Estate planning considerations unique to Colorado

Estate-related laws and taxes can vary by state. Here are a few of Colorado’s notable distinctions:

Separate Property System

Colorado, like most other states, is a separate property state, meaning that property and assets acquired during marriage are still considered the separate property of each spouse.

Portability of Estate Tax Exemption

Although Colorado does not have a state estate or inheritance tax, Colorado residents may need to consider federal estate tax portability.

Probate Process

Colorado allows for informal probate, which is a simplified process for estates that meet a certain threshold. For larger estates, formal probate may be necessary, which can be a costly and time-consuming process.

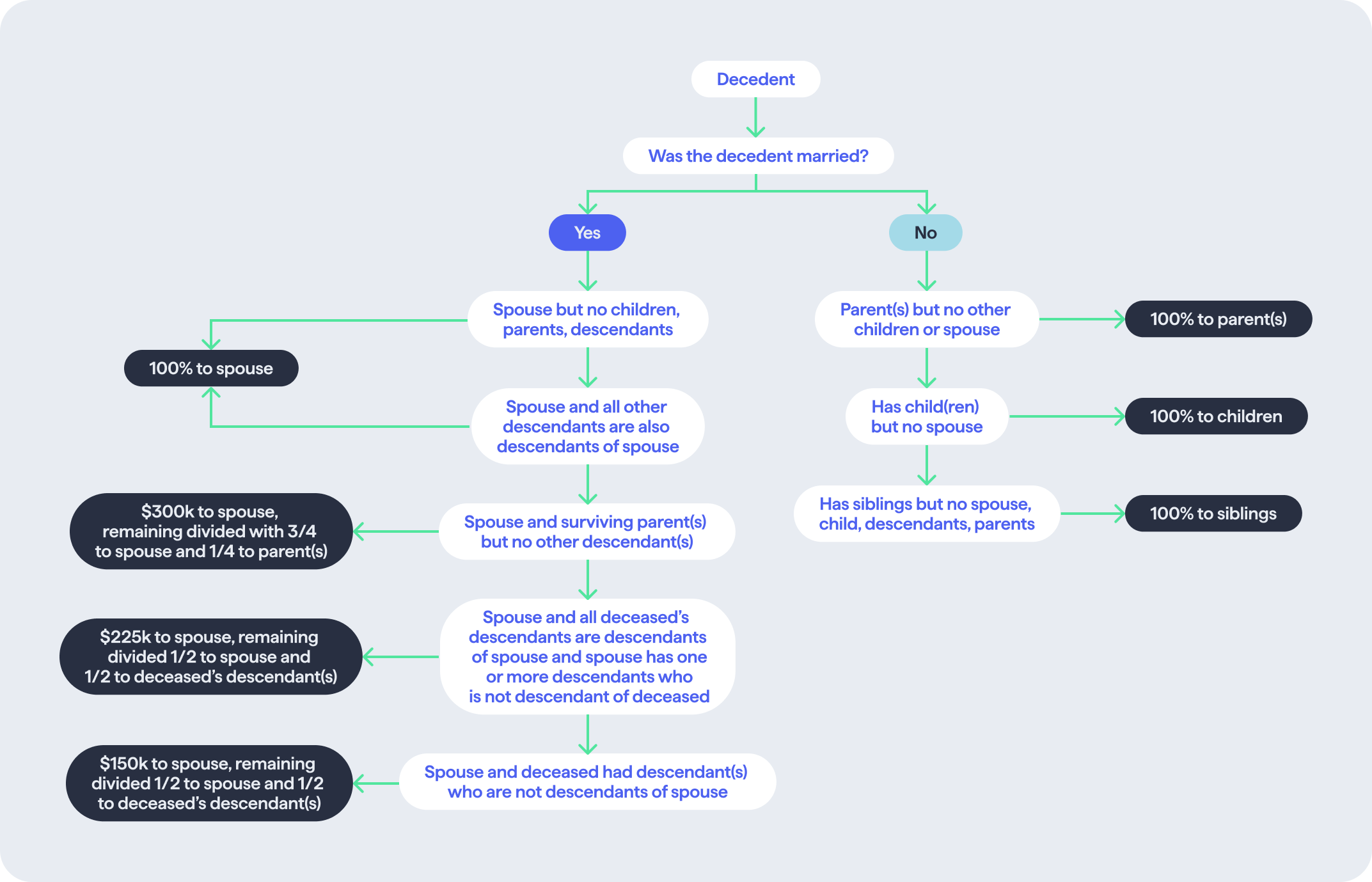

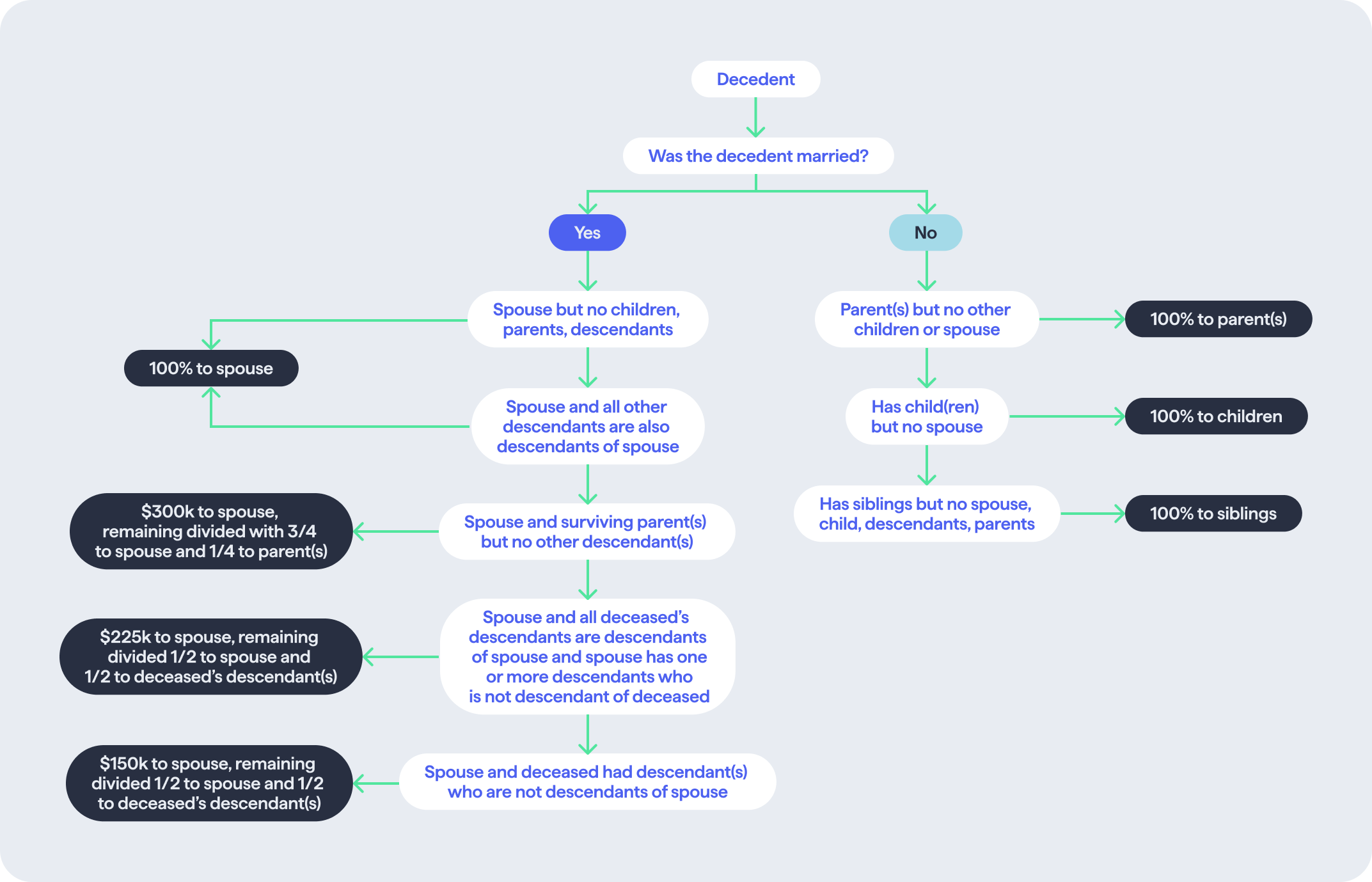

Intestate succession in Colorado

Here’s a summary of how assets transfer when a person dies intestate in Colorado: