can help streamline probate, reducing potential conflicts and hang ups. [embed]https://justvanilla.wistia.com/medias/vd3bfy1xvp[/embed] There are 12 essential documents that should be part of every probate checklist, each of which plays a part in ensuring the estate is properly administered and that the decedent’s wishes are honored. In this article, you’ll learn what each document is, how to obtain it, and what purpose it serves. Making sure you have and understand all the necessary documents can help make probate a smoother...

Jessica Lantz

•

Jul 29, 2025

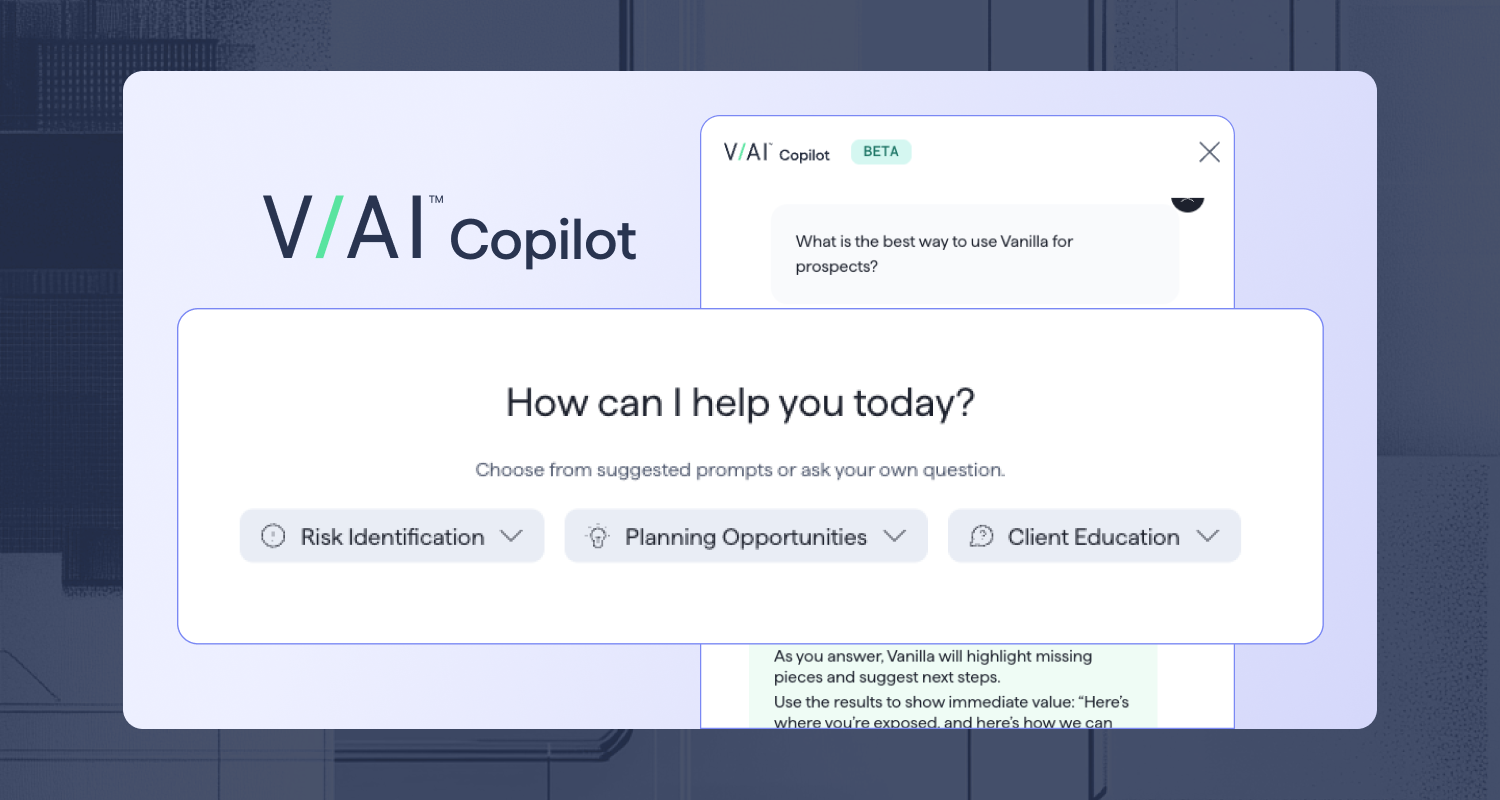

What’s New in July: Updates to V/AI, enhanced integrations, and a sneak peek...

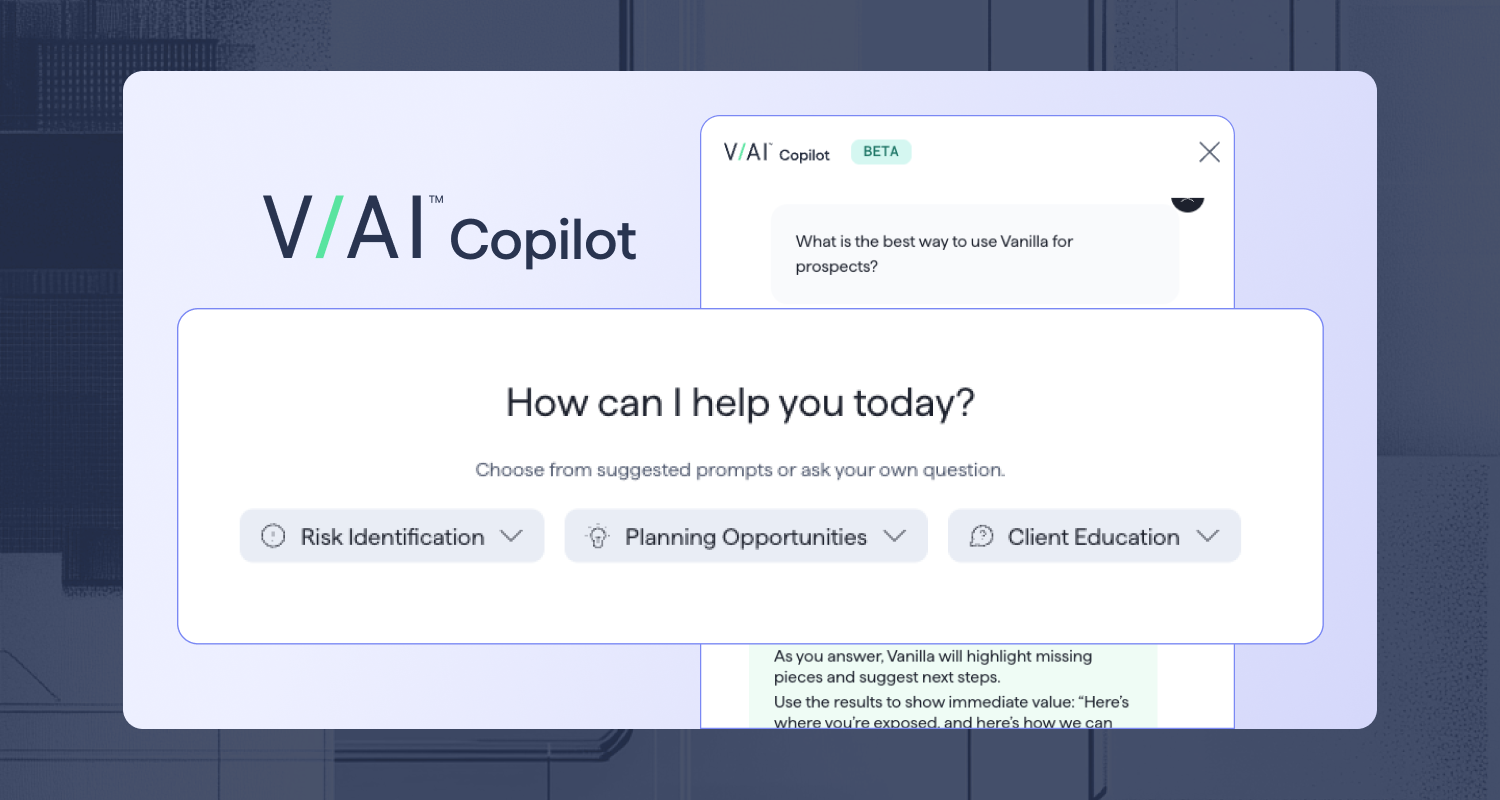

We’re launching some serious upgrades for July! This month's releases focus on expanding AI capabilities, customizing Vanilla's appearance, and enhancing your integration experience – plus, catch a special preview of our most sophisticated planning tool yet. V/AI enhancements: Your AI estate planning assistant just got smarter We’re excited to announce some game-changing updates to V/AI Copilot, and an upgraded version of V/AI Summaries this month. The Problem: Estate planning requires deep analysis across multiple data points—from financial structures to family dynamics—and advisors need AI that can provide comprehensive insights across multiple areas of a client's profile and for multiple types...

Vanilla

•

Jul 24, 2025

Vanilla Secures US Patent for Groundbreaking Estate Planning Technology for Financial Advisors

Bellevue, WA — July 24, 2025 — Vanilla, the modern estate planning platform that simplifies and elevates the advisor-client experience, announced today that it has been granted a U.S. patent for its innovative event-based resource allocation system. This proprietary technology underpins many of the platform’s most advanced capabilities, including report automation, waterfall calculations, estate visualizations and abstractions, and AI-powered opportunity discovery. The patented system represents a major breakthrough in estate planning technology, utilizing advanced machine learning models and real-time event processing to transform how financial advisors manage and allocate client resources. This technology addresses the complex challenges of estate planning...

Vanilla

•

Jul 23, 2025

Starting the Conversation: 12 Estate Planning Questions to Ask Clients

Estate planning is one of the most important conversations you'll have with your clients, yet it's often one of the most overlooked. While many people think estate planning is simply about filling out forms and signing documents, the reality is far more nuanced. True estate planning begins with understanding what your clients truly value and ensuring their deepest wishes are reflected in their plan. The key to successful estate planning lies in asking the right questions during that crucial initial consultation to help you understand not just your client's financial situation, but their hopes, fears, and long-term goals for their...

Vanilla

•

Jul 11, 2025

Does a Will Avoid Probate? The Truth and Common Misconceptions

A persistent, common misconception is the belief that having a will helps to avoid probate. Clients frequently assume their carefully crafted will protects their family from probate and its potentially lengthy court proceedings, expensive legal fees, and public disclosure of financial information. The truth often surprises clients: wills require probate to be legally effective in most situations. Understanding this relationship, and knowing how to educate clients about effective probate avoidance strategies, can significantly improve your advisory relationships while helping families achieve their actual estate planning goals. Why probate avoidance matters to your clients It's crucial to understand why probate avoidance...

Vanilla

•

Jul 10, 2025

Top 8 Benefits of Estate Planning (And Why It Matters)

Introduction Imagine a family caught off guard by the sudden loss of a loved one—left scrambling to make legal decisions, untangle financial assets, and settle emotional disputes without a clear plan. Unfortunately, this is a common reality for families without an estate plan. Many people delay or avoid estate planning due to common misconceptions: “It’s only for the wealthy,” or “I’m too young to need it.” In truth, estate planning is not just for the ultra-rich or elderly—it’s a critical process that benefits people of all ages and financial backgrounds. Whether you want to protect your children, support a charitable...

Patrick Carlson, JD, LLM

•

Jul 10, 2025

Estate Planning Under the Big Beautiful Bill

The landscape of estate planning has shifted dramatically with the passage of the One Big Beautiful Bill Act (OBBBA). For financial advisors, understanding these changes is crucial for guiding clients through a new era of permanent estate tax rules that fundamentally alter planning strategies. The game has changed: OBBBA rewrites estate tax rules The OBBBA eliminates the looming 2026 sunset provision and establishes permanent estate tax rules with a $15 million federal exemption per person starting in 2026, rather than the estimated $7.3 million that would have resulted from the sunset. This isn't just a temporary reprieve—it's a complete restructuring...

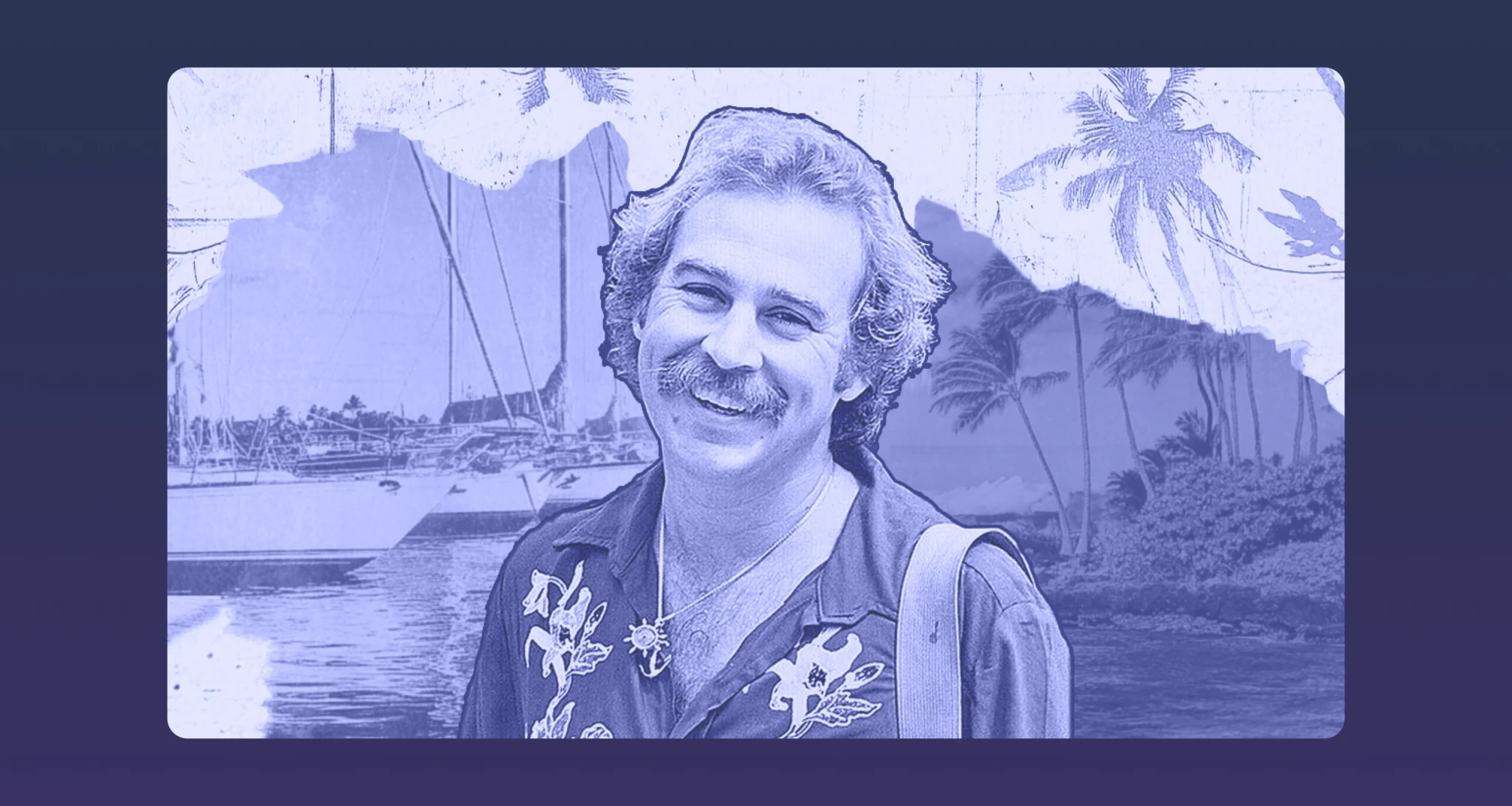

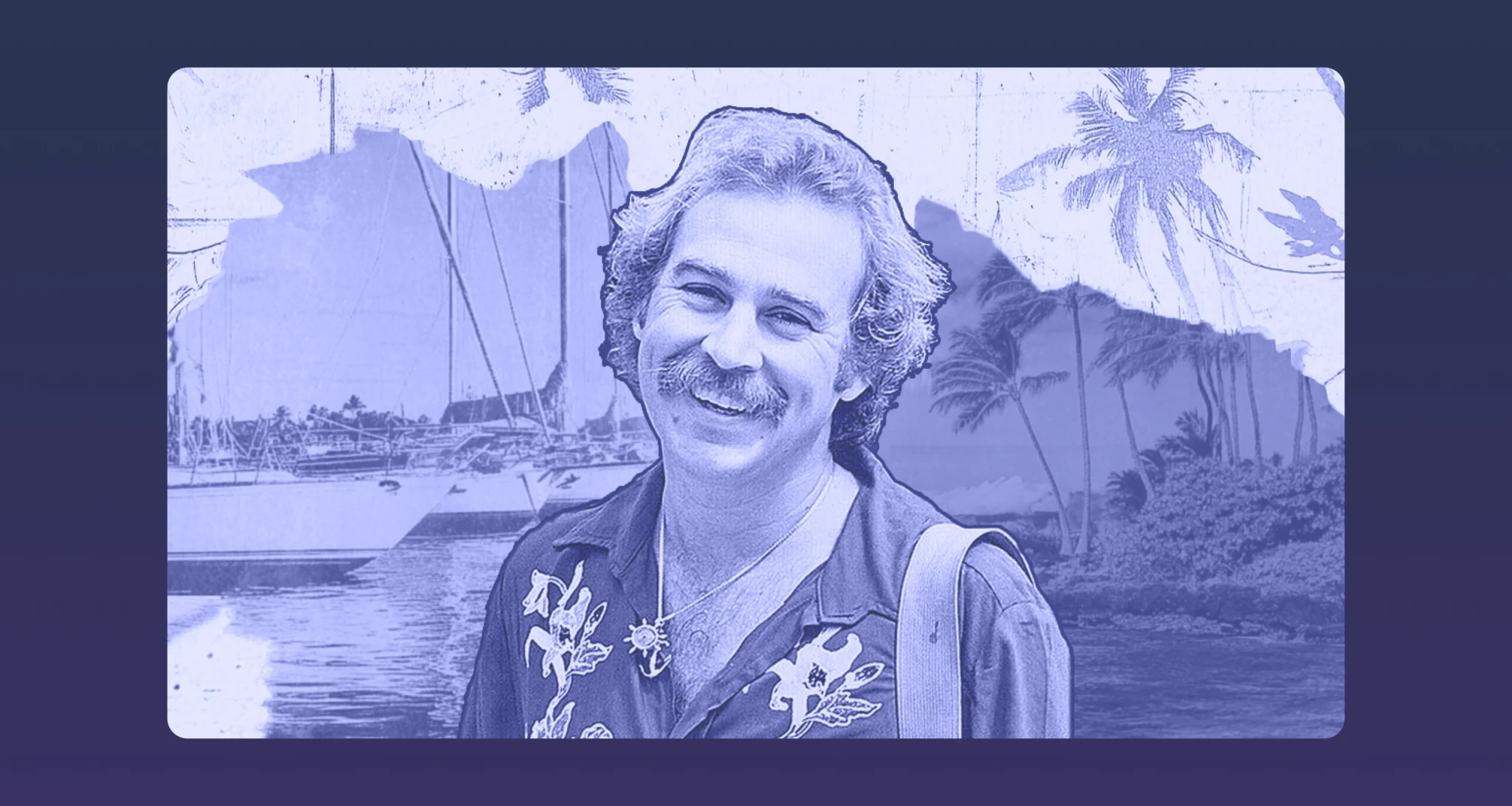

Steve Lockshin

•

Jun 27, 2025

What Jimmy Buffett’s Estate Battle Can Teach Us About Trustee Selection and Legacy...

The recent headlines surrounding Jimmy Buffett’s $275 million estate are not just tabloid fodder—they’re a case study in what happens when good planning on paper meets the unpredictability of human relationships and unclear expectations. While we don’t yet know the full facts, what’s emerging is an all-too-familiar theme: a fight over control of a legacy that was likely intended to bring comfort, not conflict. Buffett was known for living life on his own terms, building an iconic brand that fused music, real estate, hospitality, and culture. He also did what many high-profile individuals do: he put his assets into a...