Vanilla

Vanilla

What is a charitable remainder trust? (with examples)

Many people have charitable intentions that they would like to consider as part of their estate planning. However, donating assets outright during their lifetime may not meet their financial goals. A more advanced estate planning strategy, such as a charitable remainder trust, may provide the flexibility to meet their personal financial needs while guaranteeing that a charity or charities end up with the remaining asset at the end of the term or when the settlor/donor is no longer living.

When to use a Charitable Remainder Trust (CRT):

-

When you are charitably inclined; and,

-

You have highly appreciated securities you would like to diversify, and,

-

You would like a stream of income from the diversified portfolio.

What is a charitable remainder trust?

The charitable remainder trust is a legal vehicle set up by an individual (the “donor”). The donor funds the CRT with certain assets and is then entitled to draw an annual payment over the lifetime of the trust. When the donor dies (or the trust term ends), anything that remains in the trust immediately goes to a charity. The ultimate amount that the charity will receive will depend on how much the assets inside the CRT have appreciated, the payments to the donor over the trust term, and, in some cases, how long the donor lives. It is important to note that to be a valid CRT, it must always be structured so that the expected payment to the charity is at least 10% of the net fair market value of all the property initially placed in the trust.

There are two types of charitable remainder trusts with slightly different variations and related calculations with respect to any associated deduction.

Choose the one that best fits your planning needs:

Charitable Remainder Annuity Trusts (CRAT)

A CRAT pays out a set amount of money each year that falls between 5% and 50% of the value of the trust property at the time the trust was established.

Charitable Remainder Unitrusts (CRUT)

A CRUT pays out an amount each year that is based on the value of the trust (between 5% and 50%) each year. As the value of the assets held by the CRT changes, so do the payment amounts.

How does a charitable remainder trust work?

A trust agreement, prepared by an attorney, will identify the term of the trust (which can be for the lifetime of an individual, or for a set number of years not to exceed 20 years), as well as the individuals that will receive an annual payment from the CRT. The trust agreement will also establish whether it will be structured as a CRAT or a CRUT, what charitable organizations are to receive the remainder payment and who will act as trustee. The remainder must be paid out to a recognized U.S. charitable organization that’s still in existence when the final funds are disbursed.

Once the CRT has been created, the donor will transfer assets to the CRT. When the donor funds a CRT, the donor gets a charitable deduction for the present value of the expected amount that will pass to charity at the end of the trust term. The amount of the deduction that may be used that year is subject to certain AGI limitations.

During the term of the CRT, individuals named in the trust agreement will receive an annual payment. A donor may only designate annuitants at the time of the trust creation and only for living people (you cannot designate a future, unborn grandchild, for example, to receive trust payments). It is important to consider potential gift tax consequences when funding a CRT. If the donor and/or the donor/s spouse are the beneficiaries of the CRT, there are no gift tax implications when funding the CRT. However, if the donor would like another individual to receive the annual payments from the CRT, there may be gift tax implications when the CRT is funded.

What are the tax benefits of a charitable remainder trust (CRT)?

The CRT is a tax-exempt entity, so it does not pay income tax on income generated by its assets. Instead, the trust income is “carried out” to the beneficiary of the trust as payments are made each year. The income is then taxable to the CRT beneficiary and should be reported on his or her own income tax return. According to the IRS, payments to a non-charitable beneficiary are taxed as distributions of the trust’s income and gains in the following order:

-

Ordinary income: Payments are considered ordinary income first to the extent the trust had ordinary income for the year and undistributed ordinary income from prior years. If the trust has enough ordinary income to cover all payments, the entire payment is taxed as ordinary income. Beneficiaries must report payments as ordinary income as reported to them on Schedule K-1.

-

Capital gains: Once the trust’s ordinary income is exhausted, payments are taxed as capital gains based on the sale or disposition of the trust’s capital assets. These payments are taxed as capital gain to the extent of the capital gain of the trust for the current year and any undistributed capital gain income from prior years.

-

Other income: Once all ordinary income and capital gains in the trust are fully distributed, payments are characterized as other income to the extent of the trust’s current year and accumulated other income. This includes tax-exempt income.

-

Corpus: After all current-year and accumulated income and gains are fully distributed, payments would lastly be considered corpus or “principal” of the trust not subject to tax.

The trust has no limits on the number of annuitants, and you must decide if you want the payments to be set for the lifetime of an annuitant or a set number of years (not to exceed 20 years). You may only designate annuitants at the time of the trust creation and only for living people. (You cannot designate a future, unborn grandchild, for example, to receive trust payments.)

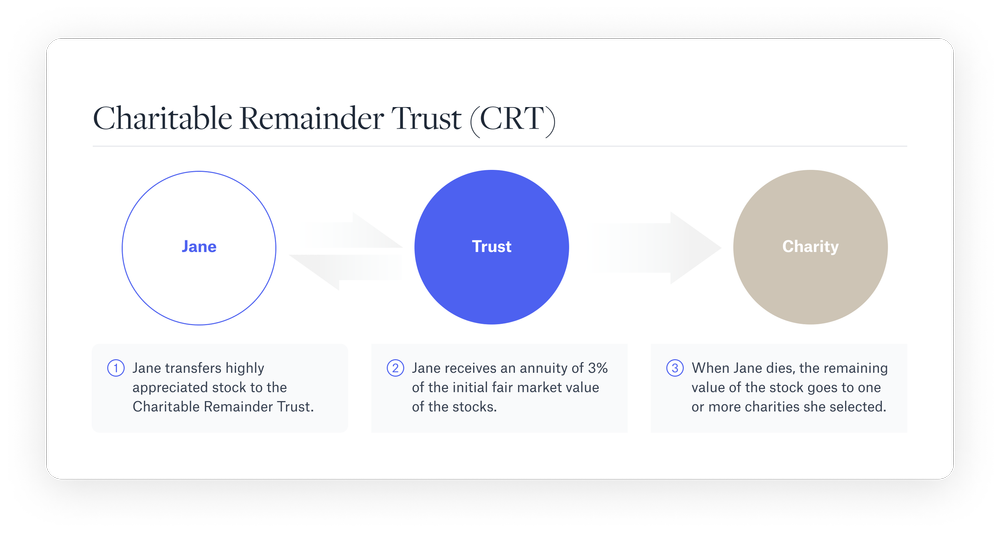

A charitable remainder trust (CRT) example

Here’s an example of how a charitable remainder trust would work for Jane, a fictional woman with significant assets.

Jane sets up a CRT and funds the CRT with highly-appreciated stock that she would like to sell. She names herself the lifetime annuitant and chooses a CRAT model with a 3% annuity, which means Jane is entitled to an annual payment equal to 3% of the initial fair market value of the assets contributed to the CRT. Jane chose a lifetime payout model, so when she dies, the trust dissolves, with the assets remaining donated to the charity she names in the trust. The amount of the deduction that Jane can take for this contribution is a function of her age and the estimated remainder of the CRT at Jane’s estimated actuarial death.

Because the CRT is a tax-exempt entity, when the trustee sells the appreciated stock, there is no immediate income tax on the capital gains. Instead, when Jane receives her annuity each year, some portion of the capital gains and any income will be “carried out” to her, and she will be responsible for the income tax on the distributions. This has the effect of deferring the income tax liability on the sale of the stock over Jane’s lifetime.

Note to financial advisors

Ask these questions to help guide clients interested in a CRT:

-

Are you charitably inclined, and does your current plan contemplate any charitable gifts upon your death?

-

Do you have any highly-appreciated stock you are not selling because you don’t want to pay the capital gains tax?

-

Who, besides yourself, could benefit from the income payments a CRT provides? Would naming friends or family as annuitants help them in a way a gift upon your death won’t? Can they handle the income tax implications of an ongoing CRT disbursement?

-

Would you now, or in the future, need to access the assets you are considering for a CRT? Have you considered how losing control over these donated assets would affect your future plans?

Learn more information about gifting strategies in Vanilla’s Guide to Gifting.

About Vanilla

Vanilla is the Estate Advisory Platform, purpose-built to enable financial advisors to build deeper relationships with their clients and empower clients to build and protect their legacy. From robust and easy-to-understand visualizations of complex estates, detailed diagrams of how assets transfer to future generations, to ongoing estate monitoring, Vanilla is reinventing the estate planning experience, end-to-end. Learn more about Vanilla’s estate planning software.

Media inquiries: Please contact press@justvanilla.com

This article is for educational purposes only and should not be considered legal advice. If you feel that the information in this article is pertinent to your situation, you may wish to consult a qualified attorney for advice tailored to your circumstances.

Published: Jan 10, 2023

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.