Estate planning considerations unique to Texas

Estate-related laws, taxes, and probate processes can vary by state. Here are a few of Texas’s notable distinctions:

No state taxes

Texas currently does not have a state estate or inheritance tax.

No small estate affidavit

Currently, Texas is one of only four states that does not offer a small estate affidavit, which would allow an estate valued below a certain threshold to go through a simplified probate process.

Probate

Compared to other states, probate in Texas can be relatively simple. There are a few reasons for this:

Texas offers “independent administration,” which allows the executor of an estate to act without court supervision for some parts of the administration process. This can make probate faster and less costly.

Muniment of Title is a probate procedure unique to Texas in which a will can be probated without the need for an administrator or executor. If there are no debts to be paid by the estate, this can enable a simpler and less expensive way to transfer assets.

In some cases, probate can be bypassed in Texas with a Small Estate Affidavit. If an estate’s value falls below a certain threshold and there are no debts to be paid, the heirs may be able to forgo a full probate administration.Community propertyTexas is a community property state, meaning that any assets acquired during a marriage are considered to be owned equally between the two spouses.

Homestead exemption

Texas offers strong homestead exemptions, including protection from creditors, protection for a surviving spouse and children, protection in bankruptcy, and more.

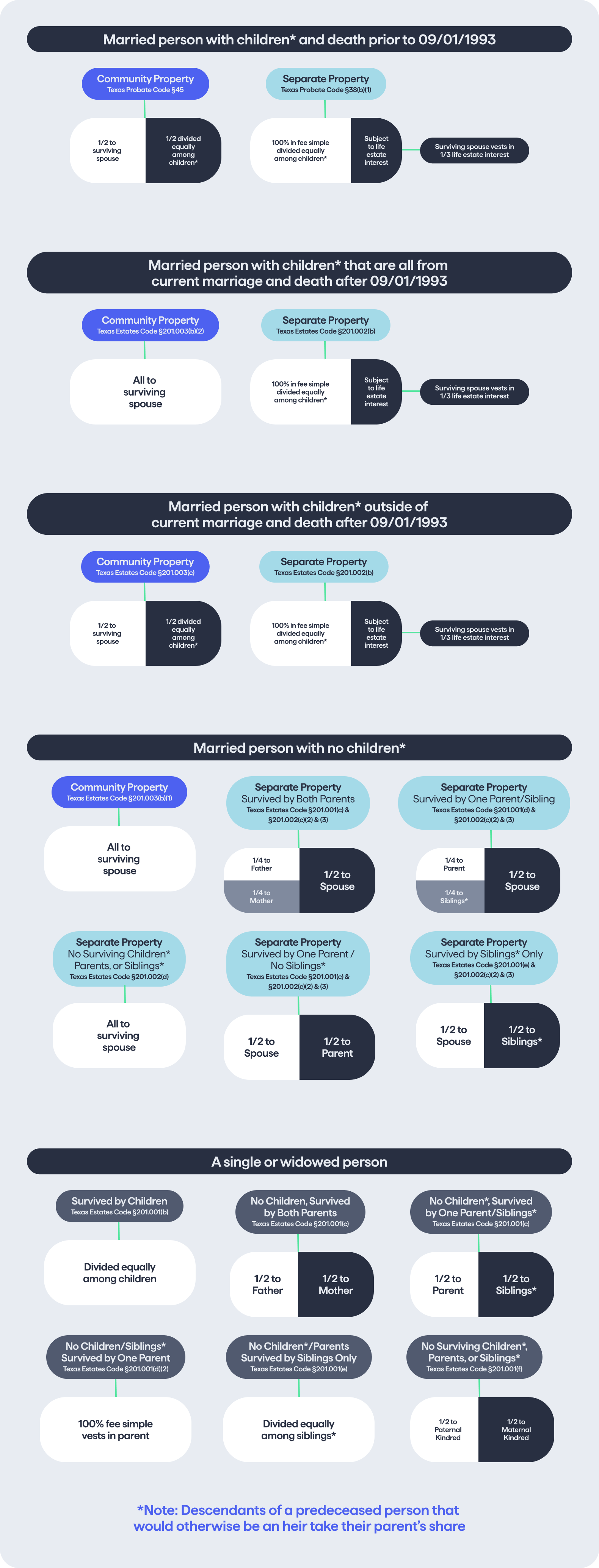

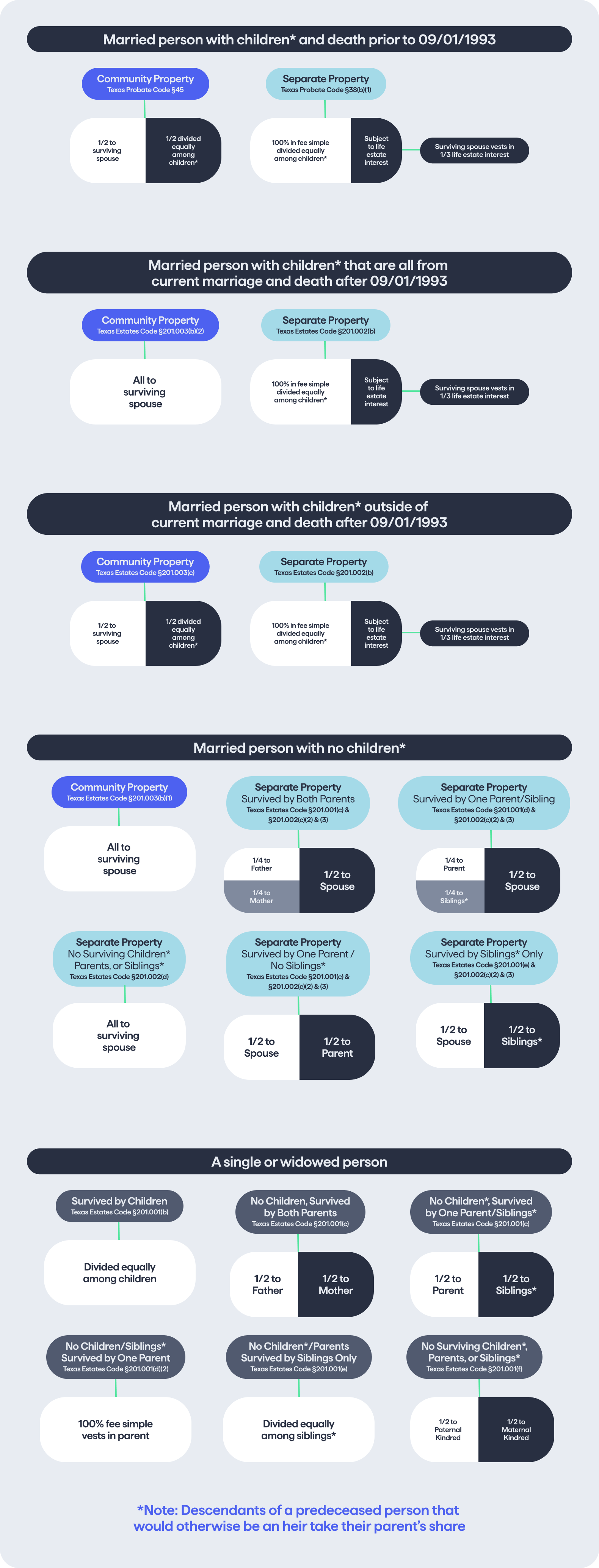

Intestate succession in Texas

Here’s a summary of how assets transfer when someone dies intestate in Texas: