Blog

Blog

John Costello

•

Apr 24, 2024

Vanilla Expands Document Creation to Offer a Complete, Modern Estate Planning Experience

New Vanilla Document Builder™️, announced at biannual Legacy Now event, delivers modern estate planning for all wealth levels. Vanilla, a leading provider of innovative estate planning software, today announced an expanded set of features for Vanilla Document BuilderTM, the modern document creation engine within the Vanilla Estate Advisory Platform. Financial advisors using Vanilla can now offer a compelling modern estate planning experience for clients across the wealth spectrum. New features include the ability to connect directly with legal experts, to get powers of attorney for adult children, and to tap into advanced tax planning options. These enhancements were unveiled at...

Blog

Blog

Rachel Pettis

•

Apr 16, 2024

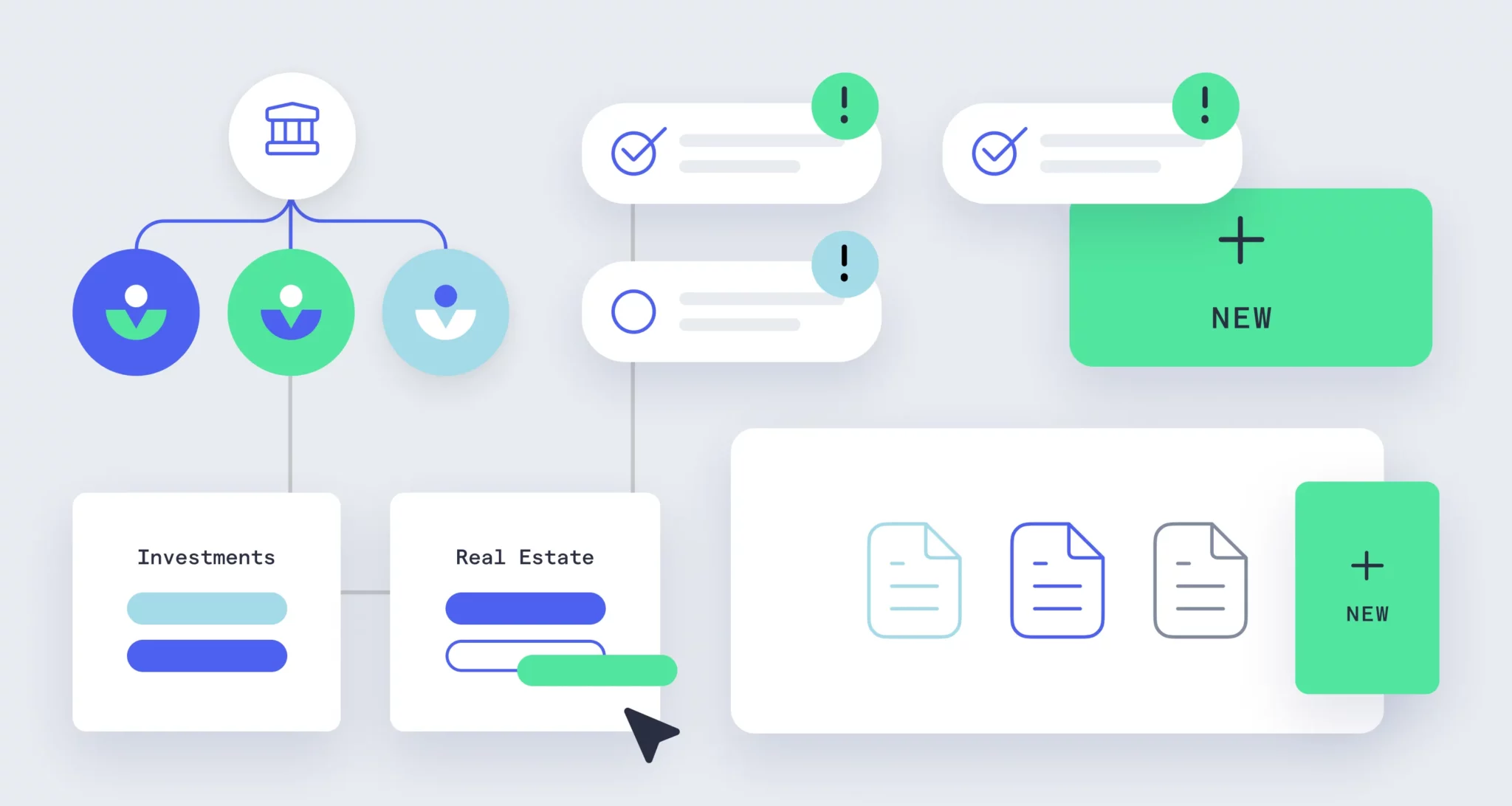

What’s New in Vanilla: New features for April 2024

Spring (and Legacy Now) is in the air! April is showering Vanilla with multiple new features, enabling our customers to: Expedite document reviews in Vanilla Estate Builder with smart suggestions powered by VAI™ and additional customization with Advanced Distributions Show the potential future impact of layering on a SLAT or GRAT with Vanilla Scenarios™ Invite clients to engage an estate attorney in certain states when completing their documents with Vanilla Document Builder Include the cost of Vanilla Document Builder in your firm’s fee structure with a Charge Me option Add your firm’s custom compliance disclosures to the Vanilla PDF report...

Blog

Blog

Simona Ondrejkova, CFP

•

Apr 15, 2024

Section 6166: How You Can Defer Estate Tax

Do you have clients who own a business or have just recently inherited one? When it comes to estate planning for business owners, understanding section 6166 of the US tax code could make a big difference in ensuring continuity of the business after the owner passes away. While there are several estate planning strategies that can help clients reduce their overall estate tax bill, those who own a business should also be aware of strategies to defer payments on estate taxes to keep their heirs from having to do a fire sale of the business just to pay taxes. So...

News Entry

News Entry

Financial Planning

•

Apr 11, 2024

To be indispensable, advisors must expand their estate planning playbook

In my 30-plus years of experience as an financial advisor, I’ve delivered impactful service not by simply focusing on maximizing investment performance, but by considering approaches that improve and protect the well-being of my clients and their families on a more human level. My most important objectives as an advisor are ensuring that my clients sleep well at night, safe in the knowledge they are in good hands; helping them to meet their financial goals; and ensuring their experience is such that they can wholeheartedly say they are glad they met us. Advisors who want to ensure that those...

Blog

Blog

Simona Ondrejkova, CFP

•

Apr 04, 2024

Schedule K-1 Forms: Managing Your Client’s Estate Income

When helping clients with their estate plan, taxes are one of the key components to take into account as part of the planning process. And while there are several estate planning strategies that can be used to minimize or eliminate estate taxes for clients, here we’ll talk specifically about taxes that an estate or a trust incurs on its income. One of the forms that clients should be familiar with if they are trustees, administrators, or beneficiaries of an estate or a trust is schedule K-1. Since there are a few different types of K-1 forms, it’s important to understand...

Blog

Blog

Madison Eubanks

•

Apr 02, 2024

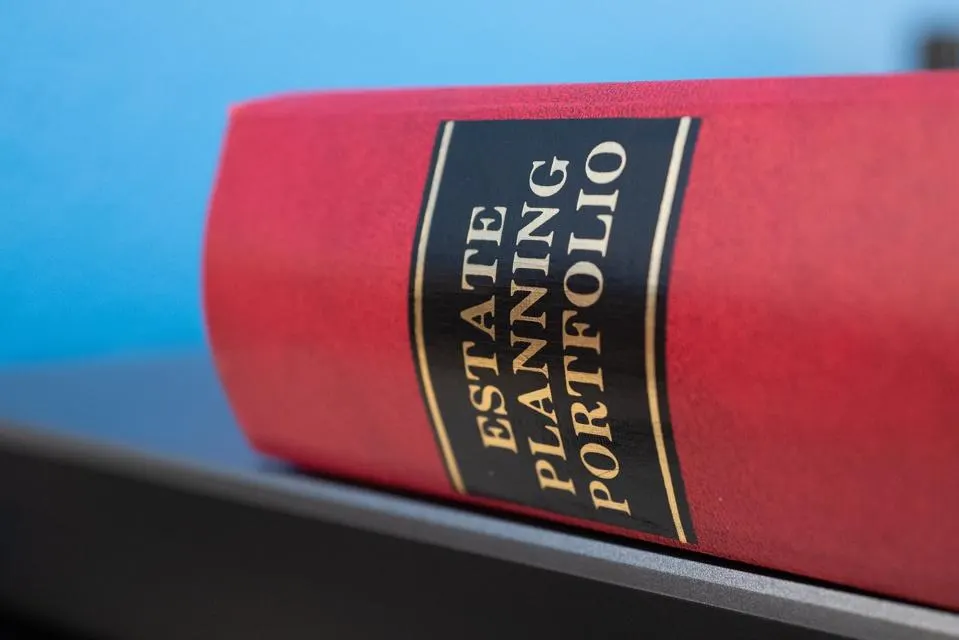

Letter of Testamentary: What It Is & Why You Need It

Creating a last will and testament is one of the most fundamental efforts in estate planning, and a key component is naming an executor to carry out the will’s instructions. The executor is the person who will administer the estate, sees it through the probate process, and settles the decedent’s final affairs—in short, it’s a big responsibility. Before the executor can begin administering a deceased person’s estate, though, the executor needs to obtain a Letter of Testamentary (also called letters testamentary). In this article, we’ll explain what a letter of testamentary is, why you might need one, how to get...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 28, 2024

Should you use a transfer on death account (TOD)?

When it comes to estate planning, each individual’s needs dictate the simplicity or complexity of the solution that will best fit their goals. For those who care about avoiding probate, ease of distribution to beneficiaries, and simplicity of set-up, a transfer on death (TOD) account could be a great option. A TOD account provides a simple way to transfer assets to beneficiaries without the need for complex legal structures like trusts. Here, we’ll explain what a TOD account is, its main benefits and drawbacks, and how it can be used as part of an estate plan to transfer wealth quickly...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 26, 2024

How AI Can Be Used in Your Law Firm

For busy attorneys, finding ways to boost efficiency can elevate client service and free up more hours in your day—and leaning on carefully chosen tools may help you achieve that. With the emergence of artificial intelligence (AI) and its practical uses in improving efficiency across so many industries, you may be wondering how—if at all—you might use it in your law practice. From removing tedious administrative tasks to speeding up case analysis and research, the latest AI technologies present many opportunities to help solo practitioners and large law firms maximize productivity while improving client outcomes. The use of AI in...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 21, 2024

Popular Software for Law Firms in 2024

As a legal professional, incorporating specialized software for lawyers into your practice can help you save countless hours and improve productivity, all while providing better service to your clients. Finding the right legal industry software can free you from routine tasks so you can spend more time on the most essential work that only you can do. Plus, many software solutions can take some of the weight off the shoulders of your assistants and paralegals, improving efficiency and productivity in your firm. Software for law firms comes in many categories. To help you gain a better idea of how legal...

Blog

Blog

Rachel Pettis

•

Mar 19, 2024

Vanilla’s new features for March – Introducing Vanilla Scenarios & an upgraded Estate...

March feature madness is in full swing here at Vanilla with new releases and an exciting launch last week! Here's what we're most excited about this month: Introducing Vanilla Scenarios™ An upgraded client Estate Profile Model the future impact of planning with Vanilla Scenarios™ Currently in the Vanilla platform, advisors, planners, and attorneys can use our recently enhanced projections feature to visualize a client’s current estate at a future point in time, like the 2026 Sunset. With Vanilla Scenarios™, rolling out over the coming months, wealth advisors will be able to model the future impact of advanced planning on top...

Webinar

Webinar

Vanilla

•

Mar 19, 2024

Legacy Now Spring 2024

In this Spring’s Legacy Now, we’ve packed an entire summit’s worth of thought-leadership content into just 1.5 hours — so even the busiest professionals will be able to attend and come away with high-impact, actionable insights. For the first time, we’ll be showcasing three different panels with subject matter experts, highlighting key learnings in different arenas of finance and estate planning, including: Panel 1: Innovative approaches to opening doors to new and 2nd-gen clients Panel 2: Scaling estate planning to every advisor in the org Panel 3: How T&E attorneys are ramping up for the 2026 exemption sunset You’ll hear...

Blog

Blog

Madison Eubanks

•

Mar 19, 2024

Practical Advice for Navigating Probate

Probate—the legal process of administering a person’s estate after their death—can be a loaded topic. Depending on the size and complexity of the decedent’s (the deceased person’s) estate, how organized their affairs were at the time of their death, the state they lived in, and many other factors, the probate process may vary widely from person to person. Of course, the best way to deal with probate is to avoid it. A thorough estate plan that includes a revocable trust dictating where assets go can allow an estate to bypass (or mostly bypass) the oft-tedious probate process. To learn more...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 14, 2024

Dynasty Trusts: Everything You Need to Know

To achieve estate planning objectives, it helps to be familiar with various types of trusts. A dynasty trust can be a great tool for clients who want to preserve their wealth or family business for several generations while minimizing estate taxes. Here, we’ll help you understand what exactly a dynasty trust is, how it works, how it differs from other trusts, how to set one up, and when it might be a good idea to use one. We’ll also discuss the tax implications of using a dynasty trust and how it can minimize a certain type of tax that specifically...

News Entry

News Entry

ThinkAdvisor

•

Mar 13, 2024

Vanilla Rolls Out Estate Plan Visualizer

Vanilla announced Wednesday the launch of a new estate plan visualization and evaluation tool called Vanilla Scenarios. The tool enables advisors to visualize potential federal and state estate tax mitigation strategies in real time, according to the firm’s announcement. Advisors can layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state of residency or beneficiaries. This approach to modeling allows advisors to showcase the potential impact of each scenario, the firm explains, providing clients with actionable insight and recommendations for meaningful planning improvements. [...] Read more: Vanilla Rolls...

Webinar

Webinar

Vanilla

•

Mar 12, 2024

Inside the 2024 Estate Planning Playbook & AMA with Steve Lockshin

Estate planning is an essential pillar of holistic financial advice — but the complexity of it can feel daunting to many advisors. In this webinar, we take you step-by-step through how to incorporate estate planning into your practice, using top advisor Steve Lockshin’s own playbook. And we delve into new developments in 2024 you’ll want to keep an eye on as you strategize. In this webinar, you’ll also see an exclusive Q&A session with two industry leaders: Steve Lockshin, co-founder of Vanilla and AdvicePeriod, and Arielle Lederman, a senior wealth advisor, strategist, and former estate attorney. You’ll come away with: ...

News Entry

News Entry

CityWire

•

Mar 12, 2024

Vanilla launches new estate modeling software

Estate planning tech firm Vanilla today launched its new planning software, making it available to clients for the first time, the firm said. The new software, called Vanilla Scenarios, will allow advisors and estate lawyers to model different estate planning strategies for their clients to help them see the implications of those strategies in real time. Scenarios will allow customers to layer a Grantor Retained Annuity Trust (GRAT), a Spousal Lifetime Access Trust (SLAT), an Irrevocable Life Insurance Trust (ILIT) and a Qualified Personal Residential Trust (QPRT) over a client’s existing estate plan, allowing them to make more...

News Entry

News Entry

Investment News

•

Mar 12, 2024

Tech provider Vanilla unveils estate planning scenarios tool

Estate planning technology firm Vanilla is looking to shake up the wealth landscape with a new planning visualization tool. The platform's latest offering, Vanilla Scenarios, seeks to modernize how advisors, wealth planners, and estate lawyers plan and optimize their clients' estate strategies. [...] Read more: Tech provider Vanilla unveils estate planning scenarios tool [Leo Almazora, Investment News]

Blog

Blog

John Costello

•

Mar 12, 2024

Vanilla Unveils Vanilla Scenarios™ to Power Interactive Estate Planning and Modeling

Vanilla Scenarios provides advisors and estate strategists with powerful planning tools to identify planning gaps, visualize future projections, and optimize plans for maximum impact. Vanilla, a leading provider of innovative estate planning software, today announced the availability of Vanilla Scenarios™, a powerful new tool designed to optimize clients' estate plans for the future. Vanilla Scenarios modernizes estate planning by providing advisors, wealth planners, and estate lawyers with unparalleled capabilities to model multiple planning scenarios dynamically and in real-time. Advisors can effortlessly layer multiple strategies onto existing plans and customize the details of each strategy, including changes to their client’s state...

Blog

Blog

Simona Ondrejkova, CFP

•

Mar 01, 2024

25 Critical Discovery Questions for Financial Advisors

Whether you’re meeting with a new prospective client or doing a client review with a client you’ve had for decades, it’s important to know how to guide the conversation. Asking the right questions allows you to gain the insights you need to provide the best advice possible while fostering a deeper connection. Because when you take the time to listen to clients’ answers to these questions mindfully, It shows that you genuinely care about their goals, values, and needs. The questions you ask at the first discovery meeting with a new potential client are especially key in building a strong...

News Entry

News Entry

ThinkAdvisor

•

Feb 23, 2024

Estate Planning Is ‘The Next Frontier’ for Advisors: Steve Lockshin

Estate planning is moving to the forefront of the consumer’s mind,” says Steve Lockshin, the founder of the estate planning platform Vanilla. His goal is to move it to the forefront of the financial advisor’s mind. In a recent interview with ThinkAdvisor, the AdvicePeriod co-founder and principal argues that estate planning is “the next frontier. This is true for anybody who has any wealth at all.” Lockshin, an early champion of high tech for advisors, discusses why he thinks estate planning will become “a staple” with financial advisors and why it is “an important family security issue.”...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 23, 2024

How Estate Administration Works & Ways to Simplify it for Your Beneficiaries

Whether you’re putting together your estate plan, assisting your clients in the process, or figuring out how to navigate the intricacies of distributing a loved one’s estate, it’s helpful to understand the estate planning and administration process. This can save you or your beneficiaries time by planning ahead so you can reduce unnecessary stress in transferring assets to heirs. When considering estate planning strategies to maximize your legacy and transfer your assets according to your wishes, it’s also helpful to consider how your estate planning & administration can be affected by probate. So today we explain the steps involved in...

Blog

Blog

John Costello

•

Feb 22, 2024

Vanilla Wins Best Financial Planning Award from WealthTech Americas

Latest award win highlights innovative estate planning technologies within Vanilla platform, including VAI and Vanilla Scenarios Vanilla, a leading provider of innovative estate planning software, has been named winner of the Financial Planning (US) category at the WealthBriefing WealthTech Americas Awards. The annual award program is organized by WealthBriefing and its sister publications WealthBriefingAsia and Family Wealth Report, recognizing achievements across the wealth management industry. The awards are designed to showcase outstanding firms and individuals that have demonstrated innovation and excellence during the last year, as evaluated by an esteemed panel of independent judges Vanilla’s win in the Financial Planning...

Webinar

Webinar

Vanilla

•

Feb 21, 2024

The Impact of Planning: Introducing Vanilla Scenarios

With Vanilla’s newest planning feature, Scenarios, advisors can visualize a client’s estate plan today and model future outcomes. Join this webinar to learn how to: Utilize the new Projections feature to create a base case showing changes in wealth at specific points in time Conduct what-if analyses and stack different planning strategies together with Scenarios to achieve client goals Visualize tax mitigation strategies and call out unwanted liability situations Have richer conversations about your clients’ futures and make meaningful planning improvements Plus, you’ll hear from Hightower why advanced planning is integral for advisors and planners to offer more value to...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 20, 2024

What Is a Credit Shelter Trust? And How Can It Help Minimize Estate...

In estate planning, there are several types of trusts especially designed to help individuals avoid or reduce estate taxes. One of these is the credit shelter trust. The credit shelter trust is often used by married couples as one of many estate planning strategies that can help them pass on more wealth to beneficiaries after both spouses pass away. Here, we explain what a credit shelter trust is, how it works, and when you or your clients should consider using it to leave a greater legacy by minimizing or even eliminating the estate tax bill. What is a credit shelter...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 16, 2024

Top Financial Advisor Software Picks for 2024

If you’re an advisor looking to deliver the highest level of client service without adding more work to your plate, the right technology stack - whether it’s financial planning software, investment management software, or estate planning software - can be an invaluable asset to your practice. From projecting retirement outcomes, to helping clients visualize the impact of different investment choices on their goals, to supporting clients in achieving their legacy goals, there is software out there that can fill nearly any gap. But where do you start when it comes to finding the best software for your practice? To save...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 15, 2024

Grantor Trust vs Non-Grantor Trust: What’s the Difference?

If you or your clients are considering an estate planning strategy that includes a trust, you may be wondering about the difference between the many types of trusts out there. Specifically, if you hear a trust referred to as a grantor trust, what does that mean? And how is this different from a non-grantor trust? Today, we’ll explain the difference between a grantor trust and a non-grantor trust and help you understand when to use each one to achieve your estate planning goals. What is a grantor trust? A grantor trust is a type of trust in which the person...

Blog

Rachel Pettis

•

Feb 12, 2024

Vanilla’s new features for February – detailed projections, collaborative onboarding, charitable calculations

February is a short month, but that doesn’t mean we’re short on new features. The Vanilla team has been working hard and are excited to bring three high-impact new features in February: Enhanced Projections Collaborative Onboarding Auto-calculations for Charitable Gifts Let's dive in. Visualize the future value of an estate with the new Projections Wealth advisors play a crucial role in helping their clients understand the full picture of their wealth both today and in the future. Generalized financial planning tools are helpful for understanding how assets grow and fall over time. But they fall short when it comes to...

Blog

Blog

Simona Ondrejkova, CFP

•

Feb 06, 2024

The Impact of AI on Financial Advisors and Four Ways to Stay Ahead

Artificial intelligence (AI) is revolutionizing the way business is done in many industries. With about 42% of large-scale organizations actively using AI in their business, the financial services industry is no exception. Individual use of large learning models (LLMs) like ChatGPT and Bard has also grown exponentially, including AI-powered software and AI based financial advisors. This begs a couple of very important questions. What does the rise of AI mean for the potential future of financial advisors, their clients, and individuals seeking out financial advice? And how can advisors leverage AI in their business to maintain a competitive edge, deliver...

Client material

Client material

Daniel Brockley

•

Feb 01, 2024

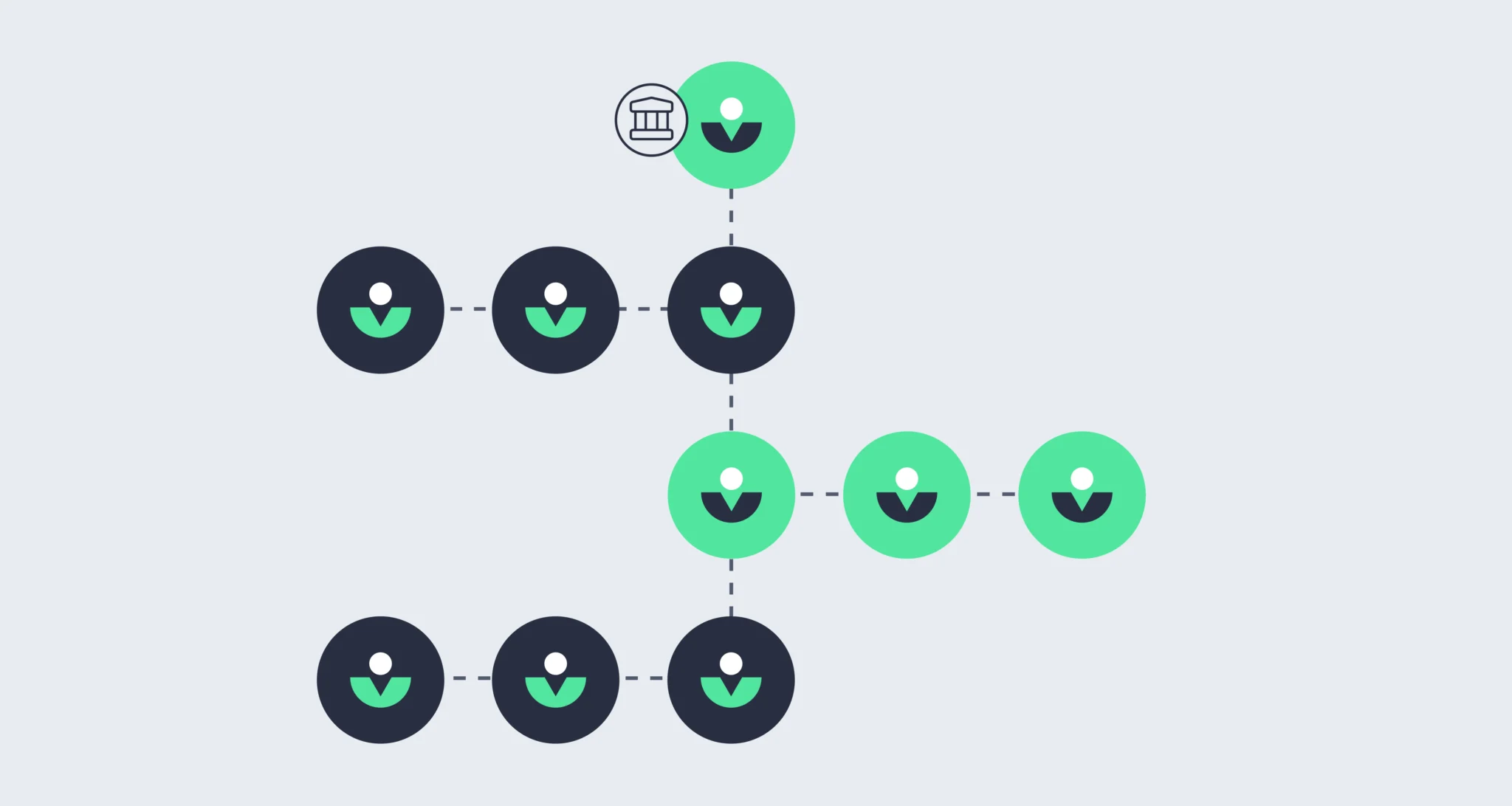

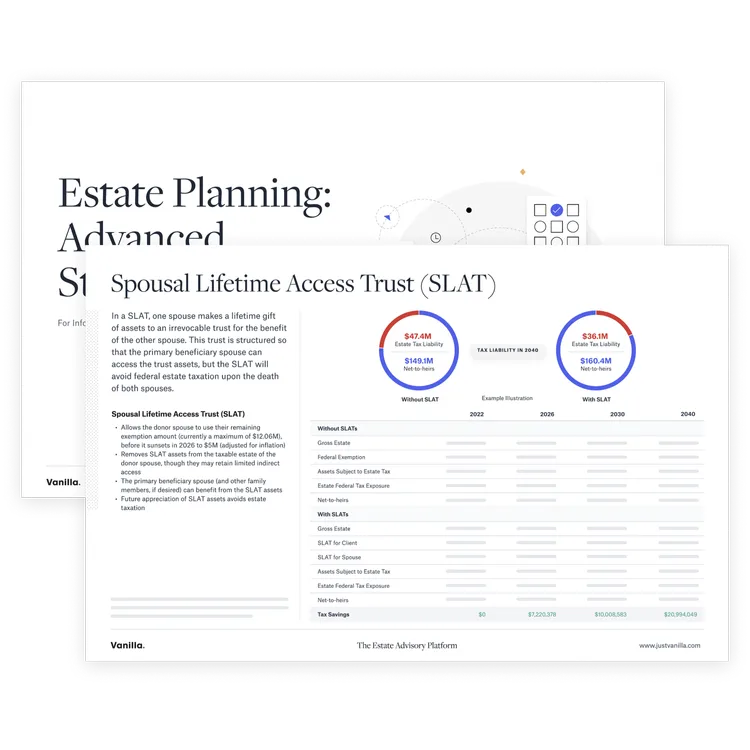

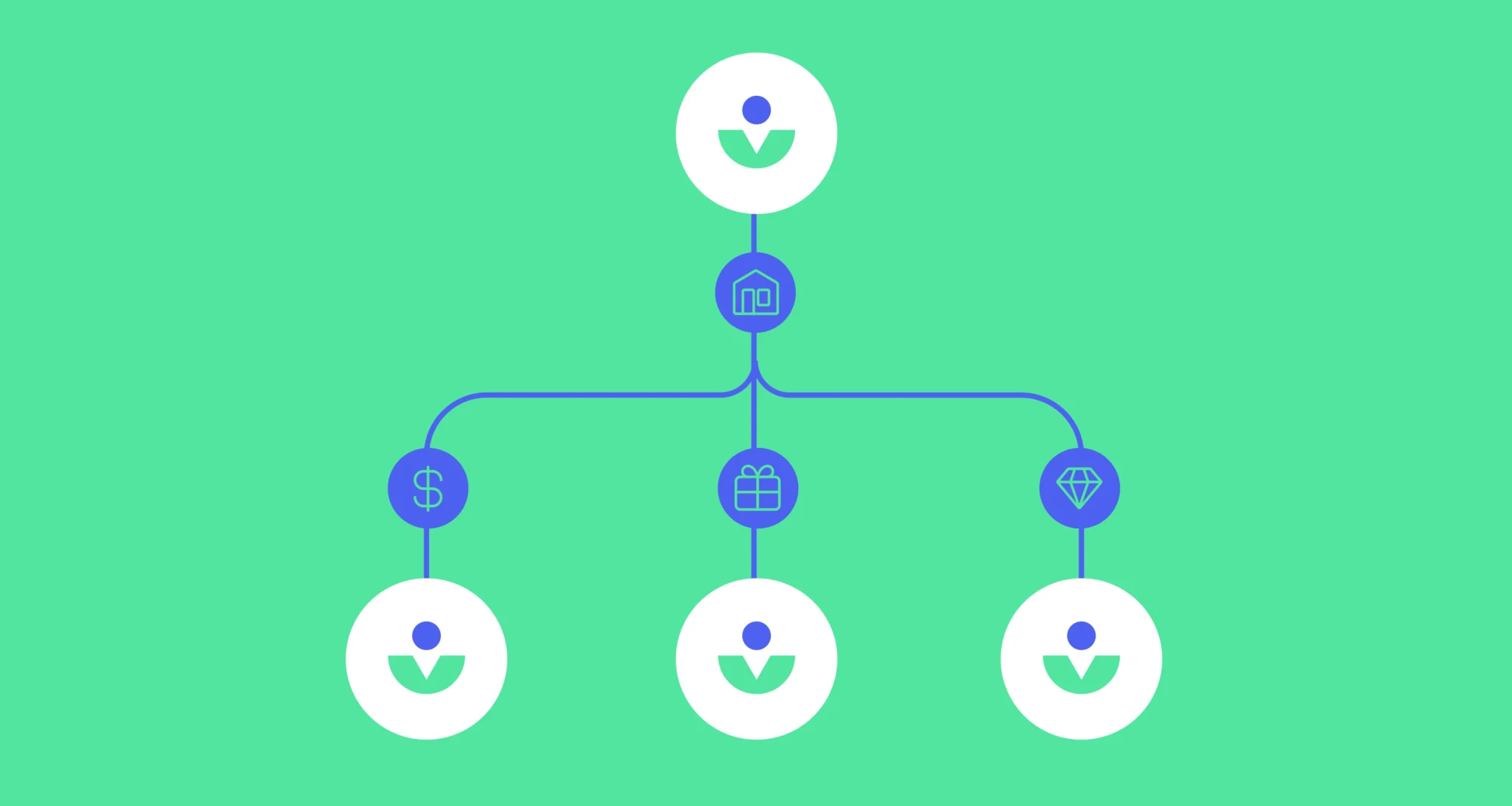

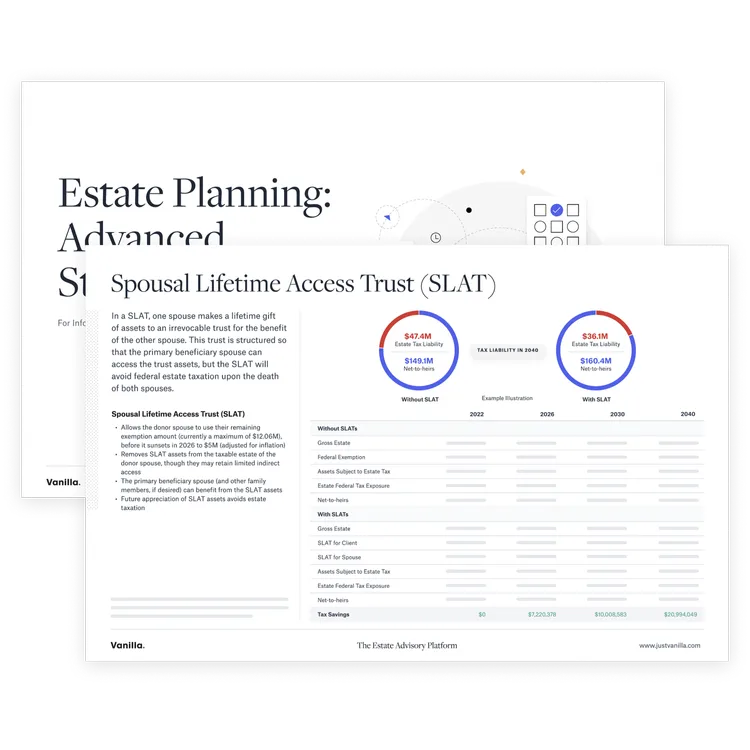

Estate Planning: Advanced strategies (Brandable)

Tax planning for clients with taxable estates has always been complex. The best way to explain strategies is with diagrams, not documents. That’s why we’ve put together this brandable PowerPoint presentation for client meetings with 10 diagrams to explain some of the advanced strategies and why anyone with $10M in assets should care about estate tax.

Webinar

Webinar

Vanilla

•

Feb 01, 2024

How to Choose the Right Estate Planning Software for Your Firm

In this webinar, you’ll get an expert POV from Erin Hulse, the CEO of Deviate Consulting, which specializes in helping firms select software and implement it into their systems. She’ll take you through step-by-step how to evaluate estate planning software, including your firm’s specific needs, security, integrations, scalability, and more. You’ll also hear from Brittany Brown, senior associate at Summit Trail Advisors, who recently went through a rigorous process of estate planning software evaluation in preparation for her firm’s purchase decision. Be sure to download the Buyer’s Guide to Estate Planning Software as well, which we will be referencing throughout...

Blog

Blog

John Costello

•

Jan 23, 2024

Vanilla Launches AI-Powered Estate Planning Assistant and Expanded Document Builder Capabilities

New AI assistant VAI Chat helps advisors with estate planning concepts; streamlined document creation gives clients a modern estate planning experience Vanilla, a leading provider of innovative estate planning software, today announced new additions to its platform, including VAI Chat, Collaborative Onboarding, and the expanded availability of Vanilla Document Builder™. VAI Chat is an AI-powered assistant designed to simplify the estate planning experience for wealth planners, advisors, and their clients. Currently in beta, VAI Chat offers an intuitive chat experience in the Vanilla platform, answering practical estate planning questions sourced from a curated corpus of estate planning content. Its capabilities...

News Entry

News Entry

Vanguard Pressroom

•

Jan 18, 2024

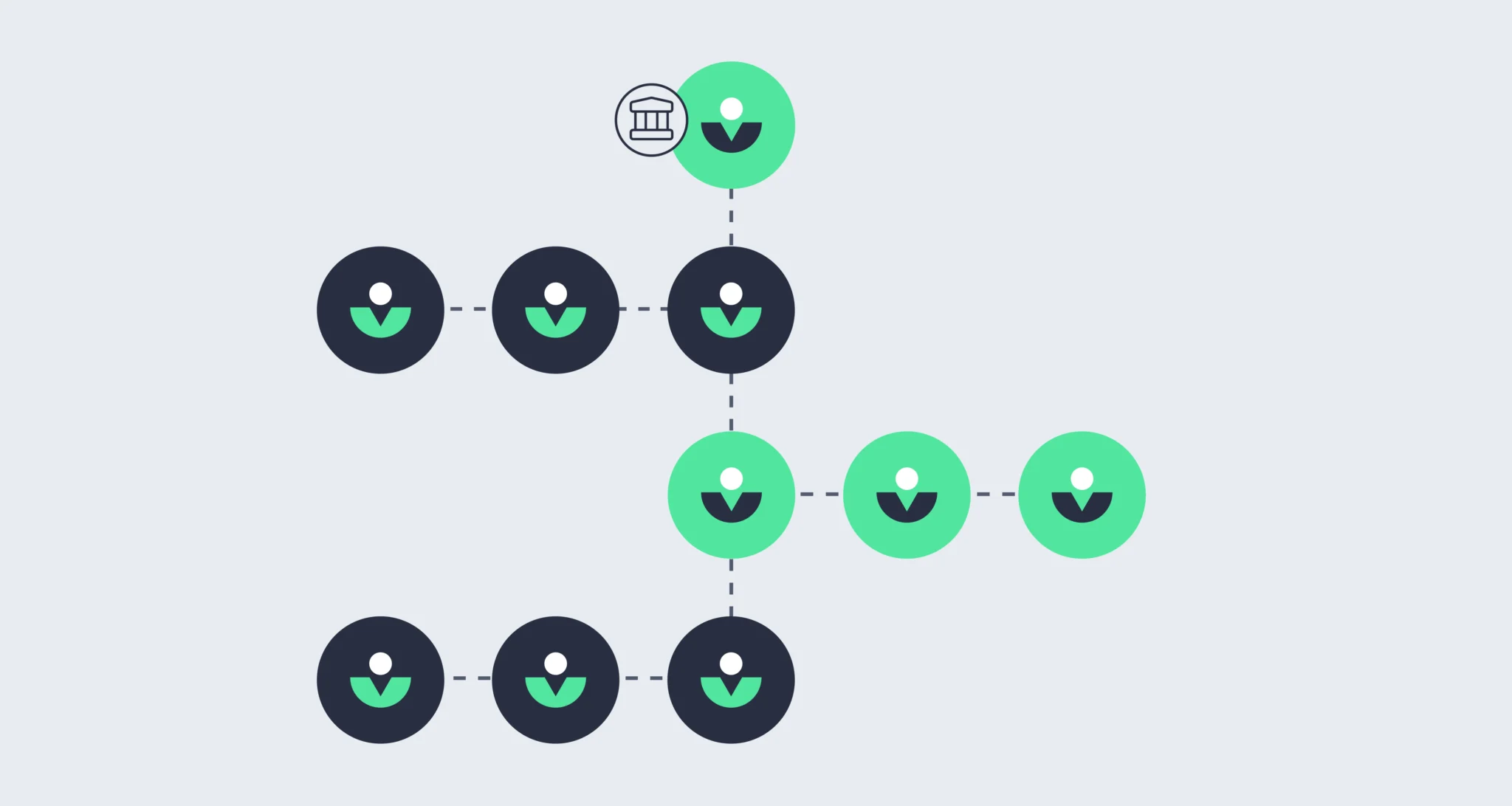

Vanguard Introduces Enhanced Digital Estate Planning Tools to Investors Through Partnership with Vanilla

Vanguard is introducing new and enhanced intergenerational wealth and legacy planning capabilities through a partnership with Vanilla, an innovative provider of digital estate planning tools and solutions. The offer was successfully piloted to a small cohort of eligible advised clients in Vanguard Personal Advisor Wealth Management over the past year and will scale to provide ultra-high-net-worth Vanguard investors with a powerful visualized approach to help manage and achieve their current and future estate planning objectives. [...] Read the full article here: Vanguard Introduces Enhanced Digital Estate Planning Tools to Investors Through Partnership with Vanilla [Pressroom, Vanguard]

Blog

Blog

John Costello

•

Jan 18, 2024

Vanguard Introduces Enhanced Digital Estate Planning Tools to Investors Through Partnership with Vanilla

Vanguard is introducing new and enhanced intergenerational wealth and legacy planning capabilities through a partnership with Vanilla, an innovative provider of digital estate planning tools and solutions. The offer was successfully piloted to a small cohort of eligible advised clients in Vanguard Personal Advisor Wealth Management over the past year and will scale to provide ultra-high-net-worth Vanguard investors with a powerful visualized approach to help manage and achieve their current and future estate planning objectives. Launched in 2015, the Personal Advisor suite of advice offers is Vanguard’s industry-leading hybrid advice service that combines a sophisticated online experience and underlying technology...

Blog

Blog

Vanilla

•

Jan 11, 2024

Vanilla Appoints Marc Dorfman as Chief Revenue Officer

Vanilla adds more than 20 years of experience in financial services and fintech to C-suite Vanilla, a leading provider of estate planning software, today announced the appointment of Marc Dorfman as Chief Revenue Officer. Marc brings extensive experience in sales and customer success to Vanilla, with over two decades of driving revenue growth and leading high-performing teams in the financial services and fintech industries. Throughout his career Marc has excelled at forging strong client relationships and navigating complex sales cycles, working with the largest asset and wealth managers in the world. In addition to guiding their investment strategies, Marc has...

Guide

Guide

Blog

Blog

Daniel Brockley

•

Jan 09, 2024

Leveraging Centers of Influence: A Strategic Approach for Financial Advisors

Ask most financial advisors how they get their best clients, and nine times out of ten, they’ll answer: referrals. Referrals are the lifeblood of new business for financial advisors, because what an advisor does requires an immense amount of trust from clients. Referrals from a friend or colleague are a shortcut to that trust. But referrals don’t have to be from other clients. Referrals from industry professionals in complementary occupations – so called “centers of influence” – can not only yield new business, but a higher level of service for your clients by integrating complementary services for a more holistic...

Webinar

Webinar

Vanilla

•

Jan 08, 2024

What’s new with Vanilla: January 2024

Learn more about Vanilla Document Builder, now generally available, and an enhanced client onboarding experience coming soon. Plus we have an exciting update regarding VAI, our purpose built AI for estate planning. Tune in to: See how your clients can create estate plan documents on-demand Expedite client onboarding and invite clients to complete a self-guided questionnaire Work smarter thanks to the power of VAI, AI for estate planning Hear about other new and upcoming features in the Estate Advisory Platform

News Entry

News Entry

SHIFT with Ross Marino [Podcast]

•

Jan 05, 2024

Preventing Trust Fund Monsters with Steve Lockshin

Steve Lockshin joins Ross Marino on advising high level investors on their retirement plans and preventing "trust fund monsters." [...] Listen to the full episode here: Preventing Trust Fund Monsters with Steve Lockshin [SHIFT with Ross Marino]

Blog

Blog

Rachel Pettis

•

Dec 29, 2023

2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning

Welcome to 2024! It's a new year which means higher inflation-adjusted exemptions. Accordingly, we have updated the Vanilla Estate Advisory Platform with the newest inflation-adjusted estate planning figures recently released by the IRS. This will enable advisors to accurately project the growth of clients’ estates and strategize on trust structures, gifting, tax mitigation and more. Source: IRS.gov Federal Estate Tax Exemption The federal estate tax exemption has increased from $12.92M to $13.61M per individual (or $27.22M per married couple). For advisors whose clients have taxable estates, it’s important to note that estate tax exemptions are “unified”. This means that if...

Webinar

Webinar

Vanilla

•

Dec 19, 2023

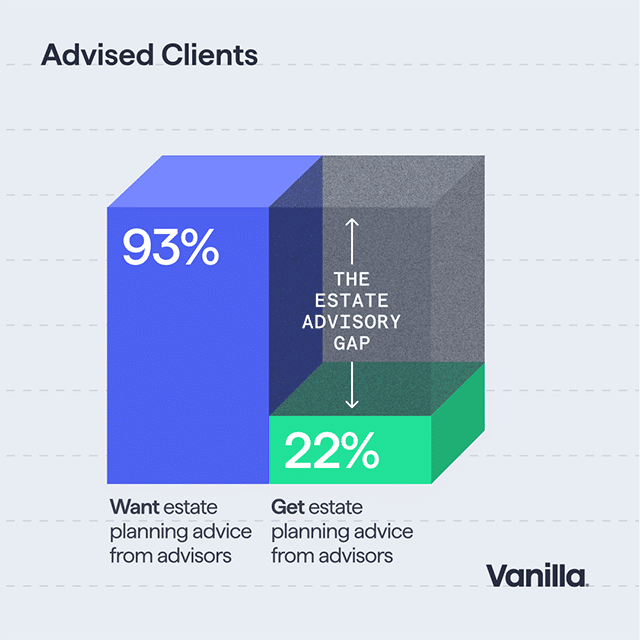

Grow Business & Deepen Client Relationships with Estate Advisory

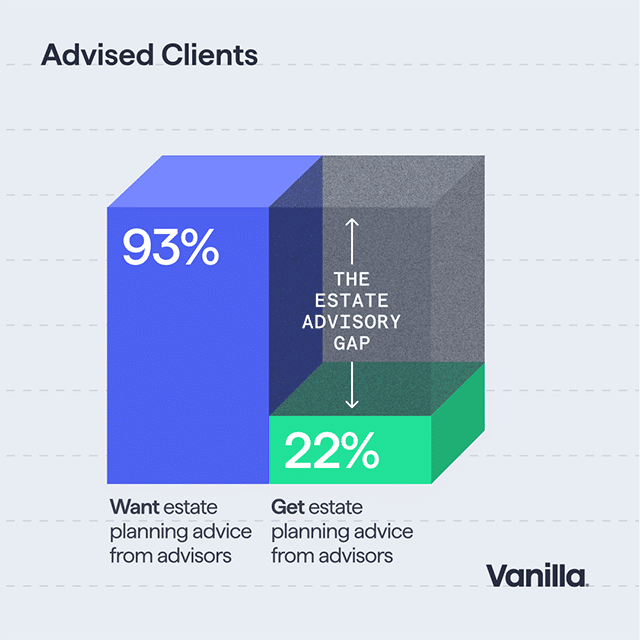

Estate advisory is the practice of using ongoing estate planning to uncover and align your clients ultimate goals. In today’s competitive market, financial advisors need a way to stand out and deliver better service to their clients. In fact, in a study conducted by Spectrem, 93% of clients want estate planning from advisors and only 22% are getting it. Estate advisory can expand existing relationships, address client pain points, and broaden prospecting opportunities. Hear from a panel of industry peers on the benefits of offering estate advisory, how to address related challenges, and grow your business. Learn how: Estate advisory...

News Entry

News Entry

The Diamond Podcast for Financial Advisors

•

Dec 14, 2023

Barron’s Top Advisor and Industry Visionary Steve Lockshin: Lessons from the Life of...

Steve Lockshin, founder of Vanilla, AdvicePeriod, and others, offers a unique perspective on how an advisor’s entrepreneurial DNA can drive their ability to serve clients and grow untethered, particularly in the independent space. Many advisors often face an unfortunate truth: The decision-makers at a firm often know very little about being an actual financial advisor. Steve Lockshin has sat on both sides of the proverbial table, and he shares two unique vantage points: The perspective of an advisor who recognizes the limitations at his current firm and the entrepreneur and problem solver who fills those gaps with new solutions....

Blog

Blog

Simona Ondrejkova, CFP

•

Dec 14, 2023

8 Key estate planning tools for financial advisors and clients

Advisors often hesitate to bring up estate planning with clients because they’re not sure where to start…or which aspects of estate planning to cover. While some estate planning strategies can be complex, advisors can still start meaningful conversations by understanding some basic estate planning tools that every client should consider. While many basic estate planning tools are simple to implement, many clients are simply unaware of their existence or importance. That’s where great advisors can come in and potentially help uncover missing pieces that could drastically affect how a clients’ wishes are carried out. Regardless of your level of estate...

Blog

Blog

Rachel Pettis

•

Dec 04, 2023

New educational pages and enhancements for Vanilla reports

If there’s one thing we all agree on here at Vanilla it’s that estate planning matters, a lot. But not every client understands just how important estate planning is. Proper estate planning ensures the preservation of wealth – and its intended purpose for clients and their families. The best planning keeps a client’s family secure, both while they’re alive and long after, whereas improper or lack of planning may expose a client to lengthy legal proceedings, unnecessary taxes, probate fees, and more. We know from advisors that clients need ongoing education to make the most informed decisions for their estate...

Webinar

Webinar

Vanilla

•

Nov 28, 2023

Best Digital Marketing Strategies for Financial Advisors in 2024

In 2024, the opportunities to land new clients for your practice through online marketing are endless. But with the rise of AI and fast-changing digital marketing trends, figuring out how to get your business in front of ideal prospects – and turn them into clients – can be confusing and overwhelming. So how should you allocate your time or budget to get the highest ROI on your digital marketing efforts? Join us as we help you navigate the sea of marketing strategies and show you how to create a strong online presence and a solid marketing plan that grows your...

Blog

Blog

Daniel Brockley

•

Nov 21, 2023

New client conversations: How to lay a rock-solid foundation to a long-term relationship

The first conversations financial advisors have with clients and prospects are more than just exchanges of information. They are pivotal moments that set the stage for a lasting and fruitful relationship. These discussions–which can sometimes span multiple initial conversations depending on the client’s financial and family complexity–go beyond numbers and portfolios. They are a chance to understand the values, goals, and family dynamics that motivate them. These conversations enable you to develop a report, which is vital if you’re to be trusted with sensitive financial and family information. And they provide an important opportunity to gain crucial information that will...

Webinar

Webinar

Vanilla

•

Nov 16, 2023

Creating Estate Planning Documents with Vanilla

Legal documents are the foundation of any estate plan, and it’s crucial that your clients have up to date documents that reflect the estate strategy you’ve helped them create. 23% of clients with more than $1 million in assets do not even have basic estate documents in place – and those who do often have docs with crucial outdated information they may not even be aware of. Vanilla Document Builder enables wealth advisors and clients to create wills and trusts with simple, intuitive questionnaires as a part of the end-to-end estate advisory process. Information from the estate documents flows directly...

Blog

Blog

Simona Ondrejkova, CFP

•

Nov 15, 2023

What is an Intentionally Defective Grantor Trust (IDGT)?

An intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and leave a lasting legacy. It is especially effective for high net worth individuals who want to pass on highly appreciated or high-growth assets while minimizing estate taxes and potentially reducing income taxes. Due to their more complex nature, IDGTs can sometimes be misunderstood and underutilized, causing clients to miss out on their many tax-saving benefits. So what is an intentionally defective grantor trust? What makes it “defective” and how can this feature be used to help your clients pass...

Blog

Blog

Simona Ondrejkova, CFP

•

Nov 06, 2023

7 Effective digital marketing strategies for financial advisors

Digital marketing offers advisors a great opportunity to expand your client base, increase your authority in the industry, and grow your business. Because digital marketing allows you to reach a wider audience of qualified prospects faster, it’s also more scalable than simply relying on in-person networking, cold calling, or other more traditional ways of acquiring financial advisor leads. Yet when it comes to online marketing, what works in other industries doesn’t necessarily always work for financial advisors. With a basic grasp of the following digital marketing strategies for wealth management, you’ll be able to connect with qualified prospects, increase awareness...

Blog

Blog

Simona Ondrejkova, CFP

•

Oct 31, 2023

What is holistic financial planning and how can it help financial advisors and...

How can advisors deepen client relationships, attract and retain more clients, and grow their revenues all at once? By integrating holistic financial planning into their practice. Holistic financial planning isn't just about staying competitive in a world filled with roboadvisors and AI. It's a client-centered approach that goes beyond optimizing investment portfolios. It's about stepping into the role of a Total Wealth Advisor who prioritizes holistic advice over selling products and truly helps clients achieve their life's most cherished goals and dreams. Although there’s a lot of talk about goals-based planning in the industry, it can be hard to know...

Webinar

Webinar

Vanilla

•

Oct 30, 2023

Flipping the traditional wealth management model on its head with estate advisory

In the last few decades, wealth management has gone through a transformation. The very expertise that used to enable firms to stand out, investment strategy, has become largely commoditized. Today, clients are looking for more from their advisors, and standing out as an advisor takes a fresh, more holistic approach. Estate advisory is the ideal entree into new and deeper client relationships. It enables advisors not only to broach financial strategy on a more intimate level, but to help clients view their finances beyond the next few decades, and into the next few generations. In this, the advisor becomes an...

Blog

Blog

Simona Ondrejkova, CFP

•

Oct 26, 2023

Culturally aware estate planning: How to build trust and deepen relationships with clients...

Great client-advisor relationships don’t just happen by accident. They’re cultivated over time and founded upon a mutual sense of trust and understanding. This starts with communication that helps clients feel safe to openly share their financial goals and challenges without fear of judgment. In an increasingly globalized world, advisors have clients who often come from many different backgrounds, belief systems, and cultures. Perhaps some of your clients emigrated to the US from other countries or grew up with immigrant parents. As a result, their beliefs and attitudes around the topics of finance and estate planning might be completely different from...

Blog

Blog

Daniel Brockley

•

Oct 24, 2023

Estate planning for digital assets: From social media and digital photos to crypto...

It used to be simple. Well, relatively simple. Physical possessions and properties were documented in trusts and wills, and when someone died, the executor would collect the keys and doll the possessions out. (Okay, I’m skipping probate and a few rather essential steps here, but you get the drift). What happens, though, when there is no physical possession – when there is no key? What happens when the assets in question are non-tangible? When they exist only in the digital world? Vanilla recently held a partner webinar with Kitces.com, where Jeff Levine outlined some key considerations that advisors and clients...

News Entry

News Entry

Investment News

•

Oct 20, 2023

Estate planning gets an AI makeover thanks to Vanilla

Artificial intelligence is certain to change how financial advisors and wealth managers operate, with many applications streamlining and accelerating processes. Estate planning solutions firm Vanilla is aiming to leverage the power of AI to speed up everyday tasks such as turning estate documents into diagrams, creating projections for federal and state-specific estate tax, and beneficiary summaries. Using its own purpose-built AI model called VAI, the firm’s newly launched suite of tools will assist advisors in understanding the unique circumstances and issues for high-net-worth families. This will include identifying planning opportunities to help advisors stay ahead of the curve....

News Entry

News Entry

CityWire

•

Oct 19, 2023

Vanilla unveils AI estate planning tools for advisors

Estate planning software provider Vanilla on Thursday revealed the launch of a suite of artificial intelligence (AI)-powered resources, which the company says will save advisors time when navigating potentially complicated estate issues. The new tools, the company says, will use AI to assess family structures and tax implications, both to provide more well rounded planning strategies and to produce graphics to help clients better understand their situation. ‘We’re proud to introduce comprehensive, tech-forward solutions that make it easy for wealth planners and advisors to deliver proactive planning advice to clients at enterprise scale,’ stated Gene Farrell, Vanilla’s chief...

Blog

Blog

Amjad Hussain

•

Oct 19, 2023

New Vanilla innovations accelerate customers’ ability to deliver Estate Advisory

When we launched the Vanilla Estate Advisory Platform just over a year ago, we did so because we saw a problem without a solution. There was a deep need for a tool that enabled wealth advisors to help clients with their estate strategy as part of their holistic financial planning. Over the past year, our customers have not only used the Vanilla platform to grow their business and bring value to clients – they have helped us grow, too. We have worked hand in hand with our customers, from small RIAs to the largest enterprise firms to innovate and bring...

Blog

Blog

Vanilla

•

Oct 19, 2023

Vanilla Announces New AI-Powered Estate Planning Innovations

New AI features to accelerate how financial advisors and wealth advisors can serve high-net-worth clients at scale SALT LAKE CITY, UT – Vanilla, a leading provider of estate planning solutions today announced several new cutting-edge tools for advisors powered by VAI™, a proprietary AI model purpose-built by Vanilla to enhance the estate planning experience. At launch, VAI will power new features like Vanilla Estate Builder™ that will reduce the time it takes to turn estate documents into powerful diagrams, federal and state-specific estate tax projections, and beneficiary summaries. The new Vanilla Scenarios™ will leverage VAI to understand the client's family structure, proactively...

Blog

Blog

Vanilla

•

Oct 19, 2023

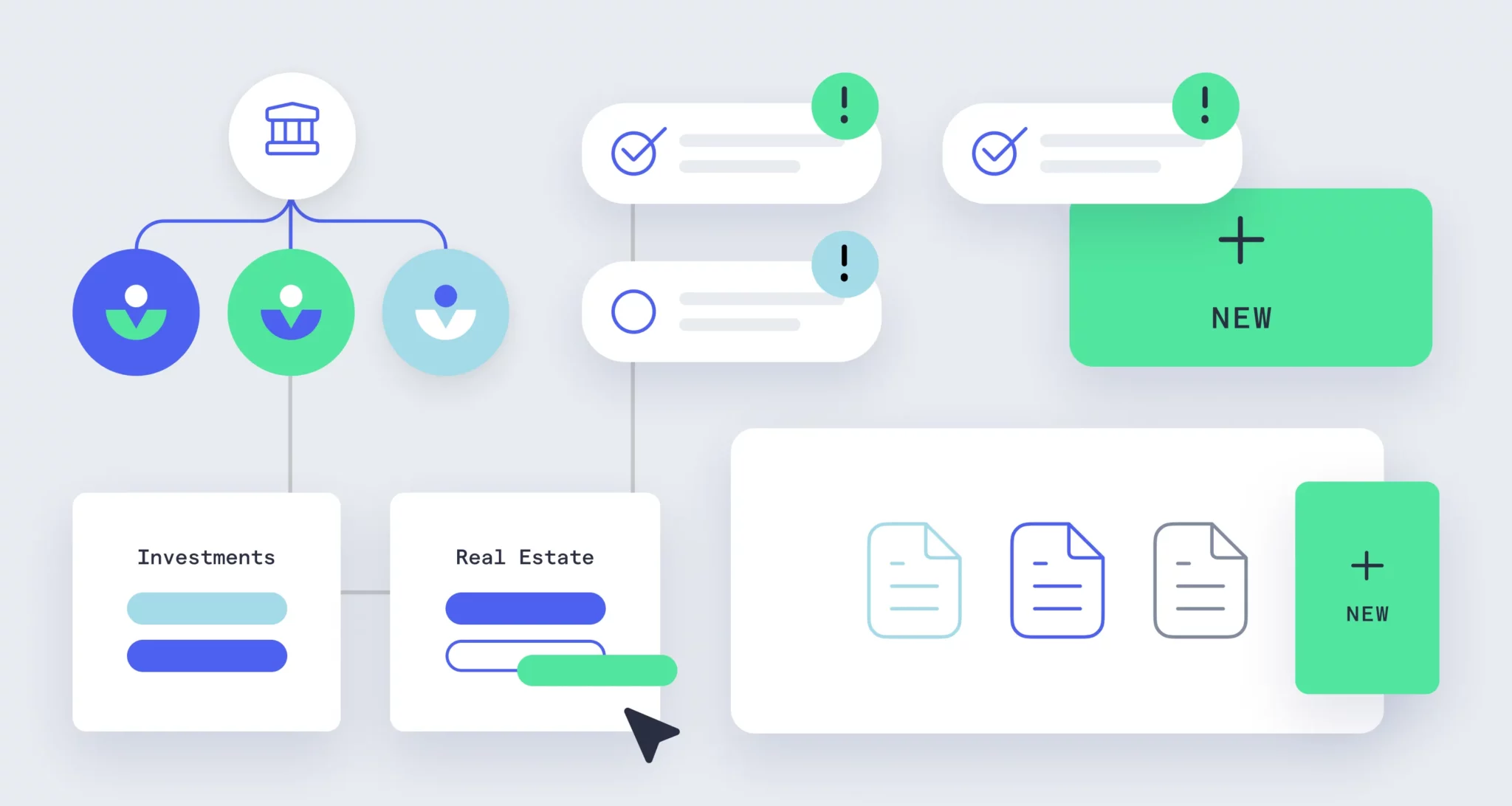

Create core estate planning documents on-demand with Vanilla Document Builder ™

Updated 10/19/23 Wealth advisors can now give clients a modern estate planning experience–starting with document creation, to estate plan visualizations and ongoing advisory At Vanilla, we believe it’s every wealth advisor's job to ensure that their clients have an estate plan that matches their values and goals. The foundation of a plan is its document, but more often than not, clients have out-of-date estate planning documents or none at all. In fact, according to Vanilla’s State of Estate Planning, 23% of clients with more than $1 million in assets do not have basic estate documents. The consequences of dying intestate,...

Blog

Blog

Simona Ondrejkova, CFP

•

Oct 09, 2023

A Guide to Estate Planning for Individuals with Special Needs

Estate planning for clients who have adults or children with special needs in their lives can be complex. Unlike traditional estate planning, special needs estate planning requires paying careful attention to the individual with special needs’ eligibility for government benefits. This is in addition to skillfully leveraging assets to most effectively attend to their unique health and wellness needs. Imagine that one of your clients is a family with three adult children, all living in different states. The two younger brothers have established their own families and are financially comfortable. But their oldest sister is living with muscular dystrophy and...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 29, 2023

Estate planning for high-net-worth and ultra-high-net-worth individuals

While everyone can benefit from a properly structured estate plan, it becomes even more critical for those with higher levels of wealth. High net worth and ultra-high net worth families often face unique challenges that may demand more sophisticated approaches to preserve and protect their wealth. Estate planning for high net worth individuals often starts with the same foundation as for smaller estates. But because larger estates are more likely to be exposed to estate taxes, creditors, and family or business conflicts, additional planning is required to mitigate these and other risks. Before offering several strategies that advisors and clients...

Blog

Blog

Gene Farrell

•

Sep 28, 2023

Vanilla appoints Nathan Hunt as Head of Finance and Doug Rybacki as Chief...

Vanilla Strengthens Its Leadership Team with Two Exceptional Hires Los Angeles, CA, – Vanilla, the industry-leading Estate Advisory Platform, is thrilled to announce the latest additions to its leadership team. Nathan Hunt joins Vanilla as Head of Finance and Doug Rybacki is joining as Vanilla’s Chief Product Officer. "We are excited to welcome Nathan and Doug to the Vanilla family. Their impressive backgrounds and strong functional leadership will help accelerate our mission of building the complete estate planning platform.” - Gene Farrell, CEO Nathan Hunt We are excited to introduce Nathan Hunt as our Head of Finance. Nathan brings a...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 26, 2023

A guide to estate tax planning for financial advisors

Beyond helping clients reduce capital gains taxes or income taxes, advisors are uniquely positioned to help clients preserve more of their wealth through proper estate tax planning. Imagine that just a few months after the unfortunate death of one of your clients, their surviving spouse or children find out they have to pay a large unexpected estate tax bill. What if this tax bill could’ve been avoided? Taking advantage of estate tax planning tools like gifting, trusts, and the marital deduction can help clients achieve their unique goals, maximize tax savings, and reduce survivors’ financial stress. Here, you’ll learn how...

Webinar

Webinar

Vanilla

•

Sep 26, 2023

Legacy Now Fall 2023

Welcome back to Legacy Now. On Oct 19th we shared the latest innovation and enhancements to the Vanilla Estate Advisory Platform. Together with our customers, we are redefining how financial advisors, wealth planners, attorneys and their clients approach one of the most important parts of each clients’ lives: their legacy. In this virtual launch event: Vanilla CEO Gene Farrell shares our view on the future of estate planning and advisory. We discussed the role technology and AI will play in transforming estate planning. Special guests discussed how they are preparing for the 2026 Exemption Sunset. Product experts presented the new...

Guide

Guide

Vanilla

•

Sep 26, 2023

New Client Conversations: An Estate Planning Checklist

Whether they're a new client, or a client with whom you haven't discussed estate planning with in the past, this checklist will take you through some important questions to ask to ensure you help meet their goals. This checklist is broken down by net worth and includes the important documents you'll want to make sure you gather.

News Entry

News Entry

Forbes

•

Sep 18, 2023

Why Modern Wealth Management Must Include Estate Planning

You’re not your grandfather’s financial advisor. The remit of advisors has been forced to adapt to a changing world and new client needs. This seismic shift, from a laser focus on assets directly under an advisor’s management to a holistic approach to monitoring wealth, is one that has benefited everyone, client and advisor alike. For the clients, the appeal is clear. They stand to gain more and feel safer when their wealth as a whole is being monitored and balanced by skilled professionals. And for advisors, the new approach allows them to serve their clients better and to develop deeper...

Blog

Blog

Jim Sinai

•

Sep 15, 2023

Vanilla’s new estate planning research reveals key opportunities for advisors

Introducing Vanilla’s first-ever State of Estate Planning report Advisors are at a crossroads. Technology is shaking things up, economic policies are evolving, and new generations of clients are knocking on the door. Finding ways to future-proof your business in the face of change and uncertainty can be daunting, so we decided to shine a light on clients' ever-changing needs and help advisors anticipate where the industry might be headed. This summer, we surveyed more than 1,000 Americans to capture the pulse of public opinion on a wide spectrum of estate planning issues. Today, we are thrilled to share the result...

News Entry

News Entry

Financial Planning

•

Sep 07, 2023

Study reveals UHNW fears in estate planning

While most Americans worry about having enough to leave behind, a new study finds that the ultrarich fear leaving too much behind and feeding "trust fund monsters." Estate planning wealthtech firm Vanilla, which is backed by investors including Michael Jordan, published a report on Thursday that dives into the motivations and fears driving Americans at all wealth levels in legacy planning. The report examines attitudes and behaviors in Americans with less affluence, reporting under $1 million of household net worth, as well as those in the high net worth and ultrahigh net worth spheres. Overall, respondents said they...

News Entry

News Entry

WealthTech Today [Podcast]

•

Sep 07, 2023

The Evolution of Estate Planning: A Conversation with Steve Lockshin, Vanilla

You’re listening to Episode 201 of the WealthTech Today podcast. I’m your host, Craig Iskowitz, founder of Ezra Group Consulting. This podcast features interviews, news and analysis on the trends and best practices, all about wealth management technology. My guest for this episode is one of the most well known leaders in the industry, Steve Lockshin. Steve is a serial entrepreneur in the wealth advisory industry. He’s a principal of RIA AdvicePeriod and co founder of Vanilla, a software platform for estate advisory and that’s what we’ll be talking about today, the estate planning software provider called Vanilla that...

Guide

Guide

Webinar

Webinar

Vanilla

•

Sep 06, 2023

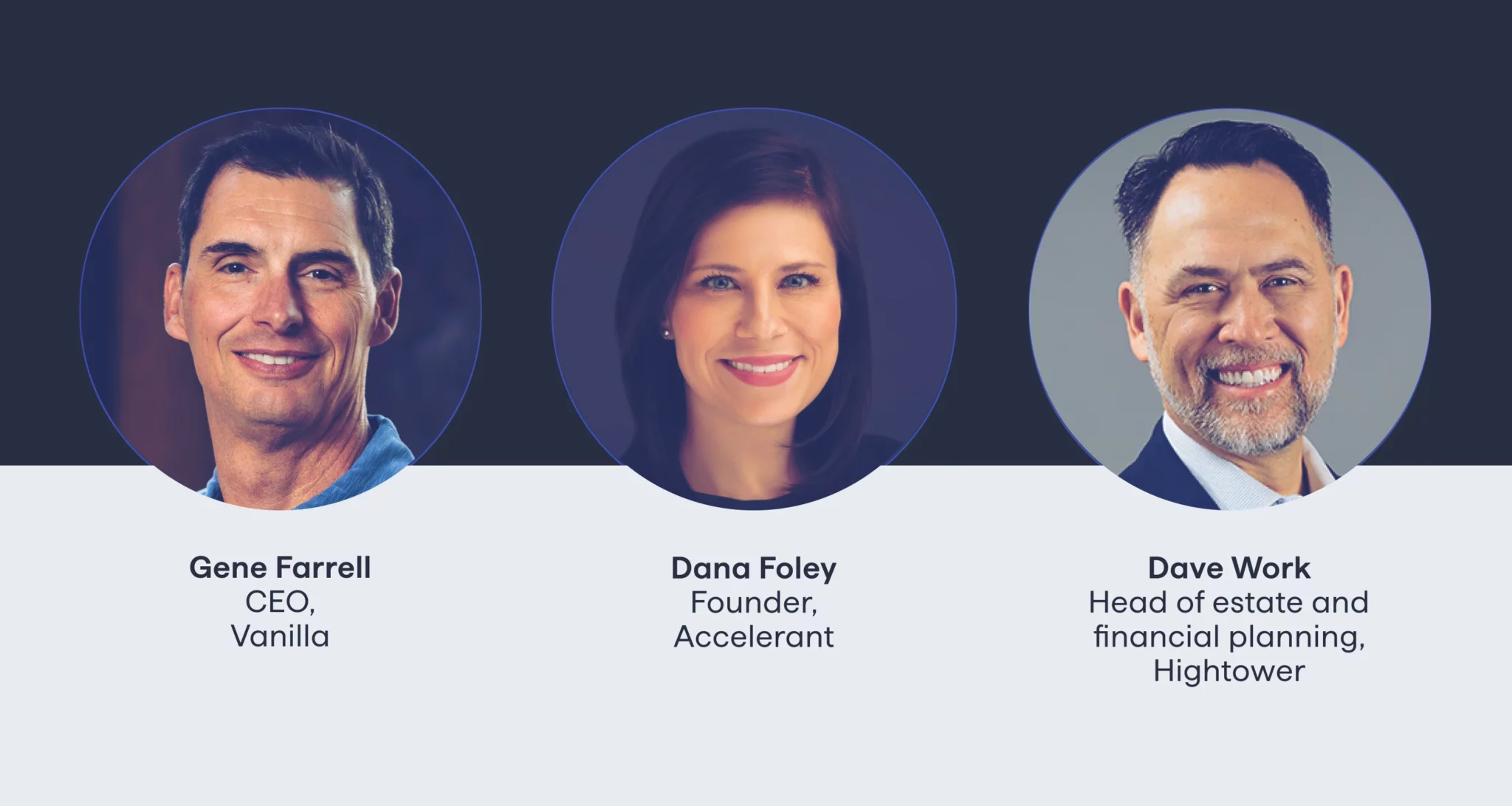

The State of Estate Planning 2023

Join three leaders in finance, technology and law as they uncover insights from a new research report on where finance and estate planning stand today – and where they are going in the future. They’ll explore how advisors can future-proof their business by embracing estate advisory. This webinar will unpack the research data, including client opinions, values, and biases related to a range of estate planning topics. Attendees will hear panelists share their expert perspectives on: Why estate advice requires intimate, difficult conversations and presents unique opportunities to deliver differentiated advice. How advisors can use estate planning to foster trust...

Blog

Blog

Simona Ondrejkova, CFP

•

Sep 05, 2023

What is a pot trust and how could it benefit your clients?

Do your clients struggle to structure their estate plan in a way that aligns with their wishes while providing for their heirs in cases of need? They might want to consider a pot trust. A pot trust is a type of trust that puts clients’ assets into a single pool for a certain group of beneficiaries. It gives the trustee the flexibility to distribute the assets as needed to benefit any given beneficiary. While some advisors highly recommend pot trusts because of their unique benefit of allowing for equitable, but not necessarily equal distribution, others view pot trusts differently. No...

News Entry

News Entry

Rethinking65

•

Aug 31, 2023

How Total Wealth Advisors Differentiate with Estate Planning and Insurance

At a recent conference, the speaker asked the audience of advisors, “Who in the room thinks they are smarter or a better investor than the people they are sitting next to?” A few bold people put their hands up, but most did not. Why? Because everyone in the room knows that beating the market consistently over a long period of time comes down to just luck. While clients would love to receive market-beating advice, no self-respecting advisor would try to win over clients by claiming to be exceptionally lucky. So, if investing and beating the market is not the...

Blog

Blog

Daniel Brockley

•

Aug 24, 2023

Estate planning for pets: Making sure the kibble keeps flowing when you’re gone

We are a nation obsessed with our pets. In the US alone, we spend $123.6 billion on our furry (and scaly) friends every year. It feels like my household alone must account for a sizable chunk of that for our derpy golden retriever Alfie, between healthcare, food, grooming, toys, the occasional boarding, more toys. You get the idea. When it comes to our dog, we are stupid in love and spare no expense. So, what happens if we’re no longer around to take care of our pets? Just as we make arrangements for our kids in the event something should...

Blog

Blog

Daniel Brockley

•

Aug 22, 2023

What is an advanced directive?

Life is unpredictable. Even if you’re at the pinnacle of health, running marathons and doing one-handed pushups, you could find yourself injured in a car wreck tomorrow. That’s why an advanced directive is so important. An advanced directive is a legal document that gives specific instructions regarding your healthcare wishes if you are incapacitated. There are any number of reasons you might not be able to communicate, including being under anesthesia, in a coma, or simply not well enough to speak coherently. In these instances, medical professionals will look to your advanced directive to guide them on how you want...

Blog

Blog

Simona Ondrejkova, CFP

•

Aug 18, 2023

10 effective lead generation strategies for financial advisors

Knowing how to generate leads as a financial advisor is key to expanding your book of business and achieving sustainable growth. That’s why it’s important to have several financial advisor prospecting tools you can lean on anytime to bring potential clients into your pipeline. While lead generation for financial advisors has usually relied on traditional channels such as networking events, cold calls, or referrals, embracing innovative marketing strategies could help advisors tap into new pools of prospects faster. This article is a comprehensive guide on how to generate leads for financial advisors who want to establish themselves as trusted experts,...

Blog

Blog

Rachel Pettis

•

Aug 17, 2023

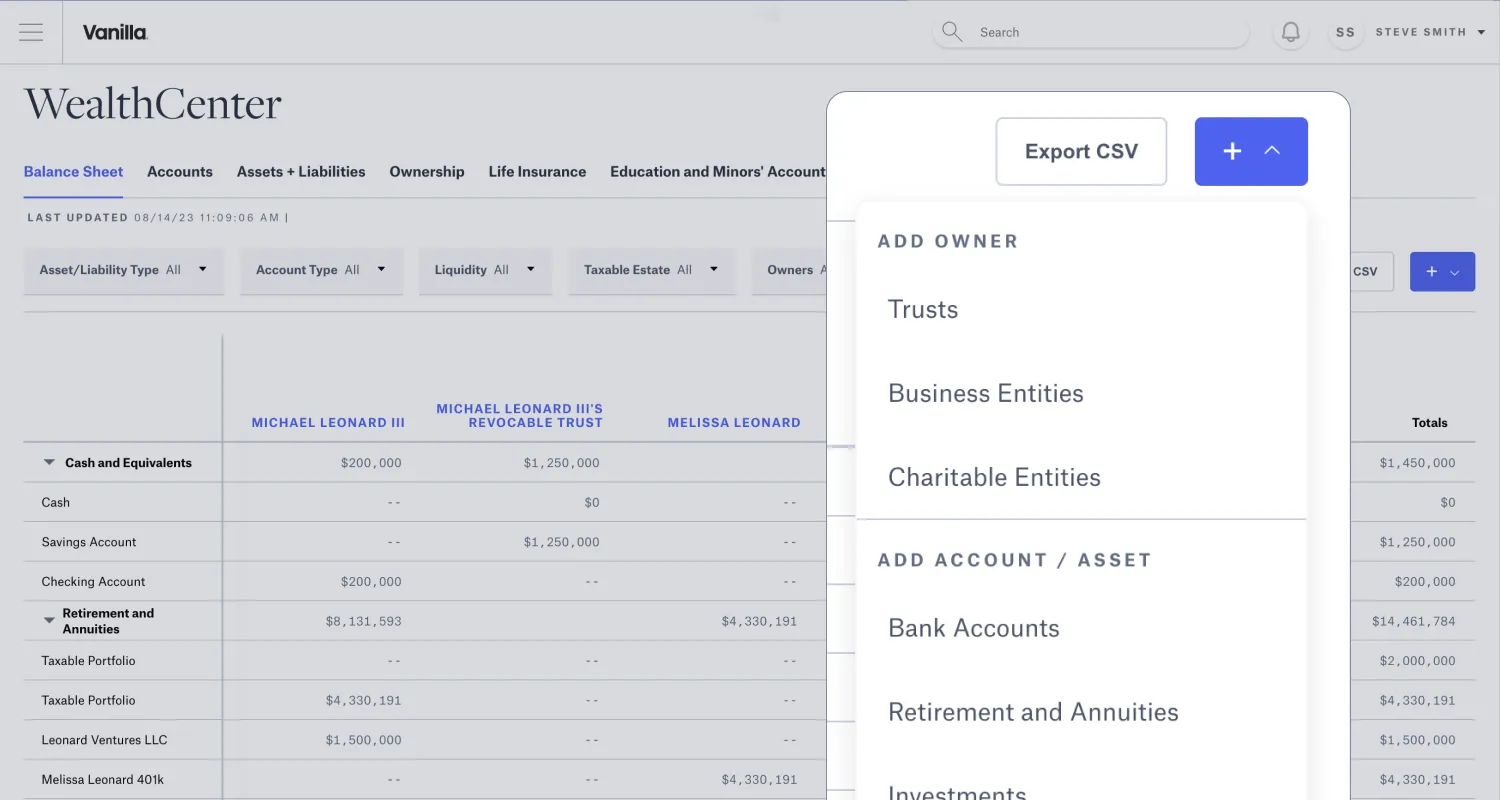

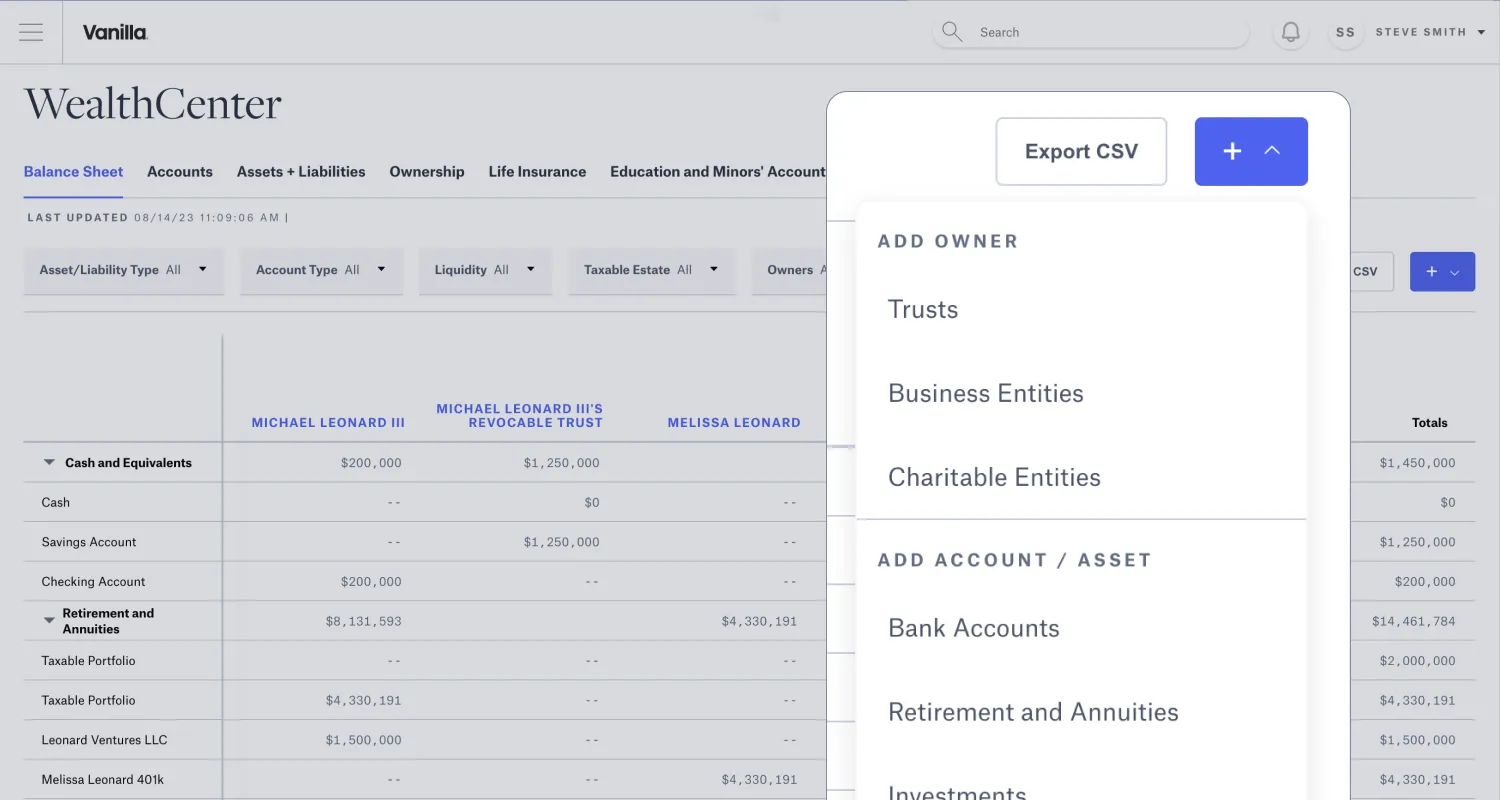

Accelerate client onboarding with the new Balance Sheet Builder

Today, we are launching a refreshed Balance Sheet Builder to help advisors bring client financial information into Vanilla more quickly. The new ownership-driven balance sheet makes it easier to enter client accounts and data. Instead of creating individual assets, entering a client’s information now begins at the account level through one centralized drop-down menu. New dynamic fly-outs for each account or asset type require minimal information to get set up which allows for a faster and more intuitive data entry process. Or if you’re using one of our integration partners, your client’s data will be reflected in the balance sheet...

Blog

Blog

Jessica Crosby

•

Aug 15, 2023

Succession planning for financial advisors: The definitive guide

In the next decade, 37% of financial advisors plan to retire. While this is an exciting milestone that many look forward to, it can also produce a fair amount of anxiety for advisors. Whether you’re a business owner or simply want to ensure your portfolio of business goes to good hands, it’s important to have a solid succession plan as you approach retirement. Your clients will be reassured to know that they’ll remain in good hands even after you’re gone, and it will give your employees and colleagues added confidence as well. As an added benefit, having a roadmap for...

Guide

Guide

Vanilla

•

Aug 10, 2023

A guide to trusts for estate planning

Trusts are an important component of financial and estate planning, but there are many types of trusts – each with unique pros and cons. This guide helps financial advisors and clients sort through the many different types of trusts to better understand what they might want to employ for their own estate strategies.

Blog

Blog

Rachel Pettis

•

Aug 08, 2023

Expedite the document abstraction process with ‘Request for Information’ notifications from Vanilla

Today, Vanilla is excited to release a new feature available during the document abstraction process. Advisors who use the Vanilla Document Abstraction Services will now receive in-app messages and e-mail notifications after submitting their client’s estate planning documents, if additional information is required. Additionally, advisors will receive a status update in Vanilla with detailed notes indicating exactly what is needed to finalize the abstraction submission. With more direct feedback between an advisor and Vanilla during the document review, advisors can onboard their clients onto the Vanilla platform faster, enhance communication, and speed up the document abstraction process for them and...

Blog

Blog

Jennifer Raess

•

Aug 07, 2023

What is estate planning, and why is it important?

What do you think of when you hear the term “estate planning?” If you’re like two-thirds of Americans over the age of 18, you may assume it’s something you can do another time. In fact, the majority of U.S. adults don’t have a will and have not done anything to plan for their estate. However, you don’t have to own a mansion or business to make estate planning work in your favor. For those with any amount of net worth, estate planning alleviates the family strife of having to make important life and financial choices on your behalf. It also...

Blog

Blog

Jim Sinai

•

Aug 02, 2023

How rising interest rates affect estate planning strategies

What changes in estate planning when rates go up? Over the past two years, interest rates have moved from near zero to 5.25%. Most clients are probably worried about how rising rates will affect their investment and retirement accounts. But advisors working with high net worth clients should also consider how a 500+ basis point shift in rates affects advanced estate planning strategies. Some strategies become more attractive as interest rates rise, while others become less attractive. Advanced estate planning strategies There are a number of advanced estate planning strategies that can be used to reduce a client’s taxable estate...

Blog

Blog

Daniel Brockley

•

Aug 01, 2023

How to approach estate planning for non-taxable clients

Vanilla recently hosted Jeff Levine, the lead financial planning nerd for Kitces.com, home of the popular Nerd’s Eye View blog, for a webinar covering key considerations when planning for non-taxable estates. While it’s impossible to pack all the great info Jeff covered in a short blog post (including a rather spectacular metaphor involving the Red Hot Chili Peppers), we’ll give you a few highlights. What are the boundaries of advice financial advisors should give in estate planning? Financial advisors often grapple with the question of where the line lies between estate planning discussions and offering unqualified legal advice. Jeff weighed...

Blog

Blog

Rachel Pettis

•

Jul 27, 2023

Quickly onboard clients and easily build customizable PDF reports

Build a more comprehensive balance sheet with new partner integration features Today, we are excited to announce several upgrades to our integrations with Black Diamond, Orion, and Addepar that enable advisors to import client financial data faster onto the Vanilla Estate Advisory Platform. With these new enhancements, an advisor can bring in more data from portfolio management systems to their client’s balance sheet for a more accurate representation of their estate. Advisors can select any number of clients in an estate to sync to a single Vanilla client profile when building out the balance sheet in the WealthCenter. Multiple clients'...

Blog

Blog

Daniel Brockley

•

Jul 20, 2023

True estate planning story: A new client facing death, without an estate plan

For Mariner Wealth Advisors paraplanner Gillian Cassidy and team, estate planning is always part of the conversation with a new client. In their onboarding process, the Mariner Wealth Advisors team inquires about existing estate plans and any life changes that may have happened since their estate documents were drawn up. They upload existing docs into Vanilla and walk through where it stands as well as potential opportunities to improve the strategy with the client. So, when a new couple came to Gillian and team, they naturally asked about their current estate plan. What they found surprised and saddened them. Gillian...

Webinar

Webinar

Vanilla

•

Jul 18, 2023

What’s new with Vanilla: August 2023

Vanilla’s product experts are back with another installment of the What’s New in Vanilla webinar series. Learn about the latest feature releases and enhancements in the Vanilla Estate Advisory platform. Watch on demand to: See how advisors can expedite client onboarding and minimize financial data entry with new upgrades to the Balance Sheet Builder. Learn how our new integrations features help save time importing financial information for multiple clients and organize data. Hear about upcoming upgrades to the document abstraction process for Wealth and Estate Strategists users in Estate Builder and customizable options in the Vanilla PDF report.

Client material

Client material

Vanilla

•

Jul 14, 2023

Why estate planning matters (Brandable PowerPoint)

Win new clients by downloading this brandable PowerPoint presentation for client meetings. It can help them understand why estate planning matters and how you, as their trusted advisor, can make the process as simple as possible by using Vanilla.

Blog

Blog

Daniel Brockley

•

Jul 13, 2023

How to avoid creating a trust fund monster: Building estates that empower (not...

We want the best for our kids–for them to be happy, healthy, and love one another. And after a lifetime of working hard and weathering the ups and downs of the market, it can be heartening to know that the toils of your labor might help set up your children for success along their own paths. But money often serves as a magnifying glass, enhancing opportunities when things go well or fraying family relationships when jealousy or greed creep in. And as you consider how to leave your estate to your children, you may have a nagging feeling you can’t...

Blog

Blog

Rachel Pettis

•

Jul 05, 2023

Visualize estate plans holistically with Class Distributions designations

Today, we are excited to announce the latest feature to go live on the Vanilla Estate Advisory Platform, Class Distributions designations for advisors and wealth and estate planning strategists. Class Distributions designations What this means for Advisors Our newest feature, Class Distributions, allows advisors to visualize how their client’s assets flow to future generations when a beneficiary predeceases the client. The addition of this new fact pattern allows the advisor and client to have a more holistic view of the entire estate. Within Vanilla, advisors can align their clients’ Family Tree with the Balance Sheet by selecting per stirpes (deceased...

Blog

Blog

Simona Ondrejkova, CFP

•

Jun 29, 2023

What to do when your client dies: A guide for financial advisors

While it’s inevitable, it’s a call every advisor dreads: your client’s spouse or family member calling to notify you that your client has passed away. During these challenging moments, advisors must be ready to navigate both the emotional and financial implications of a client’s death. But how can advisors best prepare so they can be a source of comfort for clients’ survivors while ensuring all administrative and financial tasks are taken care of as needed? To answer this, we’ve compiled a guide to help you support the surviving spouse or beneficiaries while fulfilling your duties as an advisor. Here, you’ll...

Client material

Client material

Blog

Blog

Daniel Brockley

•

Jun 20, 2023

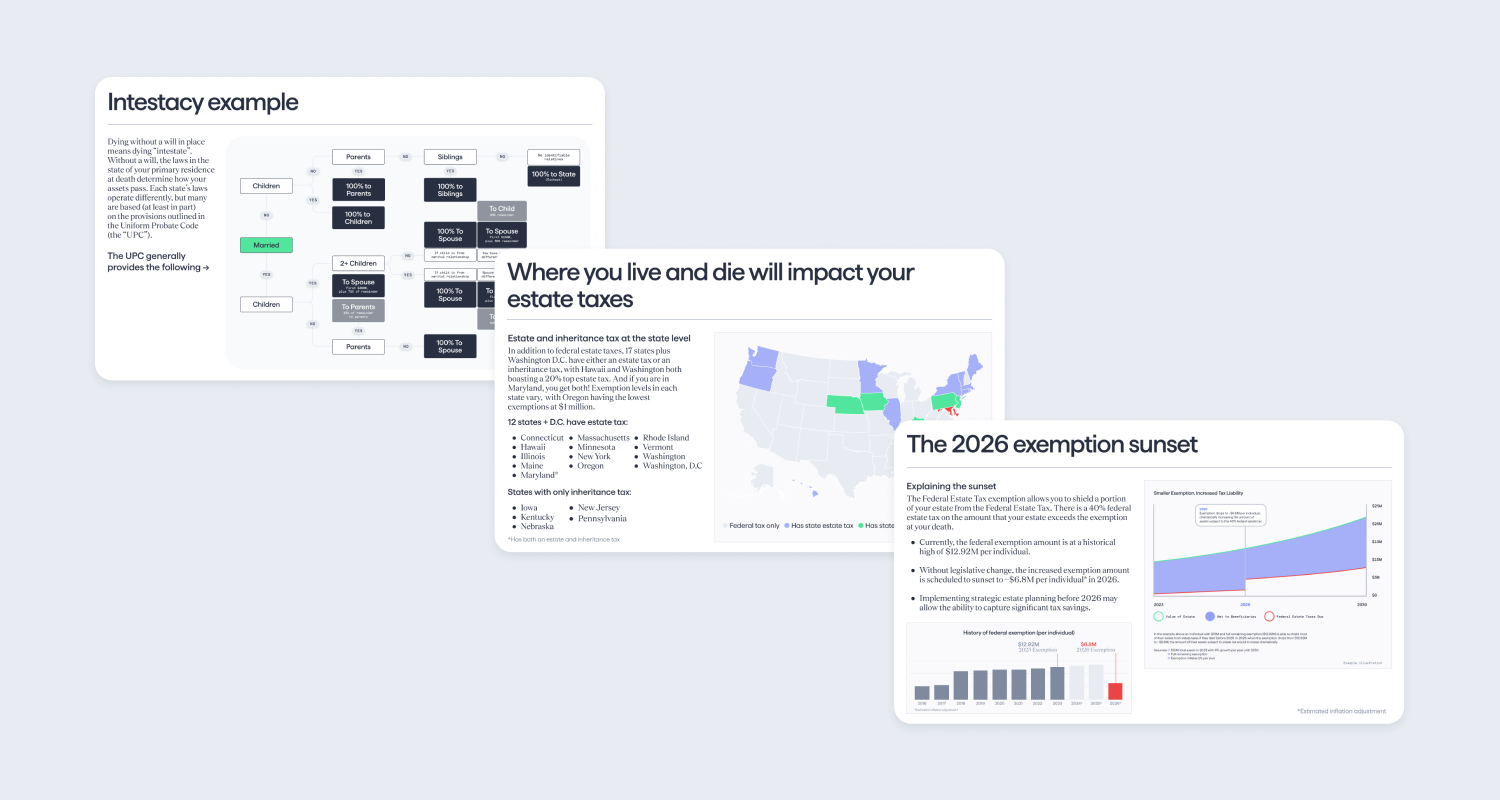

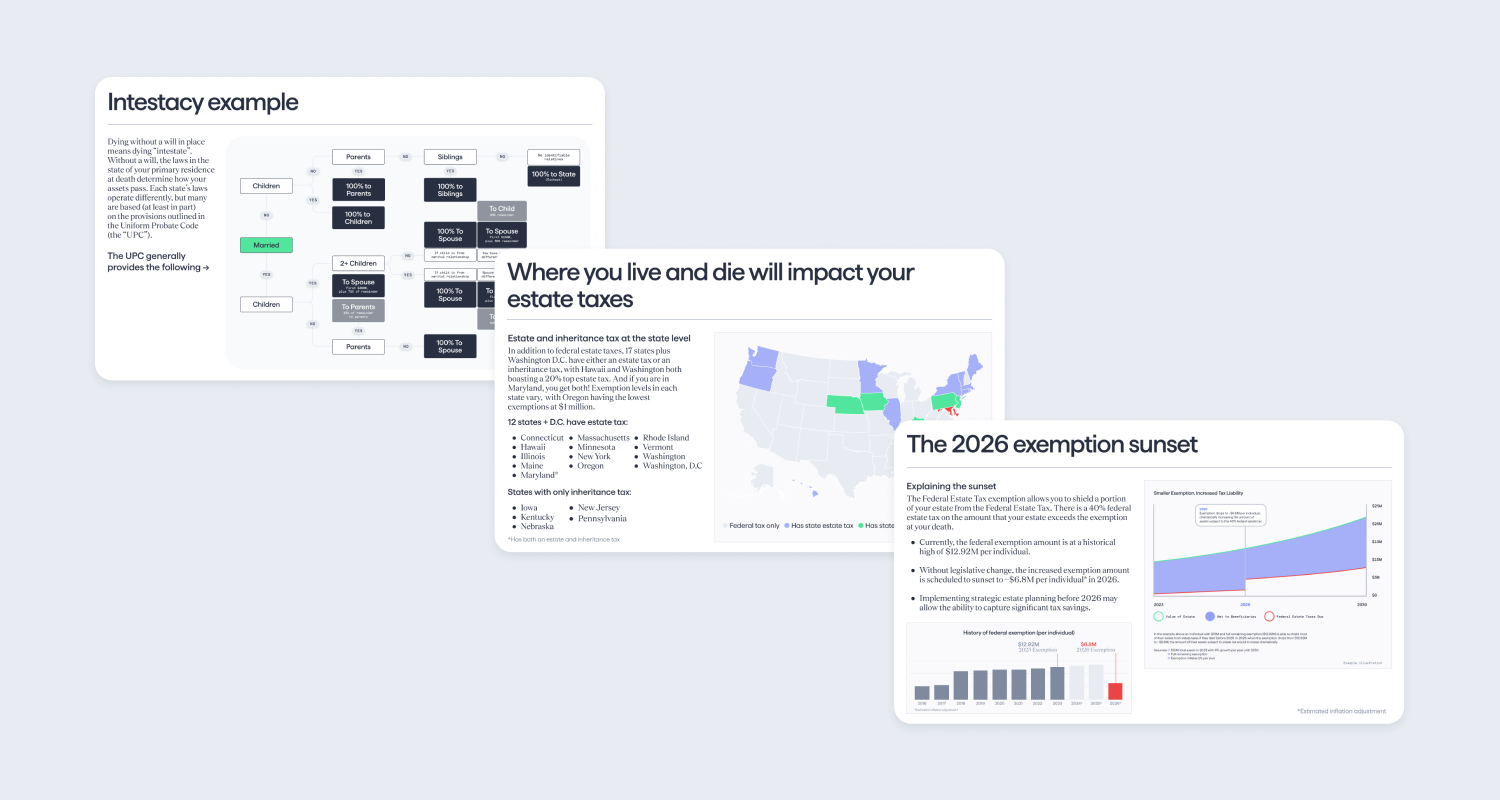

The 2026 estate tax exemption sunset is coming. Here’s what you need to...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. In 2018, the estate tax exemption was raised to an historical high of $11.18 million ($22.35 million per married couple), which has been raised yearly to adjust for inflation and put it out of sight for most estates. But the same law that raised the exemption, The Tax Cuts and Jobs Act (TCJA), is set to expire in 2026, bringing the estate tax exemption back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) –...

Blog

Blog

Rachel Pettis

•

Jun 09, 2023

Deepen client conversations with First-to-Pass analysis

At Vanilla, we are continually iterating to expand our product features and support more complex estate planning scenarios. First-to-Pass analysis We are excited to announce our newest feature, First-to-Pass. First-to-Pass allows advisors to have deeper conversations with their clients with the Vanilla Estate Advisory Platform. Now, advisors can dynamically switch between death pattern sequences, allowing advisors to provide a holistic view of the client’s estate plan. The advisor can also decide which death sequence they want to add to the PDF report before sending it to their client. And if the advisor chooses, they can send out two reports with...

Webinar

Webinar

Vanilla

•

Jun 07, 2023

What’s new with Vanilla: June 2023

This latest installment of the What’s New with Vanilla webinar series covers several new features and enhancements recently launched in the Vanilla Estate Advisory Platform: First-to-Pass analysis: See how the First-to-Pass analysis helps advisors and wealth and estate strategists visualize and gain a more holistic view of the client’s estate. Class Distributions: Learn how the Class Distributions feature will allow advisors and wealth and estate strategists to designate how their client’s assets flow to future generations when a beneficiary predeceases the client. Hear about the latest upgrades to the Vanilla PDF report including new entity tables, a display name editor,...

Client material

Client material

Blog

Blog

Rachel Pettis

•

May 25, 2023

Vanilla + Addepar Partnership: New integration simplifies estate planning

Creating a complete estate profile for a client requires blending family, estate plan, and financial information together in one place. Today, we’re happy to announce a new partnership and integration between Addepar and Vanilla to simplify bringing financial data into the Client Profile. Addepar is one of the leading portfolio management systems for wealth advisors, and by bringing the account data from Addepar into the Vanilla Estate Advisory Platform, we will help advisors create a more comprehensive picture of their client’s estate plans. During the onboarding process, advisors can save time and avoid unnecessary manual data entry by connecting their...

Webinar

Webinar

Vanilla

•

May 24, 2023

The 2026 estate tax exemption sunset: How to prepare – and why you...

For the past few years, most US tax residents haven’t needed to worry too much about estate tax. But that’s all about to change. At the end of 2025, the historically high estate exemption of $12.92M ($25.84 million per married couple) will sunset back down to an estimated $6-8 million per person or $12-16 million per couple (adjusting for inflation) – suddenly making the estate tax an important consideration for many more households. And the time to act is now. In this webinar, you’ll learn: How the estate tax exemption sunset will impact your clients Key strategies including SLATS, gifting,...

News Entry

News Entry

ThinkAdvisor

•

May 22, 2023

Act Now to Avoid Estate Planning Logjam in 2025

Clients with sufficient wealth to leave them exposed to future estate tax burdens need to understand that the time to act on the generous estate tax exemption established in 2017 by the Tax Cuts and Jobs Act is now — not when the expanded exemption sunsets the end of 2025. In fact, according to Steve Lockshin, an experienced financial advisor and the founder of AdvicePeriod and Vanilla, it is already becoming more and more difficult to timely source the capabilities of specialist tax planning experts and estate attorneys who understand the rapidly evolving needs of high-net-worth and ultra-high-net-worth clients....

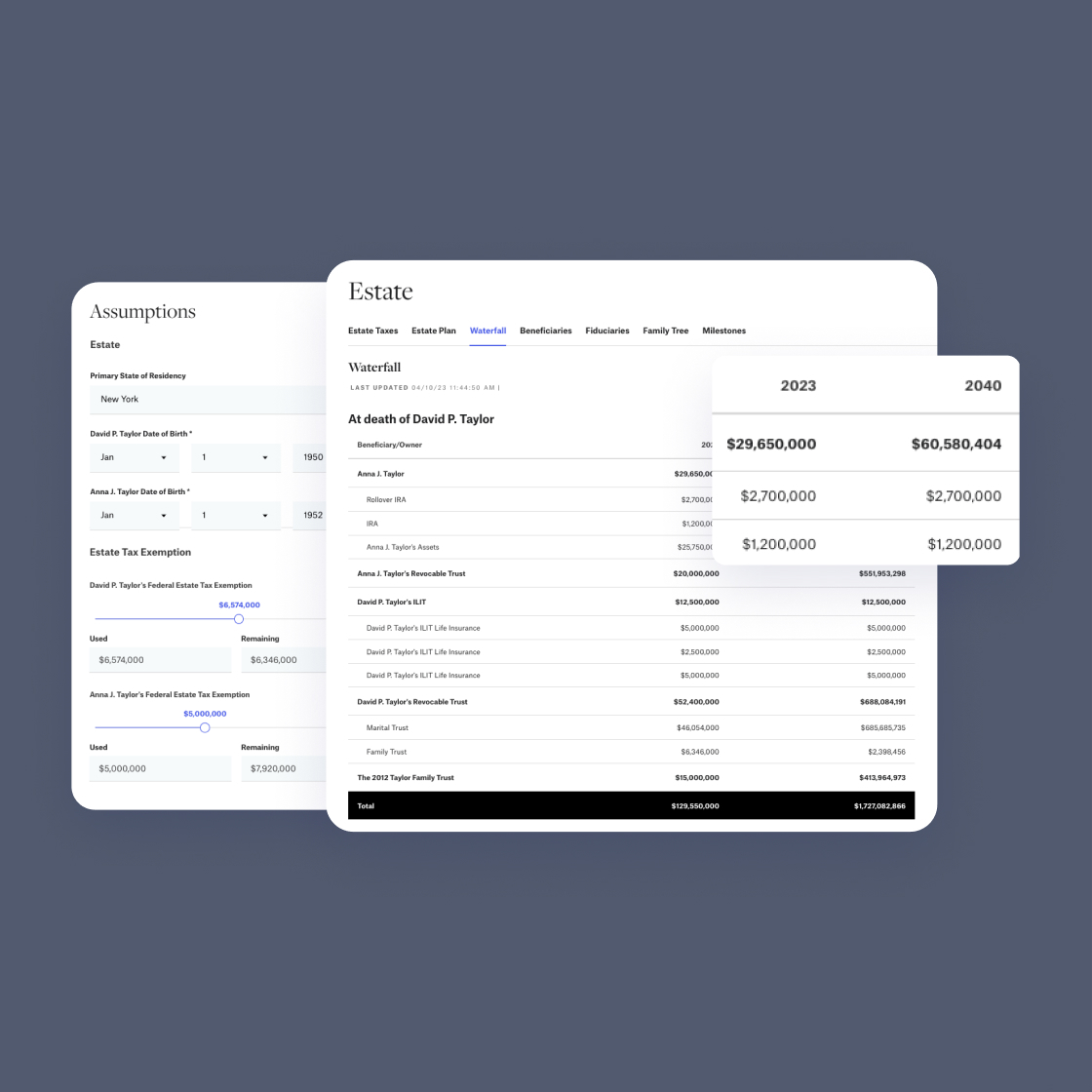

Blog

Blog

Rachel Pettis

•

May 18, 2023

Leverage sample profiles to illustrate Vanilla’s value to your clients

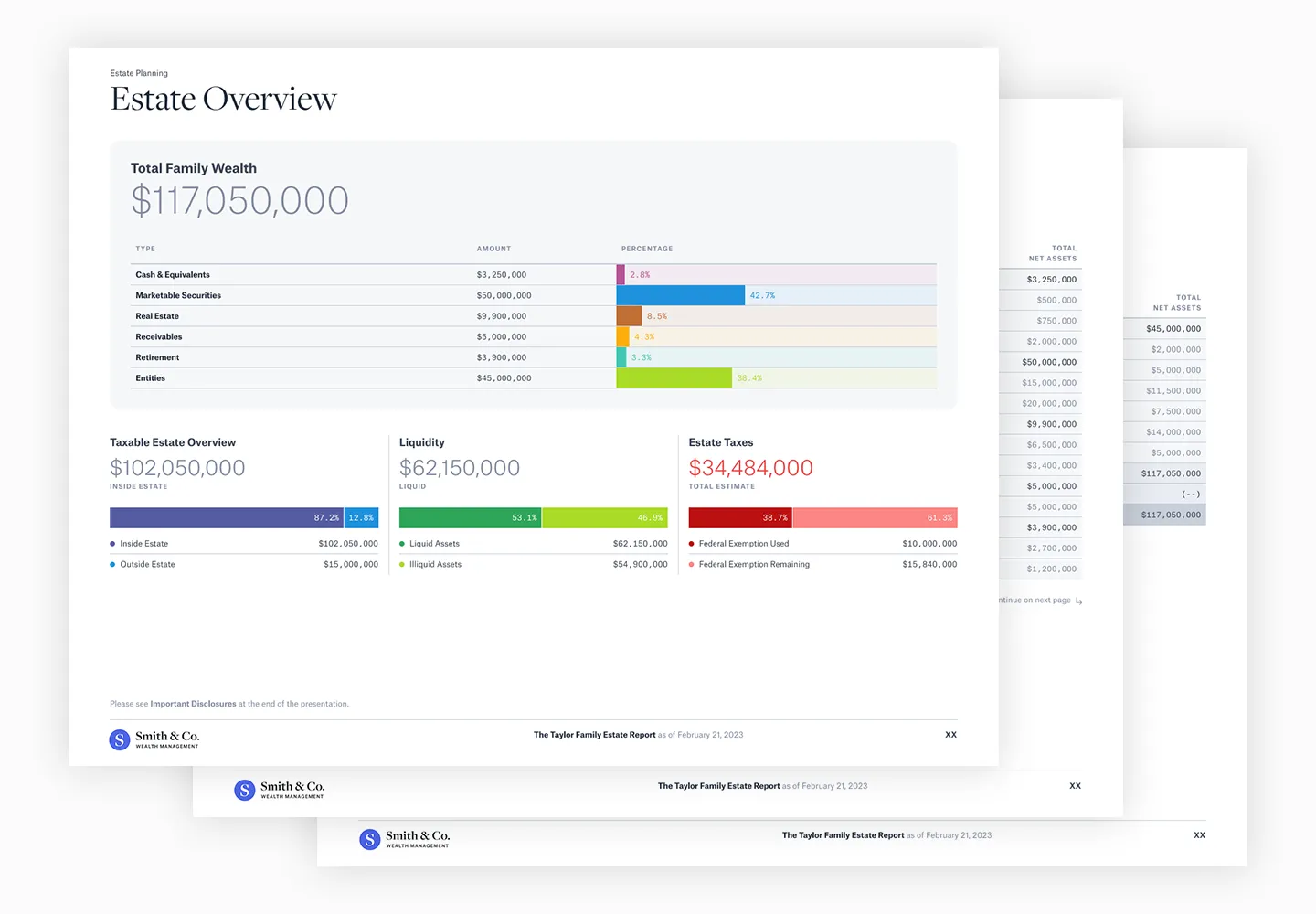

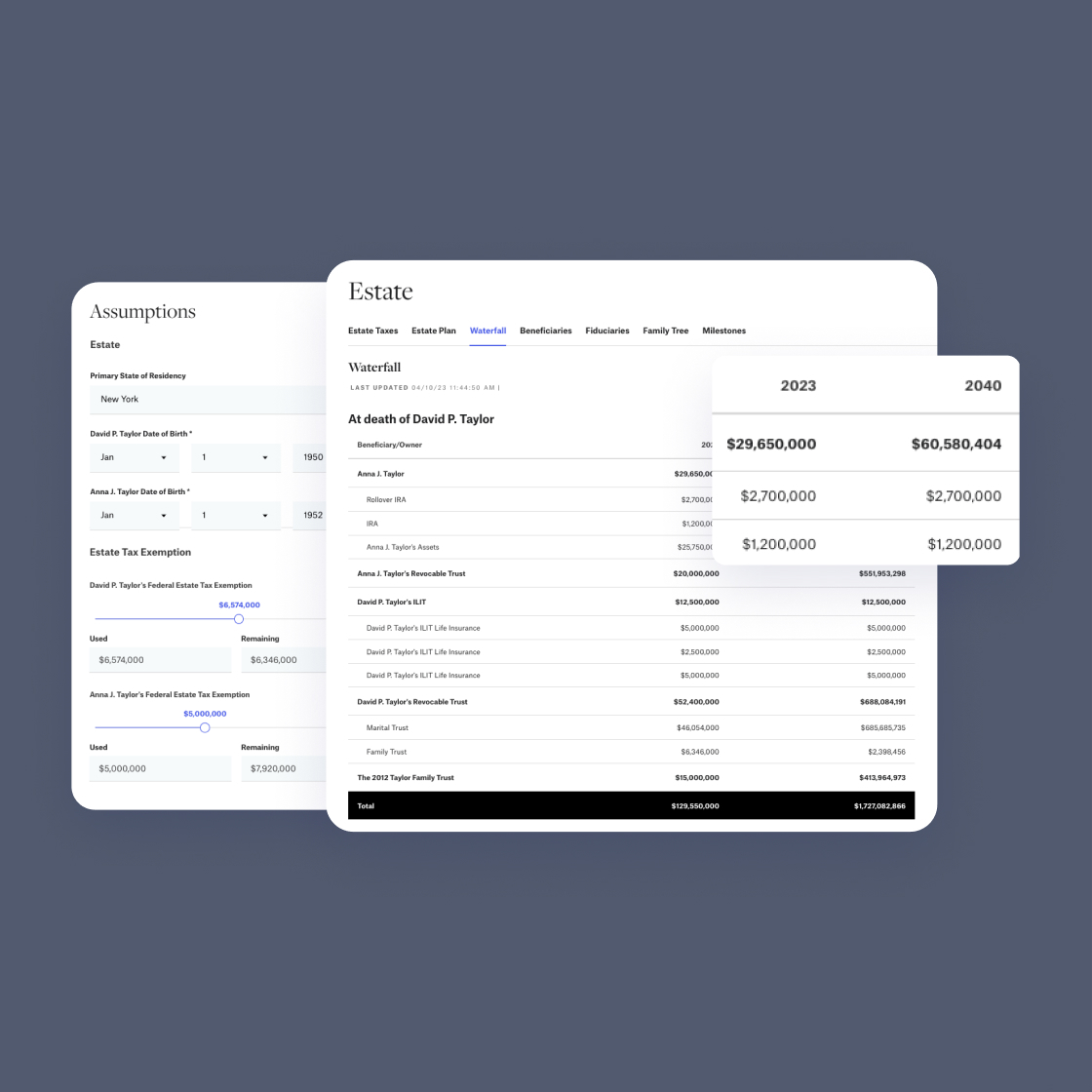

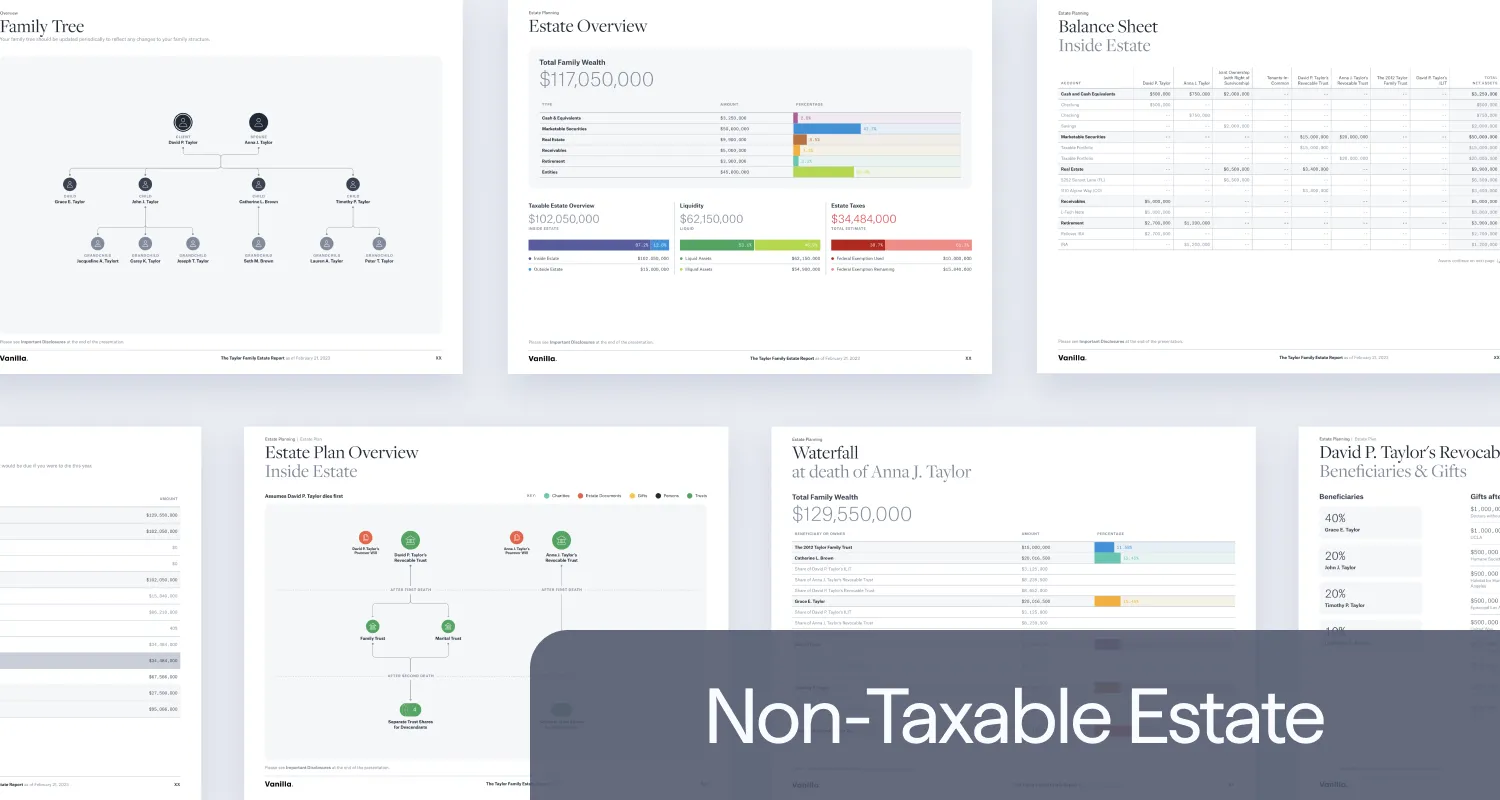

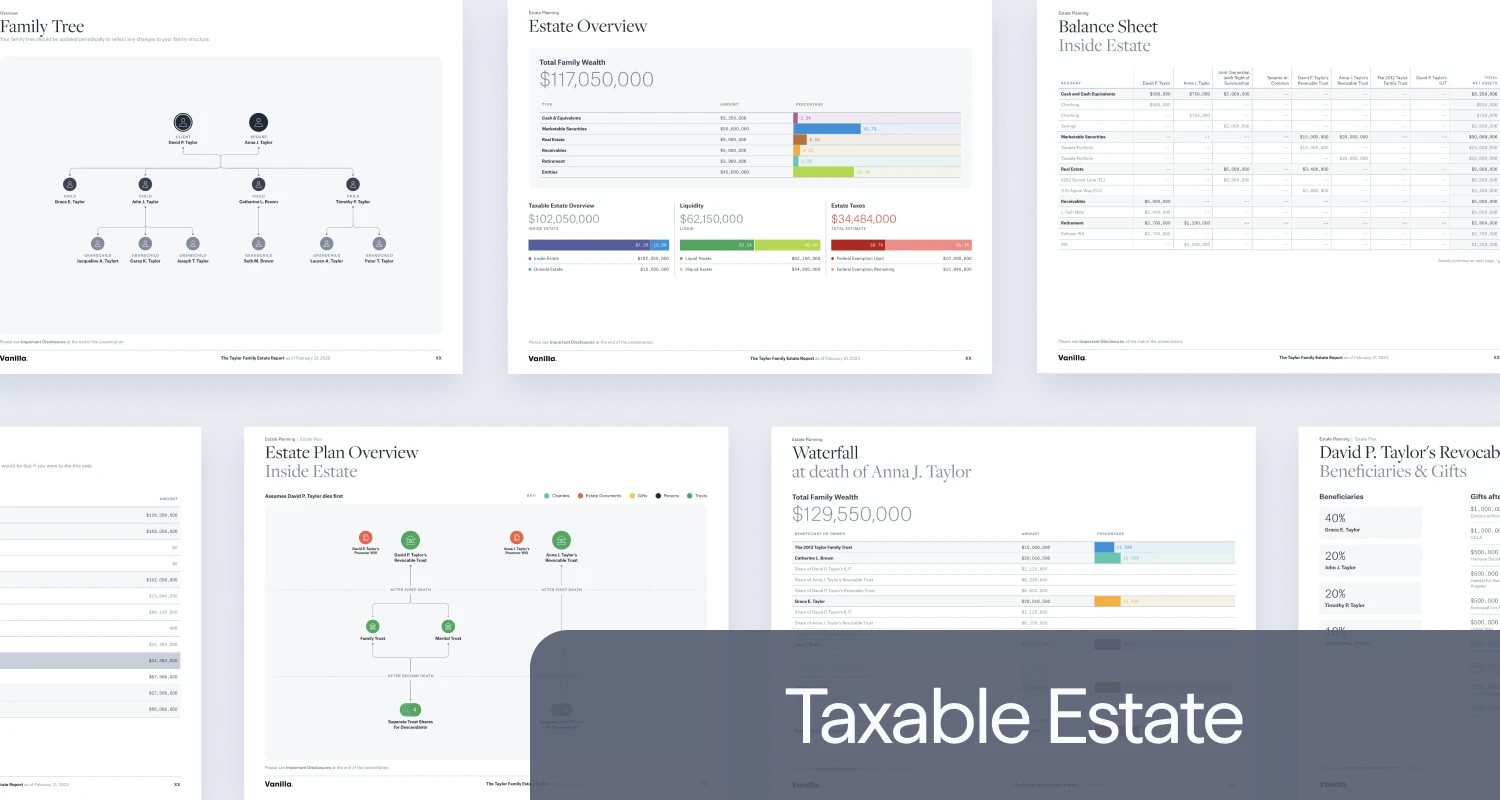

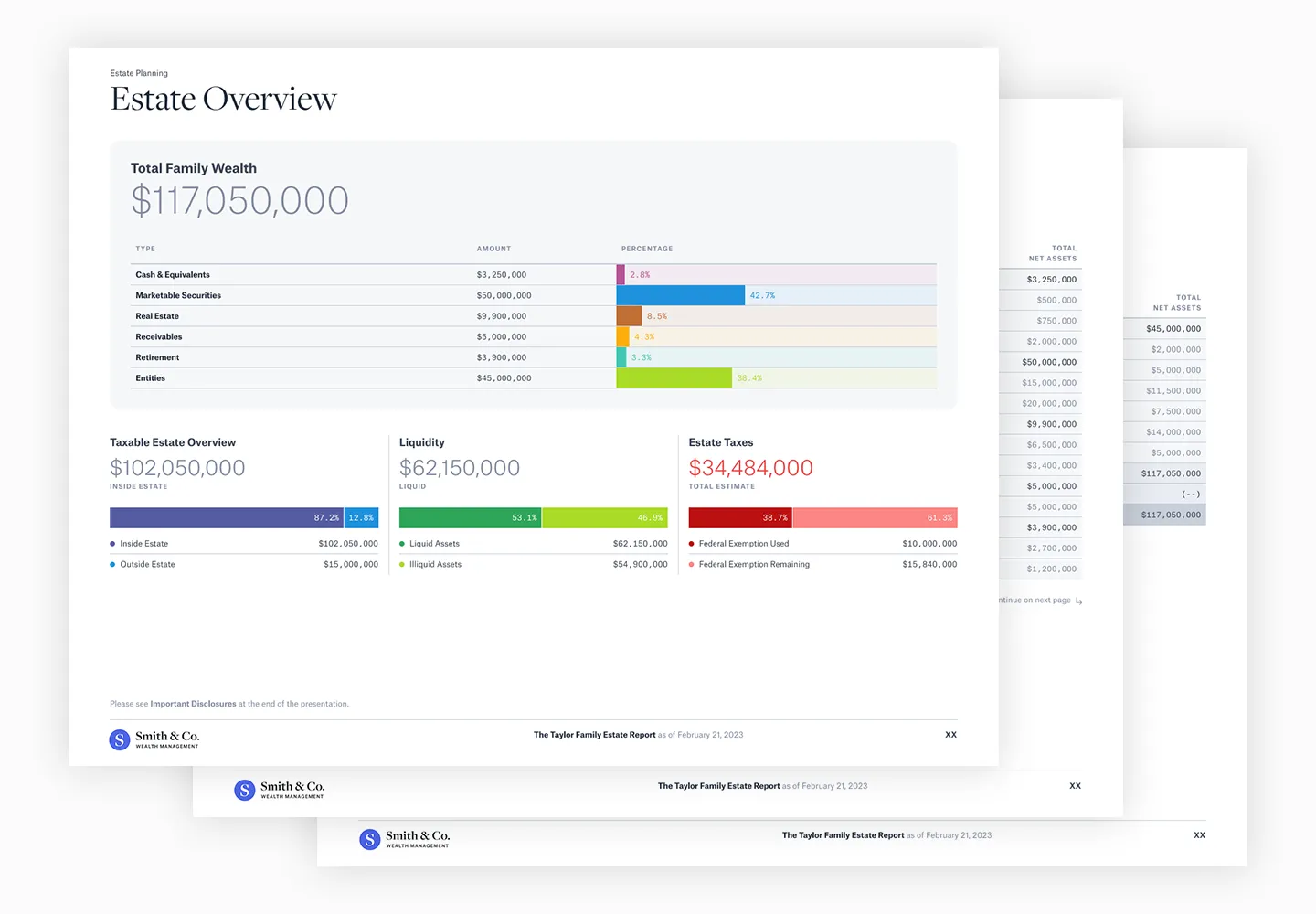

With the launch of taxable and non-taxable sample profiles, advisors can now review an example of a completed client account in Vanilla. Their clients can see how the complete picture of their estate and financial plan would be represented on the platform before onboarding their own family, financial, and estate information. During client and prospect conversations, advisors can share the completed sample profile or download the taxable or non-taxable estate PDF report. The Taylor Family is an example of a high-net worth family living in Florida with a taxable estate of $117,050,000. Their estate plan includes revocable trusts, an irrevocable...

Blog

Blog

Gene Farrell

•

May 17, 2023

The future of estate advisory: A new way to think about estate planning

[Watch Legacy Now on demand, to learn more about Vanilla’s vision for estate advisory.] I believe that technology – when used thoughtfully – can be truly transformative. And this week at our Legacy Now event, with the help of Vanilla co-founder Steve Lockshin, I had the opportunity to share how Vanilla plans to transform not just estate planning, but financial advising as a whole, with the new Vanilla Estate Advisory Software. The technology itself is only a part of the picture. It’s a tool. It’s the enabler that, when paired with exceptional advisors, will allow for a new kind...

Webinar

Webinar

Vanilla

•

May 16, 2023

The changing roles of advisors in estate planning with Bob Oros and Steve...

At our recent Legacy Now event, Hightower CEO Bob Oros and Vanilla cofounder Steve Lockshin sat down with Vanilla CEO Gene Farrell to discuss the changing roles of advisors in estate planning. Learn more about: Why advisors are leaning into Estate Advisory How to use Estate Advisory to connect with clients in a whole new way How technology is helping advisors and wealth planners serve their clients needs around estate planning You can watch the full event here.

News Entry

News Entry

Wealth Management

•

May 15, 2023

The Rise of the ‘Estate Advisor’

Move over estate planners, it’s time for "estate advisors" to take the lead. At least that's what Steve Lockshin and Vanilla hope. Estate planning tech leader Vanilla announced Tuesday the launch of what it calls the first fully integrated estate planning platform—The Vanilla Estate Advisory Platform. The product purports to offer advisors visualizations of the estate, beneficiary summary and projections, estate tax projections, a dynamic balance sheet integrated with the leading personal finance management tools and an on-demand report builder. Vanilla also offers estate-planning educational resources for both clients and advisors as part of its "Vanilla Academy." ...

Blog

Blog

Vanilla

•

May 11, 2023

What is a power of attorney – and how does it work?

Life is unpredictable. And as a financial advisor, one of the essential parts of your job is to help prepare clients for that unpredictability – whether that comes in the form of balancing a portfolio so that it’s not over reliant on a single company or sector or ensuring they have the right documents in place in case of an accident or health scare. One of these key documents is a power of attorney. A power of attorney (POA) is a legal document that authorizes an individual, known as the agent or attorney-in-fact, to act on behalf of another person,...

Webinar

Webinar

Vanilla

•

May 08, 2023

Simplify estate planning by integrating Addepar with Vanilla

Hear from the teams at Addepar and Vanilla where they’ll discuss how their partnership will bring efficiency to the estate planning process. See how the integration of Addepar into Vanilla can create a comprehensive picture of your clients’ family and financial information in their estate profile. You’ll learn how to: Ensure your clients’ estate plans and balance sheets are up-to-date Save time during the onboarding process Integrate your Addepar accounts into Vanilla

Blog

Blog

Vanilla

•

May 03, 2023

Level setting: How to approach estate planning differently depending on estate size

Many clients (and some financial advisors as well) tend to reduce estate planning to two simple categories: taxable estates and non-taxable estates. While it’s true that there are important differences in these asset levels, estate planning is not binary. It takes a nuanced approach, one that requires understanding a client’s situation and goals deeply. However, even with the understanding that a good advisor will always tailor their approach to each individual client’s needs, it can be helpful to think of client needs according to a few different distinct buckets of asset classes – beyond just taxable and non-taxable. We’ve...

Webinar

Webinar

Vanilla

•

Apr 25, 2023

What’s new with Vanilla: April 2023

Today, advisors use Vanilla to deepen client relationships, increase share of wallet and win new clients. Learn the latest innovations and product announcements on the Vanilla Estate Advisory Platform as of April 25, 2023. Our product experts will provide a deep dive into: How advisors can show their clients simple projections of their estate to help make informed planning decisions about future scenarios The new redesigned PDF estate report which enables advisors to show up with their clients in a whole new way

Blog

Blog

Vanilla

•

Apr 25, 2023

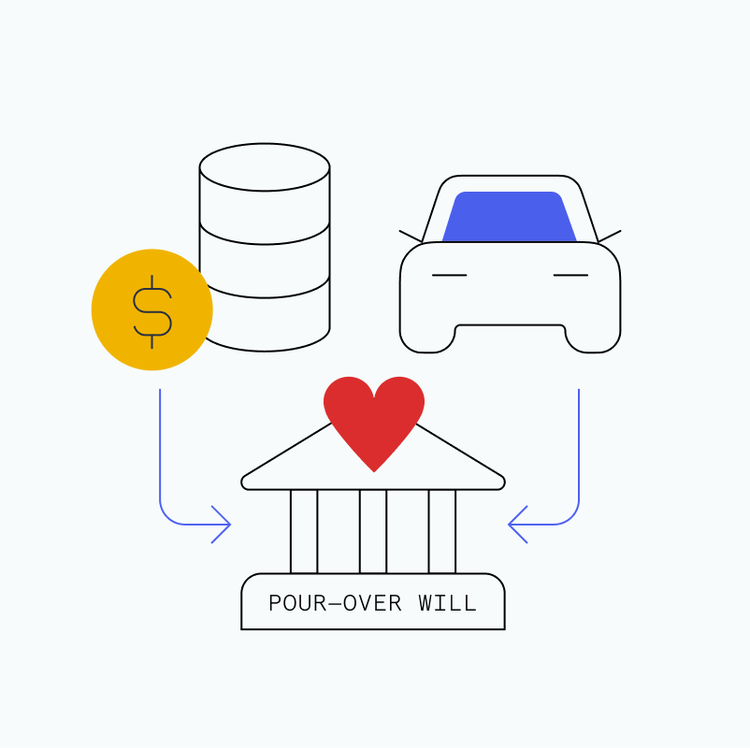

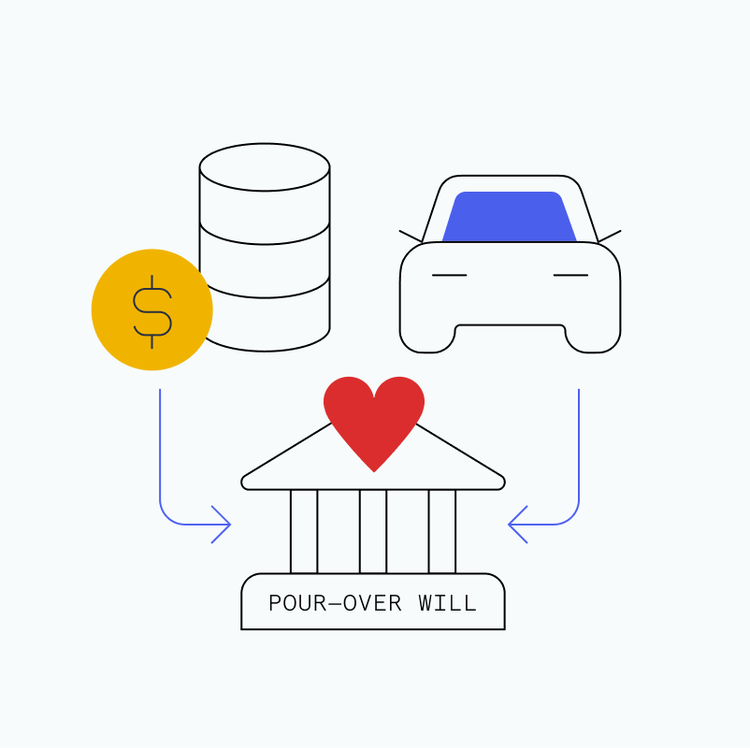

What is a living trust, a.k.a a revocable trust?

A living trust (also called a revocable trust) is a legal document created by a person during their lifetime that directs how their assets are managed during their life, and how they are to be distributed after their death. It can also help bypass or minimize the sometimes expensive and time consuming probate process required by a traditional will. A living trust is typically used in conjunction with a short will that directs all assets held in the individual’s name to “pour over” to the revocable trust on death (referred to as a “pour-over will”). This living trust estate...

Blog

Blog

Daniel Brockley

•

Apr 19, 2023

Introducing Vanilla Academy: Empowering financial advisors with free educational resources on estate planning

In a recent report by Spectrem Group, a full 93% of respondents said they want estate planning advice from their advisors, but only 22% of clients are actually receiving that advice. Vanilla aims to change that. Clients crave help from their advisors on estate planning because they recognize that their advisors are in the perfect place to provide real insights. Although clients need attorneys to draft legal documents, those attorneys don’t have the same holistic view of clients’ financial pictures–their assets, their hopes, their dreams–or their family feuds–as their financial advisors have. Not only do financial advisors have more perspective...

Blog

Blog

Vanilla

•

Apr 18, 2023

Vanilla Launches First Fully-Integrated Estate Advisory Platform

SALT LAKE CITY, UT - APRIL 18, 2023 Vanilla, a leading provider of estate planning solutions, today announced the launch of its new Estate Advisory Platform, the first fully integrated model of an estate, bringing together family, financial, and estate planning data into one place. The Vanilla Estate Advisory Platform The Vanilla Estate Advisory Platform offers dynamic visualizations of the estate, beneficiary summary and projections, estate tax projections, a dynamic balance sheet integrated with the leading personal finance management tools, and an on-demand report builder. With these features, financial advisors can deliver differentiated advice, expand client relationships, win new...

Webinar

Webinar

Vanilla

•

Apr 17, 2023

Legacy Now: Introducing the Estate Advisory Platform

With your help, we are about to completely reshape how estate planning is done. On May 16th we unveiled Vanilla’s new Estate Advisory Platform, which reimagines how financial advisors, attorneys and their clients approach one of the most important parts of their lives: their legacy. In this live, virtual launch event: Vanilla CEO Gene Farrell will outline a new vision for estate planning and the role technology will play Hightower Chairman and CEO Bob Oros will speak with Vanilla Co-Founder Steve Lockshin on the changing role of advisors in estate planning Product experts will showcase the new Vanilla platform and...

Blog

Blog

Amjad Hussain

•

Apr 13, 2023

The four ways Artificial Intelligence (AI) will transform estate planning

We’ve been hearing a lot about AI recently, and for good reason. The innovation happening with Large Language Models (LLMs) and Generative AI are remarkable, have sparked our imagination, and beg the question: What does the future hold? Of course I can’t predict the future, but I do have some thoughts about what it will mean for our industry. When it comes to estate planning, machine learning has the potential to reshape things in some important ways. This evolution may be more subtle in the present and near future – with AI playing a role in the background – but...

Blog

Blog