![]()

Setting the standard in

estate planning

Gene Farrell, CEO

Over the past 12 to 18 months, estate planning has taken on new urgency. Client expectations have risen. Market solutions have multiplied. What was once seen as a peripheral value-add has become a primary growth engine—and the most credible names in the industry are embracing estate planning like never before. Through it all, Vanilla has continued to set the standard in the category.

We’ve partnered with thousands of advisors and more than half of the 25 largest U.S. wealth management firms to deliver a platform defined by its accuracy, depth, scalability, and ability to adapt to evolving client needs. We’ve raised the bar—and delivered proven results, not just promises.

However, we also know that excellence only matters if it translates into outcomes for you and your clients.

That’s why we’re launching a new series designed to ensure you can fully leverage the latest Vanilla has to offer and share how top firms are deploying Vanilla across their client base.

In the coming weeks, you’ll hear directly from our founder and leadership team as we share insights on how to:

-

- Enable high-value conversations in minutes with AI-powered tools

- Use estate planning as a strategic driver of growth and client engagement with new tools like Estate Health Check

- Model even the most complex, multigenerational planning scenarios with unmatched precision

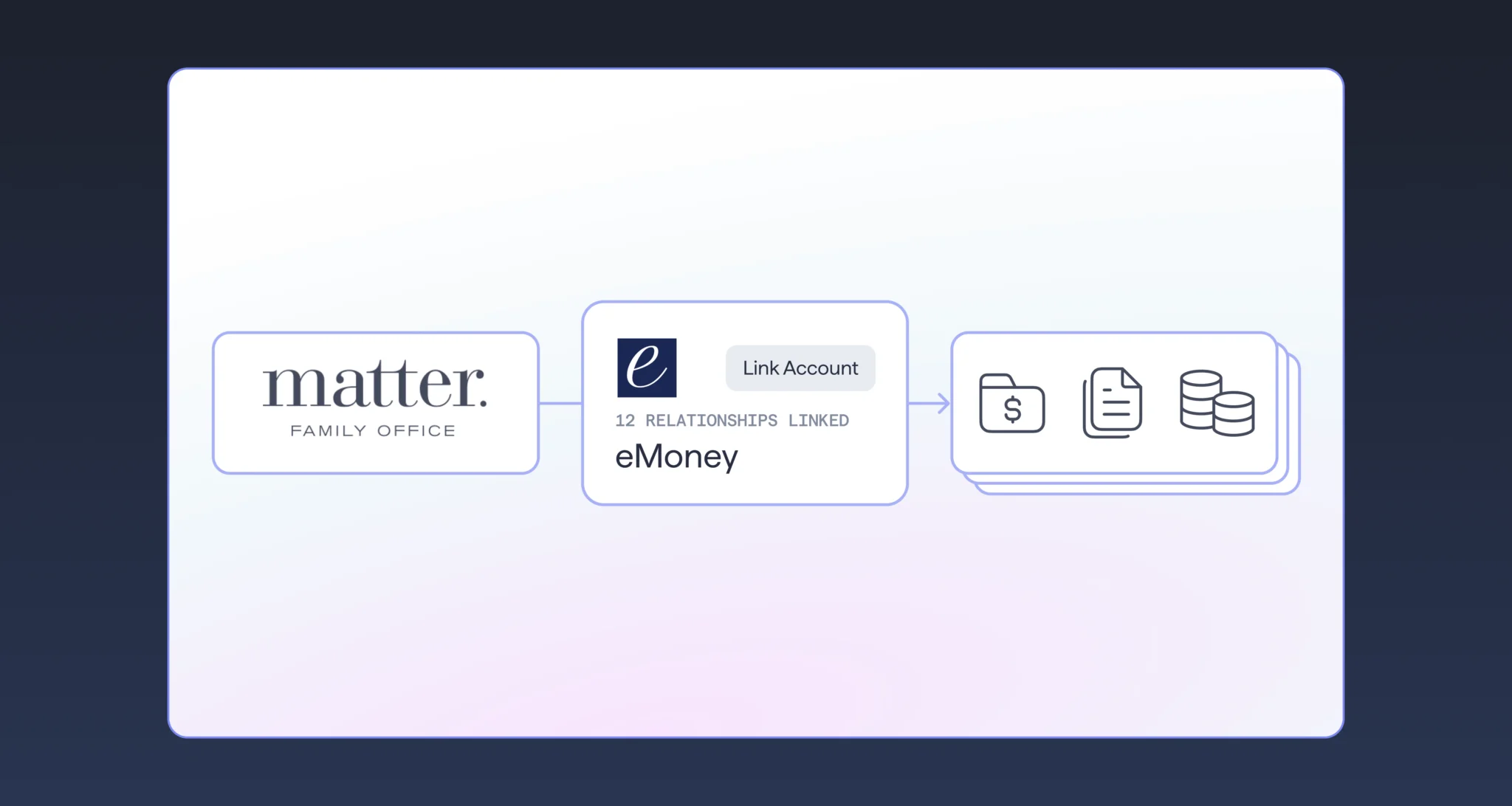

- Streamline workflows and drive adoption through integrations such as eMoney

- Combine automation with expert support through our document creation experience and nationwide attorney network

- Surface planning opportunities at both the client and book level

- Every capability is designed with one goal: to help you deliver the highest-quality planning experience with less manual effort and more impactful conversations.

We’re proud to be the most trusted estate planning platform in the market. We remain committed to setting the standard—and to working alongside you to help estate planning become an even more integrated, scalable, and valued part of your practice.

I look forward to what’s ahead.

Gene Farrell

CEO, Vanilla

Why Vanilla?

The only estate advisory platform that

- helps advisors 3X their growth

- supports clients of all sizes

- has processed 40,000+ documents

- is built on 180+ years of experience

- is trusted by the largest institutions

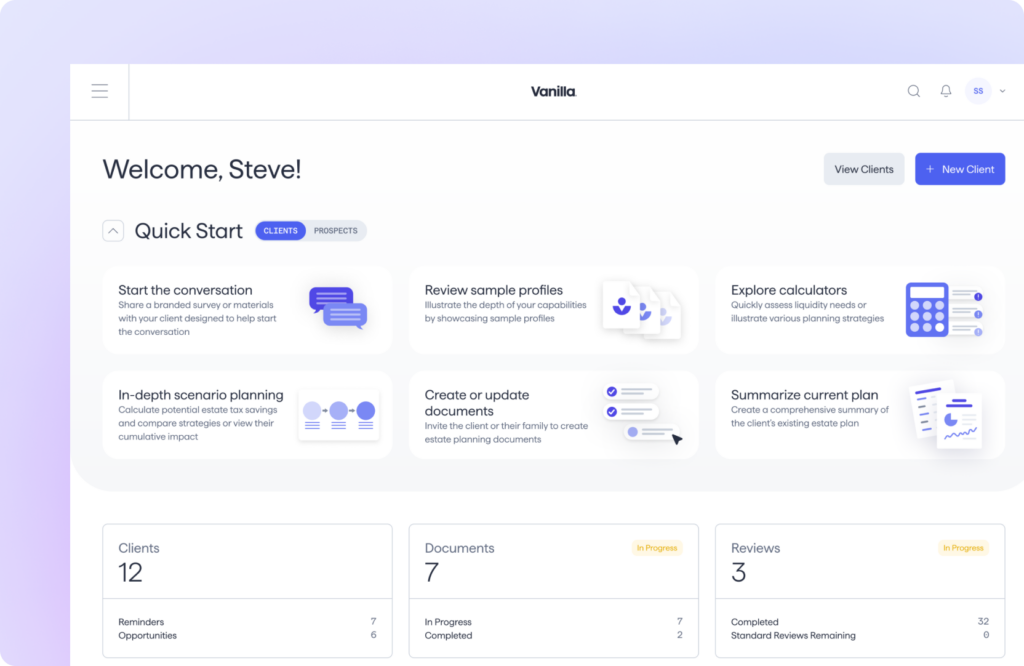

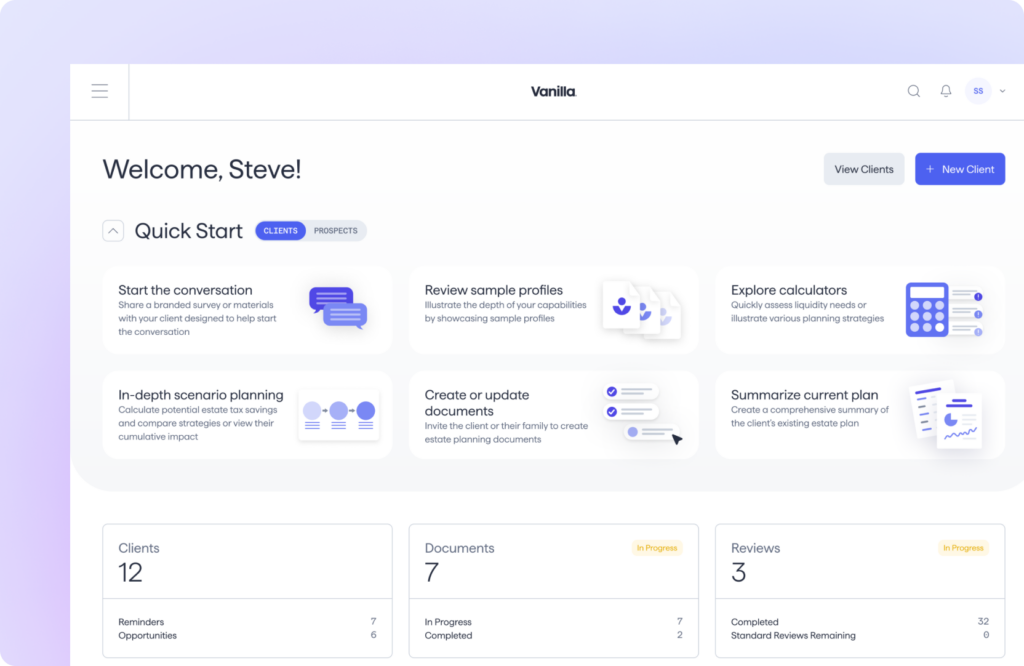

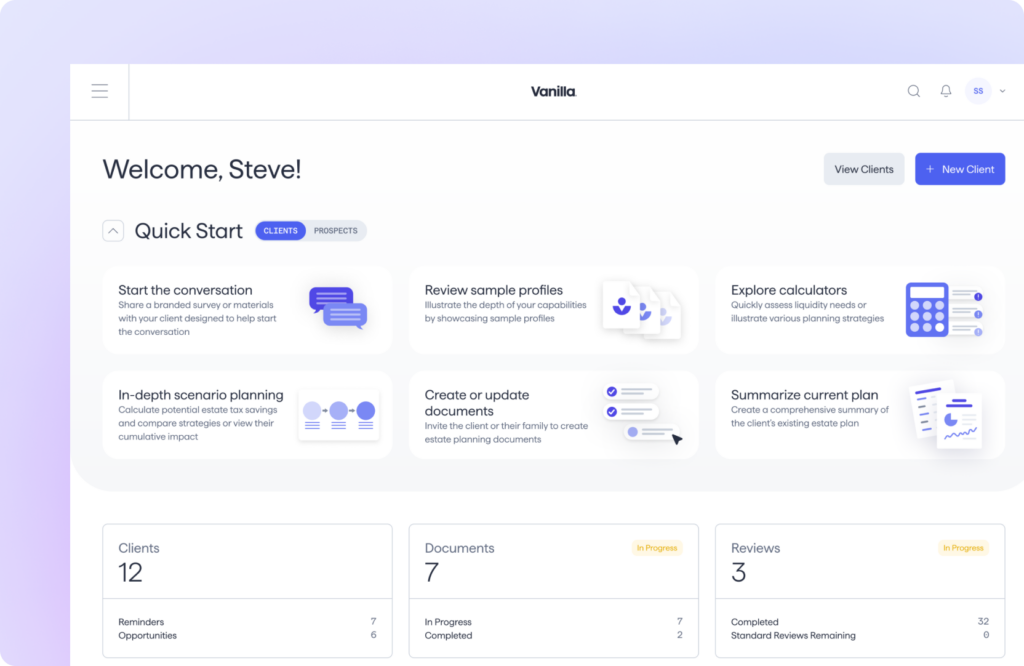

Visual, intuitive client touch points are where the rubber hits the road. Vanilla’s output has been used to win billions of dollars in AUM.

Pressure-tested across a broader range of use-cases than any other solution, with 50k+ documents and $250B+ connected assets

Vanilla was built as a turnkey service offering, allowing any firm to deliver an enterprise-grade estate planning experience to their clients.

Estate planning, supercharged

The next generation of estate planning

Transform how you engage with clients and prospects for every stage of the client journey, from mass affluent to UHNW

V/AI Estate Summaries

Help your client truly understand their plan and identify gaps

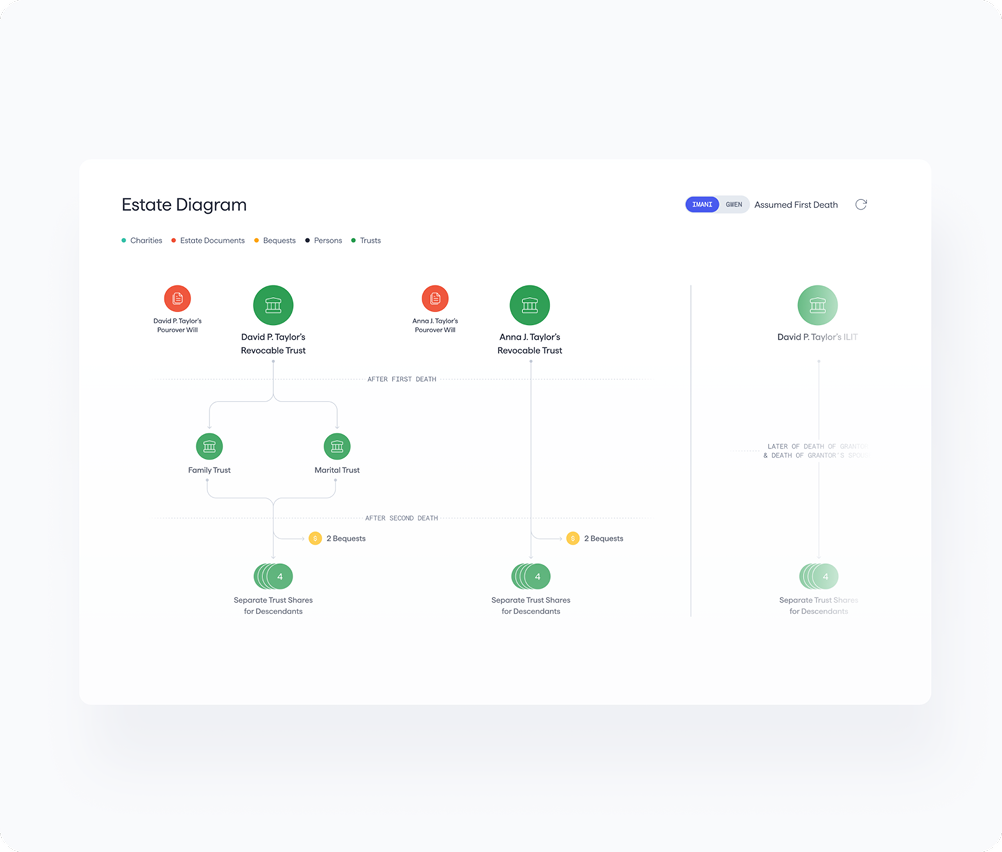

“Wow” your prospects and clients with visual summaries of their existing plan and identify opportunities to add value

“True estate planning at scale is only possible through technology—and AI pushes that even further.”

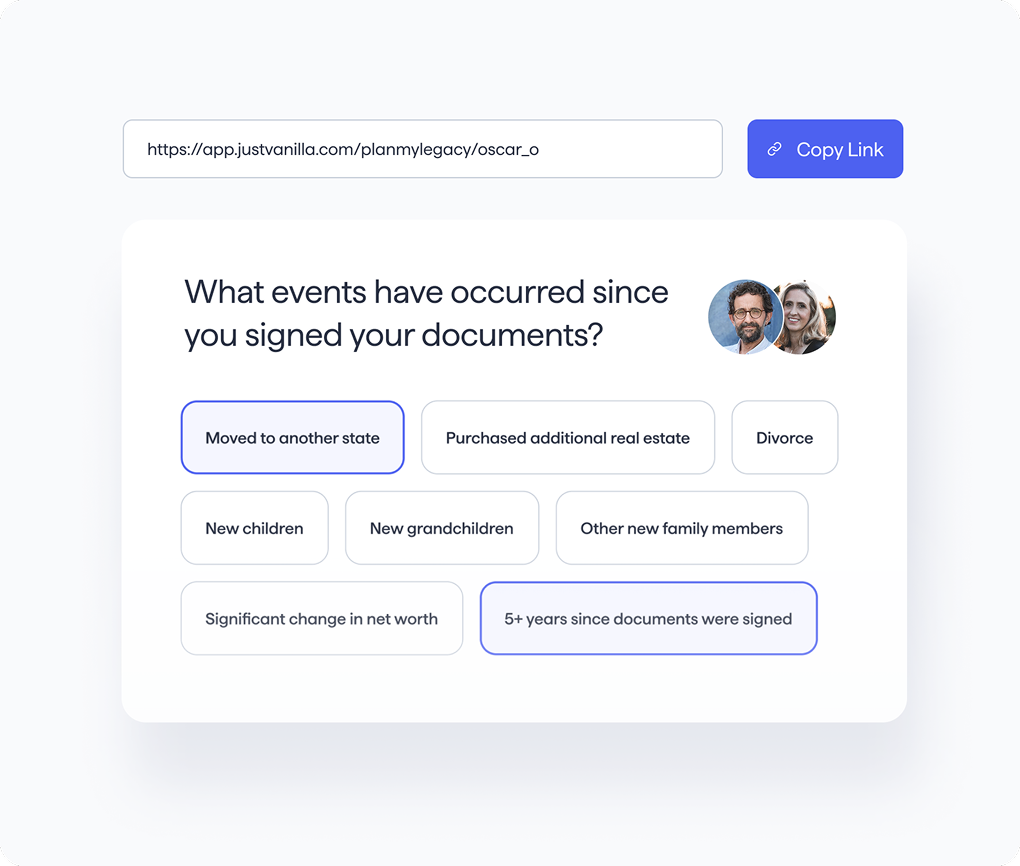

Estate Health Check™

Start the conversation with Estate Health Check™

Quickly engage prospects and clients in a differentiated way with a branded Estate Health Check™ questionnaire.

Explore upcoming webinars and more

AI in Estate Planning: Setting the Standard

AI won’t replace advisors—but advisors who use AI will replace those who don’t. Advisors who understand how to use AI to do their jobs better...

Vanilla Unveils New AI Capabilities, Redefining the Future of Scalable Estate Planning

AI-powered tools accelerate meaningful conversations, eliminate manual processes, and deliver holistic insights at scale BELLEVUE, Wash.--(BUSINESS WIRE)--Vanilla, the most trusted platform in modern estate planning,...

Connected Financial and Estate Planning: Delivering Holistic Client Outcomes

Financial advisors are increasingly recognizing that comprehensive financial planning must include estate planning to truly serve clients’ long-term goals. Traditionally, financial planning (investments, retirement, tax,...

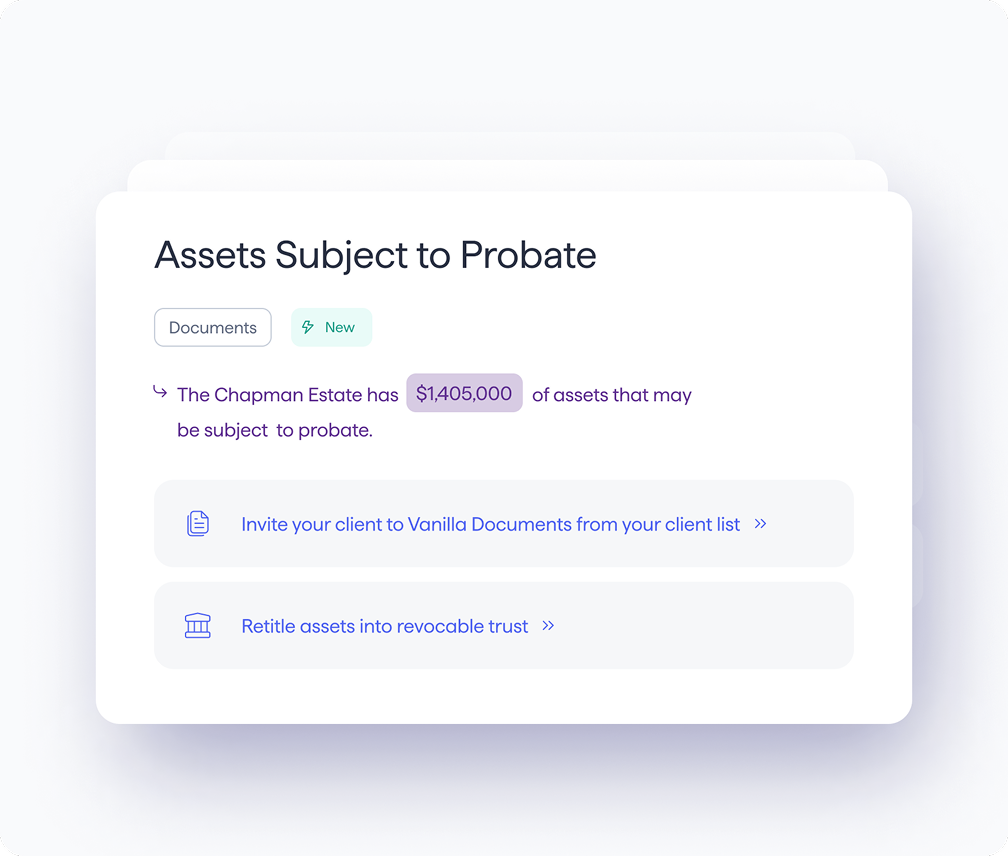

Opportunities

Proactively highlight

opportunities

Differentiate with AI-powered engagement opportunities trained on 180 years of T&E experience, from basic maintenance opportunities like asset titling to more advanced planning

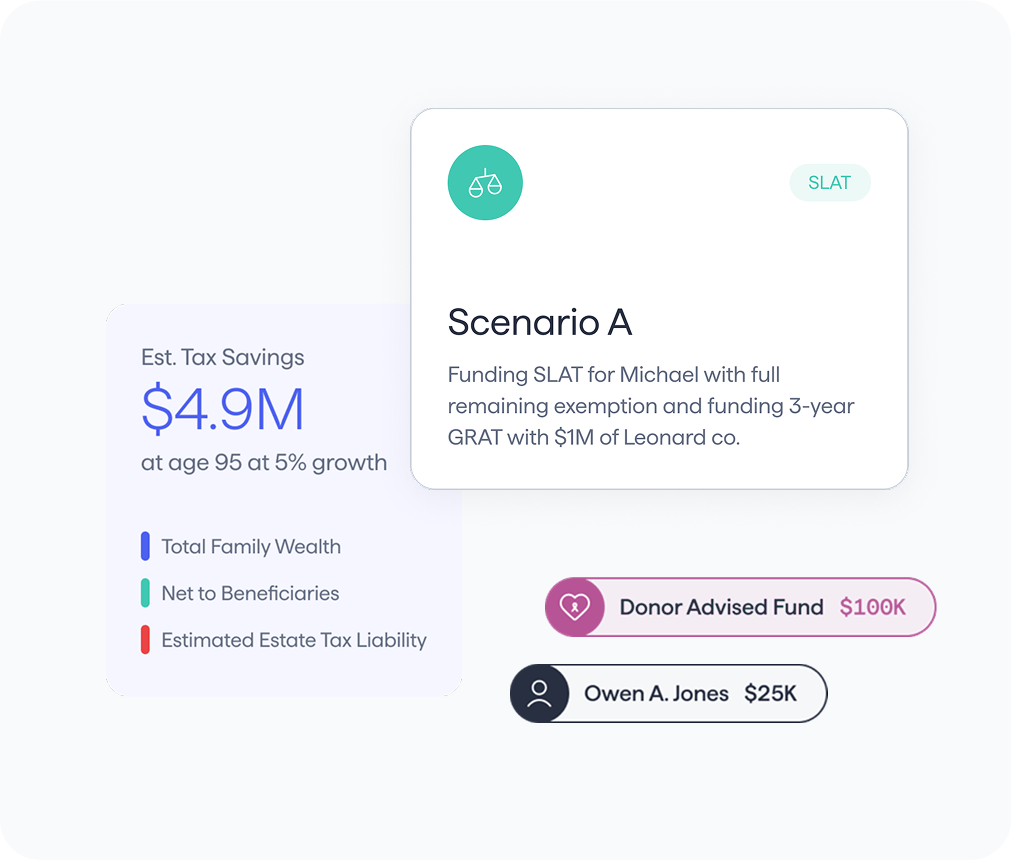

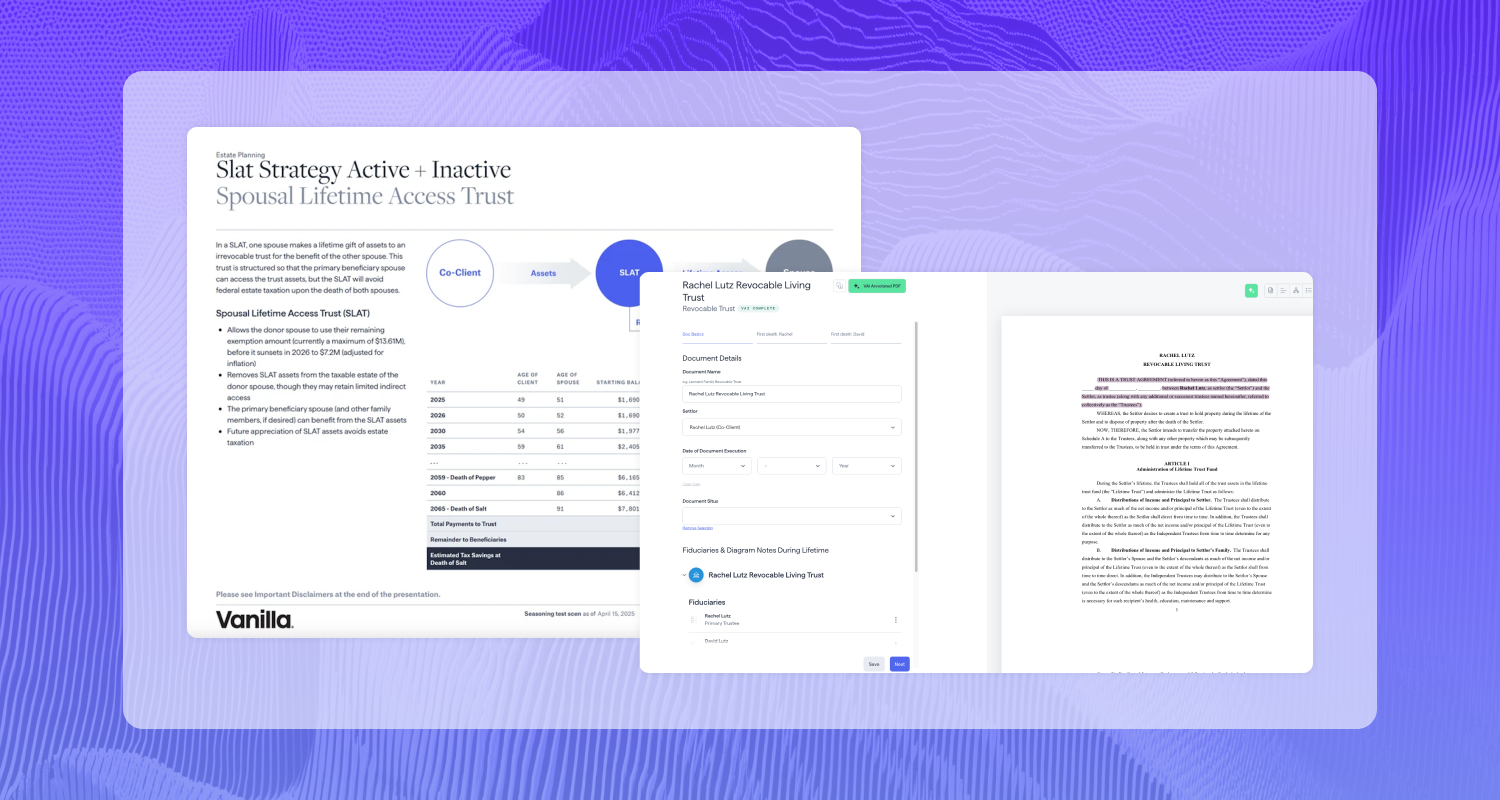

Scenarios

Explore scenarios to model tax efficiency and impact on beneficiaries

Model popular estate planning strategies like ILITs, GRATs, and IDGTs to showcase the impact of planning both now and in the future, with the ability to toggle between multiple scenarios

“[Vanilla’s] analysis was eye opening for our prospect, and now new client”

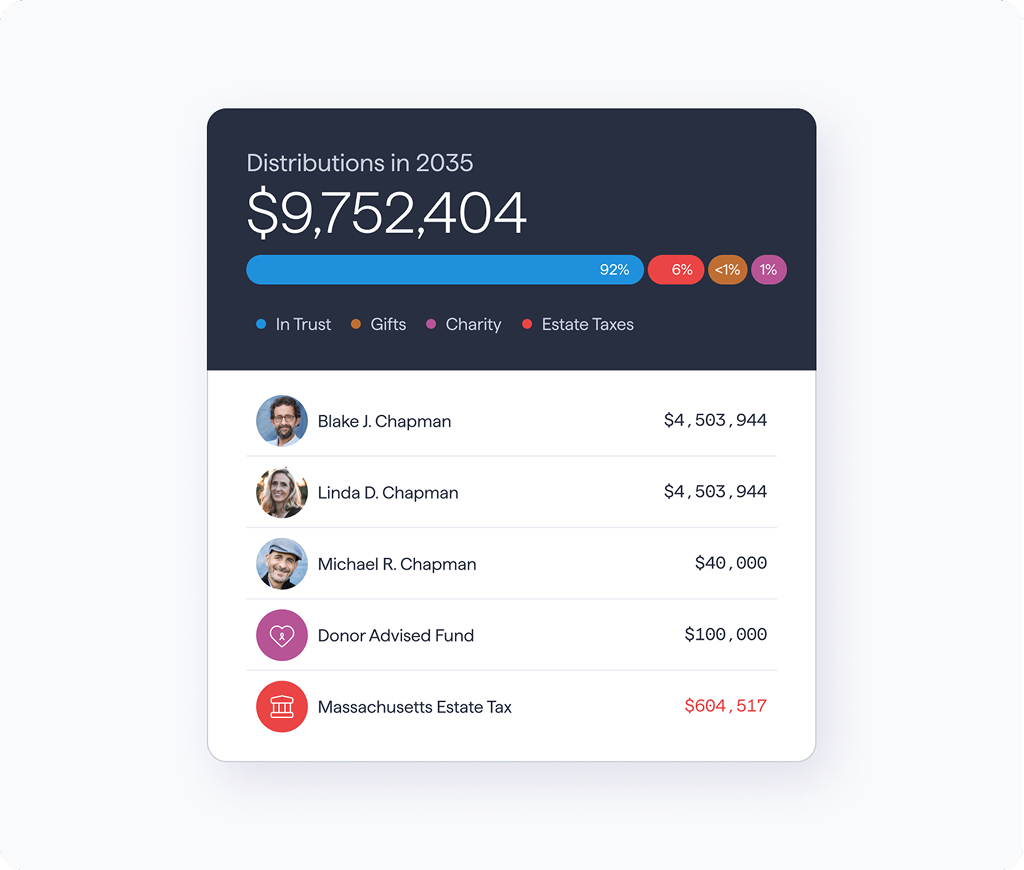

Integrations

Illustrate the impact of the client’s assets on their beneficiaries

Connect to popular integrations like eMoney to give your client a unique picture of “who gets what” with a detailed, accurate model of how their estate plan interacts with their assets

Document Creation

Protect your clients with documents built by the best in the industry

Offer estate planning document creation and updates at no cost to your client base, with document templates drafted by industry leaders and supported by the largest attorney network in the space.

“It’s a more sophisticated product that aligns with a comprehensive financial planning process”

The Vanilla Estate Planning Playbook (updated for 2025)

A step-by-step checklist to guide your client conversations, updated for 2025. This playbook is inspired by the guide used by Vanilla founder Steve Lockshin and...

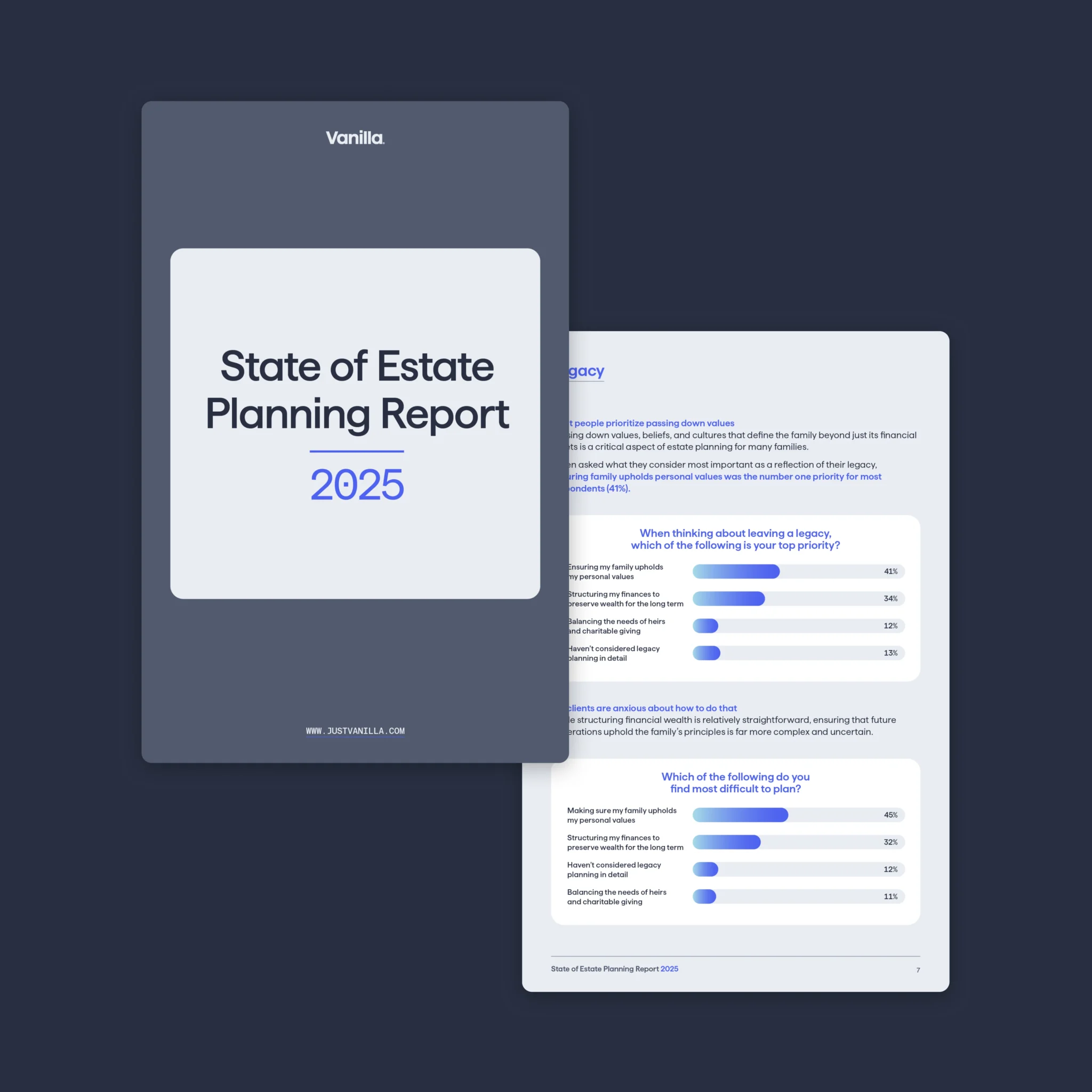

Vanilla 2025 State of Estate Planning Report

The State of Estate Planning Report, newly released for 2025, reveals emerging trends and client sentiments advisors need to know.

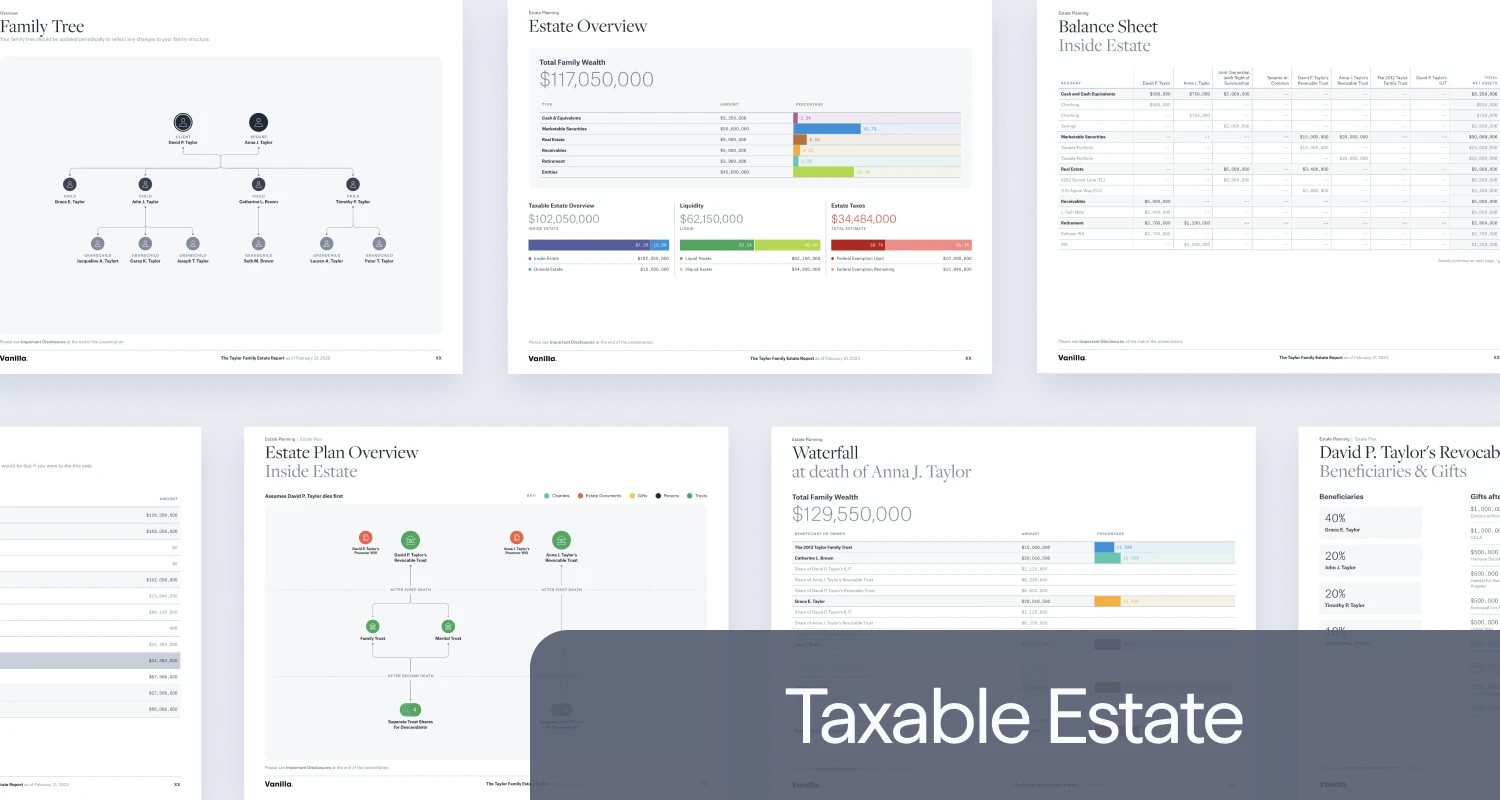

Vanilla sample report for taxable estates

With Vanilla, advisors can create a new type of deliverable that both clients and prospects have never seen before. Not only does Vanilla help advisors...

Vanilla Announces Partnership with $560B Firm Mariner

Vanilla Delivers Modern Estate Planning Capabilities to More Than 700 Advisors at Mariner Salt Lake City, UT – April 17, 2025 – Vanilla, the leading...

Unlocking Scale: How Matter Family Office Streamlines Estate Planning with Vanilla + eMoney

Vanilla recently announced our integration with eMoney, empowering financial advisors to streamline their estate planning workflows like never before. Matter Family Office, a nationally recognized...

What’s New in April: Plaid Integration, Scenarios PDF Export, Estate Builder upgrades, and...

Here at Vanilla, we’re thrilled to unveil a powerful lineup of new features and enhancements launching this month. These updates are all about delivering an...

Holistic wealth management starts here

Join thousands of advisors who use Vanilla to transform their service offering and accelerate revenue growth.