Estate planning considerations unique to California

Estate-related laws and taxes can vary by state. Here are a few of California’s notable distinctions:

Community Property System

California is one of a handful of states that recognize community property, meaning generally that assets acquired during marriage are considered to be owned equally by both spouses.

Portability of Estate Tax Exemption

Although California does not have a state estate or inheritance tax, California residents may need to consider federal estate tax portability.

Probate Process

California has one of the more expensive and time-consuming probate processes compared to other states, with one of the highest probate fees in the country.

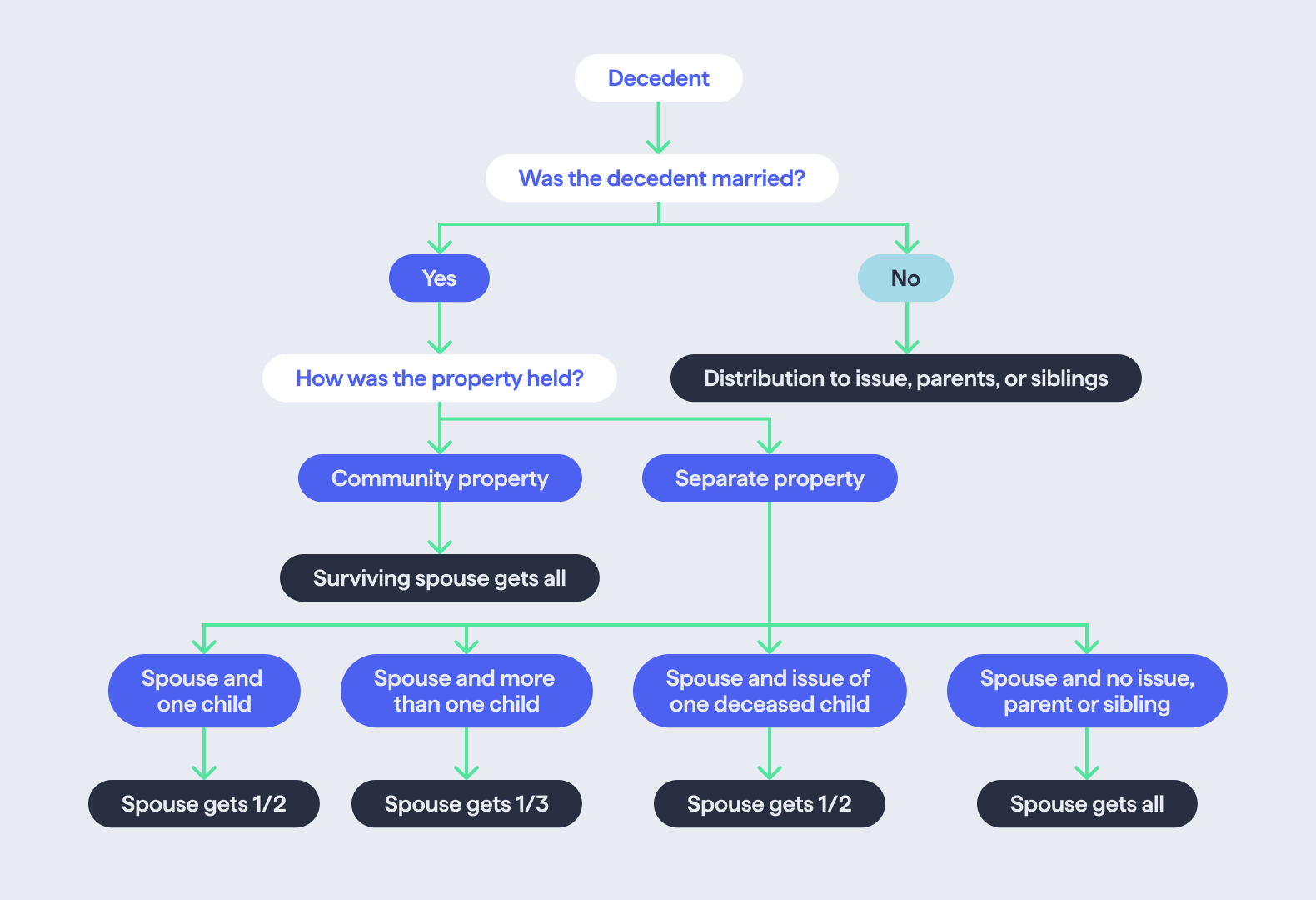

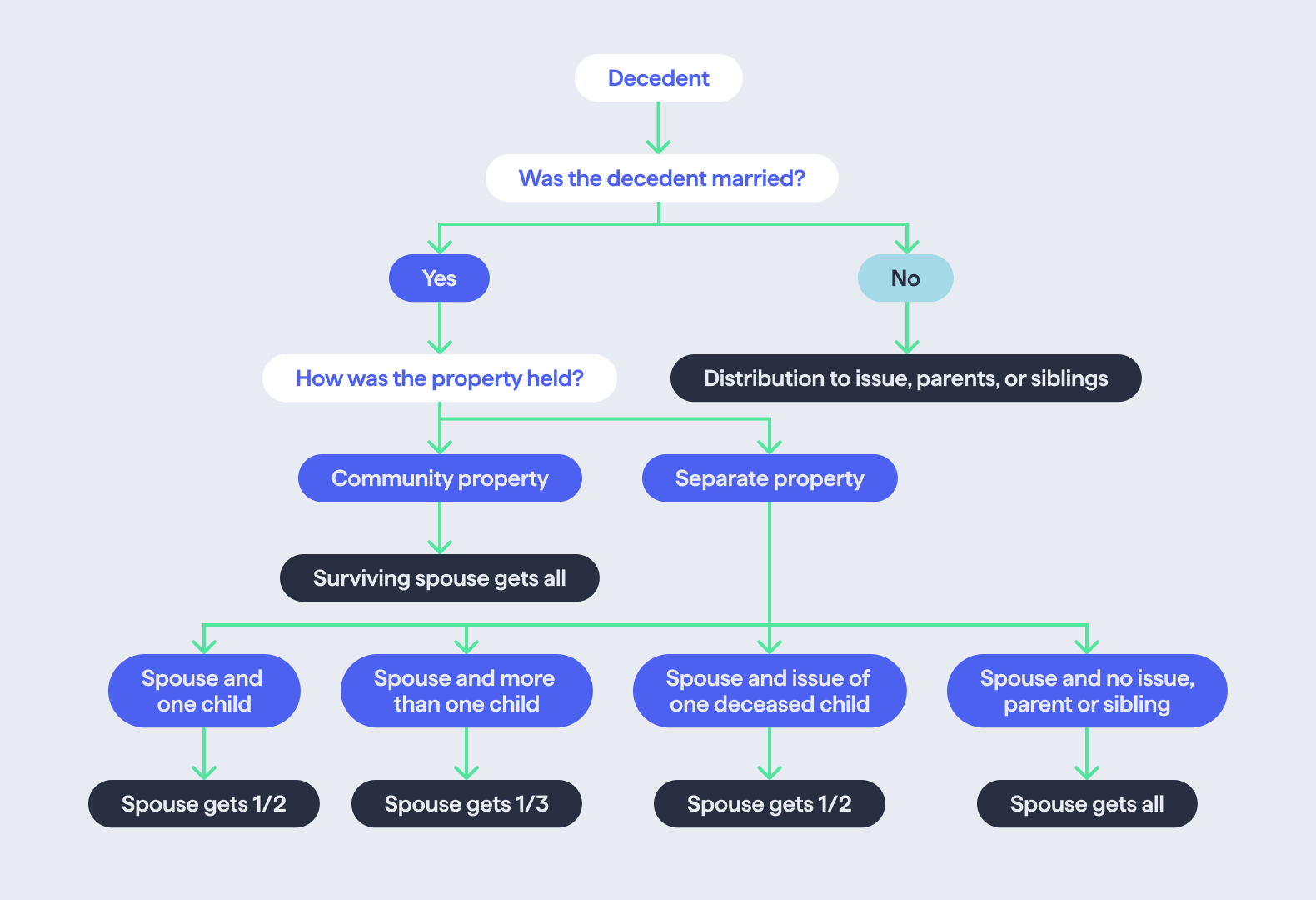

Intestate succession in California

Here’s a summary of how assets transfer when a person dies intestate in California.