Category: Estate Planning

Simona Ondrejkova, CFP

•

Apr 15, 2024

Section 6166: How You Can Defer Estate Tax

Do you have clients who own a business or have just recently inherited one? When it comes to estate planning for business owners, understanding section 6166 of the US tax code could make a big difference in ensuring continuity of the business after the owner passes away. While there are several estate planning strategies that can help clients reduce their overall estate tax bill, those who own a business should also be aware of strategies to defer payments on estate taxes to keep their heirs from having to do a fire sale of the business just to pay taxes. So...

Simona Ondrejkova, CFP

•

Apr 04, 2024

Schedule K-1 Forms: Managing Your Client’s Estate Income

When helping clients with their estate plan, taxes are one of the key components to take into account as part of the planning process. And while there are several estate planning strategies that can be used to minimize or eliminate estate taxes for clients, here we’ll talk specifically about taxes that an estate or a trust incurs on its income. One of the forms that clients should be familiar with if they are trustees, administrators, or beneficiaries of an estate or a trust is schedule K-1. Since there are a few different types of K-1 forms, it’s important to understand...

Madison Eubanks

•

Apr 02, 2024

Letter of Testamentary: What It Is & Why You Need It

Creating a last will and testament is one of the most fundamental efforts in estate planning, and a key component is naming an executor to carry out the will’s instructions. The executor is the person who will administer the estate, sees it through the probate process, and settles the decedent’s final affairs—in short, it’s a big responsibility. Before the executor can begin administering a deceased person’s estate, though, the executor needs to obtain a Letter of Testamentary (also called letters testamentary). In this article, we’ll explain what a letter of testamentary is, why you might need one, how to get...

Simona Ondrejkova, CFP

•

Mar 28, 2024

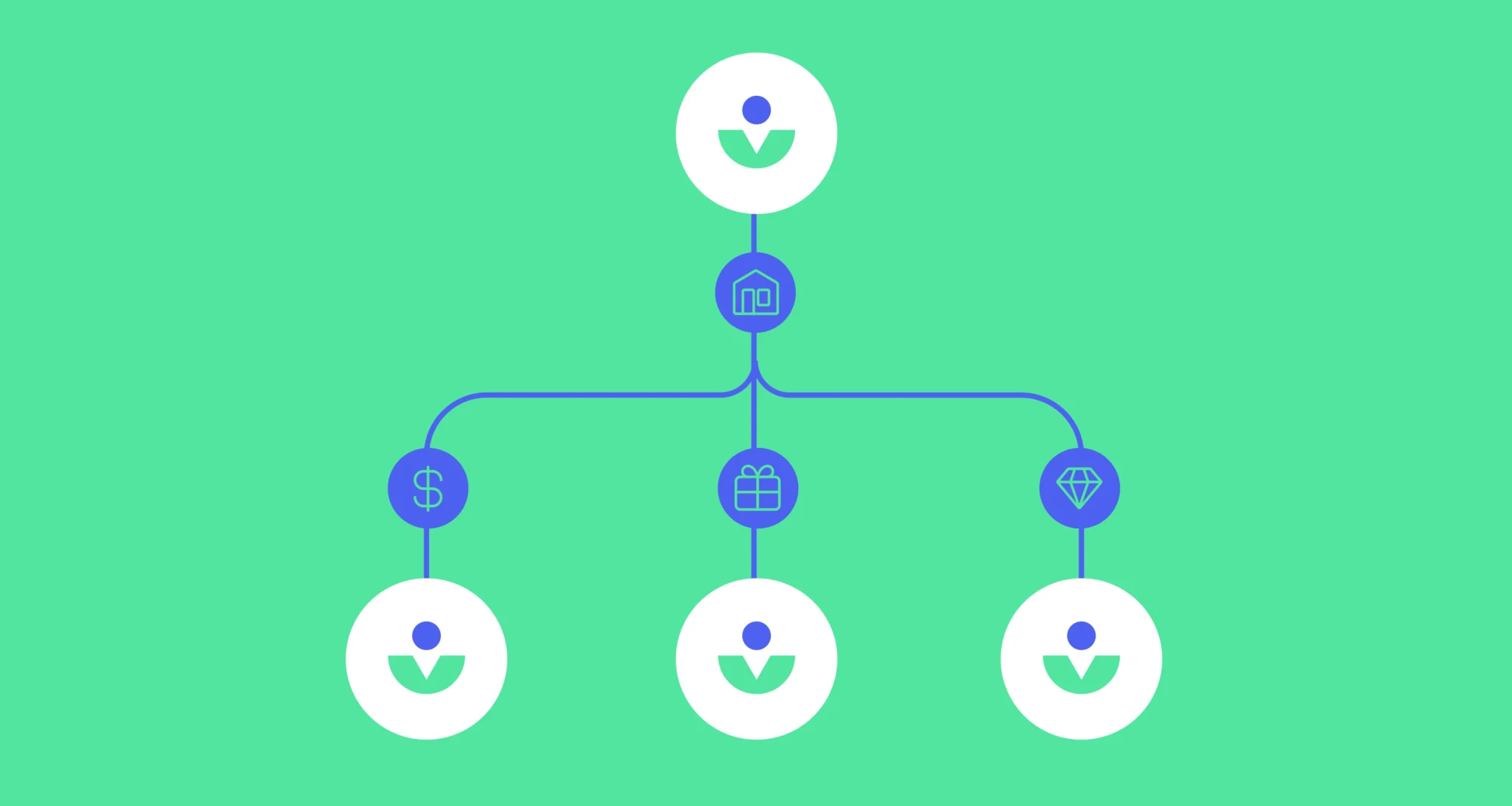

Should you use a transfer on death account (TOD)?

When it comes to estate planning, each individual’s needs dictate the simplicity or complexity of the solution that will best fit their goals. For those who care about avoiding probate, ease of distribution to beneficiaries, and simplicity of set-up, a transfer on death (TOD) account could be a great option. A TOD account provides a simple way to transfer assets to beneficiaries without the need for complex legal structures like trusts. Here, we’ll explain what a TOD account is, its main benefits and drawbacks, and how it can be used as part of an estate plan to transfer wealth quickly...

Madison Eubanks

•

Mar 19, 2024

Practical Advice for Navigating Probate

Probate—the legal process of administering a person’s estate after their death—can be a loaded topic. Depending on the size and complexity of the decedent’s (the deceased person’s) estate, how organized their affairs were at the time of their death, the state they lived in, and many other factors, the probate process may vary widely from person to person. Of course, the best way to deal with probate is to avoid it. A thorough estate plan that includes a revocable trust dictating where assets go can allow an estate to bypass (or mostly bypass) the oft-tedious probate process. To learn more...

Simona Ondrejkova, CFP

•

Mar 14, 2024

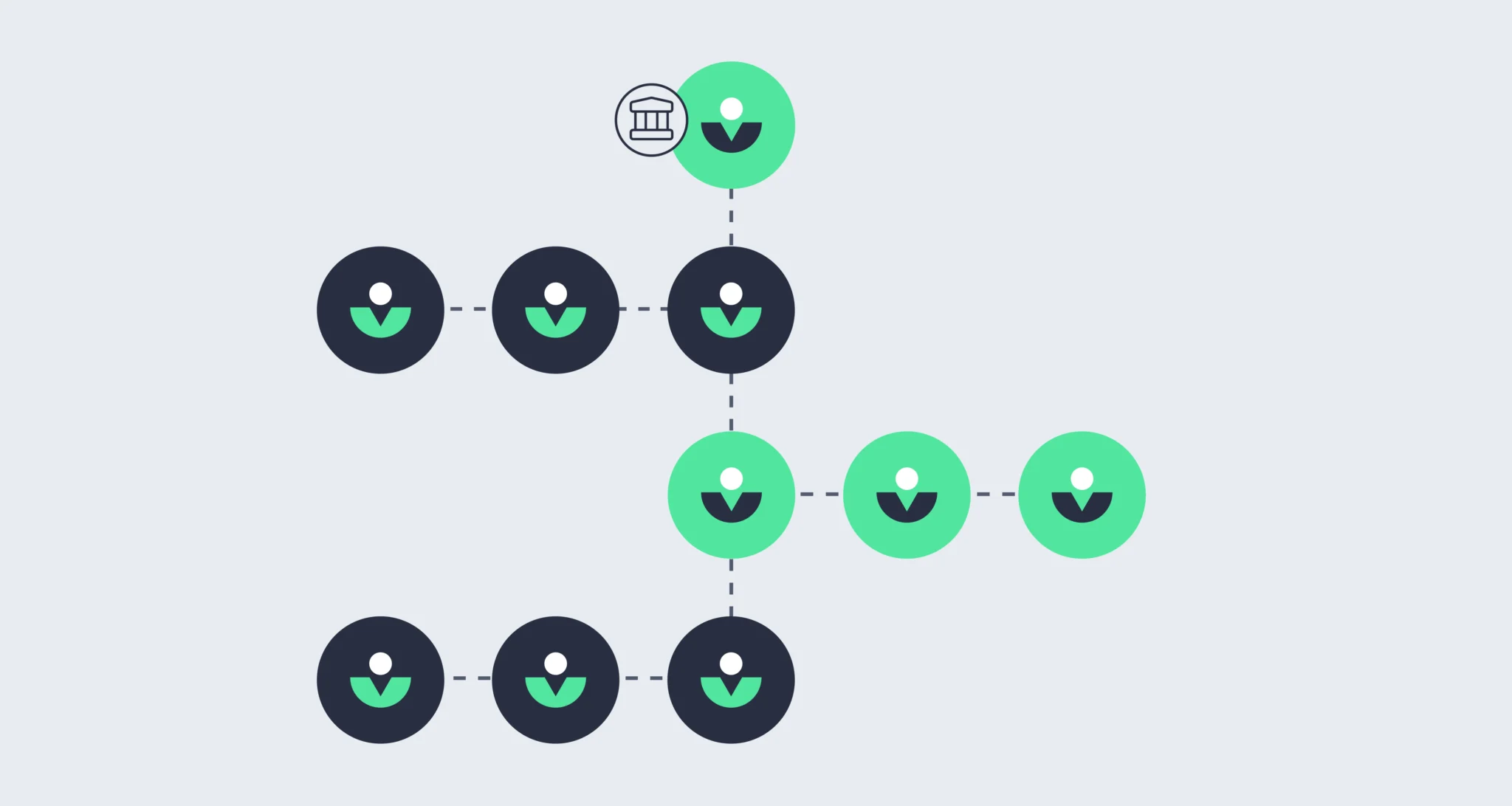

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes. Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically...

Simona Ondrejkova, CFP

•

Mar 01, 2024

25 Critical Discovery Questions for Financial Advisors

Whether you’re meeting with a new prospective client or doing a client review with a client you’ve had for decades, it’s important to know how to guide the conversation. Asking the right questions allows you to gain the insights you need to provide the best advice possible while fostering a deeper connection. Because when you take the time to listen to clients’ answers to these questions mindfully, It shows that you genuinely care about their goals, values, and needs. The questions you ask at the first discovery meeting with a new potential client are especially key in building a strong...

Simona Ondrejkova, CFP

•

Feb 23, 2024

How Estate Administration Works & Ways to Simplify it for Your Beneficiaries

Whether you’re putting together your estate plan, assisting your clients in the process, or figuring out how to navigate the intricacies of distributing a loved one’s estate, it’s helpful to understand the estate planning and administration process. This can save you or your beneficiaries time by planning ahead so you can reduce unnecessary stress in transferring assets to heirs. When considering estate planning strategies to maximize your legacy and transfer your assets according to your wishes, it’s also helpful to consider how your estate planning & administration can be affected by probate. So today we explain the steps involved in...

Simona Ondrejkova, CFP

•

Feb 15, 2024

Grantor Trust vs Non-Grantor Trust: What’s the Difference?

If you or your clients are considering an estate planning strategy that includes a trust, you may be wondering about the difference between the many types of trusts out there. Specifically, if you hear a trust referred to as a grantor trust, what does that mean? And how is this different from a non-grantor trust? Today, we’ll explain the difference between a grantor trust and a non-grantor trust and help you understand when to use each one to achieve your estate planning goals. What is a grantor trust? A grantor trust is a type of trust in which the person...