Estate planning considerations unique to Illinois

Here are some estate planning laws and regulations to be aware of in Illinois.

Small estates

Illinois offers a simplified probate process for small estates, which includes estates valued at $100,000 or less excluding real estate. Probate can be faster and less expensive in these cases. In these situations, heirs can use a Small Estate Affidavit to claim assets without a formal probate process.

Independent administration

Illinois allows for independent administration of estates, in which the executor can administer the estate without ongoing court supervision. This can speed up the administration process and reduce expenses.

No inheritance tax

Illinois does not have a state inheritance tax, which generally allows beneficiaries to claim inherited assets without paying state taxes on them.

State estate tax

Illinois does have a state estate tax, which applies to estates with values over $4 million. This means that if your estate is worth more than $4 million, there is a graduated tax rate up to 16% that would have to be paid before assets can be distributed to heirs.

Community property

Illinois is not a community property state, so assets acquired during a marriage are not automatically jointly owned by spouses. Illinois follows equitable distribution principles in divorce cases.

Probate courts

Unlike many states where probate courts are separate entities, probate proceedings in Illinois are handled by county circuit courts. Additionally, Illinois probate courts handle guardianship proceedings for minors and disabled adults as they relate to a decedent’s estate.

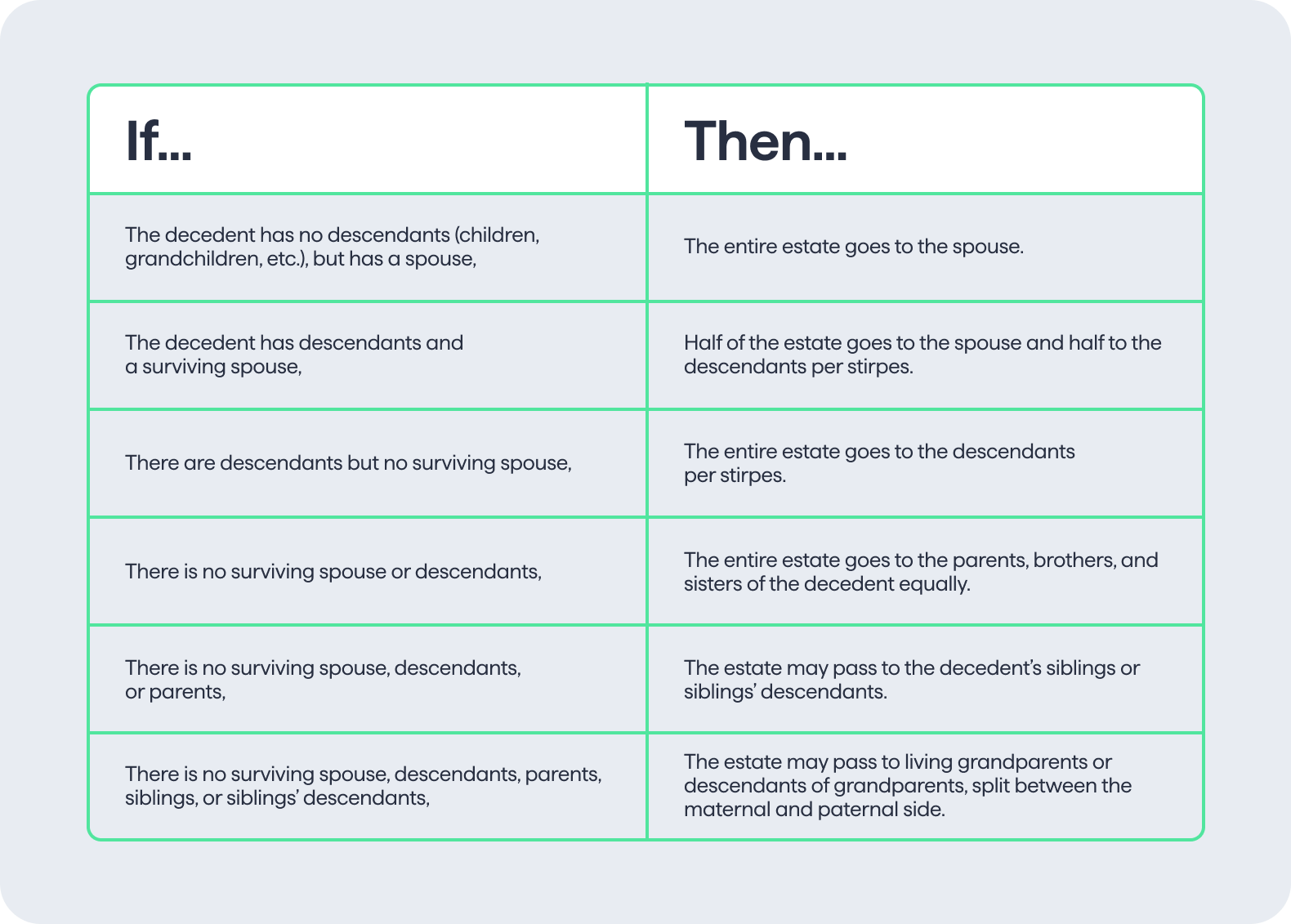

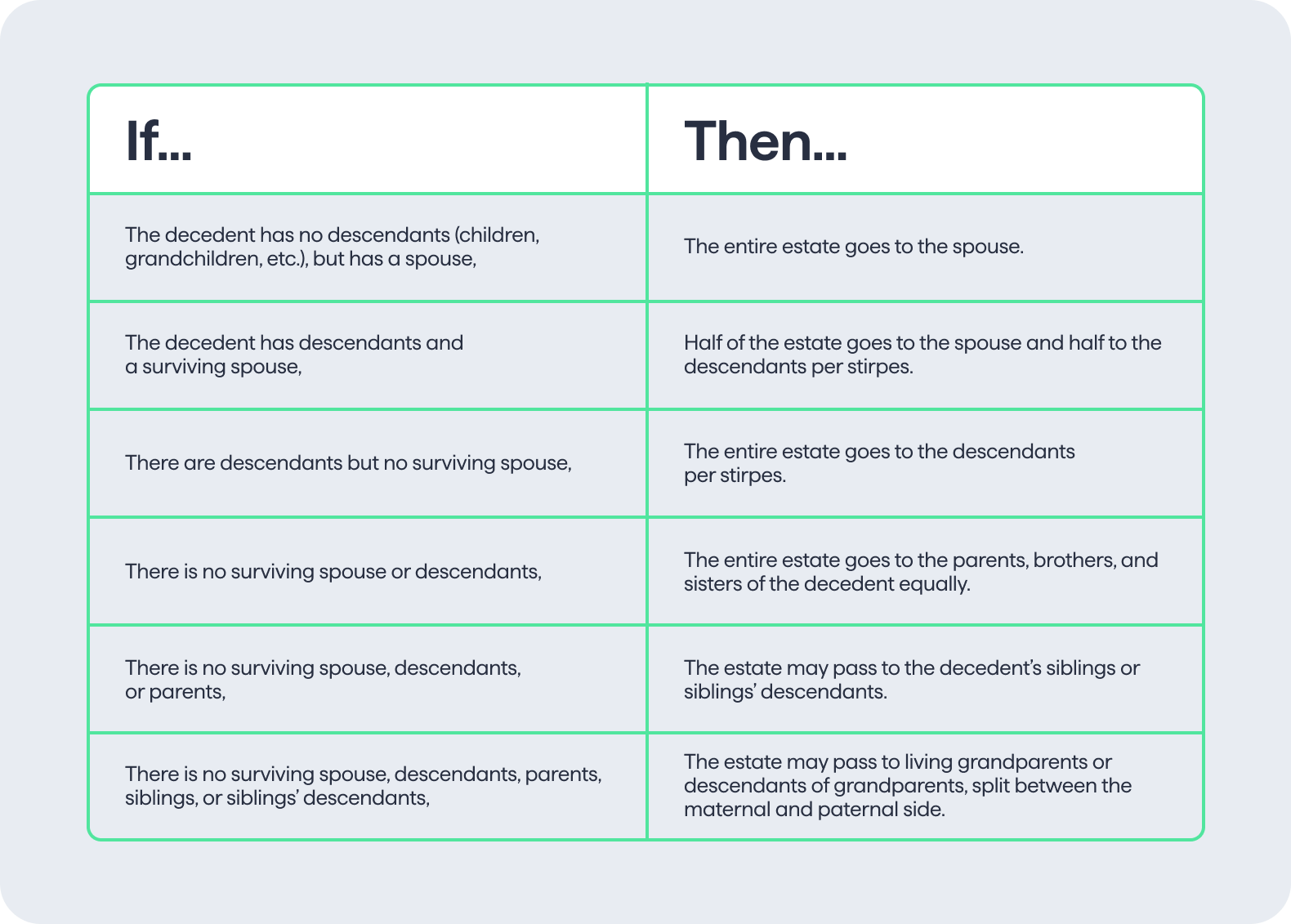

Intestate succession in Illinois

How do assets transfer when someone dies without a will in Illinois? Generally, an intestate decedent’s property passes “per stirpes,” meaning that each branch of the family receives an equal share as long as someone in that branch was living at the time of death.