Jim Sinai

Jim Sinai

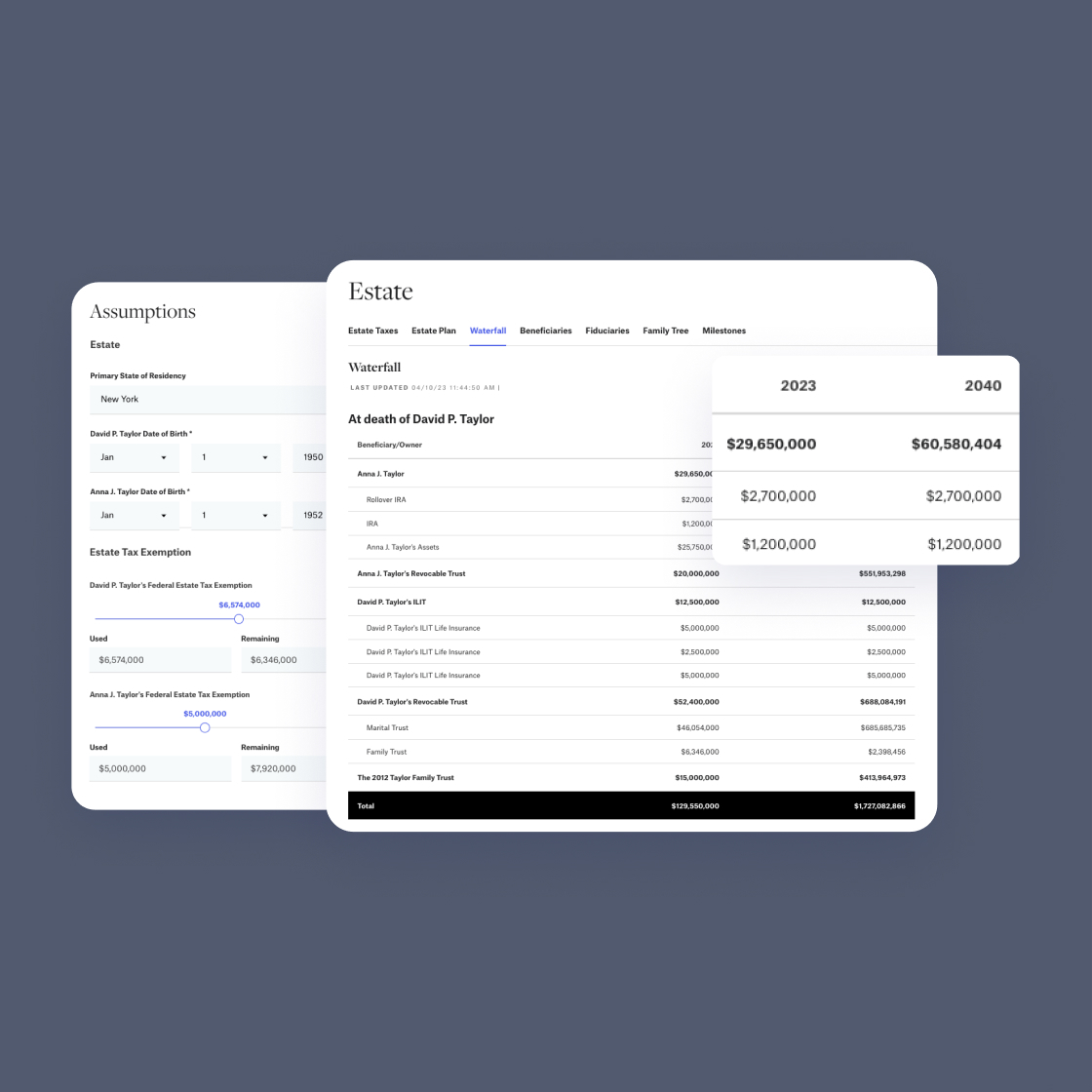

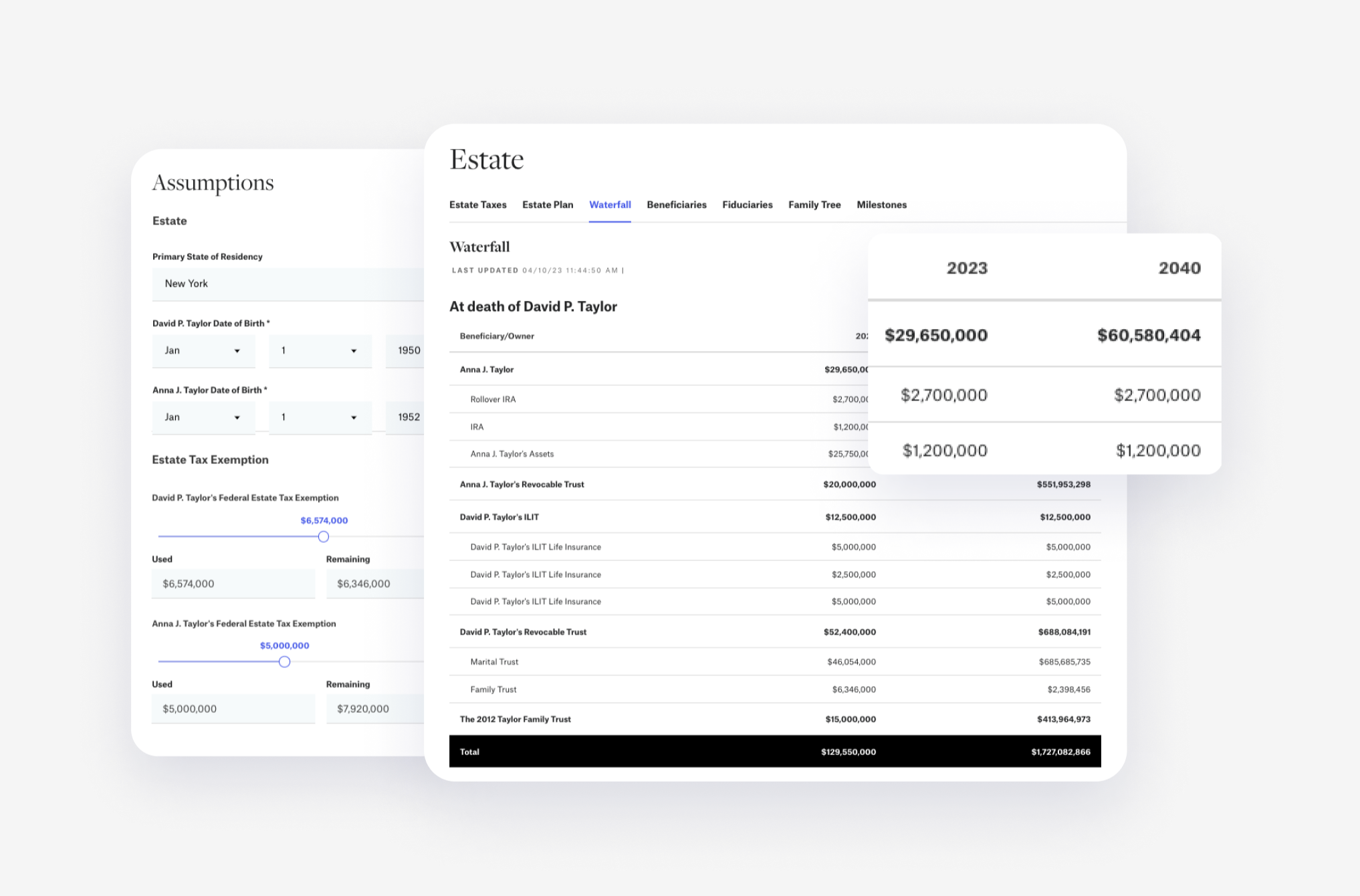

Project estate values today, and in the future

Many clients today don’t have taxable estates. But they might once the current exemption levels automatically expire on January 1, 2026, reverting back to ~$6.8 million per person (adjusted for inflation). Therefore, it becomes increasingly important for advisors to explain to their clients how their estates will look in the future so that they can make the right planning decisions.

With the release of Projections, advisors can now demonstrate how estates will behave at various levels of wealth and show their clients simple projections of their estate at a future date. Projected values flow through the Estate Tax Detail, Waterfall, and Beneficiaries upon death of the estate.

Advisors have the power to model different estate outcomes using the following assumptions:

- Primary State of Residency

- Date of Birth

- Federal Estate Tax Exemption used

- Life Expectancy

- Rate of return, either by entire estate or individual assets

These inputs will automatically be updated in the estate profile and also included in the PDF client estate report.

With these projections, advisors can more easily help their clients understand how the rate of return on their assets will impact their estate taxes and beneficiaries over a specific period of time.

Next up, we are working on enhanced estate tax, waterfall and beneficiary projections and advanced strategies scenarios.

Published: Apr 11, 2023

Ready to get started?

Deliver a whole new client conversation experience

Talk to our sales team today.