Sarah D. McDaniel, CFA

Sarah D. McDaniel, CFA

Changes in Interest Rates and Why Estate Planning Reviews Matter

The Federal Reserve’s September 2025 rate cut may create planning opportunities

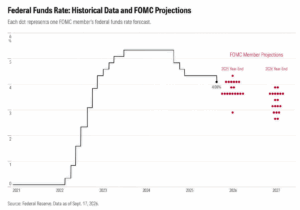

The Federal Reserve’s recent quarter-point reduction to 4.00%-4.25% represents the first rate cut of 2025 with Fed projections indicating additional cuts may follow later this year. While these monetary policy shifts primarily target economic conditions, they create significant ripple effects throughout the estate planning landscape that may warrant immediate attention.

Why interest rates drive estate planning effectiveness

Estate planning isn’t a “set it and forget it” process. The effectiveness of wealth transfer strategies fluctuates dramatically based on prevailing interest rate environments, making periodic reviews essential—particularly during periods of monetary policy transition.

Government-set rates determine planning success

The IRS establishes key rates that directly impact estate planning calculations:

- The Section 7520 rate influences charitable planning and trust valuations

- Applicable Federal Rates (AFRs) set minimum interest rates for family transactions

These rates move with broader interest rate cycles, creating windows of opportunity and periods of effectiveness.

Rate changes reshape the planning landscape

What worked optimally at 5% interest rates may be suboptimal at 3% rates, and vice versa. Families with existing plans structured during different rate environments should evaluate whether their current strategies remain appropriate or if adjustments might be warranted.

Strategies that tend to favor lower interest rate environments

- Grantor Retained Annuity Trusts (GRATs): Lower hurdle rates may make it easier for trust assets to outperform, with any excess growth passing to heirs gift tax-free.

- Charitable Lead Annuity Trusts (CLATs): Reduced rates can increase the charitable deduction and may allow more assets to pass to heirs gift tax-free.

- Intra-family Loans: Must use at least the Applicable Federal Rate (AFR). Lower AFRs can reduce borrowing costs for the borrower, which may increase opportunities for the next generation to build wealth.

- Sales to Intentionally Defective Grantor Trusts (IDGTs): Selling appreciating assets at lower rates may help shift more future growth outside the taxable estate.

- Valuation Discounts: Leverage strategies may be more effective when borrowing costs are lower, making it easier to transfer discounted assets and their growth to heirs.

Current environment assessment

Where we stand today

With rates now at 4.00%-4.25% and the Section 7520 rate at around 5.0%, we’re in a transitional environment where multiple planning approaches remain viable. This creates both opportunity and attention—opportunity because several strategies work well simultaneously, and attention because this balanced environment may not persist.

Looking ahead

The Fed’s dot plot – a quarterly chart showing where each member of the Federal Open Market Committee (FOMC) expects the federal funds rate to be in the future – suggests additional rate cuts are likely before year-end 2025. Historically, declining rate environments favor certain planning approaches while making others less attractive. Families who position themselves appropriately can benefit from the full trajectory of rate changes rather than reacting after opportunities have passed.

The case for acting now

Timing matters more than perfect strategy selection

Research shows that strategic timing often drives more value than perfect technique selection. The current environment offers a relatively window where families can evaluate multiple approaches and select those more suited for the anticipated rate trajectory.

Planning inertia carries real costs

Every month of delay potentially reduces planning efficiency as market conditions evolve. Rate-sensitive strategies become less effective when implemented late in rate cycles, while market volatility creates temporary valuation advantages that may not persist.

Professional coordination takes time

Effective estate planning requires coordination among legal, tax, and financial professionals. Complex strategies need significant time for careful implementation, meaning decisions made today position families for the potential rate environment in 2026.

Key considerations for advisors and clients

Sensitivity to rate changes

Evaluate whether your current planning approach optimizes for:

- The rate environment when it was implemented vs. today’s conditions

- Anticipated future rate changes based on Fed policy signals

- Your family’s specific risk tolerance and liquidity needs

- Changes in your wealth level and planning objectives since original implementation

The pitfalls of a DIY approach

Estate planning during transitional rate environments requires specialized expertise to navigate:

- Complex IRS regulations that change frequently

- Coordination between multiple legal and tax strategies

- Valuation considerations for different asset types

- State-specific laws that vary significantly across jurisdictions

Building the right team

Successful planning requires experienced professionals who understand:

- How rate changes impact different strategies

- The timing requirements for various approaches

- The documentation standards required for IRS compliance

- The coordination necessary among different advisors

Next steps for clients and families

Assemble a professional team

Coordinate needs among your professional advisors (estate attorneys, CPAs, financial advisors and valuation specialists) to address topics like:

- Timeline requirements for any recommended adjustments

- Time-sensitivity of implement adjustments as rates change

- Monitoring systems for ongoing rate environment changes

How Vanilla helps:

- Family & People aggregates information for key professionals and visualizes extended family relationships

- Sharing enables users to securely invite external professionals into Vanilla to collaborate by working directly on client estate plans together

- Groups allows users to share (or restrict) access to client profiles with additional suitable professionals within their firm to identify qualified referrals, facilitate more extensive collaboration and “deliver the firm”

Select appropriate strategies

Determine which planning strategies benefit from current vs. lower rate environments with considerations like:

- Current strategies that are appropriate under changing rate conditions

- New opportunities created by the evolving interest rate environment

- Modelling of different estate techniques under various rate environments

How Vanilla helps:

- Scenarios assists users to model and visualize hypothetical changes to an estate plan which can be leveraged in client conversations to help guide next steps for estate plan optimization

Inventory and value assets

Identify assets suitable for transfer strategies and review current valuations.

How Vanilla helps

- Integrations facilitate importing client financial data from some of the leading performance management systems into Vanilla’s balance sheet

- Balance Sheet organizes your client’s financial data in multiple ways: Account view (grouped by account type and ownership), Asset view (sorted by their types of asset holdings), Inside taxable estate, and Outside Taxable estate

The bottom line

Interest rate changes aren’t just economic indicators—they’re estate planning catalysts that might dramatically impact wealth transfer efficiency. The Fed’s recent cut and projected additional reductions create a time-sensitive opportunity for families to optimize their planning for the evolving rate environment.

The cost of inaction increases with each rate cycle change. Families who proactively adjust their estate planning for changing conditions position themselves to benefit from the full trajectory of rate movements, while those who delay may find themselves implementing strategies as they become less effective.

Don’t let monetary policy changes catch your estate plan unprepared. The current transitional environment offers exceptional opportunities for those who act decisively with proper professional guidance.

The information provided here does not constitute legal, financial, or tax advice. It is provided for general informational purposes only. This information may not be updated or reflect changes in law. Please consult with an estate attorney, financial advisor, or tax professional who can advise as to your particular situation.

Published: Oct 01, 2025

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.